Location-based Entertainment Market Trends, Growth, and Innovations

Location-based Entertainment Market by Systems (AR/VR, Projection Mapping, Interactive Gaming), Software (Content Management, Experience Design, Analytics & Monitoring), Application (Immersive Rides, Cinematic Experiences) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Location-Based Entertainment Market is projected to grow significantly, increasing from USD 5.47 billion in 2024 to USD 15.33 billion by 2029, with a robust CAGR of 22.9%. The LBE market refers to immersive technology-based experiences that operate from physical locations including theme parks and family entertainment centers along with arcades and museums. It integrates systems (AR/VR, projection mapping, interactive gaming) with software (content management, experience design, analytics and monitoring) and services (professional and managed) to improve real-world entertainment. These solutions enable applications in gaming along with simulation and virtual tourism and education which result in more engaging interactive experiences. Through the combination of AI and motion tracking and haptic feedback LBE creates interactive experiences that personalize entertainment beyond what traditional entertainment provides.

KEY TAKEAWAYS

- The North America location-based entertainment (LBE) market accounted for a 35.3% revenue share in 2024.

- By offering, the software segment is expected to register the highest CAGR of 23.8%.

- By application, the arcades segment is projected to grow at the fastest rate from 2024 to 2029.

- Company AT&T, China Mobile, and Sinch were identified as some of the star players in the location-based entertainment (LBE) market (global), given their strong market share and product footprint.

- Companies Clickatell, Bird, and Plivo among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The location-based entertainment market seeks to transform immersive experiences by developing advanced technology systems that unite with physical spaces to boost user involvement. The development of advanced systems and software, together with services at different levels, requires a complex process that includes AI-driven content management as well as sensory-enhanced attractions. The industry is focusing on creating personalized experiences with mixed reality and advanced haptic feedback in theme parks, gaming areas, and movie theaters.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Location-based entertainment YCC shift highlights the move from ticket-centric models to immersive, tech-driven engagement. Operators are adopting VR/AR and gamification to drive repeat visits and enhance spend per customer, while creating broader tourism and retail ecosystem value.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in VR and AR technologies

-

Rising consumer spending power

Level

-

High upfront cost

-

Limited scalability of location-based entertainment business

Level

-

Increase in live events and performances

-

Rising popularity of wearables such as fitness trackers and smartwatches

Level

-

Regulatory requirements at local, state, and federal levels

-

Necessity for consistent content updates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection

Virtual reality (VR) and augmented reality (AR) technologies are significantly advancing the location-based entertainment (LBE) market by providing hyper-realistic and immersive experiences. With higher-resolution headsets, improved motion tracking, and AI-driven interactive elements, users can enjoy more lifelike simulations. Beyond gaming, these technologies are also being applied in education, training, and tourism. Cloud AR streaming has led to no more bulky hardware and more accessibility. Haptic feedback suits, AI-generated environments, and 5G implies more sensory engagement. Location-based VR in arcades and theme parks is on the rise as businesses add dynamic motion platforms and full body tracking for more realism. For example, VR escape rooms now use AI to adjust the puzzles and tasks in real-time, offering each user a unique experience. AR museum exhibits let visitors interact with historical artifacts through real-time overlays. Theme parks are adding AR-enhanced rides and experiences that combine physical elements with digital features, making the experiences more engaging and enjoyable.

Restraint: High upfront cost

The high cost of LBE infrastructure, system, software, and facility development is a major barrier to market growth. Advanced projection systems, spatial computing setups, and custom-built immersive installations require much capital and are out of reach for smaller operators. Technology upgrades are frequent and add to long-term costs as businesses need to invest in new equipment and software to stay competitive. Licensing fees for content, high maintenance costs, and compliance with evolving safety regulations add to the financial burden. Smaller entertainment centers cannot afford to build large-scale VR arenas due to the high cost of motion-tracking cameras, high-resolution projectors, and AI-driven interactive software. For example, a fully immersive VR theme park requires haptic feedback systems and a large spatial environment, which is very costly to develop, and integrating AI-driven personalization in LBE experiences like tailored virtual environments adds another layer of cost. Despite high consumer demand, the high upfront cost is a major barrier to adoption, especially in emerging markets.

Opportunity:Increase in live events and performances

The demand for special, interactive experiences at concerts, sports, and live theatrical shows is driving the LBE market. Holographic projections, AI avatars, and interactive stage design are changing engagement. Music festivals include extended reality (XR) elements so remote attendees can experience live shows in a virtual environment. AI-driven facial recognition is being used for personal fan interactions, and motion-sensing technology is creating dance floors that react to the crowd. Sports venues are adding real-time AR overlays so fans can get instant stats, replays, and player info. For example, the NBA has introduced AR courtside experiences to enhance fan engagement. Holographic concerts are going mainstream, with artists like ABBA using volumetric capture to perform as digital avatars. Broadway shows are trying out interactive sets where the audience can control scene changes with motion-sensing technology. All this is changing how live shows are delivered, making them more immersive and accessible.

Challenge:Regulatory requirements at local, state, and federal levels

The LBE market is complicated by safety standards, data privacy, and zoning regulations, which can vary greatly by region. Adhering to accessibility guidelines, health and safety protocols, and digital content restrictions poses an operational challenge for businesses. Biometric data collection in VR-based attractions or motion sickness in immersive rides requires strict adherence to evolving policies. Cybersecurity regulations are becoming more relevant as AI and cloud-based technologies play a bigger role in LBE experiences. In the US, VR arcades and interactive gaming zones must comply with state-specific licensing requirements, which can slow down market entry for new operators. In Europe, GDPR regulations affect how personal data is collected and used in AI-driven entertainment experiences. For example, LBE venues using facial recognition for personalized guest interactions must comply with data protection laws. Regulatory uncertainty around AI-generated content in immersive storytelling is also a challenge; businesses must navigate complex legal frameworks.

Location-based Entertainment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Andretti Indoor Karting & Games is a premier Location-Based Entertainment (LBE) venue offering kart racing, arcade games, bowling, and dining experiences. To scale efficiently, Andretti Karting sought a centralized system to streamline financials, inventory, and customer experience management. Deployment of Microsoft Dynamics 365 Business Central for unified financial and operational management. | Increased operational efficiency with automated financial tracking and streamlined workflows. Improved inventory management, reducing stock shortages and supply chain disruptions. Better financial visibility, enabling real-time decision-making across multiple locations. Enhanced guest experience through optimized service delivery and resource allocation. |

|

Worldbuildr is a virtual world creation platform designed for game developers and immersive content creators. The company needed an efficient, scalable, and high-performance solution to streamline the world-building process. Utilized Unity Industry for AEC to power Worldbuildr’s world-creation tools, integrated Unity’s asset management and rendering capabilities to enhance visual fidelity. And implemented procedural generation and AI-powered design tools to accelerate content creation | Faster and more efficient world-building, reducing development time. | Seamless collaboration, enabling teams to work together from anywhere. | Enhanced visual quality, thanks to Unity’s high-performance rendering capabilities. | Scalability, allowing developers to create small or large-scale virtual worlds with ease. | Increased creative flexibility, enabling rapid iteration and experimentation |

|

Maquette is a spatial prototyping tool designed for extended reality (XR) development, needed a high-precision motion capture solution to improve real-time interaction and XR workflows. Maquette utilized OptiTrack Motion Capture by NaturalPoint for real-time XR prototyping. Integrated with VR and AR platforms, enabling immersive prototyping experiences and leveraged marker-based tracking technology to improve precision in spatial interactions. | Enhanced motion accuracy, improving the realism of XR prototypes, provided real-time feedback, allowing developers to iterate faster on designs. Seamless integration with existing XR tools for an optimized workflow, Improved collaboration, enabling teams to interact with prototypes in a shared virtual space |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The location-based entertainment ecosystem integrates a robust network of system providers and software & service providers to deliver immersive experiences. These stakeholders collaborate to develop advanced technologies and solutions, enhancing interactive entertainment across various venues. Supported by regulatory bodies, the ecosystem ensures safety, standards, and innovation, driving growth in the industry through coordinated efforts and oversight.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Location-Based Entertainment Market, By Offering

Software solutions within the LBE market will experience maximum growth because businesses need enhanced solutions for managing content, designing experiences, and analyzing visitor data to optimize immersive experiences. Advanced software solutions become necessary for LBE venues when they implement AR/VR with projection mapping and AI-powered interactions to handle real-time rendering, motion tracking, and dynamic content adaptation. The management of high-resolution visuals and interactive storytelling requires content management software to ensure smooth system synchronization. Experience design software helps create lifelike virtual worlds and custom user interactions, and operational analytics tools optimize visitor satisfaction and operational efficiency. AI-based algorithms now enable experiences that adjust according to how users interact with the system. The Genie+ system from Disney implements AI-driven software to optimize guest experiences in real time. Holovis delivers interactive theme park attractions through its experience design platform with AI and projection mapping. Cloud-based solutions, together with real-time data analytics, drive software adoption at such a fast rate that it has become the fastest-growing segment within the LBE market

Location-Based Entertainment Market, By Venue

The LBE market demonstrates that amusement parks remain dominant because they offer extensive facilities and advanced technological innovations. These entertainment locations utilize AR/VR, projection mapping, AI, and interactive displays to develop unique immersive experiences that draw large visitor numbers. Projection mapping allows operators to convert static roller coasters and dark rides into dynamic visual displays that construct meaningful stories while generating breathtaking environments. AR applications deliver interactive scavenger hunts combined with augmented storytelling features to guests while visitors can experience virtual reality attractions that provide simulated rides and immersive worlds. The ability of AI to deliver personalized guest experiences according to visitor preferences leads to enhanced satisfaction, which results in increased guest retention. Real-time analytics and IoT systems help amusement parks control crowd movement, shortening waiting times and enhancing ride quality to improve visitor satisfaction. Universal Studios applies projection mapping in its Harry Potter rides and Disney uses AR and AI to provide customized experiences at its Star Wars: Galaxy’s Edge attractions. The evolving nature of amusement parks keeps them at the forefront of the LBE market through continuous innovation that fulfills customer expectations.

Location-Based Entertainment Market, By Application Type

The Gaming segment will remain the largest market segment within LBE due to escalating requirements for immersive interactive gameplay. The gaming industry transforms into a realistic world experience through advancements that include AR/VR systems and motion tracking alongside projection mapping and AI-driven content personalization. The popularity of VR gaming arenas, interactive simulators, and esports venues continues rising because they deliver social gaming experiences with high-quality features that cannot be replicated at home. A free-roam VR system combined with haptic feedback enables players to move freely while experiencing real-time physical touch, which deepens their gaming immersion. Through projection mapping the gaming industry expands its applications by generating interactive large-scale environments that work without headsets. Cloud gaming and AI-powered customization allow games to adjust their content according to how users interact with them.

REGION

North America is estimated to account for the largest market share during the forecast period

The Asia Pacific region will see the highest growth in the location-based entertainment market due to rapid urbanization, rising disposable income, and demand for immersive entertainment. The region’s strong digital infrastructure and adoption of future tech, like AI-driven attractions and hyper-personalization, is driving growth. Countries like China, Japan, and South Korea are investing heavily in future LBE experiences. Universal Studios Beijing has introduced AR-enabled rides and AI-powered crowd management systems to enhance the visitor experience. Theme parks in Singapore and Hong Kong are introducing interactive entertainment like AI-driven holographic shows and multi-sensory attractions to attract tourists. Large-scale immersive exhibitions in cities like Tokyo and Shanghai are driving demand for technologically advanced LBE venues. The rise of location-based VR arcades, 5G-powered attractions, and digital simulation zones shows the growing consumer interest in interactive entertainment. Government and private sector investments in tourism and smart entertainment hubs are further fueling growth. With a young and tech-savvy population and an appetite for innovation, the Asia Pacific region will be the fastest-growing LBE market in the next few years.

Location-based Entertainment Market: COMPANY EVALUATION MATRIX

In the location-based entertainment market matrix, Microsoft (Star) leads with advanced AR/VR and cloud services that power immersive real-world experiences in theme parks, arcades, and interactive venues through its Azure, Mixed Reality, and PlayFab platforms. Panasonic (Emerging Leader) in location-based entertainment, delivering innovative projection, immersive display, and interactive technology solutions that enhance live events and entertainment venue experiences. While Microsoft dominates with scale and ecosystem integration, Panasonic shows strong growth potential to advance toward the leaders’ quadrant with its expanding enterprise security portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 4.40 Billion |

| Revenue Forecast in 2029 | USD 15.33 Billion |

| Growth Rate | CAGR of 22.9% from 2024-2029 |

| Actual data | 2019–2029 |

| Base year | 2023 |

| Forecast period | 2024–2029 |

| Units considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering, Venue, and Application, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Location-based Entertainment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: • Further breakdown of the North American location-based entertainment market • Further breakdown of the European location-based entertainment market • Further breakdown of the Asia Pacific location-based entertainment market • Further breakdown of the Middle Eastern & African location-based entertainment market • Further breakdown of the Latin American location-based entertainment market | • Identifies high-growth regional opportunities, enabling tailored market entry strategies. • Optimizes resource allocation and investment based on region-specific demand and trends. |

| Company Information | Detailed analysis and profiling of additional market players (up to 5) | • Broadens competitive insights, helping clients make informed strategic and investment decisions. • Reveals market gaps and opportunities, supporting differentiation and targeted growth initiatives. |

RECENT DEVELOPMENTS

- April 2024 : Barco announced the launch of its RGB laser projectors, specifically designed to enhance premium cinema experiences with superior brightness, color accuracy, and image quality.

- May 2024 : The Singapore Tourism Board and Google announced their plan to expand their partnership to create more augmented reality (AR) experiences, which will be directly available on Google Maps for the first time.

- February 2024 : Meta announced the Quest 3 at Connect 2024, featuring advanced mixed reality capabilities with improved visuals, performance, and new immersive experiences.

- April 2023 : Samsung announced its partnership with Qualcomm and Google to build an ecosystem for extended reality (XR).

- October 2021 : NVIDIA introduced CloudXR for location-based VR, leveraging 5G technology to deliver immersive, high-quality VR experiences in real-time at large-scale locations.

Table of Contents

Methodology

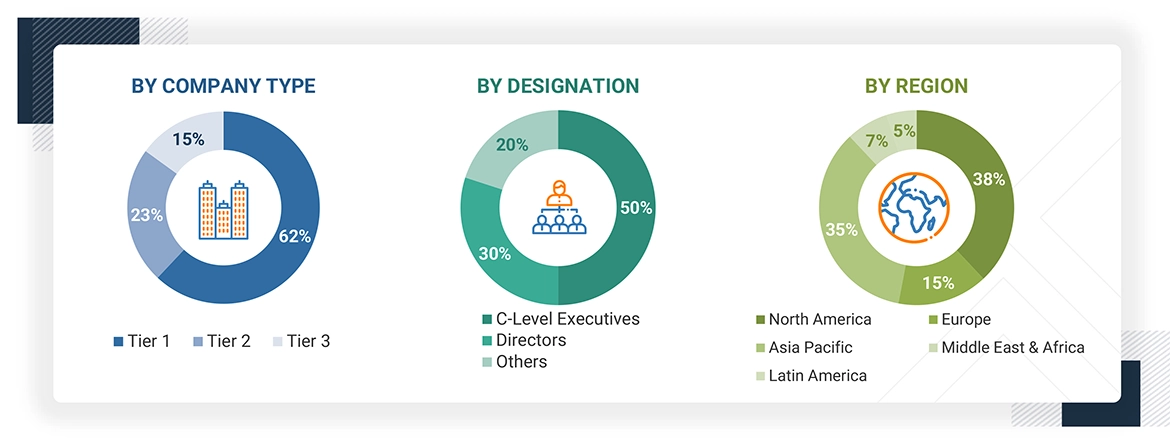

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the Location-Based entertainment market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with numerous primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as the International Association of Amusement Parks and Attractions (IAAPA), and Themed Entertainment Association (TEA), were also referred to. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Location-Based entertainment market. The primary sources from the demand side included Location-Based entertainment end users, consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between USD 500 million to 1 billion; and Tier 3

companies’ revenue ranges in between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

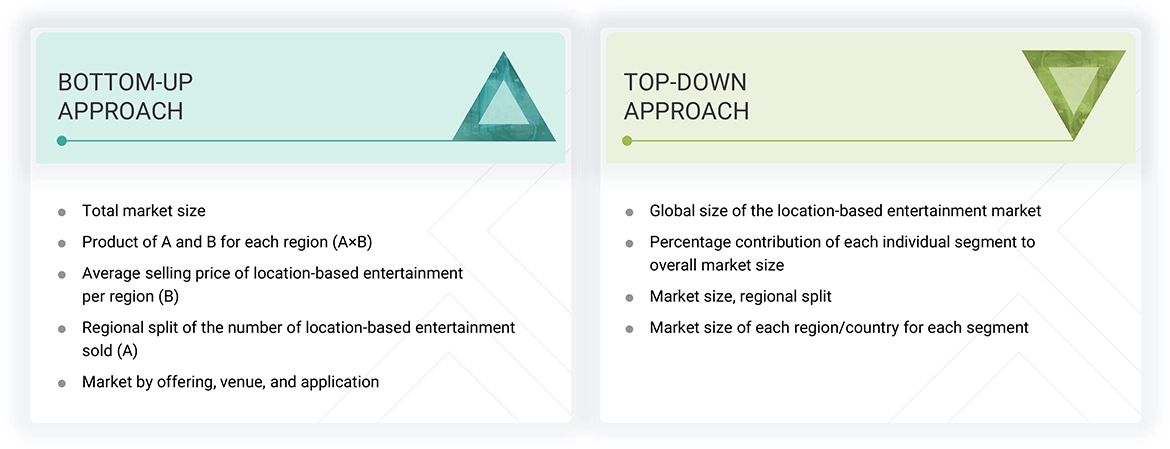

Multiple approaches were adopted to estimate and forecast the size of the Location-Based entertainment market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Location-Based entertainment.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Location-Based entertainment market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Location-based Entertainment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the Location-Based entertainment market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Location-Based entertainment refers to a specific segment of the entertainment industry leveraging advanced technologies, such as Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Projection Mapping, Motion Capture, and other related technologies to deliver highly immersive and captivating experiences to visitors at various venues, including amusement parks, theme parks, arcades, and similar entertainment destinations.

Using cutting-edge technologies, location-based entertainment venues aim to create highly engaging, interactive, and memorable experiences and provide visitors with a unique and personalized form of entertainment that traditional media cannot replicate.

Stakeholders

- Location-Based entertainment hardware providers

- Location-Based entertainment software providers

- Location-Based entertainment service providers

- Location-Based entertainment technology providers

- Managed Service Providers (MSPs)

- Content developers

- Venue owners

- Visitors/Customers

- Event planners and producers

- Regional and global government organizations

- Investors and venture capitalists

Report Objectives

- To define, describe, and forecast the Location-Based entertainment market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market by offering (system, software, services), venue, application, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise Information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Location-based Entertainment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Location-based Entertainment Market