Lightweight Aggregates Market

Lightweight Aggregates Market by Type (Expanded Clay, Fly Ash, Pumice, Diatomite, Perlite), End-Use Industry (Building & Construction, Infrastructure), And Region - Global Forecast to 2030

Updated on : November 27, 2025

LIGHTWEIGHT AGGREGATES MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The lightweight aggregates market is projected to grow from USD 12.7 billion in 2024 to 15.5 billion by 2029, or a CAGR of 3.4%, due primarily to increased applications for construction and infrastructure, residential buildings, and industrial uses. The use of lightweight aggregates to improve structural performance, decrease dead weight in construction, assist with seismic resistance, and increase thermal insulation will encourage market growth. Likewise, the advancement of new materials with beneficial properties, such as fly ash-based aggregates, expanded clay and shale products, and improved pozzolanic properties, increases durability and sustainability while improving the performance of lightweight aggregates in high-rise buildings, bridge construction, and precast concrete applications. Greater usage for green building initiatives that pursue LEED and BREEAM certifications and sustainable construction practices also show environmental improvements with conservation, and an increase in operational efficiencies with the construction industry.

KEY TAKEAWAYS

-

BY COMPONENTThe lightweight aggregates market based on type proposes fly ash, expanded clay, expanded perlite, pumice, diatomite, and others. The fly ash segment accounts for the largest market share, mainly because fly ash is a by-product that is produced from coal combustion in power plants and provides lightweight properties, high strength to weight ratio, and pozzolanic properties. Fly ash improves concrete durable and workability properties while reducing costs of materials overall.

-

BY TECHNOLOGYThe lightweight aggregates market by end-use industry comprises of building & construction, infrastructure, and other Types. Building & construction dominates the market in share, largely because of the demand for structural performance, weight savings, seismic resistance, and thermal insulation for tall buildings, bridges, tunnels, and precast concrete items. Residential construction is driven by urbanization and population growth and the use of lightweight aggregates to improve building performance and meet green building certification requirements; for example, LEED and BREEAM.

-

BY REGIONThe region-based lightweight aggregates market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America accounts for the largest share of the market, due to significant investments in infrastructure, green building initiatives, and rigorous sustainability regulations, all of which encourage the use of lightweight materials in building and construction.

-

COMPETITIVE LANDSCAPEArcosa Inc.(US), Stalite Lightweight Aggregate (US), Boral Industries Inc. (Australia), Leca International (Denmark), Laterlite S.P.A. (Italy), are leading companies of syntactic foam market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, acquisitions, and expansions, to increase their market presence.

The use of lightweight aggregates to improve structural performance, decrease dead weight in construction, assist with seismic resistance, and increase thermal insulation will encourage market growth. Likewise, the advancement of new materials with beneficial properties, such as fly ash-based aggregates, expanded clay and shale products, and improved pozzolanic properties, increases durability and sustainability while improving the performance of lightweight aggregates in high-rise buildings, bridge construction, and precast concrete applications. Greater usage for green building initiatives that pursue LEED and BREEAM certifications and sustainable construction practices also show environmental improvements with conservation, and an increase in operational efficiencies with the construction industry.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of lightweight aggregates manufacturers, and target applications are the clients of lightweight aggregates manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of lightweight aggregates manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Increase in construction activities globally

-

§Global trend toward sustainable infrastructure

Level

-

§Fluctuations in energy costs

-

§Sensitivity to proper mixing techniques

Level

-

§Extensive use of lightweight aggregates in global infrastructure development

-

§Rise in population and rapid urbanization

Level

-

§Exploitation of natural resources

-

§Harmful emissions from lightweight aggregate production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver – Increase in construction activities globally

Construction activity around the world is a major driver of the growth in the lightweight aggregates market. Lightweight aggregates are mainly used in concrete for high-rise buildings, bridges, precast buildings, and even in roofing or flooring systems. Lightweight aggregates improve seismic resistance and incurred less dead-weight compared to normal aggregate. The Royal Institution of Chartered Surveyors (RICS) Global Construction Monitor Q4 2024 showed some modest recovery in construction activity, and the Construction Sentiment Index (CSI) signaled a positive outlook; particularly in the Middle East & Africa, Asia Pacific, and North America. Following the COVID-19 pandemic, the US Census Bureau indicated that construction spending grew from USD 2,122.2 billion in January 2024 to USD 2,192.5 billion in January 2025, and that construction output in the EU had a growth rate of 0.6% for building construction and growth rate of 0.7% for civil engineering construction. In addition, China's Five-Year Plan (2021 - 2025) has been a substantial investment aimed at developing transportation, energy, and water infrastructure, as well deploying 5G to cities in China. In 2023, 89.5% of chinese municipalities reported having access to Grade III or above highways, and over 4.25 million 5G base stations have since been installed. These efforts signal the continuation of training in construction and infrastructure, and therefore, future demand for lightweight aggregates is expected to increase, owing to their ability to improve structural performance, lightweight, and thermal insulation properties.

Restraint –Fluctuations in energy costs

Lightweight aggregates, created from shale, clay, or slate, typically cost 30-50% more than conventional materials because of the energy-intensive production methods. These methods require heating raw materials in rotary kilns to high temperatures, which requires a lot of energy supplied by coal, coke, natural gas, or fuel oil. The cost of energy fluctuates and adds to the cost of lightweight aggregates. Producers also face increased pressure due to higher energy costs because of higher prices energy prices overall. The International Energy Agency (IEA) noted that natural gas markets in the world will remain tight until 2025, due to constantly increasing demand and supply returning only very slowly to levels prior to the pandemic and a continual energy crisis in the world. The pressure is much needed to create some international partnership to address supply security for gas. The rising costs of electricity are also causing difficulties for producers, especially when wholesale electricity prices fluctuate frequently, partially due to geopolitics with global tensions. This volatility complicates costs, creating an obstacle for industry participants to expanding supplies and markets.

Opportunity – Rise in population and rapid urbanization

The increase in global population and rapid urbanization provide significant opportunities for manufacturers of lightweight aggregates. With the demographic shifts in the world, there continues to be a rapid rise in demand for infrastructure, residential building, housing, and industrial developments. In 2024, the world population is over 8.1 billion people, and it is projected to reach about 10 billion people by 2060. This growth will create a greater need for more living space, resulting in an increased demand for residential building and a surge in the lightweight aggregates market. Urbanization also provides further opportunities for lightweight aggregates, especially with the building of new buildings and infrastructure for industrial facilities. This demographic shift has occurred rapidly, with populations migrating from rural or suburban areas into urban cities. World Bank data lists that as of 2023, around 4.6 billion people lived in urban areas, which is about half the world population, while about 3.45 billion people lived in rural communities. This will be fueled by population growth, developing economies, technology improvements, and increased quality of life in urban areas. Clearly, with increasing urban population, the lightweight aggregates market will have significant growth as it meets the growing needs of the growing urban population.

Challenge – Exploitation of natural resources

Lightweight aggregate is a specific material that is derived from volcanic rock and consists of a porous material and is considered natural resources including perlite, shale, clay, volcanic ash, and diatomite. However, lightweight aggregates remain far less available than conventional aggregates, which did present significant challenges for the environment with the construction industry widespread use of natural resources. In the past fifty years the extraction of natural resources has tripled due to the large scale of infrastructures and materials use, and the UN Environment Programme (UNEP) projects that material extraction could increase by 60% by 2060. This is a risk to global goals addressing climate change, biodiversity, and pollution as these natural resource extractions and fossil fuel, metal and non-metallic mineral processing (including sand, gravel, and clay) contribute significantly towards 35% of global emission. The increasing extractions can have serious implications for achieving sustainability goals and ambitions for climate change and biodiversity. Given the accelerating trend of extraction and depletion of non-renewable resources based on the extremely sought-after need for high concrete manufacturing, lightweight aggregates can face very serious potential challenges as available materials decline and environmental concerns rise. Environmental change could create interruptions in the supply chain accompanied by significant increases in production costs, while the pressure for regulations, to promote other sustainable options and a circular economy approach within the built environment would possibly increase in the construction industry.

Lightweight Aggregates Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The construction of a multi-story residential tower in Chicago faced significant challenges due to weight limitations on the existing foundation. Traditional concrete solutions would have exceeded the structural capacity, necessitating costly reinforcements and potential project delays. The developers sought an innovative approach to reduce the building’s overall load without compromising structural integrity or performance. | To address the challenge, lightweight structural concrete incorporating Arcosa Lightweight Aggregate was used for the building’s floor slabs. It helped reduce weight compared to conventional concrete while maintaining the required strength, enhanced the thermal insulation, and made it easier to work with the material, reducing labor costs and timelines. |

|

The construction of the Longthorpe A47 Footbridge in Peterborough faced a critical challenge due to the weak underlying ground conditions. The traditional use of standard fill materials would have placed an excessive load on the soil, leading to potential settlement issues and structural instability. The project required a lightweight yet durable solution to support the footbridge embankments while maintaining long-term stability. | To address the challenge, LECA Lightweight Aggregate was chosen as the primary fill material for the embankments. It significantly reduced the overall load on the ground while ensuring stability. Its lightweight nature minimized settlement risks and facilitated easier handling and installation. The material’s high drainage capacity also helped prevent water accumulation, further enhancing the embankment’s durability and performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The lightweight aggregate market operates importantly on the value chain of first sourcing raw materials such as expanded clay, perlite, and pumice and then, their utilization in construction and infrastructure. Lightweight aggregate manufacturing aggregates typically process raw materials through crushing, heating, and/or pelletizing to ensure that they possess important material performance attributes such as low density, strength, insulation, etc. while also ensuring compliance with environmental and regulatory safety standards. First, demand for lightweight aggregate is driven by voluntary and regulatory initiatives in some regions encouraging sustainable building materials. Second, advanced production technologies and recycling technologies are promoting better product performance and sustainability. Finally, the performance of lightweight aggregates has a strong correlation with the testing of material properties such as strength, absorption and durability, to ensure consistent performance for all end-use categories of products e.g. concrete, blocks, precast, etc. Incorporating sustainable materials, energy-efficient production, and digital optimization continue to enhance innovation and growth throughout the lightweight aggregate market ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lightweight Aggregates Market, By Type

Fly ash represents the leading portion of the lightweight aggregates market. Fly ash is a by-product of the burning of coal in power generating stations. Fly ash is a lightweight aggregate that has the desired structural properties (high strength-to-weight ratio), pozzolanic properties, and is therefore suitable for many construction applications, including concrete (concrete production), road construction, and precast building elements. The growing emphasis on sustainable and eco-friendly construction materials has augmented the demand for fly ash-based lightweight aggregates, due to their contributions to reducing carbon footprint and promoting circular economy concepts. Widespread utilization of fly ash in the construction industry is primarily motivated by its ability to improve the durability, workability, and overall reduced materials cost for concrete. As a partial replacement for cement, fly ash improves the resistance of concrete to sulfate attack, reduces concrete shrinkage, and improves long-term strength of concrete, thus being advantageous for many infrastructure items such as bridges, highways, and high-rise buildings.

Lightweight Aggregates Market, By End Use Industry

The largest end-use industry for lightweight aggregates is building & construction. With urbanization and population growth driving demand for residential, commercial and industrial buildings, the need for lightweight aggregates continued increasing. The construction industry's leading role in the light-weight aggregates market can also be attributed to its increased emphasis on green building practices and stricter sustainability regulations. Infrastructure development projects including roads, bridges, and tunnels and airport runways, are foremost users of light-weight aggregates because they have a high strength-to-weight ratio, durability, and can withstand severe environmental conditions. China, India and the US are investing heavily in infrastructure, and they now actively use lightweight aggregates as part of their construction.

REGION

Asia Pacific's Urban Growth and Regulations Drive Intumescent Coatings Demand

In 2024, North America led the lightweight aggregates market. Demand for lightweight aggregates across residential, commercial, and industrial construction projects in the region is growing amid accelerating urbanization and population growth. A variety of government programs, including LEED (Leadership in Energy and Environmental Design) certification and strict building codes, are leading to increased use of lightweight materials. The United States has initiated significant infrastructure projects, while Canada is investing heavily in green infrastructure that includes sustainable building and housing, and all these activities are growing the demand for lightweight aggregates. North America's commitment to the principles of circular economy and recycling waste is hastening the use of industrial by-products to further promote environmental sustainability. Leading market players in North America are investing in research and development to enhance product quality, produce more product, and develop new applications for lightweight aggregates in a wide variety of industries.

Lightweight Aggregates Market: COMPANY EVALUATION MATRIX

In the lightweight agrregates market matrix, Arcosa Inc. (Star), leads the market. The company has developed a strong position in construction and energy, utilizing a complete product range, long-standing technical reputation, and global supply chains to impact the market. Leca International is an emerging leader that is developing momentum through R&D efforts, and technical innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Stalite Lightweight Aggregate (US)

- Saint-Gobain (France)

- Holcim-Utelite (US)

- Arcosa Inc.(US)

- Laterlite S.P.A. (Italy)

- Buildex, LLC (US)

- Northeast Solite Corporation (US)

- Norlite, LLC (US)

- Liapor GMBH & CO. KG (Germany)

- Argex (Belgium)

- Hess Pumice Products (US)

- Supreme Perlite (US)

- Dicalite Management Group, LLC (US)

- Carolina Perlite Co., Inc. (US)

- Norcal Perlite Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD13.1Billion |

| Market Forecast in 2030 (Value) | USD 15.5 Billion |

| Growth Rate | CAGR of 3.4% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Types, Fly ash, Expanded clay, Pumice, Perlite, Diatomite, other types By End-use Industry: Building & Construction, Infrastructure, Othrer End Use Industries |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: Lightweight Aggregates Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Smart Labels | • Detailed company profiles of lightweight aggregatees competitors (financials, product portfolio) • Market segmentation by type (fly ash, expanded clay, pumice, diatomite, perlite, other types) • Market segmentation by end use industry (building & construction, infrastructure, other end use industries) | • Identified & profiled key players for lightweight aggregates companies • Track adoption trends in high-growth North America industries (fly ash, expanded clay, pumice, diatomite, perlite, other types) |

RECENT DEVELOPMENTS

- October 2024 : Arcosa, Inc. announced the completion of its previously disclosed acquisition of the construction materials business of Stavola Holding Corporation and its affiliated entities (“Stavola”) for USD 1.2 billion.

- June 2021 : LECA International, a part of the Saint-Gobain Group expanded its production capacity in Estonia by reopening the LECA plant in Häädemeeste. This decision is driven by the positive outlook for the construction market, which is expected to experience sustainable growth. The Häädemeeste site will have a production capacity of approximately 350,000 m³, with a primary focus on supplying the Baltic market while also creating opportunities for exports to international markets. Currently, LECA International operates two block plants in the Baltics, and the reopening of the Leca LWA kiln will strengthen its market presence in the region.

Table of Contents

Methodology

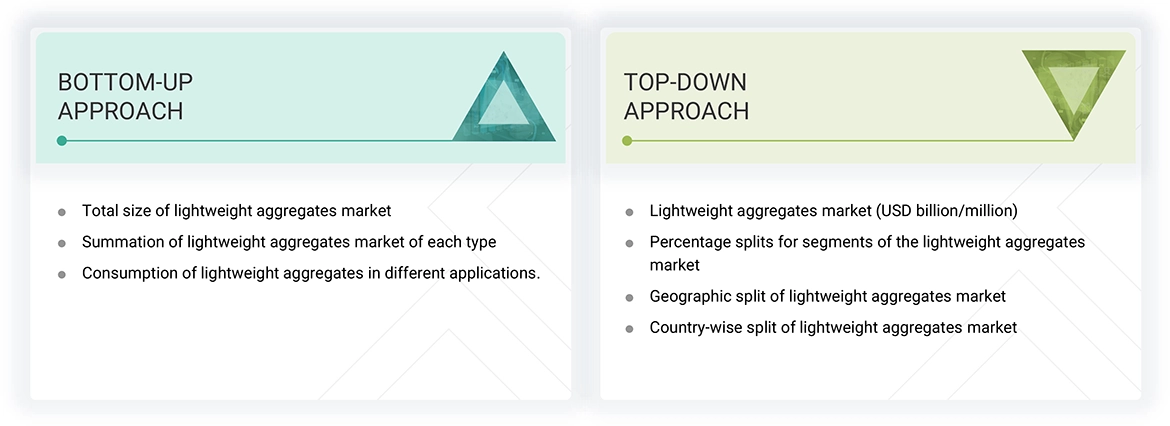

The study involved four major activities for estimating the current size of the global lightweight aggregates market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Lightweight aggregates through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the lightweight aggregates market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering lightweight aggregates is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the lightweight aggregates market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of lightweight aggregates vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the lightweight aggregates market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of lightweight aggregates offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

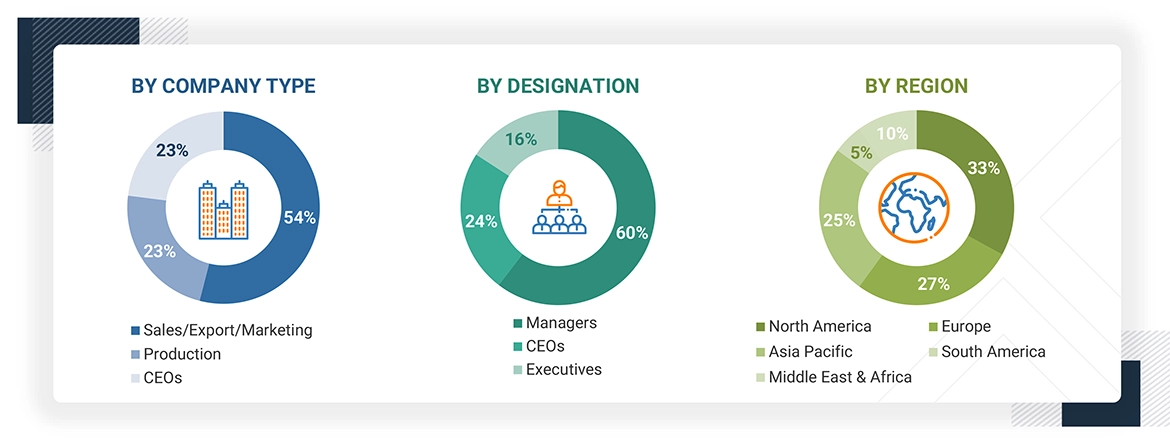

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the lightweight aggregates market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Lightweight aggregate is a type of coarse aggregate used in the production of lightweight concrete products such as concrete blocks, structural concrete, and pavement. Lightweight aggregates are categorized into two main types: natural and artificial. Natural lightweight aggregates are naturally occurring materials that include pumice, volcanic cinders, scoria, sawdust, rice husk, and diatomite. The artificial lightweight aggregates include expanded clay and shale, perlite, vermiculite, fly ash, slag, and others. Lightweight aggregates are aggregates of mineral origin with a particle density not exceeding 2000 kg/m³ or a loose bulk density not exceeding 1200 kg/m³. The high porosity of lightweight aggregates enhances their thermal insulation and soundproofing properties. Their irregular shape and rough surface texture improve the bonding strength between the aggregate and cement paste in concrete, resulting in enhanced mechanical performance. The reduced weight of lightweight concrete helps lower the dead load on a structure, allowing for the use of smaller foundations and thinner structural elements. The lower weight reduces shipping and handling costs. Lightweight aggregates are used in the construction industry for producing lightweight concrete in structural and non-structural applications. They are also used in infrastructure and other applications such as geotechnical.

Stakeholders

- Lightweight Aggregates Manufacturers

- Raw Material Suppliers

- Construction Companies

- Distribution and Logistics Company

- Infrastructure Developers

- Precast Concrete Manufacturers

- Research & Development Entities

- Industry Associations and Regulatory Bodies

- Waste Management and Recycling Companies

- End Users

Report Objectives

- To estimate and forecast the lightweight aggregates market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market product, application, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisitions, product launches, agreements, and expansions in the lightweight aggregates market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lightweight Aggregates Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Lightweight Aggregates Market