Modified Cassava Starch Market

Modified Cassava Starch Market by Product Type (Pre-Gelatinized Starches, Extruded Cassava Starch, Dextrinized Starches, Maltodextrins, Fermented Cassava Starch), Form, Application, Type of Modification, Function, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The modified cassava starch market is expected to reach USD 3.37 billion by 2030, from USD 2.52 billion in 2025, with a CAGR of 6.0%. Consumer preference for gluten-free, non-GMO, and minimally processed ingredients is boosting the use of cassava-based modified starches in baked goods, dairy alternatives, sauces, baby foods, and plant-based formulations.

KEY TAKEAWAYS

- The Asia Pacific dominated the modified cassava starch market, accounting for a 49.6% share in 2024.

- Chemical modification dominates the modified cassava starch market.

- By form, the dry segment accounted for the largest share (85.5%) of the modified cassava starch market in terms of value in 2024.

- The fermented cassava starch segment is expected to be the fastest-growing product type with a CAGR of 7.2% during the forecast period (2025–2030).

- By application, the food & beverages segment is projected to dominate during the forecast period.

- Roquette, ADM, Cargill, Ingredion Incorporated, and Thai Wah Public Company Limited were identified as star players in the modified cassava starch market, given their strong market share and extensive product footprint.

- Neo Nam Viet Co., Ltd., Vietnam Tapioca Starch Solutions, General Starch Limited, and Starch Asia, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Modified cassava starch is becoming an essential component across food, packaging, pharmaceutical, and industrial applications. It enables manufacturers to meet evolving consumer and regulatory demands while ensuring sustainability, cost efficiency, and functionality. There are significant opportunities to innovate and expand the use of modified cassava starch in biodegradable packaging, clean-label foods, bio-based adhesives, and specialty industrial applications worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Incorporating clean-label innovation, functional versatility, and sustainable sourcing in modified cassava starch improves product performance, meets changing regulatory and dietary needs, and opens up new application opportunities, driving market expansion and reshaping competitive dynamics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Diversified food and industrial applications

-

Superior functional properties

Level

-

Climate volatility and agricultural dependence

-

Technological and infrastructure limitations

Level

-

Rise of clean label and gluten free trends

-

Emerging applications of modified cassava starch

Level

-

Competitive threat from substitute starches

-

Geopolitical tensions and trade barriers stirring market volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Diversified food and industrial applications

Modified cassava starch is valued for its multifunctional properties, making it essential in both food and industrial sectors. In food, it acts as a thickener, stabilizer, and gelling agent, effectively used in products like sauces, soups, dairy items, and gluten-free baked goods. About 65% of starches in food processing are modified, highlighting their importance in product quality. In industrial applications, modified cassava starch enhances paper strength and printability, aids in textile processing, and serves as a natural excipient in pharmaceuticals. Its biodegradability positions it well for bioplastics and adhesives in line with sustainability trends. Research in Thailand, supported by the Ministry of Higher Education, has advanced its use in sustainable materials. A 2021 study from King Mongkut’s University explored using cassava by-products for energy efficiency, promoting low-waste starch processing.

Restraint: Climate volatility and agricultural dependence

According to FAOSTAT, global cassava production reached approximately 330 million tons in 2022, with Nigeria contributing around 60 million tons, followed by DRC, Thailand, and Brazil. Although cassava is recognized for its drought resilience and ability to grow in poor soils, its output remains highly vulnerable to climate fluctuations such as flooding, and unpredictable rainfall patterns can affect yields. These environmental risks are intensified by increasing costs of essential agricultural inputs like fertilizers, fuel, and labor, all of which raise production costs and create uncertainty in supply chains. Consequently, processors of modified cassava starch face unstable raw material availability and pricing.

Opportunity: Rise of clean label and gluten free trends

The global increase in gluten-free and clean-label food consumption is changing ingredient demand across various sectors. According to the Gluten-Free Certification Organization, the gluten-free market was valued at over USD 6 billion in recent years and continues to grow steadily due to higher diagnoses of celiac disease and gluten sensitivity, along with a broader consumer preference for “clean” and minimally processed foods. This trend indicates a shift toward transparency, simplicity, and allergen-friendly formulations. As more consumers seek health-conscious and allergen-free products, there is a significant growth opportunity for modified cassava starch, supported by regulatory environments that favor clear labeling and ingredient transparency.

Challenge: Competitive threat from substitute starches

In global starch markets, tapioca starch competes strongly with corn and potato starch, which often have advantages in cost or performance. Corn starch benefits from large-scale production in the US and China, making it a widely available and cost-effective option for many industrial uses. Meanwhile, potato starch, mostly produced in Europe, is favored for its superior functional qualities, such as better clarity and freeze-thaw stability in sauces, frozen foods, and specialty items. Additionally, emerging sources like pea and rice starch are gaining popularity, especially in gluten-free, vegan, and clean-label food markets. Pea starch is increasingly used in bioplastics, cosmetics, and baby formulas, highlighting its expanding range of applications. These developments increase competition for modified cassava starch, which must demonstrate its value through cost-efficiency, supply stability, and positive ingredient perception.

modified cassava starch market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Focus on clean-label and specialty starches derived from cassava for dairy, bakery, and beverages | Innovation in functional ingredients, ability to meet rising demand for healthier food formulations |

|

Development of modified cassava starches for food applications (thickeners, stabilizers, texturizers) | Wide product portfolio, strong presence in food & beverage sector, global distribution network |

|

Food-grade and nutrition-focused cassava starch derivatives | Provides unique technical and texture properties suited to sauces that require stability under challenging conditions |

|

Modified tapioca blends for bakery and confectionery applications | Enhances texture, moisture retention, and shelf life in baked goods, providing a soft crumb and improved freshness in bread, cakes, and pastries |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The modified cassava starch market ecosystem involves interconnected relationships among key stakeholders, including modified cassava starch manufacturers, technology providers, primary user companies, and regulatory bodies. Manufacturers like Cargill, Ingredion, ADM, Roquette, SPAC, and Thai Wah produce modified starch products with enhanced functional properties. These manufacturers rely on technology providers such as GEA and Microtec Engineering Group for the specialized machinery and engineering solutions required for starch modification. The manufactured starch is then supplied to multinational corporations in the food and consumer goods industries, including Nestlé, Kellogg's, PepsiCo, P&G, and Unilever. They incorporate the modified starch into their products for various purposes, such as thickening, stabilizing, and texturizing. This integrated supply chain is overseen by regulatory bodies like the FDA, USDA, and EFSA, which ensure product safety, quality, and compliance with food and industrial standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Modified Cassava Starch Market, By Type of Modification

Chemical modification dominates the market. This strong position is due to its wide applicability across industries such as food, paper, textiles, and pharmaceuticals, where enhanced properties like thermal stability, resistance to acids, and improved texture are essential. Physical modification is the second-largest segment; this method is especially popular in clean-label and non-chemical formulations, aligning with the growing consumer demand for natural ingredients. Enzymatic modification, though the smallest segment, is expected to grow quickly because of its precision, eco-friendliness, and increasing use in high-value applications like pharmaceuticals and specialty foods.

Modified Cassava Starch Market, By Application

Food & beverages remain the largest segment, supported by modified cassava starch's role as a thickener, stabilizer, and texture enhancer in processed foods, baked goods, dairy products, and ready meals. The growing global demand for clean-label, gluten-free, and plant-based food options further boosts cassava starch adoption in this sector. The industrial segment is the fastest-growing. Its expansion is driven by the increasing applications of modified cassava starch in paper manufacturing, textiles, adhesives, and biodegradable materials. Environmental regulations and the push for bio-based alternatives to petroleum-derived inputs are encouraging industrial users to adopt renewable and biodegradable starch solutions.

REGION

North America to be fastest-growing region in modified cassava starch market

North America is expected to experience the fastest growth in the modified cassava starch market. Bioethanol policies have decreased corn availability for starch production, causing supply and price pressures. As a result, industries are turning to alternatives like cassava starch, which provides similar functional properties. Advances in starch modification techniques further boost cassava starch demand in the region. In the US, modified cassava starch is commonly used in gluten-free baked goods, processed snacks, sauces, and meat substitutes because of its excellent thickening and stabilizing qualities. Specialty types, such as pregelatinized and cross-linked starches, are gaining popularity in functional food applications. In Canada, the market benefits from a growing preference for organic and non-GMO modified starches, especially in frozen foods, baby nutrition, and dairy alternatives. Strict labeling and food safety standards are driving the demand for high-quality, clean-label starches.

modified cassava starch market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the modified cassava starch market, Thai Wah (Thailand), positioned as a Star, leads the market with its extensive portfolio of modified cassava starches tailored for various food and industrial applications. These are supplied to local and foreign markets, with key exports to China, Japan, South Korea, Indonesia, and other countries in East Asia and the ASEAN region. These modified starches are used in various industrial applications, including the food and paper industries, supporting Thai Wah’s position as a major player in the regional and global starch markets. Agrana (Austria) is recognized as an Emerging Leader; the company benefits from integrated supply chains and established industry relationships. Its strategic joint venture with Ingredion to expand starch production in Romania aims to boost capacity, reduce costs, and strengthen supply and innovation across Europe, the Middle East, and Africa.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.39 Billion |

| Revenue Forecast in 2030 | USD 3.37 Billion |

| Growth Rate (2025–2030) | 6.00% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD Million), Volume (Tons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trend |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

WHAT IS IN IT FOR YOU: modified cassava starch market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand analysis of modified cassava starch across food and beverages, industrial and feed applications |

|

|

| Market trend analysis of types of modifications |

|

|

| Market share of powder, liquid, additive forms |

|

|

RECENT DEVELOPMENTS

- June 2025 : Agrana Stärke GmbH and Ingredion Germany formed a joint venture, with Ingredion acquiring a 49% stake in Agrana’s Romanian starch company, S.C. AGFD ?andarei s.r.l. This aims to increase the starch production capacity, improve cost efficiency, and strengthen competitiveness in the EMEA region.

- November 2024 : Thai Wah partnered with Japan’s Fuji Nihon Corporation to form a joint venture aimed at driving innovation in the agri-food sector. This focuses on producing and distributing tapioca starch and related products, with the new company based in Thailand—Thai Wah holding a 51% stake and Fuji Nihon 49%. The partnership seeks to expand its market presence across the Asia Pacific region, enhance global distribution, and develop sustainable, health-focused food solutions. Both companies are committed to leveraging food science and technology to meet evolving consumer needs while promoting environmental sustainability.

- August 2024 : Roquette Frères, a global leader in plant-based ingredients, introduced four new hydroxypropylated tapioca starches under the CLEARAM TR line. These cook-up starches are designed to improve viscosity, consistency, and elasticity in various food applications such as sauces, dairy desserts, yogurts, and bakery fillings. The launch aims to meet evolving texture demands in the food industry and complements Roquette’s existing botanical starch offerings.

- January 2024 : SMS Corporation launched a new product KREATION 10 CS a modified tapioca starch. Its benefit is improving puffing ability and expansion in snack products.

- December 2023 : SMS Corporation and KMUTNB agreed to enter into a cooperation by signing a memorandum of understanding on bioplastic development from tapioca innovation.

Table of Contents

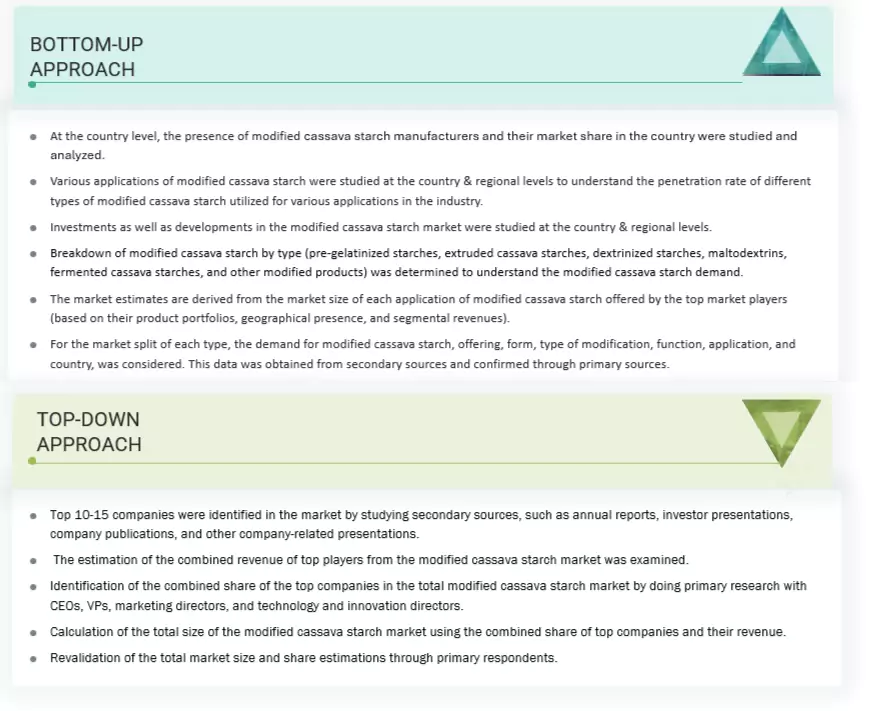

Methodology

The study involved two major approaches in estimating the current size of the modified cassava starch market. Exhaustive secondary research was carried out to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

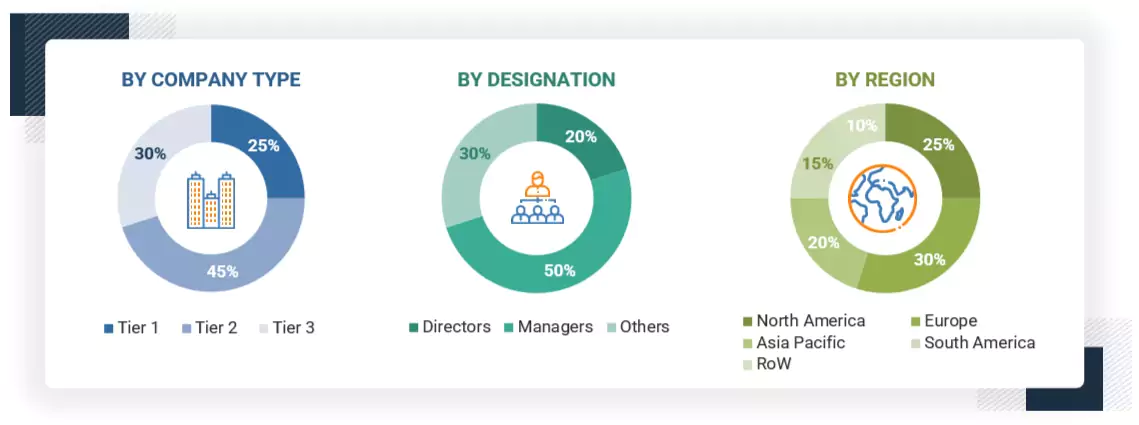

Extensive primary research was conducted after obtaining information regarding the modified cassava starch market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to modified cassava starch forms, types of modification, functions, applications, and regions. Stakeholders from the demand side, such as food and beverage manufacturers, pharmaceutical and nutraceutical companies, and industrial and textile processors, were interviewed to understand the buyers’ perspective on the suppliers, products, and their current usage of modified cassava starch and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per

the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100

million = Revenue = USD 1 billion; Tier 3: Revenue

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY |

DESIGNATION |

|

Archer Daniels Midland Company (US) |

General Manager |

|

Ingredion (US) |

Sales Manager |

|

Cargill (US) |

Manager |

|

Roquette (France) |

Head of Processing Department |

|

SPAC Starch Products Private Limited (India) |

Marketing Manager |

|

Thai Wah (Thailand) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the modified cassava starch market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Modified Cassava Starch Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall modified cassava starch market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Modified cassava starch is a derivative of native cassava starch, which is extracted from the root of the cassava plant. The native starch is altered to enhance its properties for specific applications through various physical, chemical, or enzymatic processes. These modifications improve the starch’s stability, texture, water retention, heat resistance, and shelf life, making it more suitable for demanding industrial and food processing conditions. The ability to tailor its properties through different modification techniques enables its use in a diverse range of applications, meeting the growing demand for functional and diet-specific ingredients in the global market.

Stakeholders

- Manufacturers, dealers, and suppliers of modified cassava starch

- Food and beverage manufacturers

- Paper and packaging manufacturers

- Textile and laundry product manufacturers

- Raw cassava and starch suppliers

- Pharmaceutical formulation companies

- Machinery and technology providers for starch modification

- Adhesive and construction material manufacturers

- Chemical suppliers for starch processing

-

Regulatory bodies and institutions:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Central Food Technological Research Institute (CFTRI)

- European Food Safety Authority (EFSA)

- National Agency for Food and Drug Administration and Control (NAFDAC)

- ASEAN Food and Beverage Alliance (AFBA)

- Logistics providers & transporters

- Technology consultants and agri-business strategy firms

- Export-import traders and global starch distributors

-

Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sector

Report Objectives

- To determine and project the size of the modified cassava starch market based on product type, form, type of modification, function, application, and region in terms of value over five years, ranging from 2025 to 2030.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the modified cassava starch market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

cProduct Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe modified cassava starch market into key countries.

- Further breakdown of the Rest of Asia Pacific modified cassava starch market into key countries.

- Further breakdown of the Rest of South America modified cassava starch market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the modified cassava starch market?

The modified cassava starch market is estimated to be USD 2.52 billion in 2025 and is projected to reach USD 3.37 billion by 2030, at a CAGR of 6.0% during the forecast period.

Which are the key players in the market, and how intense is the competition?

ADM (US), Cargill, Incorporated (US), Roquette Frères (France), Ingredion Inc. (US), Thai Wah Public Company Limited (Thailand), Agrana (Austria), Banpong Tapioca (Thailand), and Sonish Starch Technology Co., Ltd. (Thailand) are some of the key market players.

The market for modified cassava starch is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing.

Which region is projected to account for the largest share of the modified cassava starch market?

Asia Pacific, particularly Thailand and Vietnam, has a high market share, driven by a combination of agricultural abundance, low-cost production, industrial demand, and global export capacity.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the modified cassava starch market?

The drivers for the modified cassava starch market include growth in cassava production, diversified food and industrial applications, superior functional properties, government support, and agricultural development.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Modified Cassava Starch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Modified Cassava Starch Market