Industrial Point-of-Use Water Treatment Systems Market

Industrial Point-of-Use Water Treatment Systems Market by Device Type (Inline POU Filters, Free-standing Industrial Purifiers, Under-The-Sink POU Systems, Wall-Mounted POU Units, Counter-Top POU Systems), Technology (Activated Carbon Filtration, Ultrafiltration, Reverse Osmosis, UV Disinfection, Ion Exchange, Other Technologies), Application (Food & Beverage Processing, Healthcare, Manufacturing, Laboratories & R&D Facilities, Commercial & Institutional), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial point-of-use water treatment systems market is projected to reach USD 6.03 billion by 2030 from USD 4.13 billion in 2025, at a CAGR of 6.52% from 2025 to 2030. The market is projected to experience strong growth during the forecast period, driven by increasing demand for high-purity water across various industries, including manufacturing, laboratories, food processing, and healthcare facilities. Industrial operators are increasingly adopting point-of-use systems because they provide on-demand purification at specific operational points, ensuring consistent water quality for sensitive processes. One of the major growth factors is the heightened regulatory emphasis on microbial control, chemical safety, and process water standards, which is prompting industries to shift toward localized, technology-driven treatment units. The expansion of industrial clusters in emerging economies, coupled with increasing investments in R&D and small-batch production facilities, is further accelerating market adoption. Point-of-use technologies such as RO, UV, ultrafiltration, and activated carbon systems are gaining traction due to their ability to offer cost-efficient, easy-to-maintain, and scalable solutions. Moreover, industries are prioritizing systems that reduce water wastage and minimize chemical usage, aligning with global sustainability goals.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 6.52%, driven by the largest food & beverage industry, healthcare expansion, and booming industrial POU demand.

-

BY DEVICE TYPEInline POU filters dominate the industrial POU water treatment market due to their compact design, ease of installation, and low maintenance, making them ideal for space-constrained industrial facilities.

-

BY TECHNOLOGYThe activated carbon filtration segment holds the largest share in the industrial POU water treatment systems market due to its effectiveness in removing organic compounds, chlorine, and taste/odor contaminants.

-

BY APPLICATIONThe food & beverage processing segment holds the largest share due to stringent water quality requirements for product safety.

-

COMPETITIVE LANDSCAPEPentair (US), 3M (US), A. O. Smith (US), Culligan International (US), and Eureka Forbes Ltd (India) are leading companies of industrial POU water treatment systems market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, acquisitions, and expansions, to increase their market presence.

The industrial point-of-use water treatment systems market is expected to grow at a strong pace globally, driven by the increasing demand for high-purity, microbially safe, and process-stable water across rapidly expanding sectors such as pharmaceuticals, electronics, food processing, and precision manufacturing. With industries increasingly relying on sophisticated machinery and sensitive production environments, the demand for decentralized “point-of-use” purification units has surged to ensure consistent water quality at the exact location of consumption. The growing establishment of laboratories, R&D facilities, and clean manufacturing zones has further accelerated adoption, as even minimal contaminants can affect product integrity and testing accuracy. Industrial facilities facing fluctuating municipal water quality are turning to point-of-use systems as a reliable solution to maintain regulatory compliance and operational efficiency. The Asia Pacific remains the fastest-growing region due to rapid industrialization, urban expansion, and government-supported manufacturing initiatives that require stringent water treatment standards. Additionally, the global shift toward resource-efficient operations is encouraging manufacturers to adopt compact point-of-use technologies that reduce water wastage, energy consumption, and chemical dependency. Stricter hygiene norms, rising automation, and the need to protect high-value equipment are also reinforcing market growth. As sustainability pressures intensify, industries are increasingly preferring advanced point-of-use systems such as UV disinfection, ultrafiltration, and low-energy RO. These advancements make industrial POU water treatment systems essential enablers of safer, cleaner, and more resilient industrial infrastructure worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of industrial POU water treatment systems manufacturers, and target applications are the clients of industrial POU water treatment systems manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of industrial POU water treatment systems manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent Water Quality Regulations and Compliance Requirements

-

Growing Water Scarcity and Sustainability Initiatives

Level

-

High Initial Investment and Maintenance Costs

-

Technical Complexity and Skilled Workforce Requirements

Level

-

Industrial Expansion in Emerging Markets and Smart Water Management

-

Circular Economy and Water Reuse Initiatives

Level

-

Water Source Variability and Contaminant Complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent Water Quality Regulations and Compliance Requirements

The industrial POU water treatment systems market is driven by increasingly strict water quality regulations and compliance standards across industries. Manufacturing facilities, particularly in pharmaceuticals, food and beverage, and electronics sectors, face stringent requirements for water purity to ensure product quality and safety. Regulatory bodies such as the FDA, EPA, and EU directives mandate specific water quality standards, compelling industries to invest in advanced POU treatment systems. This is not only driving adoption but also creating demand for certified and validated treatment solutions. As corporate sustainability initiatives and environmental awareness grow, the two-fold advantage of regulatory compliance and resource conservation is driving demand faster, making industrial POU water treatment systems a critical investment for modern manufacturing operations.

Restraint: Stringent Water Quality Regulations and Compliance Requirements

The industrial POU water treatment systems face adoption challenges due to substantial upfront capital investment and ongoing operational expenses. Installing advanced treatment technologies such as reverse osmosis, ultrafiltration, or multi-stage systems requires significant initial expenditure, which can be prohibitive for small and medium-sized enterprises. Additionally, these systems demand regular maintenance, membrane replacement, and technical expertise to ensure optimal performance, further escalating the total cost of ownership. Complex installation requirements and the need to integrate with existing infrastructure can extend implementation timelines and increase costs. Energy consumption for operating high-pressure systems and periodic compliance testing add to operational expenses, creating financial barriers that slow market penetration, particularly in cost-sensitive industries and developing regions.

Opportunity: Industrial Expansion in Emerging Markets and Smart Water Management

The growing industrialization in emerging economies, particularly across Asia Pacific, Latin America, and parts of Africa, presents significant growth opportunities for industrial POU water treatment systems. Rapid expansion of manufacturing sectors, coupled with increasing awareness of water quality standards and resource scarcity, is driving demand for localized treatment solutions. The integration of IoT sensors, real-time monitoring, and predictive maintenance capabilities is creating a new generation of smart POU systems that optimize water usage, reduce waste, and provide data-driven insights for operational efficiency. Industries are increasingly recognizing that decentralized, point-of-use treatment offers advantages over centralized systems, including reduced infrastructure costs, lower contamination risks, and greater flexibility. As water scarcity intensifies globally and industries seek to minimize their environmental footprint, POU water treatment systems represent a sustainable solution that aligns with both regulatory requirements and corporate sustainability goals, positioning the market for substantial expansion.

Challenge: Water Source Variability and Contaminant Complexity

Industrial POU water treatment systems face significant challenges due to highly variable water source quality and increasingly complex contaminant profiles. Feed water composition can vary dramatically based on geographic location, seasonal changes, and municipal supply fluctuations, requiring adaptable treatment solutions. Industries must contend with emerging contaminants such as microplastics, PFAS (per- and polyfluoroalkyl substances), pharmaceuticals, and endocrine disruptors that conventional treatment technologies may not effectively remove. This necessitates multi-barrier treatment approaches and frequent system adjustments to maintain consistent output quality. Additionally, industries operating across multiple locations face the challenge of standardizing treatment protocols while accommodating local water quality variations. The need for continuous monitoring, regular water testing, and potential system reconfiguration increases operational complexity and costs, making it difficult for facilities to maintain consistent water quality standards across all points of use.

INDUSTRIAL POINT-OF-USE WATER TREATMENT SYSTEMS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Intel Corporation – Arizona Semiconductor Fabrication Facility required advanced POU water treatment systems for ultrapure water production in chip manufacturing. The facility processes over 10 million gallons of water daily and needed multiple POU systems strategically located throughout the fab to ensure consistent water quality at critical production points. Systems included reverse osmosis, electrodeionization, and UV treatment technologies installed at various clean room locations. | Achieved water resistivity of 18.2 MΩ·cm at all points of use, meeting stringent semiconductor industry standards. Reduced water distribution infrastructure costs by 30% compared to centralized systems. Minimized contamination risks through localized treatment, improving chip yield rates and product quality while enabling real-time water quality monitoring. |

|

Nestlé Waters – European Bottling Plant Expansion implemented distributed POU treatment systems across multiple filling lines to ensure consistent water quality for beverage production. Each production line received dedicated treatment modules including activated carbon filtration, UV disinfection, and ozone treatment sized specifically for line capacity requirements. The modular approach allowed for independent operation and maintenance of each line's water system. | Enhanced production flexibility by allowing individual lines to operate independently without relying on central treatment infrastructure. Reduced cross-contamination risks between production lines processing different beverage types. Achieved 99.9% uptime for water supply to production lines through redundant POU systems, preventing costly production stoppages and maintaining product consistency across all facilities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem of the industrial point-of-use water treatment systems market involves a vertically integrated framework from component manufacturing to deployment in end-use applications across various industries. Key components, including membranes, filtration media, UV lamps, activated carbon, and control systems, are sourced and assembled to meet specific water quality standards. System manufacturers develop and optimize treatment configurations to enhance purification efficiency, contaminant removal capabilities, and operational reliability. These systems undergo rigorous testing for performance validation, regulatory compliance, and integration with existing infrastructure. Installation methods such as skid-mounted assemblies, modular designs, or custom-engineered solutions ensure optimal performance for applications in pharmaceuticals, food and beverage, electronics, and other facilities. Finished systems are then deployed to meet the water quality requirements of different end-use industries, including manufacturing, biotechnology, healthcare, and laboratory operations. Regulatory frameworks, water scarcity concerns, sustainability initiatives, and evolving industry standards influence production, innovation, and adoption. The integration of technological advancements such as IoT monitoring, predictive maintenance, smart sensors, and AI-driven optimization enhances efficiency, reliability, and compliance across the value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Point-of-Use Water Treatment Systems Market, by Device Type

Inline POU filters hold the largest share in the industrial POU water treatment systems market primarily because of their compact configuration, low installation complexity, and strong adaptability across a wide range of industrial environments. These systems are designed to be integrated directly into existing water lines, eliminating the need for structural modifications and reducing downtime, which is a major advantage for manufacturing, food processing, labs, and commercial facilities. Their cost-efficiency, both in terms of upfront investment and ongoing maintenance, makes them highly attractive for industries seeking localized water purification without the expense of centralized treatment units. Inline filters can effectively remove sediments, chlorine, microbial contaminants, or chemicals depending on the chosen cartridge, offering customizable purification tailored to specific process or drinking-water needs. Moreover, their modular and scalable design allows industries to add or replace filters quickly to meet varying flow rates and contamination levels. With increasing regulatory pressure for safe potable water access at workplaces and the growing need for point-specific purification within industrial processes, inline POU filters provide a reliable, compliant, and easy-to-manage solution, thereby securing their dominant share in the market.

Industrial Point-of-Use Water Treatment Systems Market, by Technology

In 2024, activated carbon filtration technology captured the largest market share due to its effectiveness in removing organic compounds, chlorine, volatile organic compounds (VOCs), pesticides, and taste/odor contaminants. Activated carbon systems are popular because they offer cost-effective purification with relatively low operational costs and ease of integration into existing infrastructure. The ability to handle diverse contaminant profiles makes them essential in food and beverage processing, chemical manufacturing, and pharmaceutical applications where removal of specific organic contaminants is critical. Their proven reliability and versatility across different industrial sectors has given them a dominant edge in the market as the preferred first-line treatment technology. Ultrafiltration (UF) technology holds the second-largest share due to its efficiency in removing suspended solids, bacteria, viruses, and high molecular weight compounds without requiring high operating pressures. UF systems provide excellent microbial control while maintaining lower energy consumption compared to pressure-driven membrane processes

Industrial Point-of-Use Water Treatment Systems Market, by Application

In 2024, the food and beverage processing segment held the largest market share due to stringent water quality requirements for product safety and consistency. Food manufacturers require high-purity water for ingredient preparation, product formulation, equipment cleaning, and steam generation. Strict regulatory oversight from agencies like FDA and USDA mandates specific water quality standards to prevent contamination and ensure consumer safety. The critical role of water quality in maintaining product taste, appearance, and shelf life makes POU treatment systems indispensable in this sector. The healthcare and medical segment also represents a significant share due to the most stringent water purity requirements, including Water for Injection (WFI) and purified water meeting USP and EP standards. POU systems deliver documented water quality with full traceability and validation support, meeting demanding GMP compliance requirements where water quality directly impacts patient safety.

REGION

The industrial point-of-use water treatment systems market in Asia Pacific is driven by rapid industrialization, water scarcity, regulatory standards, and technological advancements

In 2024, Asia Pacific captured the largest market share and exhibited the fastest growth rate due to rapid industrialization and manufacturing expansion in China, India, South Korea, and Southeast Asian nations. The region's position as a global manufacturing hub drives substantial demand across various industries, including electronics, pharmaceuticals, and food processing. Asia Pacific faces increasing water scarcity challenges and stricter environmental regulations that mandate efficient water use, thereby accelerating the adoption of POU systems. The growing awareness of water quality standards and the diverse local water conditions creates substantial opportunities for decentralized treatment solutions. North America holds the second-largest market share due to the stringent regulatory frameworks enforced by the EPA and the FDA. The region benefits from well-established water quality standards, advanced industrial infrastructure, and the presence of major pharmaceutical and food processing companies. North America's emphasis on sustainability initiatives and environmental responsibility further supports consistent market demand and technological advancement in POU water treatment systems.

INDUSTRIAL POINT-OF-USE WATER TREATMENT SYSTEMS MARKET: COMPANY EVALUATION MATRIX

In the industrial point-of-use water treatment systems market matrix, 3M (Star) leads the market. 3M is the clear leader in the market. The company has established a strong presence in the food & beverage, pharmaceutical, and manufacturing sectors, utilizing a comprehensive product portfolio that includes reverse osmosis, ultrafiltration, and activated carbon systems, along with advanced monitoring capabilities and a global service network, to positively impact the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Pentair (UK)

- Culligan International (US)

- BWT Holding GmbH

- Xylem(US)

- Eureka Forbes Ltd (India)

- Veolia Water Technologies(France)

- SUEZ (France)

- Ecolab (US)

- 3M (US)

- Toray Industries, Inc. (Japan)

- DuPont (US)

- LG Water Solutions (South Korea)

- A. O. Smith Corporation (US)

- Coway Co. Ltd (South Korea)

- Kent RO Systems Ltd (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.13 Billion |

| Market Forecast in 2030 (Value) | USD 6.03 Billion |

| Growth Rate | CAGR of 6.52% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Device Type: Inline POU Filters, Free-standing Industrial Purifiers, Under-the-sink POU Systems, Wall-mounted POU Units, and, Counter-top POU Systems. By Application Techniques: Food & Beverage Processing, Healthcare and Medical, Manufacturing, Laboratories & R&D facilities, and Commercial & Institutional Settings ByTechnology: Activated Carbon Filtration, Ultrafiltration (UF), Reverse Osmosis (RO), UV Disinfection, Ion Exchange, and Other Technologies |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: INDUSTRIAL POINT-OF-USE WATER TREATMENT SYSTEMS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Point of Use Water Treatment Systems | • Detailed company profiles of point of use water treatment systems competitors (financials, product portfolio) • Market segmentation by device (table top pitchers, counter top units, under the sink filters, faucet-mounted filters, free-standing water purifiers, whole house water treatment, and others) • Market segmentation by technology (reverse osmosis systems, ultrafiltration systems, distillation, disinfection, activated carbon, ion exchange, and other technologies) Customer landscape mapping by application (residential, commercial) Customer landscape mapping by sales channel (rdirect, distributor) | • Identified & profiled 20+ point of use water treatment systems companies • Track adoption trends in high-growth APAC application areas (such as residential, and non-residential) |

RECENT DEVELOPMENTS

- February 2025 : Culligan International has acquired Stonybrook Water Company, an independent supplier of commercial point-of-use (POU) water and ice appliances based in Manchester-by-the-Sea, Massachusetts.

- July 2024 : A. O. Smith Corporation has announced the acquisition of Pureit (owned by Hindustan Unilever Limited), a leading residential water-purification brand in South Asia. This strengthens the company's global water-treatment portfolio, giving it greater scale, a stronger product line-up, and improved distribution, especially in South Asia.

- May 2024 : Grundfos announced an agreement to acquire Culligan’s Commercial & Industrial (C&I) division in Italy, France and the UK. With this acquisition, Grundfos expands its water-treatment and wastewater-management capabilities — adding a complementary portfolio of commercial & industrial water-treatment solutions, strengthening its position in the European market

- March 2022 : Pentair signed a definitive agreement to acquire Manitowoc Ice (from Welbilt, Inc.) for about USD 1.6 billion. Manitowoc Ice, a global leader in commercial ice-maker machines, with over 1 million installed units and more than 200 models worldwide, brings Pentair a strong complementary asset in commercial water & ice solutions

- March 2024 : Sherwin-Williams has launched FIRETEX FX7002, a solvent-based acrylic intumescent fire protection coating designed especially for steel in commercial construction.

Table of Contents

Methodology

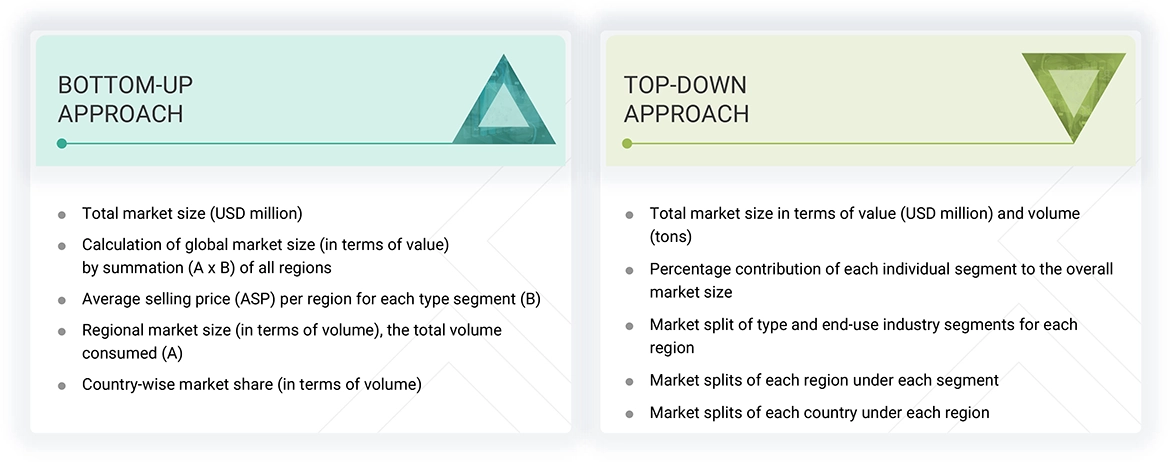

The study involved four major activities to estimate the current size of the global industrial point-of-use water treatment systems market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial point-of-use water treatment systems through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the industrial point-of-use water treatment systems market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for the companies offering industrial point-of-use water treatment systems is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the industrial point-of-use water treatment systems market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of industrial point-of-use water treatment systems vendors, forums, certified publications, and white papers. Secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the industrial point-of-use water treatment systems market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of industrial point-of-use water treatment systems offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global industrial point-of-use water treatment systems market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Market Definition

Industrial industrial point-of-use water treatment systems are devices installed on individual taps or multiple taps to provide high-quality water that is free from contaminants like chlorine, iron, sulfur, and dissolved solids. This purified water is suitable for drinking, cooking, and other uses in both, residential and non-residential settings. These compact filtration or purification devices are placed directly where water is consumed, such as kitchen sinks, faucets, or even portable pitchers, ensuring immediate access to clean and safe water.

Tabletop pitchers, whole-house water treatments, faucet-mounted filters, countertop units, under-the-sink filters, free-standing water purifiers, and other variants are examples of products included in industrial point-of-use water treatment systems. These systems utilize various technologies to enhance effectiveness and user-friendliness, such as reverse osmosis (RO) systems, ultrafiltration systems, and activated carbon filtration.

Stakeholders

- Raw Material Suppliers and Producers

- Regulatory Bodies

- Point-of-use Water Treatment System Distributors/Suppliers

- Environmental Protection Bodies

- Local Governments

- End-use Industries

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the global industrial point-of-use water treatment systems market based on device, technology, sales channel, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as product launches, collaborations, acquisitions, expansions, and partnerships, in the industrial point-of-use water treatment systems market

- To provide the impact of AI on the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Point-of-Use Water Treatment Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Point-of-Use Water Treatment Systems Market