Liquid Cooled EV Charging Cable Market

Liquid Cooled EV Charging Cable Market by Cable Power Capacity, Cable Length, Cable Diameter, Application, Jacket Material, Cooling Fluid and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The liquid cooled EV charging cable market is projected to grow from USD 0.51 billion in 2025 to USD 1.28 billion by 2032, representing a compound annual growth rate (CAGR) of 14.0%. This growth is driven by a rapid shift toward ultrafast DC charging, where increasing current levels make air-cooled cables thermally and ergonomically impractical. A clear transition in technology is taking place, moving toward integrated liquid cooling and microchannel designs that enable sustained operations at power levels ranging from 150 kW to 350 kW. These advancements result in smaller, lighter, and more flexible cables. Additionally, improvements in vehicle platforms, such as larger battery packs and higher charge acceptance rates, require charging infrastructure to deliver high power without derating, which directly supports the adoption of liquid-cooled cables. The economics of charging networks contribute to this trend, as liquid cooled cables enhance station uptime, utilization, and long-term reliability, while also accommodating compact high-power charger designs. Stricter safety expectations, durability requirements, and the necessity of future-proofing installations for even higher power levels are further accelerating the shift from optional to standard use of liquid-cooled charging cables in fast charging networks.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to be the largest market during the forecast period. It is projected to grow from USD 416.7 million to USD 1,074.2 million, registering a CAGR of 14.5%.

-

By Cable Power CapacityBy cable power capacity, the 500–900 kW segment is expected to lead the liquid cooled EV charging cable market during the forecast period. It is projected to grow from USD 430.9 million in 2025 to USD 1,095.5 million by 2032.

-

By ApplicationBy application, the ultrafast charging segment is expected to lead the liquid cooled EV charging cable market during the forecast period. This segment is projected to grow from USD 509.2 million in 2025 to USD 1257.4 million by 2032, at a CAGR of 13.8% from 2025 to 2032.

-

By Cable LengthBy cable length, the above 8 meters segment is projected to be the fastest-growing segment during the forecast period.

-

By Cable DiameterBy cable diameter, the 30–50 mm segment is expected to lead the liquid cooled EV charging cable market during the forecast period. This segment is projected to grow from 76 thousand units in 2025 to 224 thousand units in 2032, at a CAGR of 16.6%.

-

Jacket MaterialBy jacket material, the thermoplastic elastomer segment is expected to be the largest and the fastest-growing segment during the forecast period. The segment is projected to grow from 81 thousand units in 2025 to 269 thousand units in 2032, registering at a CAGR of 18.7%.

-

Cooling FluidBy cooling fluid, the water glycol segment is expected to lead the liquid cooled EV charging cable market during the forecast period. This segment is projected to grow from 94 thousand units in 2025 to 291 thousand units in 2032, at a CAGR of 17.6%.

-

Competitive Landscape - Key PlayersPhoenix Contact (Germany), HUBER+SUHNER (Switzerland), BRUGG eConnect (Switzerland), Sinbon Electronics Co., Ltd. (Taiwan), and LEONI (Germany) are some of the star players in the market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsQingdao Penoda Electrical (China), Suzhou Yihang Electronic Science & Technology (China), Zhengzhou Saichuan Electronic Technology (China), and Southwire Company (US) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The market for liquid cooled EV charging cables is growing as charging infrastructure providers prioritize system reliability and user experience. Increasing power ratings of chargers are putting more thermal stress on traditional cable designs, which is driving the shift toward liquid cooled solutions. These cables enable sustained high power delivery while being lighter and easier to handle. Standardized cable assemblies are also reducing integration complexity for charger manufacturers. Additionally, advancements in thermal management are facilitating the deployment of these cables in regions with varying climate conditions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The shift from 350–500 kW cables to 500 kW–1 MW systems indicates that future revenue will increasingly depend on the requirements set by manufacturers of Ultrafast II and megawatt charging stations, rather than just on the specifications of standalone cables. The performance of cables is becoming a critical factor influencing the capability of charging stations. This transition highlights the importance of avoiding thermal derating, implementing advanced thermal control, and reducing failure rates. It demonstrates that simply having high power output is no longer enough. The key performance metric now is the ability to maintain rated power without degradation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for ultrafast and megawatt charging

-

Need for improved cable design with faster heat dissipation qualities

Level

-

High maintenance cost

-

High installation and service complexity

Level

-

Advancements in dielectric coolants and material technology

-

Growing use case for heavy duty truck charging

Level

-

Regulatory uncertainty with coolant systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for ultrafast and megawatt charging

The demand for ultrafast charging in the range of 350 to 600 kW, as well as megawatt charging of up to 1 MW, is increasing due to the growing capacities of electric vehicle (EV) batteries and rising charger utilization rates across passenger and commercial segments. Long-distance travel, high-throughput highway corridors, and fleet-based operations are placing pressure on the need to reduce charging time per vehicle while ensuring predictable energy delivery. At high power levels, the charging infrastructure must effectively manage increased current and heat generation. This necessity is driving a shift toward systems designed for sustained high power output rather than those that only handle short peak loads.

Restraint: High maintenance cost

The high maintenance cost is a significant limitation in the liquid cooled EV charging cable market, as it increases the expenses associated with maintaining charging infrastructure assets. While liquid cooled EV charging cables improve charging rates, they also necessitate more frequent monitoring and maintenance compared to air-cooled cables. For charging network operators, this increased need for oversight makes managing the charging network more challenging.

Opportunity: Advancements in dielectric coolants and material technology

Dielectric coolants and advanced insulation materials are becoming essential for high-power, liquid-cooled EV charging cables. These innovations enable cooling without electrical contact, allow for higher current density, and ensure stable operation without thermal derating or electrical risks. There is a noticeable shift from traditional cooling fluids, such as water-glycol mixtures and mineral oils, to engineered dielectric fluids, advanced polymers, and composite conductors. This transition is leading to reduced cable diameter and weight while enhancing durability, efficiency, and uptime in ultrafast and megawatt charging scenarios. The adoption of solutions like silicone-based fluids and specialized dielectric coolants that can sustain currents of 500 A and beyond is proving beneficial. These materials support continuous operation across a wide range of temperatures, have lower maintenance requirements, and comply with stringent safety and performance standards.

Challenge: Regulatory uncertainty with coolant systems

A factor limiting the use of coolant passages in liquid cooled EV charging cables is the degree of regulatory imbalance. Current regulations focus on electrical safety and compatibility, rather than effectively establishing standards for the conductivity thresholds of coolant fluids or ensuring appropriate sealing requirements to prevent leaks throughout their lifespan. While there have been incremental advancements, such as China’s national standard GB 29743.2, the situation remains fragmented in the US and European regions. This inconsistency contributes to delays in certification and increases costs, hindering the development of a more standardized industry.

LIQUID COOLED EV CHARGING CABLE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides liquid cooled DC charging cable systems integrated with connectors and power electronics for public and fleet fast charging installations | Improve charging reliability by maintaining stable thermal performance at sustained high current levels |

|

Supplies liquid cooled charging cables for highway and ultrafast charging corridors with continuous high power demand | Enable consistent high power delivery by minimizing electrical losses during extended charging sessions |

|

Delivers liquid cooled charging cables designed for high utilization commercial and heavy duty charging environments | Extend cable service life through enhanced mechanical strength under intensive operational use |

|

Provides liquid cooled charging cable assemblies as part of integrated charger systems for fast charging deployments | Reduce installation complexity by offering system-ready and customized cable solutions |

|

Supplies liquid cooled charging cables for public fast charging stations requiring compact routing and ease of handling | Enhance user handling and station ergonomics while sustaining high power charging capability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The liquid cooled electric vehicle EV charging cable market ecosystem involves a variety of interdependent players. Raw material and component suppliers include players like Prysmian, Nexans, and Dow. Cable and connector manufacturers include HUBER+SUHNER, BRUGG eConnect, and Phoenix Contact. Thermal management specialists include Parker, MAHLE, and Eaton. Charging equipment original equipment manufacturers (OEMs) include Siemens, ABB, and Delta. These OEMs integrate components into ultrafast and megawatt charging systems. Vehicle OEMs include Tesla, Volkswagen, Volvo, and Stellantis. They influence performance requirements based on the architectures of vehicles. Infrastructure operators, including ChargePoint, EVgo, and Shell, drive the deployment and utilization of charging stations. Finally, safety, interoperability, and compliance are overseen by testing and standards bodies such as TÜV SÜD, Intertek, SAE International, and ISO. Together, these organizations support the development, validation, and scaling of liquid-cooled charging cable technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Liquid Cooled EV Charging Cable Market, by Cable Power Capacity

The 500–900 kW segment is projected to be the largest market during the forecast period. Cables with this capacity range align with most installations of ultrafast DC chargers, which require liquid cooling designs for effective thermal management. This range is becoming the standard for passenger electric vehicles (EVs), buses, and light commercial vehicles, facilitating charger standardization and high asset utilization. Demand for these cables is further driven by the rapid deployment of ultrafast chargers, the increasing adoption of high-voltage vehicle platforms, the growth of fleet and corridor charging, and a better cost-to-performance balance compared to megawatt systems.

Liquid Cooled EV Charging Cable Market, by Application

The ultrafast charging segment is expected to dominate the liquid cooled EV charging cable market in 2025. This growth is due to its direct service to the high-volume passenger and light commercial electric vehicle (EV) market, which leads global EV deployment. The rapid expansion of public and semi-public charging infrastructure along highways and urban corridors is driving the large-scale installation of chargers with a capacity of 350 kW and above, resulting in a sustained demand for liquid-cooled cables. Furthermore, the increasing adoption of 800 V passenger EV platforms reinforces this trend, as liquid-cooled cables are necessary to safely support higher current operations at scale.

Liquid Cooled EV Charging Cable Market, by Cable Length

The 5–8 meters segment is projected to lead the liquid cooled EV charging cable market during the forecast period due to its optimal balance of electrical efficiency, thermal performance, and cost. This length minimizes voltage drop and coolant pressure loss during high-current charging, while avoiding the additional material and handling complexities associated with longer cables. It also allows for flexible routing in standard public charging layouts without the need for extra joints, which reduces installation time and lowers reliability risks. Consequently, charger manufacturers and operators are standardizing the 5 to 8 meters as the most practical length for large-scale public fast charging deployments.

Liquid Cooled EV Charging Cable Market, by Cable Diameter

The 30–50 mm segment is projected to lead the market during the forecast period. Cables in this diameter range balance power-handling capability, thermal performance, flexibility, and ease of installation for ultrafast and megawatt-class DC charging systems. This diameter range supports the high current transmission needed for chargers of 350 kW and above while keeping the cable weight and bending radius manageable. Additionally, liquid cooling remains efficient within this range, allowing heat to be effectively removed without complicating hose design or increasing coolant flow resistance.

Liquid Cooled EV Charging Cable Market, by Jacket Material

The thermoplastic elastomer segment is expected to lead the market in 2025 due to its flexibility, durability, and resistance to high temperatures and chemicals. This material facilitates easier handling and installation of high-power cables while ensuring effective insulation performance under continuous thermal and mechanical stress. Key driving factors for its adoption include the growing use of ultrafast and megawatt chargers, stringent safety standards that necessitate reliable insulation, and the demand for long-lasting, maintenance-free cables in commercial and public charging infrastructure.

Liquid Cooled EV Charging Cable Market, by Cooling Fluid

The water glycol segment is projected to lead the market during the forecast period because it effectively dissipates heat at high charging power while ensuring system safety and cost efficiency. Its established use in automotive thermal management ensures reliable performance across diverse climates. Additionally, it provides benefits such as freeze protection and corrosion resistance. Moreover, its compatibility with existing components and well-understood safety standards simplifies integration, accelerates adoption by cable manufacturers, and supports large-scale deployment in public and commercial charging infrastructure.

REGION

Asia Pacific to be the largest and fastest-growing region in the global liquid cooled EV charging cable market during the forecast period

The Asia Pacific region is at the forefront of the global liquid cooled electric vehicle (EV) charging cable market, largely driven by countries like China, South Korea, and emerging markets, such as India and Japan. These areas have dense EV fleets and extensive public charging networks, which are propelling the demand for cables that can handle high current loads without overheating. China serves as the primary growth driver, with approximately 30% of new DC chargers being ultrafast. The strong government support in China and South Korea is accelerating the rollout of ultrafast charging through subsidies and infrastructure programs. South Korea is actively promoting the transition to high-power public and highway charging that aligns with next-generation EV platforms. This shift reinforces the demand for liquid cooled cables that are compatible with systems operating at 800 V and above. Additionally, the region boasts strong manufacturing capabilities and suppliers, such as Phoenix Contact, Huber+Suhner, TE Connectivity, Leoni AG, and Sinbon Electronics. Real-world applications, such as BYD’s megawatt flash charging systems and China’s ultra-fast charging corridors, are establishing liquid cooled cables as essential for developing high-power, high-utilization charging infrastructure in the Asia Pacific region.

LIQUID COOLED EV CHARGING CABLE MARKET: COMPANY EVALUATION MATRIX

Phoenix Contact, based in Germany, is recognized as a Star Player in the liquid cooled EV charging cable market. The company is developing liquid cooled charging cables that can sustain very high current levels, meeting the demands of megawatt charging. Its engineering efforts prioritize thermal stability, safety, and long-duty cycle reliability. On the other hand, TE Connectivity is classified as an emerging leader. Its transportation solutions division focuses on providing connectors, terminals, sensors, and cable assemblies for various vehicles, including passenger cars, commercial vehicles, and electric and hybrid platforms. This includes components for battery systems, onboard chargers, DC converters, and EV charging solutions. TE Connectivity invests heavily in advanced research and development for vehicle electrification and high-power applications, which also encompass liquid-cooled EV charging connectors and cable assemblies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Phoenix Contact (Germany)

- HUBER+SUHNER (Switzerland)

- BRUGG Group (Switzerland)

- LEONI (Germany)

- SINBON Electronics (Taiwan)

- OMG EV Cable (China)

- Kempower (Finland)

- Fiver evse (China)

- Shanghai Mida EV Power (China)

- Coroflex (Germany)

- TE Connectivity (Ireland)

- Zhejiang Yonggui Electric Equipment (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.32 Billion |

| Market Forecast in 2032 (Value) | USD 1.28 Billion |

| Growth Rate | CAGR of 14.0% from 2025–2032 |

| Years Considered | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Thousand Units), Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Company Share, Growth Factors and Trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe |

WHAT IS IN IT FOR YOU: LIQUID COOLED EV CHARGING CABLE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Ultrafast DC charging station operator | Cables designed with liquid cooling and high current conductor materials to handle 500–900 kW charging |

|

| Public EV charging infrastructure developer | Customized cables supporting 800V and 1000V systems |

|

| Urban EV charging infrastructure integrator | Optimized cable diameter and liquid cooling layout for ergonomic handling |

|

| Highway and corridor charging network provider | Enhanced thermal management with advanced materials and precision liquid cooling |

|

| Regional EV charging network developer | Customized connectors and assemblies specific to Asia Pacific charging networks |

|

RECENT DEVELOPMENTS

- October 2025 : Phoenix Contact launched preassembled M12 push-pull network cables that deliver 10 Gbps Ethernet transmission via CAT6A X-coded design with advanced 360° shielding for interference-free performance in harsh electromagnetic environments.

- September 2025 : Autel Energy integrated Phoenix Contact’s 1,000 A liquid cooled CCS2 cable and connector into its new MaxiCharger DT1000 high-power EV charging system.

- August 2025 : SINBON announced plans to expand its manufacturing operations in the US with an investment of around USD 8.5 million by opening a new facility in Ohio. The facility would more than double its local production footprint to support industrial robotics, automotive, and renewable energy demand. The expansion strengthened cable assembly and connectivity manufacturing, including EV-related cable assemblies.

- August 2025 : SINBON Electronics inaugurated a new manufacturing facility in Mexico with an investment of around USD 27 million, expanding its regional capability for producing cable assemblies and interconnection systems used in automotive electrification and charging infrastructure. The facility strengthened localized manufacturing of high-current cable assemblies that are relevant to EV charging equipment.

- May 2025 : Phoenix Contact introduced the second generation of liquid-cooled CHARX connect professional CCS charging cables capable of transmitting up to 1,000 kW in boost mode and 800 kW continuously, advancing ultra-fast DC charging for electric vehicles and larger battery-equipped commercial vehicles.

Table of Contents

Methodology

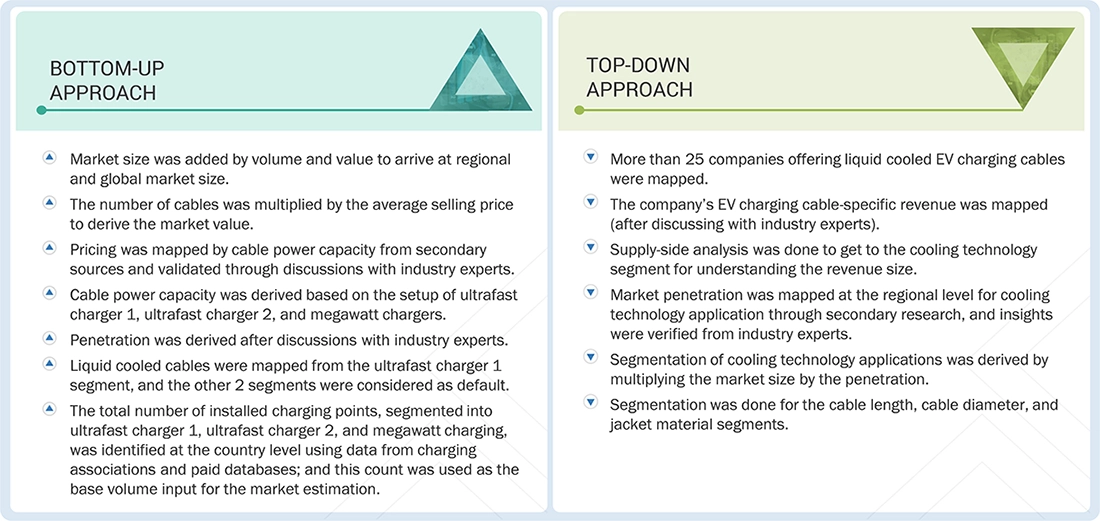

The study involved four major activities in estimating the current size of the liquid cooled EV charging cable market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports/presentations, press releases, industry association publications [publications of electric vehicle manufacturers, International Energy Agency (IEA), Alternative Fuel Data Centre (AFDC), European Alternate Fuels Observatory (EAFO), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], EV-related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles, company websites, whitepapers, databases, and articles from recognized associations and government publishing sources, were referred to. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research for an extensive commercial study of the liquid cooled EV charging cable market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews were conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely Asia Pacific, Europe, and North America. Approximately 40% and 60% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations to provide a holistic viewpoint in our report. Brief sessions with highly experienced independent consultants were conducted to reinforce findings from primaries after interacting with industry experts. This, along with the in-house subject matter experts’ opinions, led to the findings, as described in the remainder of this report.

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

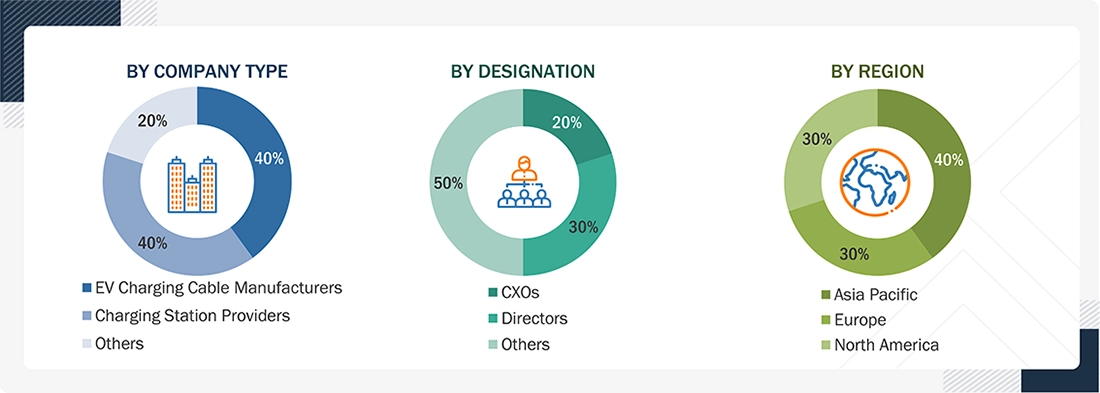

Breakdown of Primaries

Note: Others include Purchase and Sales Managers, Marketing Managers, and Product Managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up methodology was followed to estimate the size of the liquid cooled EV charging cable market by application. It involved the identification of the number of ultrafast 1, ultrafast 2, and megawatt charging points from country-level associations and paid databases. Also, the penetration for liquid cooled cables was derived through discussions with industry experts, while the other two segments were considered as default users of liquid cooled cables. Cable power capacity was then derived based on the setup of ultrafast 1, ultrafast 2, and megawatt chargers. Pricing was mapped by cable power capacity from secondary sources and validated through discussions with industry experts. The number of cables was multiplied by the average selling price to derive the market value. Market size by volume and value was then aggregated to arrive at regional and global market size estimates.

Data Triangulation

More than 25 companies were mapped as providers of liquid cooled EV charging cables. Company-specific revenue for EV charging cables was mapped after discussions with industry experts. Supply-side analysis was conducted to identify the cooling technology segment and understand its revenue contribution. Market penetration for cooling technology applications was mapped at the regional level through secondary research, with insights validated by industry experts. Segmentation by cooling technology application was calculated by multiplying the market size by penetration rates. A similar approach was applied for segmentation by cable length, cable diameter, and jacket material.

Market Definition

A liquid cooled EV charging cable is a high-power charging cable that circulates a non-conductive coolant (like a dielectric fluid) through internal channels to dissipate heat, allowing for much faster charging by preventing overheating, and resulting in thinner, lighter, and safer cables compared to bulky air-cooled versions. This system uses a pump to circulate the liquid, removing heat from the conductors and connectors for sustained high current flow, enabling rapid charging times for electric vehicles.

Report Objectives

- To segment and forecast the liquid cooled EV charging cable market in terms of volume (Thousand Units) and value (USD Million)

- To define, describe, and forecast the market based on cable power capacity, cable length, cable diameter, application, jacket material, and cooling fluid

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To define, describe, and forecast the size of the liquid cooled EV charging cable market with respect to growth trends and prospects, and determine the contribution of the segments to the total market

- To segment the market and forecast its size, by volume and value, based on region (Asia Pacific, Europe, and North America)

- To segment and forecast the market size, by volume and value, based on cable power capacity (300–499 kW, 500–900 kW, and Above 900 kW)

- To segment and forecast the market size, by volume and value, based on application (Ultrafast Charging and Megawatt Charging)

- To segment and forecast the market size, by volume, based on cable length (Below 5 Meters, 5-8 Meters, and Above 8 Meters)

- To segment and forecast the market size, by volume, based on cable diameter (Below 30 mm, 30–50 mm, and Above 50 mm)

- To segment and forecast the market size, by volume, based on jacket material (Rubber, Thermoplastic Elastomer, and Polyvinyl Chloride)

- To segment and forecast the market size, by volume, based on cooling fluid (Water Glycol and Others)

- To provide detailed information regarding the major factors (drivers, challenges, restraints, and opportunities) influencing market growth

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To study the following with respect to the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- Funding, By Application

- Key Conferences & Events

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the liquid cooled EV charging cable market

- To track and analyze competitive developments, such as deals (mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Liquid Cooled EV Charging Cable Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Liquid Cooled EV Charging Cable Market