Methyl Acetate Market

Methyl Acetate Market by Grade (Industrial grade, Pharmaceutical grade, and Food grade), Purity (= 99% Purity, 90–99% Purity, and < 90% purity), Sales Channel (Direct and Indirect), End-use Industry, and Region – Global Forecast to 2030

METHYL ACETATE MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The methyl acetate market is expected to reach USD 388.5 million by 2030 from USD 228.0 million in 2025, at a CAGR of 7.9% during the forecast period. The methyl acetate market is witnessing robust expansion propelled by increasing demand in the coatings, adhesives, pharmaceuticals, and personal care sectors. In 2024, global vehicle sales were 95.3 million units (Source: OICA), enhancing the demand for coatings and surface treatments, with methyl acetate facilitating swift drying and impeccable finishes. Its minimal toxicity, VOC-exempt designation under the U.S. EPA, and exceptional solubility render it a favored solvent in industrial applications. In 2024, investments in eco-friendly and high-performance formulations significantly surged, facilitating their use in adhesives, inks, and pharmaceutical processing. The adaptability, compliance, and efficiency of methyl acetate render it indispensable for contemporary industrial manufacturing and ecologically compliant practices.

KEY TAKEAWAYS

-

BY GRADEThe methyl acetate market is categorized into Industrial, Pharmaceutical, and Food Grades. Industrial Grade caters to high-volume coatings, adhesives, and inks; Pharmaceutical Grade guarantees elevated purity for active pharmaceutical ingredients; Food Grade complies with safety regulations for flavorings and perfumes. Each grade offers performance, compliance, and adaptability.

-

BY PURITYSegmented into ≥99%, 90–99%, and <90% Purity, with ≥99% used in pharmaceuticals, electronics, and high-performance coatings; 90–99% in industrial applications; and <90% in less critical uses.

-

BY SALES CHANNELSegmented into Direct and Indirect. Direct serves large-scale industrial users with bulk supply, while Indirect via distributors supports small- and medium-scale manufacturers with flexible delivery.

-

BY END-USE INDUSTRYKey end-use sectors includes Paints & Coatings, Adhesives & Sealants, Pharmaceuticals, Inks, Personal Care & Cosmetics, and Additional End-use Industries. The pharmaceutical sector is anticipated to be the most rapidly expanding end-use industry.

-

BY REGIONThe Asia Pacific region is expected to experience the fastest growth in the methyl acetate market due to rapid industrialization, expanding automotive and electronics manufacturing, increasing demand for coatings and adhesives, and growing adoption of eco-friendly, VOC-compliant solvents.

-

COMPETITIVE LANDSCAPEMajor players employ both inorganic and organic growth methods, including collaborations, acquisitions, and geographic expansions. BASF, Thermofisher Scientific Inc., Merck KGaA, Celanese Corporation, and Eastman Chemical Company (US)are investing in innovation to meet the increasing demand for effective and compliant methyl acetate products.

The methyl acetate market is likely to grow quickly in the next few years because demand for coatings, adhesives, pharmaceuticals, and personal care products is rising, and there is more focus on following VOC and environmental rules. Methyl acetate is a good choice for paints, adhesives, inks, and pharmaceutical processing because it is not very toxic, evaporates quickly, and dissolves well. Its effectiveness and versatility make it possible to dry quickly, get high-quality finishes, and handle it safely. This has led to its use in a wide range of industrial, consumer, and pharmaceutical applications, while also making sure that it meets all regulations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on clients' businesses is driven by changes in industrial, automotive, pharmaceutical, and consumer goods sectors. The influence on clients' businesses is driven by changes in industrial, automotive, pharmaceutical, and consumer goods sectors. The primary client of methyl acetate manufactures include coatings and paints producers, adhesive and sealant manufacturers, pharmaceutical companies, ink formulators, and personal care product developers. The demand for methyl acetate is affected by fluctuations in production levels, regulatory requirements, and environmental compliance standards. Changes in client engagement directly influence sales volumes and revenue for methyl acetate suppliers, rendering market trends and operational adjustments vital to their business plans.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

METHYL ACETATE MARKET DYNAMICS

Level

-

Rising adoption of methyl acetate in the paints, coatings, and adhesives industry

-

Strong demand for eco-friendly, low-VOC solvents

Level

-

Flammability, inhalation hazards & high handling costs

-

Intense competition from well-established solvents

Level

-

Expanding applications across high-growth industries

-

Growth through bio-based and circular economy integration

Level

-

Stringent regulatory compliance across regions

-

Escalating production costs driven by feedstock volatility and energy intensity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of methyl acetate in the paints, coatings, and adhesives industry

Methyl acetate is progressively utilized as a solvent in paints, coatings, and adhesives owing to its rapid evaporation, low toxicity, and subtle odor, rendering it suitable for applications necessitating swift drying and diminished environmental impact. It is extensively utilized in automotive refinishing, architectural coatings, and industrial adhesives. Prominent manufacturers, including Sherwin-Williams and Axalta, utilize it in environmentally sustainable coatings, whilst products like 3M™ General Trim Adhesive contain 15-40% methyl acetate to ensure rapid drying and robust adhesion on various surfaces. The growth of automotive production, especially in Asia, Oceania, and the Middle East, has propelled global vehicle sales by 15.4% from 2019 to 2024 (Source: OICA), hence augmenting the demand for automotive paints, basecoats, clearcoats, primers, and structural adhesives.

Restraint: Flammability, inhalation hazards & high handling costs

The flammability of methyl acetate and its related safety hazards constrain its operational adaptability and scalability. It is a Category 2 flammable liquid (GHS/OSHA) with a flash point of 14 °F (−10 °C) and explosive vapor-air mixtures (3.1–16%). This means that it needs to be handled, stored, and transported very carefully. For compliance, facilities must be explosion-proof, have good ventilation, grounded equipment, solvent recovery systems, leak detection, emergency training, and have personal protective equipment (PPE). Transportation under UN 1231, Class 3, Packing Group II adds more rules and makes things more complicated. These extensive safety and regulatory controls add to operational costs and limit agility and are significant barriers to the widespread use and adoption of methyl acetate as an industrial solvent and cleaner.

Opportunity: Expanding applications across high-growth industries

Methyl acetate offers a growing opportunity as an environmentally friendly, high-performance solvent in agrochemicals, electronics, pharmaceuticals, and cosmetics. Low toxicity, fast evaporation, biodegradability, and compliance to regulations allow safer, eco-friendly applications. Certification by the U.S. EPA for nonfood agrochemical uses enables the manufacture of compatible products, while electronics profit from near-zero residue cleaning and defluxing. Pharmaceutical-grade methyl acetate (≥99.5%) complies with ICH Q3C low-toxicity solvent standards, and FDA GRAS certification makes it suitable for use in food and cosmetics. Increased demand from high-performance, safer alternative solvents for various industries makes methyl acetate a top solution for sustainable, compliant formulations.

Challenge: Stringent regulatory compliance across regions

The methyl acetate market encounters significant risk due to intricate international regulations. Organizations must adhere to environmental and chemical safety standards, including EU REACH, U.S. TSCA, and VOC regulations. Methyl acetate has been prohibited under REACH Annex XVII and needs risk assessments, chemical safety reports, and exposure scenarios prior to entering the market. TSCA SNURs require a 90-day prior notification for new applications, whereas NESHAP 40 CFR Part 63 Subpart FFFF enforces stringent emission regulations (Source: EPA, 2023). In Canada, it is classified as a Class 3 flammable liquid under the Transportation of Dangerous Goods Regulations (TDGR). Regulatory requirements increase compliance costs, restrict market access, and complicate operations, especially for SMEs.

Methyl Acetate Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Celanese utilizes methyl acetate in automotive coatings to achieve fast drying times and excellent resin solubility. This application is particularly beneficial in regions with stringent environmental regulations, as methyl acetate's low volatile organic compound (VOC) content helps meet these standards. | Methyl acetate in automotive coatings speeds up production, ensures regulatory compliance, and enhances coating quality through excellent resin compatibility. |

|

Concern over child ingestion of nail polish remover with 50% methyl acetate prompted a toxicological review to assess cosmetic safety. | Found safe under normal use; recommended child-proof packaging, warning labels, and avoiding attractive coloring to reduce accidental ingestion. |

|

Modeled a lab-scale methyl acetate reactive distillation (RD) column using the DIVA® simulator to test feasibility and system dynamics. | Validated RD as efficient; revealed nonlinear behaviors; confirmed need for advanced controls and potential for process intensification. |

|

Eastman incorporates methyl acetate in the formulation of inks for flexible packaging. The solvent's low toxicity and high solvency power make it an ideal choice for creating inks that are both effective and safer for consumers. | Using methyl acetate in packaging inks reduces health risks, ensures vibrant, high-quality prints, and meets safety standards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

METHYL ACETATE MARKET ECOSYSTEM

The methyl acetate market ecosystem includes raw material suppliers, methyl acetate manufacturers, distributors, and end users. Raw material suppliers offer essential base chemicals. Methyl acetate manufacturers produce methyl acetate of different grade to meet the needs of numerous end-use industries without compromising regulatory requirements. Distributors bring market access through a proper supply chain. The paints, coatings, adhesives, sealants, pharmaceuticals and other industries employs methyl acetate for applications requiring fast evaporation, strong solvency, low toxicity, and environmental compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Methyl Acetate Market, By Grade

The industrial grade methyl acetate segment was the leading segment of the global methyl acetate market in 2024, mainly because of its application in paints, coatings, adhesives, inks, and cleaning products. As the product with great solubility, rapid evaporation, low toxicity, and meeting the regulations, it is the perfect material for industries that are looking for high-performance, environmentally friendly solvents. The increasing need encompasses electronics, construction, automotive, and packaging, wherein methyl acetate acts as a safer substitute for hazardous solvents. Its feature as the most compatible with resins and polymers makes it easier to use in different types of molding and formulations. This segment's characteristic of replacing harmful solvents while supporting sustainable production has been the reason for its position as the leader in the global methyl acetate market.

Methyl Acetate Market, By End-use Industry

The methyl acetate market in 2024 was mainly led by the paints and coatings end use, due to its excellent surface finish, high solvency, fast evaporation rate, and low toxicity. Increasingly utilized in automotive, construction, and industrial sectors, it facilitates effortless application, rapid drying, and resilient coatings. The compatibility with diverse resins and pigments enhances formulation versatility, while adherence to VOC norms ensures environmental sustainability. The increasing need for decorative and protective coatings, propelled by infrastructural and industrial expansion, has solidified this segment's dominance, with continuous developments broadening its applicability across worldwide end-use sectors.

REGION

Asia Pacific to be the fastest-growing region in the global methyl acetate market during the forecast period

The Asia Pacific region showcases the fastest growth due to its strong manufacturing base, expanding manufacturing capability, and growing end-user demand. The prominent economies consist of China, India, Japan, and South Korea that include strong manufacturing industries in paint and coating, adhesives and sealants, pharmaceutical, and personal care. Growing urbanization and infrastructure increases demand for use in the building and automotive sector. The growth of the pharmaceutical industry will be aided through government initiatives and healthcare investments. Due to cost-efficient manufacturing, availability of raw materials, favorable trade practices, and increased environmental regulation encouraging the use of green solvents, the Asia Pacific region is set to be a significant growth area for methyl acetate during the forecast period.

Methyl Acetate Market: COMPANY EVALUATION MATRIX

BASF (Star) dominates the methyl acetate market due to its global presence, extensive product portfolio, and strong technological expertise, delivering high-performance solutions across coatings, adhesives, pharmaceuticals, and personal care applications. Anhui Wanwei Group Co., Ltd. (Emerging Leader) is expanding by offering cost-effective and innovative methyl acetate products for industrial, pharmaceutical, and consumer applications, demonstrating notable progress toward the leader’s quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

METHYL ACETATE MARKET PLAYERS

METHYL ACETATE MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 211.0 MN |

| Market Forecast in 2030 (value) | USD 388.5 MN |

| Growth Rate | 7.9% |

| Years Considered | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • Grade: Industrial Grade, Pharmaceutical Grade, and Food Grade • Purity: ≥ 99% Purity, 90–99% Purity, and <90% Purity • Sales Channel: Direct and Indirect • End-use Industry: Paints and Coatings, Adhesives and Sealants, Pharmaceuticals, Inks, Personal Care and Cosmetics, and Other End-use Industries |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Methyl Acetate Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Methyl Acetate Manufacturer | • Profiles of key methyl acetate manufacturers (financials, product range, key strategies, developments) • Segment-wise demand mapping • Analysis of partnership & distribution networks | • Identified & profiled 20+ methyl acetate recycling companies • Identified regional market gaps & supply chain vulnerabilities • Targeted high-value customer segments for business development • Detected sector-specific growth inflection points |

| Industrial Grade Methyl Acetate Manufacturer | • Benchmarking industrial grade methyl acetate for paints & coatings, adhesive & sealants, and inks • Mapping of major industrial end-users and regional distributors • Evaluation of regulatory compliance, environmental restrictions, and switching barriers | • Forecast shifts in demand across end-use industries including paints & coatings, adhesive & sealants, and inks. • Identify high-margin industrial segments and potential growth pockets |

| Pharmaceutical Grade Methyl Acetate Manufacturer | • Comparative benchmarking of pharmaceutical grade methyl acetate for pharmaceutical industry. • Mapping of key industrial consumers, distributors, and contract manufacturers • Assessment of switching costs, regional regulations, and supply chain constraints | • Anticipate shifts in customer adoption between Industrial grade vs Pharmaceutical grade • Pinpoint high-value applications and regions for market penetration • Guide product development toward high-demand, high-margin niche applications |

RECENT DEVELOPMENTS

- May 2025 : BASF plans to acquire DOMO Chemicals' 49% stake in the Alsachimie joint venture, aiming for full ownership by mid-2025.

- June 2024 : Merck completed a USD 195.4 million expansion of its Schnelldorf Distribution Center, adding 25,000 square meters and nearly doubling its size.

- May 2024 : Thermo Fisher Scientific entered into a strategic distribution agreement with Bio-Techne Corporation to enhance the availability of Bio-Techne’s life sciences products across Europe.

- April 2024 : Thermo Fisher Scientific is set to expand its presence in Indonesia with the inauguration of its first official office in Jakarta.

- March 2024 : Celanese Corporation expanded its production capabilities with the startup of a new 1.3 million ton acetic acid facility at Clear Lake.

Table of Contents

Methodology

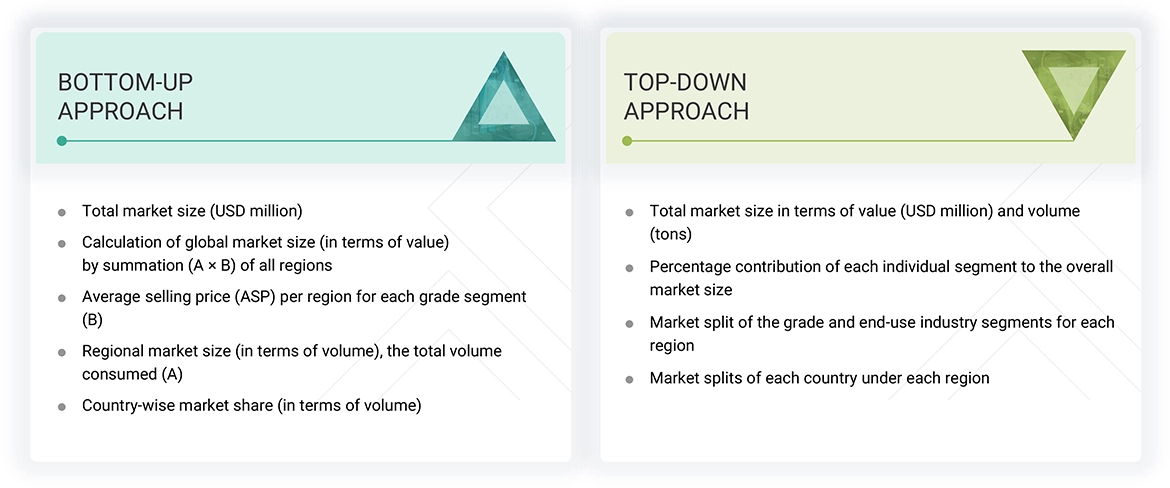

The study involved four major activities to estimate the current size of the global methyl acetate market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of methyl acetate through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the methyl acetate market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for companies offering methyl acetate is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to in order to identify and collect information for this study on the methyl acetate market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of door vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the methyl acetate market. After the complete market engineering (calculations for market statistics, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of methyl acetate offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

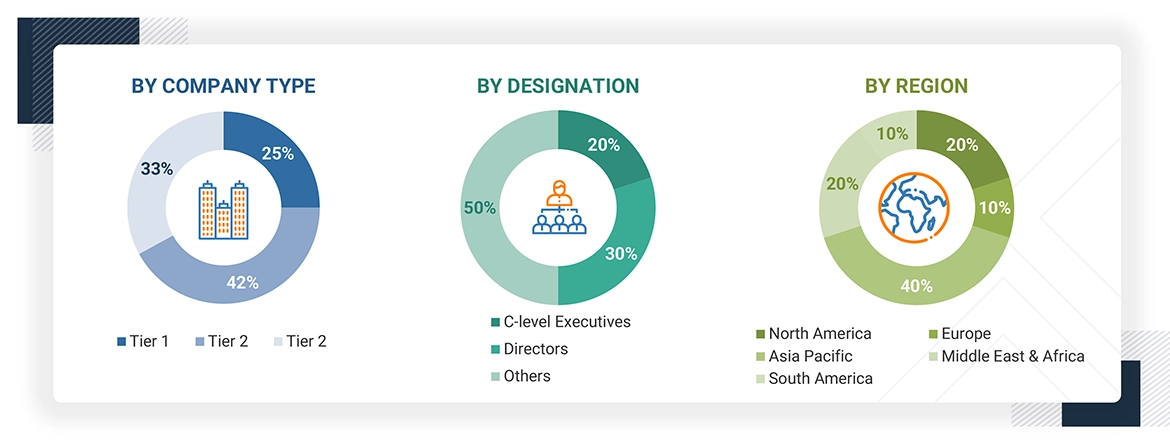

The following is the breakdown of primary respondents.

Notes: Other designations include sales, marketing, and product managers.

Tier 1: > USD 1 Billion; Tier 2: USD 500 million to USD 1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global methyl acetate market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Methyl acetate is a rapidly evaporating, low-toxicity organic ester solvent commonly utilized in industrial and commercial applications. The methyl ester of acetic acid possesses a sweet, fruity aroma and dissipates rapidly. These attributes render it highly esteemed in paints and coatings, adhesives, inks, personal care products, and chemical synthesis, where it provides effective solvency, seamless application, and improved performance. Methyl acetate is predominantly synthesized via the esterification of methanol and acetic acid, exhibiting advantageous environmental characteristics, including low photochemical reactivity and the ability to serve as a safer substitute for more harmful solvents like toluene and acetone. Its low surface tension, strong volatility, and broad miscibility with a variety of organic solvents make it suitable for use in a wide range of formulations. The International Union of Pure and Applied Chemistry (IUPAC) recognizes methyl acetate as a volatile organic compound (VOC) and a highly flammable liquid, and it is controlled by authorities such as the United States Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA).

Stakeholders

- Methyl acetate manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global methyl acetate market, based on grade, purity, sales channel, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as acquisitions, expansions, partnerships, and agreements in the methyl acetate market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

Which factors are propelling the growth of the methyl acetate market?

Rising adoption of methyl acetate in the paints, coatings, and adhesives industry, strong demand for eco-friendly, low-VOC solvents, and expansion in emerging economies.

What are the major challenges to the growth of the methyl acetate market?

Stringent regulatory compliance across regions and escalating production costs driven by feedstock volatility and energy intensity.

What are the significant opportunities in the methyl acetate market?

Expanding applications across high-growth industries and growth through bio-based and circular economy integration are expected to create lucrative opportunities for market players.

What are the major factors restraining the growth of the methyl acetate market?

Flammability, inhalation hazards & high handling costs, and intense competition from well-established solvents.

Who are the major players in the methyl acetate market?

Major players include BASF (Germany), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Celanese Corporation (US), and Eastman Chemical Company (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Methyl Acetate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Methyl Acetate Market