Centrifugal High-Speed Separators Market

Centrifugal High-Speed Separators Market By Type (Disc-stack Centrifuges, Decanter Centrifuges, Tubular Centrifuges, Basket Centrifuges, Solid-bowl Centrifuges), By Capacity (Small Capacity (3,000–10,000 L/Hour), Medium Capacity (10,000–30,000 L/Hour), Large Capacity (> 30,000 L/Hour)), By Application (Dairy Processing, Beverage Clarification, Edible Oil Refining, Plant-based Protein Processing, Brewing And Fermentation), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The centrifugal high-speed separators market is growing steadily, supported by rising demand for efficient, hygienic, and high-throughput separation technologies across dairy, beverage, and plant-based processing industries. Expanding global dairy production driven by higher consumption of milk, cream, yogurt, cheese, and value-added ingredients continues to push processors toward separators that ensure precise cream extraction, effective clarification, and continuous operation with minimal downtime. At the same time, the rapid expansion of plant-based beverages such as oat, almond, and soy drinks has intensified the need for advanced solid–liquid separation systems capable of handling fiber-rich formulations while maintaining consistency and product stability. Increasing consumer preference for clean-label, minimally processed foods further drives adoption, as centrifugal separators support longer shelf life, contamination control, and improved product purity. Regulatory bodies like the FDA and USDA enforce strict hygiene and safety standards, compelling food & beverage manufacturers to upgrade to modern centrifuges equipped with CIP functionality, automation, and traceable quality control. Technological advancements including smart sensors, predictive maintenance, variable-speed drives, and energy-efficient designs enhance performance while lowering operational costs, aligning well with sustainability targets and government incentives promoting eco-efficient processing. Additionally, the booming ready-to-drink (RTD) beverage market encompassing juices, functional drinks, cold brews, and nutritional beverages requires continuous, high-capacity separation lines, making high-speed centrifugal systems indispensable for ensuring clarity, microbial stability, and uniformity. Together, these factors are propelling strong growth in the global centrifugal high-speed separators market.

KEY TAKEAWAYS

-

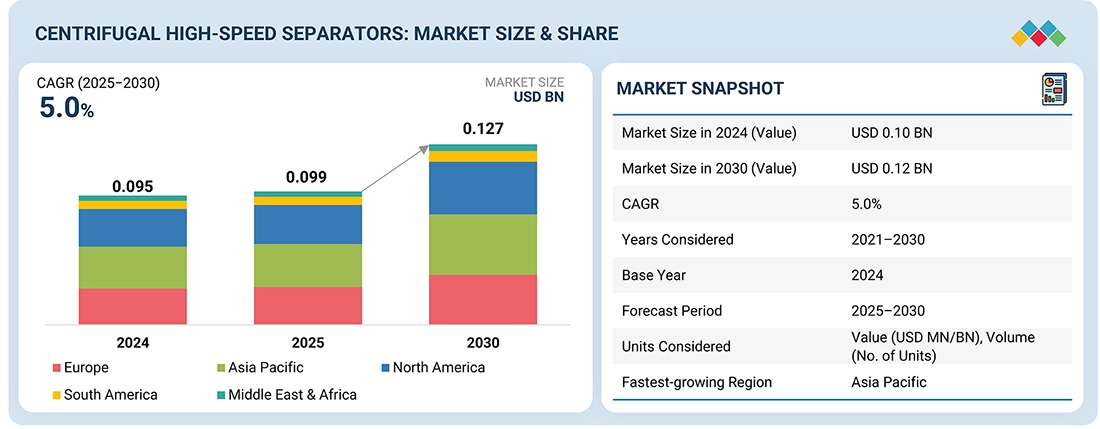

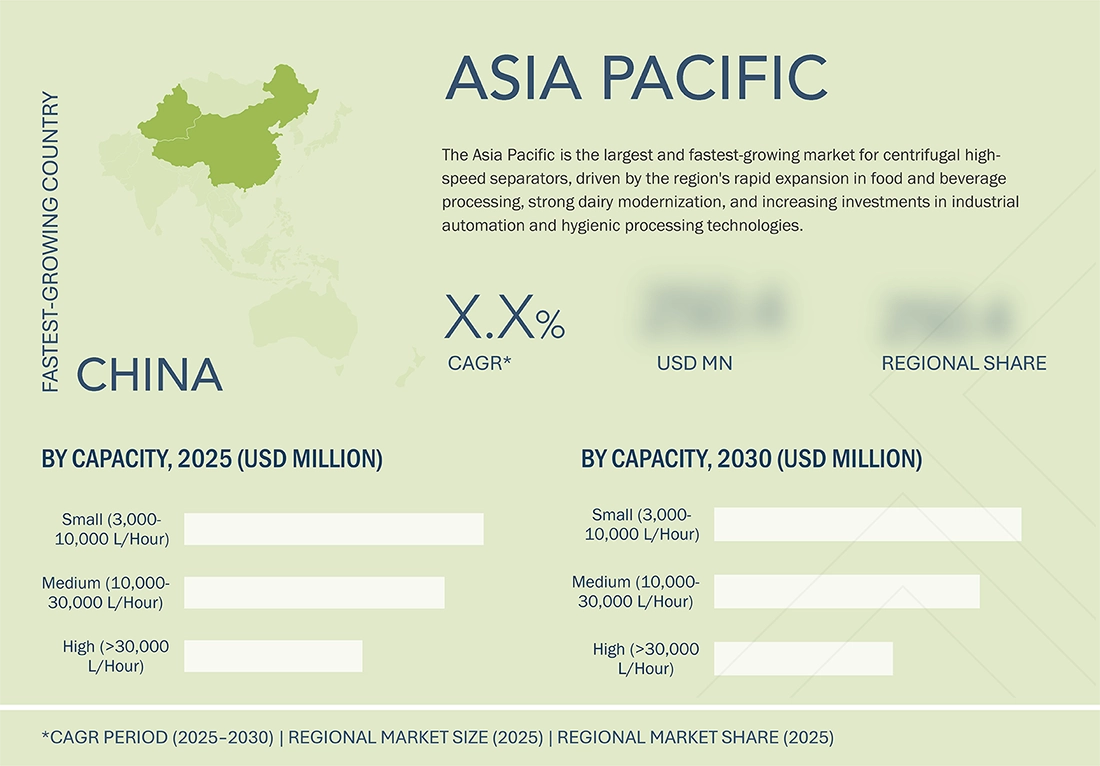

BY REGIONThe Asia Pacific regional market accounted for a share of 32.2% of the global centrifugal high-speed separators market.

-

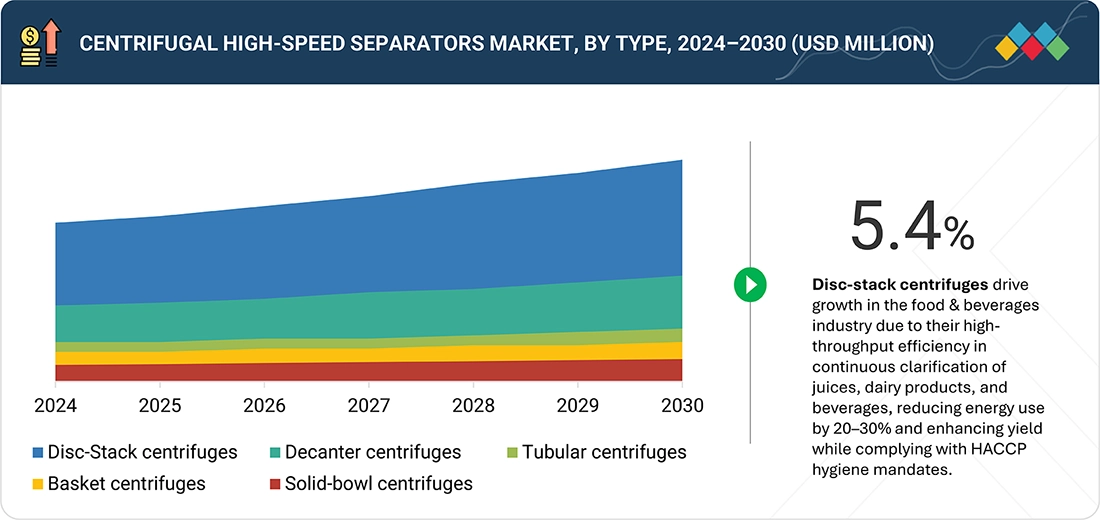

BY TYPEBy type, disc-stack centrifuges is expected to register the highest CAGR of 5.4% during the forecast period.

-

BY CAPACITYBy capacity, the small capacity (3,000–10,000 L/hour) segment is estimated to be the fastest-growing during the forecast period.

-

BY APPLICATIONBy application, dairy processing is expected to dominate the market.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSAlfa Laval, GEA Group Aktiengesellschaft, and IHI Rotating Machinery Engineering Co., Ltd. were identified as some star players in the centrifugal high-speed separators market (global), given their strong market share and product footprint

-

COMPETITIVE LANDSCAPE- STARTUPS/SMEsHAUS Centrifuge Technologies, PIERALISI MAIP SPA, and ANDREAS HETTICH GMBH, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as progressive companies

The centrifugal high-speed separators market is expanding steadily, driven by rising dairy processing volumes, growth in plant-based beverages, and increasing demand for hygienic, efficient separation technologies in the food & beverage industries. These separators enable high-throughput clarification, cream separation, and microbial reduction, supporting cleaner labels and better product quality. Strict FDA and USDA regulations are prompting manufacturers to upgrade to advanced, automated, and CIP-enabled systems to meet safety and hygiene standards. Additionally, the surge in ready-to-drink (RTD) beverages and ongoing sustainability efforts, including energy-efficient designs and government incentives, are accelerating the adoption of these products. Together, these factors position the market for continued, technology-driven growth.

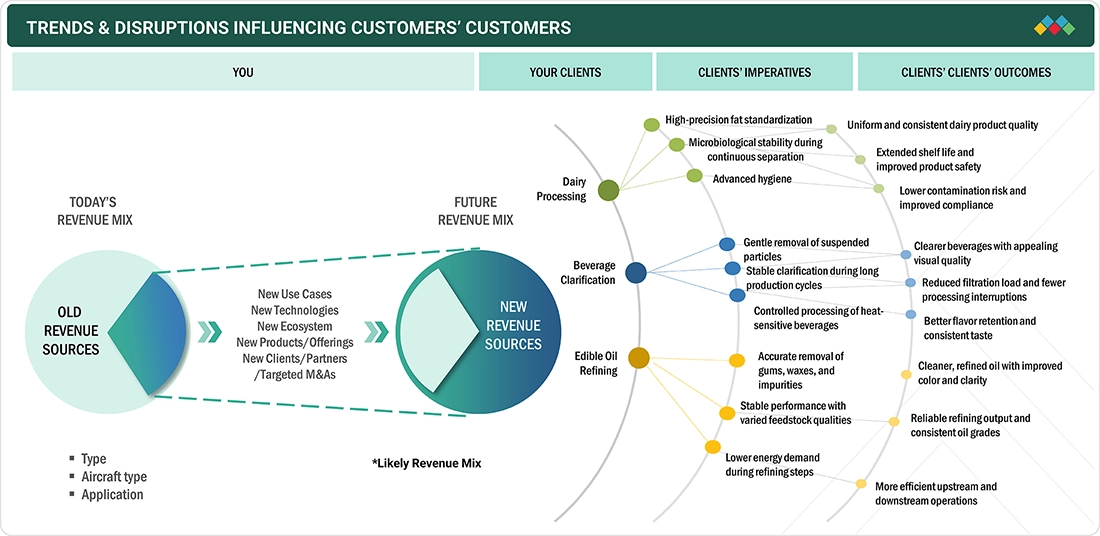

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The centrifugal high-speed separators market is undergoing significant transformation driven by technological advancements, shifting consumer expectations, and evolving regulatory pressures. A major trend shaping the market is the rapid adoption of automation and smart manufacturing solutions. Modern separators now integrate IoT-enabled monitoring, predictive maintenance, and AI-based control systems that optimize bowl speed, reduce energy consumption, and minimize downtime which are crucial for high-volume dairy, beverage, and plant-based processing. Sustainability is another key disruptor, with manufacturers designing energy-efficient motors, friction-reduction systems, and water-saving CIP technologies to meet decarbonization goals and qualify for government incentives. The surge in plant-based beverages and functional RTD drinks is also reshaping separator design, demanding equipment capable of handling diverse viscosities, fine particulates, and complex emulsions without compromising yield or clarity. At the same time, stringent FDA, USDA, and global food safety regulations are accelerating the shift toward hygienic, fully enclosed, and contamination-resistant separator systems. Industry consolidation, where larger players acquire smaller processing plants, further drives the need for standardized, interoperable separation equipment across facilities. Disruptions also stem from material innovations such as corrosion-resistant alloys and advanced coatings that reduce fouling and extend performance life. Collectively, these trends are redefining efficiency, sustainability, and operational precision in the centrifugal high-speed separators market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing dairy production and processing volumes

-

Rising production of plant-based beverages requiring solid–liquid separation technologies

Level

-

High capital and maintenance costs

Level

-

Rising government incentives for sustainable food automation

-

High growth in RTD beverages creates demand for continuous, high-throughput separation systems

Level

-

Minimizing energy consumption of high-speed systems without compromising separation efficiency

-

Minimizing downtime during cleaning and servicing in fast-moving production environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing dairy production and processing volumes

A key driver for the centrifugal high-speed separators market is the rapid expansion of dairy processing volumes across global and regional markets. As demand for milk, cream, cheese, yogurt, and specialized dairy ingredients increases, processors rely heavily on advanced separation technologies to improve efficiency, maintain hygiene standards, and maximize product yield. High-speed separators enable faster cream extraction, more efficient clarification, and improved consistency—capabilities essential for maintaining throughput in large-scale facilities. Additionally, the surge in value-added dairy exports and investments in modernized processing lines further boosts the adoption of centrifugal separators. Their ability to operate continuously, handle high solids loading, and deliver precise separation performance positions them as indispensable equipment in meeting rising production demands without compromising product quality or safety.

Restraint: High capital and maintenance costs

High capital and maintenance costs represent one of the most significant restraints to widespread adoption of centrifugal high-speed separators. These machines require advanced engineering, precision components, and durable materials that can withstand extreme rotational forces, making them expensive to purchase and install. Furthermore, maintenance can be costly due to the need for specialized technicians, frequent cleaning cycles, and replacement of wear-prone parts such as bowl seals, discs, and bearings. For small and medium-sized processors, especially in dairy, juice, and craft beverage segments, these upfront and recurring costs become a major financial barrier. The challenge is amplified in operations where margins are thin, limiting their ability to invest in high-performance separators even when operational efficiency gains would be beneficial. This cost sensitivity slows market penetration in emerging and cost-constrained sectors.

Opportunity: Rising government incentives for sustainable food automation create strong opportunities.

A major opportunity for the centrifugal high-speed separators market lies in the growing availability of government incentives aimed at promoting sustainable food processing and automation. Across many regions, food and beverage processors can access tax credits, subsidies, and funding programs to adopt energy-efficient machinery and modernize outdated equipment. These incentives reduce the financial burden of upgrading to advanced centrifugal separators, which offer lower energy consumption, improved waste management, and enhanced product safety. As policymakers push for greener manufacturing practices, demand for separators with features such as optimized power usage, CIP integration, water recycling, and reduced environmental footprint is expected to accelerate. This creates strong growth potential for equipment manufacturers offering automation-ready, eco-efficient, and compliance-friendly separation technologies tailored to evolving regulatory and sustainability frameworks.

Challenge: Minimizing energy consumption of high-speed systems without compromising separation efficiency

A core challenge in the centrifugal separators market is reducing energy consumption while maintaining optimal separation efficiency. High-speed separators operate at extremely high rotational speeds, often 5,000–10,000 RPM or more, which inherently demands significant energy input. As processors face rising energy costs and sustainability pressures, improving efficiency becomes critical. However, lowering power consumption without sacrificing throughput, separation precision, or solids handling capacity is technologically complex. Manufacturers must balance aerodynamic design, bowl geometry, motor optimization, and friction reduction to achieve desired results. At the same time, processors expect continuous, high-capacity operation, making it difficult to implement energy-saving modes without impacting productivity. This challenge drives ongoing R&D in smart controls, variable-speed drives, lightweight materials, and innovative bowl designs.

High-Speed Separators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of advanced centrifugal separators for dairy applications, including milk clarification, cream separation, whey processing, and bacteria removal | Superior product purity, reduced microbial load, improved yield, enhanced hygiene, and compliance with FDA/USDA food safety standards |

|

Integration of high-speed separators into beverage processing lines for juice clarification, beer polishing, wine stabilization, and removal of solids in RTD beverages | Continuous high-throughput operation, higher clarity and stability, reduced downtime, and optimized production efficiency for large beverage manufacturers |

|

Deployment of automated separators with CIP systems, IoT-enabled monitoring, and energy-efficient bowl designs for food and industrial bioprocessing | Lower operational costs, predictive maintenance, minimized cleaning time, better energy performance, and improved overall equipment effectiveness (OEE) |

|

Manufacturing of solid–liquid and liquid–liquid separators for plant-based beverages, fermentation processes, edible oils, and pharmaceutical ingredients | Uniform texture and product consistency, high extraction yields, adaptability to viscous and fiber-rich feeds, and enhanced sustainability due to reduced waste |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem for centrifugal high-speed separators is shaped by a well-structured network of raw material suppliers, component manufacturers, separator OEMs, distributors, system integrators, and end-use industries. At the base are suppliers providing stainless steel, precision bearings, motors, control electronics, and automation components essential for high-speed operation. OEMs such as specialized separator manufacturers design and assemble machines with advanced features like optimized bowl geometry, variable frequency drives, and automated discharge systems. Distributors and channel partners enable regional reach, after-sales service, and maintenance support, while system integrators incorporate separators into broader industrial processing lines. The end-use landscape spans food & beverage, dairy, pharmaceuticals, biotechnology, chemicals, marine, and oil & gas, each requiring high throughput, hygiene, and reliability. The ecosystem also includes regulatory bodies that ensure compliance with sanitary, safety, and emission standards, as well as technology providers offering IoT, monitoring, and predictive maintenance solutions. Overall, the market ecosystem is interconnected, innovation-driven, quality-intensive, and heavily reliant on strong service infrastructure.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Centrifugal High-Speed Separators Market, by Type

Disc-stack centrifuges hold the largest market share in the centrifugal high-speed separators market primarily due to their unmatched efficiency, versatility, and ability to handle complex separation tasks across key end-use industries. Their unique bowl design, featuring multiple conical discs, creates a significantly larger settling area, enabling the rapid separation of fine particles and immiscible liquids at high throughput. This makes them ideal for high-demand sectors such as dairy, food & beverage, pharmaceuticals, biotech, and chemicals, where consistent clarity, hygiene, and reliability are critical. Disc-stack systems also support continuous operation, reduced downtime, and automated solids discharge, improving process efficiency and lowering operational costs. Their compact footprint, high g-force capability, and adaptability to varying feed conditions further strengthen their dominance. Additionally, regulatory-driven demand for higher purity levels in the life sciences and food processing industries has intensified the adoption of disc-stack technology, which inherently supports sanitary designs and CIP/SIP compatibility. The extensive availability of configurations like clarifiers, purifiers, and concentrators ensures they meet diverse industry needs better than alternative separator types, such as tubular bowl or decanter centrifuges. Collectively, these technical and operational advantages position disc-stack centrifuges as the most preferred and commercially successful separator type in the global market.

Centrifugal High-Speed Separators Market, by Capacity

Small-capacity centrifugal high-speed separators in the 3,000–10,000 L/hour range hold the largest market share because they perfectly align with the operational needs of the majority of end-use industries, particularly dairy, food & beverage, brewing, pharmaceuticals, and biotech, where medium-scale, high-frequency batch processing is the norm. These industries prioritize flexibility, ease of integration, and lower capital expenditure, advantages that small-capacity units deliver more effectively than larger systems. Their compact design supports installation in space-constrained facilities, allowing manufacturers to scale production gradually without committing to oversized, high-maintenance equipment. Additionally, the rise of craft breweries, specialty food processors, small and mid-sized dairy plants, and decentralized pharmaceutical manufacturing has created strong demand for separators that offer high separation efficiency at moderate flow rates. Small-capacity units also provide faster cleaning cycles, lower power consumption, shorter changeover times, and easier maintenance, making them more cost-efficient for daily operations. Regulatory pressure for improved hygiene and product purity further accelerates their adoption, as these systems can meet stringent standards while maintaining high throughput within manageable volumes. Their versatility in clarifying, purifying, and concentrating a wide variety of feedstocks makes them the default choice for operators seeking performance, affordability, and reliability, ultimately driving their dominance in the global market.

Centrifugal High-Speed Separators Market, by Application

Dairy processing is the largest application segment for the centrifugal high-speed separators market because the industry relies heavily on separation technology as a core, non-negotiable step in almost every stage of production, including milk clarification, cream separation, standardization, whey processing, and bacterial removal. High-speed separators enable precise fat separation, consistent product quality, and high hygiene standards, which are critical in dairy, where even minor impurities or inconsistencies can directly affect shelf life, safety, and taste. With global dairy demand rising for products such as milk, cheese, butter, yogurt, and infant formula, processors are increasingly relying on efficient separation systems to handle large volumes while maintaining compliance with stringent food safety regulations. Centrifugal separators also allow dairy plants to optimize yield by maximizing cream recovery and improving downstream processing efficiency. Their ability to operate continuously, achieve high throughput, and reduce microbial load makes them indispensable for both large industrial dairies and fast-growing mid-scale processors. Additionally, technological advancements such as hermetic designs, self-cleaning features, and energy-efficient drives further boost adoption. Since no alternative technology matches the speed, precision, and cost-effectiveness of centrifugal separation for dairy applications, the segment naturally dominates the market and continues to drive consistent demand globally.

REGION

Asia Pacific to be the fastest-growing region in the global centrifugal high-speed separators market during the forecast period

The Asia Pacific is the largest and fastest-growing market for centrifugal high-speed separators, driven by the rapidly expanding food and beverage processing industry, which is fueled by a rising population, urbanization, and shifting dietary preferences toward packaged, high-quality dairy, beverage, and plant-based products. Countries such as China, India, Japan, and Southeast Asian nations are witnessing strong growth in milk production, large-scale dairy modernization, and increasing consumption of value-added products like yogurt, cheese, and functional beverages, all of which require advanced separation technology for efficiency, hygiene, and consistency. The region’s booming ready-to-drink (RTD) beverage sector, including juices, teas, nutritional drinks, and fermented beverages, further accelerates the need for continuous, high-throughput clarification systems. Government initiatives promoting food safety, automation, and technology upgrading are encouraging processors to invest in modern centrifugal separators with CIP, energy-efficient designs, and higher separation precision. Additionally, Asia Pacific hosts a large base of small and medium-scale food processors that benefit from compact and flexible separator systems, expanding the market further. Rapid industrial growth in biotechnology, pharmaceuticals, chemicals, and edible oils also contributes significantly, as these industries rely on centrifugal separation for purification and refinement. Strong manufacturing capabilities, growing capital investments, and increasing adoption of Western-style processing standards collectively position Asia Pacific as the dominant and fastest-growing regional market.

High-Speed Separators Market: COMPANY EVALUATION MATRIX

In the centrifugal high-speed separators market matrix, ALFA LAVAL (Star) maintains a dominant position driven by its long-standing expertise in separation technology, extensive global footprint, and continuous innovation in energy-efficient, automated disc-stack separator systems. The company’s solutions are deeply integrated across dairy processing, beverages, pharmaceuticals, marine, and industrial applications, enabling high throughput, superior clarification efficiency, and compliance with stringent safety and hygiene standards. Flottweg SE (Emerging Leader) is rapidly strengthening its competitive position by leveraging its engineering excellence, advanced bowl design technologies, and expanding manufacturing capabilities, particularly to meet rising demand from food processing, biotech, and environmental applications worldwide. Meanwhile, several regional and mid-tier manufacturers are expanding their portfolios to focus on modular, low-maintenance separators tailored for small and medium-sized plants seeking cost-effective and reliable clarification. While ALFA LAVAL sustains its leadership through technological depth, strong service networks, and a broad portfolio addressing both high-capacity and specialized applications, Flottweg SE demonstrates an increasing potential to capture a significant market share. Its emphasis on precision engineering, high separation efficiency, and robust after-sales support positions it strongly as industries accelerate adoption of automated, hygienic, and sustainable separation solutions across dairy, beverages, chemicals, marine, and wastewater treatment applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ALFA LAVAL (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- Mitsubishi Kakoki Kaisha, Ltd. (Japan)

- TOMOE Engineering Co., Ltd. (Japan)

- Tetra Pak International S.A. (Sweden)

- IHI Rotating Machinery Engineering Co., Ltd. (Japan)

- Ferrum AG (Switzerland)

- ANDRITZ (Austria)

- SPX FLOW, Inc. (US)

- Flottweg SE (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.10 Billion |

| Market Size in 2030 (Value) | USD 0.12 Billion |

| Growth Rate | CAGR of 5.0% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (No. of Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

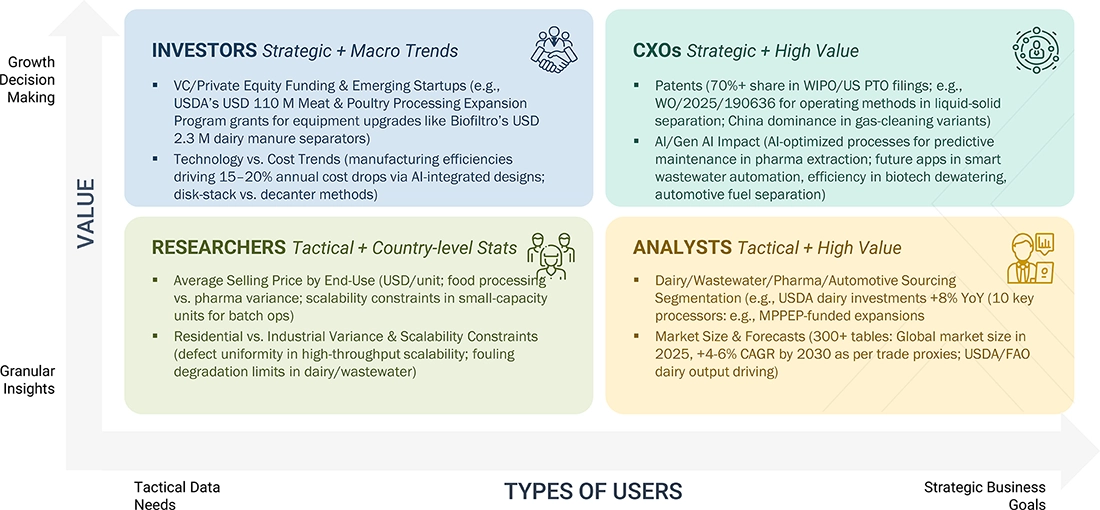

WHAT IS IN IT FOR YOU: High-Speed Separators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Breakdown |

|

Helps clients identify high-potential countries for equipment sales, understand regulatory impacts on separator demand, evaluate modernization needs in food & beverage plants, and design region-specific expansion or partnership strategies |

| Application-specific Deep Dive |

|

Enables stakeholders to target fast-growing processing segments, optimize product portfolios (disc-stack vs. decanter), and support R&D for application-specific innovations such as CIP systems, energy-saving drives, high-solids handling, and microbial safety compliance |

| Capacity Customization |

|

|

RECENT DEVELOPMENTS

- Septmber 2025 : GEA introduced the GSI 260 skid, a new-generation separator for the beverage industry, designed for higher yield and lower resource consumption. Featuring a direct drive, modular design, and integrated Water Saving Unit, the compact plug-and-play system minimizes freshwater and energy use while enabling quick installation.

- June 2025 : In collaboration with ScaleUp Bio, ALFA LAVAL is supporting Singapore’s “30 by 30” food security initiative by supplying advanced high-speed separation and membrane technologies for precision fermentation facilities in Tuas. The project includes Alfa Laval’s Pureferm 250 high-speed separator and MBPX404 separation system, designed to enhance energy efficiency and processing flexibility.

- October 2024 : Tomoe Engineering Co., Ltd. has acquired a new industrial site in Ayase-shi, Kanagawa, to construct a factory dedicated to manufacturing large-size centrifuges, driven by rising overseas demand. Tomoe Machinery Co., Ltd., a wholly owned subsidiary specializing in sheet metal and welding fabrication for centrifuges, will relocate to this new site. The full factory completion is targeted for March 2027.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the centrifugal high-speed separators market. Exhaustive secondary research was conducted to gather information on the market, its peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key centrifugal high-speed separators, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The centrifugal high-speed separators market comprises several stakeholders in the value chain, including raw material suppliers, manufacturers, and end-users. Various primary sources from the supply and demand sides of the centrifugal high-speed separators market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the centrifugal high-speed separators industry.

Primary interviews were conducted to gather insights, including market statistics, revenue data collected from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, capacity, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on suppliers, products, component providers, and their current usage of centrifugal high-speed separators, as well as their future outlook for their business, which will impact the overall market.

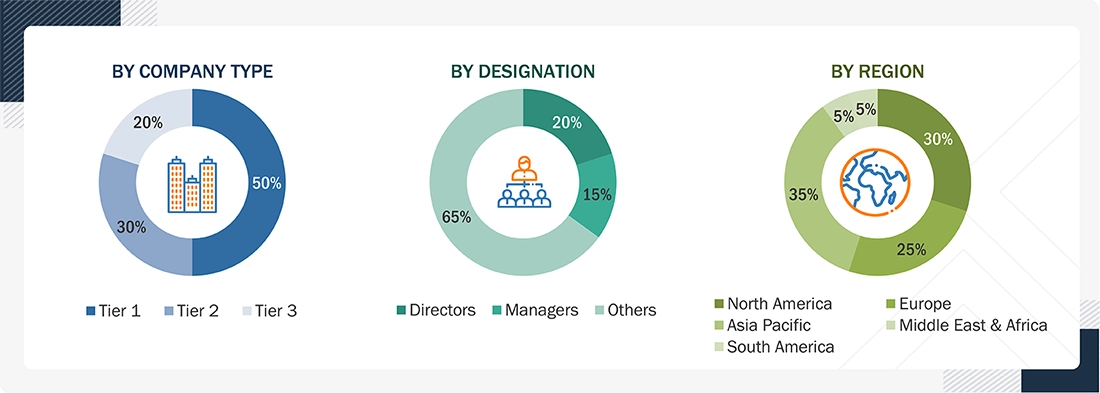

The breakdown of profiles of the primary interviewees is illustrated in the figure below.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for centrifugal high-speed separators for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, capacity, application, and regions were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis, and presented in this report.

Data Triangulation

After determining the total market size of centrifugal high-speed separators through the estimation process mentioned above, the overall market has been segmented into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The centrifugal high-speed separators market refers to the industry focused on the design, manufacturing, distribution, and utilization of advanced mechanical separation systems that operate at very high rotational speeds to separate solids from liquids or separate liquids of different densities. These machines rely on strong centrifugal force to achieve continuous, efficient, and precise separation, making them essential equipment in food, beverage, and dairy processing. The market encompasses a range of separator types, including disc stack, tubular, decanter, basket, and solid bowl systems, each engineered to meet specific processing requirements related to clarity, purity, product consistency, and operational reliability. The demand in this market is driven by the need for stable product quality, enhanced processing efficiency, and compliance with stringent hygiene and safety standards across industries that handle large volumes of liquid-based materials.

Manufacturers in the centrifugal high-speed separators market provide equipment with varying capacities, automation levels, and design configurations to support applications such as milk skimming, beverage clarification, edible oil purification, plant protein extraction, and fermentation management. As processing plants expand, upgrade, and modernize their operations, the market continues to grow, driven by the need for dependable separation technologies that can enhance yield, reduce waste, and ensure consistent product performance.

Stakeholders

- Centrifugal High-Speed Separator Manufacturers

- Centrifugal High-Speed Separators Traders, Distributors, and Suppliers

- Raw Material Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the centrifugal high-speed separators market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application, capacity, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as product launch, collaboration, contract, acquisition, and expansion in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Centrifugal High-Speed Separators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Centrifugal High-Speed Separators Market