Multimodal Transport Market

Multimodal Transport Market By Configuration (Two Mode, Three Mode, Hybrid/ Others), End-use Industry (Retail, Food & Beverages, Pharmaceuticals & Healthcare, Chemicals & Materials, Manufacturing), Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The multimodal transport market is projected to grow from USD 98.61 billion in 2025 to USD 159.30 billion in 2032 at a CAGR of 7.1%, supported by rising cross-border trade volumes, expanding port–rail–road connectivity, and increasing reliance on integrated end-to-end logistics networks. Market growth is driven by the shift toward digitally coordinated multimodal services, including e-documentation, real-time cargo visibility platforms, and integrated control towers that enhance reliability and reduce transit variability. Global supply-chain realignments driven by trade uncertainties, near-shoring initiatives, and diversification of freight corridors are accelerating the adoption of modal mix and strengthening long-term market expansion.

KEY TAKEAWAYS

-

BY CONFIGURATIONThe two-mode configuration dominates the multimodal transport market, holding a market size of USD 74.29 billion in 2025.

-

BY END-USE INDUSTRYThe manufacturing segment leads the multimodal transport market and is projected to reach USD 45.54 billion in 2032.

-

BY REGIONThe Asia Pacific leads the multimodal transport market, with a 41.3% market share in terms of value.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)DSV, Deutsche Post AG, Kuehne+Nagel, and A.P. Moller-Maersk have been identified as some of the star players in the multimodal transport market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE (STARTUPS)Forto and Flexport, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The multimodal transport market is shaped by advancements in digital integration, including real-time visibility platforms, automated handoff management, and unified documentation systems, which enable faster and more reliable cross-mode coordination. The growing use of AI-driven route optimization, IoT-enabled asset tracking, and control-tower orchestration is increasing operational efficiency and boosting multimodal adoption across major trade corridors. Expanding port–rail–road connectivity and inland logistics capacity support higher shipment density and reduce transit variability, while sustainability regulations are encouraging shippers to adopt lower-emission modal combinations. Infrastructure bottlenecks, labor shortages, and customs complexity remain challenges, prompting operators to invest in network expansion, digital modernization, and strategic partnerships to support next-generation multimodal logistics models.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The multimodal service mix is shifting toward digitally coordinated two-mode solutions, integrated distribution services, and visibility-enabled cross-border flows, driven by port–rail–road integration and rising service standardization. Innovations in control-tower platforms, e-documentation, and automated handoff management are enabling faster, more reliable multimodal execution with lower variability. The growing adoption of AI-based routing, IoT tracking, and sustainability-driven modal shift programs is further expanding the demand for integrated multimodal logistics models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Cost efficiency through optimization and dynamic mode routing

-

Electrification to dominate freight movement

Level

-

Dominance of road transport due to its flexibility and reliability

-

Limited adoption among SMEs due to complexity and resource constraints

Level

-

Market access and entry into new trade routes

-

Reduction of trade barriers for smoother cross-border movement of goods.

Level

-

Regulatory and legal barriers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Cost efficiency through optimization and dynamic mode routing

Cost efficiency in multimodal transport is increasingly driven by optimization and dynamic mode routing, allowing shippers to balance cost and transit time without compromising service levels. By continuously analyzing network capacity, congestion patterns, and lane performance, operators can shift between rail, road, and sea based on real-time conditions. This reduces empty miles, minimizes detention and demurrage, and improves asset utilization across corridors. As digital visibility and predictive tools mature, dynamic routing is becoming a proactive cost-control strategy rather than a reactive planning adjustment.

Restraint: Dominance of road transport due to its flexibility and reliability

The dominance of road transport continues to slow the shift toward multimodal logistics because companies rely on its high flexibility and easy point-to-point movement for most shipments. Road networks offer quick scheduling and predictable delivery, making businesses less willing to experiment with rail or combined mode options. In many regions, limited rail connectivity and coordination requirements add extra effort compared to a single-mode road movement. As a result, shippers often stick to familiar road-based workflows, hindering wider adoption of cost-efficient and sustainable modal alternatives.

Opportunity: Market access and entry into new trade routes

Expanding market access and entry into new trade routes is becoming a major opportunity for the multimodal transport market as global supply chains diversify beyond traditional lanes. Companies are increasingly exploring alternate corridors and emerging regional hubs to reduce dependence on congested routes and geopolitical risk. New port linkages, cross-border agreements, and inland terminal developments are enabling smoother rail–road–sea connectivity and opening access to previously underserved markets. As shippers enter new regions, the need for integrated multimodal partners grows, supporting faster market penetration and more resilient distribution networks.

Challenge: Regulatory and legal barriers

Regulatory and legal barriers remain a major challenge for multimodal transport, as policies and compliance requirements vary widely across regions and border points. Differences in customs procedures, documentation standards, and liability rules create additional coordination effort and longer clearance times for shippers. In many markets, fragmented licensing frameworks and limited mutual recognition between authorities make it difficult to seamlessly link rail, road, and port operations. These inconsistencies increase operational risk and discourage companies from adopting multimodal solutions, slowing efficiency gains and cross-border network expansion.

multimodal-transport-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Shift from air-only China–Brazil lane to multimodal MIMEX solution; major emission reduction while maintaining service levels | Single coordinated ocean–road–air flow under DHL management; lower logistics costs and improved supply-chain reliability |

|

End-to-end UK logistics support covering inbound warehousing, e-commerce fulfilment, store deliveries, and returns via DSV | Streamlined operations with improved service responsiveness; dedicated account management, flexible drop-ship adaptation, and eVisibility-based real-time tracking |

|

Consolidation of fragmented shipments from 100+ brands into ~5,000 full truckloads via C.H. Robinson; optimization of seasonal beauty displays and fixture distribution with drayage and transloading support | Achieved ~98% on-time delivery across consolidated loads; saved ~12,000 labor hours annually by reducing in-store handling effort |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem for multimodal transport is shaped by four interconnected participant groups that enable end-to-end cargo movement. Multimodal transport operators act as the central coordinators, managing mode combinations, routing, and service execution under a single contract. Infrastructure and terminal operators provide the backbone through ports, rail terminals, inland depots, and logistics parks that support smooth handoffs across modes. Technology providers enable digital visibility, documentation, and control-tower integration, improving reliability and decision-making. End-use industries such as manufacturing, retail, manufacturing, and chemicals & materials drive demand patterns, influencing lane selection, service intensity, and network expansion priorities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Multimodal Transport Market, By Configuration

Two-mode configurations are expected to hold the largest share in the multimodal transport market, supported by their balance of cost efficiency and reliable transit performance. They combine long-haul advantages of rail or sea with the flexible first- and last-mile reach of road, making them the preferred choice for most regional and cross-border flows. Increasing adoption across manufacturing, retail, and pharmaceuticals & healthcare further reinforces two-mode dominance as companies prioritize simpler coordination and faster scalability.

Multimodal Transport Market, By End-use Industry

Manufacturing is expected to hold the largest share of the multimodal transport market, driven by high shipment frequency and the continuous movement of components and finished goods across regional and global supply chains. The segment relies heavily on cost-efficient rail–road and road–sea combinations to support just-in-time and just-in-sequence production models. Ongoing investments in industrial corridors, export-oriented output, and supplier base expansion continue to reinforce manufacturing as the leading end-use segment.

REGION

Asia Pacific to be largest market for multimodal transport market during forecast period

The Asia Pacific is expected to hold the largest share of the multimodal transport market, driven by strong export-led manufacturing and dense trade corridors across China, Japan, South Korea, and Southeast Asia. Massive investments in port modernization, rail–road integration, and inland logistics parks are accelerating multimodal capacity and network efficiency. Rapid growth in regionalized supply chains, cross-border e-commerce, and near-shoring continues to reinforce the region’s leadership. Ongoing government initiatives, such as digital documentation mandates and multimodal policy incentives, are further boosting adoption and long-term market momentum.

multimodal-transport-market: COMPANY EVALUATION MATRIX

In the multimodal transport market matrix, DSV (Star) leads with its extensive global network, integrated freight forwarding and warehousing capabilities, and strong multimodal orchestration across rail–road–sea routes driving large-scale adoption for end-to-end logistics and cross-border flow optimization. GEODIS (Emerging Leader) is gaining momentum through accelerated expansion in contract logistics, enhanced visibility platforms, and growing multimodal service offerings, showing strong potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DSV (Denmark)

- Deutsche Post AG (Germany)

- Kuehne+Nagel (Switzerland)

- NIPPON EXPRESS HOLDINGS (Japan)

- A.P. Moller ? Maersk (Denmark)

- CMA CGM Group (France)

- Marubeni Corporation (Japan)

- C.H. Robinson Worldwide, Inc. (US)

- GEODIS (France)

- XPO, Inc. (US)

- NYK Line (Japan)

- Expeditors International of Washington, Inc. (US)

- United Parcel Service of America, Inc. (US)

- Hapag-Lloyd AG (Germany)

- KLN Logistics Group Limited(China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 95.80 BN |

| Market Forecast in 2032 (Value) | USD 159.30 BN |

| Growth Rate | CAGR of 7.1% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Billion-Ton-Km) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • To segment and forecast the market based on configuration (two-mode, three-mode, hybrid/others)• To segment and forecast the market by end-use industry (retail, chemicals & materials, manufacturing, oil & gas, pharmaceuticals & healthcare, food & beverages, others) |

| Regions Covered | Asia Pacific, Europe, North America, and Rest of the World |

WHAT IS IN IT FOR YOU: multimodal-transport-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Multimodal Transport Operator | • Go-to-market assessment for new players • Global competitor benchmarking | • Informed launch strategy • Prioritized partnerships for various players |

| Shipper | • Mode-mix feasibility assessment for China–Europe and intra-Asia flows | • Reduced transport spends with stable service levels • Better planning accuracy and risk-reduced supply chain |

| 3PL / 4PL Logistics Provider | • Value-added services benchmarking (consolidation, returns, e-documentation) • Digital capability gap assessment for visibility and control-tower integration | • Strengthened differentiation in customer bids • Faster onboarding of multimodal clients |

| Multimodal Transport Operator | • Digital readiness assessment for visibility, e-documentation, and control-tower integration • Adoption roadmap for phased multimodal digitalization | • Faster exception handling and reduced manual workload |

RECENT DEVELOPMENTS

- September 2025 : Deutsche Post AG, through its business unit DHL Supply Chain, acquired SDS Rx.com, specializing in final-mile delivery and transportation for long-term care facilities, specialty pharmacies, and health system networks. This acquisition strengthens DHL’s capabilities in the life sciences and healthcare sector. It enables the company to deliver integrated, time-critical logistics solutions across every stage of the LSHC supply chain.

- September 2025 : CMA CGM announced the acquisition of Freightliner UK Intermodal Logistics, a leading rail freight and terminal operator in the UK. The deal strengthens CMA CGM’s intermodal and rail logistics presence in Europe, aligning with its strategy to promote sustainable, low-carbon transport through a modal shift from road to rail. Freightliner will continue to operate independently as a multi-user and multi-customer rail logistics provider while benefiting from CMA CGM’s global logistics and shipping network. The transaction is expected to close in early 2026, subject to regulatory approval.

- April 2025 : DSV completed the acquisition of DB SCHENKER. The deal significantly enhances DSV’s global logistics network, doubling its size and expanding its workforce across more than 90 countries. This transformative acquisition establishes DSV as a world-leading transport and logistics provider, strengthens its ability to deliver end-to-end supply chain solutions, and provides a solid foundation for sustainable, digital, and flexible growth.

- February 2025 : NIPPON EXPRESS HOLDINGS completed the acquisition of 100% shares of Simon Hegele, making it a wholly owned subsidiary. Simon Hegele operates over 50 locations globally with around 2,800 employees and is recognized for its customized logistics services in the healthcare, industrial, retail, and pharmaceutical sectors. This acquisition strengthens NIPPON EXPRESS HOLDINGS’ presence in Europe and supports its strategic expansion in healthcare-focused logistics, with both companies aiming to leverage their complementary strengths and global market access to deliver innovative, integrated logistics solutions worldwide.

- November 2024 : Kuehne+Nagel announced the acquisition of a 51% majority stake in IMC Logistics, a leading US marine drayage and intermodal transport provider. With this strategic investment, Kuehne+Nagel strengthens its access to one of North America’s most critical logistics networks, enhancing its flexibility and resilience in managing end-to-end intermodal solutions. The acquisition builds on a long-standing collaboration between the two firms, and the IMC brand will be retained to ensure continuity while it integrates with Kuehne+Nagel’s global sea logistics network.

Table of Contents

Methodology

The research study extensively utilizes secondary sources, including company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the multimodal transport market. In-depth interviews have been conducted with various primary sources, experts from related industries, multimodal operators, and service providers, to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and trade-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data have been collected and analyzed to determine the overall market size, which has been further validated by primary research.

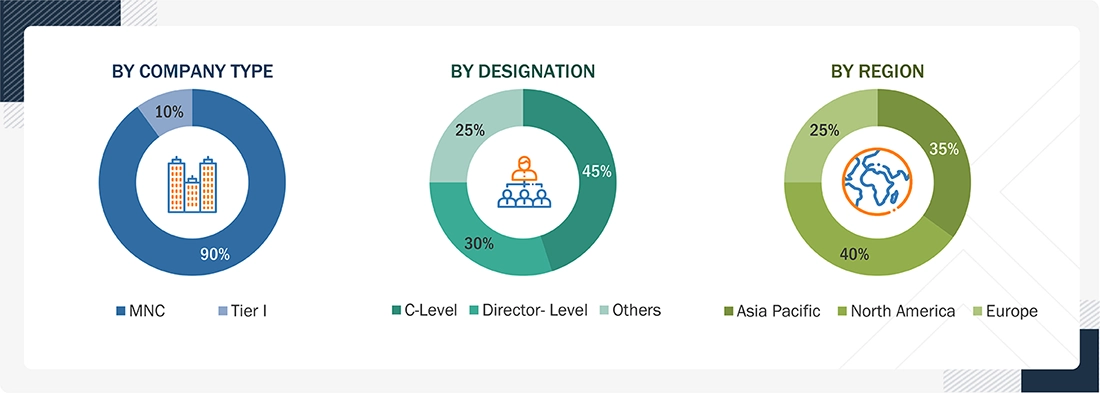

Primary Research

Extensive primary research has been conducted following the development of a comprehensive understanding of the multimodal transport market through secondary research. Multiple interviews have been held with stakeholders from both the demand and supply sides. Demand-side participants include manufacturers, retail and e-commerce logistics teams, and global shippers responsible for planning inbound and outbound distribution. Supply-side respondents comprise freight forwarders, integrated logistics providers, port and terminal operators, rail and inland transport companies, and industry associations involved in corridor development and policy. The study covers respondents across North America, Europe, the Asia Pacific, and emerging trade markets in the Middle East and South Asia. Approximately one-third of interviews have represented the demand side, while the remaining share has come from service providers and infrastructure operators. Primary insights have been collected through structured questionnaires, virtual discussions, and email interactions with experts in network planning, procurement, digital transformation, and operations, capturing their perspectives on service requirements, capacity constraints, technology adoption, and future investment priorities.

Following these interviews, brief validation sessions have been conducted with independent logistics consultants, and the findings have been further reviewed by in-house subject matter specialists to ensure accuracy and alignment with industry developments.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As outlined below, a comprehensive market estimation methodology has been applied to assess and validate the volume and value of the multimodal transport market, as well as its associated subsegments.

- Mapped country-level freight transport volumes (in billion ton-kilometers) using data from national transport authorities, logistics associations, paid databases, and global sources such as the World Bank, UNCTAD, and OECD

- Calculated multimodal freight penetration for each country and region based on mapped freight movement and modal usage patterns

- Developed multimodal freight forecasts using macroeconomic indicators, international trade growth, infrastructure investments, logistics performance indices, and government initiatives supporting intermodal connectivity and sustainable transport

- Derived market segments by mapping across transport modes (road, rail, sea, air) and evaluating freight volumes, network connectivity, infrastructure capacity, and integration efficiency for each country/region

- Refined segment estimates using insights from primary interviews with logistics providers, infrastructure operators, and industry experts

- Aggregated country-level freight volumes to determine total regional and global multimodal transport volumes

- Converted volumes to market value by multiplying average freight rates (USD per ton or TEU) for each mode with corresponding multimodal freight volumes at the country level

- Summed regional and service type values to derive the final global market size for the multimodal transport market

Multimodal Transport Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the outlined methodology, the multimodal transport market has been further segmented across configuration types, end-use industries, and regions. A data triangulation process has been applied to validate these breakdowns and ensure accuracy in the final market figures. This involved cross-verifying extrapolated estimates through multiple lenses, including regional trade flows, infrastructure capacity, policy developments, and service adoption trends, utilizing inputs from both demand-side stakeholders (shippers and manufacturers) and supply-side participants (logistics providers and corridor operators). By reconciling insights from secondary datasets, primary interviews, and macro-economic indicators, the final values for each segment and subsegment have been refined to reflect a consistent and reliable market assessment./p>

Market Definition

The multimodal transport market refers to the integrated movement of freight using two or more modes of transportation, such as road, rail, air, or inland waterways, under a single contract or operator with standardized units, such as containers (20ft or 40ft), to ensure seamless handoffs. Multimodal transport enables efficient transit across multiple transport systems, reducing handling time, transit delays, and overall logistics costs. Multimodal transport leverages the strengths of each mode, combining flexibility, cost efficiency, and environmental benefits to optimize end-to-end supply chain operations. This approach is increasingly adopted in global trade, urban mobility, and logistics networks, supported by growing infrastructure investments, digital tracking systems, and sustainable transportation initiatives. Rail manages the longest leg in multimodal freight transport, accounting for the bulk of freight volume.

Key Stakeholders

- Government & Regulatory Bodies

- Infrastructure Developers & Operators

- Logistics & Transport Service Providers

- Technology & Solution Providers

- Financial & Investment Institutions

- Trade Associations & Multilateral Organizations

- End-use Industries

Report Objectives

- To analyze and forecast the multimodal transport market in terms of volume (billion-ton-km) and value (USD billion) from 2025 to 2032

-

To segment and forecast the multimodal transport market size in terms of volume and value based on the following:

- By configuration type (two-mode, three-mode, hybrid/others)

- By end-use industry (retail, food & beverages, chemicals & materials, pharmaceuticals & healthcare, manufacturing, oil & gas, and other end-use industries)

- By region (North America, Europe, the Asia Pacific, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the evaluation matrix of leading players operating in the market

- To strategically analyze the key player strategies and company revenue analysis of key players in the market from 2021 to 2025

-

To study the following aspects of the report

- Trends/Disruptions Impacting Multimodal Transport Market

- Market Ecosystem

- Technology Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Pricing Analysis

- Macroeconomic Outlook

- Company Valuation and Financial Metrics

- Brand and Product Comparison

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments and launches, and other activities undertaken by the key industry participants

Available Customizations:

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to 5)

- Multimodal Transport Market, By Container Freight, At Regional Level

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Multimodal Transport Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Multimodal Transport Market