Hydrochloric Acid Electrolysis Market

Hydrochloric Acid Electrolysis Market by Technology (Membrane Technology, Diaphragm Technology), Application (Polyurethane Industry (MDI/TDI), PVC Production or Chlorination, Fumed Silica Production, Agrochemical, Other Applications), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hydrochloric acid electrolysis market is projected to reach USD 0.99 billion by 2030 from USD 0.84 billion in 2025, at a CAGR of 3.4% from 2025 to 2030. Its market growth is fuelled by increasing demand for chlorine recovery, environmental regulations, and sustainability goals. Also, environmental regulations becoming more stringent is making industries switch to cleaner, closed-loop production systems. The economic feasibility of the process is also made easier with technological innovations in electrolysis, including energy-efficient apparatus and enhancements in the membrane cells.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe hydrochloric acid electrolysis market by technology includes membrane electrolysis, diaphragm electrolysis, and mercury electrolysis. Membrane electrolysis dominates the market due to its higher energy efficiency, high- purity chlorine output, and environmental compliance.

-

BY APPLICATIONThe hydrochloric acid electrolysis market by application includes polyurethane industry (MDI/TDI/HDI), PVC production & chlorination, fumed silica production, agrochemical, and other applications. The polyurethane industry is the largest segment because it generates large volumes of by- product hydrochloric acid during chlorination processes, which can be converted back into chlorine through electrolysis.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 3.7%, driven by the strong demand for chlorine-based derivatives such as polyvinyl chloride (PVC).

-

COMPETITIVE LANDSCAPEThe market is driven by strategic partnerships and expansions from leading players such as thyssenkrupp nucera (Germany), Bluestar (Beijing) Chemical Machinery Co., Ltd. (China), and Covestro AG (Germany). These companies are expanding their global presence, enhancing product offerings, and penetrating new regional markets.

? The hydrochloric acid electrolysis is experiencing rapid growth, meeting industrial, environmental, and technological factors. With the growing interest of industries like chemicals, pharmaceuticals in sustainability and circular approaches, the usage of chlorine recovery hydrochloric acid electrolysis is also increasing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The customers of the hydrochloric acid electrolysis market are subject to the increasing demand of the chlorine to the industry such as PVC, chemicals, and others that makes the production efficient and reliable. Meanwhile, the pressure to move towards more sustainable and cost-efficient electrolysis technologies is being exerted by the rising cost of energy, more stringent environmental laws, and the need to move towards more environmentally friendly and low-carbon processes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for chlorine in downstream industries

-

Energy efficiency improvements through ODC technology in hydrochloric acid electrolysis

Level

-

Long-term licensing and installed base of hydrochloric acid oxidation plants

-

High capital investment

Level

-

Sustainability and circular economy practices

Level

-

Volatility in energy prices

-

Regulatory and safety compliance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for chlorine in downstream industries

Polyvinyl chloride (PVC) is the most common plastic worldwide, and the consumption of PVC resin has reached over 40 million tonnes annually, with an average annual increase of 3 per cent, especially in developing countries. Approximately 6.5 million tonnes per annum of PVC products are manufactured in the EU-27, UK, Norway, and Switzerland, of which an amount of 5.1 million tonnes of PVC resin is consumed in that region, making up approximately 10 percent of all the plastics in Europe. The versatility of PVC is very high, which makes it utilized in an enormous number of applications that contribute to the infrastructure of our modern world as well as the improvement of our daily lives. Chlorine is also a vital base chemical in world chemical processes, comprising the core of key downstream products, including PVC, isocyanates, including MDI and TDI (polyurethane foams), solvents, and pharmaceutical intermediates. Of these, production of PVC consumes some 40 per cent of world chlorine production, that is, close to 16 million tonnes of chlorine annually. Most of the globe is manufacturing PVC in major regions, which include China, Europe, and North America, where they are collectively responsible for more than 50 percent capacity in the world. When manufacturing using chlorine-intensive processes, hydrochloric acid is a byproduct of the process, particularly when in large-scale manufacture such as PVC and MDI manufacture.

Restraint: High capital investment

The process of establishing a hydrochloric acid electrolysis plant requires a great amount of investment, particularly when complex technologies are involved, such as oxygen-depolarized cathodes (ODC). The process involves very specialized materials that are highly corrosion-resistant because of the extreme nature of corrosive hydrochloric acid and reactive gas products, chlorine and hydrogen. The cost is also compounded by much-needed elements of high-performance electrodes, membrane cells, tough containment systems, and advanced power electronics. Further, the safety of the operation requires massive infrastructure such as a gas handling unit, a monitoring unit, as well as a response mechanism to emergencies, which escalates the original cost even further. The smaller and medium-sized chemical manufacturers are unable to meet these capital requirements, often due to them being a significant impediment. Most companies have limited budgets and will need to make wise investments whose benefit is apparent in the short term.

Opportunity: Sustainability and circular economic practices

The rise of sustainability and the idea of the circular economy with a global approach draws on the need to have a more responsible and resource-efficient technology that chemical manufacturing companies use, and hydrochloric acid electrolysis becomes a central aspect. Such a process is crucial in a circular production system because it transforms HCI, which is one of the common byproducts of chemical manufacturing, into high-purity chlorine and hydrogen gases. Capturing and reusing these valuable materials within the plant can enable businesses to dispose of hazardous materials, decrease the discharge to the environment, and minimize raw materials that are produced as virgin materials. This will not only increase resource efficiency but will also favor uninterrupted production without depending on the external supply chain. Electrolysis of HCI enables firms to reduce greenhouse gas emissions produced in transporting, storing, and producing chlorine externally. On-site recovery model reduces operational expenditure on energy, improves energy efficiency, and helps to achieve steadily higher environmental standards. It serves the Environmental, Social, and Governance (ESG) objectives as well, nowadays playing a pivotal role in investor confidence, security, and competitive standing on the market.

Challenge: Market fragmentation and knowledge gaps

The hydrochloric acid electrolysis market remains relatively fragmented, and it is not as mature as the more developed chemical processing technology. The technical guidelines, performance measurement indices and certification systems are not globally standardized, and this is also a major barrier to adoption on a larger scale. In absence of such benchmarks, purchasers, especially those who are less versed with technology, may have a lot of doubts when making decisions on the systems. The process of decision making can be delayed by concerns regarding the long-term reliability, compatibility with the existing infrastructure, the fulfillment of safety standards, and operational efficiency of the product. Non-standardization also makes comparison of the vendors difficult and makes the firm look towards internal testing or that done by some third party which is not always applicable in case of smaller firms. Moreover, the knowledge gap in the market remains high particularly among small and medium size chemical manufacturers in the developing areas. Constrained market education, unfamiliarity with technical aspects of hydrochloric acid electrolysis, and the lack of sustainable supplier ecosystems make the application of HCI electrolysis mostly the preserve of early adopters.

Hydrochloric Acid Electrolysis Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Needed to reduce CO2 emissions from chlorine production in alignment with EU Green Deal and corporate sustainability targets. | Adopted oxygen-depolarized cathode (ODC) electrolysis, reducing energy consumption by ~25% and lowering annual CO2 emissions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hydrochloric acid electrolysis market covers an analysis of the interdependent system of key players affecting the technology development, adoption, and commercialization. This ecosystem consists of technology providers, chemical manufacturers, and their component suppliers, regulatory agencies that establish environmental and safety requirements, and research institutions that provide innovation. Also, government organizations providing incentives or sustainable mandates and finance providers who fund financial institution projects have a key role to play in enabling adoption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydrochloric Acid Electrolysis Market, By Technology

Membrane technology has gained dominance as the leading technology in the hydrochloric acid electrolysis market through its high efficiency, environmental friendliness, and compliance with the changing regulatory norms. This technology is much safer with less risk of hazardous byproducts and does not require any toxic chemicals such as mercury or asbestos, which were popular in electrolysis practices during previous generations. Energy efficiency is another significant benefit of membrane technology, so the technology consumes less power and generates less heat, which ultimately leads to the fact that it is cheaper than other technological solutions. Their capacity to produce efficient high current density, as well as the capacity to be used under diverse conditions, makes them of high interest to the manufacturers who would want flexible and reliable operation. Besides, membrane technology is compatible with the current UN sustainability and regulatory changes like the Minamata Convention on Mercury, which is encouraging companies to use mercury-free processing methods.

Hydrochloric Acid Electrolysis Market, By Application

The polyurethane industry segment dominated the overall hydrochloric acid electrolysis market in 2024. MDI, TDI, and HDI are key raw materials in the production of polyurethanes, which are extensively utilized in flexible and rigid foams, coatings, adhesives, as well as insulation materials. MDI/TDI/HDI production results in generating huge volumes of hydrochloric acid in chlorination reactions, which are often at low concentrations, unsuitable for sale or repurposing. Instead of this HCI going to waste, the trend among manufacturers has been to process it through electrolysis to create useful chlorine and hydrogen. Upon recovery, producers have an opportunity to utilize chlorine directly as an input to their upstream chlorination operations, hence closing the loop of resources and cutting off the reliance on an external source of chlorine. This reduces waste and raw materials bills, besides promoting sustainability and regulatory standards. Also, on-site electrolysis makes the transport and storage of large masses of chlorine less dangerous and polluting.

REGION

Asia Pacific to be fastest-growing region in global hydrochloric acid electrolysis market during forecast period

The Asia Pacific market is the dominant market in hydrochloric acid electrolysis that boasts a fast- growing chemical manufacturing base, boasting of a high demand for chlorine derivatives and growing attention on sustainable industrial processes. Development in countries such as China, India, Japan, and South Korea is known to be major producers of such chemicals as methylene diphenyl diisocyanate (MDI), toluene diisocyanate (TDI), and polyvinyl chloride (PVC), which have high production levels that produce massive amounts of HCL as a byproduct. Further, robust economic development, expanding urban population, and robust demand are region-wide factors driving investment in polyurethane, pharmaceuticals, and water treatment, all of which use or produce chlorine. The governments in the region are also establishing stricter environmental regulations, leading to favorable conditions to deploy hydrochloric acid electrolysis.

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.81 Billion |

| Market Forecast in 2030 (Value) | USD 0.99 Billion |

| Growth Rate | CAGR of 3.4% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Technology: Membrane Electrolysis, Diaphragm Electrolysis, and Mercury Electrolysis By Application: Polyurethane Industry (MDI/TDI/HDI), PVC Production & Chlorination, Fumed Silica Production, and Agrochemical, and Other Applications |

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: Hydrochloric Acid Electrolysis Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Chemical Producers in Asia Pacific | Competitive profiling of hydrochloric acid electrolysis technology providers (business overview, financials, product portfolio) Benchmarking of diaphragm vs membrane technologies | Identified leading suppliers with HCL electrolysis technologies Quantified data for leading countries in the region for HCL Electrolysis. |

RECENT DEVELOPMENTS

- February 2023 : The world's first large-scale chlorine production plant utilizing oxygen depolarized cathode (ODC) electrolysis technology has commenced operations in Tarragona, Spain. This innovative and energy-efficient electrolysis process was jointly developed by Covestro and thyssenkrupp nucera, building upon thyssenkrupp nucera's established expertise in electrolysis technology.

- February 2023 : Covestro successfully started a new world-scale chlorine production facility in Tarragona, Spain. This marks the first large-scale plant globally to utilize the highly innovative and energy-efficient Oxygen Depolarized Cathode (ODC) technology, developed by Covestro in collaboration with its partners. The facility provides a reliable, sustainable, and self-sufficient supply of chlorine and caustic soda for MDI production on-site. This development further reinforces Covestro's European MDI production network, supporting the manufacture of rigid polyurethane foam used in the insulation of refrigeration appliances and buildings. The new chlorine facility is the first industrial-scale plant globally to implement the innovative Oxygen Depolarized Cathode (ODC) technology. This advanced technology was developed through a collaboration between Covestro and thyssenkrupp nucera.

- January 2023 : Covestro and LANXESS collaborated to make the energy-intensive production of basic chemicals at their Lower Rhine sites in Germany more climate- friendly. LANXESS sources chlorine, caustic soda, and hydrogen from Covestro's ISCC PLUS-certified facilities in Leverkusen and Krefeld-Uerdingen. Effective immediately, Covestro is producing approximately one-third of the volume supplied to LANXESS using electricity generated from hydropower, backed by guarantees of origin.

Table of Contents

Methodology

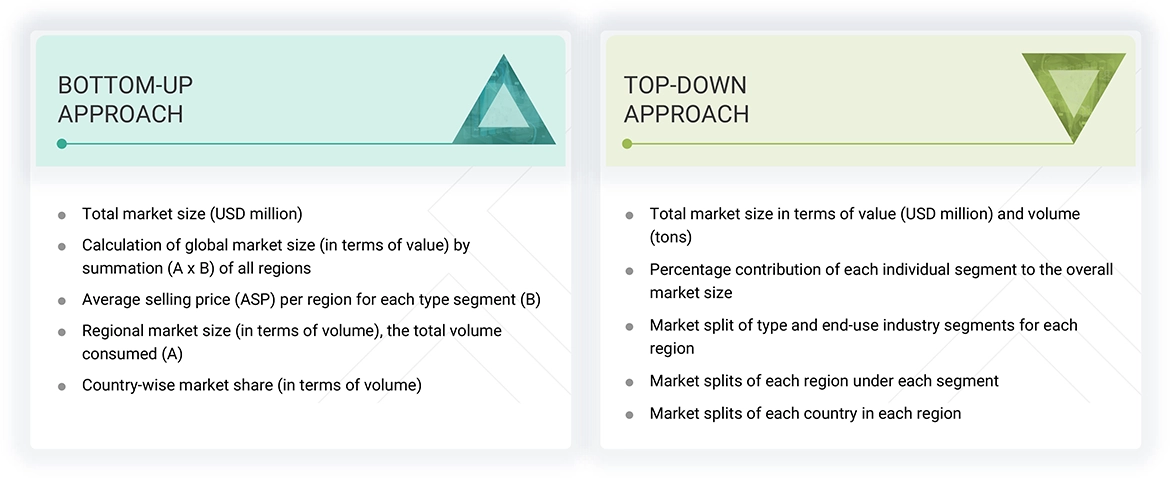

The study involved four major activities to estimate the current size of the hydrochloric acid electrolysis market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of hydrochloric acid electrolysis through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the hydrochloric acid electrolysis market. After that, market breakdown and data triangulation procedures were used to determine the sizes of different segments of the market.

Secondary Research

The market for the companies offering hydrochloric acid electrolysis is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the hydrochloric acid electrolysis market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of hydrochloric acid electrolysis vendors, forums, certified publications, and white papers. Secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the hydrochloric acid electrolysis market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of hydrochloric acid electrolysis offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list the key information/insights throughout the report.

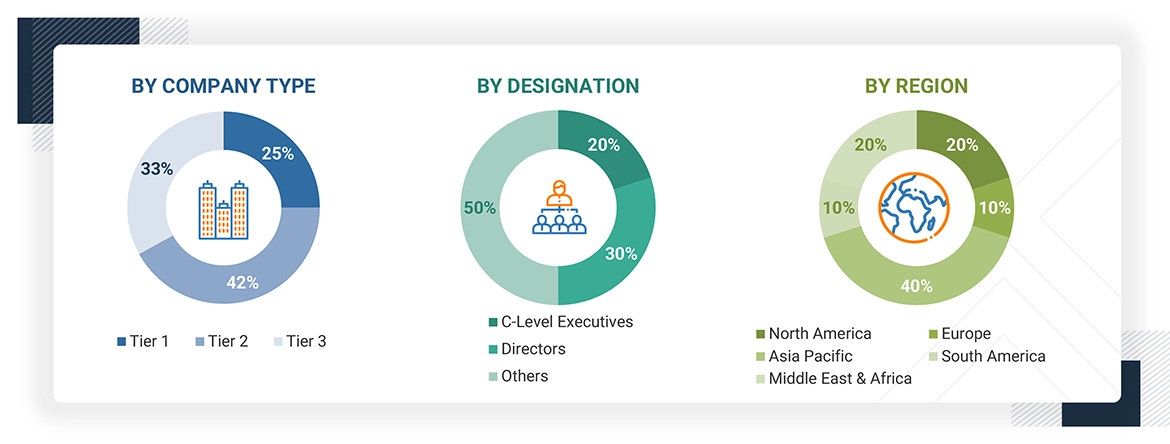

Following is the breakdown of interviews with experts:

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global hydrochloric acid electrolysis market. These approaches were also used extensively to estimate the sizes of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Hydrochloric acid electrolysis is an electrochemical process that involves the decomposition of hydrogen chloride (HCl), usually in aqueous (hydrochloric acid) form, into its elemental components: chlorine gas (Cl2) and hydrogen gas (H2), using electrical energy. This process is carried out in an electrolyzer, a specialized device equipped with electrodes and often separated by a membrane or diaphragm to prevent product recombination. The main goal of HCL electrolysis is to recover chlorine from HCl-containing waste or by-product streams, especially in the chemical and petrochemical industries. It is considered an environmentally sustainable method of chlorine production because it helps reduce demand for chlorine from primary sources (like salt electrolysis) and minimizes hazardous HCL disposal.

The basic electrochemical reaction for HCl electrolysis is:

2HCl (aq) → H2(g) + Cl2(g)

In this reaction:

At the anode (oxidation):

2Cl? → Cl2(g) + 2e −

At the cathode (reduction):

2H+ + 2e − → H2(g)

This means that hydrogen ions (H?) are reduced to hydrogen gas at the cathode, while chloride ions (Cl?) are oxidized to chlorine gas at the anode. The process requires careful control of voltage and cell design to optimize efficiency and minimize side reactions. Modern technologies, such as the oxygen-depolarized cathode (ODC) help reduce energy consumption by replacing hydrogen evolution at the cathode with oxygen reduction. HCL electrolysis is widely used in the polyurethane industry (MDI/TDI), PVC production, chlorination, fumed silica production, agrochemicals, and other applications.

Stakeholders

- Technology Providers

- Chemical & Industrial End Users

- Engineering, Procurement & Construction (EPC) Companies

- Regulators & Environmental Agencies

- Industrial Gas Suppliers

- Research Institutions & Universities

- Investors & Financial Institutions

- Licensing & Technology Consultants

Report Objectives

- To define, describe, and forecast the size of the global hydrochloric acid electrolysis market based on technology, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, and Rest of the World

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as expansions, and partnerships, in the hydrochloric acid electrolysis market

- To provide the impact of AI on the market

Key Questions Addressed by the Report

Which factors are propelling the growth of the hydrochloric acid electrolysis market?

Growing demand for chlorine in downstream industries is one of the primary factors driving market growth.

What are the major challenges to the growth of the hydrochloric acid electrolysis market?

Volatility in energy prices is a major challenge impacting the market.

What are the major opportunities in the hydrochloric acid electrolysis market?

Sustainability and circular economy practices are expected to create lucrative opportunities for market players.

What are the major factors restraining the growth of the hydrochloric acid electrolysis market?

High capital investment is the major factor restraining market growth.

Who are the major players in the hydrochloric acid electrolysis market?

Major players include thyssenkrupp nucera (Germany), Industrie De Nora S.p.A. (Italy), Covestro AG (Germany), and Bluestar (Beijing) Chemical Machinery Co., Ltd. (China).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrochloric Acid Electrolysis Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrochloric Acid Electrolysis Market