Microplastic Analysis Market

Microplastic Analysis Market by Analyte [Polyethylene, Polystyrene, Polypropylene], Product [Microscopy (Optical, Electron), Spectroscopy (FTIR, Raman, GC-MS, LC-MS), Software, Consumables], Application [Water, Soil, Air], End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global microplastic analysis market is expected to experience significant growth, with projections indicating it will reach USD 383.1 million by 2030, up from USD 266.9 million in 2025, representing a CAGR of 7.5%. The demand for reagents and consumables in microplastic analysis is driven by stricter environmental regulations and increased monitoring requirements across water, food, and consumer goods industries, which necessitate frequent and accurate testing. Rising public and industrial awareness of microplastic contamination, coupled with the need for standardized, reproducible results, is pushing laboratories to use high-quality reagents, filters, dyes, and calibration standards. Additionally, technological advancements in analytical methods—such as fluorescence staining, spectroscopy, and automated imaging—rely on specialized consumables. The growing number of research institutions, contract testing labs, and industrial end-users further supports recurring consumption and market growth.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe product type segment which includes instruments, software & services, and reagents & consumables the reagents and consumables category is expected to witness the fastest growth in the microplastic analysis market. Increasing regulatory testing mandates and expanding research initiatives are fueling consistent demand for premium consumables and reagents, including filtration membranes, reference standards, and sample preparation kits, to support precise and reliable microplastic detection

-

BY ANALYTE TYPEThe analyte type segment which includes polyethylene, polystyrene, polypropylene, polytetrafluoroethylene, other types. polyethylene is expected to witness the fastest growth in the microplastic analysis market. Growing environmental monitoring efforts and regulatory scrutiny toward polyethylene waste one of the most widely used and commonly detected plastics in water and soil are driving demand for advanced analytical techniques to accurately identify and quantify polyethylene microplastics

-

BY APPLICATIONThe application segment which includes water testing, soil testing , air testing, and other sample testing. Water testing is expected to witness the fastest growth in the microplastic analysis market. Growing regulatory focus on water quality and increasing detection of microplastics in drinking water, wastewater, and surface water are driving strong demand for advanced testing solutions in the water testing segment.

-

BY END-USERSThe end user segment which includes water treatment plants, food & beverages company, pharmaceutical company, chemical & packaging industries, textiles Industries, other end-users. water treatment plants is expected to witness the fastest growth in the microplastic analysis market. Rising concerns over microplastic contamination in wastewater and stricter regulations for effluent quality are driving water treatment plants to adopt advanced microplastic monitoring and analysis solutions to ensure compliance and environmental safety

-

BY REGIONThe region segment includes North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Europe is expected to witness the fastest growth in the microplastic analysis market. Strong environmental regulations and growing emphasis on monitoring plastic pollution are driving significant adoption of advanced microplastic analysis solutions across Europe.

The major driving factors for microplastic analysis across end user segments stem from increasing regulatory pressures, environmental concerns, and consumer health awareness. For water treatment plants, the need to monitor and reduce microplastic discharge drives the adoption of advanced filtration and detection technologies. In the food and beverage industry, detection of microplastics in products ensures safety, quality, and compliance with emerging regulations, while strengthening consumer trust. Pharmaceutical companies are focusing on monitoring microplastic contamination in raw materials and water used in production to maintain product safety and regulatory compliance. Meanwhile, the chemical and packaging industries face pressure to reduce plastic waste and adopt sustainable practices, prompting investments in microplastic detection and quality control to mitigate environmental impact and adhere to evolving regulations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Microplastic analysis is increasingly aligned with major trends and disruptions affecting your customers’ customers. It plays a critical role in addressing imperatives such as Regulatory Compliance, product safety and quality assurance, and environmental responsibility and sustainability. These priorities directly contribute to key outcomes, including enhanced product quality and safety, Reduced Environmental Impact, and compliance and risk mitigation. As regulatory scrutiny and consumer awareness around plastic pollution and its health implications grow, microplastic analysis empowers organizations to make data-driven decisions, achieve operational excellence, and reinforce market and brand trust. This analytical capability is becoming increasingly essential across various sectors, including food and beverages, pharmaceuticals, water treatment, textiles, and packaging. In addition to ensuring compliance and quality, microplastic analysis acts as a catalyst for innovation and sustainable transformation. By enabling companies to monitor, quantify, and mitigate the presence of microplastics in their products and processes, it supports the development of eco-friendly materials, encourages technological adoption, and enhances transparency in supply chains. Ultimately, it positions businesses as proactive leaders in environmental stewardship, helping them meet the rising expectations of both regulators and environmentally conscious consumers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing public concern over potential health risks of microplastic exposure in human body

-

Technological advancements in spectroscopy, microscopy systems

Level

-

Elevated costs of instruments used for microplastic analysis

-

Highly stringent regulatory and compliance requirements

Level

-

Expanding growth prospects in emerging economies

-

Integration of AI and ML technologies for microplastic analysis

Level

-

Limited availability of trained technicians in microplastic detection

-

Lack of standardized protocols for microplastic detection

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing public concern over potential health risks of microplastic exposure in human body

Growing public concern over the potential health risks of microplastic exposure in the human body is becoming a major driver for research, regulation, and demand in microplastic analysis. Studies indicate that microplastics can enter the body through ingestion of contaminated food and water, inhalation of airborne particles, and even via personal care products. Although the long-term health effects are still under investigation, early evidence suggests that microplastics may cause inflammation, oxidative stress, and accumulation of toxic chemicals in tissues, raising significant concerns among consumers and regulatory authorities. This heightened awareness is prompting governments, industries, and healthcare organizations to focus on monitoring, testing, and mitigation strategies, creating strong growth opportunities for advanced microplastic detection technologies and analytical instruments. Microplastics have been detected throughout the human body, including in the blood, saliva, liver, kidneys, lungs, and placenta, raising questions about their potential impact on health. Their presence in blood vessels is associated with an increased risk of heart attacks, strokes, inflammation, and clotting, while the chemicals within microplastics have been linked to cancer, immune system dysfunction, reproductive issues, and developmental delays.

Restraint: Highly stringent regulatory and compliance requirements

The adoption of microplastic analysis technologies is being significantly influenced by stringent regulatory and compliance requirements globally. Regulatory bodies in North America, Europe, and the Asia Pacific have introduced strict guidelines for monitoring microplastics in water, food, and consumer products, aiming to mitigate environmental contamination and protect human health. For example, the U.S. Environmental Protection Agency (EPA) has initiated water quality monitoring programs and allocated significant funding for microplastic research, while the European Union’s Water Framework Directive mandates regular monitoring of microplastic levels in surface water and wastewater. These regulations compel industries and laboratories to adopt advanced analytical instruments, standardized protocols, and robust testing methodologies to ensure compliance. In addition, compliance requirements are driving the development of standardized reference materials, validated testing methods, and certified reagents and consumables to guarantee accurate and reproducible results. Industries such as water treatment, food and beverage, pharmaceuticals, and packaging are under pressure to demonstrate adherence to these standards to maintain consumer trust and avoid penalties. The increasing focus on regulatory reporting, environmental accountability, and product safety is fueling market demand for automated, high-precision microplastic detection solutions, thereby accelerating the adoption of state-of-the-art spectroscopy, imaging, and AI-integrated analytical instruments

Opportunity: Expanding growth prospects in emerging economies

The microplastic analysis market is witnessing expanding growth prospects in developing and emerging markets due to increasing awareness of environmental pollution and public health concerns. Rapid industrialization, urbanization, and growing plastic consumption in regions such as the Asia Pacific, Latin America, and parts of Africa have led to a rise in microplastic contamination in water, soil, and air. Governments in these regions are implementing stricter environmental regulations and monitoring programs, driving demand for advanced microplastic detection technologies. Additionally, the rising number of research institutions, environmental testing laboratories, and private companies focusing on sustainability and pollution control is further boosting market growth. Emerging markets also present opportunities for technological adoption, driven by investments in modern water treatment infrastructure, food safety initiatives, and environmental monitoring projects. For instance, large-scale urban water and wastewater projects in countries such as India, China, and Brazil are creating a demand for accurate microplastic detection and monitoring solutions. Furthermore, increasing collaboration with global technology providers is enabling local laboratories to access high-precision instruments such as FTIR, Raman spectroscopy, and AI-based analytical platforms. These factors contribute to a robust growth outlook for the microplastic analysis market in developing and emerging economies

Challenge: Limited availability of trained technicians in microplastic detection

The limited availability of skilled technicians in microplastic detection poses a major obstacle to the broader adoption of microplastic analysis technologies. Techniques such as FTIR microscopy, Raman spectroscopy, and AI-assisted imaging require specialized expertise to operate and accurately interpret results. Currently, there is a significant shortage of professionals with the necessary skills in this emerging field, which can delay the deployment of microplastic monitoring programs and hinder the effective use of advanced detection technologies. Moreover, the high complexity and cost of microplastic analysis instruments further exacerbate the challenge of training and retaining qualified personnel. Equipment like high-resolution mass spectrometers and advanced microscopy systems demands substantial financial investment, ongoing maintenance, and precise calibration, all of which require advanced technical proficiency. In many developing regions, limited access to such resources worsens the shortage of trained technicians. The rapid evolution of detection methods, including AI-based tools, also necessitates continuous professional development. Without strategic investment in training and education programs, the gap between the growing demand for microplastic analysis and the availability of qualified personnel is likely to persist, potentially slowing the implementation of effective environmental monitoring and mitigation efforts.

microplastic-analysis-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Monitoring microplastics in raw, treated, and distribution water, evaluating the removal efficiency of filtration and treatment processes, and conducting regulatory compliance testing for drinking water standards | Ensures the delivery of safe and clean water to consumers while optimizing treatment processes and maintaining full regulatory compliance |

|

1) Testing bottled water, packaged foods, and beverages for microplastic contamination 2) Evaluating packaging materials for microplastic leaching 3) Quality control during production and supply chain monitoring | Protects consumer health by guaranteeing microplastic-free products and enhances brand reputation and trust through rigorous quality control |

|

1) Detecting microplastics in raw materials, excipients, and finished products 2) Monitoring contamination in water used in production processes 3) Ensuring compliance with pharmaceutical safety standards | Maintains high product quality and safety standards while ensuring compliance with stringent regulatory requirements and minimizing contamination risks |

|

1) Analyzing textile effluents for microplastic fibers 2) Assessing the impact of washing processes on microplastic release 3) Testing finished textile products for embedded microplastics | Promotes sustainable manufacturing practices by reducing microplastic release, minimizing environmental impact, and enhancing corporate social responsibility |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The microplastic analysis ecosystem, as illustrated in the image, highlights a comprehensive network of stakeholders involved in monitoring and addressing microplastic pollution. It includes manufacturers such as Thermo Fisher Scientific, Agilent, PerkinElmer, and Bruker, which provide analytical instruments and technologies. Raw material suppliers, such as Metrohm, JASCO, and AIMPLAS, support the ecosystem with essential components and materials. Regulatory authorities, including the FDA, EFSA, and various environmental ministries, set guidelines and ensure compliance. Finally, end users such as Veolia, Nestlé, Johnson & Johnson, and Novartis apply these technologies to monitor and reduce microplastic contamination in their operations. This ecosystem represents a collaborative effort among science, regulation, and industry to address a growing environmental challenge.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Microplastic Analysis Market, By Product type

The microplastic analysis market is segmented by product type into instruments (microscopy instruments (optical microscopy, electronic microscopy, electronic microscopy), spectroscopy instruments [FTIR spectroscopy, Raman spectroscopy, gas chromatography-mass spectrometry (GC-MS), gas chromatography-mass spectrometry (GC-MS)], software & services (integrated software, AI-based software), and reagents and consumables. The reagents and consumables segment held the largest revenue share of the microplastic analysis market. The demand for reagents and consumables in microplastic analysis is primarily driven by the need for accurate, reliable, and standardized testing across various environmental and industrial applications. Increasing regulatory requirements and stricter quality standards in water treatment, food and beverage, pharmaceutical, and packaging industries compel laboratories to use high-quality reagents, dyes, filters, and calibration standards to ensure reproducible results. Additionally, the rising awareness of microplastic pollution and its potential health and ecological impacts is boosting testing frequency. Meanwhile, technological advancements such as fluorescence staining, automated imaging, and spectroscopy rely on specialized consumables. The growing number of research institutions, contract testing labs, and industrial users further contributes to recurring consumption, making reagents and consumables a critical and expanding segment in the microplastic analysis market.

Microplastic Analysis Market, Analyte Type

The market for microplastic analysis is divided into polyethylene, polystyrene, polypropylene, polytetrafluoroethylene, and other product types. The polyethylene segment held the largest revenue share of the microplastic analysis market. Polyethylene (PE) is a dominant analyte in microplastic analysis due to its widespread use in packaging, plastic bags, bottles, and various consumer products, making it one of the most prevalent pollutants in aquatic and terrestrial environments. The driving factors for its analysis include rising environmental and public health concerns, stringent regulatory requirements for monitoring microplastic contamination, and growing research on the ecological impact of PE particles. Additionally, advances in analytical techniques, such as FTIR and Raman spectroscopy, coupled with AI-based detection tools, have enhanced the accuracy and efficiency of polyethylene identification and quantification, further driving demand for its analysis in water, soil, food, and industrial samples.

Microplastic Analysis Market, Application

The market for microplastic analysis is divided into water testing, soil testing, air testing, and other applications. The water testing segment is also expected to retain its leadership position in the microplastic analysis market during the forecast period. Water testing has emerged as the major application segment in microplastic analysis due to escalating concerns over the contamination of drinking water, rivers, oceans, and wastewater with plastic particles. Regulatory mandates, such as those from the U.S. EPA and the European Union’s Water Framework Directive, require frequent monitoring of microplastics in water, driving adoption of advanced analytical technologies. Increasing public awareness of the health risks associated with microplastic ingestion, coupled with growing investment in water treatment infrastructure, has further accelerated demand. Additionally, technological advancements in high-throughput spectroscopy, microscopy, and AI-driven detection enable precise identification and quantification of microplastics, making water testing a critical focus area for laboratories, environmental agencies, and industrial stakeholders.

REGION

North America to be fastest-growing region in global life science instrumentation market during forecast period

The microplastic analysis market in North America holds the largest share globally, followed by the European and the Asia Pacific regions. Market growth in North America is primarily driven by stringent regulatory frameworks, increasing environmental monitoring requirements, and heightened public and governmental awareness of microplastic contamination in water, food, and ecosystems. The region’s proactive approach—reflected in directives such as the single-use plastics directive, advanced wastewater treatment standards, and initiatives encouraging industries, environmental agencies, and research organizations to strengthen their testing capabilities—further supports expansion. Additionally, rising R&D investments, the adoption of advanced analytical technologies such as FTIR, Raman spectroscopy, and mass spectrometry, and growing collaborations between academia and regulatory bodies are accelerating market progress. Increasing concern over the potential health impacts of microplastics in drinking water, seafood, and consumer products is also driving greater surveillance and demand for comprehensive analytical instruments and services across North America

microplastic-analysis-market: COMPANY EVALUATION MATRIX

The microplastic analysis market company evaluation matrix visually categorizes companies based on their market share and rank, as well as their product footprint. Thermo Fisher Scientific is positioned as a Star, indicating a strong market position with a broad product footprint. TESCAN is identified as an Emerging Leader, showing growth potential but with a more limited product footprint compared to the leading players. Companies in the Participants and Pervasive Players categories have varying degrees of market influence and product range, with the latter group offering more widespread product availability but with lower market share. The matrix provides insights into the competitive landscape, highlighting key players and their strategic positioning in the microplastic analysis industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 266.9 Million |

| Market Forecast in 2030 (Value) | USD 383.1 Billion |

| Growth Rate | CAGR of 7.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: microplastic-analysis-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| High-throughput analysis for large water treatment plants | Instruments equipped with automated sample handling and multi-sample feeders | Increased productivity, reduced manual labor, faster turnaround time |

| Detection of ultra-small microplastics (<1 µm) in beverages and food | Integration of high-resolution Raman spectroscopy with AI-based image analysis | Improved sensitivity and accuracy, compliance with food safety regulations |

| Portable and field-deployable solutions for environmental monitoring | Compact, battery-operated FTIR or Raman units with cloud-based data transmission | On-site testing, real-time monitoring, reduced sample transport costs |

| Integration with laboratory information management systems (LIMS) | Custom software interfaces and automated reporting modules | Streamlined data management, easier compliance reporting, enhanced traceability |

RECENT DEVELOPMENTS

- May 2025 : Thermo Fisher Scientific Inc (US) launched the system to automate and streamline workflows to obtain more detailed and accurate insights from critical cellular samples

- May 2025 : Agilent announced new enhancements to the 8850 Gas Chromatograph (GC), adding compatibility with single and triple quadrupole mass spectrometry (MS) systems, along with supporting tools and technologies designed to boost laboratory productivity

- February 2025 : Bruker (US) launched a high-performance 3D X-ray microscope (XRM) using micro-Computed Tomography (microCT), which offers a large field-of-view high-efficiency detector.

Table of Contents

Methodology

This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global microplastic analysis market. Additionally, in-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from leading market players, and industry consultants. These interviews helped obtain and validate critical qualitative and quantitative data while assessing the growth prospects. The global market size, initially estimated through secondary research, was then refined and finalized through triangulation with insights from primary research.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was employed to identify and collect information relevant to the comprehensive, technical, market-oriented, and commercial study of the microplastic analysis market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the microplastic analysis market. The primary sources from the demand side include OEMs, private and contract testing organizations, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

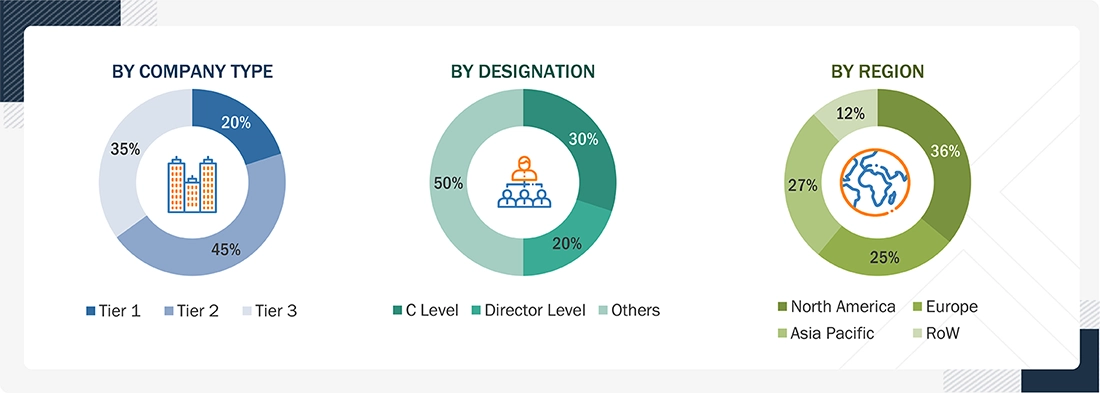

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the microplastic analysis market. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the microplastic analysis market was generated.

- Mapping annual revenues generated by major global players from the microplastic analysis segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global microplastic analysis market as of 2024

- Extrapolating the global value of the microplastic analysis industry

Microplastic Analysis Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the market size through the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The microplastic analysis market encompasses technologies, instruments, and methodologies used to detect, identify, and quantify microscopic plastic particles typically less than 5 millimeters in size across various environmental and industrial settings. Detection techniques, including spectroscopy (FTIR, Raman), mass spectrometry, and advanced imaging (electron microscopy), enable accurate identification of polymer types and concentrations in samples. These solutions are applied across freshwater, marine, air, and terrestrial ecosystems, as well as in various industries, including water treatment, food & beverage, cosmetics, pharmaceuticals, and environmental monitoring. The analysis plays a crucial role in assessing plastic pollution, protecting human health, ensuring product safety, and facilitating regulatory compliance.

Key Stakeholders

- Microplastic Detection Manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers of raw materials and manufacturing equipment

- Microplastic Detection Traders, Distributors, and Suppliers

- Standards Development Officers

- Environmental Protection Agency (EPA) Officials

- Research and development (R&D) companies

- Laboratory Directors

- Analytical Chemists

- QA/QC Managers

- Government Agencies

- Regulatory Agencies

- Solid Waste Management Directors

Report Objectives

- To define, describe, and forecast the microplastic analysis market based on product type, analyte type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global microplastic analysis market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global microplastic analysis market

- To analyze key growth opportunities in the global microplastic analysis market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East & Africa (GCC Countries and the Rest of Middle East & Africa)

- To profile the key players in the microplastic analysis market and comprehensively analyse their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global microplastic analysis market, such as agreements, expansions, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies.

Company Information

- Detailed analysis and profiling of additional market players (up to three).

Geographical Analysis

- A further breakdown of the Rest of Asia Pacific microplastic analysis market into countries

- A further breakdown of the Rest of European microplastic analysis market into countries

- A further breakdown of the Rest of Latin American microplastic analysis market into countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Microplastic Analysis Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Microplastic Analysis Market