2

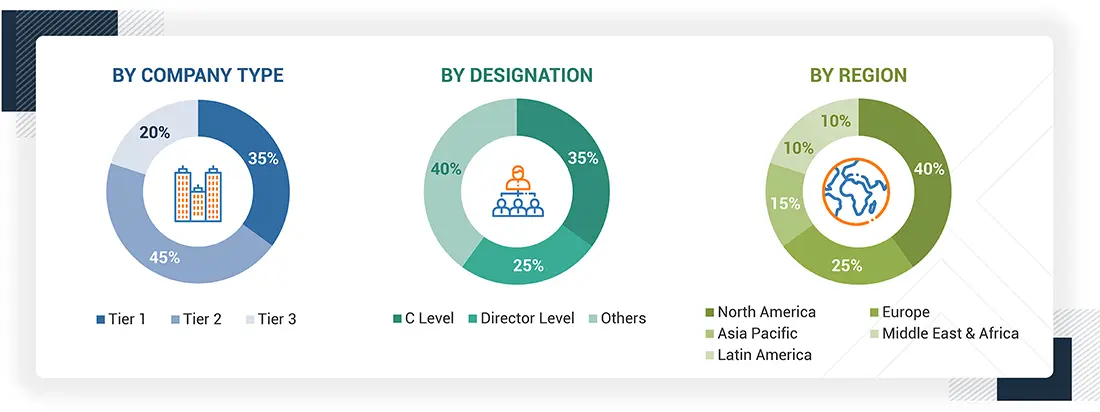

RESEARCH METHODOLOGY

40

5

MARKET OVERVIEW

Strategic integration of multi-tiered defense systems reshapes global defense markets amid rising geopolitical tensions.

64

5.2.1.1

DEMAND FOR STANDARDIZED IAMD ARCHITECTURES ACROSS ALLIED AND COALITION FORCES

5.2.1.2

EMERGENCE OF HYPERSONIC GLIDE VEHICLES, SLEATH MISSILES, AND RE-ENTRY VEHICLES

5.2.1.3

RAPID ADOPTION OF MULTI-TIERED ARCHITECTURES COMBINING SHORT, MEDIUM, AND LONG-RANGE DEFENSE SYSTEMS

5.2.1.4

HEIGHTENED GEOPOLITICAL CONFLICTS

5.2.2.1

RESTRICTIONS ON TRANSFERRING SENSITIVE BMC4I TECHNOLOGIES

5.2.2.2

RESISTANCE TO REPLACING STANDALONE SYSTEMS WITH FULLY INTEGRATED NETWORKS

5.2.3.1

INTEGRATION OF TERRESTRIAL, AIRBORNE, AND SPACE-BASED ASSETS INTO A UNIFIED ARCHITECTURE

5.2.3.2

UNTAPPED POTENTIAL FOR SHARED IAMD FRAMEWORKS ACROSS NEIGHBORING STATES

5.2.3.3

RECURRING REVENUES FROM UPGRADES, DIGITAL TWIN DEPLOYMENTS, AND MODULAR BATTLE MANAGEMENT ENHANCEMENTS

5.2.3.4

RECAPITALIZATION PROGRAMS FOR NATIONAL-LEVEL INTEGRATED DEFENSE NETWORKS

5.2.4.1

TECHNICAL BARRIERS IN HARMONIZING DATA FROM DISSIMILAR RADAR BANDS AND SENSORS

5.2.4.2

VULNERABILITY OF CENTRALIZED C2 NODES TO CYBER INTRUSION OR ELECTRONIC ATTACK

5.2.4.3

PREFERENCE FOR VISIBLE KINETIC PLATFORMS OVER INVESTMENTS IN COMMAND, CONTROL, AND INTEGRATION INFRASTRUCTURE

5.3.1

AVERAGE SELLING PRICE OF INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS

5.3.1.1

SHORT-RANGE IAMD PROGRAMS

5.3.1.2

MEDIUM-RANGE IAMD PROGRAMS

5.3.1.3

LONG-RANGE IAMD PROGRAMS

5.3.2

AVERAGE SELLING PRICE TREND, BY REGION

5.4.4

C2/BATTLE MANAGEMENT

5.4.5

INFRASTRUCTURE AND SITE SUPPORT

5.4.6

SERVICES AND LIFECYCLE SUPPORT

5.5.1

INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2021–2024

5.5.2

INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2025–2030

5.6

INVESTMENT AND FUNDING SCENARIO

5.7

TOTAL COST OF OWNERSHIP

5.8

KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.9.1.1

REAL-TIME USE OF AI/ML TO PROCESS RADAR, EO/IR, SATELLITE, AND SIGINT DATA INTO FIRE-CONTROL QUALITY TRACKS

5.9.1.2

NEW SEEKERS, PROPULSION, AND KILL-VEHICLE TECHNOLOGIES DESIGNED TO TRACK AND NEUTRALIZE MANEUVERING HYPERSONIC THREATS

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.1

JAMMING, SPOOFING, AND DECEPTION SYSTEMS THAT CONTEST ADVERSARY MISSILE SEEKERS AND RADARS

5.9.2.2

HIGH-ALTITUDE DRONES EXTENDING REACH AND PERSISTENCE OF IAMD SYSTENS

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

HIGH-ENERGY LASERS AND HIGH-POWER MICROWAVES FOR LOW-COST INTERCEPTION OF UAVS, ROCKETS, AND CRUISE MISSILES

5.9.3.2

INFRARED AND EO SATELLITES PROVIDING GLOBAL COVERAGE FOR MISSILE LAUNCHES

5.12.1

RESILIENT COMMUNICATION AND MULTI-DOMAIN DATA LINKS

5.12.2

MULTI-MISSION INTERCEPTORS

5.12.3

HYPERSONIC DEFENSE TESTBEDS AND SIMULATION PLATFORMS

5.12.4

ENERGY STORAGE AND POWER MANAGEMENT FOR DIRECTED ENERGY SYSTEMS

5.13.1

SYSTEM-LEVEL IMPACT

5.13.1.1

REAL-TIME MULTI-SENSOR FUSION

5.13.1.2

AUTOMATED THREAT PRIORITIZATION AND ENGAGEMENT MANAGEMENT

5.13.1.3

ACCELERATED DECISION LOOPS

5.13.1.4

ADAPTIVE BATTLE MANAGEMENT

5.13.2

SUBSYSTEM-LEVEL IMPACT

5.13.2.1

AI IN RADARS AND SENSORS

5.13.2.3

AI IN INTERCEPTORS AND KILL VEHICLES

6

INDUSTRY TRENDS

Discover emerging global industry trends reshaping ecosystems and value chains amid evolving regulations and tariffs.

90

6.1.1

PROMINENT COMPANIES

6.1.2

PRIVATE AND SMALL ENTERPRISES

6.2.1

RESEARCH AND DEVELOPMENT

6.2.3

SUBSYSTEM/PRODUCT MANUFACTURING

6.2.4

ASSEMBLY AND INTEGRATION

6.3.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.3.2.5

REST OF THE WORLD

6.4.3

PRICE IMPACT ANALYSIS

6.4.4

IMPACT ON COUNTRY/REGION

6.4.5

IMPACT ON END-USE INDUSTRIES

6.5.1

IMPORT SCENARIO (HS CODE 9306)

6.5.2

EXPORT SCENARIO (HS CODE 9306)

6.6.1

DEPLOYMENT OF PATRIOT PAC-3 IN UKRAINE

6.6.2

ADOPTION OF NASAMS FOR NATO’S EASTERN FLANK

6.6.3

INTEGRATION OF S-400 AMID INDO-PAK TENSIONS

6.7

KEY CONFERENCES AND EVENTS

6.8

MACROECONOMIC OUTLOOK

6.9.1

AI-PREDICTIVE MAINTENANCE AND DIGITAL TWINS

6.9.2

QUANTUM-ENHANCED SENSING

6.9.3

CYBER-HARDENING AND ZERO-TRUST SECURITY ARCHITECTURES

7

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

109

7.2

MISSILE DEFENSE SYSTEMS

7.2.1

EXPANDING BALLISTIC AND CRUISE MISSILE THREATS TO DRIVE MARKET

7.2.2

USE CASE: PATRIOT PAC-3 MSE BY RTX AND LOCKHEED MARTIN CORPORATION

7.3

ANTI-AIRCRAFT SYSTEMS

7.3.1

INTEGRATION OF AI-ASSISTED TARGET RECOGNITION TO COUNTER AERIAL THREATS TO DRIVE MARKET

7.3.2

USE CASE: IRIS-T SLM BY DIEHL DEFENCE

7.4

COUNTER-UNMANNED AERIAL SYSTEMS

7.4.1

GROWING PROLIFERATION OF DRONES AND LOITERING MUNITIONS TO DRIVE MARKET

7.4.2

USE CASE: DRONEGUN MKIII BY DRONESHIELD

7.5

COUNTER-ROCKET ARTILLERY AND MORTAR SYSTEMS

7.5.1

INCREASING INDIRECT FIRE THREATS TO DRIVE MARKET

7.5.2

USE CASE: IRON DOME BY RAFAEL ADVANCED DEFENSE SYSTEMS

7.6

COUNTER-HYPERSONIC DEFENSE SYSTEMS

7.6.1

ONGOING DEVELOPMENT OF HYPERSONIC WEAPONS TO DRIVE MARKET

7.6.2

USE CASE: GLIDE PHASE INTERCEPTOR BY RTX AND NORTHROP GRUMMAN

7.7

INTEGRATED MULTI-THREAT SYSTEMS

7.7.1

RISING HYBRID AND MULTI-DOMAIN THREATS TO DRIVE MARKET

7.7.2

USE CASE: BARAK-MX SYSTEM BY ISRAEL AEROSPACE INDUSTRIES

8

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 14 Data Tables

116

8.2.1

DIVERSITY OF MISSILE, DRONE, AND ARTILLERY THREATS TO DRIVE MARKET

8.2.3

DIRECTED ENERGY WEAPONS

8.2.4

CLOSE-IN WEAPON SYSTEMS & GUNS

8.2.5

MAN-PORTABLE AIR DEFENSE SYSTEMS

8.3.1

NEED FOR RAPID MULTI-TARGET ENGAGEMENTS TO DRIVE MARKET

8.3.2

ENGAGEMENT OPERATION CENTERS

8.3.3

TARGET ACQUISITION & TRACKING SYSTEMS

8.4.1

INCREASED STEALTH AND HYPERSONIC CHALLENGES TO DRIVE MARKET

8.4.2

EARLY WARNING RADARS

8.4.3

FIRE CONTROL RADARS

8.4.4

EO/IR & SPACE SENSORS

8.5.1

ELEVATED DEMAND FOR SURVIVABILITY AND MODULARITY TO DRIVE MARKET

8.5.3

VERTICAL LAUNCHING SYSTEMS

8.6.1

EXTENSIVE USE IN HYBRID AND COALITION WARFARE TO DRIVE MARKET

8.6.2

CENTRALIZED COMMAND & CONTROL

8.6.3

INTEGRATED BATTLE MANAGEMENT SYSTEMS

8.7.1

GROWING MULTINATIONAL OPERATIONS AND SATURATION THREATS TO DRIVE MARKET

8.7.2

COALITION INTEROPERABILITY SOFTWARE

8.7.3

DATA FUSION SYSTEMS

9

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

126

9.2.1

RISE OF DRONES AND LOW-FLYING AIRCRAFT TO DRIVE MARKET

9.2.2

USE CASE: PANTSIR-S1 BY KBP INSTRUMENT DESIGN BUREAU

9.3.1

REGIONAL SECURITY TENSIONS TO DRIVE MARKET

9.3.2

USE CASE: NASAMS BY KONGSBERG

9.4.1

EXPANSION OF LONG-RANGE STRIKE CAPABILITIES TO DRIVE MARKET

9.4.2

THEATER MISSILE DEFENSE (TMD)

9.4.3

GROUND-BASED MIDCOURSE DEFENSE (GMD)

9.4.4

USE CASE: THAAD BY LOCKHEED MARTIN CORPORATION

10

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

131

10.2.1

EMPHASIS ON GROUND-BASED MISSILE DEFENSE AND MODERNIZATION TO DRIVE MARKET

10.2.2

KEY PROGRAMS PROCURED BY ARMY

10.2.2.1

PATRIOT PAC-3 MSE

10.2.2.5

KM-SAM CHEONGUNG-II

10.2.2.17

KP-SAM SHINGUNG

10.2.2.19

IGLA-S AND ADVANCING DRDO VSHORAD

10.3.1

NAVAL FOCUS ON INTEGRATED FLEET PROTECTION AND MODULAR MISSILE DEFENSE TO DRIVE MARKET

10.3.2

KEY PROGRAMS PROCURED BY NAVY

10.4.1

NEED FOR REAL-TIME SITUATIONAL AWARENESS AND NETWORKED COMMAND INTEGRATION TO DRIVE MARKET

10.4.2

KEY PROGRAMS PROCURED BY AIR FORCE

11

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION

Comprehensive coverage of 8 Regions with country-level deep-dive of 16 Countries | 236 Data Tables.

140

11.2.2.1

COMPREHENSIVE MODERNIZATION PROGRAMS AND SUSTAINED PROCUREMENT TO DRIVE MARKET

11.2.3.1

NEED TO COUNTER EVOLVING THREATS TO DRIVE MARKET

11.3.2.1

DOMESTIC DEFENSE MODERNIZATION STRATEGY TO DRIVE MARKET

11.3.3.1

ESSI LEADERSHIP AND EXPANDED IRIS-T SLM PROCUREMENT TO DRIVE MARKET

11.3.4.1

DEFENSE UPGRADE PROGRAMS AND STRONG MARITIME CAPABILITIES TO DRIVE MARKET

11.3.5.1

COMMITMENT TO MULTINATIONAL DEFENSE TO DRIVE MARKET

11.3.6.1

PATRIOT MODERNIZATION AND AEGIS-EQUIPPED FRIGATE EXPANSION TO DRIVE MARKET

11.3.7.1

EXPANDING IAMD CAPABILITIES THROUGH WISLA AND NAREW TO DRIVE MARKET

11.4.2.1

FOCUS ON MILITARY MODERNIZATION AS PART OF PLA REFORMS TO DRIVE MARKET

11.4.3.1

RISING THREATS FROM NORTH KOREA’S BALLISTIC MISSILE PROGRAM AND CHINA’S MISSILE ARSENAL TO DRIVE MARKET

11.4.4.1

DEVELOPMENT OF INDIGENOUS BALLISTIC MISSILE DEFENSE SYSTEMS TO DRIVE MARKET

11.4.5.1

REGIONAL SECURITY CHALLENGES TO DRIVE MARKET

11.4.6.1

STRONG PUSH TOWARD LAYERED AIR DEFENSE AND ADVANCED RADAR INTEGRATION TO DRIVE MARKET

11.4.7.1

ASTER 30 UPGRADE AND ALLIED PARTNERSHIPS TO DRIVE MARKET

11.4.8

REST OF ASIA PACIFIC

11.5.3.1

IRON DOME, DAVID’S SLING, AND ARROW EXPANSION TO DRIVE MARKET

11.5.4.1

INDIGENOUS DEVELOPMENT AND NATO COOPERATION TO DRIVE MARKET

11.5.5

REST OF MIDDLE EAST

11.6.2.1

SELECTIVE PROCUREMENT OF NASAMS, SPYDER, AND INDIGENOUS RADAR PROGRAMS TO DRIVE MARKET

11.6.3.1

ADVANCED SYSTEM PROCUREMENTS IN ALGERIA AND MOROCCO TO DRIVE MARKET

12

COMPETITIVE LANDSCAPE

Discover how strategic moves and market shares define industry leaders and emerging competitors.

235

12.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

12.3

REVENUE ANALYSIS, 2021–2024

12.4

MARKET SHARE ANALYSIS, 2024

12.5

BRAND/PRODUCT COMPARISON

12.6

COMPANY VALUATION AND FINANCIAL METRICS

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

12.7.5.1

COMPANY FOOTPRINT

12.7.5.2

REGION FOOTPRINT

12.7.5.3

SYSTEM FOOTPRINT

12.7.5.4

COMPONENT FOOTPRINT

12.8

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

12.8.1

PROGRESSIVE COMPANIES

12.8.2

RESPONSIVE COMPANIES

12.8.5

COMPETITIVE BENCHMARKING

12.8.5.1

LIST OF START-UPS/SMES

12.8.5.2

COMPETITIVE BENCHMARKING OF START-UPS/SMES

12.9

COMPETITIVE SCENARIO

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

260

13.1.1.1

BUSINESS OVERVIEW

13.1.1.2

PRODUCTS OFFERED

13.1.1.3

RECENT DEVELOPMENTS

13.1.2

LOCKHEED MARTIN CORPORATION

13.1.8

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

13.1.12

DIEHL STIFTUNG & CO. KG

13.1.13

MITSUBISHI HEAVY INDUSTRIES, LTD.

13.2.2

CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION

13.2.3

BHARAT DYNAMICS LIMITED

13.2.4

BHARAT ELECTRONICS LIMITED

13.2.6

ELBIT SYSTEMS LTD.

13.2.9

INDRA SISTEMAS, S.A.

14.1

LONG LIST OF COMPANIES

14.3

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES

TABLE 2

TRANSFORMATIVE TECHNOLOGIES DRIVING ADOPTION

TABLE 3

AVERAGE SELLING PRICE OF SHORT-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

TABLE 4

AVERAGE SELLING PRICE OF MEDIUM-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

TABLE 5

AVERAGE SELLING PRICE OF LONG-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

TABLE 6

AVERAGE SELLING PRICE TREND, BY REGION, 2019–2024 (USD MILLION)

TABLE 7

BILL OF MATERIALS FOR INTEGRATED AIR AND MISSILE DEFENSE PROGRAMS, 2024

TABLE 8

INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2021–2024 (UNITS)

TABLE 9

INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2025–2030 (UNITS)

TABLE 10

TOTAL COST OF OWNERSHIP OF INTEGRATED AIR AND MISSILE DEFENSE PROGRAMS

TABLE 11

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

TABLE 12

KEY BUYING CRITERIA, BY COMPONENT

TABLE 13

EVOLUTION OF INTEGRATED AIR AND MISSILE DEFENSE TECHNOLOGIES

TABLE 15

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 16

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 22

IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 23

EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 24

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 25

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 26

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 27

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 28

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 29

WEAPON SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 30

WEAPON SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 31

FIRE CONTROL SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 32

FIRE CONTROL SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 33

RADARS & SENSORS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 34

RADARS & SENSORS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 35

LAUNCHERS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 36

LAUNCHERS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 37

COMMAND & CONTROL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 38

COMMAND & CONTROL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 39

SYSTEM INTEGRATION: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 40

SYSTEM INTEGRATION: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 41

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 42

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 43

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 44

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 45

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 46

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 47

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 48

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 49

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 50

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 51

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 52

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 53

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 54

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 55

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 56

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 57

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 58

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 59

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 60

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 61

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 62

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 63

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 64

US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 65

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 66

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 67

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 68

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 69

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 70

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 71

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 72

CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 73

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 74

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 75

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 76

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 77

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 78

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 79

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 80

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 81

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 82

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 83

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 84

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 85

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 86

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 87

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 88

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 89

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 90

UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 91

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 92

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 93

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 94

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 95

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 96

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 97

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 98

GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 99

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 100

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 101

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 102

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 103

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 104

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 105

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 106

FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 107

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 108

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 109

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 110

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 111

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 112

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 113

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 114

ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 115

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 116

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 117

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 118

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 119

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 120

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 121

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 122

SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 123

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 124

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 125

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 126

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 127

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 128

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 129

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 130

POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 131

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 132

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 133

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 134

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 135

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 136

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 137

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 138

REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 139

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 140

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 141

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 142

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 143

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 144

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 145

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 146

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 147

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 148

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 149

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 150

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 151

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 152

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 153

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 154

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 155

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 156

CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 157

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 158

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 159

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 160

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 161

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 162

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 163

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 164

JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 165

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 166

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 167

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 168

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 169

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 170

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 171

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 172

INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 173

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 174

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 175

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 176

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 177

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 178

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 179

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 180

SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 181

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 182

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 183

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 184

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 185

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 186

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 187

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 188

AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 189

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 190

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 191

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 192

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 193

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 194

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 195

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 196

SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 197

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 198

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 199

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 200

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 201

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 202

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 203

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 204

REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 205

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 206

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 207

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 208

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 209

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 210

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 211

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 212

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 213

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 214

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 215

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 216

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 217

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 218

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 219

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 220

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 221

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 222

UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 223

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 224

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 225

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 226

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 227

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 228

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 229

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 230

SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 231

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 232

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 233

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 234

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 235

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 236

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 237

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 238

ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 239

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 240

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 241

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 242

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 243

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 244

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 245

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 246

TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 247

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 248

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 249

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 250

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 251

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 252

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 253

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 254

REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 255

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 256

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 257

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 258

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 259

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 260

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 261

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 262

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 263

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 264

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 265

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 266

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 267

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 268

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 269

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 270

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 271

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 272

LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 273

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 274

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 275

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021–2024 (USD MILLION)

TABLE 276

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 277

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 278

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 279

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 280

AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 281

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

TABLE 282

INTEGRATED AIR AND MISSILE DEFENSE MARKET: DEGREE OF COMPETITION

TABLE 283

REGION FOOTPRINT

TABLE 284

SYSTEM FOOTPRINT

TABLE 285

COMPONENT FOOTPRINT

TABLE 286

LIST OF START-UPS/SMES

TABLE 287

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 288

INTEGRATED AIR AND MISSILE DEFENSE MARKET: DEALS, 2021–2025

TABLE 289

INTEGRATED AIR AND MISSILE DEFENSE MARKET: OTHERS, 2021–2025

TABLE 290

RTX: COMPANY OVERVIEW

TABLE 291

RTX: PRODUCTS OFFERED

TABLE 293

LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

TABLE 294

LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

TABLE 295

LOCKHEED MARTIN CORPORATION: DEALS

TABLE 296

LOCKHEED MARTIN CORPORATION: OTHERS

TABLE 297

MBDA: COMPANY OVERVIEW

TABLE 298

MBDA: PRODUCTS OFFERED

TABLE 300

NORTHROP GRUMMAN: COMPANY OVERVIEW

TABLE 301

NORTHROP GRUMMAN: PRODUCTS OFFERED

TABLE 302

NORTHROP GRUMMAN: OTHERS

TABLE 303

IAI: COMPANY OVERVIEW

TABLE 304

IAI: PRODUCTS OFFERED

TABLE 307

THALES: COMPANY OVERVIEW

TABLE 308

THALES: PRODUCTS OFFERED

TABLE 310

RHEINMETALL AG: COMPANY OVERVIEW

TABLE 311

RHEINMETALL AG: PRODUCTS OFFERED

TABLE 312

RHEINMETALL AG: OTHERS

TABLE 313

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

TABLE 314

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

TABLE 315

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

TABLE 316

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: OTHERS

TABLE 317

KONGSBERG: COMPANY OVERVIEW

TABLE 318

KONGSBERG: PRODUCTS OFFERED

TABLE 319

KONGSBERG: DEALS

TABLE 320

KONGSBERG: OTHERS

TABLE 321

HANWHA GROUP: COMPANY OVERVIEW

TABLE 322

HANWHA GROUP: PRODUCTS OFFERED

TABLE 323

ASELSAN A.S.: COMPANY OVERVIEW

TABLE 324

ASELSAN A.S.: PRODUCTS OFFERED

TABLE 325

ASELSAN A.S.: DEALS

TABLE 326

DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

TABLE 327

DIEHL STIFTUNG & CO. KG: PRODUCTS OFFERED

TABLE 328

DIEHL STIFTUNG & CO. KG: DEALS

TABLE 329

MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

TABLE 330

MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

TABLE 331

MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

TABLE 332

LIG NEX1: COMPANY OVERVIEW

TABLE 333

LIG NEX1: PRODUCTS OFFERED

TABLE 334

LIG NEX1: OTHERS

TABLE 335

HENSOLDT AG: COMPANY OVERVIEW

TABLE 336

HENSOLDT AG: PRODUCTS OFFERED

TABLE 337

HENSOLDT AG: DEALS

TABLE 338

HENSOLDT AG: OTHERS

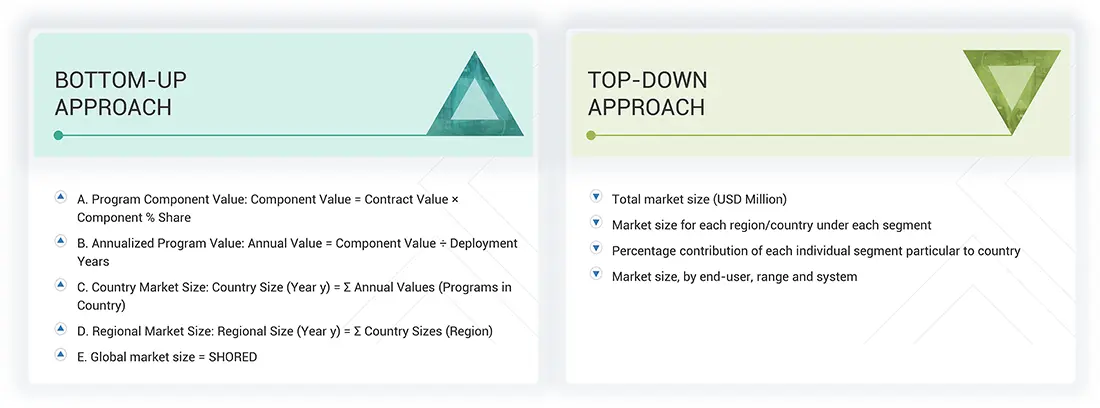

FIGURE 1

INTEGRATED AIR AND MISSILE DEFENSE MARKET SEGMENTATION

FIGURE 2

RESEARCH DESIGN MODEL

FIGURE 4

BOTTOM-UP APPROACH

FIGURE 5

TOP-DOWN APPROACH

FIGURE 6

DATA TRIANGULATION

FIGURE 7

KEY INSIGHTS AND MARKET HIGHLIGHTS

FIGURE 8

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 9

HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

FIGURE 10

MIDDLE EAST TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

FIGURE 11

INTEGRATED AIR AND MISSILE DEFENSE MARKET DYNAMICS

FIGURE 12

AVERAGE SELLING PRICE TREND, BY REGION, 2019–2024 (USD MILLION)

FIGURE 13

INVESTMENT AND FUNDING SCENARIO, 2019−2024

FIGURE 14

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

FIGURE 15

KEY BUYING CRITERIA, BY COMPONENT

FIGURE 16

TECHNOLOGY ROADMAP FOR INTEGRATED AIR AND MISSILE DEFENSE

FIGURE 17

PATENT ANALYSIS

FIGURE 18

TECHNOLOGY TRENDS

FIGURE 19

IMPACT OF AI ON SYSTEM LEVEL

FIGURE 20

IMPACT OF AI ON SUBSYSTEM LEVEL

FIGURE 21

ECOSYSTEM ANALYSIS

FIGURE 22

VALUE CHAIN ANALYSIS

FIGURE 23

IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 24

EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 25

IMPACT OF MEGATRENDS

FIGURE 26

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

FIGURE 27

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

FIGURE 28

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025–2030 (USD MILLION)

FIGURE 29

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025–2030 (USD MILLION)

FIGURE 30

INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025–2030

FIGURE 31

NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

FIGURE 32

EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

FIGURE 33

ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

FIGURE 34

MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

FIGURE 35

REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

FIGURE 36

REVENUE ANALYSIS OF TOP LISTED PLAYERS, 2021–2024 (USD MILLION)

FIGURE 37

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 38

BRAND/PRODUCT COMPARISON

FIGURE 39

COMPANY VALUATION (USD BILLION)

FIGURE 40

FINANCIAL METRICS (EV/EBIDTA)

FIGURE 41

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 42

COMPANY FOOTPRINT

FIGURE 43

COMPANY EVALUATION MATRIX (START-UP/SMES), 2024

FIGURE 44

RTX: COMPANY SNAPSHOT

FIGURE 45

LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

FIGURE 46

NORTHROP GRUMMAN: COMPANY SNAPSHOT

FIGURE 47

IAI: COMPANY SNAPSHOT

FIGURE 48

THALES: COMPANY SNAPSHOT

FIGURE 49

RHEINMETALL AG: COMPANY SNAPSHOT

FIGURE 50

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 51

KONGSBERG: COMPANY SNAPSHOT

FIGURE 52

HANWHA GROUP: COMPANY SNAPSHOT

FIGURE 53

ASELSAN A.S.: COMPANY SNAPSHOT

FIGURE 54

MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 55

LIG NEX1: COMPANY SNAPSHOT

FIGURE 56

HENSOLDT AG: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Integrated Air and Missile Defense Market