Industrial Reels Market Size, Share & Trends, 2025 To 2030

Industrial Reels Market by Hose Reel, Cable Reel, Static Grounding Reel, Rewind Type (Manual Crank, Electric, Hydraulic, Pneumatic), Power Supply Management, DEF Dispensing, Construction & Infrastructure, Refuelling Stations - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Industrial Reels market is projected to reach USD 0.62 billion by 2030 from USD 0.50 billion in 2025, at a CAGR of 4.4% from 2025 to 2030. The increase in demand for efficient cable and hose management within industrial activities, with safety, durability, and organization being the essence, is driving the growth. With the modernization of industries, there is a demand for reliable solutions that offer reduced downtime and increased maintenance.

KEY TAKEAWAYS

-

BY TYPECable reels are expected to grow at the highest CAGR in the industrial reels market due to increasing demand for efficient cable management in manufacturing, construction, and energy industries. The growing use of automation, robotics, and EV infrastructure has further boosted demand for reliable cable handling solutions.

-

BY REWIND TYPEThe manual crank reel market is expected to dominate due to its cost-effectiveness, simplicity, and reliability. Its low maintenance and portability make it ideal for industries like construction, agriculture, and manufacturing, especially in remote or rugged locations.

-

BY MATERIALAluminum is projected to grow the fastest in the industrial reels market due to its lightweight, corrosion resistance, and high durability. Its recyclability and long lifespan align with sustainability goals, while advancements in processing technology enhance its performance and cost efficiency.

-

BY APPLICATIONPower supply management holds the largest market share in the industrial reels market due to the growing demand for efficient and safe cable management. The need to ensure reliable power delivery in automation, manufacturing, and renewable energy sectors continues to support strong market growth.

-

BY INDUSTRYThe construction industry holds the largest market share in the industrial reels market due to the high demand for efficient cable and hose management in large-scale projects. Rising global infrastructure investments are further driving demand for reels that enhance safety and workflow efficiency.

-

BY REGIONThe Asia Pacific holds the largest market share in the industrial reels market and is also expected to witness the highest CAGR. Rapid industrialization, infrastructure expansion, and strong adoption of automation in countries like China and India are key growth drivers in the region.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships, investments, and expansions. For instance, In July 2024, Cavotec SA launched a new production facility in India that enhances manufacturing capacity for reels and shore power solutions, catering to industrial, ports, and maritime customers.

The industrial reels market is driven by rising automation, advancements in material handling, and increasing emphasis on safety and operational efficiency across industries. Growing industrial development and demand for sustainable, energy-efficient solutions are further propelling market expansion.

MARKET DYNAMICS

Level

-

Growth in construction and infrastructure projects

-

Increasing investments in microgrid projects

Level

-

High initial costs and maintenance expenses

Level

-

Rise of EV charging infrastructure

-

Rising demand for fire safety and emergency response equipment

Level

-

Corrosion challenges in harsh environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in construction and infrastructure projects

Industrial reels play a vital role in construction and infrastructure projects. They help move, use, and store power cables, hydraulic hoses, and fiber-optic lines in an organized way. On large construction sites, reels keep electrical wires tidy, which saves time, prevents tangles, and improves safety. Big projects such as building roads, bridges, and power grids rely on reels to handle high-voltage cables and fluid systems. This ensures everything operates efficiently. As these projects become more complex and require more cables, the demand for strong, high-capacity reels continues to increase.

Restraint: High initial costs and maintenance expenses

One of the primary constraints in the industrial reels market is that the equipment is expensive to procure. Reels that handle hoses, cables, and static grounding are usually manufactured to high standards with robust materials, such as stainless steel and aluminum, for durability and long service life. Quality comes with a price tag, and precision engineering increases these costs even further. Coupled with features such as motorized retraction or automatic winding, the cost rises to a point where SMEs can scarcely justify the investment. In many cost-sensitive contexts, the purchase price alone is a blocking factor, especially when budgets are thin or alternative manual handling means seem more accessible in the short run.

Opportunity: Rise of EV charging infrastructure

Industrial reels are integral to the evolving infrastructure for electric vehicle (EV) charging, particularly as demand for EVs increases. Effective management of high-voltage charging cables is crucial, and industrial reels facilitate the organized storage, deployment, and handling of these cables, minimizing damage risk and enhancing operational efficiency at charging stations.

Challenge: Corrosion challenges in harsh environments

Industrial reels face a harsh outdoor environment at oil rigs, mining locations, and construction areas, where they are exposed to water and moisture, UV light, extreme temperatures, and corrosive chemical substances. Extended exposure to these elements will degrade any rugged material structure until the reels lose their essential strength. The failure rate of these systems increases simultaneously with shortened equipment lifespan, creating dangerous safety situations when reliability for hose and cable management is critical in sectors including firefighting and energy production.

Industrial Reels Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hannay Reels provides heavy-duty hose and cable reels for equipment maintenance, industrial fire protection, welding applications, hydraulic and pneumatic tools, and chemical transfer operations across agriculture, aviation, manufacturing, and waste management industries. | Enhanced workplace safety with organized hose and cable management, improved operational efficiency through quick deployment and retraction, reduced equipment damage and downtime, and extended service life through durable construction |

|

Reelcraft manufactures spring-driven, motor-driven, and hand crank reels for fluid transfer, power distribution, and air delivery systems in industrial, commercial, and professional settings including vehicle service, refueling operations, and MRO applications. | Increased productivity through accessible hose and cord management, enhanced durability for demanding industrial environments, reduced trip hazards and workplace injuries, and optimized space utilization in manufacturing facilities |

|

Coxreels delivers heavy-duty hose, cord, and cable reels for industrial manufacturing operations, welding applications, assembly lines, and fabrication facilities requiring reliable equipment in rugged factory, plant, and mill environments. | Superior durability through robust American manufacturing standards, reliable performance in harsh industrial conditions, reduced maintenance costs with long-lasting construction, and versatile deployment options across diverse applications |

|

Nederman produces industrial hose and cable reels in stainless steel and aluminum for fluid and power supply management, lubrication systems, signal transmission in crane operations, tanker overfill protection, and camera surveillance applications. | Decades-long durability through premium materials engineering, corrosion resistance for harsh environments, easy worker access to oils and fluids, IP44 water protection for outdoor applications, and reliable signal transmission for safety-critical systems |

|

Cavotec SA specializes in spring-driven cable and hose reels fully assembled and tested for demanding crane operations, mining applications, and industrial environments requiring guaranteed reliability in difficult and challenging conditions. | Guaranteed reliability through comprehensive pre-delivery testing, superior performance in extreme industrial conditions, reduced downtime in critical crane and mining operations, and automation compatibility for advanced industrial systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial reels market ecosystem comprises raw material suppliers, manufacturers, distributors, and end-use industries. Key raw material providers such as SABIC, Alcoa, ArcelorMittal, and Nucor supply essential materials like steel and aluminum. Leading manufacturers including Hannay Reels, Reelcraft, Coxreels, and Cavotec design and produce reels for various applications. Distributors such as Grainger, Fastenal, MSC, and Air Systems facilitate market reach and product availability. These reels serve multiple end-use sectors including construction, transportation, utility and electricity, and maritime industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Reels Market, By Type

The industrial reels market, by type, includes hose reels, cable reels, and static grounding reels used across construction, transportation, utility, manufacturing, agriculture, and oil & gas sectors. Hose reels hold the largest share due to their vital role in fluid transfer and pressure management. The market growth is driven by increasing automation, workplace safety regulations, and the need for organized hose and cable handling.

Industrial Reels Market, By Rewind Type

The market, by rewind type, is segmented into manual crank, electric, hydraulic, and pneumatic systems, each serving different operational needs. Electric rewind reels dominate owing to their automated and reliable performance in industrial environments. Growing industrial automation, demand for high efficiency, and the shift toward electric and hydraulic systems are key drivers of this segment’s expansion.

Industrial Reels Market, By Material

The market, by material, covers steel, aluminum, composites, and plastic, with steel further divided into mild and stainless steel. Steel reels lead the segment for their strength, corrosion resistance, and durability under demanding conditions. Increasing use in heavy-duty and offshore applications, along with rising demand for high-performance materials, continues to fuel market growth.

Industrial Reels Market, By Application

The market, by application, is segmented into power supply management, DEF dispensing, welding operations, construction & infrastructure, and refueling stations. Power supply management applications dominate due to the need for reliable and safe cable handling in utilities and construction. Expanding investments in infrastructure and renewable energy are further boosting demand for advanced reel systems.

Industrial Reels Market, By Industry

The market, by industry, spans transportation, utility, construction, mining, maritime, military & government, airport operations, and other sectors such as agriculture, oil & gas, and manufacturing. The construction industry holds the largest share, driven by widespread reel usage for power, fluid, and equipment management at worksites. Global infrastructure development and safety requirements are key factors fueling this growth.

REGION

During the forecast period, Asia Pacific is expected to hold the largest market share and grow at the fastest CAGR.

The industrial reels market in Asia Pacific is growing steadily due to rapid industrial development, automation, and infrastructure projects. Industries such as manufacturing, construction, oil & gas, and logistics are using reels to improve safety and manage cables and hoses more efficiently. Government programs like “Make in India” and “Made in China 2025” are encouraging greater use of automation, further boosting demand. Expanding renewable energy projects, offshore drilling, and warehouse automation are also driving the need for advanced and durable industrial reels across the region.

Industrial Reels Market: COMPANY EVALUATION MATRIX

In the Industrial Reels market matrix, Hannay Rasis Inc. (US) and Reeicraft Industries (US) lead the market with strong service portfolios, wide presence, and effective strategic growth initiatives, driving innovations and market expansion. Cavotec SA (Switzerland) is an emerging leader with a focused, innovative product portfolio, gradually expanding its influence despite a smaller market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.48 Billion |

| Market Forecast in 2030 (Value) | USD 0.50 Billion |

| Growth Rate | CAGR of 4.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Industrial Reels Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Hose Reels Provider |

|

|

| Construction Reels Provider |

|

|

| US-Based Industrial Reels Startup |

|

|

| India-Based Static Grounding Reels Provider |

|

|

| Europe-Based Transportation Reels Provider |

|

|

RECENT DEVELOPMENTS

- January 2025 : Cavotec SA received an order for 1,000 spring cable reels from Qwello, a German electric vehicle charging station operator, for deployment across Europe, supporting reliable and scalable EV charging solutions.

- November 2024 : Cavotec Hong Kong Limited, a subsidiary of Cavotec SA, entered into a strategic cooperation agreement with Shanghai Zhenhua Heavy Industries Company Limited to enhance port infrastructure automation and electrification.

- July 2024 : Cavotec SA launched a new production facility in India to enhance its manufacturing capacity for reels and shore power solutions, serving industrial, port, and maritime customers.

- March 2023 : Hannay Reels Inc. launched the MS-1000 Spray Series, a compact, lightweight manual reel for pressure washing, washdown, and spray applications with an optimized footprint and shorter crank handle for tight spaces.

- November 2022 : United Equipment Accessories, Inc. acquired American Reeling Devices, Inc., a heavy-duty hose, cord, and cable reel manufacturer, enhancing product offerings and strengthening customer service capabilities.

Table of Contents

Methodology

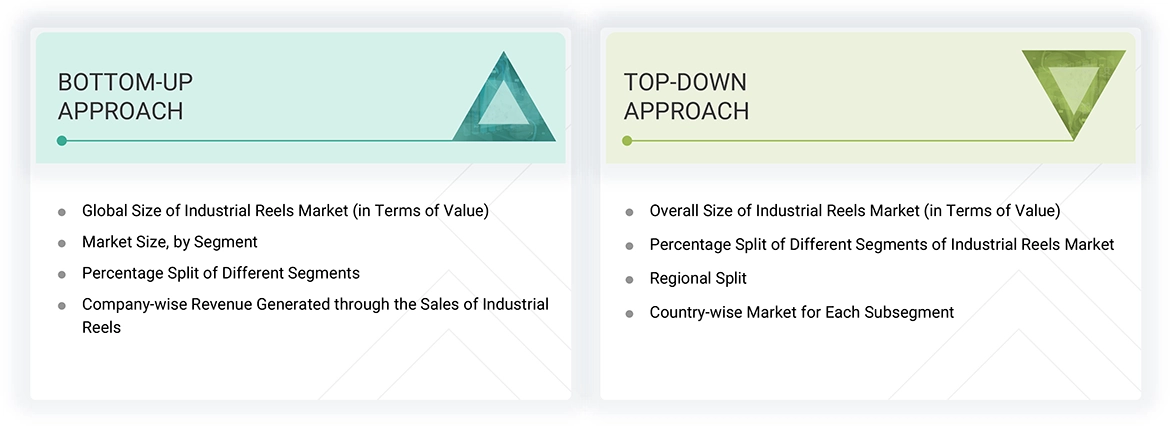

The study used four major activities to estimate the market size of the industrial reels. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the industrial reels market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the industrial reels market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the Cejn Ab, Kris-Tech Wire, Designacable, Coxreels, and various other sources. Moreover, the study involved extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect valuable information for a technical, market-oriented, and commercial study of the industrial reels market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

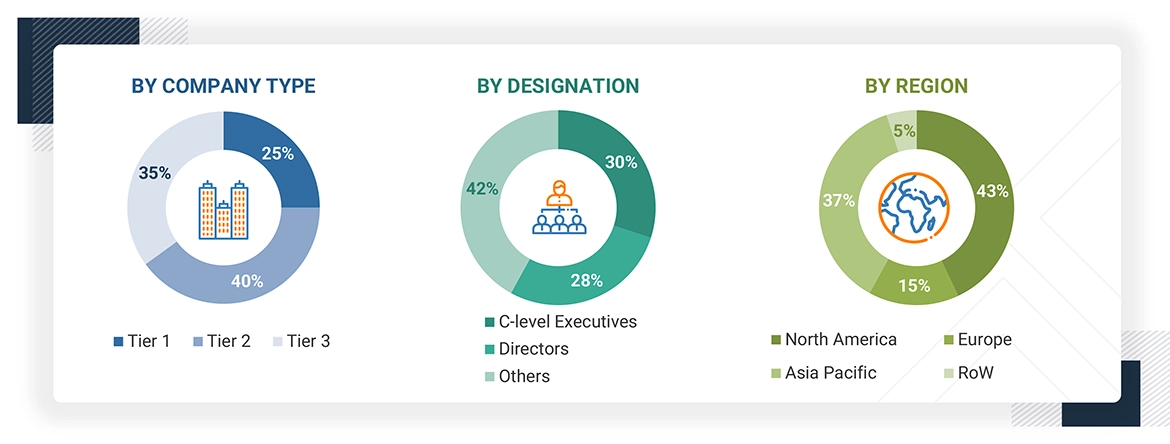

In the primary research, various sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the industrial reels ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the industrial reels market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side players across key regions: North America, Europe, Asia Pacific, and Rest of the World (Middle East, Africa, and South America). Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject-matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Note: The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 revenue = ≥USD 1 billion; Tier 2 revenue = between USD 100 million and USD 1 billion; and Tier 3 revenue = ≤USD 100 million. Other designations include sales managers, marketing managers, and product managers.

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the industrial reels market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Industrial Reels Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the industrial reels market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

Industrial reels are rugged equipment that store, wind, and unwind hoses, cables, or cords in industrial and commercial settings. They are essential in ensuring neat, efficient, and safe operations by avoiding tangling, wear and tear, and trip hazards. Industrial reels are available in various models, including spring, motorized, and manual models. To endure extreme working conditions, they are constructed using heavy-duty materials, such as steel, aluminum, or composite plastics. These reels accommodate power distribution, fluid transfer, welding, fueling, and pneumatic tool operation. Widely employed in industries such as construction, manufacturing, oil & gas, transportation, and utilities, industrial reels enhance productivity, increase equipment lifespan, and promote safety in stationary and mobile industrial operations. The ongoing demand for improved automation and advanced technology and the increasing adoption of electric vehicles (EVs) are the key factors driving the growth of the industrial reels market worldwide.

Key Stakeholders

- Raw material providers

- Component manufacturers

- OEMs (original equipment manufacturers)

- System integrators

- Distributors and retailers

- End-use industries

Report Objectives

- To estimate and forecast the size of the industrial reels market, in terms of value, based on type, rewind type, material, application, industry, and region

- To identify market opportunities across transportation, utility/electricity, construction, mining, maritime, military & government, airport, and other industries

- To analyze different industrial reel types and their adoption across various industries

- To describe and forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the industrial reels value chain

- To strategically analyze micromarkets regarding individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches/developments and acquisitions adopted by the key market players to enhance their market position

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the industrial reels market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the industrial reels market.

Product Analysis

- Product matrix, for a detailed comparison of the product portfolio of each company in the Industrial Reels Market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Reels Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Reels Market