Induction Heating Market

Induction Heating Market by Power (Upto 10 kW, 10 kW - 100 kW, Above 100 kW) By Frequency (1-10 kHz, 10-50 kHz, 50 kHz -1 mHz) By Application (Metal Melting, Annealing, Heat Treating, Brazing And Soldering, Surface Hardening) By End-User (Metal Industry, Industrial Manufacturing, Automotive, Plastic Processing, Electronics & Semiconductors, Consumer Appliances, Medical Industry), Region- Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global induction heating market is projected to reach USD 879.5 million by 2030 from an estimated USD 616.5 million in 2025, at a CAGR of 7.4% during the forecast period. The induction heating market is witnessing steady growth as industries increasingly prioritize efficiency, precision, and cleaner energy solutions. Rising adoption of advanced heating technologies such as induction, infrared, and resistance systems is driven by expanding manufacturing activity across automotive, metals, electronics, and machinery sectors. Energy-efficiency regulations, digital automation, and modernization initiatives are further accelerating the shift toward smarter, low-emission heating systems. With strong investment in both new facilities and retrofit projects, the market outlook remains positive, supported by growing demand for reliable, high-performance heating solutions.

KEY TAKEAWAYS

- By Region, Asia Pacific is expected to dominate the market during the forecast period.

- The market for induction heating with an output of up to 10–100 kW was valued at USD 257.1 million in 2024 and is projected to reach USD 392.8 million by 2030, growing at a CAGR of 7.4% during the forecast period.

- The market for induction heating systems in the 10–50 kHz range, was valued at USD 251.1 million in 2024 and is expected to reach USD 382.1 million by 2030, expanding at a CAGR of 7.3% during the forecast period.

- The market for induction heating for heat treating was valued at USD 157.6 million in 2024 and is projected to reach USD 242.8 million by 2030, growing at a CAGR of 7.5% from 2025 to 2030.

- The market for induction heating for metal end use industry was valued at USD 171.8 million in 2024 and is projected to reach USD 256.2 million by 2030, growing at a CAGR of 6.9% from 2025 to 2030.

- Major market players use organic and inorganic strategies like partnerships and investments to drive growth in inTEST Corporation, Inductotherm Group, ENRX , and Park-Ohio Holdings Corporation have entered various product launches to meet the increasing demand for Industrial Heating in innovative uses.

There is an increasing need for advanced induction heating systems as manufacturers move toward higher automation, precision processing, and energy-efficient production. Modernization of factories across automotive, metals, electronics, and heavy engineering sectors is driving the adoption of induction, infrared, resistance, and optimized combustion systems to improve reliability, minimize downtime, and enable tighter process control. The shift toward cleaner and more efficient heat sources is further supported by global sustainability targets and stricter emission regulations. The rising integration of digital technologies, including IoT-based monitoring, AI-enabled temperature control, and predictive maintenance, is creating additional incentives to upgrade to modern industrial heating equipment.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The induction heating market is projected to grow at a CAGR of 7.3% during the forecast period by value. Key trends driving industrial heating demand include the rapid expansion of industrial activities across the automotive, metals, electronics, and machinery sectors, as well as a strong push toward automation and energy-efficient production technologies. Manufacturers are increasingly adopting induction, infrared, and advanced resistance heating systems to achieve faster processing times, reduced energy consumption, and improved product consistency. Additionally, tightening environmental regulations and sustainability initiatives are accelerating the shift toward low-emission and digitally controlled heating solutions. Growing investments in modernization, capacity expansion, and high-performance material processing further reinforce the market’s positive growth outlook.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand from advanced manufacturing, automation, and electrification trends

-

Global focus on energy efficiency & decarbonization

Level

-

High upfront CAPEX for larger systems

Level

-

EV & automotive supply chain upgrades

Level

-

Resistance heating

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing Demand from Advanced Manufacturing, Automation, and Electrification Trends.

The induction heating market is witnessing accelerated adoption as industries’ worldwide transition toward advanced manufacturing, automation-driven workflows, and broad-scale electrification of production systems. Modern manufacturing environments in automotive, aerospace, electronics, and precision machining increasingly rely on induction heating because it supports high-precision, repeatable, and digitally controlled thermal processing critical for zero-defect production goals. With Industry 4.0 becoming the global benchmark, factories are integrating induction equipment with smart controllers, PLCs, sensors, and SCADA systems for real-time monitoring, adaptive process control, and data-driven optimization. Strong global trade activity in medium- and high-technology manufactured goods evident from the rising export and import values in recent years reflects expanding industrial output and the continuous modernization of manufacturing capabilities. As countries increase their exports of high-tech goods, demand strengthens for reliable and efficient processing technologies like induction heating that ensure consistent quality and higher throughput. Similarly, rising imports of advanced industrial machinery indicate greater cross-border adoption of automated production equipment, further fueling induction heating penetration in key sectors. The electrification of industrial heating systems driven by energy efficiency targets and decarbonization commitments is another major force accelerating the replacement of traditional fossil-fuel-based furnaces with electric induction systems. Sectors such as EV manufacturing, battery module assembly, semiconductors, and high-speed machining require tightly controlled heating systems for brazing, annealing, hardening, and material bonding, all of which benefit from induction’s precise energy transfer. Combined with automated handling through industrial robotics, induction heating is now seen as a strategic enabler of productivity, sustainability, and cost optimization. As global manufacturing trade continues to rise, the corresponding expansion in high-tech production capacity is expected to further intensify the demand for advanced induction heating technologies.

Restraint: High upfront CAPEX for larger systems

A major restraint in the induction heating market is the significantly high upfront capital investment required for medium- and large-capacity systems, especially those used in automotive forging, aerospace component hardening, heavy machinery manufacturing, and large-scale metallurgical operations. Industrial-grade induction systems require advanced power supplies, solid-state inverters, customized coils, water-cooling units, and high-frequency controllers, all of which substantially increase system cost compared to conventional gas-fired or resistance furnaces. For large installations, the cost of designing custom coils for unique geometries or high-throughput lines further adds to CAPEX. The challenge intensifies when industries must align these systems with available electrical infrastructure. As global T&D networks expand particularly in non-OECD regions with 3,749 GW capacity additions and over 20 million km of new distribution lines by 2035—many manufacturing plants are required to upgrade their internal electrical distribution, switchgear, and transformers before adopting high-power induction heating units. Even in developed markets, where grid refurbishment is ongoing, compliance with modern electrical standards often demands additional spending on harmonics filters, automation interfaces, PLC integration, and safety interlocks. For small and mid-sized metalworking firms, these combined costs create long payback periods, making it difficult to justify replacing cheaper fossil-fuel-based heaters despite the superior efficiency and precision of induction technology. Financing constraints and the need for operator training and maintenance competencies add further financial pressure. As a result, the high upfront CAPEX associated with large induction heating systems continues to be a major barrier, slowing penetration in cost-sensitive industries and emerging economies. Overcoming this restraint will require incentives, leasing models, and dedicated industrial-efficiency funding mechanisms.

Opportunity: EV & Automotive Supply Chain Upgrades

The rapid expansion of the electric vehicle (EV) market is unlocking significant opportunities for induction heating manufacturers, as automakers and component suppliers upgrade production lines to meet surging global demand. According to the International Energy Agency (IEA), global electric car stock rose sharply from 2021 to 2023, with the 2023 figure reaching its highest level ever driven by major markets such as China, Europe, and the U.S. This exponential growth is putting pressure on supply chains to modernize forging, hardening, brazing, and joining operations, creating strong demand for induction heating solutions. EV components such as motor shafts, inverter parts, battery cooling plates, copper busbars, and lightweight aluminum structures require highly precise, energy-efficient heating an area where induction systems provide major advantages over gas-fired and resistance heating technologies. The EV shift also accelerates automation, with induction heaters being integrated into robotic welding cells, automated heat-treatment lines, and smart manufacturing workflows to achieve zero-defect production. As governments push EV manufacturing through industrial policies, new factories and gigafactories are being built in Asia, Europe, and North America. Each of these facilities requires advanced heat-treatment and metallurgical processing equipment, making induction heating a core enabling technology for next-generation EV supply chains. The strong uptick in EV adoption from 2021 to 2023, as reflected in your IEA bar chart, directly translates into rising equipment upgrades across Tier-1, Tier-2, and Tier-3 suppliers. Combined with ongoing grid modernization and electrification efforts, the rapid EV market expansion is expected to sustain high demand for induction heating systems in drivetrain, battery, motor, and precision metal processing applications over the next decade.

Challenge: Resistance Heating

Resistance heating remains a persistent competitive challenge for the induction heating market, particularly in regions where industrial buyers prioritize low upfront cost over long-term efficiency. Traditional resistance heating systems are simpler, widely available, and familiar to operators, making them a default choice for small and medium enterprises looking to avoid high CAPEX technologies. Despite being less energy-efficient, resistance heating systems involve minimal installation complexity and require fewer specialized components, reducing the need for skilled technicians. As a result, industries like metal fabrication, automotive component workshops, and local forging units continue to rely on resistance heaters for basic thermal tasks. This creates an adoption barrier for advanced induction heating systems, which are typically associated with precision heating, higher frequency control, and digitally governed power supplies. In cost-sensitive markets, buyers often hesitate to migrate to induction systems due to perceived risks related to workforce training, process adaptation, and equipment integration. Moreover, in many developing economies, utilities offer subsidized electricity for industrial heating, making resistance-based systems appear economically viable. Together, these factors restrict the pace of technology transition and create competitive friction for induction heating suppliers.

Induction Heating Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies induction heating systems for metal heat-treating, forging, brazing, and automotive component hardening. | The solutions offered by ITC provide highly precise and repeatable heating that improves process consistency and product quality. They also help manufacturers lower energy consumption due to the efficiency of induction technologies, while enabling faster heating cycles that significantly increase production throughput. |

|

Provides industrial induction systems for weld heat-treating, automotive shaft hardening, and advanced materials processing. | Taylor-Winfield’s systems ensure uniform heating across workpieces, which directly improves weld integrity and overall component strength. Their technology reduces operating costs by minimizing heat losses and maintenance requirements while delivering consistent production quality. |

|

Tata Motors uses induction heating technologies including induction, combustion, and infrared heating for processes such as automotive component hardening, gear and shaft heat-treating, brazing of fuel system components, preheating for welding, and thermal processing of chassis and powertrain parts. | By integrating industrial heating systems into its manufacturing operations, Tata Motors achieves consistent metallurgical properties across critical automotive components, resulting in enhanced durability and performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map provides a quick snapshot of the key stakeholders involved in the induction heating market, from component providers and end users to regulatory bodies/standards organizations. This list is not exhaustive and is meant to give an idea of the key market players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial heating Market, by End user

The induction heating market serves a diverse range of end users, including the Metal Industry, Industrial Manufacturing, Automotive, Plastics Processing, electronics and semiconductors, Consumer Appliances, and the Medical Industry. Among these, the Metal Industry remains the largest and one of the most influential segments due to its heavy reliance on heat-intensive processes such as melting, forging, annealing, heat treating, and surface hardening. As steel plants, foundries, and forging facilities continue to expand capacity and modernize operations, demand for efficient and high-performance heating systems has grown substantially. The production of metals increasingly requires precise and rapid heating cycles to ensure consistent metallurgical properties, dimensional accuracy, and enhanced mechanical performance of components. Industrial heating technologies—particularly induction heating—enable cleaner, faster, and more energy-efficient processing compared to traditional fuel-based furnaces. This performance advantage is crucial as metal producers face rising quality standards, stricter emission rules, and higher pressure to reduce operational costs. Furthermore, the shift toward lightweight alloys, high-strength steels, and advanced materials in automotive, aerospace, and machinery manufacturing has increased the need for highly controlled heating solutions. Digitalization trends, including temperature profiling, automation, and predictive maintenance, further enhance the efficiency and reliability of heating systems used in metal processing. With continued investments in infrastructure, renewable energy equipment, and industrial expansion across Asia-Pacific and North America, the Metal Industry is expected to maintain its dominance and remain the most rapidly evolving end-user segment in the Industrial Heating market.

Industrial heating Market, by Power

The power rating categories for induction heating include Up to 10 kW, 10 kW – 100 kW, and Above 100 kW systems. The 10 kW – 100 kW segment has emerged as the dominant and fastest-growing category due to its broad applicability across mid-scale manufacturing operations. This power range strikes an optimal balance between heating output, energy efficiency, and system cost, making it highly suitable for applications such as heat treating, brazing, soldering, annealing, billet heating, and component hardening. Industries prefer this segment because it supports both continuous and batch operations while maintaining flexibility in production layouts. The systems are compact, easy to integrate into automated lines, and require significantly lower infrastructure investment compared to large-capacity furnaces. This makes them ideal for modernization programs where businesses seek to replace legacy heating systems with faster, cleaner, and more controllable solutions. Additionally, growth in the automotive, electronics, and machinery sectors has fueled demand for medium-power heating solutions that deliver precision and repeatability. As global manufacturers move toward leaner operations, predictive maintenance, and energy-optimized systems, the 10 kW – 100 kW power class continues to offer the best return on investment, firmly establishing it as the largest segment in the overall market.

Industrial heating Market, by Application

The Induction Heating market spans several application areas, including Metal Melting, Annealing, Heat Treating, Brazing & Soldering, and Surface Hardening. Heat Treating stands out as the largest application segment due to its central role in enhancing material properties such as hardness, durability, wear resistance, and structural integrity. Industries like automotive, aerospace, heavy machinery, and metal fabrication increasingly rely on heat treating to meet higher performance requirements for gears, shafts, springs, bearings, tools, and structural components. Modern heating technologies—especially induction heating—support rapid heating cycles, precise temperature control, and consistent quality outcomes, making them ideal for heat-treating processes. The growth of electric vehicles, renewable energy machinery, and smart manufacturing has further boosted demand for heat-treated metals and alloys. Additionally, the transition from gas-fired furnaces to electric, energy-efficient systems is accelerating across Europe, North America, and Asia. This shift further strengthens the dominance of heat treating as industries prioritize high throughput, reduced distortion, and improved metallurgical performance.

Industrial heating Market, by Frequency

Induction heating systems are segmented by operating frequency into 1–10 kHz, 10–50 kHz, and 50 kHz – 1 MHz. The 10–50 kHz range represents the largest and most widely adopted segment because it provides an excellent balance of heating penetration and surface-level precision. This frequency range is particularly effective for processes such as brazing, annealing, heat treating, and hot forming, where both uniform heating and moderate depth penetration are required. Manufacturers favor this frequency band due to its high electrical efficiency, stable heating characteristics, and compatibility with a broad variety of ferrous and non-ferrous materials. The segment also benefits from the rising adoption of induction heating systems across automotive, metal fabrication, and electronics sectors, where rapid and consistent heating is essential for high-volume production. Additionally, the 10–50 kHz category supports advanced control systems, temperature sensing, and automation technologies that enhance process repeatability and product quality. As industries shift toward greener, energy-saving heating solutions, this frequency range continues to deliver superior operational performance—making it the preferred choice for most industrial users.

REGION

Asia Pacific to be fastest-growing region in global industrial heating market during forecast period

Asia Pacific is expected to be the fastest-growing region in the Induction Heating Market due to the rapid pace of industrialization, large-scale manufacturing expansion, and strong investment inflows across key sectors such as automotive, metals, electronics, chemicals, and food processing. Countries such as China, India, Japan, are aggressively upgrading their industrial infrastructure, driving demand for advanced heating systems such as induction, combustion, infrared, and electric heaters. The region’s shift toward energy-efficient and low-emission heating technologies, supported by government sustainability programs and stricter environmental regulations, is accelerating the adoption of modern industrial heating solutions. Growing renewable integration, electrification of process heating, and the rise of smart factories under initiatives like “Make in India,” “China Manufacturing 2025,” and Japan’s “Society 5.0” are further boosting demand. Additionally, APAC benefits from low manufacturing costs, expanding SME ecosystems, rising foreign direct investment, and rapid growth in consumer goods and electronics production, all of which require temperature-controlled industrial processes. Increasing automation, digitalization, and the adoption of AI-driven heating optimization technologies also position the region as the fastest-growing market during the forecast period.

Induction Heating Market: COMPANY EVALUATION MATRIX

In the induction heating market matrix, Inductotherm Group (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across industries. Magneforce Inc. (Emerging Leader) is gaining traction with high-efficiency Industrial Heating. While the Inductotherm group. dominates with scale, Magneforce Inc. shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 616.8 MN |

| Market Size in 2030 (Value) | USD 879.5 MN |

| Growth Rate | CAGR 7.4% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | BY POWER (UPTO 10 KW, 10 KW –100 KW, ABOVE 100 KW) |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Induction Heating Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Induction Heating Manufacturer | Mapping induction heating products across different end users | Support entry into utilities value chain with tailored opportunity mapping |

RECENT DEVELOPMENTS

- August 2025 : Inductotherm Group has relocated to a newly constructed manufacturing facility in Kocaeli, marking a significant milestone in the company's growth strategy. The new state-of-the-art facility is designed to expand production capabilities, improve operational efficiency, and strengthen the company’s presence in Türkiye.

- January 2024 : ENRX has strengthened its strategic partnership with Roctool by investing €2 million through the acquisition of 1,111,111 new shares at €1.80 each. As part of the deal, ENRX will join Roctool’s Board of Directors. The collaboration aims to combine Roctool’s advanced molding technologies with ENRX’s induction expertise to drive innovation and sustainability. Roctool’s technology will soon be showcased at ENRX’s Shanghai and Detroit sites and major international trade shows.

- December 23 : inTEST Corporation launched the EKOHEAT 2 family of induction heating systems, representing the next generation of Ambrell’s established VPA technology. It also includes Advanced Internal Monitoring, an industry-exclusive architecture that integrates internal diagnostics, temperature and pressure monitoring, and enhanced control of voltage, power, and frequency.

- January 2022 : inTEST Corporation announced the opening of a new Applications Laboratory in Monterrey, Mexico, in partnership with EPGA Induction. The expansion of Ambrell’s induction heating laboratory presence into Mexico and Latin America significantly strengthened the company’s regional market reach and customer engagement. The company was able to provide faster, hands-on technical support, localized testing, and solutions for customers across various industries.

Table of Contents

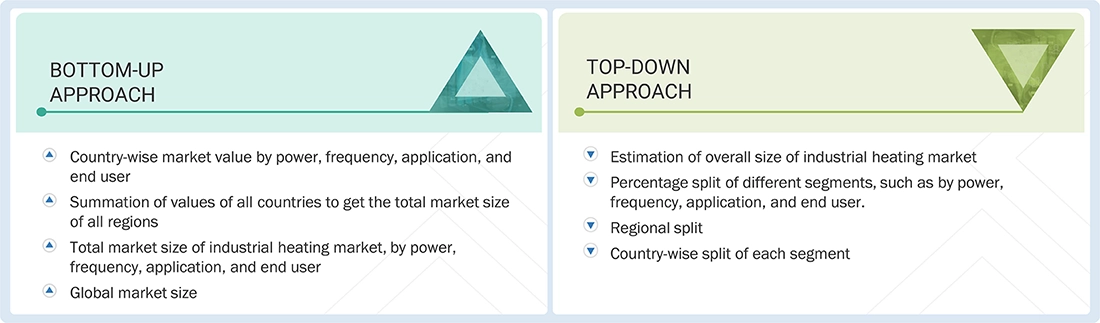

Methodology

The study involved major activities in estimating the current size of the Induction Heating market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the Induction heating market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Induction Heating market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The Induction heating market comprises a diverse ecosystem of stakeholders, including manufacturers, technology vendors, system integrators, and service providers throughout the value chain. On the demand side, market growth is supported by increasing adoption of Induction Heating in a wide range of applications spanning On the demand side, market growth is supported by increasing adoption of Induction Heating in a wide range of applications spanning metal forging and forming, heat treatment, brazing and soldering, shrink-fitting, melting, annealing, surface hardening, plastic and composite processing, semiconductor manufacturing, and advanced materials processing. These applications require precise, rapid, and energy-efficient heating, prompting industries to shift from conventional combustion systems to electrically powered heating technologies that offer higher control, lower emissions, and better integration with automated production lines. The expanding use of high-quality components in the automotive and electronics industries further reinforces demand for reliable heating processes that ensure metallurgical accuracy and consistent product performance. As industrial operations globally pursue productivity enhancement, energy optimization, and emissions reduction, the adoption of modern Induction Heating solutions continues to rise across all major downstream sectors.

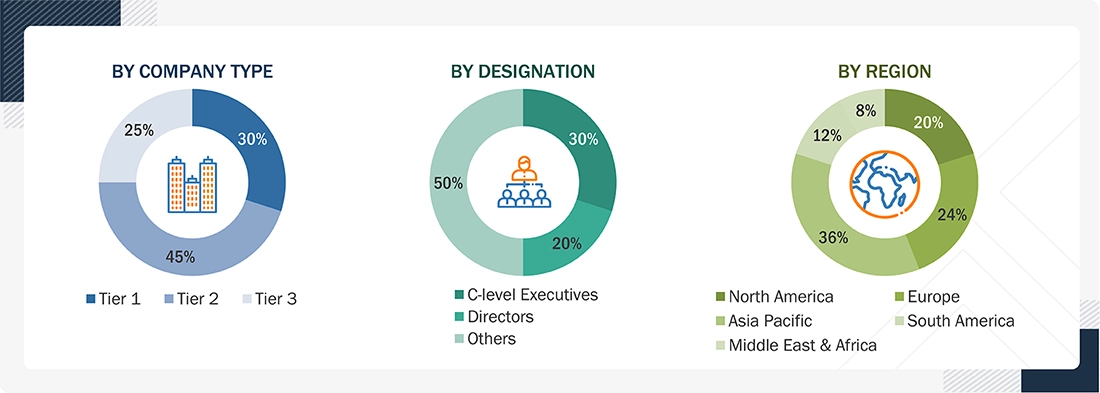

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the Induction heating market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the Induction Heating market.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

An induction heating system is a specialized power electronic system/power supply that rectifies AC to DC and then inverts DC into high-frequency AC power for efficient, stable induction heating applications in various industrial processes. This high-frequency AC drives an induction heating coil, generating electromagnetic fields that induce eddy currents in conductive materials, producing rapid, localized, and controllable heating without direct contact, flames, or emissions.

These systems utilize technologies such as induction, infrared, resistance, and RF heating to deliver precise, uniform, and repeatable heating cycles essential for forging, brazing, hardening, melting, annealing, shrink-fitting, and surface treatment. Induction Heating equipment operates through carefully regulated power and frequency parameters, ensuring that heat is applied with the required depth, speed, and thermal accuracy. By replacing traditional gas or fuel-based heating methods with electrically driven systems, industries benefit from higher efficiency, reduced maintenance, lower emissions, and improved process consistency. Induction Heating serves as a critical interface between raw material preparation and finished product quality, enabling fully automated, flexible, and high-performance manufacturing operations across automotive, electronics, and machinery production.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Induction Heating manufacturers, dealers, and suppliers

- System Integrators and Contractors

- Organizations, forums, alliances, and associations

- Public & private companies

- State and national regulatory authorities

Report Objectives

- To describe and forecast the Induction Heating market, by power, frequency, application, and end user, in terms of value.

- To describe and forecast the Induction heating market for various segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, in terms of value

- To describe and forecast the Induction Heating market, by region, in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the Induction Heating supply chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, impact of gen AI/AI, and the 2024 US tariff impact.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the market’s competitive landscape.

- To analyze growth strategies, such as acquisitions, investments, expansions, and product launches, adopted by market players in the Induction heating market

Induction Heating Market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Induction Heating Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Induction Heating Market