Green Methanol Market

Green Methanol Market by Feedstock (Biomass, Green Hydrogen, CCS), Derivative (Formaldehyde, Dimethyl Ether & Methyl Tert-Butyl Ether, Gasoline, Methanol-to-Olefin, Solvents), Application (Chemical Feedstock, Fuel), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global green methanol market is anticipated to grow from USD 2.59 billion in 2025 to USD 11.18 billion by 2030, registering a CAGR of 34.0% from 2025 to 2030. The market is driven by stringent environmental regulations, the push for sustainability goals, and the integration of renewable energy sources. Advances in production technologies and increasing demand for clean fuels in transportation and industrial applications further boost their adoption. Growing consumer awareness and preferences for eco-friendly products also play a significant role. Green methanol is applied across multiple industries; it is used as a chemical feed stock and as fuel in the automotive and chemical industries.

KEY TAKEAWAYS

-

BY FEEDSTOCKThe green methanol market comprises biomass, green hydrogen, and carbon capture & storage. The carbon capture & storage segment is expected to grow at the highest rate during the forecast period due to its ability to reduce CO2 emissions, making production more sustainable. This attracts industries aiming to lower their carbon footprints and comply with environmental regulations.

-

BY DERIVATIVEThe key derivatives include formaldehyde, gasoline, green methanol-to-olefins/ green methanol-to-propylene, methyl tert-butyl ether, acetic acid, dimethyl ether, methyl methacrylate, biodiesel, and others. The demand for green methanol-to-olefin has been growing rapidly. Methyl tert-butyl ether, a gasoline additive that enhances air quality, and dimethyl ether, a clean-burning fuel with properties similar to propane, highlight green methanol's versatility.

-

BY APPLICATIONThe application segment includes chemical feedstock, fuel, and others. The fuel segment is expected to lead the market due to its increasing adoption in marine and sustainable aviation fuels. Green methanol's low carbon footprint and compatibility with existing infrastructure make it an attractive choice for reducing emissions in the marine industry.

-

BY REGIONGreen methanol market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America leads the green methanol market due to the high demand for sustainable fuels, supportive government policies, the presence of key industry players, abundant renewable feedstock, and significant investments in infrastructure and technology.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including new product launches, acquisitions, partnerships, and expansions. For instance, in February 2025, Mitsubishi Gas Chemical Company Methanol Reformer S.L. and Element 1 Corp. signed a Memorandum of Understanding (MOU) to collaborate on developing and commercializing hydrogen solutions using methanol reforming technology, focusing on the design, manufacture, and sales of modular, mass-producible Methanol-to-Hydrogen generators.

The green methanol market is witnessing steady growth, driven by a rising focus on reducing greenhouse gas emissions and addressing climate change, which is increasing the demand for green methanol as a sustainable alternative to traditional fossil fuel-derived methanol. Additionally, government policies that promote renewable energy usage and aim to decrease greenhouse gas emissions are further fueling investment and expansion in the green methanol market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The shift in revenue sources over the next 4-5 years and its impact along the value chain. Currently, 80% of revenue comes from existing sources, with 20% from new opportunities. In the future, this mix is expected to invert, with 80% from new revenue streams. This shows how your business (“You”) transitions into green methanol fuel and fuel cells, which then influence your client’s industries (heavy industries, gasoline, and battery manufacturers) and further extend to your client’s clients across sectors like automotive, logistics, marine transport, food & beverage, and power storage. It highlights the cascading effect of innovation and market shifts on end customers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Increasing demand for sustainable and renewable energy

-

•Demand for green methanol in automotive and construction industries

Level

-

•Competing fuel options – ethanol, hydrogen, and biodiesel

Level

-

•Green methanol as alternative fuel in marine and manufacturing industries

-

•Green methanol fuel cells in transportation and energy sectors

Level

-

•Cost competitiveness to produce green methanol

-

•Consumer awareness about benefits of green methanol

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for sustainable and renewable energy sources and rising demand for green methanol in automotive and construction

The growing demand for sustainable and renewable energy sources is a key factor driving the green methanol market. Industries are increasingly seeking to reduce their carbon footprint and comply with environmental regulations. Moreover, the automotive and construction sectors are expanding their use of green methanol due to its cleaner-burning properties and its potential to lower emissions. This combined demand for energy sustainability and specific market applications significantly contributes to the growth of green methanol.

Restraint: Competing fuel options - ethanol, hydrogen, biofuels

The green methanol market faces challenges from competing fuels such as ethanol, hydrogen, and biofuels. These alternative fuels already have established supply chains and technologies, which often make them more accessible and sometimes cheaper to utilize. This competition can hinder green methanol's ability to attract investment and expand its market share. Additionally, transitioning to green methanol may necessitate significant changes to existing systems, creating barriers for many potential users.

Opportunity: Use of green methanol as an alternative fuel in marine and manufacturing industries

Green methanol presents significant opportunities as an alternative fuel in the marine and manufacturing industries. In the marine sector, its lower emissions make it an attractive option for meeting strict environmental regulations and reducing the carbon footprint of shipping. In manufacturing, green methanol can serve as a sustainable feedstock, supporting the industry's shift towards greener production processes. These applications highlight green methanol's potential to drive sustainability and innovation in key industrial sectors.

Challenge: Infrastructure, scale, and efficiency limitations for production of green methanol

Green methanol faces challenges related to infrastructure, scale, and efficiency in its production. Existing infrastructure is often inadequate for large-scale green methanol production and distribution, necessitating significant investment. Additionally, scaling up production to meet demand while maintaining cost-effectiveness and high efficiency remains a technical hurdle. Overcoming these limitations is essential for green methanol to become a viable alternative fuel on a broad scale.

Green Methanol Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Shipping companies are adopting green methanol as a marine fuel to reduce greenhouse gas emissions and comply with environmental regulations | Reduction in CO2 emissions by up to 65%, compliance with sulfur emission standards, and alignment with net-zero targets |

|

Production of plastics and chemicals using green methanol derived from biomass or waste materials | Reduction in fossil fuel dependency, lower carbon footprint, and potential cost savings in plastic production |

|

Conversion of renewable electricity into green methanol for energy storage and later use in power generation | Enhanced energy storage solutions, reduced reliance on fossil fuels, and improved grid stability |

|

Integration of biogas plants with Power-to-X technology to produce green methanol from renewable CO2 and hydrogen | Efficient utilization of renewable resources, reduction in greenhouse gas emissions, and potential cost-effective methanol production |

|

Co-production of cement and green methanol using renewable hydrogen and carbon capture technologies | Lower CO2 abatement costs, efficient use of renewable energy, and support for industrial decarbonization |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The green methanol market ecosystem consists of raw material manufacturers and suppliers (e.g., Carbon Recycling International, Methanex Corporation), green methanol manufacturers (e.g., Air Liquide, Air Products), distributors (e.g., Avaada, Kapsom), and end users (e.g., Maersk, Cosco Shipping). Green methanol derivative like formaldehyde, gasoline, green methanol-to-olefins/ green methanol-to-propylene, methyl tert-butyl ether, acetic acid, dimethyl ether, methyl methacrylate, biodiesel, and others are provided to end users for use in various applications. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Green Methanol Market, By Application

The green methanol fuel segment is experiencing the highest compound annual growth rate (CAGR) due to technological advancements, supportive government policies, and increased environmental awareness. The marine industry has seen significant adoption of green methanol, especially following the International Maritime Organization's (IMO) 2020 sulfur emission regulations. For instance, Maersk has ordered 12 green methanol-powered ships, which are scheduled for delivery in 2024. In the transportation sector, China's Geely Auto Group launched the first methanol-powered passenger vehicle in 2022, aligning with the country's carbon reduction goals. The aviation industry is also embracing green methanol; companies like Prometheus Fuels and Carbon Clean Solutions are developing Sustainable Aviation Fuel (SAF) technologies to help meet the International Air Transport Association's (IATA) target of net-zero carbon emissions by 2050. Government initiatives, such as the European Union's Fit for 55 package and the US Inflation Reduction Act of 2022, provide substantial support for the growth of green methanol. Additionally, technological advancements, including Carbon Capture and Utilization (CCU) and advanced electrolyzers, are crucial for this sector. Notable examples include Carbon Recycling International in Iceland and Nel Hydrogen in Norway. Regionally, Europe leads with its Green Deal, aiming for carbon neutrality by 2050. China is driving growth in the Asia Pacific with its dual carbon goals, while Canada is making significant investments in green methanol through Methanex Corporation. Collaborations, like Methanex's 2023 partnership with Enerkem Inc. to produce bio-methanol from waste, highlight the sector's dynamic growth.

Green Methanol Market, By Feedstock

Biomass-based green methanol holds the largest market share primarily due to its abundant availability and renewable nature. Biomass, which is derived from agricultural residues, forestry waste, and other organic materials, serves as a sustainable and versatile feedstock for methanol production. Using biomass helps reduce waste and greenhouse gas emissions, aligning with environmental objectives. Furthermore, advancements in biomass conversion technologies have enhanced the efficiency and cost-effectiveness of the production process. These factors collectively position biomass as an attractive and leading feedstock in the green methanol market.

REGION

North America is projected to achieve the highest CAGR during the forecast period

North America is expected to have the highest CAGR growth in the green methanol market during the forecast period due to several key factors. Firstly, stringent environmental regulations and policies aimed at reducing greenhouse gas emissions are driving the demand for sustainable alternatives like green methanol. Secondly, significant investments in renewable energy infrastructure and advanced technologies support the production of green methanol. Thirdly, the presence of major industry players and ongoing research & development initiatives enhance market expansion. Additionally, government incentives and subsidies for green energy projects further encourage growth. The increasing awareness and commitment to sustainability across various sectors also contributes to the rising demand for green methanol in North America.

Green Methanol Market: COMPANY EVALUATION MATRIX

In the green methanol market matrix, Carbon Recycling International (Star) leads with a strong market share and extensive product footprint, driven by its green methanol solutions which is adopted by various applications. Mitsubishi Gas Chemical Company, Inc. (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Carbon Recycling International dominates through scale and diversified portfolio, Mitsubishi Gas Chemical Company, Inc.’s green methanol shows significant potential to move toward the leaders’ quadrant as demand for green methanol continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.95 BN |

| Market Forecast in 2030 | USD 11.18 BN |

| CAGR (2025–2030) | 34.0% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Kiloton) |

| Report Coverage | The report defines, segments, and projects the green methanol market size based on feedstock, derivative, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions they undertake in the market. |

| Segments Covered | • Feedstock (Biomass, Green Hydrogen, Carbon Capture & Storage) |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Green Methanol Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Shipping & Maritime Operators | • Benchmark lifecycle GHG reduction potential vs. LNG, ammonia, and conventional marine fuels. | • Quantify ROI from low-carbon fuel adoption. |

| Chemical & Refining Companies | • Feedstock sourcing analysis for CO2 and green hydrogen integration. | • Build sustainability advantage in downstream chemicals. |

| Automotive & Mobility OEMs | • Evaluate green methanol integration for hybrid fuel cells and internal combustion adaptation. | • Reduce well-to-wheel CO2 by up to 80%. |

| Power & Energy Developers | • Assess potential for green methanol as energy carrier for renewable power storage. | • Enable renewable integration and grid stability. |

| Industrial & Cement Players | • Co-processing study for CO2 capture and methanol synthesis integration. | • Achieve deep decarbonization with carbon circularity. |

RECENT DEVELOPMENTS

- February 2025 : Mitsubishi Gas Chemical Company Methanol Reformer S.L. and Element 1 Corp. signed a Memorandum of Understanding (MOU) to collaborate on developing and commercializing hydrogen solutions using methanol reforming technology, focusing on the design, manufacture, and sales of modular, mass-producible Methanol-to-Hydrogen generators.

- October 2024 : Carbon Recycling International entered into an agreement with Taoving Group to implement its methanol synthesis technology in a new large-scale E-methanol production facility in Lioyuen, China, further expanding its presence in the country.

- September 2024 : Methanex Corporation signed an agreement to acquire OCI Global’s International Methanol Business for USD 2.05 billion. This acquisition will strengthen Methanex’s position as a global methanol leader by increasing its capacity, enhancing feedstock access, and accelerating growth in the low-carbon methanol segment.

- May 2024 : SunGas Renewables Inc. partnered with C2X LLC to accelerate green methanol production in North America through technology, investment, and facility development.

Table of Contents

Methodology

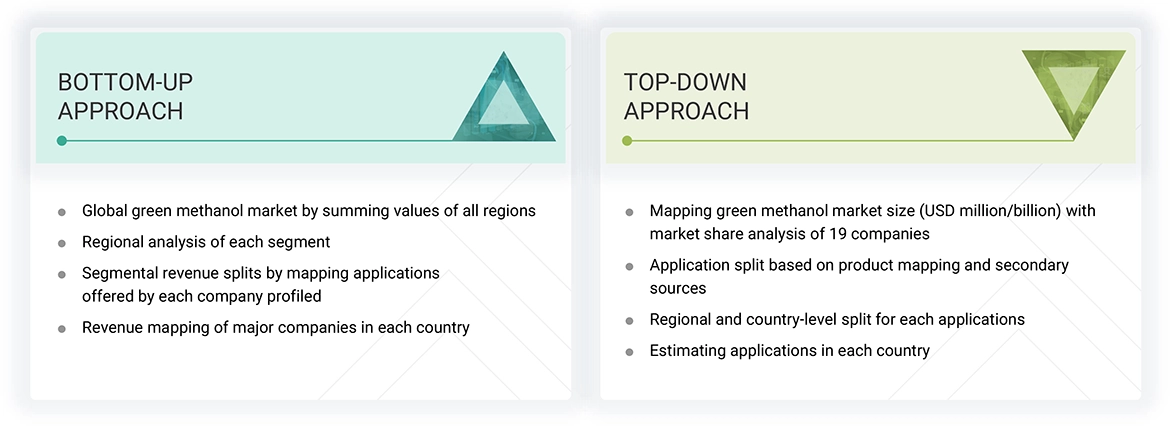

The study involved four major activities in estimating the current size of the green methanol market—exhaustive secondary research collected information on the market, peer markets, and parent markets. The subsequent steps involved confirming these findings, assumptions, and sizing with industry experts throughout the green methanol value chain through primary research. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Following this, the market segmentation and data triangulation methods were applied to determine the size of various segments and subsegments.

Secondary Research

For this research, secondary sources include annual reports, press releases, and presentations from companies, as well as white papers, certified publications, articles by reputable authors, and information from trusted websites. These sources were used to gather crucial details about the industry's supply chain, key players, market categories, segmentation based on industry trends down to regional markets, and significant developments from a market-focused viewpoint.

Primary Research

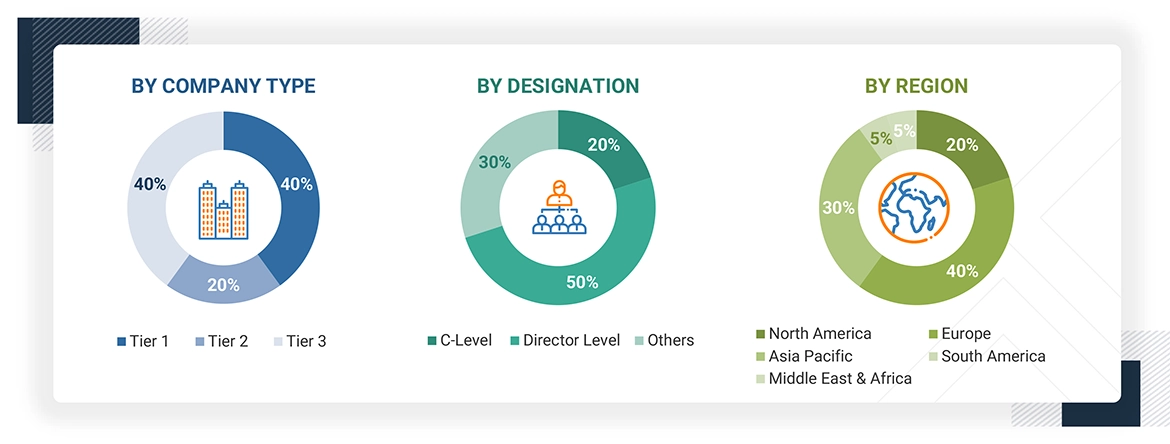

The green methanol market comprises several stakeholders, such as raw material suppliers, technology support providers, green methanol manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Key personnel from both sides of the market—supply and demand—were interviewed to gather detailed information. Supply-side primary sources included industry experts like CEOs, vice presidents, marketing and technology directors, and other key executives from companies in the green methanol market. On the demand side, it included directors, marketing leaders, and procurement managers from various industries sourcing green methanol. Below is a breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Two methods, top-down and bottom-up, were used to ascertain and confirm the overall size of the green methanol market. These methods were also used to estimate the size of different segments of the market. The approaches used to estimate the market size are given below.

Global Green Methanol Market: Bottom-up and Top-down Approach

The sections below outline how the total market size for this study was calculated.

- The main market participants were identified using secondary research methods.

- The market share across different regions was determined using a combination of primary and secondary research methods.

- The value chain and market size of the green methanol market, in terms of value and volume, were determined through primary and secondary research.

- All percentages, distributions, and divisions were calculated using secondary sources and confirmed through primary sources.

- This research study comprehensively considered all relevant market parameters, examining them in detail, validating them through primary research, and analyzing them to derive the final quantitative and qualitative data.

- The research involved analyzing the annual and financial reports of leading market players and conducting interviews with industry experts, including CEOs, VPs, directors, sales managers, and marketing executives, to gather significant quantitative and qualitative insights.

Data Triangulation

Once the overall market size was determined using the methods described earlier, the market was divided into multiple segments and subsegments. To complete the market engineering process, the data triangulation and market breakdown procedures were utilized to precisely calculate the statistics for each market segment and subsegment. Triangulation involved analyzing factors and trends from both, the demand and supply sides of the chemical sector.

Market Definition

According to the Methanol Institute, methanol (CH3OH) is a liquid chemical used in thousands of everyday products, including plastics, paints, cosmetics, and fuels. Liquid methanol is produced from synthesis gas, which consists of a blend of hydrogen, carbon dioxide, and carbon monoxide. These simple ingredients can be sourced from various feedstocks using different technological approaches.

Green or renewable methanol is an ultra-low-carbon chemical produced through sustainable processes. Green methanol can be categorized into two main types: bio-methanol and e-methanol, which are determined by the green feedstocks employed. Bio-methanol involves replacing traditional coal or natural gas feedstocks with biomass or biogas sources. At the same time, e-methanol is produced by combining green hydrogen with carbon dioxide from direct air carbon capture or biogenic sources.

Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of green methanol

- Traders, distributors, and suppliers

- Regulatory bodies and government agencies

- Research & development (R&D) institutions

- End-use industries

- Consulting firms, trade associations, and industry bodies

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the green methanol market size in terms of value and volume

- To offer comprehensive insights into the primary factors (such as drivers, restraints, challenges, and opportunities) impacting the market

- To analyze and forecast the global green methanol market based on feedstock, derivative, application, and region

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five regions: Asia Pacific, Europe, South America, Middle East & Africa, and North America, along with their respective key countries

- To monitor and assess competitive advancements, including acquisitions, partnerships, collaborations, agreements, and expansions within the market

- To strategically outline the key players and thoroughly evaluate their market position and primary capabilities

Key Questions Addressed by the Report

What is driving the green methanol market?

The global shift toward cleaner energy sources and the imperative to reduce carbon emissions are primary drivers in the green methanol market.

Which region is projected to show the highest CAGR in the green methanol market during the forecast period?

North America is expected to exhibit the highest CAGR during the forecast period.

What is the primary source of green methanol?

Biomass is a significant source of green methanol due to its abundant and renewable characteristics. Processes such as gasification and pyrolysis can convert biomass into methanol, providing a sustainable alternative to fossil fuels. The versatility and environmental benefits of biomass enhance its role in green methanol production, supporting the transition to cleaner energy sources.

Who are the major players in the green methanol market?

Key market players include Enerkem Inc. (Canada), Carbon Recycling International Inc. (Iceland), Methanex Corporation (Canada), Proman (Switzerland), and Södra (Sweden).

What is the expected CAGR for the green methanol market in terms of value from 2025 to 2030?

The market is anticipated to achieve a CAGR of 34.0% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Green Methanol Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Green Methanol Market