Loudspeaker Market Size, Share & Trends

Loudspeaker Market by Product (Portable Speaker, Soundbar, Home Theatre, In-wall, Outdoor, Subwoofer, PA System), Functionality (Smart, Traditional), Component (Driver, Diaphragm, Voice Coil, Amplifier, Magnet), Connectivity - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The loudspeaker market is projected to reach USD 20.49 billion by 2030 from USD 16.42 billion in 2025, at a CAGR of 4.5% from 2025 to 2030. The growth of the loudspeaker market is driven by increasing demand for consumer electronics, the rise of smart home technologies, and the expanding use of advanced infotainment systems in vehicles.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to dominate the loudspeaker market with a share of 40.5% in 2025.

-

BY PRODUCT TYPEThe portable speakers segment is estimated to account for the largest share of 35.0% in 2025, supported by rising consumer demand for compact and wireless audio solutions, increasing smartphone penetration, and the growing popularity of on-the-go entertainment.

-

BY FUNCTIONALITYBy functionality, the smart speakers segment is expected to grow at the highest CAGR of 5.8% during the forecast period.

-

BY CONNECTIVITYThe wireless segment is projected to grow the fastest as advances in Bluetooth, Wi-Fi, and battery technology have improved performance and reliability.

-

BY VERTICALBy vertical, the Residential segment is projected to hold a share of 41.2% in 2024.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)Samsung (South Korea), Bose Corporation (US), Sony Group Corporation (Japan), and Yamaha Corporation (Japan) were identified as Star players in the loudspeaker market, given their strong global brand presence, extensive product portfolios, and continuous focus on innovation.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Empower Tribe IP FZE (UAE), Kanto (Canada), Riva Audio (US), and Fulcrum Acoustic, LLC (US) have emerged as startups and SMEs driving technological innovation and market agility in the loudspeaker industry.

The loudspeaker market is growing due to a combination of technological advancements and shifting consumer behaviors. Increasing demand for high-quality audio in consumer electronics, such as smartphones, smart TVs, and wireless speakers, is a major driver, fueled by the popularity of music and video streaming services. The rise of smart homes and voice-controlled devices has also boosted demand for integrated loudspeakers in smart speakers and IoT devices. In the automotive sector, an increasing number of vehicles are being equipped with advanced infotainment systems that require premium sound solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions are significantly reshaping the loudspeaker market by driving innovation, shifting consumer preferences, and altering competitive dynamics. The rise of wireless, smart, and portable speakers has redefined user expectations, emphasizing convenience, connectivity, and multifunctionality. AI integration, voice assistants, and smart home compatibility are pushing manufacturers to evolve beyond traditional audio products. At the same time, disruptions such as supply chain challenges, the push for sustainability, and competition from tech giants are pressuring companies to rethink design, sourcing, and market strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for smart speakers and home entertainment systems

-

Advancements in 3D audio technology

Level

-

High competition and price sensitivity

-

Environmental concerns and recycling regulations

Level

-

Rising popularity of wireless and Bluetooth technologies

-

Expansion in emerging markets

Level

-

Technological obsolescence and rapid innovation

-

Supply chain disruptions and component shortages

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for smart speakers and home entertainment systems

The growing popularity of voice-controlled devices, smart home ecosystems, and streaming platforms is fueling increased interest in smart speakers and home entertainment systems. Consumers are prioritizing convenience, seamless connectivity, and high-quality audio experiences, leading to a surge in demand for loudspeakers that integrate intelligent features and support immersive, multi-room sound environments.

Restraint: High competition and price sensitivity

Intense market competition and high price sensitivity are key restraints in the loudspeaker industry, limiting profit margins and creating challenges for differentiation. With numerous players offering similar features at competitive prices, consumers often base purchasing decisions on cost rather than brand or performance, making it difficult for manufacturers to maintain pricing power and invest in innovation.

Opportunity: Rising popularity of wireless and Bluetooth technologies

Wireless and Bluetooth technology are gaining popularity for offering hassle-free connectivity, easy setup, and enhanced user convenience without the need for complex wiring. As consumers seek seamless integration with smartphones, tablets, laptops, and smart home devices, the demand for compact, portable, and aesthetically pleasing loudspeakers continues to grow. These technologies also support features like multi-room audio, voice control, and hands-free operation, aligning with modern lifestyle preferences. As a result, manufacturers are increasingly focusing on wireless innovations to meet evolving consumer expectations and stay competitive in a rapidly changing market.

Challenge: Technological obsolescence and rapid innovation

Technological obsolescence and rapid innovation present significant challenges in the loudspeaker market, as frequent advancements in wireless connectivity, smart features, and audio processing quickly render older models outdated. Manufacturers face constant pressure to innovate and update their product lines to keep up with evolving consumer expectations and competing technologies. This fast-paced environment shortens product life cycles and increases R&D costs, while also creating difficulties in inventory management and long-term customer retention.

Loudspeaker Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Wireless speakers integrated into the SmartThings ecosystem for smart home audio control via voice and app interfaces | Centralized automation, hands-free operation, and seamless device interoperability |

|

Utilization of adaptive audio technology in Bose speakers to automatically adjust sound based on room acoustics | Personalized, high-quality sound optimized for various environments |

|

Use of LDAC-enabled Bluetooth speakers for high-resolution wireless audio streaming | Superior sound quality delivered wirelessly, appealing to audiophiles |

|

Use of multi-room audio systems for synchronized playback and individual control of wireless speakers across multiple rooms | Flexible and scalable whole-home audio experiences |

|

Utilization of the MusicCast platform to connect loudspeakers and other audio devices into a unified home entertainment network | Centralized control with support for high-resolution, multi-device audio playback |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The loudspeaker ecosystem encompasses research & development, manufacturers, distributors, and end-users. R&D focuses on innovation in materials, sound quality, and wireless technology. Manufacturers produce a variety of loudspeaker products based on these innovations. Distributors handle logistics and supply chain management to deliver products globally. End users purchase and utilize loudspeakers in various applications, including consumer electronics, automotive, and professional audio.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Loudspeaker Market, by Product Type

Portable speakers are expected to grow fastest during the forecast period due to the rising demand for wireless and easily transportable audio solutions. Advances in Bluetooth technology and longer battery life improve both connectivity and listening duration, making these devices more convenient. Their compact, durable designs cater to outdoor activities, travel, and social gatherings. Additionally, the increasing use of smartphones and music streaming services fuels consumer interest. This combination of convenience, mobility, and improved technology is driving rapid market growth for portable speakers.

Loudspeaker Market, by Functionality

Smart speakers are expected to grow at the fastest rate during the forecast period, driven by the increasing adoption of voice assistants such as Alexa, Google Assistant, and Siri. Their ability to control smart home devices, provide hands-free information, and stream music makes them highly popular. Advances in AI and natural language processing improve user interaction and functionality. Growing consumer preference for connected, convenient, and multifunctional devices further boosts demand. Additionally, expanding smart home ecosystems and integration with other IoT devices support strong market growth.

Loudspeaker Market, by Connectivity

Wireless connectivity is estimated to grow the fastest during the forecast period due to the increasing demand for cable-free audio solutions. Advances in Bluetooth, Wi-Fi, and other wireless technologies improve connection stability, range, and sound quality. Consumers prefer the convenience and flexibility of wireless devices for both portable and home audio systems. The rise of smart homes and IoT devices further drives the adoption of wireless speakers. This shift toward seamless, untethered audio experiences fuels rapid growth in wireless connectivity within the loudspeaker market.

Loudspeaker Market, by Vertical

The residential segment dominated due to increased consumer spending on home entertainment and smart home devices. Growing adoption of smart speakers, wireless audio systems, and home theaters is driving demand. Additionally, more people are investing in high-quality audio setups for remote work, gaming, and streaming. Rising disposable incomes and the trend toward connected, convenient lifestyles further boost growth in the residential loudspeaker market.

REGION

Asia Pacific to be fastest-growing region in global loudspeaker market during forecast period

Asia Pacific is set to grow the fastest in the loudspeaker market due to its large and expanding population, rising disposable incomes, and rapid urbanization. The increasing penetration of smartphones and the growing demand for smart home and portable audio devices are major factors. Additionally, the region’s strong manufacturing base and expanding e-commerce infrastructure support faster product availability and adoption. Emerging markets, such as China, India, and Southeast Asia, are driving significant growth in both the consumer and commercial loudspeaker segments.

Loudspeaker Market: COMPANY EVALUATION MATRIX

Samsung (Star) leads the loudspeaker market with a strong market share and a wide product lineup that emphasizes advanced wireless connectivity and seamless integration within its smart home ecosystem. Its innovation in AI features and high-quality audio solutions has secured broad consumer adoption and brand loyalty. Panasonic Corporation (Emerging Leader) is rapidly gaining ground by focusing on durable, eco-friendly loudspeakers and affordable smart audio devices, especially in emerging markets. While Samsung dominates through scale and technological advancements, Panasonic’s growing emphasis on innovation and niche market opportunities positions it well for future growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 15.57 Billion |

| Market Forecast, 2030 (Value) | USD 20.49 Billion |

| Growth Rate | CAGR of 4.5% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Loudspeaker Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Consumer Electronics OEM |

|

|

| Automotive OEM |

|

|

| Professional Audio Equipment Manufacturer |

|

|

| Smart Home Device Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : Bose introduced a new product to its renowned SoundLink Bluetooth speaker lineup: the SoundLink Home Bluetooth Speaker. Compact yet powerful, this speaker would deliver high-quality sound in a sleek design that effortlessly integrates into any room.

- September 2024 : Bose introduced the new Bose Smart Soundbar, a compact soundbar equipped with Dolby Atmos and proprietary Bose TrueSpace technology, providing immersive audio for its size. Replacing the Bose Smart Soundbar 600, the updated model included A.I. Dialogue Mode and debuted the new Bose Personal Surround technology.

- June 2024 : HARMAN Professional Solutions, a subsidiary of Samsung, announced the launch of the JBL Professional Pro SoundBar PSB-2, enhancing its PSB soundbar lineup by adding HDMI and Bluetooth digital source inputs.

- May 2024 : Sony India introduced the ULT POWER SOUND series, a new lineup of wireless speakers and noise-canceling headphones. Designed for music enthusiasts, the series delivered deep, powerful audio meant to resonate with listeners.

- January 2024 : Panasonic introduced its latest party speaker, the TMAX45, a high-power audio system that would deliver an impressive 1000W (RMS) output. Equipped with 6.5-inch dual woofers, dual tweeters, and bass reflex ports, it offered immersive and high-quality sound for an enhanced listening experience.

Table of Contents

Methodology

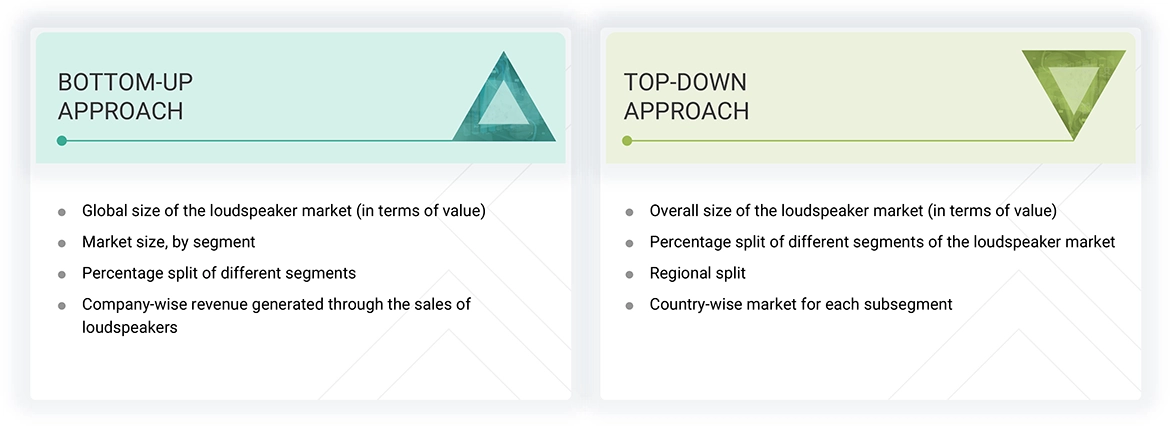

The study used four major activities to estimate the market size of loudspeakers. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the loudspeaker market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the loudspeaker market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the loudspeaker market. Vendor offerings have been taken into consideration to determine market segmentation.

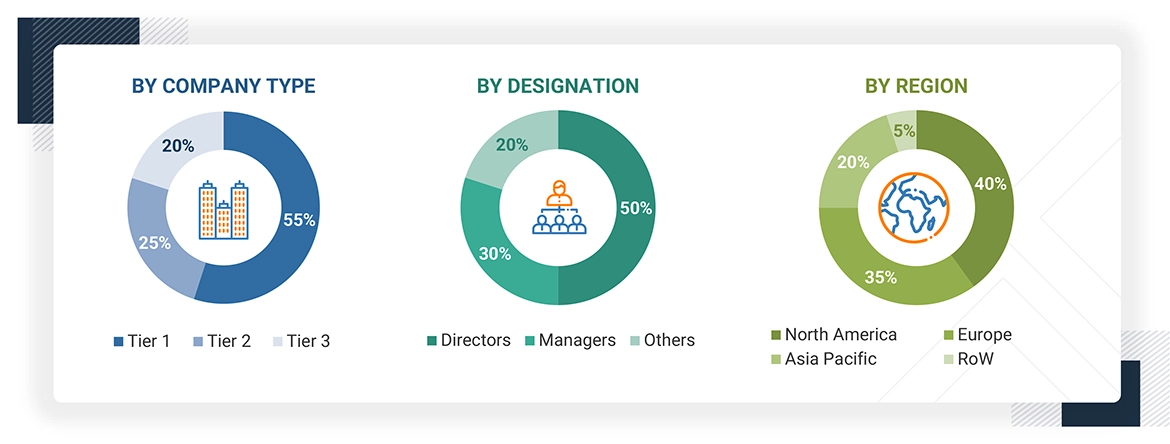

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the loudspeaker ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the loudspeaker market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side players across key regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative andquantitative information.

Primary data has been collected through questionnaires, emails, and telephone interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the loudspeaker market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Loudspeaker Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the loudspeaker market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

A loudspeaker is a device that converts electrical audio signals into sound, allowing users to hear music, speech, or other audio. It is commonly used across consumer electronics, automotive systems, public address systems, and home entertainment setups. Loudspeakers come in various designs and sizes, including portable Bluetooth speakers, soundbars, and high-end audio systems tailored to different applications and environments. Manufacturers focus on sound quality, power output, and connectivity features to cater to personal and professional audio needs.

Key Stakeholders

- Loudspeaker material and component providers

- Loudspeaker providers, integrators, and installers

- Electronic hardware equipment manufacturers

- Loudspeaker software and solution providers

- Consulting companies

- Loudspeaker-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and startup companies

- Distributors and traders

- Original equipment manufacturers (OEMs)

- End users

Report Objectives

- To define, describe, and forecast the loudspeaker market, in terms of value, segmented by product type, connectivity, functionality, and vertical

- To describe and forecast the market, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the loudspeaker market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the loudspeaker market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players, comprehensively analyze their market shares and core competencies, and provide a detailed competitive landscape for market leaders

- To analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, and product launches and developments in the loudspeaker market

- To analyze the impact of the macroeconomic factors impacting the loudspeaker market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the loudspeaker market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the loudspeaker market.

Key Questions Addressed by the Report

Which are the major companies in the loudspeaker market? What are their significant strategies to strengthen their market presence?

The major companies in the loudspeaker market are Bose Corporation (US), Samsung (South Korea), Sony Group Corporation (Japan), Panasonic Corporation (Japan), and Yamaha Corporation (Japan). These players adopt major strategies, including product launches and developments, collaborations, acquisitions, and expansions.

Which region is expected to dominate the loudspeaker market?

The loudspeaker market in Asia Pacific is poised for strong growth due to rapid urbanization, rising disposable incomes, and increasing adoption of smart home audio technologies across emerging economies like China and India.

What are the opportunities for new market entrants?

There are significant opportunities for startup companies in the loudspeaker market. These companies provide innovative and diverse product portfolios.

What are the drivers and opportunities for the loudspeaker market?

Rising demand for immersive audio experiences, growth in smart homes and infotainment systems, and increasing investments in public address and entertainment infrastructure are fueling market growth.

What are the major loudspeaker technologies expected to drive the market's growth in the next five years?

Major technologies expected to drive loudspeaker market growth include wireless connectivity (Bluetooth, Wi-Fi), voice assistant integration, and advanced acoustic and DSP (digital signal processing) technologies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Loudspeaker Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Loudspeaker Market