High-performance Additives Market

High-performance Additives Market By Product Type (Stabilizers, Fillers, Vulcanization Agents, Softeners, Resin), Function(Performance Additives, Processing Additives) End-Use Industry (Automotive, Medical) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The High-performance additives market size is projected to grow from USD 14.02 billion in 2024 to USD 20.11 billion by 2029, at a CAGR of 7.5%, during the forecast period. Technological advancements, regulatory needs, industrial expansion, and shifting expectations for material performance drive the demand for high-performance additives. Ongoing innovation within material science allows for the creation of additives that increase durability, strength, and functionality, making them critical to various applications. Regulation and industrial standards compel producers to use additives that enhance safety, efficiency, and compliance with changing regulations.

KEY TAKEAWAYS

-

BY TYPEThe high-performance additives market is broadly divided into performance additives and processing additives. Performance additives are used to enhance the end-use characteristics of materials, such as mechanical strength, UV resistance, and surface appearance. These include stabilizers, resins, and fillers that impart durability and improved performance to end products. Processing additives, on the other hand, are utilized during the manufacturing process to enhance flowability, elasticity, and dispersion. Softeners and vulcanization agents fall under this category, ensuring efficient processing and uniform product quality. The growing demand for materials that balance performance with manufacturability continues to drive innovation across both additive types.

-

BY PRODUCT TYPEBased on product, the market is segmented into Softeners, Vulcanization Agents, Resins, Stabilizers, Fillers, and Others. Softeners enhance flexibility and tactile comfort, making them essential in medical gloves and automotive seals. Vulcanization agents improve elasticity, tensile strength, and heat resistance in rubber compounds. Resins contribute to superior adhesion and chemical resistance, particularly in coatings and molded products. Stabilizers protect materials from degradation caused by heat, light, and oxygen, extending product lifespan. Fillers, such as silica and carbon black, reinforce strength and reduce material costs. The “Others” category includes specialized additives like antioxidants, anti-tack agents, and flame retardants tailored for specific performance needs.

-

BY END-USE INDUSTRYThe major end-use industries for high-performance additives include medical, automotive, and others. The medical industry utilizes these additives in surgical and examination gloves, emphasizing softness, strength, and sterilization stability. The automotive sector relies heavily on vulcanization agents, stabilizers, and fillers to produce durable tires, seals, and gaskets capable of withstanding harsh environments. The others category includes industrial, consumer goods, and electronics sectors that use these additives for improving surface finish, resistance, and overall product longevity. Growing health awareness and rising vehicle production are expected to be the major factors driving demand from these end-use sectors.

-

BY REGIONThe Asia Pacific region dominates the global high-performance additives market owing to the strong presence of major rubber and polymer manufacturing hubs in China, India, Japan, and South Korea. The region benefits from low-cost raw material availability, rapid industrialization, and a large customer base in automotive and healthcare industries. North America and Europe follow, driven by technological advancements, sustainable formulation development, and stringent product performance regulations. Meanwhile, the Middle East & Africa and Latin America are emerging markets with growing investments in automotive component manufacturing and healthcare infrastructure, boosting additive consumption.

-

COMPETITIVE LANDSCAPEThe competitive landscape of the high-performance additives market is characterized by strong participation from multinational chemical companies and specialized additive producers. BASF, Evonik Industries, Clariant, Lanxess, and Solvay are among the leading players with extensive product portfolios addressing both performance and processing needs. These companies emphasize sustainability, R&D innovation, and regulatory compliance to maintain competitive advantage. BASF and Evonik focus on developing bio-based and multifunctional additive solutions, while Clariant leverages its expertise in surface chemistry and polymer enhancement. Continuous innovation and the introduction of high-purity, eco-friendly additive formulations are shaping the future competitiveness of the market.

The growing demand for improved material performance has resulted in an escalating demand for high-performance additives. These chemical compounds of high specialization provide enhanced durability, strength, heat resistance, and functionality, and they are therefore crucial in demanding applications. They are used extensively across industries like medicine and automotive and assist in meeting stringent safety and performance specifications. Key drivers for the high-performance additives market are regulatory advancements, material science developments, and rising complexity of modern applications. Continued investments in research and development are also key factors driving their demand.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shifts in industrial demand patterns or regulatory changes have a direct ripple effect on the high performance additives industry. Variations in the consumption of plastics, coatings, or lubricants can significantly influence the purchasing behavior of high performance additives end-users, including automotive, construction, and aerospace manufacturers. Such fluctuations directly impact the revenues of high performance additives suppliers and affect the operational stability of producers integrated along the value chain. As the market increasingly depends on sustainable and eco-friendly additive grades, even minor disruptions in industrial production, environmental policies, or raw material availability can have substantial consequences across the high performance additives supply network.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Improved mechanical strength, wear resistance, thermal stability, and chemical resilience is enhancing the use of high-performance additives in demanding applications Stringent wastewater regulations

-

High-Performance Additives enhances Lightweighting and Material Efficiency in aircrafts and other heavy vehicles

Level

-

Face development and application complexities are complex areas

Level

-

Bio-Based and Sustainable Additives are driving Environmental Sustainability Without Compromising Performance efficacy

-

AI optimized additives enabling custom high performance material formulations act as an opportunity factor

Level

-

Ensuring High-performance while adopting sustainable and eco-friendly additive solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Optimizing rolling resistance for EVs to improve battery performance

The optimization of rolling resistance in electric vehicles (EVs) has become an important driver of battery efficiency, driving range, and overall vehicle performance and thus a major driver for the high-performance additives market. Rolling resistance is defined as the energy dissipated when a tire is moving over a surface, and it has a direct impact on the energy consumed by an EV. As EVs are powered by batteries alone, the lowering of rolling resistance can result in enormous efficiency gains, enabling cars to travel further on every charge. Performance additives are essential in the achievement of this through the improvement of tire formulations, reducing the level of friction, and increasing material durability without any loss of safety or handling performance.

Restraint: Face development and application complexities are complex areas

The production and application of high-performance additives come with immense complexities that hinder market growth. Creation of these additives entails advanced research, precise engineering, and extreme testing to ensure they function as desired without compromising material integrity. Achieving the right combination of properties, for instance, greater strength, thermal stability, chemical resistance, and compatibility with different base materials is another level of complexity. Moreover, the manufacturing processes for high-performance additives tend to be complex, the equipment used is specialized, and stringent quality control is required, resulting in increased production expense.

Opportunities: Bio-Based and Sustainable Additives are driving Environmental Sustainability Without Compromising Performance efficacy

The increasing need for eco-friendly options has presented a major opportunity for the growth of bio-based and sustainable additives within the high-performance additives market. With industries and governments driving towards more stringent environmental regulations and sustainability programs, companies are turning toward greener products that minimize the impact on the environment without decreasing performance. Sustainable and bio-based additives, made from renewable materials like plant-based polymers, natural oils, and biodegradable chemicals, provide a promising alternative to replace conventional petrochemical-based additives. These bio-based additives improve material properties like durability, thermal stability, and chemical resistance while being in sync with global sustainability objectives, and hence they are a preferred option for numerous applications.

Challenges: Ensuring High-performance while adopting sustainable and eco-friendly additive solutions

Maintaining high performance while embracing green and sustainable additive solutions is the biggest challenge the high-performance additives industry faces. Historically, most high-performance additives have come from petrochemical sources based on their improved functionality, durability, and value for money. The increasing momentum toward sustainability, coupled with tough environmental regulations, has forced industry players to switch to bio-based, non-hazardous, and biodegradable alternatives. Although this transition follows global sustainability imperatives, it poses a few technical, economic, and legislative challenges that render market growth problematic.

high-performance-additives-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use as additives in petroleum refining for enhancing fuel performance in high-octane gasoline production | Efficient and economical production of high-quality fuel / Recyclable additives / Improved refinery yields |

|

Production of high performance additives for plastics, coatings, and lubricants in various industrial applications | Exceptional durability and thermal stability / Non-stick and chemically inert properties / Versatile use in automotive, aerospace, and industrial sectors |

|

Application in advanced manufacturing processes for semiconductors | Precise enhancement of material properties / Ensures high-purity surfaces / Supports advanced electronics production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of the High-performance additives market. The profiled companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. The value of ecosystem analysis in the High-performance additives market is its ability to uncover essential relationships among key stakeholders. It identifies the variables driving technological innovation, regulatory pressures, and market demand. By understanding these relationships, businesses can identify opportunities for innovation, optimize supply chains, and align with market trends to gain a competitive advantage.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High-Performance additives market, By Type

Stabilizers dominate the market in terms of size for high-performance additives because of their vital contribution towards improving the durability, processability, and long-term stability of materials across multiple applications. They play a very important role in the prevention of material degradation owing to heat, oxidation, UV light, and mechanical stress to ensure end products retain performance and lifespan in tough environmental conditions. Polymer processing is the most demanding industry for stabilizers, which find application in protecting against discoloration, brittleness, and loss of mechanical properties in manufacturing and in the life of the product.

High-Performance additives market, By produc type

Performance additives hold the largest segment in the market for high-performance additives due mainly to their key function of enhancing the physical, mechanical, and chemical properties of materials, thus resulting in improved functionality and durability. In contrast to processing additives, which support manufacturing processes predominantly through flowability, mold release, or dispersion, performance additives directly affect the end-use properties of the finished product, making them indispensable in those sectors calling for quality, long-lasting materials. One of the prime reasons for the dominance of performance additives is that they are capable of modifying vital material characteristics such as strength, thermal stability, chemical resistance, impact resistance, and weatherability.

High-Performance additives market, By end-use industry

The automotive end-use segment accounts for the largest share in the market of high-performance additives owing to the widespread usage of these additives in tires, followed by fuel and seals and gaskets. Tires are a vital element in vehicles, and companies use high-performance additives to improve durability, traction, and fuel economy. Additives like silica, carbon black, and antidegradants enhance tire strength, rolling resistance, and weather resistance, making them more efficient and durable. As fuel-efficient and high-performance vehicles gain popularity, tire makers are always investing in the latest additive technologies to maximize performance and sustainability. High-performance additives also contribute significantly to fuel formulations, which increase combustion efficiency, lower emissions, and inhibit engine deposits.

REGION

Asia Pacific to be fastest-growing region in global Anhydrous hydrofluoric acid market during forecast period

The Asia Pacific region holds the leading position in the global high-performance additives market, supported by the presence of major rubber and polymer manufacturing hubs across China, India, Japan, and South Korea. The region’s dominance is driven by abundant raw material availability, rapid industrial expansion, and a strong consumer base in both the automotive and healthcare sectors. North America and Europe trail closely, fueled by ongoing technological advancements, sustainable formulation initiatives, and stringent performance standards. In contrast, the Middle East & Africa and Latin America are emerging as promising markets, backed by increasing investments in automotive production and healthcare infrastructure, which are contributing to the growing demand for high-performance additives.

high-performance-additives-market: COMPANY EVALUATION MATRIX

Paragraph Content: In the high performance additives market matrix, BASF SE (Star) leads with a dominant market share and a strong global footprint, supported by its extensive range of additives widely used in plastics, coatings, and lubricants production. Arkema (Emerging leaders) leverages its advanced processing technologies and consistent product innovation to strengthen its competitive positioning, particularly in North America and Europe. Meanwhile, Synthomer PLC (Participants) is expanding visibility through its diversified specialty chemicals portfolio, emphasizing additives applications in automotive and aerospace industries. While BASF E maintains leadership through scale and technological depth, Arkema and Synthomer PLC demonstrate rising potential to capture greater market share as demand for high-performance, sustainable industrial solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 14.0 Billion |

| Revenue Forecast in 2030 | USD 20.1 Billion |

| Growth Rate | CAGR of 7.5% from 2025–2030 |

| Actual data | 2021–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: high-performance-additives-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | In-depth analysis of high performance additives demand and supply key regions, including the United States, China, Japan, Germany, and India; report includes production trends, import/export flows, and regulatory frameworks. | Helps stakeholders identify high-growth national markets, plan accurate entry strategies, and forecast demand with better precision. |

| Application-Specific Deep Dive | Customized analysis of high performance additives applications with detailed sub-segmentation: Plastics (e.g., automotive components), Coatings (e.g., aerospace finishes), and Lubricants (e.g., industrial machinery); includes industry-specific insights. | Supports clients in targeting niche applications, optimizing R&D investments, and building specialized product portfolios for diverse industries. |

| Form /Type Customization | Comparative analysis of high performance additives available in different purity levels (e.g., technical-grade, high-purity) and forms (e.g., powder, liquid); covers performance benchmarks such as compatibility, stability, and shelf life across industrial uses. | Enables manufacturers and buyers to optimize selection based on performance, cost, and suitability, while unlocking opportunities in high-purity and premium-grade applications. |

| Competitive Benchmarking | Extended profiling of global and regional players such as Solvay Chemicals, Honeywell, and Daikin Industries; includes SWOT analysis, product positioning, pricing, and innovation pipelines. | Provides clients with a clear competitive landscape, helping them identify positioning opportunities, potential partners, and strategies for market entry or acquisitions. |

RECENT DEVELOPMENTS

- February 2025 : LANXESS has launched Vulkanox HS Scopeblue, a novel rubber additive for increasing the sustainability and lifespan of tires. This new antidegradant consists of 55% sustainable raw materials and is a sustainable alternative to the tried-and-tested antioxidant Vulkanox HS (TMQ). Through its production with biocircular acetone and green power, the carbon footprint of Vulkanox HS Scopeblue is over 30% lower than that of conventional products.

- January 2025 : Solvay and Hankook formed a strategic alliance by signing a Memorandum of Understanding (MoU) to create circular silica from waste and biosourced materials for tire production. The partnership combines Solvay's silica expertise and sustainability focus with Hankook's cutting-edge manufacturing capabilities and robust market presence.

- January 2024 : BASF launched the new generation of its Keropur gasoline additive bottle in Taiwan's automotive aftermarket. This new formula is specifically tailored to address the technical requirements of contemporary direct injection spark ignition (DISI) combustion engines while still offering superior performance on traditional port fuel injection (PFI) engines.

- November 2022 : Evonik Industries AG entered into a partnership with Biesterfeld Performance Rubber GmbH to drive the distribution of its premium rubber additive VESTENAMER in the EMEA region (excluding Italy). The alliance seeks to facilitate a responsive and stable value chain, enhancing the availability of products in major industrial markets like the rubber recycling sector.

- November 2022 : Evonik Industries AG joined forces with Biesterfeld Performance Rubber GmbH to expand the distribution of its high-performance rubber additive VESTENAMER throughout the EMEA region (Italy excluded). This partnership is to provide a flexible and secure supply chain, increasing product availability in strategic industrial markets like rubber recycling.

Table of Contents

Methodology

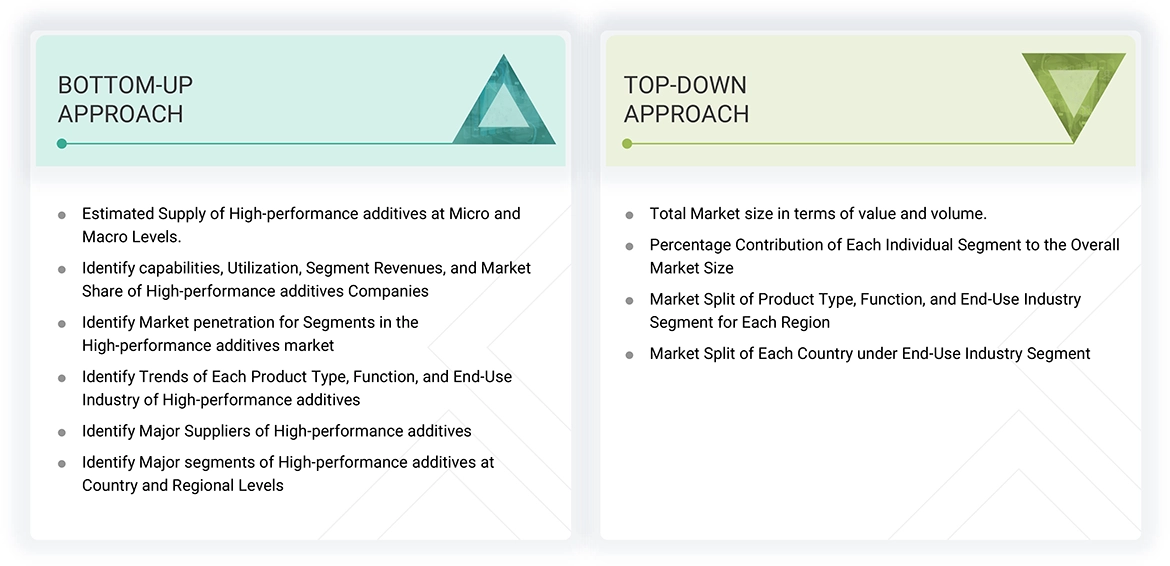

The study involved four major activities in estimating the market size of the High-performance additives market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key high-performance additives, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The High-performance additives market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the High-performance additives market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the High-performance additives industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of high-performance additives and future outlook of their business which will affect the overall market.

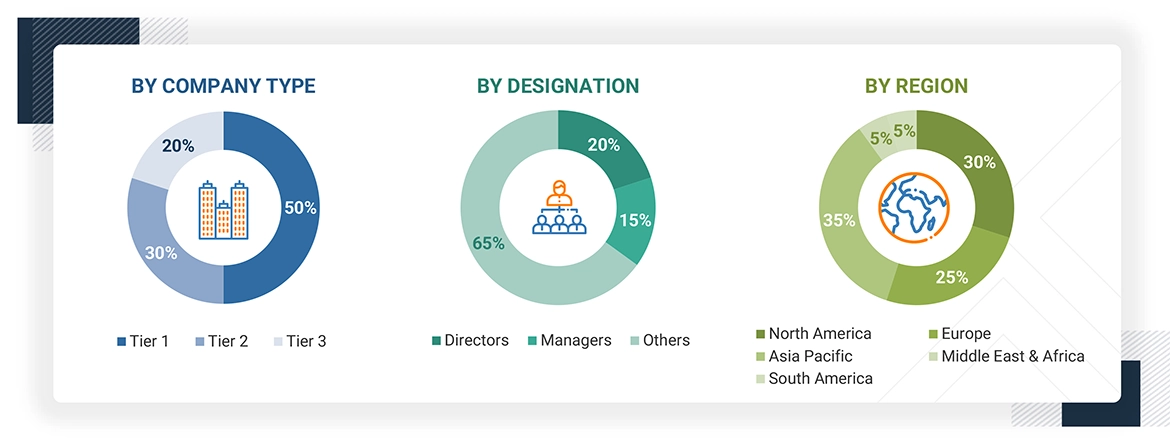

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for High-performance additives for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on product type, function, end-use industry, and regions were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

High-Performance Additives Market: Bottum-Up and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process High-performance additives above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

High-performance additives are specialty chemical compounds designed to improve materials' properties for a wide variety of industries ranging from automotive to medical, construction, and electronic. The high-performance additives find applications in providing durability, flexural strength, thermal stability, and resistance against environmental stresses including UV radiation, oxidation, and high- and low-temperature conditions. Advances in the field of polymer science and materials engineering have compelled the need for advanced additives facilitating superior performance in harsh conditions. Manufacturers are interested in creating formulations that provide greater efficiency, lower energy usage, and better processing ability. Stringent regulations and growing requirements for material performance also drive the industry towards superior additive technologies.

Stakeholders

- High-performance additives Manufacturers

- High-performance additives Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the High-performance additives market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on product type, function, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent development such as product launch, partnership, acquisition, and expansion in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High-performance Additives Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in High-performance Additives Market