Seatbelt Material Market

Seatbelt Material Market by Component (Retractor, Buckle, Anchor, and Others), Type of Component by Material (Steel/Aluminium, Polycarbonate, and Nylon), and Vehicle Type (Passenger Car, LCV, and HCV), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The seatbelt material market is projected to grow from 677.42 megatons in 2025 to 807.02 megatons in 2032 at a CAGR of 2.5%. Growth in the seatbelt material market is due to an increase in safety norms & regulations, a rise in vehicle production & ownership, and an increase in consumer awareness of safety. The rise of autonomous and semi-autonomous vehicles is accelerating demand for advanced seatbelt materials, as these vehicles require safety systems that can protect occupants in a wider range of seating positions and crash scenarios.

KEY TAKEAWAYS

-

BY VEHICLE TYPEThe passenger car segment holds the largest market share as there is a rise in private vehicle ownership, especially in emerging economies, and a shift toward personal mobility.

-

by componentThe retractor segment holds the largest market share. Retractors are an important part of the modern seatbelt systems/passive safety systems, which are offered for both front, middle, and rear seats of passenger cars, and are required for compliance with global safety regulations, making them a compulsory feature for every vehicle. Their technological evolution, with features like emergency locking, automatic locking, load limiters, and pretensioners, has further boosted their dominance, as automakers and regulators increasingly demand advanced restraint systems to enhance occupant protection.

-

seatbelt bucKle market (ICE), by materialThe Asia Pacific region holds the largest market share due to the high production of vehicles in China, India, and South Korea. The market for seatbelt buckles in Europe is growing due to higher safety regulations and an emphasis on passenger safety.

-

seatbelt retractor market (ICE), by materialThe steel/aluminum material holds the largest market share, owing to the high strength and durability features that enhance the safety factors, leading to withstand significant stresses during the time of collision. The Asia Pacific region holds the largest market share due to high sales of compact SUVs and passenger cars.

-

seatbelt Anchor market (ICE), by materialThe Asia Pacific region holds the largest market share, primarily driven by rapid growth in vehicle production and sales in populous emerging economies such as China, India, and Japan.

-

Seatbelt material market (BEV), by componentThe retractor segment holds the largest market share, due to emerging safety regualtions and government mandates. The Asia Pacific region holds the largest market share. The rapid increase in BEV sales across the region, driven by supportive government policies, rising environmental awareness, and expanding EV infrastructure, has directly fueled higher demand for seatbelt buckles.

-

SEATBELT RETRACTOR MARKET (BEV), BY MATERIALThe steel/aluminum segment holds the largest market share due to the increase in the sales of BEVs worldwide.

-

Seatbelt Anchor market (bev), by materialThe Asia Pacific market, led by China, is the world’s largest and fastest-growing market for compact and hatchback cars. Government organizations such as China’s Ministry of Industry and Information Technology (MIIT) and the ASEAN Automotive Federation actively promote policies supporting vehicle innovation, safety, and electrification, further driving SUV demand and market expansion.

-

Seatbelt buckle market (BEV), by materialEurope is the fastest-growing market as the region’s automotive sector is prioritizing lightweight steel for seatbelt buckles in BEVs to reduce overall vehicle mass,

-

Seatbelt material market (ICE), by regionThe Asia Pacific region holds the largest market share. The production of passenger cars is high in the region, with China contributing more than 55% of the market. In Asia Pacific, China holds the largest market share. However, the market is expected to decline during the forecast period due to an increase in sales of BEVs in the country.

According to JATO Dynamics Limited, BEV sales showed robust growth, where BEVs account for 17% of new car registrations in Europe in April 2025, which is higher than the previous year, and US electric vehicle sales have risen by 11.4% year over year in Q1 2025. This surge in BEV adoption, along with broader vehicle production increases, is fueling demand for seatbelt materials, driven by stricter safety regulations and consumer emphasis on occupant protection. Modern BEVs are increasingly equipped with advanced active safety systems. Autonomous emergency braking, lane-keeping assistance, and adaptive cruise control are often integrated with smart seatbelt technologies to optimize occupant restraint and enhance crash avoidance capabilities. This integration of new safety features in BEVs not only boosts demand for advanced seatbelt systems but also drives innovation and growth in the seatbelt market as automakers prioritize safety to meet regulatory standards and consumer expectations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the automotive seatbelt material market indicate a transition toward advanced and intelligent safety materials. The revenue mix is evolving from conventional components such as retractors, anchors, and buckles to new sources including advanced lightweight materials, high-strength composites, and smart seatbelt textiles. These innovations are driven by the growing integration of ADAS, active and passive safety systems, and autonomous vehicle technologies. Manufacturers are investing in inflatables, heated belts, and intelligent fabrics to enhance comfort and safety compliance. Rising safety mandates, sustainability goals, and the demand for lightweighting are further reshaping the seatbelt material ecosystem, positioning high-performance and adaptive materials as key future revenue drivers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in stringency in safety standards

-

Growing crash tests

Level

-

Increase in development of active safety systems

Level

-

Shift to lightweight and sustainable materials

-

Integration of smart textiles

Level

-

Chemical compatibility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVER: Increase in stringency in safety standards

The global automotive sector is undergoing a significant transformation, driven by increasingly stringent safety regulations aimed at reducing fatalities and improving occupant protection. Regulatory bodies across major automotive markets—including the US, Europe, China, and India—are mandating advanced restraint systems, improved occupant sensing technologies, and enhanced crash performance. This regulatory push is particularly evident in the evolution of seatbelt-related standards, which now emphasize not only mechanical strength but also integrated electronic features such as seatbelt reminders (SBRs), load limiters, and pretensioners.

RESTRAINT: Rising integration of active safety systems

The growing adoption of advanced driver assistance systems works in collaboration with modern seatbelt systems to maximise occupant safety, especially during emergency cases. The integration leverages real-time data from ADAS sensors such as cameras, radar, and LiDAR to anticipate potential collisions or hazardous manoeuvres and coordinate seatbelt responses accordingly. While these systems significantly reduce the likelihood of crashes, they also create a perception of reduced dependency on passive safety systems, such as seatbelts. Various automakers are investing in the R&D of electronic and sensor-based safety systems. As active safety technologies become a key differentiator in consumer decision-making, passive systems, despite being mandatory, receive less innovation focus. This results in slower advancement and reduced procurement of premium seatbelt materials such as aramid-polyester blends, laminated TPU textiles, or eco-friendly coated fabrics. The presence of collision avoidance features can lead to a perception among both manufacturers and end-users that vehicles are inherently safer, thereby diminishing the perceived urgency to invest in high-performance seatbelt solutions. This is particularly true in markets where consumer awareness of passive safety technologies is relatively low.

OPPORTUNITY: Shift to lightweight and sustainable materials

The automotive sector is undergoing a strategic shift toward lightweight and sustainable materials in seatbelt manufacturing. In response to tightening global regulations and OEM efforts to reduce vehicle weight and emissions, ultra-high-strength polyester and nylon are emerging as preferred solutions. These advanced fibers offer high tensile strength-to-weight ratios, enabling thinner, lighter seatbelts that meet stringent safety standards such as FMVSS 209, ECE R16, and IS 16833. Simultaneously, sustainable alternatives like recycled PET (rPET) and bio-based polymers such as PLA are gaining traction. These materials reduce dependence on virgin plastics and lower carbon emissions while maintaining performance integrity. OEMs, including Toyota and Ford, have already integrated such eco-friendly seatbelt fabrics into production, aligning with broader environmental goals. The adoption of lightweight and sustainable seatbelt materials presents a competitive edge for suppliers. It enables compliance with evolving safety norms, supports automakers’ ESG strategies, and meets growing consumer demand for greener vehicles, positioning these innovations at the forefront of future mobility solutions.

CHALLENGE: Chemical compatibility

A significant challenge in the seatbelt material market is ensuring chemical compatibility, meaning the materials must remain stable and maintain their mechanical properties when exposed to various chemicals commonly found in vehicles. These include fuels, oils, plasticizers, and a range of cleaning agents used for interior maintenance. Exposure to such substances can cause degradation, discoloration, or loss of tensile strength, potentially compromising the safety and durability of the seatbelt over time. Polyester, the industry standard for seatbelt webbing, offers excellent resistance to most automotive chemicals, moisture, UV radiation, and abrasion, making it well-suited for long-term use. However, as manufacturers explore alternative or more sustainable materials like aramid fibers or advanced nylons, chemical resistance profiles can vary significantly. This necessitates rigorous testing and validation to ensure these materials can withstand exposure without performance loss. In conclusion, maintaining chemical compatibility is critical to the reliability and safety of seatbelts throughout their service life. With increasing innovation and the introduction of new materials, continuous evaluation against a broad spectrum of automotive chemicals and cleaning products is essential to meet safety standards and ensure customer confidence.

ICE & BEV SEATBELT MATERIAL MARKET SIZE, SHARE & ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures advanced seatbelt materials and systems, including retractors, pretensioners, and load limiters for all vehicle types—ICE and EV. Focuses on sustainable production, offering fossil-free steel components and eco-friendly webbing. | Leading global safety supplier with broad OEM partnerships. Delivers high reliability, compliance with stringent safety regulations, and reduced carbon footprint through sustainable innovation. |

|

Produces seatbelt materials and integrated passive safety systems for passenger and commercial vehicles; offers smart seatbelt technology and sensors. | Strong track record in digitalization and smart safety systems. Enhances occupant protection and enables advanced integration with vehicle electronics. |

|

Develops seatbelt webs, retractors, and buckle assemblies using high-strength polyester, polypropylene, and nylon. Supplies to both OEMs and aftermarket (offline & online channels). | Wide material portfolio with innovative lightweight engineering for electric vehicles. Delivers durability, adaptability to new crash testing standards, and supply chain resilience. |

|

Specializes in seatbelt material development and weaving for various seating configurations. Partners with global OEMs for custom component integration. | Provides tailored solutions for diverse vehicle models and local regulatory compliance, focusing on high-tensile strength and comfort. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major seatbelt material market companies have the latest technologies, diversified portfolios, and global distribution networks. The major players in the seatbelt material market include Autoliv (Sweden), Joyson Safety Systems (US), ZF Friedrichshafen AG (Germany), Tokairika, Co., Ltd. (Japan), and Yanfeng (Japan).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Seatbelt buckle market (ICE), by vehicle type

The passenger car segment holds the largest market share contributing more than 70%, as there is a rise in private vehicle ownership, especially in emerging economies, and a shift toward personal mobility. This rise in vehicle sales has fueled robust growth in the seatbelt market as manufacturers and regulators prioritize advanced safety features in response to both regulatory mandates and rising road safety awareness.

Seatbelt buckle market (ICE), by material

The polycarbonate segment is projected to grow at the fastest rate with a CAGR ranginging between 10-15% during the forecast period. This growth reflects a broader material transition trend across the automotive industry, where manufacturers are replacing heavier metals with high-performance engineering plastics to enhance fuel efficiency and meet emission targets. Polycarbonate’s adoption is accelerating due to advances in polymer reinforcement and precision molding technologies that improve structural strength, dimensional stability, and thermal resistance.

Seatbelt material market (BEV), by component

The retractor segment holds the largest market share which is more than 60%. The governments worldwide are amending safety standards for mandating advanced retractors with load limiters and pretensioners in BEVs with active safety technologies in the front and rear row seats. Also, seatbelt manufacturers are investing in R&D to advance retractors.

Seatbelt retractor market (BEV), by material

The polycarbonate segment is the fastest-growing material category, registering a CAGR of more than 10% between 2025-2032. This acceleration is driven by the automotive industry’s focus on lightweighting to extend vehicle range and optimize energy efficiency. Polycarbonate’s high strength-to-weight ratio and impact resistance make it an ideal substitute for metal components without compromising crash safety standards.

Seatbelt material market (ICE), by region

Europe is the fastest-growing region in the seatbelt material market for internal combustion engine (ICE) vehicles. This growth is primarily driven by the region’s stringent safety and sustainability regulations under frameworks such as the EU General Safety Regulation (GSR) and Euro NCAP standards, which continue to push for higher-quality, durable, and recyclable restraint materials.

REGION

The Asia Pacific region holds the largest share of the seatbelt material market.

The Asia Pacific region holds the largest share of the global seatbelt material market, driven by its robust vehicle production, rapid urbanisation, and rising disposable incomes that have significantly increased vehicle ownership across countries like China, India, and Japan. In 2024, China held the largest market share in the world. It leads the market in the internal combustion engine (ICE) and electric vehicle (EV) segments. The surge in demand for compact SUVs in the Asia Pacific markets is driven by OEMs such as Hyundai and other regional players, with many new models featuring captain seats in the middle row, each equipped with dedicated seatbelt retractors for enhanced occupant protection. While economy models, particularly ICE vehicles, typically offer retractors for front captain’s seats or rear bench seats, the growing demand for premium vehicles in the Asia Pacific market has resulted in the widespread adoption of retractors in rear and even third-row seating positions to meet stringent safety standards. Regulatory measures, such as India’s mandate for rear seatbelt reminders, are further boosting adoption rates. Across all segments, seatbelt retractors utilize high-strength polyester or nylon webbing, steel or reinforced plastic housings, and metal alloy locking mechanisms. With China’s commanding production share, the rapid shift to EVs, and increasing SUV and premium vehicle demand, the Asia Pacific market is set for continued robust growth in seatbelt retractor adoption, driven by evolving regulations and consumer expectations for advanced safety.

ICE & BEV SEATBELT MATERIAL MARKET SIZE, SHARE & ANALYSIS: COMPANY EVALUATION MATRIX

In the seatbelt material market matrix, Autoliv (Star) stands out with its robust global leadership and pioneering innovation in occupant safety, driving widespread adoption of advanced seatbelt materials among automotive OEMs through close collaborations and extensive R&D capabilities. Holmbergs Safety Systems (Emerging Player) is gaining momentum by working closely with leading brands and carriers, focusing on both child and occupant safety. Holmbergs demonstrates strong potential through its relentless pursuit of superior safety, comfort, and peace of mind, supported by design and manufacturing expertise, particularly in tailor-made solutions and next-generation safety systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | 677.42 Megatones |

| Market Size Forecast in 2032 | 807.02 Megatones |

| Growth Rate | CAGR of 2.5% from 2025-2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Volume (Megatones/Kilotons) |

| Report Coverage | market size forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Seatbelt Material Market, By Component (Retractor, Buckle, Anchor, Pillar Loops & Others), Component Type by Material (Steel/Aluminum, Polycarbonate/PU, and Nylon), and Vehicle Type (Passenger Car, LCV, and HCV), and Region - Global Forecast to 2032 |

| Regional Scope | Asia Pacific, Europe, Americas, and the Rest of the World |

WHAT IS IN IT FOR YOU: ICE & BEV SEATBELT MATERIAL MARKET SIZE, SHARE & ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Automaker (Europe) | Competitor benchmarking on seatbelt suppliers and product innovations Trends in new seatbelt technologies (pretensioners, load limiters, smart belts) | Inform seatbelt sourcing and supplier strategy |

| Automotive Safety Regulator (Asia) | Country-wise seatbelt use compliance rates and regulatory analysis. Case studies on enforcement campaigns and impacts | Support policy updates to raise seatbelt usage. Recommend best practices to improve compliance. |

| Tier-1 Seatbelt Manufacturer (US) | Market sizing and OEM demand forecasts. Analysis of automotive OEM supply contracts | Guide manufacturing capacity planning. Spot new OEM partnership opportunities. |

| Ride-sharing Service Provider (Global) | User behavior study of rear seatbelt usage. Feasibility study of in-vehicle seatbelt usage alerts. | Improve passenger safety communication. Enhance rider trust and brand image |

| Local Fleet Operator (Middle East) | Review of seatbelt retrofit options for older commercial vehicles. Vendor benchmarking on aftermarket seatbelt solutions | Assess cost-effectiveness of upgrades. Streamline procurement and installation |

RECENT DEVELOPMENTS

- December 2024 : ZF LIFETEC's electro-locking system, an electromechanical upgrade to traditional seatbelt locking mechanisms, replaced the steel ball sensor with an electromagnetic coil controlled by a central ECU. It enhances safety via pre-crash triggering (synced with ADAS) and improves comfort by reducing unwanted locking on rough roads.

- December 2024 : ZF LIFETEC showcased a product named SPR6.1 for the rear seatbelt system. It features mechanical decoupling, which adjusts to passengers’ weight during crashes to reduce excessive force, enhancing safety and comfort. It is designed specifically for EV vehicles.

- September 2024 : Holmbergs filed for insolvency for its Romanian subsidiary company, Te-Rox Prod, which was acquired in early 2020 to produce child car seat components and seatbelts. The insolvency was filed due to increasing energy/labor costs and Europe’s regulatory challenges for the expensive recertifications. Also, the company relocated some of its operations from Hungary and Lithuania.

Table of Contents

Methodology

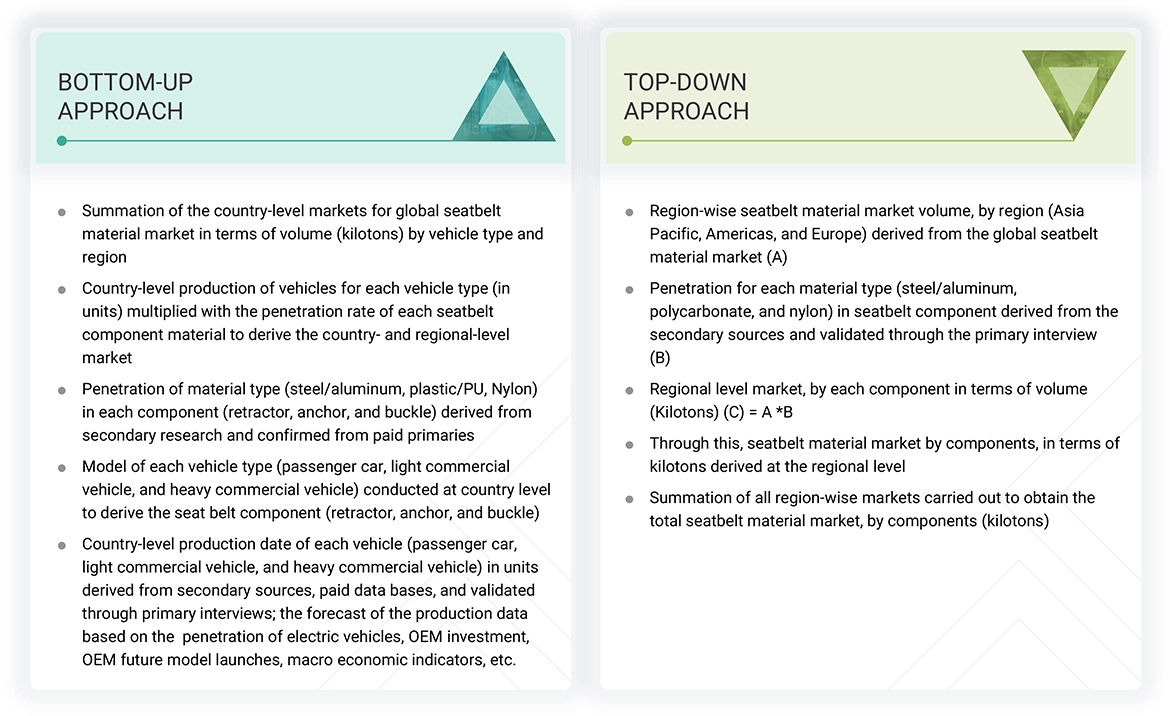

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive seatbelt material market study. The study involved four main activities in estimating the current size of the seatbelt materials market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as different seatbelts offered in each row of vehicle body types, seatbelt material types, and upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect helpful information for an extensive commercial study of the seatbelt materials market. Secondary sources included company annual reports/presentations, press releases, industry association publications [such as publications on AMIA - The Mexican Association of the Automotive Industry Automotive Component Manufacturers Association of India (ACMA), Canadian Automobile Association (CAA), China Association of Automobile Manufacturers (CAAM), Databases such as Factiva and Bloomberg, European Automobile Manufacturers' Association (EAMA), Environmental Protection Agency (EPA), International Council on Clean Transportation (ICCT), International Organization of Motor Vehicle Manufacturers (OICA), Investor Presentations and Annual Reports of Key Market Players, Japan Automobile Manufacturers Association (JAMA), Korea Automobile Manufacturers Association (KAMA), National Association of Automobile Manufacturers of South Africa (NAAMSA), other component manufacturer associations, Society of Indian Automobile Manufacturers (SIAM), Corporate Filings (such as annual reports, investor presentations, and financial statements), trade, business, and related associations, International Organization for Standardization, automotive seatbelt manufacturers blogs/articles/magazines, key secondary sources to estimate the seatbelt material market size),seatbelt materials-related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles. Additionally, secondary research and model mapping were carried out to understand the average volume of seatbelt materials, which come with different seatbelt components, and the historical sales of seatbelt components.

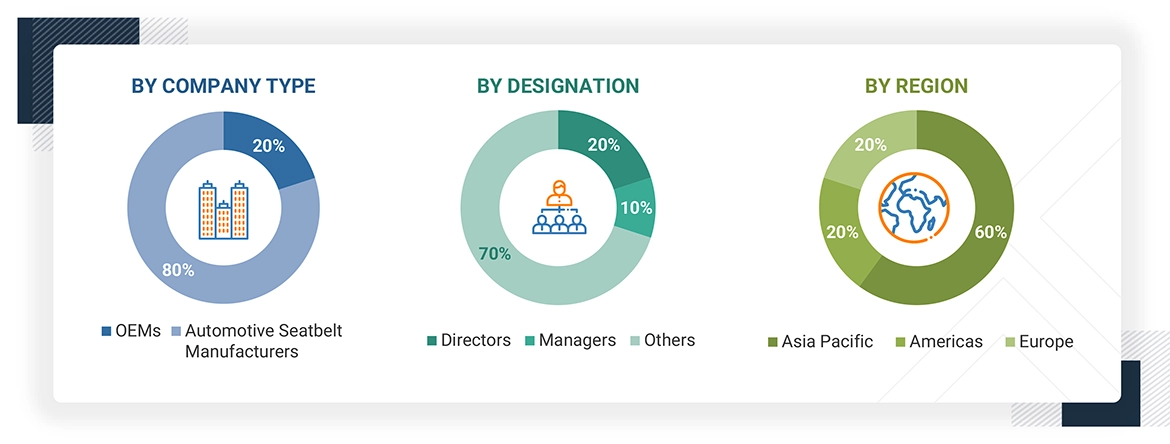

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as research and development experts, CEOs, CTOs, COOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from different vital companies operating in the seatbelt materials market.

After the complete market engineering, which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been undertaken to identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the opinions of in-house experts, led to the conclusions described in the remainder of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume side of the Seatbelt materials market and other dependent submarkets, as mentioned below:

- The bottom-up approach was used to estimate and validate the market size in terms of volume for the seatbelt material market.

- Various vehicle bodies (sedan, hatchback, SUV 5-seater, SUV 7-seater, trucks, and buses) were considered with different row arrangements according to body type.

- Accordingly, the model mapping was conducted for all the vehicles that were offered with a two or three-row seating arrangement option at the country level.

- Each vehicle type was then multiplied by each seatbelt component (retractor, buckle, anchor, and pillar loop) to obtain the regional-level market for the seatbelt market.

ICE & BEV Seatbelt Material Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

Seatbelts: An automotive seatbelt, also known as a safety belt, is the primary restraint system (PRS) in vehicles designed to secure the driver or passenger and limit their movement during a collision or sudden stop, thereby reducing the risk of serious or fatal injury. Modern seatbelt webbing is typically made from high-tensile polyester with a strength of about 3,000–6,000 lb (1,400–2,700 kg) and is commonly 46 or 48 mm wide. Seatbelts are equipped with features like emergency locking retractors (ELR), pretensioners, and energy management loops to enhance occupant protection during crashes. Research shows that seatbelts can reduce the risk of fatal injuries for drivers by up to 50% and for front-seat passengers by 45%.

Retractor: The retractor is the male portion of the seatbelt where the actual seatbelt webbing material feeds out. The seatbelt retractor is made up of a spring, some gears, a sensor, a pyrotechnic explosive device, and a mechanism that is engineered to also lock up when a crash or accident occurs.

Buckle: A seatbelt buckle is a fastening device, typically metallic, that secures the seatbelt. It is designed to hold the buckle's tongue, which is attached to the seatbelt webbing, and allows for easy fastening and unfastening with minimal force. The buckle's primary function is to restrain occupants during sudden deceleration or collisions, minimizing the risk of injury.

Anchor: A seatbelt anchor, or latch plate, is the mechanism that connects the seatbelt webbing to the buckle, allowing the belt to be secured. It is a vital part of the seatbelt system, ensuring the belt stays fastened during travel and potentially during a collision. All vehicles are required to have a locking seatbelt feature, either at the retractor or the anchor plate, a requirement known as the lockability standard.

Stakeholders

- Automotive OEMs

- Seatbelt Manufacturers

- Tier 1 & Tier 2 Suppliers

- Regulatory Bodies

- Automotive Active Safety Technology Providers

- Aftermarket Suppliers

Report Objectives

- To define, describe, and forecast the seatbelt material market concerning individual growth trends and prospects and determine the contribution of each segment to the total market

- To forecast the market size by volume (kilotons)

- Market (ICE), By Component (Retractor, Buckle, Anchor, and Others)

- Seatbelt Retractor Market (ICE), By Material (Steel/Aluminum, Polycarbonate, and Nylon)

- Seatbelt Buckle Market (ICE), By Material (Steel/Aluminum, Polycarbonate, and Nylon)

- Seatbelt Anchor Market, By Material (Steel/Aluminum and Polycarbonate)

- Market, By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle)

- Market (BEV), By Components (Retractors, Buckle, and Anchor)

- Seatbelt Retractor Market (BEV), By Material (Steel/Aluminum, Polycarbonate, and Nylon)

- Seatbelt Buckle Market (BEV), By Material (Steel/Aluminum, Polycarbonate, and Nylon)

- Seatbelt Anchor Market, By Material (Steel/Aluminum and Polycarbonate)

- By Region - Asia Pacific (China, India, Japan, and South Korea), Europe (Germany, UK, France, Spain, and Italy), Americas (US, Canada, Mexico, Argentina, and Brazil)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) and conduct patent analysis, key buying criteria, trade analysis, technology analysis, case study analysis, supply chain analysis, regulatory analysis, key conferences and events, and investment scenario

- To analyze the market share of leading players in the seatbelt material market

- To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies

- To strategically analyze markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze recent developments, such as partnerships, supply agreements, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the market

Available Customizations

Seatbelt Materials Market, By Pillar Loop

- Polycarbonate

- Steel/Aluminum

Seatbelt Materials Market, By Latch Plate

- Steel/Aluminum

- Others

Detailed Analysis and Profiling of Additional Market Players (Up to 3)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Seatbelt Material Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Seatbelt Material Market