Medical Device Plastics Market

Medical Device Plastics Market by Material (Standard Plastics, Engineering Plastics), Source, Manufacturing Process (Extrusion, CNC Machining, Injection Molding), Application (Diagnostics Equipment, Surgical Instruments), & Region - Global Forecast to 2030

Updated on : December 11, 2025

MEDICAL DEVICE PLASTICS MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global medical device plastics market was valued at USD 21.93 billion in 2025 and is projected to reach USD 31.82 billion by 2030, growing at 7.7% cagr from 2025 to 2030. The market is growing due to increasing healthcare expenditure, rising demand for lightweight, cost-effective, materials, and rapid advancements in medical technology. The shift toward single-use and disposable devices for infection control, coupled with expanding applications in minimally invasive and wearable medical devices, is driving strong market momentum.

KEY TAKEAWAYS

-

BY MATERIALThe medical device plastics market by material includes standard plastics, engineering plastics, and others. The standard plastics segment leads the medical device plastics market due to its cost-effectiveness, versatility, and wide applicability across disposable and non-invasive medical devices. Materials such as PVC, PE, and PP are widely used in tubing, IV bags, connectors, and packaging because of their excellent chemical resistance, flexibility, and ease of sterilization. The growing demand for single-use medical products and low-cost mass production—especially in high-volume markets like North America and the Asia Pacific continues to drive the dominance of standard plastics in the medical sector.

-

BY SOURCEThe medical device plastics market by source includes fossil-based and bio-based. The fossil-based plastics segment leads the medical device plastics market, driven by its established supply chain, proven performance, and regulatory reliability in medical applications. Materials derived from petrochemical sources—such as polypropylene (PP), polyethylene (PE), polycarbonate (PC), and PVC—are widely used due to their durability, sterilization compatibility, and cost-efficiency. Despite growing sustainability concerns, fossil-based plastics remain the preferred choice for most medical device manufacturers because they offer consistent quality, scalability, and compliance with FDA and ISO standards essential for high-precision molded components.

-

BY MANUFACTURING PROCESSESThe medical device plastics market by manufacturing process includes extrusion, CNC machining, injection molding, vacuum casting, thermoforming, blow molding, and others. The injection molding segment leads the medical device plastics market due to its precision, scalability, and cost-effectiveness in producing complex medical components. This process allows manufacturers to create high-quality, sterile, and dimensionally accurate parts such as housings, connectors, and enclosures used in diagnostic and non-invasive devices. The method supports mass production with minimal material waste, making it ideal for single-use and disposable medical applications. Additionally, ongoing automation and material advancements are further boosting adoption across North America, Europe, and the Asia Pacific.

-

BY APPLICATIONThe medical device plastics market by application includes diagnostics equipment, surgical instruments, delivery systems, point-of-care-devices, wearable medical devices, medical device housings and others. The delivery systems segment leads the medical device plastics market, driven by the rising demand for advanced drug delivery devices, such as syringes, infusion sets, and inhalers. These systems require lightweight, durable, and biocompatible plastics to ensure patient safety and precise medication control. Growth is further supported by the increasing prevalence of chronic diseases, expansion of home healthcare, and adoption of self-administration devices.

-

BY REGIONThe Asia Pacific region is the fastest-growing market for medical device plastics, driven by rapid healthcare infrastructure expansion, rising medical device manufacturing capacity, and government initiatives promoting local production in countries such as China, India, and South Korea. Increasing demand for cost-effective, high-quality disposable and non-invasive medical devices, coupled with the availability of skilled labor and lower manufacturing costs, is further accelerating regional growth.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Jabil Inc. (US), Phillips Medisize (US), Donatelle Plastics, LLC (US), Spectrum Plastics Group (US), Bemis Manufacturing Company (US), Nolato (Sweden), Trelleborg AB (Sweden), Freudenberg Medical (US), Viant (US), and SMC Ltd. (US). These companies are advancing in medical device plastic products and related technologies compared to other competitors.

The medical device plastics market is projected to reach USD 31.82 billion by 2030 from USD 21.93 billion in 2025, at a CAGR of 7.7% from 2025 to 2030. The global medical device plastics market is witnessing robust growth driven by rising healthcare spending, increasing adoption of lightweight materials, and rapid advancements in medical and diagnostic technologies. The growing preference for single-use and disposable devices to ensure infection control further supports market expansion. Regionally, North America leads with strong regulatory standards and high R&D investment, Europe emphasizes sustainability and recyclable polymers, while Asia Pacific experiences the fastest growth due to expanding healthcare infrastructure, domestic manufacturing, and cost-effective production capabilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medical device plastics market is being reshaped by evolving healthcare trends and disruptive technologies that directly impact end users, healthcare providers, and patients. Growing demand for non-invasive, connected, and patient-centric devices, combined with sustainability goals and regulatory advancements, is driving OEMs and contract manufacturers to innovate rapidly. These shifts are influencing how medical devices are designed, manufactured, and delivered, creating new opportunities for suppliers of high-performance molded plastic components.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MEDICAL DEVICE PLASTICS MARKET DYNAMICS

Level

-

Continuous investment in healthcare segment

-

Growing aging population and chronic diseases

Level

-

Volatility in raw material prices

Level

-

Contract manufacturing boom

-

Growth in emerging markets

Level

-

Quality and biocompatibility testing requirements

-

Skilled workforce and technology gaps

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Continuous investment in healthcare segment

The global medical device plastics market is being strongly propelled by continuous investment in the healthcare sector, driven by rising healthcare expenditure, technological innovation, and increasing demand for advanced medical solutions. Governments, private healthcare providers, and medical OEMs are expanding infrastructure and capacity to meet the growing needs of aging populations and the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses. This sustained investment is fostering greater adoption of diagnostic and therapeutic devices, many of which rely on precision-molded plastic components for lightweight, durable properties. Major healthcare markets such as the US, Germany, Japan, and China are leading this investment wave through large-scale funding for R&D, manufacturing modernization, and digital healthcare transformation. For instance, the increasing integration of wearable monitoring devices and remote patient management tools is driving demand for plastics that offer superior chemical resistance and sterilization compatibility. Additionally, global players are establishing regional manufacturing hubs to strengthen supply chain resilience and ensure compliance with evolving regulatory frameworks.

Restraint: Volatility in raw material prices

One of the major restraints for the global medical device plastics market is the fluctuation in raw material prices, particularly those derived from petrochemical sources such as polypropylene (PP), polyethylene (PE), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS). The pricing of these polymers is closely tied to crude oil and natural gas markets, which are highly sensitive to geopolitical tensions, supply chain disruptions, and global demand fluctuations. Such volatility directly affects production costs for medical-grade plastics and molded components, putting pressure on manufacturers’ margins and pricing strategies. Moreover, medical device producers must maintain strict quality and regulatory compliance standards, which limit their ability to switch to cheaper material substitutes when prices rise. This adds further complexity to cost management. Regional trade policies and transportation costs also contribute to pricing instability, particularly in North America and Europe, where dependence on imported resins remains high. The unpredictability of raw material costs can hinder long-term contract agreements and investment decisions for both OEMs and contract manufacturers, ultimately restraining steady market growth despite rising healthcare demand.

Opportunity: Contract manufacturing boom

The contract manufacturing boom presents a significant growth opportunity for the global medical device plastics market. As medical device OEMs increasingly focus on innovation, product differentiation, and cost optimization, they are outsourcing the production of plastic components and assemblies to specialized contract manufacturers. The North American medical device contract manufacturing market alone is projected to reach USD 33.45 billion by 2030, growing at a CAGR of 11.4% (2025–2030), with strong demand in drug delivery (12.8% CAGR) and cardiovascular devices (12.7% CAGR). This surge in outsourcing is driven by the rising need for single-use, precision-molded, and sterile device assemblies, as well as the increasing complexity of medical devices requiring advanced molding technologies. The US dominates this segment, accounting for 80–90% of the North American market, due to its strong base of FDA-approved facilities and established players such as Phillips-Medisize, Jabil, SMC, and Flex. This trend offers tremendous opportunities for medical plastic suppliers and molders to expand capacity, invest in automation, and develop next-generation biocompatible polymers. The growing reliance on contract manufacturing is thus accelerating innovation and strengthening the overall medical plastics ecosystem globally.

Challenge: Skilled workforce and technology gaps

The global medical device plastics industry is increasingly facing a shortage of skilled labor and widening technological gaps, which pose significant challenges to sustained growth. As demand for high-precision and high-quality molded plastic components rises, especially in advanced applications such as wearables, diagnostics, and drug delivery devices, manufacturers are struggling to recruit and retain qualified technicians and engineers. According to recent industry reports, over 60% of plastic injection molding companies have reported difficulties in finding skilled workers between 2022 and 2024. This talent shortage directly impacts production efficiency, quality control, and innovation capacity, leading to increased operational costs and slower adoption of advanced manufacturing technologies like automation, robotics, and digital molding simulation. In addition, training programs often lag behind industry needs, with only about 30% of graduates meeting employers’ expectations in technical skillsets. To bridge this gap, companies are increasingly investing in workforce upskilling, smart factory initiatives, and collaborative training programs. However, the lack of skilled personnel remains a pressing challenge that could constrain capacity expansion and technological progress in the medical device plastics market.

Medical Device Plastics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes precision-molded engineering plastics for surgical instruments, infusion sets, and delivery systems | Enhanced device reliability, lightweight design, high sterilization resistance, and improved patient safety |

|

Uses molded plastic housings and components in diagnostics and transfusion systems, including point-of-care analyzers and test cartridges | Facilitates rapid diagnostics, ensures contamination control, and supports scalable high-volume manufacturing |

|

Employs plastics in catheters, stents, and minimally invasive surgical tools | Improves flexibility, minimizes tissue trauma, and ensures consistent performance in high-stress environments |

|

Integrates medical-grade plastics in syringes, IV sets, and single-use devices for drug delivery | Cost-efficient, single-use safety, superior barrier properties, and compatibility with sterilization methods |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical device plastics ecosystem is a dynamic and interconnected network comprising raw material suppliers, compounders, molders, OEMs, contract manufacturers, and end users. This ecosystem functions cohesively to design, develop, and deliver high-performance plastic components that meet stringent regulatory, safety, and performance standards in healthcare applications. Key materials such as engineering polymers, standard plastics, and bio-based resins flow through multiple value-chain stages, from formulation and precision molding to sterilization and assembly. With continuous advancements in medical technology, miniaturization, and sustainability, the ecosystem is evolving rapidly to support innovations in wearable, diagnostic, and noninvasive medical devices. Collaboration among material innovators, molding specialists, and device manufacturers ensures improved product quality, compliance, and cost efficiency.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Device Plastics Market, by Material

The standard plastics segment is expected to lead the global medical device plastics market due to its wide applicability, cost-effectiveness, and proven performance in diverse healthcare environments. Standard plastics such as polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and polystyrene (PS) are extensively used in the production of disposable syringes, IV bags, tubing, connectors, and diagnostic consumables, making them indispensable in both hospital and home healthcare settings. Their ease of processing, chemical resistance, flexibility, and sterilization compatibility make them ideal for mass production of medical disposables and noninvasive medical components. From a market standpoint, rising demand for single-use and disposable medical devices—driven by infection control needs and increased procedural volumes—continues to propel the use of standard plastics. Additionally, their regulatory acceptance by the FDA and EMA, combined with advancements in medical-grade formulations, is reinforcing their dominance. Emerging economies in the Asia Pacific are also expanding healthcare infrastructure and manufacturing capacity, further accelerating consumption. In contrast, mature markets like North America and Europe are focusing on sustainable plastic alternatives and recycling initiatives, ensuring that standard plastics evolve alongside industry regulations and sustainability goals.

Medical Device Plastics Market, by Manufacturing Process

The injection molding segment leads the global medical device plastics market, driven by its precision, scalability, and ability to produce complex geometries at high volumes and low cost. This manufacturing process is essential for producing critical medical components such as housings, connectors, syringes, diagnostic casings, and wearable device enclosures, which demand tight tolerances and consistent quality. Technological advancements such as micro-injection molding, multi-material molding, and overmolding are further enhancing the capability of this process, enabling the integration of multiple functions within a single component—critical for modern diagnostic and wearable medical devices. The growing adoption of automation and smart manufacturing systems, particularly in North America and the Asia Pacific, is improving production efficiency and reducing costs. Moreover, medical device OEMs and contract manufacturers like Phillips-Medisize, SMC Ltd., Jabil, and Flex Ltd. are expanding their injection molding capabilities to meet rising global demand. With its balance of design flexibility, precision, and cost efficiency, injection molding remains the backbone of medical device plastic manufacturing and is expected to sustain its leading position over the forecast period.

Medical Device Plastics Market, by Application

The delivery systems segment leads the global medical device plastics market, driven by the growing demand for drug delivery and fluid management devices such as syringes, IV components, catheters, infusion sets, and inhalation systems. The segment’s growth is supported by the increasing prevalence of chronic diseases, the expansion of home healthcare, and the development of advanced and non-invasive drug delivery technologies. In the Asia Pacific, rapid healthcare infrastructure expansion and local manufacturing incentives are boosting production of cost-effective delivery systems. Meanwhile, Europe is seeing strong adoption of sustainable and bio-based plastics to align with green medical manufacturing regulations. Additionally, innovations in pre-filled syringes, wearable injectors, and smart infusion devices are creating new opportunities for material suppliers and molders. Leading manufacturers are heavily investing in plastic-based delivery systems due to their design flexibility, safety, and mass-production efficiency.

REGION

Asia Pacific to be fastest-growing region in global medical device plastics market during forecast period

The Asia Pacific region is the fastest-growing market for medical device plastics, driven by rapid healthcare infrastructure expansion, rising medical device manufacturing, and increasing investments in domestic production capabilities. Countries like China, India, South Korea, and Singapore are emerging as key hubs for medical device molding and assembly, supported by strong government incentives and foreign direct investments in the healthcare and life sciences sectors. Growing demand for affordable, high-quality medical devices, combined with the shift of global OEMs and contract manufacturers toward the region for cost efficiency and supply chain resilience, is accelerating plastic component production. Furthermore, the expansion of non-invasive and home healthcare devices, along with advancements in 3D printing, precision molding, and automation, is strengthening APAC’s position in the global market.

Medical Device Plastics Market: COMPANY EVALUATION MATRIX

In the medical device plastics market matrix, Jabil (Star), a US company, leads the market through its high-quality medical device plastic products, which find extensive applications in various applications such as diagnostic equipment, surgical instruments, drug delivery, and others. Viant (Emerging Leader) is gaining traction with its technological advancements in medical device plastics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.38 Billion |

| Market Forecast in 2030 (Value) | USD 31.82 Billion |

| Growth Rate | CAGR of 7.7% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Medical Device Plastics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Device Plastic Products Supplier |

|

Supported go-to-market strategy and positioning vs competitors |

| Country-level Insights for High-growth Regions | Provided detailed market sizing and forecasts for the US, Canada, and Mexico | Helped the client identify region-specific growth hotspots and investment opportunities |

RECENT DEVELOPMENTS

- March 2025 : In March 2025, Jabil announced plans to open a new manufacturing facility in Gujarat, India, marking its second plant in the country. The expansion strengthens Jabil’s global medtech manufacturing network, supporting the production of advanced orthopedic devices, surgical tools, robotics systems, in vitro diagnostics, and chronic disease management platforms such as insulin pumps and GLP-1 autoinjectors. This move aligns with Jabil’s strategy to expand its medical device capabilities in high-growth regions, enhance supply chain resilience, and accelerate time-to-market for next-generation healthcare technologies.

- February 2025 : Jabil has acquired Pharmaceutics International (Pii), a contract development and manufacturing organization (CDMO), to expand its pharmaceutical and drug delivery capabilities. This acquisition enhances Jabil’s ability to support clients from early-stage drug development through large-scale commercialization, strengthening its position in the drug delivery device segment. With Pii’s expertise, Jabil can now offer integrated solutions for the development and production of on-body pumps, pen injectors, auto-injectors, and inhalers, aligning with the growing global demand for advanced, patient-friendly, and non-invasive drug delivery systems.

- August 2023 : DuPont has completed its acquisition of Spectrum Plastics Group, a leading manufacturer of specialty medical devices and precision plastic components. Spectrum, with annual revenues of approximately USD 500 million and a global workforce of 2,200 employees, strengthens DuPont’s presence in the medical device and healthcare materials market.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the medical device plastics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation were employed to determine the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering medical device plastics and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the medical device plastics market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the medical device plastics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief executive officers (CXOs), vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from the medical device plastics industry, as well as vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to material, source, manufacturing process, application, and region segments. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking medical device plastics, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of medical device plastics and future outlook of their business, which will affect the overall market.

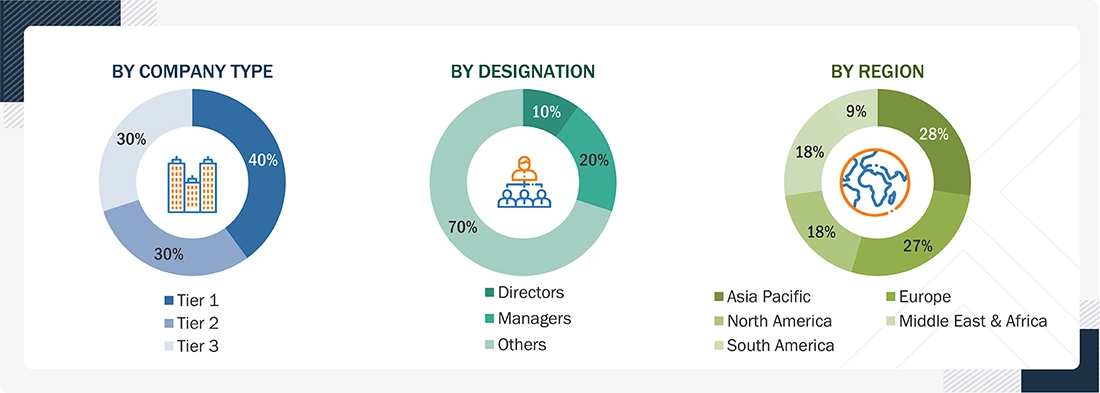

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of medical device plastics market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for medical device plastics in different applications at the regional level. Such procurements provide information on the demand aspects of the medical device plastics industry for each application. For each application, all possible segments of the medical device plastics market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Molded plastic components for medical devices refer to precision-molded parts made from polymers used in products such as diagnostic imaging systems, patient monitors, wearable sensors, and respiratory care devices. These components provide lightweight, durable, and design-flexible solutions that enhance patient comfort and device portability. Manufactured under strict FDA and ISO standards, they ensure safety, performance, and compatibility with cleaning and disinfection processes.

Stakeholders

- Medical Device Plastic Manufacturers

- Medical Device Plastic Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the medical device plastics market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global medical device plastics market, by material, source type, manufacturing process, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships, collaborations, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Device Plastics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medical Device Plastics Market