Medium Frequency Magnetics Market

Medium Frequency Magnetics Market by Type, Converter Type, Power Output, Voltage, Application (Power Conversion Systems, Renewable & Energy Systems, Electronics & Industrial Equipment, Specialized Systems), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The medium frequency magnetics market is estimated to reach USD 1.99 billion in 2025 and USD 2.70 billion by 2030, registering a CAGR of 6.3% during the forecast period (2025–2030). Market growth is driven by the rising adoption of renewable energy systems, electric vehicles, and advanced power conversion technologies, which require efficient and compact magnetic components. Increasing investments in energy-efficient infrastructure, industrial automation, and data center power systems further accelerate demand. Additionally, industries such as aerospace, medical, telecommunications, and automotive are increasingly integrating medium frequency transformers and inductors to enhance performance, reduce losses, and support miniaturization, making medium frequency magnetics essential for next-generation power electronics applications.

KEY TAKEAWAYS

-

BY TYPEBased on type, the medium frequency magnetics market is segmented into transformers, inductors, reactors, and others (including chokes, filters, planar magnetics, magnetic amplifiers, and custom/hybrid magnetics). Transformers hold the largest share from 2025 to 2030 due to their critical role in voltage conversion, isolation, and high-efficiency energy transfer across power supplies, inverters, and EV chargers. The Inductors segment is projected to grow at the fastest CAGR, supported by increasing demand in automotive power electronics, DC–DC converters, and renewable systems for energy storage and grid applications.

-

BY CONVERTER TYPEThe market is segmented into AC–AC converters, DC–DC converters, renewable energy inverters (DC–AC–DC), and solid-state transformers (SSTs). The renewable energy inverters (DC–AC–DC) segment is set to account for the largest market share due to growing global investments in solar, wind, and distributed energy systems requiring efficient power conversion at medium frequencies. Meanwhile, solid-state transformers (SSTs) are expected to register the highest growth rate owing to their ability to integrate power conversion, protection, and communication functions, making them ideal for modern smart grids and electric mobility infrastructure.

-

BY POWER OUTPUTBased on power output, the market is categorized into low (up to 10 kW), medium (10–500 kW), and high (above 500 kW) segments. The medium (10–500 kW) segment dominates and is also estimated to be the fastest-growing, driven by its extensive application across renewable inverters, electric mobility, industrial converters, and smart grid systems that require efficient medium-scale power conversion and compact magnetic designs.

-

BY VOLTAGEBy voltage, the market is divided into low voltage (400 V–1 kV) and medium voltage (1–35 kV). The low voltage segment leads the market, as it is widely used in renewable power electronics, consumer electronics, and low-voltage industrial systems. However, the medium voltage category is projected to expand rapidly due to increasing deployment of high-power converters in grid-connected renewable systems and electric vehicle fast-charging networks.

-

BY APPLICATIONThe medium frequency magnetics market is segmented into power conversion systems, renewable & energy systems, electronics & industrial equipment, and specialized systems. Power conversion systems are estimated to account for the largest market share, driven by their essential role in converting and conditioning electrical energy efficiently across various devices and grid systems. The renewable & energy systems segment is expected to grow at the fastest pace, fueled by global clean energy targets and expanding renewable infrastructure that relies on high-efficiency magnetics for inverter and grid interfaces.

-

BY REGIONThe regions covered include North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific region dominates due to strong industrial growth, government support for renewable integration, and rapid EV and electronics manufacturing expansion, particularly in China, Japan, and South Korea. North America is expected to be the fastest-growing region, led by technological innovation, high investment in smart grid modernization, and the scaling of renewable and aerospace power electronics systems.

-

COMPETITIVE LANDSCAPEThe medium frequency magnetics market is moderately consolidated, with major players adopting organic and inorganic strategies such as partnerships, product innovation, and acquisitions to strengthen their global footprint. Companies are focusing on high-efficiency, compact, and thermally optimized designs catering to renewable energy, EV, and aerospace applications. Continuous advancements in magnetic materials, insulation technologies, and solid-state converter integration remain central to maintaining competitiveness and addressing the evolving demands of the global power electronics ecosystem.

The global medium frequency magnetics market is witnessing robust growth, driven by the increasing adoption of power electronics across renewable energy systems, electric vehicles, industrial automation, and data centers. The market benefits from the accelerating shift toward electrification, digitalization, and sustainable power conversion solutions. Medium frequency magnetic components, such as transformers, inductors, and reactors, enable high-efficiency energy transfer, reduced system weight, and compact designs, making them critical for next-generation power systems. Technological advancements in core materials, wide-bandgap semiconductors, and solid-state converters are further enhancing performance and efficiency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medium frequency magnetics market is driven by the rising demand for efficient power conversion and energy management solutions across renewable energy, electric vehicles, and industrial automation sectors. With the growing emphasis on high-efficiency and compact power electronics, medium frequency transformers and inductors are becoming essential components in inverters, converters, and power supplies. The market is further fueled by advancements in wide bandgap semiconductors (SiC and GaN), the expansion of renewable energy installations, and the shift toward electrification and decentralized energy systems. Additionally, industries such as aerospace, automotive, and data centers are increasingly adopting medium frequency magnetics to achieve higher power density, reduced losses, and enhanced thermal performance in modern electronic systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mandatory Grid Modernization and Resilience Requirements

-

Accelerated Integration of Distributed and Renewable Energy Resources (DERs)

Level

-

High Manufacturing Cost and Technical Complexity of Advanced Components

-

Critical Vulnerabilities in Global Supply Chains for Magnetic Materials

Level

-

Development of Advanced Soft Magnetic Materials for Medium-to-High Frequency Applications

-

Expansion into High-Voltage/High-Power DC Microgrids and Distribution Systems (MVDC)

Level

-

Need for Standardization and Interoperability Protocols

-

Managing Extreme Thermal Stresses in High-Density Design

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Mandatory Grid Modernization and Resilience Requirements

The growing focus on grid modernization, driven by decarbonization and energy resilience policies, is creating strong momentum for medium frequency magnetics. Modern electric grids require solid-state transformers (SSTs), high-frequency converters, and power-electronic interfaces that depend on compact, efficient magnetic components operating at medium frequencies. Governments and utilities worldwide are investing heavily in grid resilience programs, such as the US DOE’s Grid Resilience and Innovation Partnerships (GRIP) and the EU’s Trans-European Networks for Energy (TEN-E), which emphasize digitalized, flexible power conversion. These initiatives directly stimulate demand for advanced magnetics that can enhance efficiency, reduce losses, and support bi-directional power flow.

Restraint: High Manufacturing Cost and Technical Complexity of Advanced Components

Medium-frequency magnetic components involve advanced materials, such as amorphous and nanocrystalline alloys, and require precise manufacturing processes to ensure thermal stability, minimal losses, and mechanical integrity. The production cost is elevated due to tight tolerances, specialized winding techniques, and the need for high-performance core materials with consistent magnetic properties. Additionally, achieving optimal magnetic design at medium frequencies necessitates complex modeling and simulation, which increases development time and cost. This technical and cost-intensive landscape acts as a significant restraint for small and mid-scale manufacturers.

Opportunity: Expansion into High-Voltage/High-Power DC Microgrids and Distribution Systems (MVDC)

Medium-frequency magnetics are finding new applications in the emerging MVDC infrastructure, which is gaining traction for long-distance transmission, naval power systems, and industrial facilities. MVDC architectures rely on high-frequency isolation and voltage conversion, both of which require medium-frequency transformers and inductors. This transition from conventional AC systems to DC-based networks offers a substantial growth frontier for magnetics manufacturers. As countries pursue large-scale electrification and decarbonization goals, the development of resilient MVDC systems opens lucrative opportunities for MFM suppliers to integrate advanced materials and modular designs into next-generation DC networks.

Challenge: Need for Standardization and Interoperability Protocols

Despite technological progress, the medium-frequency magnetics market faces a lack of harmonized standards and testing methodologies. The integration of SSTs, converters, and magnetics across multi-vendor ecosystems often results in interoperability issues. Without established certification pathways, product validation and compliance become time-consuming and costly. The absence of globally aligned standards, especially in emerging applications like MVDC grids and EV ultra-fast chargers, poses a barrier to large-scale deployment and market confidence. Coordinated efforts between standardization bodies, governments, and industry stakeholders are required to establish uniform design and testing frameworks.

medium frequency magnetics market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed and validated high-power medium-frequency magnetics (e.g., DC active filters, dual-active bridges, multiport converters) using new amorphous and nanocomposite core materials and advanced core/winding techniques (e.g., strain-annealing, multiparameter material screening, new test beds) for power electronic converters | Enabled higher power density and efficiency in converters (not possible with standard materials), better core loss control, thorough multiparameter material selection, effective thermal and anisotropic design | Reduced transformer weight and size |

|

Designed and built a 150 kW, medium-voltage, medium-frequency DC-DC solid-state transformer for medium-voltage grid interface using high-voltage SiC technology, with custom ferrite and nanocrystalline cores | Pioneered modeling and mitigation of parasitic capacitance-driven high-frequency resonance | Delivered a high-density, reliable MVDC transformer; minimized high-frequency oscillations | Improved insulation and thermal stability | Validated solid-state transformer technology with real-world 100 kW+ lab deployment and grid application readiness |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medium frequency magnetics ecosystem includes key stakeholders such as raw material suppliers (such as TDK, VAC, LS Cable & System, and Proterial), manufacturers (BLOCK, Jackson Transformer, Cefem Group), and system integrators (such as ABB, Siemens, and Schneider Electric). Component distributors like RS, Mouser Electronics, and Arrow Electronics manage product supply, while testing and certification bodies such as UL Solutions, DNV, and TÜV Rheinland ensure quality standards. OEMs and end users like SMA, Tesla, BYD, and GE Healthcare drive demand across renewable energy, automotive, and healthcare sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medium Frequency Magnetics Market, by Type

The global medium frequency magnetics market by type is led by transformers, which hold the largest market share owing to their crucial role in efficient power conversion, isolation, and voltage regulation across renewable energy, electric vehicle charging, and industrial applications. Medium frequency transformers are widely used in inverters, converters, and power supplies for solar, wind, and energy storage systems, as they provide compact design, high power density, and reduced core losses. Their integration into solid-state transformers and advanced converter architectures further strengthens their dominance across power electronics and smart grid systems.

Medium Frequency Magnetics Market, by Power Output

The medium (10–500 kW) power output segment dominates the market and is also projected to grow at the fastest CAGR. This range is ideal for renewable inverters, EV fast chargers, and industrial drives that require efficient power transfer with minimal losses. Medium frequency magnetics within this range are highly valued for optimizing energy conversion efficiency in distributed energy systems, grid-tied converters, and hybrid electric systems. Their ability to offer scalability and improved performance under varying load conditions makes them preferred across industrial automation, mobility, and renewable sectors.

Medium Frequency Magnetics Market, by Converter Type

The renewable energy inverters (DC–AC–DC) segment accounts for the largest share in the medium frequency magnetics market, driven by the expansion of solar and wind power installations globally. These magnetics are integral to inverter architectures that enable efficient DC–AC and bidirectional power conversion, supporting grid integration and energy storage systems. The growing penetration of wide-bandgap semiconductor technologies, such as SiC and GaN, is enhancing inverter efficiency and power density, fueling demand for high-frequency magnetic components across renewable applications.

Medium Frequency Magnetics Market, by Voltage

The low voltage (400 V–1 kV) segment holds the largest share in the market due to its widespread use in power converters, renewable systems, and EV infrastructure. These voltage levels are essential in distributed power systems where efficiency, compactness, and thermal performance are critical. However, medium voltage (1–35 kV) systems are emerging rapidly, particularly in utility-scale renewable projects and industrial converters, where they enable higher power throughput and improved grid interfacing.

Medium Frequency Magnetics Market, by Application

The power conversion systems segment dominates the market, driven by the increasing integration of magnetics in inverters, converters, and power conditioning units for renewable and industrial applications. These systems depend on medium frequency magnetics for energy transfer, voltage regulation, and efficiency optimization. Meanwhile, renewable and energy systems represent the fastest-growing application area, supported by the global shift toward clean energy, energy storage, and electrification trends that demand reliable, compact, and efficient magnetic solutions.

REGION

Asia Pacific to be the largest region in the global medium frequency magnetics market during the forecast period

The Asia Pacific region is expected to hold the largest share in the global medium frequency magnetics market during the forecast period. This dominance is primarily attributed to the rapid expansion of renewable energy infrastructure, strong growth in electric vehicle manufacturing, and rising investments in industrial automation and power electronics across countries such as China, Japan, South Korea, and India. The region’s robust electronics manufacturing ecosystem, coupled with government initiatives promoting clean energy and electrification, is driving substantial demand for high-efficiency magnetics in inverters, converters, and charging systems. Additionally, the presence of leading component manufacturers and a strong supply chain for magnetic materials and cores further enhances the region’s leadership position in the market.

medium frequency magnetics market: COMPANY EVALUATION MATRIX

Eaton (Star) leads the medium frequency magnetics market with a robust global presence, advanced R&D capabilities, and a comprehensive product portfolio spanning transformers, inductors, and reactors. The company’s focus on innovation, energy-efficient designs, and strong customer partnerships across automotive, renewable, and industrial applications drives its dominance in the market. CTM Magnetics (Emerging Leader) is rapidly gaining momentum through its expanding product range and expertise in high-performance magnetic materials tailored for next-generation power electronics. While TDK maintains its leadership with scale and technological depth, Vacuumschmelze demonstrates significant growth potential and is well-positioned to advance toward the leaders' quadrant in the coming years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.89 Billion |

| Market Forecast, 2030 (Value) | USD 2.70 Billion |

| Growth Rate | CAGR 6.3% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: medium frequency magnetics market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation |

|

|

RECENT DEVELOPMENTS

- December 2024 : CEFEM POWER announced the expansion of its presence in the US. As a leading manufacturer of passive components renowned for quality and performance, they are committed to meeting the specific needs of the US market while showcasing French expertise and craftsmanship.

- December 2024 : AQ Group entered into a binding agreement to acquire mdexx inductive electronics GmbH, mdexx Magnetronic Devices GmbH, mdexx Magnetronic Devices s.r.o., and Michael Riedel, Transformatorenbau GmbH. mdexx is a leading supplier of specialized inductive components, such as reactors, transformers, and filters, in the low to medium power and frequency range. Michael Riedel, Transformatorenbau, is a leading supplier in the design and manufacture of custom-made transformers, reactors, and filters in the small to medium power range. Operations are conducted from Weyhe and Ilshofen in Germany and Trutnov in the Czech Republic and involve approximately 400 people.

- October 2024 : Standex International acquired Amran Instrument Transformers (headquartered in the US) and Narayan Powertech Pvt. Ltd. (headquartered in India) for a combined USD 462 million, using cash and Standex stock. Both companies manufacture low- and medium-voltage instrument transformers installed in over 50 countries.

Table of Contents

Methodology

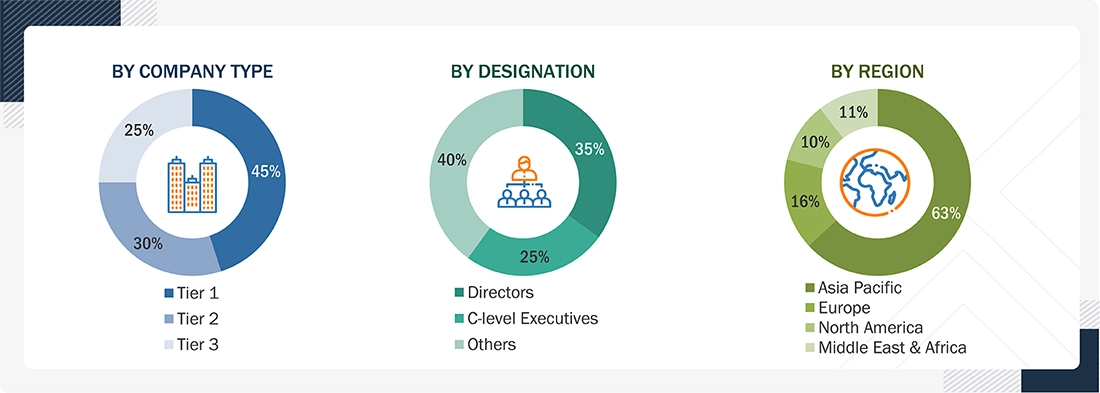

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, and ICIS, to identify and collect information useful for this technical, market-oriented, and commercial study of the global medium frequency magnetics market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess market growth prospects.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, such as D&B, Bloomberg, and Factiva; white papers and articles from recognized authors; and publications and databases from associations, such as the Magnetic Materials Producers Association (MMPA), the Institute of Electrical and Electronics Engineers (IEEE), the International Electrotechnical Commission (IEC), and the Transformer Association (TA). Secondary research has been used to gather key information about major players, market segmentation, industry trends, and technological advancements in the medium frequency magnetics market. This research has also helped identify key market developments and competitive landscapes, map the industry’s value chain, and compile a database of prominent market participants.

Primary Research

In the primary research process, various sources from the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report and analyze prospects. Primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the medium frequency magnetics market. Primary sources from the demand side include experts and key persons.

After the complete market engineering process (including calculations of market statistics, market breakdown, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics, such as drivers, opportunities, challenges, trends, and strategies, adopted by key players.

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From

USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

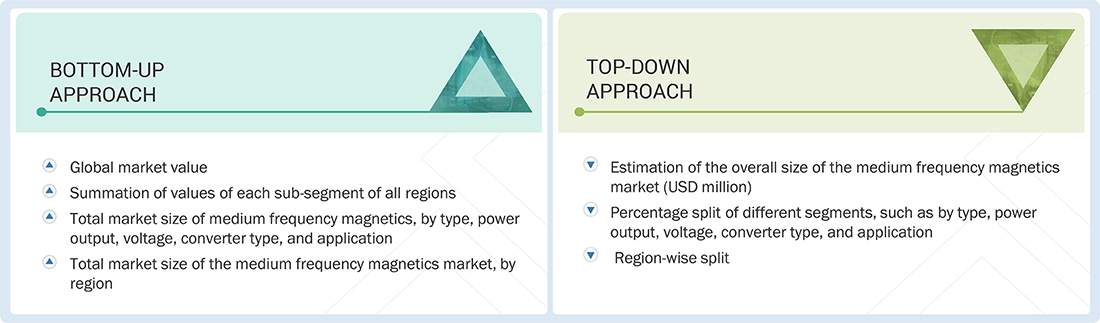

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the market size of medium frequency magnetics for various end users in each region. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of key market players and extensive interviews for insights from industry leaders, such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Medium Frequency Magnetics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation procedure has been used to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has been validated using the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources: the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Medium Frequency Magnetics include transformers, inductors, reactors, and other magnetic components designed to operate in the medium frequency range (typically from 1 kHz up to hundreds of kHz, depending on application). They are essential in power conversion, renewable energy systems, EV charging, aerospace, industrial equipment, and consumer electronics.

Stakeholders

- Government and research organizations

- State and national regulatory authorities

- Standards and certification bodies

- Organizations, forums, alliances, and industry associations

- Institutional investors

- Investors/Shareholders

- Environmental and energy efficiency research institutes

- Manufacturers’ associations

- Medium frequency magnetics manufacturers, dealers, and suppliers

- Core material and winding wire manufacturers

- Semiconductor and converter system manufacturers

- Electrical equipment and power conversion system integrators

- Renewable energy developers and EPC contractors

- Power utilities, grid operators, and industrial end users

- Electric vehicle charging infrastructure developers

- Data center operators and smart grid solution providers

- Consulting and engineering firms in the power electronics and energy domain

Report Objectives

- To define, describe, analyze, and forecast the medium frequency magnetics market based on converter type, power output, product type, voltage, application, end-user, and region, in terms of value

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their country-level market sizes, in terms of value and volume

- To forecast the medium frequency magnetics market, by region, in terms of volume

- To give comprehensive details regarding drivers, restraints, opportunities, and challenges impacting the expansion of the medium frequency magnetics market

- To systematically examine the market for medium frequency transformers in terms of each segment’s contributions to the market, growth trends, and prospects

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market maps, ecosystem analysis, regulatory landscape, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s five forces analysis, key stakeholders and buying criteria, regulatory analysis, AI/Gen AI impact, and 2025 US tariff impact analysis on the market

- To conduct a strategic analysis of micromarkets concerning their respective growth trends, planned expansions, and market share contributions

- To sketch into a competitive environment for market participants and assess the potential for stakeholders in the medium frequency magnetics business

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players for the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments in the medium frequency magnetics market, such as sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the medium frequency magnetics market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medium Frequency Magnetics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medium Frequency Magnetics Market