Industrial Boiler Market

Industrial Boiler Market by Fuel (Natural Gas, Coal, Oil), Boiler Type (Fire Tube, Water Tube), Function (Hot Water, Steam), Boiler Horsepower, End-use Industry (Chemical & Petrochemical, Food, Pulp & Paper) And Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial boilers market is projected to reach USD 20.75 billion by 2030 from USD 17.22 billion in 2025, at a CAGR of 3.8% from 2025 to 2030. The global industrial boiler market is expanding due to rising demand from food, chemical, and power generation industries, coupled with the modernization of manufacturing facilities

KEY TAKEAWAYS

-

BY FUEL TYPEThe industrial boilers market by fuel type include natural gas, coal, oil, and others. Natural gas dominates the fuel type segment of the industrial boiler market due to its high energy efficiency, cleaner combustion, and lower greenhouse gas emissions compared to coal or oil.

-

BY BOILER TYPEThe industrial boilers market by boiler type includes ,fire-tube, water-tube and other boiler types. The fire-tube boiler segment leads the industrial boiler market due to its cost-effectiveness, simple design, and ease of installation and maintenance. These boilers are highly preferred for low to medium pressure applications in industries such as food processing, chemical, textile, and paper.

-

BY FUNCTIONThe industrial boilers market by function type includes hot water and steam. The steam boiler segment dominates the industrial boiler market as it is widely used across power generation, chemical processing, food and beverage, and refining industries.

-

BY BOILER HORSEPOWERThe industrial boilers market by boiler horsepower includes 10-150 BHP, 151-300 BHP, 301-600 BHP and above 600 BHP. The 10–150 BHP (boiler horsepower) segment dominates the industrial boiler market due to its versatility, compact design, and suitability for small to medium-scale industrial operations.

-

BY END-USE INDUSTRYThe industrial boilers market by end-use industry includes chemicals & petrochemicals, food, paper & pulp, metal & mining, power generation, and other end-use industries. The chemical and petrochemical industry dominates the global industrial boiler market due to its high and continuous demand for process steam and heat in large-scale production facilities. These industries rely heavily on boilers for distillation, chemical reactions, and material processing, making them the largest end-use segment worldwide.

-

BY REGIONThe industrial boilers market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. The Asia-Pacific region leads the industrial boiler market due to rapid industrialization, urbanization, and strong manufacturing growth across countries like China, India, and Southeast Asia. Additionally, rising energy demand and government investments in clean and efficient industrial infrastructure further drive market dominance.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Babcock & Wilcox Enterprises, (US), Siemens (Germany), Wood (UK), Dongfang Electric Corporation Limited (DEC LTD.) (China), Robert Bosch GmbH (Bosch) (Germany), Mitsubishi Heavy Industries, Ltd. (MHI) (Japan), Thermax Limited (India), Sofinter (Italy), Bhel (India), and Cleaver-Brooks, Inc. (US). are some of the major players in the industrial boilers market.

The global industrial boiler market is witnessing strong growth driven by increasing demand from the food, chemical, and power generation sectors, along with the modernization of manufacturing facilities. The growing adoption of energy-efficient, low-emission, and biomass or gas-fired boilers is further propelling the market. Moreover, government-led decarbonization efforts and rising industrial infrastructure investments across Asia-Pacific and the Middle East are boosting overall market expansion

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of industrial boilers suppliers, which, in turn, impacts the revenues of industrial boilers manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand of electricity and power generation

-

High Demand from major end-use industries

Level

-

High initial investment and operating cost

Level

-

Adoption of biomass boilers to achieve low carbon emission targets

-

Increasing demand for compact designs and lean operation

Level

-

Increasing energy prices

-

Stringent regulations and emission control

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising demand of electricity and power generation

The increasing global demand for electricity is one of the most significant drivers for the industrial boilers market, especially in industrialized countries and developing economies. With increased urbanization, population, and industrial activities, the demand for efficient and stable power generation has risen dramatically, which has resulted in increased utilization of industrial boilers in thermal power plants, and in various other facilities. In Asia Pacific and African developing countries, accelerated industrialization and growing infrastructure necessitate round-the-clock power supply, driving investment in coal-fired, gas-fired, and biomass power plants based on high-capacity boilers for the production of steam. China and India are experiencing tremendous growth in thermal and renewable power generation, leading to high demand for low-emission, high-efficiency industrial boilers. In the developed world of Europe and North America, the emphasis is turning towards cleaner and greener energy alternatives, with increasing uptake of natural gas, hydrogen fuel-based, and waste heat recovery boilers to provide electricity needs while adhering to stringent environmental policies. The growth of combined heat and power (CHP) plants, where industrial boilers are used for simultaneous electricity and heat production, is also driving the market growth

Restraint: High initial investment and operating cost

The high capital expenditure and operating expenses of industrial boilers are among the primary factors that impede the growth of the industrial boilers market. The purchasing, installation, and commissioning of industrial boilers requires a significant capital expenditure, which poses a challenge for small to medium enterprises (SMEs) and low resource industries. IIn addition to investment, operational expenditure also has significant importance. To maximize their efficiency, industrial boilers need an uninterrupted fuel supply and regular servicing and maintenance. Fuel prices tend to be everchanging, especially for natural gas and biomass, which influences operational expenses.. Adhering to strict emission standards also contributes to the cost of doing business. Manufacturers have to spend on pollution control equipment, water treatment facilities, and monitoring devices to comply with government requirements, such as the EPA Boiler MACT standards in the US or the EU Industrial Emissions Directive (IED). Such added costs may deter some companies from modernizing or transitioning to newer boiler systems, thus hindering the market growth. While technology and government stimulus seek to cut cost barriers, the capital and operating costs remain a major restrain on the use of industrial boilers, especially in price-conscious markets

Opportunity: Adoption of biomass boilers to achieve low carbon emission targets

Increasing global interest in lowering carbon emissions and pollution and achieving sustainability targets is creating a significant opportunity for industrial sector’s uptake of biomass boilers. Biomass boilers, fueled with organic materials like wood pellets, farm wastes, and forestry residues, are gaining popularity as a green alternative to coal and oil-fired boilers. With governments and industries seeking to achieve net-zero objectives, carbon price mechanisms, and strict emission limits, demand for biomass boilers is on the rise. Many countries, especially in the European Union and North America, have established economic incentives, grants, and tax credits to encourage industries to move towards biomass-fueled heating systems. Measures such as the European Union's Renewable Energy Directive (RED II) and the US Renewable Heat Incentive (RHI) is supporting the utilization of biomass boilers to reduce the consumption of fossil fuels. Meanwhile, advances in technology for biomass combustion, waste heat recovery, and automated fuel feeding systems are increasing efficiency and making biomass boilers a low-emission, affordable industrial solution. With industries increasingly looking into sustainable energy solutions and carbon reduction programs, the use of biomass boilers presents a lucrative market opportunity for expansion while allowing companies to meet their environmental commitments

Challenge:: Increasing energy prices

The increasing energy price is a major issue for the industrial boiler industry, affecting the operating cost as well as profitability of industries using boilers for steam and heat production. Volatility in fuel prices, such as natural gas, coal, and biomass, poses uncertainty for companies, which impact the long-term cost planning. As energy prices keep on changing as a result of geopolitical tensions, supply chain issues, and increased global demand, industries experience higher operating expenses, making industrial boilers less attractive. Natural gas, one of the main fuels used in modern & advanced boilers, has experienced considerable price volatility in recent years, as a result of geopolitical circumstances, wars, tension between countries, and supply shortages. Moreover, the increase in coal price has been attributed to supply restrictions and rising carbon pricing regulations that discourage the consumption of fossil fuels. Even biomass fuel, regarded as an affordable substitute, witnessed price increases owing to logistical issues and increased demand for renewable fuel. Governments are also implementing stronger carbon taxes and pollution controls, applying additional fiscal stress on the sectors to opt for cleaner but invariably costlier fuels. To counter these challenges, many organizations are focusing energy efficiency enhancement, and superior combustion technologies

industrial-boiler-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Industrial boilers provide process steam and heat for chemical synthesis, distillation, and other unit operations in large-scale chemical manufacturing. | Reliable and efficient steam supply for continuous operations.. |

|

Boilers generate high-pressure steam used for refining crude oil, powering turbines, and supporting hydrogen and gas processing units | Stable and safe steam generation for refining units. |

|

Boilers provide steam and thermal energy for dyeing, finishing, and drying of textiles | Uniform heat distribution ensuring fabric quality. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial boiler ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material supplies, equipment suppliers, manufacturers, distributors, and end users. The raw material suppliers provide steel, alloy steel, carbon steel and others to industrial boilers manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Indutrial Boilers Market, By End-use Industry

The power generation sector is a vital industry that propels world economic development by providing electricity to industries, commercial complexes, and residential settlements. With the increasing demand for energy due to industrial growth, urbanization, and technological innovation, power plants are shifting towards efficient and sustainable ways of generating energy. The sector is based on different sources of energy, such as fossil fuels (coal, natural gas, oil), nuclear energy, and renewable energy (biomass, hydro, solar, and wind), . In among the most influential sources of electricity generation worldwide are thermal power plants. Industrial boilers are a crucial part of power generation, especially in thermal power plants where they generate high-pressure steam to propel turbines for the generation of electricity. Boilers are employed in coal-fired, gas-fired, biomass, and waste-to-energy power plants, providing a constant steam supply for turbine operation. Supercritical and ultra-supercritical boilers have been engineered to enhance efficiency and minimize emissions as technology improves, making power plants more sustainable

Indutrial Boilers Market, By Fuel Type

Both nuclear-fired and biomass boilers are viable alternatives to fossil fuel systems and make contributions to the generation of low-carbon energy globally. Biomass boilers, well known for industrial steam production, renewable energy, and thermal power plant operations, employ wood pellets and crop residues as fuel. They attain low emissions in addition to fossil fuel replacement. However, issues of storage and fuel availability are present. They are more efficient with new combustion methods. Nuclear energy based on nuclear boilers rely on fission reactions to generate steam to power electric power plants. The initial investment is quite high and there is a radioactiv waste poses a significant environmental & health hazards . Both these technologies provide low pollution advantages to industrial and power generation processes, allowing the shift towards sustainable energy systems

REGION

Asia Pacifi to be fastest-growing region in global medical filtration market during forecast period

In the Asia-Pacific region, the market for industrial boilers is fastest growing market globally due to the increasing investment in power generation, new expansions of factories, and heightened energy consumption. Major growth is observed in China, India, Japan, and South Korea due to rapid urbanization, industrial expansion, and government policies that focus on energy conservation. Chemical plants, food factories, textile and apparel manufacturers, and pharmaceutical companies depend on industrial boilers for steam and process heating, which further fuels the market growth. The demand for electricity is also driving the adoption of industrial boilers in power stations, and more gas and coal power plants and biomass energy plants are being added. Governments are implementing stricter control policies regarding emission and pollution, therefore incentivizing industries to adopt high-efficiency, low emission boilers. Such policies include the “Blue Sky Protection Plan” in China and the renewable energy push in India that seeks to promote cleaner boiler technology use

industrial-boiler-market: COMPANY EVALUATION MATRIX

In the medical coting market matrix, Babcock & Wilcox (Star), a US based company, leads the market through its high-quality industrial boilers products, which find extensive applications in various end-use industries such as chemical, food and others.Harbin Electirc Corporation (Emerging Leader) is gaining traction with its technological advancements in industrial boiler.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD16.59 Billion |

| Market Forecast in 2030 (Value) | USD 20.75 Billion |

| Growth Rate | CAGR of 3.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: industrial-boiler-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Industrial Boilers Supplier |

|

Supported go-to-market strategy and positioning vs competitors |

| Country-level insights for high-growth regions | Provided detailed market sizing and forecasts for the U.S., Germany, China, India, and Japan | Helped the client identify region-specific growth hotspots and investment opportunities |

| Identify emerging boiler technologies with potential ROI | Conducted technology scouting and feasibility analysis | Supported investment decisions and innovation roadmap for clients |

| Evaluate regulatory compliance for new market entry | Compiled local emission, safety & efficiency standards per country | Ensured smooth market entry and minimized legal risks |

RECENT DEVELOPMENTS

- March 2025 : Wood launched a new office in Darwin to drive its expansion in the Northern Territory (NT), supporting a growing portfolio of onshore and offshore projects in maintenance, operations, and engineering

- March 2025 : Wood, a global leader in consulting and engineering, launched a specialized center in Abu Dhabi dedicated to technical, strategic, and economic energy transition solutions. This ‘energy transition hub’ will support clients across the Middle East, providing the advisory and technical expertise needed to drive energy diversification and achieve net-zero targets

- Feburary 2025 : Cleaver-Brooks introduced myBoilerRoom, an advanced digital solution designed to optimize efficiency, enhance reliability, and drive cost savings for facilities. This technology allows users to strategically plan and design custom boiler room strategies tailored to achieve their operational goals

- November 2023 : Mitsubishi Heavy Industries Ltd. (MHI) and Orica signed a Memorandum of Understanding to explore collaboration opportunities for emission reduction initiatives, reflecting their shared commitment to decarbonization

- November 2023 : Mitsubishi Heavy Industries, Ltd. (MHI) and Indonesia's Institute Technology Bandung (ITB) strengthened their R&D collaboration to advance zero-carbon technologies in Indonesia. The second research phase focuses on exploring the potential of zero-carbon power generation, aiming to integrate proven gas turbine technologies and support cleaner energy solutions in the region

Table of Contents

Methodology

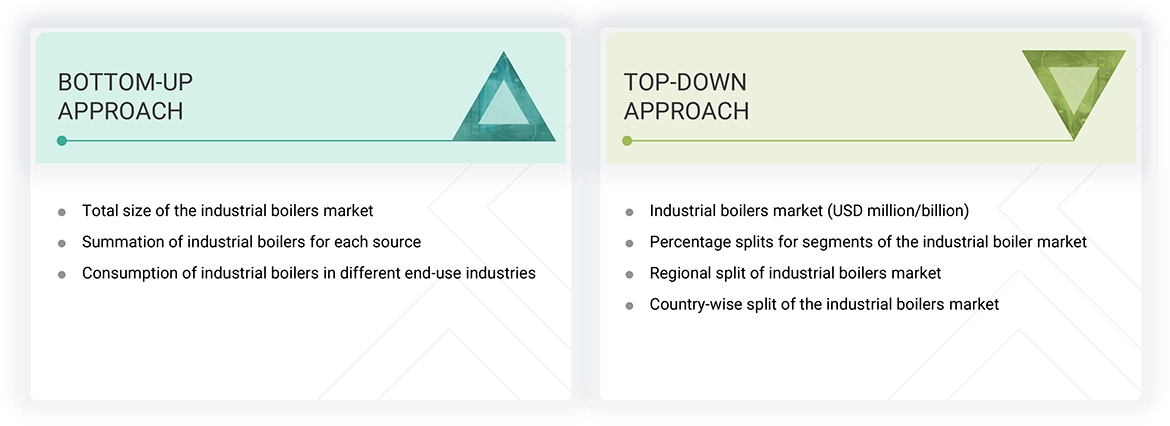

The study involved four major activities for estimating the current size of the global industrial boiler market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial boiler through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the industrial boiler market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the industrial boiler market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The industrial boiler market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the industrial boiler market. Primary sources from the supply side include associations and institutions involved in the industrial boiler market, key opinion leaders, and processing players.

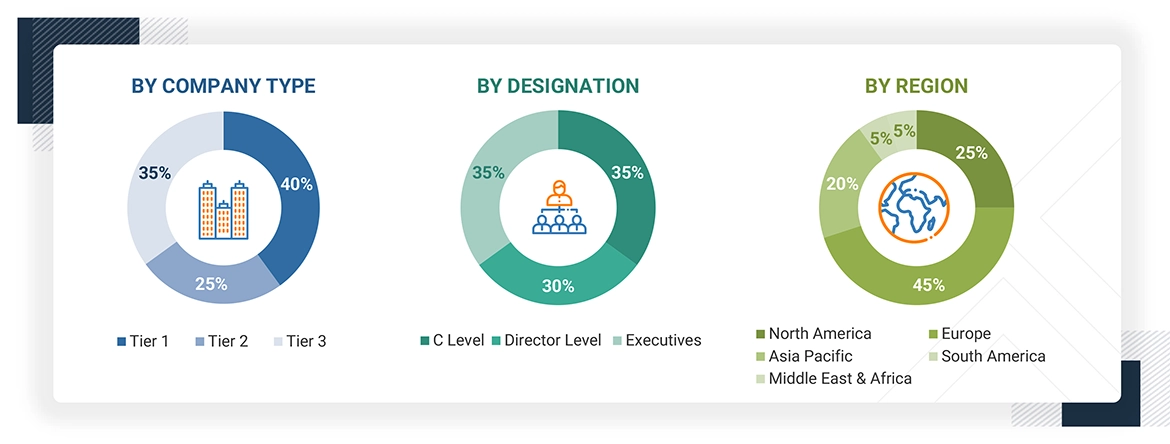

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the industrial boiler market by boiler type, fuel type, function, boiler horsepower and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the industrial boiler market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

An industrial boiler is a closed vessel where water is heated to produce steam at a desired pressure and temperature. Combustion of fuels such as oil, gas, and coal generate thermal energy that is transferred to the water in the vessel. This helps increase pressure and convert the liquid into steam. Industrial boilers heat water and generate steam for humidification and industrial heating applications. Industrial boilers can generate a greater amount of heat than boilers used in commercial or residential settings.

Stakeholders

- Industrial Boiler Manufacturers

- Raw Material Suppliers

- Equipment suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the industrial boilers market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on boiler type, fuel type, function type, boiler horse power, end-use industry and region.

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the industrial boiler market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Boiler Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Boiler Market