Industrial Oxygen Generator Market

Industrial Oxygen Generator Market by Gas Type and Flow Rate (Industrial oxygen, Medical Oxygen), Size (Stationary, Portable), Design (Cylinder, Plug & Play), Technology (Pressure Swing Adsorption (PSA) Based Generator, Membrane-Based Generator, Cryogenic-Based Industrial Generator), End-Use Industry, and Region - Global Forecast to 2030

INDUSTRIAL OXYGEN GENERATOR MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market for industrial oxygen generators is predicted to rise from USD 6.75 billion in 2025 to USD 10.05 billion in 2030, at a CAGR of 8.3%. The industrial oxygen generator market is driven by increasing demand across various industries due to technological advancements and a focus on efficiency. These generators use methods like pressure swing adsorption (PSA), membrane-based systems, and cryogenic processes to produce oxygen. Manufacturers can customize these systems to meet specific needs in sectors like healthcare and industry. As the demand for on-site oxygen production grows for operational efficiency and environmental benefits, the need for advanced oxygen generation technology is expected to rise.

KEY TAKEAWAYS

-

By Gas Type and Flow RateIndustrial oxygen generators form the faster-growing segment over medical oxygen generators. Industrial oxygen generation demands solutions across varied flow rate ranges to match sector-specific needs. Small units serve niche operations with precise oxygen delivery, mid-range systems support medium-scale industries with modular, cost-efficient designs, and high-capacity plants power large-scale sectors like petrochemicals, glass, and metals with reliable, automated performance.

-

By SizeStationary oxygen generators are estimated to account for the larger market share in the industrial oxygen generator market primarily because they are best suited for industries that require a continuous and large-volume oxygen supply, such as steel, chemicals, and water treatment. These systems offer cost efficiency by eliminating the need for purchasing and transporting oxygen cylinders or liquid oxygen, making them more economical over time despite higher initial investment.

-

By DesignCylinder-based oxygen generators are estimated to account for the larger market share by size in the industrial oxygen generator market, mainly due to their wide applicability, convenience, and established distribution infrastructure. These systems are commonly used across diverse industries such as healthcare, welding, metal fabrication, food processing, and small-scale manufacturing, where on-site generation is not feasible or cost-effective.

-

By TechnologyPressure swing adsorption (PSA) technology is estimated to account for the largest market share in the industrial oxygen generator market because it offers the best balance of efficiency, reliability, and cost-effectiveness for on-site oxygen production. PSA systems can generate oxygen with high purity levels (typically 90–99%) directly from ambient air, making them ideal for a wide range of industrial applications such as metal cutting, glass manufacturing, wastewater treatment, and chemical processing.

-

By End-use IndustryThe medical & healthcare end use industry is set to register the highest market share during the forecast period. In the health and medical fields, oxygen generators are designed to provide on-demand, continuous high-purity oxygen in accordance with strict biomedical and regulatory requirements for hospitals, clinics, emergency care departments, and pharmaceutical producers. Manufacturers include considerations for reliability, redundancy, and maintenance of the systems to support continuous patient care, while also maintaining small footprints to fit limited medical physical infrastructure.

-

By RegionThe industrial oxygen generator market is led by Asia Pacific based on the industrial demand for oxygen as it is home to the largest manufacturing regions in the world.

-

Competitive LandscapeLeading companies in the industrial oxygen generator market are embracing both organic and inorganic strategies, including exciting partnerships and smart investments, to satisfy the growing demand across innovative applications. Notable players like Air Liquide (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), and Linde plc (UK) are actively collaborating to improve their product offerings, showcasing their commitment to innovation and customer satisfaction.

The industrial oxygen generator market is experiencing steady growth, fueled by rising demand across industries for reliable, high-purity, and cost-efficient oxygen supply. Drivers include the need to enhance operational efficiency, reduce dependency on bulk cylinder logistics, and comply with strict environmental and safety standards. Market dynamics are being reshaped by new collaborations between equipment manufacturers and end-use industries, investments in energy-efficient generation technologies, and innovations such as smart plug-and-play systems and hybrid PSA–membrane solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Industrial oxygen generators are vital for daily operations across multiple industries, including healthcare, metal processing, chemicals & petrochemicals, aquaculture, oil & gas, manufacturing, and packaging. Healthcare remains one of the most important applications, alongside metal fabrication, wastewater treatment, chemical processing, and aquaculture oxygenation. Growing demand for reliable, high-purity oxygen in both industrial and medical settings and the need for energy-efficient on-site production are driving adoption in both developed and emerging economies. Increased urbanization, expanding industrial activity, and growing healthcare infrastructure in countries such as Brazil, India, China, and throughout the ASEAN region are expected to further boost market growth, as industries aim to reduce reliance on bulk oxygen deliveries and enhance operational resilience.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

INDUSTRIAL OXYGEN GENERATOR MARKET DYNAMICS

Level

-

Rising development of healthcare infrastructure

-

Increasing prevalence of chronic respiratory diseases

Level

-

Stringent compliance standards

Level

-

Increasing demand in aquaculture industry

-

Rising demand for high-purity oxygen in ozone generation

Level

-

High installation and integration costs

-

Specialized Maintenance Needs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising development of healthcare infrastructure

The growth of government healthcare infrastructure, coupled with coordinated investments from international donors and development organizations, is significantly driving the oxygen generator market. On-site oxygen generation systems have become essential medical assets globally, particularly in emerging economies, as they provide a dependable, cost-effective source of oxygen that operates independently from centralized health systems. The US government, for instance, has donated oxygen generation plants to Peru in response to the COVID-19 third wave, while Ghana has launched a new liquid oxygen plant. Additionally, Unitaid's Oxygen Access Program in East Africa is now securing an initial USD 22 million in capital funding for further expansion into Tanzania, following its successful launch in Kenya in October 2024.

Restraint: Stringent compliance standards

The global oxygen generator market suffers from strict and complex regulations in all key markets that impact commercialization timelines, costs of operations, and product development timelines. In Europe, medical oxygen generators are defined as medical devices in the Medical Device Regulation (MDR) 2017/745 and the previous Directive 93/42/EEC, including ISO 10083 for the plant specification and also requiring compliance with European Pharmacopoeia medical oxygen 93 for purity. Manufacturers must have ISO 13485 certification and plan on redundant sources for safety.

Opportunity: Increasing demand in aquaculture industry

The aquaculture industry presents significant growth potential for oxygen generator products, with a portion of the need for high-purity oxygen for fish health, growth, and sustainable operations within the industry. Leading manufacturers, through strategic alliances or technologies, continue to take the lead in the niche. OXYMAT has developed a unique aquaculture-oriented suite of product offerings, both modular PSA systems and frame-mounted X-series units and Nordic configurations designed to provide flexibility, application, and reliability in land-based or offshore aquaculture. The partnership with Oxzo, a Norwegian aquaculture oxygenation company, is advancing energy-efficient oxygenation systems that improve the operational efficiencies and sustainability for fish operations.

Challenge: High installation and integration costs

The oxygen generator market continues to face challenges from limited parts availability and servicing network capacity, which impact uptime and reliability. Delays in sourcing spare parts can exacerbate downtime, decrease oxygen purity, lead to no gas availability, and interrupt medical and industrial work. In healthcare, disruptions can endanger patient safety, while in industrial environments, interruptions result in loss of production. Challenges sourcing spare parts in a robust supply chain significantly deteriorate oxygen concentration output and performance overall.

Industrial Oxygen Generator Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses oxygen generators to supply medical-grade oxygen for hospitals, clinics, and mobile healthcare units | Reliable on-site supply, reduced dependence on cylinders, ensures compliance with medical standards |

|

Deploys oxygen generators in chemical processing and oxidation reactions within specialty chemical plants | Continuous high-purity oxygen flow, improved process efficiency, lower logistics and energy costs |

|

Integrates oxygen generators into steelmaking and metallurgy operations for combustion, oxidation, and decarburization | Enhanced furnace efficiency, reduced fuel consumption, consistent oxygen availability on-site |

|

Utilizes oxygen generators in wastewater treatment plants for aeration and biological processes | Improved water quality, reduced chemical usage, sustainable operations, lower operating costs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

INDUSTRIAL OXYGEN GENERATOR MARKET ECOSYSTEM

The industrial oxygen generator ecosystem consists of a complicated network of component suppliers, technology partners, manufacturers, system integrators, service providers, and end users. The main components consist of air compressors, filtration equipment, oxygen generation device (PSA or membrane), control panel, and storage tank. Technology partners offer automation, IoT, and AI enhancements that will improve efficiency and monitoring capabilities. Manufacturers can assemble configurable generators based on specific customer needs within the industry, while integrators will introduce the ambient oxygen to production line activities. Service providers provide up-front consultation and ongoing installation, maintenance, and technical support. End-users derive from all industries, including food processing, pharmaceuticals, electronics, and metal fabrication, which are all potential players, as are regulators, government policies, and sustainability standards that influence development and market viability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

INDUSTRIAL OXYGEN GENERATOR MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Oxygen Generator Market, by Gas Type and Flow Rate

The medical oxygen generator sector must focus on reliability, compliance, and patient safety across various flow rates. For lower flow applications (up to 2 NM3/HR), compact, portable, or modular devices are essential for use in rural clinics, emergency response, and specialized care, requiring easy deployment, redundancy, and continuous oxygen supply. In the mid-capacity range (2.1–14 NM3/HR), there is a growing demand from mid-sized hospitals and regional facilities, necessitating a balance between scalable flow rates and features such as built-in purification, monitoring systems, and alarms, while ensuring regulatory compliance.

Industrial Oxygen Generator Market, by Size

Manufacturers of stationary oxygen generators regard these systems as essential infrastructure assets due to their reliability, scalability, and operational efficiency. These generators ensure a continuous and uninterrupted supply of oxygen for various infrastructures, typically in settings that are less critical than their original applications, such as large medical centers, industrial workplaces, and municipal utilities. Industry leaders like Air Liquide offer advanced solutions, including UPOX VSA and FLOXAL O2 VSA and PSA Oxygen Generators, which deliver high-purity oxygen consistently. Additionally, Linde plc provides PSA Oxygen Plants designed for on-site production of oxygen at 93% purity, ensuring seamless integration with facility gas grids.

Industrial Oxygen Generator Market, by Design

While developing cylinder-based oxygen solutions, manufacturers must prioritize durability, effective refill logistics, and the retention of saleable purity over extended periods to withstand the demands of the cylinder refilling process. Key design considerations include the engineering of pressure vessels, ensuring portability and usability, and adhering to international safety standards for gas transportation containers. One notable advantage of oxygen cylinders is their function as independent energy sources, enabling immediate utilization of high-pressure gas upon demand, which supports unique operational mechanics within the using facility.

Industrial Oxygen Generator Market, by Technology Type

Pressure swing adsorption (PSA) technology dominates the oxygen generator market due to its optimal balance of cost, efficiency, and versatility across various industries. Unlike cryogenic systems, which require substantial capital investment and are primarily designed for large-scale production, PSA units are more economical and easier to install, operate, and maintain. They enable onsite oxygen generation, thereby reducing dependence on bulk suppliers and cylinders, which leads to significant savings in logistics and operational costs. PSA systems typically produce oxygen with a purity level of 90–95%, a range that meets the requirements for diverse applications in healthcare, metal processing, water treatment, aquaculture, and food packaging.

Industrial Oxygen Generator Market, by End Use

In the health and medical sectors, oxygen generators are meticulously engineered to deliver on-demand, continuous high-purity oxygen, adhering to stringent biomedical and regulatory standards required by hospitals, clinics, emergency care departments, and pharmaceutical manufacturers. Manufacturers prioritize reliability, redundancy, and system maintenance to ensure uninterrupted patient care while accommodating space constraints inherent in medical facilities. The Air Liquide FLOXAL O2, available in VSA-i, SIGMA, and PSA formats, enables medical institutions to generate their own oxygen on-site, thereby enhancing supply security and minimizing reliance on bulk deliveries.

REGION

Asia Pacific to be fastest-growing region in industrial oxygen generator market during forecast period

The industrial oxygen generator market exhibits substantial growth in the Asia Pacific region, driven by robust industrial demand and economic expansion, as well as significant infrastructure development initiatives. This region, which encompasses China, India, Japan, and South Korea, serves as a critical hub for some of the largest manufacturing sectors globally. Industries that exhibit a high demand for substantial volumes of gases and a reliable supply of oxygen include steelmaking, metal processing, chemicals, glass production, shipbuilding, pulp and paper manufacturing, and wastewater treatment. This diverse industrial landscape underscores the vital importance of oxygen generators in facilitating various manufacturing and processing operations throughout the region.

Industrial Oxygen Generator Market: COMPANY EVALUATION MATRIX

In the oxygen generator market matrix, Air Liquide (Star) leads with a strong market share and a broad product portfolio, supported by its advanced PSA and cryogenic oxygen generation systems that are widely adopted across medical, industrial, and energy sectors. Oxymat (Emerging Leader) is steadily gaining recognition with its specialized PSA solutions and customized systems designed for diverse applications, strengthening its position through innovation and tailored offerings. While Air Liquide dominates through scale, global presence, and a diverse range of technologies, Oxymat shows strong potential to move toward the leaders’ quadrant as demand for onsite and modular oxygen generation solutions continues to rise across end-use industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

INDUSTRIAL OXYGEN GENERATOR MARKET PLAYERS

INDUSTRIAL OXYGEN GENERATOR MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 6.25 Billion |

| Market Forecast, 2030 (value) | USD 10.05 Billion |

| Growth Rate | CAGR of 8.3% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Industrial Oxygen Generator Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Medical Gas Equipment Manufacturer (US) |

|

|

| Industrial Gases Company (Global Player) |

|

|

| Aquaculture Solutions Provider |

|

|

| Oxygen Generator OEM (India-based) |

|

|

| Hospital Infrastructure EPC Contractor (MENA) |

|

|

RECENT DEVELOPMENTS

- June 2025 : Air Liquide’s USD-200-million investment in modernizing its Louisiana ASU and expanding pipeline infrastructure supports a long-term oxygen and nitrogen supply contract with Dow, enhancing delivery efficiency and reliability. This development strengthened Air Liquide’s foothold in the onsite oxygen generation market by expanding its pipeline network and capacity to serve large industrial clients along the Gulf Coast.

- June 2024 : Air Liquide planned to invest up to USD 850 million to build four large modular air separation units in Baytown, TX, supporting ExxonMobil’s low-carbon hydrogen project and boosting its oxygen capacity in Texas by 50%, marking its largest-ever industrial investment. This strengthened Air Liquide’s position in the oxygen generators market by expanding low-carbon production capacity and reinforcing its leadership in sustainable industrial gas solutions in the US.

- October 2024 : Linde announced that it has started supplying industrial gases to PT Freeport Indonesia, a major mining company. Linde invested USD 120 million to build, own, and operate a new on-site air separation unit (ASU), the largest in Indonesia and Linde’s biggest in Southeast Asia. This ASU supplies oxygen and nitrogen to PT Freeport’s new copper smelter and refining facility in Manyar, one of the largest copper processing sites globally.

- September 2023 : The Air Products and Chemicals, Inc. announced that it will supply advanced oxygen generation equipment for a wastewater treatment plant in Montreal, Canada. This project aimed at enhancing the plant’s oxygen supply capabilities, improving the efficiency and environmental performance of wastewater treatment processes. The partnership demonstrated Air Products' commitment to providing innovative solutions for sustainable water treatment infrastructure.

- December 2022 : Atlas Copco acquired Shandong Meditech Medical Technology, a Chinese company specializing in manufacturing oxygen generators and onsite oxygen generation solutions for medical and home use. Founded in 2003 with about 70 employees, Shandong Meditech was a well-established brand in one of the world's largest healthcare oxygen markets. The acquisition would enhance Atlas Copco's product portfolio and global service reach through its Medical Gas Solutions Division.

Table of Contents

Methodology

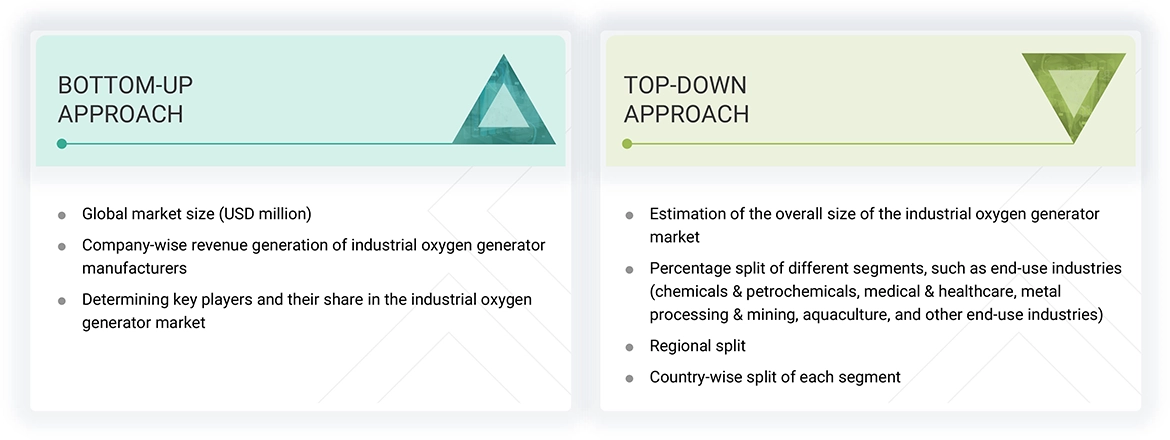

The study involves two major activities in estimating the current market size for the industrial oxygen generator market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering industrial oxygen generators and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the industrial oxygen generator market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the industrial oxygen generator market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from industrial oxygen generator industry vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking industrial oxygen generator services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of industrial oxygen generator and future outlook of their business which will affect the overall market.

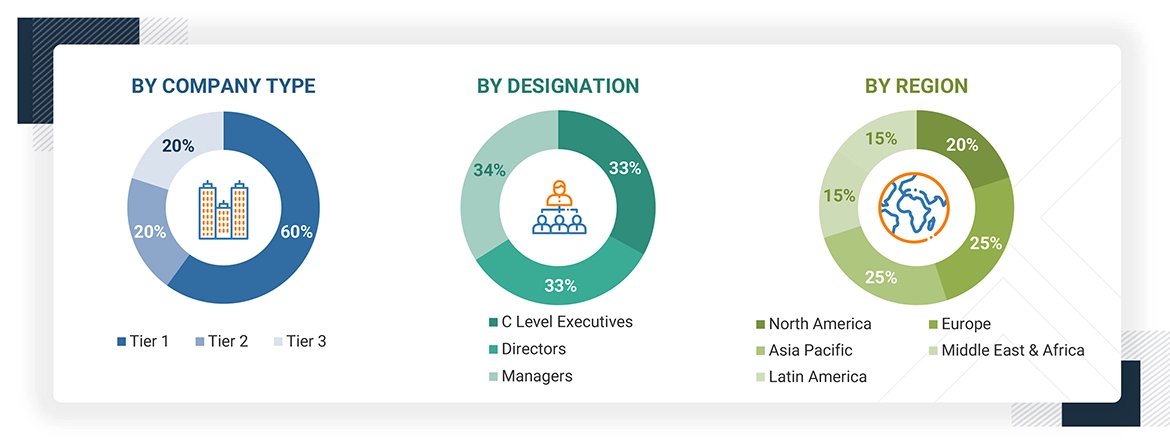

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the industrial oxygen generator market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for industrial oxygen generator in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the industrial oxygen generator industry for each application. For each end-use, all possible segments of the industrial oxygen generator market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The industrial oxygen generator market encompasses the design, manufacturing, distribution, and servicing of systems that produce oxygen on-site for a wide range of industrial applications. These generators are most commonly based on pressure swing adsorption (PSA), vacuum PSA (VPSA), and cryogenic separation technologies that extract oxygen from ambient air and deliver it at required purity levels, typically ranging from 90% to 99.5%. Industrial oxygen generators are used extensively across sectors such as metal processing, chemicals, glass manufacturing, pulp and paper, aquaculture, wastewater treatment, and food & beverage processing, where oxygen is essential for combustion efficiency, oxidation processes, or water quality enhancement. Unlike bulk liquid oxygen or compressed gas cylinders, on-site generators provide a continuous, cost-effective, and reliable supply, reducing dependency on external deliveries and minimizing storage and transportation risks. The market also includes after-sales services, spare parts supply, maintenance contracts, and integration with process automation systems, making it a capital-intensive but operationally efficient segment. Growing emphasis on energy efficiency, sustainability, and operational autonomy is further shaping the demand and technological evolution of industrial oxygen generation systems worldwide.

Stakeholders

- Industrial Oxygen Generator Manufacturers

- Industrial Oxygen Generator Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the industrial oxygen generator market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global industrial oxygen generator market, by gas type and flow rate, size, design, technology, end-use industry, and region

- To forecast the market size in five main regions (along with country-level data), North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaborations, and product developments/launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the industrial oxygen generator market? What key strategies have market players adopted to strengthen their market presence?

Key players include Air Liquide (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Linde plc (UK), OXYMAT (Denmark), CAIRE Inc. (US), INMATEC GaseTechnologie GmbH & Co. KG (Germany), Oxygen Generating Systems International (US), PCI Gases (US), GENERON (US), and SYSADVANCE (Portugal). Strategies include product launches, mergers & acquisitions, agreements, collaborations & partnerships, and expansions.

What are the drivers and opportunities for the industrial oxygen generator market?

Drivers include healthcare infrastructure development, rising chronic respiratory disease cases, and growing demand in aquaculture. Opportunities come from ozone applications using high-purity oxygen technology and other expanding industrial uses.

Which region is expected to hold the largest market share?

Asia Pacific is expected to hold the largest market share due to its strong industrial base, regulatory stringency, and technological leadership.

What is the projected growth rate of the industrial oxygen generator market over the next five years?

The market is projected to grow at a CAGR of 8.3% during the forecast period.

How is the industrial oxygen generator market aligned for future growth?

The market is growing steadily, characterized by a consolidated structure with many regional players planning to expand their production capacities.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Oxygen Generator Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Oxygen Generator Market