Humanized Mouse and Rat Model Market: Growth, Size, Share, and Trends

Humanized Mouse and Rat Model Market by Type (Genetic Models, Cell-based Models, Rat Models), Application (Oncology, Immunology, Neuroscience, Toxicology, Infectious Diseases), End User (Pharma, Biotech), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

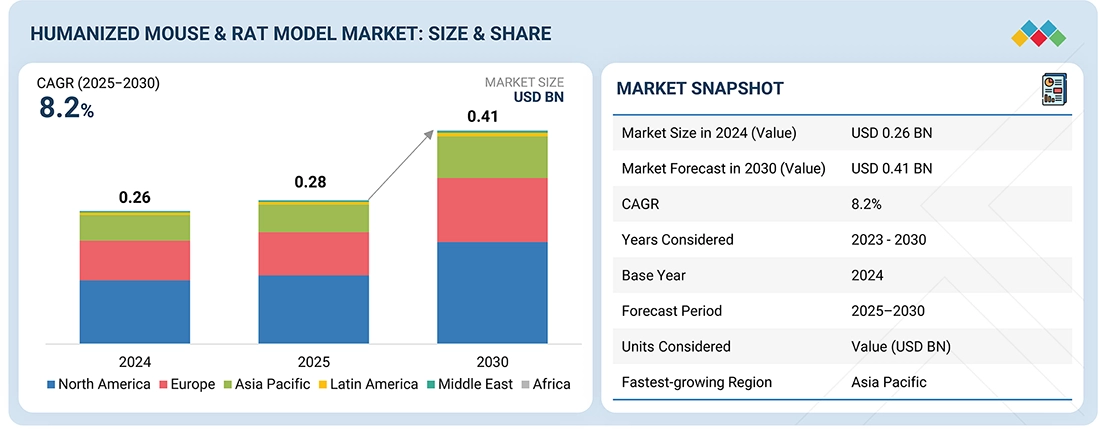

The humanized mouse and rat model market is projected to reach USD 0.41 billion in 2030 from USD 0.28 billion in 2025, at a CAGR of 8.2%. Growth in the humanized mouse and rat model market is majorly driven by the rising use of humanized models in drug discovery research, rising demand for personalized medicine, government-funded initiatives for cancer research, increasing R&D activities in the pharmaceutical & biotechnology industry.

KEY TAKEAWAYS

-

By RegionThe North America humanized mouse & rat model market accounted for a 47.7% revenue share in 2024.

-

By TypeBy type, the humanized mouse model segment is expected to dominate the market throughout the forecast period.

-

By ApplicationBy application, the oncology segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End UserBy end user, the pharma & biotech segment is expected to dominate the market throughout the forecast period.

-

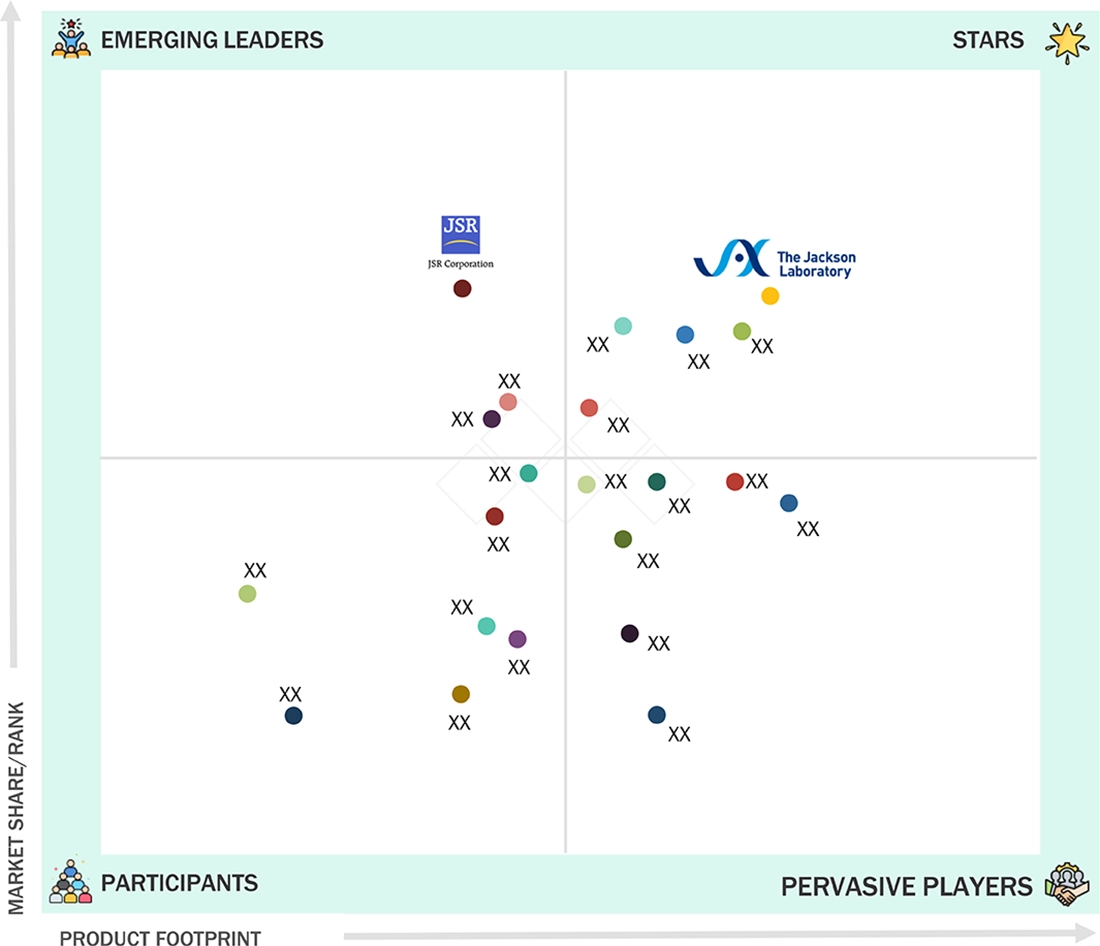

Key PlayersCompanies like Charles River Laboratories (US), The Jackson Laboratory (JAX) (US), Taconic Biosciences, Inc. (US) were identified as some of the star players in the humanized mouse & rat model market (global), given their strong market share and model type footprint.

-

SMEsCompanies like Xenopat (Spain) and Shanghai Medicilon Inc. (China) among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Continuous research is being undertaken to develop treatments for immunodeficiency disorders, cancers, and other rare diseases. A majority of these research studies are highly dependent on animal models. Owing to this, market players continuously focus on innovations in mouse models. Growth in the humanized mouse and rat model market is majorly driven by the Rising use of humanized models in drug discovery research, rising demand for personalized medicine, government-funded initiatives for cancer research, increasing R&D activities in the pharmaceutical & biotechnology industry. However, the high cost of custom humanized models and regulatory compliance for ethical use of animal mode are expected to restrain the growth of this market during the forecast period.

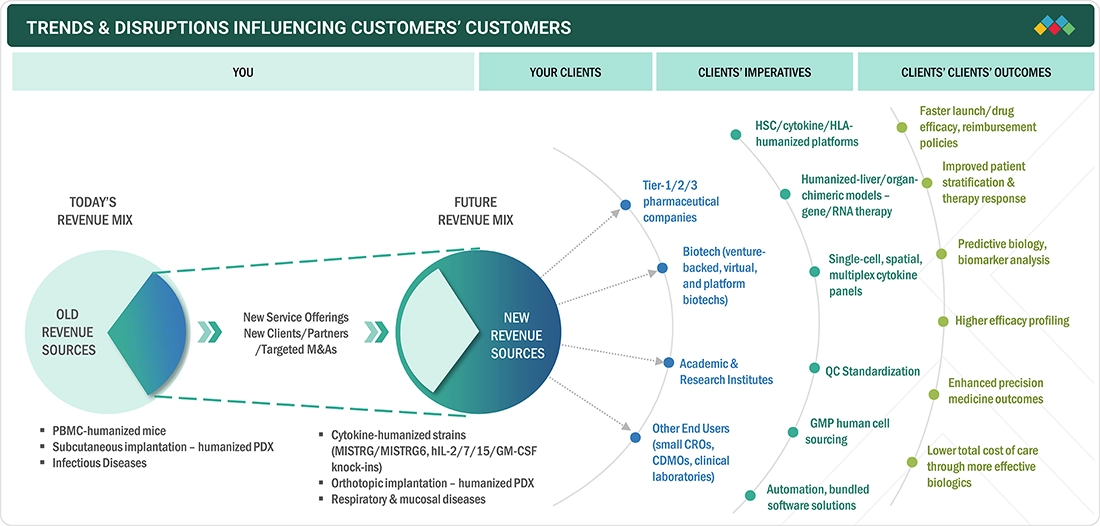

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The humanized mouse & rat models market is shifting from basic PBMC-humanized setups to HSC/cytokine/HLA-humanized and organ-chimeric platforms that deliver tighter human relevance for modern modalities. Core buyers—pharma/biotech, CRO/CDMOs, and translational centers—need to de-risk bispecifics/TCEs, cell therapies (CAR-T/NK), ADCs/radioligands, and in vivo gene/RNA editing while compressing study cycle times. Their imperatives are to standardize immune phenotyping, solve delivery & durability (AAV/LNP/non-viral RNP), and embed single-cell, spatial, and multiplex cytokine analytics with harmonized SOPs and GMP cell sourcing. Vendors that package pre-validated I/O-ready cohorts, organ-chimeric options (e.g., humanized liver/islet/skin), imaging (BLI/µCT/MRI), and IND-grade data rooms will win share. For clients’ clients—patients, payers, and regulators—this translates into faster translation, higher technical/regulatory success, more reliable biomarkers for patient stratification, and lower total program costs through fewer late-stage failures.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising use of humanized models in drug discovery research.

-

Emerging preclinical applications of humanized mouse models.

Level

-

Introduction of FDA Modernization Act 2.0/3.0

-

Stringent regulatory compliance for ethical use of animal models

Level

-

Emergence of CRISPR in biomedical research.

-

Growing preference for humanized PDX models.

Level

-

Alternative methods for animal testing.

-

Limitations of humanized mouse models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising use of humanized models in drug discovery research.

The demand for humanized mouse models is increasing in immuno-oncology research, attributed to increased research studies validating their efficacy. Demand for humanized mice models is expected to increase in the drug discovery and development activities associated with cancer immunotherapies. The latest approvals for cancer immunotherapies require the use of well-characterized models for drug discovery activities. Humanized mouse models play a pivotal role in testing the interaction of cancer therapeutic candidates with human systems.

Restraint: Introduction of FDA Modernization Act 2.0/3.0.

The enactment of the FDA Modernization Act 2.0 in December 2022—and the subsequent introduction of the FDA Modernization Act 3.0 in February 2024—signals a significant shift in the regulatory landscape, encouraging the adoption of non-animal alternatives in drug development. These legislative changes promote the use of advanced in vitro models, such as human hepatocytes, HepG2 cells, and iPSC-derived hepatocyte-like cells, as viable alternatives to animal models for preclinical testing.

Opportunity: Emergence of CRISPR in biomedical research.

CRISPR is seen as a revolutionary technology for gene editing. Using the Cas9 enzyme differentiates CRISPR from other forms of genetic modification. CRISPR is used in the development of genetically modified mouse strains, making the process not only quicker but also less expensive. Thus, the emergence of CRISPR as a popular technology is expected to offer potential growth opportunities for market players over the coming years.

Challenge: Alternative methods for animal testing.

Developing efficient and reliable alternatives to animal testing poses significant challenges to the growth of the global humanized mouse and rat model market. The increasing pressure from animal rights activists is compelling research institutes and companies to seek options to minimize the use of animals in research activities. This has further led to the development of several alternatives for testing, such as in vitro methods and models based on human cells and tissue cultures; computerized patient-drug databases and virtual drug trials; computer models and simulations (in silico models); organs-on-chips; stem cell and genetic testing methods; and non-invasive imaging techniques, such as MRI, CT, and microdosing.

humanized-mouse-model-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Humanized-liver PXB-mice used to evaluate hepatic safety of RNAi therapeutics VIR-2218 and ALN-HBV prior to clinical development in hepatitis B. | Human-relevant DMPK/safety readouts for oligos; earlier detection of hepatotoxicity risk and higher translational confidence versus conventional mouse strains, helping de-risk IND decisions. |

|

Collaboration with JAX to compare CD34+ HSC–engrafted NSG/NSG-SGM3 strain variants and characterize human immune-cell reconstitution for immuno-oncology studies (humanized NSG platform selection). | Sponsor gets data-driven model selection for bispecifics/IO work (better human immune repertoire, survival window), reducing false negatives/positives and shortening time to a fit-for-purpose humanized model. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The humanized mouse and rat model market operates within a multifaceted ecosystem involving various stakeholders. Each entity plays a critical role in ensuring the development, distribution, and application of these models for advanced biomedical research. Raw materials suppliers provide essential components such as genetic materials, human cells, laboratory reagents, and specialized equipment. Model providers specialize in the development and production of humanized mouse and rat models. End users include pharmaceutical companies, academic institutions, and contract research organizations (CROs). These entities use humanized models for preclinical research activities. Regulatory bodies, such as the FDA (USA), EMA (Europe), and other regional authorities, oversee compliance with ethical standards and research guidelines.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Humanized Mouse & Rat Model Market, By Type

As of 2024, humanized mouse model segment held the largest share of the market and will continue leading the market through 2030. The humanized mouse models’ segment is further divided into genetic humanized mouse models and cell-based humanized mouse models. The cell-based humanized mouse models segment includes CD34 humanized mouse models, PBMC humanized mouse models, and BLT humanized mouse models. These models have witnessed a higher demand as these mouse strains support the convenient engraftment of human cells and tissues as compared to other models.

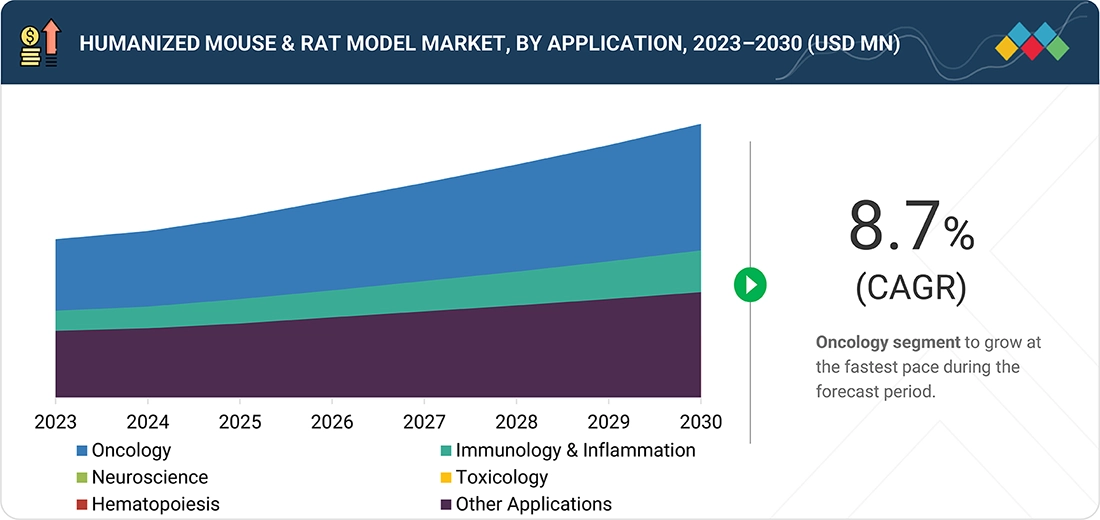

Humanized Mouse & Rat Model Market, By Application

In 2024, oncology application segment is expected to grow at the fastest pace during the forecast period. The high growth rate of this segment can be attributed to the rising research activities and growing funding investments from governments to conduct cancer research studies. Humanized mouse models have significantly contributed to understanding cancer biology, as they help validate gene functions, identify novel cancer genes & tumor biomarkers, understand the molecular and cellular mechanisms underlying tumor initiation, and provide better clinical models to test novel therapeutic strategies.

Humanized Mouse & Rat Model Market, By End User

The pharma & biotech companies segment is expected to dominate the humanized mouse & rat model market through the forecast period. Factors such as the rising expenditure for innovative drug development and the growing preference for personalized medicine are expected to support the growth of the pharmaceutical & biotechnology companies segment

REGION

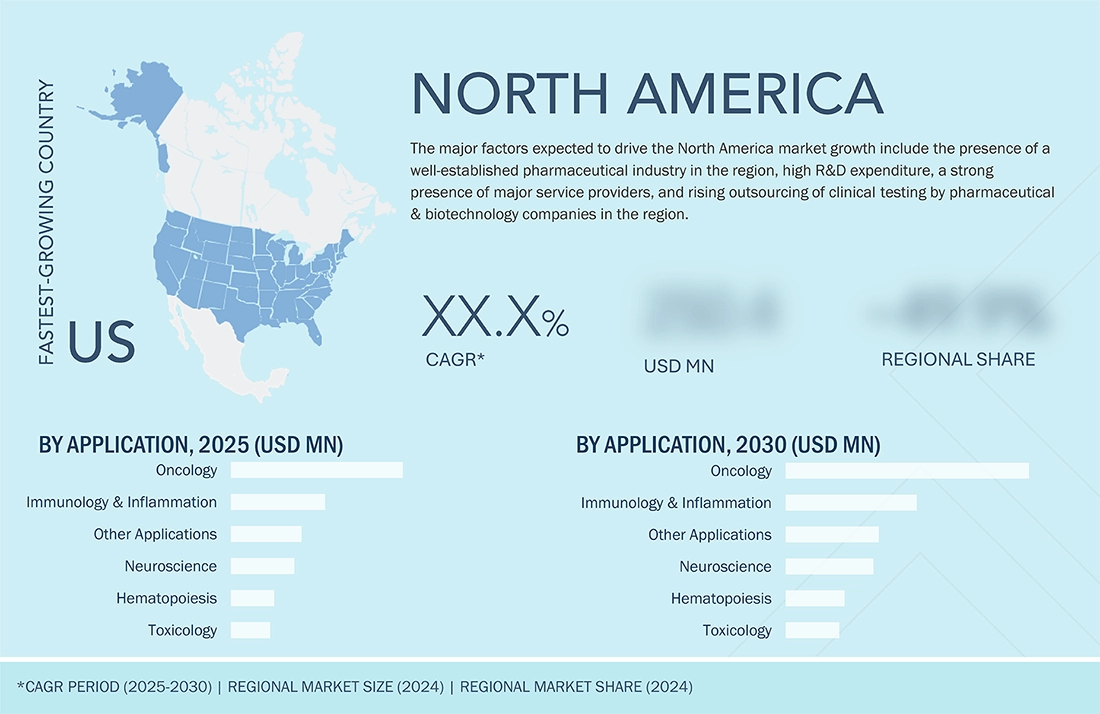

North America to be the largest revenue generating region in the humanized mouse & rat model market during forecast period

North America dominated the humanized mouse & rat model market with the largest share. The large share of North America is attributed to the increasing production of monoclonal antibodies, continued and responsible use of animals, rising preclinical activities by CROs and pharmaceutical companies, implementation of revised funding plans by the National Institutes of Health (NIH), and growing stem cell research in Canada.

humanized-mouse-model-market: COMPANY EVALUATION MATRIX

In the humanized mouse & rat model market key players market matrix, The Jackson Laboratory (Star) leads with a strong market share and extensive model type footprint. The company saw an increase in revenue from driven by the continuous investment in research and development to improve and expand its product offerings. JSR Corporation (Emerging Leader) is gaining visibility with its specialized solutions and tailored solutions for humanize models. The company's expanding its regional presence and caters to a comprehensive portfolio of offerings. The company entered the market with the acquisition of Crown Bioscience International. Crown Bioscience International is a global drug discovery and development services company providing translational platforms to advanced oncology.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Charles River Laboratories (US)

- The Jackson Laboratory (JAX) (US)

- Taconic Biosciences, Inc. (US)

- JSR Corporation (US) (Crown Biosciences)

- Champions Oncology, Inc. (US)

- CLEA Japan Inc. (Japan)

- genOway (France), Inotiv (US)

- Janvier Labs (France)

- Altogen Labs (US)

- Vitalstar Biotechnology (China)

- Ingenious Targeting Laboratory (US)

- Reaction Biology (US)

- Harbour BioMed (Netherlands)

- Oncodesign Services (France)

- Pharmatest Services (Finland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.26 Billion |

| Market Forecast in 2030 (Value) | USD 0.41 Billion |

| Growth Rate | CAGR of 8.2% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East, and Africa |

WHAT IS IN IT FOR YOU: humanized-mouse-model-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Analysis | Additional profiles of regional/local players, their market position/share, strategies, and service portfolios | Insights to uncover market gaps and refine differentiation strategies. |

| End User Market Assessment | Comprehensive list of end users typically engaged in discovery, development & manufacturing of biologics (cell therapy, gene therapy) across targeted regions/countries. | Insights on identifying potential customers of humanized mouse & rat model |

| Region-level Market Share Analysis, Cross-segmental Analysis | Cross-segmental analysis between model types and application, region-specific competitive analysis. | Insights on White Spaces & Unmet Needs, interconnections and supply chain opportunities. |

RECENT DEVELOPMENTS

- March 2025 : Harbour BioMed announced a global strategic collaboration with AstraZeneca to discover and develop next-generation multi-specific antibodies for immunology, oncology, and beyond. The strategic collaboration includes an option to license multiple programs utilizing Harbour BioMed’s proprietary Harbour Mice fully human antibody technology platform in multiple therapeutic areas and a USD 105 million equity investment by AstraZeneca in Harbour BioMed.

- Novermber 2024 : Taconic Biosciences, Inc. expanded mouse model production and colony management services with the opening of a new US West Coast facility.

- August 2023 : The company entered into a four-year agreement with Harlan Holdings Ltd., in which the buyer will have exclusive rights to breed and sell all of the company’s rat and mouse research models within Israel. The company will receive a 2% royalty during this four-year period.

Table of Contents

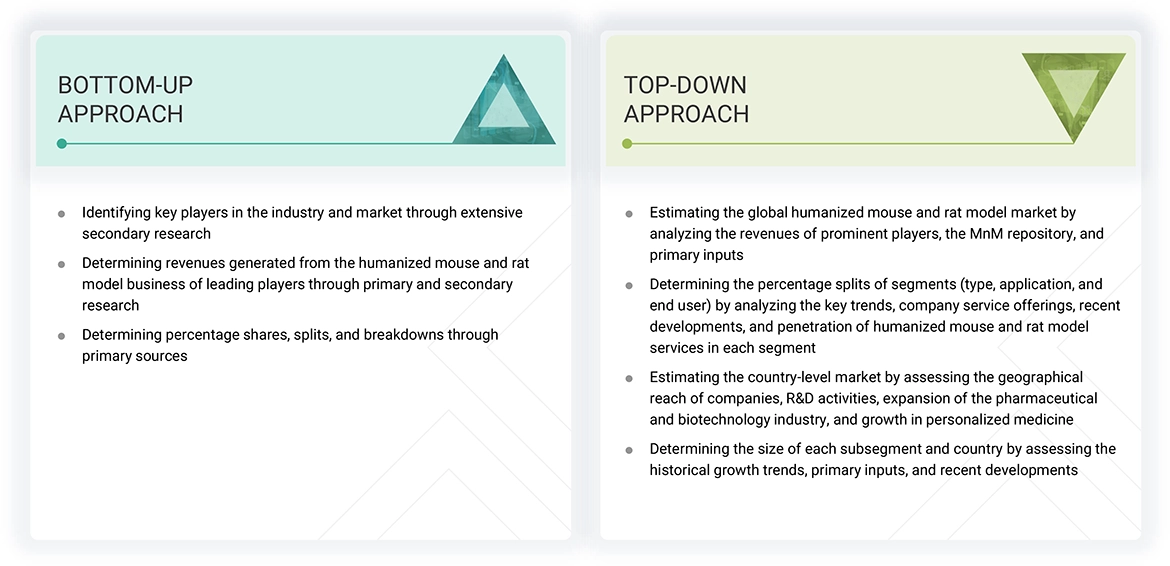

Methodology

The research study used secondary sources, directories, and databases to identify and collect valuable information to analyze the global humanized mouse and rat model market. Widespread interviews were conducted with various primary participants, including key industry members, subject-matter experts (SMEs), C-level managers of leading market players, and industry consultants, to obtain and verify qualitative and quantitative information and evaluate the growth scenarios of the market. The global market size was estimated through secondary research (top-down and bottom-up), followed by data triangulation with inputs from industry experts to determine the final market size.

Secondary Research

Secondary research was used to identify and collect information for the technical, market-oriented, and commercial study of the humanized mouse and rat model market. The secondary sources used for this study include the American Association for Cancer Research (AACR), American Association for Laboratory Animal Science (AALAS), European Society for Medical Oncology (ESMO), European Association for Cancer Research (EACR), Humanized Mouse Resource (HMR), National Center for Biotechnology Information (NCBI), and Association for Assessment and Accreditation of Laboratory Animal Care International (AAALAC).

Academic Journals and Company Websites; corporate & regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations were also used to obtain major information about key market players and market segmentation corresponding to industry trends, regional/country-level markets, market developments, and technology prospects. Secondary data was collected and analyzed to determine the market size of the global humanized mouse and rat model market, which was further validated through primary research.

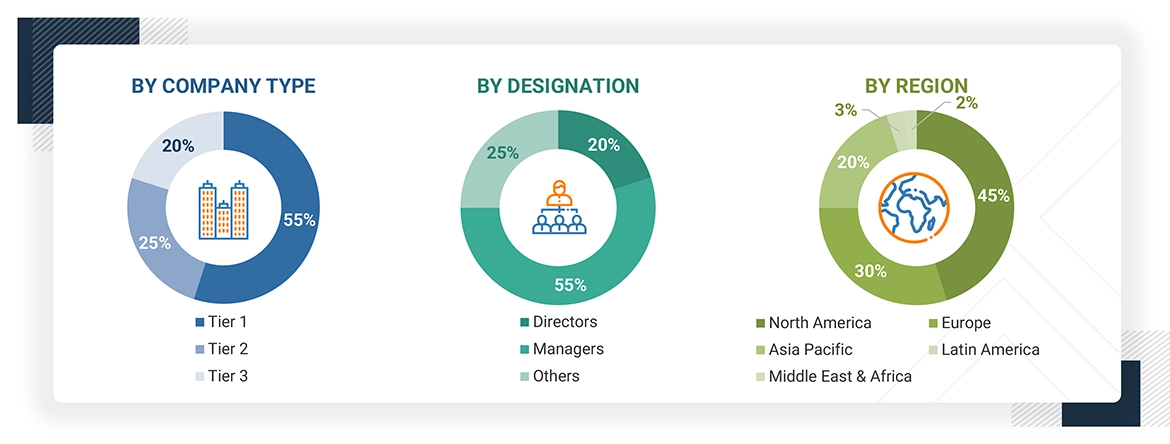

Primary Research

Primary research was conducted after acquiring basic knowledge about the global humanized mouse and rat model market through secondary research. A series of primary interviews were conducted with market experts from the demand side, including professionals from the pharmaceutical and biopharmaceutical industries and academic institutions. Additionally, interviews were held with individuals from the supply side, such as C-level and D-level executives, product managers, and marketing and sales managers from key manufacturers, distributors, and channel partners. The primary interviews were conducted across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Approximately 80% and 20% of the primary interviews were conducted with supply-side and demand-side participants. This data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The breakdown of the primary respondents is given below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the humanized mouse and rat model market. These methods were also used extensively to estimate the size of various subsegments in the market.

Data Triangulation

After determining the market size from the above estimation process, the total market was divided into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A humanized mouse and rat model is an immunodeficient organism genetically engineered to study immune responses to drugs or identify potential disease targets. These models are widely used to study human diseases and genes. Researchers in both academia and industry, along with clinicians, extensively use humanized mouse and rat models in their research applications. Humanized mouse and rat models are beneficial tools for immuno-oncology and infectious disease research. They have improved the ability to predict human responses to new therapeutics in clinical development.

Stakeholders

- Research and consulting firms

- Biopharmaceutical manufacturers

- Pharmaceutical manufacturers

- Mouse model and service companies

- Government and private research institutes

- Manufacturers and suppliers of animal care products

- Clinical research organizations (CROs)

- Academic and research institutes

- Venture capitalists

- Laboratory animal care associations

- Public and private animal health agencies

Report Objectives

- To define, describe, and forecast the humanized mouse and rat model market by type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 concerning individual growth trends, prospects, and contributions to the overall humanized mouse and rat model market

- To assess the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments for North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments, such as product/service launches, partnerships, agreements, collaborations, and expansions

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Humanized Mouse and Rat Model Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Humanized Mouse and Rat Model Market