Home Hydroponics Market

Home Hydroponics Market by Product Type (Hydroponic Growing Systems and Components), System Type (Aggregate Systems and Liquid Systems), Crop Seed Type (Leafy Greens & Herbs and Fruits & Vegetables), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The home hydroponics market is projected to expand from USD 1.80 billion in 2025 to USD 3.77 billion by 2030, at a CAGR of 16.0% during the forecast period. The global market for home hydroponics is gaining traction, driven by increasing urbanization, which restricts the availability of garden space for conventional gardening, and growing interest in indoor food growth. Customers are opting for hydroponics for its potential to grow clean, high-yielding crops with much less water and land. Advances in sensor monitoring, automation, and simple-to-assemble kits are simplifying setup and maintenance, thus becoming popular even among beginners and hobbyists. Expansion in e-commerce has improved the accessibility of home DIY systems, nutrients, and components. The trend towards sustainable living, as well as concern about food quality and fear of supply chain failure, also persists to spur worldwide home hydroponics adoption

KEY TAKEAWAYS

-

BY SYSTEM TYPEBy system type, it includes aggregate systems—which use solid media like perlite or clay pellets for root support—and liquid systems, where roots are directly immersed in nutrient-rich water for faster growth and higher yield.

-

BY PRODUCT TYPEBy product type, the market is divided into hydroponic growing systems and components. Growing systems comprise complete setups such as NFT, DWC, and drip systems, while components include essential parts like pumps, lights, sensors, and nutrient solutions.

-

BY CROP SEED TYPEBy crop type, the market covers leafy greens & herbs, fruits & vegetables, and ornamentals. Leafy greens and herbs lead due to easy adaptability and short cycles, fruits and vegetables are expanding for year-round production, and ornamentals are gaining popularity for decorative indoor gardening.

-

BY REGIONThe home hydroponics market by region is led by North America, driven by high consumer awareness, technological adoption, and strong distribution networks from major players like The Scotts Company and Hydrofarm. Europe follows, supported by sustainability initiatives, eco-friendly consumer preferences, and urban gardening trends. The Asia Pacific region is the fastest-growing, fueled by rapid urbanization, smaller living spaces, and increasing adoption of indoor farming in countries such as Japan, China, and India. Latin America and the Middle East & Africa show emerging potential, driven by growing interest in self-sufficient food production and water-efficient cultivation systems.

-

COMPETITIVE LANDSCAPEThe home hydroponics market is highly competitive, driven by innovation and technology integration. Key players such as The Scotts Company (Hawthorne Gardening), Hydrofarm Holdings, GrowGeneration, Click & Grow, and Rise Gardens lead through smart, automated, and IoT-enabled systems designed for urban and indoor farming. Emerging startups are intensifying competition with compact, aesthetic, and affordable designs. Strategic mergers, partnerships, and product innovations are central to market growth, while sustainability, energy efficiency, and user-friendly features remain key differentiators shaping the competitive landscape.

The home hydroponics market is positively impacted by several key segments, including smart hydroponic systems, nutrient solutions, and compact grow kits. Smart systems, such as those offered by Rise Gardens and AeroGarden, integrate app-based monitoring and automation, appealing to consumers and simplifying plant care. Nutrient solutions are in high demand due to their critical role in optimizing plant growth and yield. Compact grow kits, like wick and drip systems, cater to urban households with limited space, driving adoption among beginners and small-scale gardeners.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The home hydroponics market is experiencing significant trend disruptions driven by technology, sustainability, and consumer behavior shifts. The integration of IoT, AI, and automation in hydroponic systems is transforming home gardening into a data-driven, low-maintenance experience. Rising environmental awareness and the push for water-efficient and pesticide-free food production are accelerating adoption among urban consumers. Additionally, modular, space-saving designs and smart app-controlled systems are expanding accessibility for beginners. The increasing influence of e-commerce channels, along with growing interest in self-sufficiency and healthy living, is further reshaping market dynamics and driving product innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements in home hydroponics systems

-

Water efficiency & sustainability

Level

-

Limited crop diversity in hydroponics

-

Technical complexity

Level

-

Integration of smart home technology

-

E-commerce and Direct-to-Consumer Channels

Level

-

High initial installation cost

-

High initial cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological advancements in home hydroponics systems

The home hydroponics market is experiencing significant growth driven by technological advancements. Automation, smart monitoring systems, and energy-efficient lighting are pivotal in enhancing the efficiency and accessibility of at-home hydroponic systems. Notably, the integration of Internet of Things (IoT) solutions allows consumers to remotely monitor and manage critical parameters, including pH levels, nutrient concentration, and water temperature, through mobile applications. This technological evolution is not only streamlining operations but also enabling greater precision in home cultivation, thereby expanding market potential and consumer engagement.

Restraint: Limited crop diversity in hydroponics

One of the significant constraints in the home hydroponics industry is the limited crop diversity that can be successfully cultivated using the systems. Although hydroponics is perfectly adapted for leafy greens, herbs, and some small fruiting plants like cherry tomatoes or strawberries, it is difficult for the larger, deep-rooted, or long-cycle crops such as potatoes, corn, or melons. These plants typically require more space, support systems, or specific environmental conditions that most home setups cannot provide. As a result, consumers will be limited in their options for diversifying their produce, which may restrict long-term involvement and perceived value.

Opportunity: Integration of smart home technology

The application of smart home technology is an enormous opportunity in the home hydroponics industry. With an increasing number of households integrating IoT devices, hydroponic systems are being transformed to become part of the smart home infrastructure. Intelligent hydroponic systems can now be equipped with sensors to monitor temperature, humidity, water, and nutrient levels, which can be regulated and monitored through mobile apps or voice assistants such as Amazon Alexa or Google Home. Such automation eliminates the need for manual intervention and enables growers to make subtle adjustments to growing conditions for enhanced yields and well-cared-for plants.

Challenge: High initial installation cost

One of the challenges to the home hydroponic market is the upfront cost of installation, which serves as a significant disincentive to potential consumers, mainly in price-sensitive markets. Unlike traditional gardening, hydroponic systems require specialized equipment in the form of grow lights, pumps, air stones, pH meters, nutrient solutions, and pots on which to cultivate. Even initial kits range from USD 100 to USD 300, while more advanced, modular, or automatic systems range more than USD 1,000.

Home Hydroponics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of integrated home hydroponic systems and nutrient solutions | Offers user-friendly, scalable systems for indoor vegetable and herb cultivation; enhances plant growth and yield consistency |

|

Distribution of LED grow lights, climate controls, and nutrient delivery systems for home setups | Ensures optimal growing conditions, energy efficiency, and higher productivity for urban gardeners |

|

Operation of retail and online platforms for hydroponic equipment and home gardening solutions | Provides one-stop access to hydroponic products; simplifies system setup and maintenance for consumer |

|

Smart countertop hydroponic gardens with automated water and nutrient control | Enables easy, low-maintenance indoor cultivation for beginners; ensures consistent harvests year-round |

|

Modular hydroponic units connected with mobile app control and monitoring | Delivers real-time nutrient and water management; supports customized plant growth and home scalability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of home hydroponics systems. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include The Scotts Company LLC (US), Hydrofarm (US), GrowGeneration Corp. (US), Rise Gardens (US), and Gardyn (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Home Hydroponics Market, By system type

As of 2024, the home hydroponics market by system type is divided into aggregate systems and liquid systems. Aggregate systems use solid growing media such as perlite, rock wool, or clay pellets to support plant roots and are popular for home setups due to their simplicity and cost-effectiveness. Liquid systems, where roots are directly suspended in nutrient solutions, offer faster nutrient absorption and higher yields, making them suitable for advanced home growers.

Home Hydroponics Market, By product type

As of 2024, By product type, the market is segmented into hydroponic growing systems and components. Growing systems include complete setups such as nutrient film technique (NFT), deep-water culture (DWC), and drip systems, while components cover pumps, reservoirs, grow lights, sensors, and nutrient solutions essential for system operation. Together, these segments reflect the market’s balance between ready-to-use solutions for beginners and customizable kits for experienced users.

Home Hydroponics Market, By crop seed type

As of 2024, the home hydroponics market by crop type is categorized into leafy greens & herbs, fruits & vegetables, and ornamentals. Leafy greens and herbs—such as lettuce, spinach, basil, and mint—dominate the segment due to their short growth cycles and high adaptability to hydroponic systems. Fruits and vegetables, including tomatoes, strawberries, and peppers, are gaining traction as consumers seek year-round, pesticide-free produce. The ornamental segment, comprising flowers and decorative plants, is also expanding as urban consumers use hydroponic setups for aesthetic and indoor gardening purposes.

REGION

Asia Pacific to be fastest-growing region in home hydroponics market during forecast period

Asia Pacific is the fastest-growing market for home hydroponics due to urbanization, density of population, and increasing focus on food security and sustainable agriculture. With an increasing number of people relocating to cities and the population density growing, consumers in China, India, Japan, South Korea, and Singapore are turning to indoor farming systems like hydroponics due to space constraints. The region is seeing a growing awareness of health, nutrition, and pesticide-free food among the urban middle class and young adults, who are open to adopting intelligent and green practices technologies.

Home Hydroponics Market: COMPANY EVALUATION MATRIX

The home hydroponics market is experiencing strong growth, driven by rising urbanization, interest in sustainable home food production, and adoption of smart indoor farming systems. Companies such as The Scotts Company (Hawthorne), Hydrofarm Holdings, GrowGeneration, Rise Gardens, and Click & Grow are leading the market through innovations in automated and app-controlled hydroponic kits. Evaluation of these companies centers on their innovation capabilities, distribution reach, and cost efficiency, as well as their ability to scale production and maintain profitability amid supply chain pressures. North America dominates the market, while Asia Pacific shows the fastest expansion potential.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.56 Billion |

| Market Forecast in 2030 (Value) | USD 3.77 Billion |

| Growth Rate | CAGR of 16.0% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Home Hydroponics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America–based Consumer Electronics & Home Appliance Company |

|

|

| European Indoor Gardening Solutions Provider |

|

|

| APAC-based Agritech / Smart Home Startup |

|

|

| Global Distribution & Retail Company |

|

|

| Investor / Private Equity Firm |

|

|

RECENT DEVELOPMENTS

- In June 2025, GrowGeneration Corp. acquired Viagrow, a domestic supplier of gardening and hydroponic equipment.

- In November 2023, Click & Grow partnered with Urban Cultivator to scale up the cultivation of its plant pods for commercial use.

- In January 2023, Rise Gardens launched a new top-of-the-line, fully modular garden at CES 2023.

- In October 2022, Gardyn launched Gardyn Home 3.0, its most advanced home hydroponic system.

- In May 2022, The Scotts Company LLC acquired Australia-based Cyco, a leading brand offering premium nutrients, additives, and growing media for the hydroponics market.

Table of Contents

Methodology

The study involved two major approaches in estimating the current size of the home hydroponics market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

After obtaining information regarding the home hydroponics market through secondary research, extensive primary research was conducted. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephone interviews.

The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation.

Primary research also helped in understanding the various trends related to home hydroponics based on product type, system type, crop seed type, and region. Stakeholders from the demand side, including urban consumers, home décor enthusiasts, wellness consumers, and health-conscious individuals, were interviewed to gain insights into their perspectives on suppliers, products, and their current usage of home hydroponics. This understanding will help us assess the overall market outlook and its impact on business trends.

Note: The three tiers of the companies are defined based on their total

revenues in 2022 or 2023, as per the availability of financial data: Tier 1: Revenue > USD 1 billion;

Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

The Scotts Company LLC (US) |

Sales Manager |

|

Hydrofarm (US) |

Sales Manager |

|

Rise Gardens (US) |

Manager |

|

Gardyn (US) |

Operation Manager |

|

WE Hydroponics (India) |

Marketing Manager |

Market Size Estimation

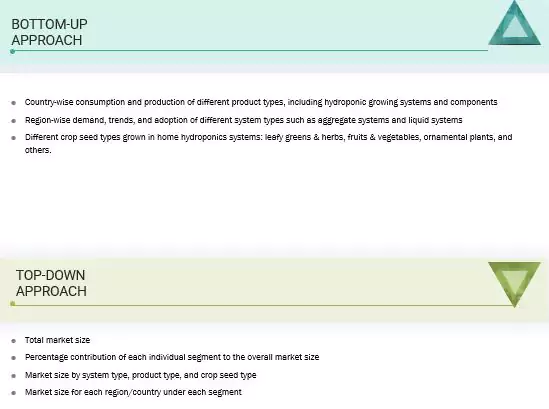

The top-down and bottom-up approaches were used to estimate and validate the total size of the home hydroponics market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Home Hydroponics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall home hydroponics market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Home hydroponics refers to a method of growing plants indoors or in residential spaces without soil. It uses nutrient-rich water solutions to deliver essential minerals directly to the plant roots. This technique allows for controlled cultivation of vegetables, herbs, and ornamental plants in compact setups, often enhanced by LED grow lights, automated irrigation systems, and smart monitoring tools.

Stakeholders

- Manufacturers & Suppliers

- Distributors & Retail Channels

- Policy Makers & Regulatory Bodies

- Investors & Venture Capitalists

- Consumers

Report Objectives

- To determine and project the size of the home hydroponics market based on the product type, system type, crop seed type, and regions in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the home hydroponics market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe home hydroponics market into key countries

- Further breakdown of the Rest of Asia Pacific home hydroponics market into key countries

- Further breakdown of the Rest of South America home hydroponics market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the home hydroponics market?

The home hydroponics market is estimated to be USD 1.80 billion in 2025 and is projected to reach USD 3.77 billion by 2030, registering a CAGR of 16.0% during the forecast period.

Which are the key players in the market, and how intense is the competition?

The Scotts Company LLC (US), Hydrofarm (US), GrowGeneration Corp. (US), Rise Gardens (US), and Gardyn (US) are some of the key market players.

The market for home hydroponics is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the home hydroponics market?

North America has the largest market share of home hydroponics due to high consumer demand for organic, pesticide-free produce, extensive urbanization, and high adoption of smart home technologies. Availability of major market companies such as AeroGarden and Rise Gardens, together with a growing awareness of sustainable lifestyles and food security, has boosted market growth. Besides, the region has strong infrastructure, increased disposable income, and favorable government policies encouraging urban farming, bolstering its leadership in the international market.

What kind of information is provided in the company profiles section?

The company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the home hydroponics market?

The home hydroponics market is driven by rising demand for fresh, pesticide-free food, increasing urbanization, limited gardening space, and growing interest in sustainable living. Technological advancements, such as smart monitoring systems and energy-efficient grow lights, along with health awareness and food security concerns, are further boosting market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Home Hydroponics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Home Hydroponics Market