LNG Station Market

LNG Station Market by Solution (EPC, Components), Station Type (Fixed LNG, Mobile LNG, Bunkering LNG), Application (Heavy-duty Vehicles, Light-duty Vehicles, Marine), Capacity (Small Scale, Medium Scale, Large Scale), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The LNG station market is projected to grow from USD 0.90 billion in 2024 to USD 1.56 billion by 2030 at a CAGR of 9.0% during the forecast period. The market is expected to witness substantial growth as the demand for cleaner and more sustainable transport fuels continues to rise.

KEY TAKEAWAYS

-

BY APPLICATIONHeavy-duty vehicles are expected to dominate the applications market, given its high energy density and long driving range benefits.

-

BY STATION TYPEFixed LNG stations hold the largest share of the market, by station type, offering high fueling capacity, operational stability, and advantages in serving large fleets and heavy-duty vehicles.

-

BY SOLUTIONSThe engineering, procurement, and construction (EPC) segment is projected to hold the largest market share.

-

BY CAPACITYThe small-scale segment is driven by the increasing demand for localized and flexible LNG distribution, lower infrastructure costs, and rapid deployment capabilities.

-

BY REGIONThe Asia Pacific is projected to be the largest region in the LNG station market during the forecast period, driven by rapid industrialization, urbanization, and a growing demand for cleaner alternative fuels.

-

COMPETITIVE LANDSCAPEShell plc, CNPC, and GRUPO HAM are strong players in this market and have entered into agreements and partnerships for growth.

The shift away from conventional diesel and petrol, particularly in heavy-duty road and marine transport, is driving the adoption of LNG as a viable alternative. LNG stations comprise various advanced components, including cryogenic pumps, dispensers, storage tanks, and control systems, which enable the safe and efficient delivery of liquefied natural gas (LNG).

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Major firms in the LNG station sector, such as Cryonorm Group (Netherlands), Chart Industries (US), Cryostar (France), and Dover Fueling Solutions (US), have expanded their offerings across the LNG station to diversify income sources. The LNG station market is being influenced by emerging trends and technologies that are transforming customer business models. With increasing regulatory pressure to cut greenhouse gas emissions, logistics and fleet operators are adopting LNG as a cleaner alternative to diesel, supported by government subsidies and low-emission zones. Recent innovations such as cryogenic robotic refueling arms, automated LNG dispensers, and real-time fuel tracking software enhance operational efficiency and user safety. Moreover, floating LNG production, AI for station expansions, and advanced cryogenic technology & energy recovery systems are helping customers lower carbon intensity while optimizing fuel usage.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of LNG as a transportation fuel

-

Boosting government backing and enforcing tougher emission control measures

Level

-

High initial capital investment for vehicles

-

Complex storage and handling requirements for fuels

Level

-

Expansion of marine and off-grid applications

-

Integration of Bio-LNG and e-LNG

Level

-

Regulatory and safety concerns

-

Excess supply in the market and increased competition

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of LNG as a transportation fuel

The shift to cleaner fuels emphasizes liquefied natural gas (LNG) as key in global transportation, especially for long-haul and heavy vehicles. Countries aim to cut emissions, making LNG a viable diesel substitute due to its environmental benefits, efficiency, and cost. Growing natural gas demand, driven by energy security, industrialization, and climate goals, boosts LNG’s role, especially in emerging economies expanding clean transport infrastructure while managing costs. The growing natural gas and LNG use in transport promotes economic growth and environmental care.

Restraint: High initial capital investment

A key barrier to LNG transport adoption is the high upfront cost for vehicles and infrastructure. LNG trucks cost 30–50% more than diesel due to specialized systems. Building refueling stations with cryogenic tanks, vaporizers, and pressurization adds to costs, requiring advanced engineering and safety. Cryospain notes these complexities hinder widespread adoption, especially where funding or ROI is uncertain. Consequently, small and medium fleet operators find it hard to justify such investments without strong policy incentives.

Opportunity: Growth in marine and off-grid applications

The maritime industry is undergoing a transformation due to the IMO decarbonization agenda, which aims for a 50% GHG reduction by 2050 and stricter NO? and sulfur limits. Shipowners are increasingly adopting LNG, which complies with IMO 2020 sulfur caps and reduces CO2 by up to 20%, NO? by 85%, and nearly eliminates SO? and PM. Over 900 LNG ships are expected to be operating globally by 2030, with companies like CMA CGM, Hapag-Lloyd, and MSC investing in dual-fuel LNG engines. LNG bunkering infrastructure is expanding at key ports like Rotterdam, Singapore, Shanghai, and Houston. LNG is now used in cargo ships, cruise lines, ferries, and offshore support vessels.

Challenge: Regulatory and safety concerns

Regulatory and safety challenges still present major hurdles in the LNG and broader gas fuel markets. The handling, transportation, and storage of LNG, CNG, and emerging fuels, such as bio-LNG and e-LNG, are subject to complex, evolving regulations to reduce risks associated with flammability, cryogenic hazards, and methane leaks. Multiple regulatory systems across countries can raise compliance costs and slow project approvals. Because of its cryogenic temperature (-162°C) and flammability, LNG raises safety concerns such as spills, fires, and explosions. Although rare, incidents increase public scrutiny and require strict safety management systems, which raise operational costs. Additionally, methane slip during extraction, processing, and distribution adds to greenhouse gas emissions and draws regulatory attention.

LNG Station Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A Major Energy Company wanted to design and build selective LNG fueling stations across the US. To mitigate risk and ensure profitability for the venture, they needed a way to distribute and dispense LNG in the most reliable and cost-effective manner, which could be easily replicated at new fueling station sites as needed, with a low-maintenance piping system. | The partnership between the energy company and Chart Inc. brought significant benefits in operations, economics, and the environment. Vacuum-insulated piping (VIP) systems improved thermal efficiency, cut heat loss by nearly 90%, and extended infrastructure lifespan up to ten times, lowering maintenance and downtime, reducing lifecycle costs, and boosting reliability. Each LNG station now supports up to 150 trucks daily, ensuring scalability and steady performance. Overall, the project created a sustainable, cost-effective fueling network, supporting long-term profitability and promoting cleaner, energy-efficient transportation across the US. |

|

Cryostar SAS, a pioneer in cryogenic equipment, faced challenges in maintaining high-quality project deliverables, streamlining modification processes, and integrating components like process, piping, instrumentation, and structure in power and gas liquefaction projects. The company aimed to improve time management, support 3D piping models, and enhance engineering coordination. To stay a leader in clean energy and cryogenics, Cryostar required a fully integrated engineering and data management solution to improve accuracy and reduce costly rework. | The adoption of integrated engineering and data management solutions gave LNG station operators operational advantages by enabling real-time coordination, automation, and standardized data flow, which minimized errors, reduced manual work, lowered rework and costs, and improved project efficiency and asset performance. These benefits enhanced project delivery, resource use, and competitiveness. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The LNG station ecosystem comprises interconnected players that enable the production, transport, and use of liquefied natural gas as a cleaner fuel for heavy-duty transport. It begins with LNG producers, such as Shell (UK) and Gazprom (Russia), who supply LNG to the market. Component manufacturers such as Chart Industries (US) and Linde (Ireland) provide cryogenic tanks and dispensers. EPC companies, such as Technip Energies (France), build LNG stations. Distributors such as Air Products (US) handle fuel transport to these stations. Operators, including Petronet LNG (India), manage station infrastructure and serve end users such as UPS (US) and Maersk (Denmark) that use LNG in trucks and ships. The ecosystem is bolstered by aftermarket service providers such as Emerson and Cryoquip. Additionally, governmental policies and technology firms are playing crucial roles in advancing digitalization and facilitating the adoption of clean energy solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LNG Station Market, By Solution

The EPC segment is expected to hold the largest market share. This growth is driven by the rising preference for turnkey solutions that simplify project execution and lessen operational complexity. EPC providers handle everything from design and equipment procurement to construction and commissioning, ensuring projects are delivered on time and within budget. Their integrated approach improves coordination across engineering disciplines, reduces risks, and boosts overall project efficiency.

LNG Station Market, By Station Type

Fixed LNG stations are expected to dominate due to their robust infrastructure, high storage capacity, and ability to serve industrial, transportation, and power sectors reliably. These stations provide continuous, large-scale LNG supply, ensuring operational stability and supporting long-term energy needs. Fixed LNG Stations benefit from established pipelines, safety protocols, and economies of scale, making them more cost-effective for sustained operations compared to mobile or bunkering stations.

LNG Station Market, By Application

The heavy-duty vehicles segment is anticipated to hold the largest market share. The growth is driven by increasing adoption of LNG as a cleaner alternative fuel for long-haul trucks, buses, and commercial transport fleets. LNG offers higher energy density, longer driving ranges, and lower greenhouse gas emissions compared to conventional fuels, making it ideal for heavy-duty applications. Expanding government incentives, stricter emission norms, and rising demand for sustainable freight solutions further support the adoption of LNG for heavy-duty vehicles, reinforcing their dominant position in the market.

LNG Station Market, By Capacity

The small-scale segment is projected to dominate the market, by capacity. This dominance is attributed to its flexibility, cost-effectiveness, and suitability for decentralized energy distribution. Small-scale LNG stations enable localized fueling for transportation, remote industries, and smaller power applications, reducing dependency on large infrastructure networks. Their rapid installation, lower capital requirements, and scalability make them an attractive option for emerging markets and regions with limited pipeline access.

REGION

Europe to be largest-growing region in global LNG Station market during forecast period

The LNG Station market in Europe is growing rapidly due to decarbonization targets and strict emission rules under the EU Green Deal. Governments promote LNG as a transitional fuel to cut CO2 and NOx in transportation and marine sectors. Expanding LNG infrastructure, supported by initiatives like AFIR, boosts adoption. Countries like Germany, France, Spain, and the Netherlands invest heavily to promote cleaner mobility and energy diversity. Technological advances and cross-border collaborations improve supply chains, strengthening Europe’s role in sustainable fuel infrastructure.

LNG Station Market: COMPANY EVALUATION MATRIX

Shell plc (Star) and GRUPO HAM (Emerging Leader) are key players driving growth in the LNG Station market. Shell leads with large-scale investments in LNG refueling infrastructure, leveraging its global logistics network and advanced technologies to expand LNG availability for transportation, marine, and industrial applications. Its strategic focus on sustainability and clean energy transition aligns with Europe’s decarbonization goals. Meanwhile, GRUPO HAM is accelerating market development through innovative station designs, mobile refueling solutions, and renewable-integrated LNG systems. The company’s strong European presence and collaborative projects enhance LNG accessibility and efficiency, collectively strengthening the regional and global LNG fueling ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.90 Billion |

| Market Forecast in 2030 (Value) | USD 1.56 Billion |

| Growth Rate | CAGR of 9.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, RoW |

WHAT IS IN IT FOR YOU: LNG Station Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European Client | Region-wise comparative analysis of LNG and CNG truck adoption across Europe and the US |

|

RECENT DEVELOPMENTS

- February 2025 : In February 2025, Kunlun Energy, a CNPC subsidiary, completed Hong Kong’s first ship-to-ship LNG bunkering by refueling 2,200 tons of LNG to the container ship Zim Aquamarine.

- January 2025 : Chart Industries signed a global master goods and services agreement with Exxon Mobil Corporation to supply LNG equipment, technology, and services, including cold boxes and IPSMR process technology.

- July 2022 : Westfalen opened a new LNG station in Cologne, its fourth after Münster, Herford, and Herne. With two fueling lanes and a 17-meter tank storing 30 tons of LNG, it can fuel up to 150 trucks, offering environmental and financial benefits.

- May 2021 : Shell plc has expanded its global LNG bunkering network with the charter of a new 5,000 m³ LNG bunkering vessel, built in Spain and operated by Knutsen OAS Shipping.

Table of Contents

Methodology

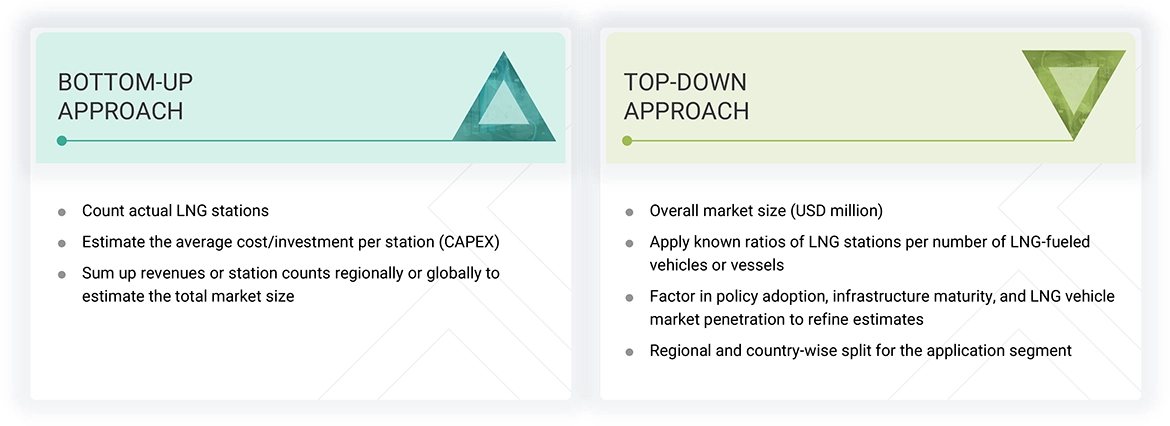

The study involved major activities in estimating the current size of the LNG station market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the LNG station market.

In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasts for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was conducted on the complete market engineering process to list key information/insights throughout the report.

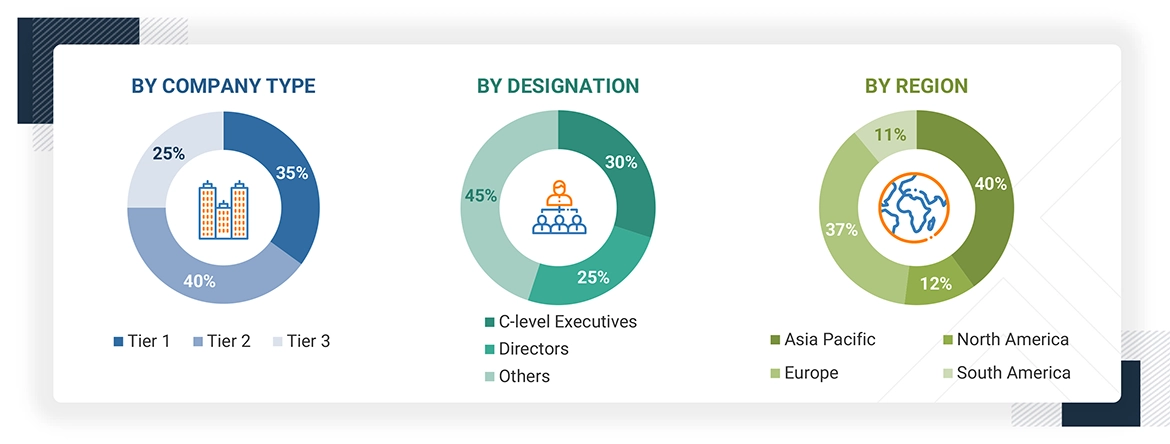

The following is the breakdown of primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global LNG station market and to evaluate the sizes of various other dependent submarkets. The key players in the market were identified through secondary research, and their shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights with industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

LNG Station Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. Wherever applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An LNG station is a facility that stores and dispenses liquefied natural gas, which is natural gas cooled to approximately -260°F (-162°C) to convert it into a liquid state. This liquefaction process reduces the gas's volume by about 600 times, facilitating easier storage and transportation. LNG stations are integral in supplying fuel for vehicles and ships equipped to run on LNG, contributing to reduced greenhouse gas emissions compared to conventional fuels.

The LNG station market is defined as the sum of revenues generated by the year-on-year installation of LNG stations across three regions.

Stakeholders

- LNG terminal operators

- Engineering, procurement, and construction (EPC) companies

- National and regional governments/Regulators

- LNG suppliers/Producers

- Shipping and logistics companies

- National oil and gas companies

- Consulting companies in the oil & gas industry

- Oil and gas associations

Report Objectives

- To define, describe, segment, and forecast the LNG station market by station type, application, solution, and capacity in terms of value

- To define, describe, segment, and forecast the LNG station market, by station type and region, in terms of volume

- To forecast the market sizes for three major regions, namely North America, Europe, and Asia Pacific, along with their key countries, in terms of value, whereas the rest of the world region will provide qualitative insights

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the LNG station market

- To provide the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, regulatory analysis, and the impact of the 2025 US tariff on the market

- To analyze opportunities for stakeholders in the LNG station market and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as contracts, agreements, partnerships, and joint ventures, in the LNG station market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the LNG station market, by country, for Europe, Asia Pacific, and North America

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the LNG Station market?

The current market size of the LNG station market is USD 0.90 billion in 2025.

What are the major drivers for the LNG Station Market?

Rising demand for renewable energy and government incentives and policies are the major drivers for the market.

Which is the largest regional market for LNG stations during the forecast period?

Asia Pacific is the largest market for LNG stations. Government initiatives supporting natural gas adoption in transportation and power generation accelerate market growth. In addition, the expanding fleet of LNG-powered vehicles and increasing import terminals across the region contribute to the rising demand. These factors position Asia Pacific as a dominant force in the LNG station market.

Which is expected to be the largest market by solution in the LNG station market during the forecast period?

EPC (Engineering, Procurement, and Construction) is expected to be the largest market by solution in the LNG station market during the forecast period. This growth is driven by the increasing demand for turnkey infrastructure solutions that streamline project execution. EPC providers offer end-to-end services, ensuring timely delivery, cost-efficiency, and compliance with safety and environmental standards.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LNG Station Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LNG Station Market