Natural Disaster Management Market

Natural Disaster Management Market by Solution (Seismic Warning & Monitoring Systems, Flood Beacons, Lightning Detectors), Application (Volcano Detection, Forest Fire Detection, Landslide Detection, Earthquake Detection) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The natural disaster management market is projected to expand from USD 63.95 billion in 2024 to USD 114.04 billion by 2029, at a CAGR of 12.3% during the forecast period. The increasing occurrence of hurricanes, floods, wildfires, and other extreme weather patterns, intensified by climate change, necessitates advanced disaster management solutions.

KEY TAKEAWAYS

-

BY OFFERINGThe natural disaster management market comprises solutions and services. The solutions encompass proactive measures such as seismic warning and monitoring systems, flood beacons, floating sensor networks, lightning detectors, acoustic real-time monitoring systems, and other solutions. These solutions aim to minimize damage, protect lives, and enhance community resilience against disasters like earthquakes, hurricanes, floods, and wildfires

-

BY APPLICATIONThis section provides details of the natural disaster management market by application and is segmented into volcano detection, flood detection, forest fire detection, landslide detection, earthquake detection, victim localization and positioning, weather monitoring, and other applications (storm, drought, and extreme temperature detection). These natural disasters can be devastating, leading to property damage and loss of human lives. To eliminate or lessen the impacts of these natural disasters, IoT-based systems and sensors detect various natural disasters

-

BY END USERThis segment comprises end users such as government organizations, private companies, law enforcement agencies, and rescue personnel. Natural disaster management solutions are vital in supporting these end users in the natural disaster detection and disaster management process.

-

BY COMMUNICATION SYSTEMThe communication system segment consists of first responder tools, satellite-assisted equipment, vehicle-ready gateways, and emergency response radars. Natural disasters occur suddenly and leave the land and its people shattered. Cyclones, earthquakes, floods, and more can take a heavy toll on human life and finances. In such cases, first responders have to respond quickly, and it is necessary to have efficient communication systems. Advanced technologies such as AI, IoT, and smart devices are proposed to help the first responders.

-

BY REGIONThe natural disaster management market covers North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America has experienced significant growth in the natural disaster management market and is expected to be the largest contributor to this sector. This growth is driven by the high frequency of hurricanes, wildfires, and floods, along with advanced technological adoption and robust government support.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, in July 2024, Trimble extended its strategic partnership with Esri to enhance GIS, location intelligence, and mapping solutions, aiming to optimize processes, automate workflows, and support greener infrastructure planning and operations.

This surge in natural disasters is creating a pressing need for improved early warning systems, resilient infrastructure, and efficient emergency response mechanisms. Governments, companies and community leaders are putting much of their resources into disaster management systems to lower the damage caused by these disasters, urging developers to create better solutions through AI prediction systems advanced sensors and reliable data transmission tools.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of natural disaster management solution providers, and target applications are clients of natural disaster management solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of natural disaster management solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Escalating frequency and intensity of climate-related disasters

-

Technological advancements in IoT and AI

Level

-

Funding limitations in emerging economies

-

Interoperability and data integration issues

Level

-

Expansion of remote sensing and satellite technologies

-

Development of AI-powered predictive analytics

Level

-

Cybersecurity vulnerabilities

-

Data privacy and ethical concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Escalating frequency and intensity of climate-related disasters

The natural disaster management market experiences strong growth because of the sudden increase in climate change leading to frequent weather-related natural disasters. The World Meteorological Organization reports that disasters have risen five times since the last 50 years because of climate change and weather and water-related hazards. The disasters have led to 2 million fatalities while creating economic losses worth USD 4.3 trillion. According to a United Nations Office for Disaster Risk Reduction (UNDRR) report extreme weather events have grown more frequent and destructive leading to extensive damage across the globe. The year 2023 witnessed extreme weather resulting in massive financial damage alongside the tragic deaths of thousands of people. The necessity to implement proactive disaster management solutions has become essential for all communities. The rising need to protect lives and infrastructure and economies from escalating climate-related disaster threats drives the market. Governments and businesses together with communities worldwide experience a strong pressure to back early warning systems alongside resilient infrastructure and advanced monitoring technologies.

Restraint: Interoperability and data integration issues

Disaster management systems pose challenges to interoperability and data integration since they contain multiple advanced technologies that utilize various data sources. Multiple organizations work with different systems which prevents smooth communication and joint coordination efforts. Extensive data management capabilities and analysis tools are necessary to unify information from multiple sources including sensor networks and social media with satellite imagery. Standardized protocols together with consistent data formats become essential for complete data sharing and successful partnership between organizations. The challenge becomes more difficult because organizations need to protect both data security and privacy. The resolution of interoperability problems alongside data integration challenges demands joint efforts by technology companies and public agencies and industrial stakeholders to implement common data platforms and communication protocols

Opportunity: Expansion of remote sensing and satellite technologies

Modern remote sensing and satellite technology bring new ways to check and evaluate disasters. Remote sensing tools like satellites and LiDAR help us measure terrain features along with facility and environment factors. These systems observe weather changes and track storms while providing data about disaster outcomes. The expansion of satellite data services and image processing technology helps decrease remote sensing costs while making this technology available to more users. The availability of new technology allows developers to build creative programs that monitor floods, wildfires and assess infrastructure status with greater accuracy. Remote sensing becomes an essential disaster management tool since it can collect information from hard-to-reach locations.

Challenge: Cybersecurity vulnerabilities

Digital technologies and connected devices used in disaster management make it more vulnerable to cyberattacks. The systems used for infrastructure protection and disaster alerts plus emergency communications can be attacked maliciously. Cyberattacks harm system operations, invade data security, and slow down emergency response work. Strong security measures like data encryption combined with user permissions and threat sensors protect disaster management systems against cyberattacks. Organizations perform continuous security evaluations and tests to find and fix possible threats. Leaders from government, technology companies and cybersecurity need to work together to set up strong security plans for these systems.

Natural Disaster Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Braskem Idesa Sapi, a leading petrochemical company in Mexico, faced challenges in ensuring employee safety during natural disasters and socio-political events. It needed a reliable communication system to quickly locate and check on its employees' well-being | FACT24 allowed Braskem Idesa Sapi to effectively communicate with and locate employees during critical events, achieving a 75% response rate even after a major earthquake. The system enabled rapid roll calls, geolocation of employees in risk areas, and reliable communication despite overloaded networks. This ensured employee safety, reduced organizational risk, and provided a quick and agile response during emergencies, leading to increased confidence in its crisis management capabilities. |

|

Niagara Region, home to nearly 500,000 residents and a major tourist destination, faces challenges from severe weather, including "lake effect" winter storms, alongside other potential emergencies. The region's Emergency Management division needed a robust communication system to coordinate responses across multiple agencies and municipalities. | AtHoc streamlined emergency communication, enabling rapid and efficient alerting during critical events. The platform facilitated better coordination and collaboration among diverse agencies, saving time and resources. The ease of use allowed for widespread adoption and training across multiple departments and municipalities. During the Christmas 2022 storm, AtHoc proved instrumental in mobilizing the CERT, demonstrating its effectiveness in real-world crisis management. The region now benefits from a unified system that ensures timely and accurate communication, enhancing overall emergency preparedness and response capabilities. |

|

The Bahamas Department of Meteorology is responsible for tracking weather and issuing warnings across the archipelago, a nation of 700 islands spread over a vast ocean area, prone to hurricanes and severe weather. As a tourist-dependent nation, accurate and timely weather information is critical for both public safety and economic stability. | The enhanced weather monitoring and early warning system enabled the Bahamas Department of Meteorology to provide accurate and timely information during severe weather events, as demonstrated during Hurricane Dorian in 2019. The system helped save lives and minimize property damage by allowing citizens to prepare and seek shelter. The solution provides comprehensive situational awareness, facilitating data-driven decisions and ensuring the continuity of international flights, which is vital for the tourism industry. The Bahamas now has a reliable, nationwide early warning system, significantly improving its weather resilience and public safety. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The natural disaster management market is highly competitive and comprises many vendors who offer solutions to a specific or niche market segment. Several changes in the natural disaster management market have occurred in recent years. Currently, the vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements. NEC (Japan), Hexagon (Sweden), Nokia (Finland), Xylem (US), Esri (US), Everbridge (US), Blackberry (Canada), are some of the major players operating in this ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Natural Disaster Management Market, By Offering

Among the by solution sub-segment, the flood detection segment is estimated to account for the largest market share during the forecast period. Flood detection systems leverage advanced technologies together with monitoring systems to both trigger early alerts about potential flooding events and analyze potential risks and minimize flood damage. The implementation of loT-enabled water level sensors together with rainfall gauges and soil moisture detectors provides constant environmental monitoring for detecting upcoming flooding conditions. Al-powered predictive analytics combine historical data with weather patterns and hydrological models to generate flood predictions and warn users in advance. The early detection capability enables authorities to predict floods by determining when and how severe floods will occur which enables better resource management for disaster response. Flood detection systems help lower the economic repercussions of floods by assisting with strategic post-event recovery planning and by reducing damage to infrastructures along with agricultural areas and real estate.

REGION

North America is expected to hold the largest market share during the forecast period.

North America holds the largest revenue share in the natural disaster management market. The combination of advanced technologies such as IOT with Al and cloud computing and edge computing makes North America the leader in natural disaster management market. Natural disasters such as hurricanes, wildfires, floods and tornadoes have increased in the region to cause extensive life loss and damage to properties and economic instabilities. The United Nations launched EW4All at COP27 in November 2022 to support North American efforts in strengthening early warning systems as a defense against death and economic loss. The region uses strong economic foundations along with research capabilities to make large investments in constructing disaster-resistant management structures through smart city developments and Industrial internet and cybersecurity initiatives.

Natural Disaster Management Market: COMPANY EVALUATION MATRIX

In the natural disaster management market matrix, NEC (Star) leads with a strong market share and extensive product footprint, as they are vital for enabling AI- and sensor-based early warning, rapid response, and resilient infrastructure management. SuperMap (Emerging Leaders) solutions are important for providing advanced geospatial analytics that enhance disaster prediction, situational awareness, and decision-making efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 63.95 Billion |

| Market Forecast in 2029 (value) | USD 114.04 Billion |

| Growth Rate | CAGR of 12.3% from 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Offering, Application, End User, Communication System, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Natural Disaster Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies | Enhanced understanding of competitive positioning and product offerings |

| Leading Solution Provider | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Deeper insights into market dynamics and potential strategic partnerships |

| Leading Solution Provider | Geogaphic Analysis: Further breakdown of countries in Rest of Asia Pacific, Europe, Middle East & Africa, and Latin America | Deeper insights into remaining countries |

RECENT DEVELOPMENTS

- January 2025 : Hexagon to acquire Septentrio to boost Resilient Assured Positioning. This acquisition combines Septentrio's Global Navigation Satellite System (GNSS) expertise with Hexagon's positioning technologies, enabling advanced solutions for robotics, UAVs, and other autonomous applications. This will enhance the availability of high-accuracy and reliable positioning technology.

- November 2024 : Everbridge and Riskonnect, an integrated risk management (IRM) solutions provider, partnered to integrate business continuity management with emergency communications. This will enable organizations to improve crisis response, recovery, and resilience through real-time alerts and streamlined communication.

- October 2024 : NEC Indonesia and Sinar Mas Land formed a strategic partnership to enhance climate change resilience. This collaboration leverages Adaptation Finance, a United Nations Environment Programme (UNEP) initiative, to assess climate-related disaster risks and develop mitigation strategies. By employing disaster mitigation visualization technology, the partnership aims to improve business resilience and promote sustainable development.

- August 2024 : Swisscom Broadcast selected Nokia to deploy a nationwide Drones-as-a-Service network across Switzerland. 300 Nokia Drone-in-a-Box units are planned for deployment to enable emergency response, perimeter protection, and infrastructure inspection, which will help keep public safety workers safe.

- July 2024 : Trimble extended its strategic partnership with Esri to enhance GIS, location intelligence, and mapping solutions, aiming to optimize processes, automate workflows, and support greener infrastructure planning and operations

Table of Contents

Methodology

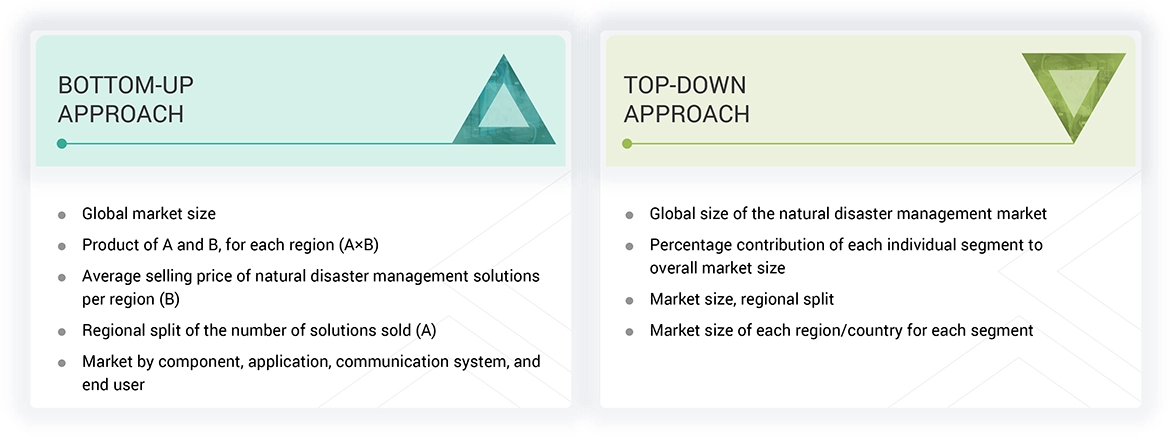

The research study involved four major activities in estimating the natural disaster management market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering natural disaster management solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations, such as the International Journal of Disaster Risk Reduction and the Journal of Homeland Security and Emergency Management. Associations such as the United Nations Office for Disaster Risk Reduction (UNDRR), International Federation of Red Cross and Red Crescent Societies (IFRC), and Global Disaster Preparedness Center (GDPC) were also referred to.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

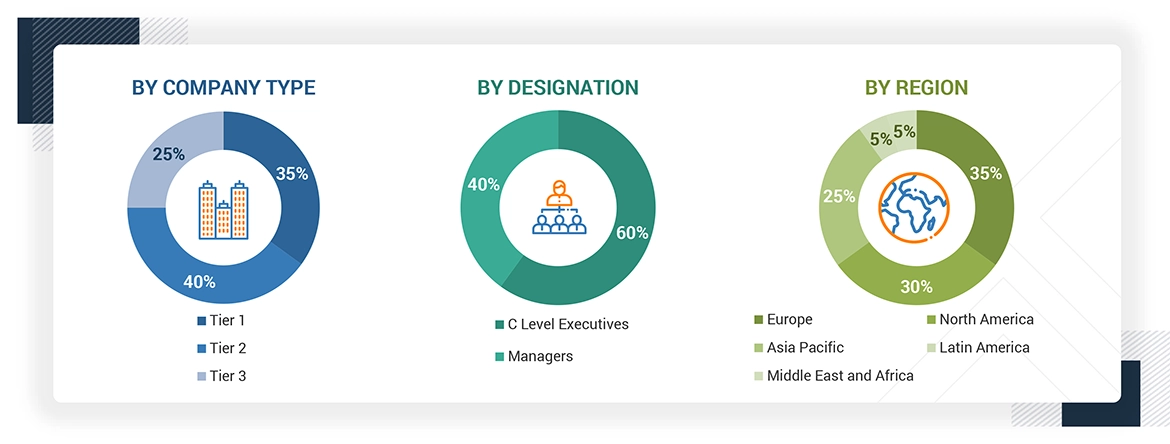

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, Such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from natural disaster management solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use natural disaster management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of natural disaster management solutions which is expected to affect the overall natural disaster management market growth.

Note 1: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies range between USD 500 million and 1 billion in overall revenues, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the natural disaster management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Natural Disaster Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the natural disaster management market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The natural disaster management market size has been validated using top-down and bottom-up approaches.

Market Definition

The natural disaster management market focuses on the technologies, solutions, and services designed to help predict, mitigate, respond to, and recover from natural disasters like hurricanes, earthquakes, floods, and wildfires. It includes a wide range of tools, such as early warning systems, emergency communication networks, geospatial mapping, and rescue equipment used by governments, emergency responders, businesses, and relief organizations.

Stakeholders

- Original Equipment Manufacturers (OEMs)

- Internet of Things (IoT) Technology Vendors

- Technology Vendors

- Managed Service Providers (MSPs)

- Networking and Communications Service Providers (CSPs)

- Consulting and Advisory Firms

- Governments and Urban Planning Agencies

- Regional Associations

- Investors and Venture Capitalists

- Independent Software Vendors

- Value-Added Resellers (VARs) and Distributors

Report Objectives

- To determine, segment, and forecast the natural disaster management market based on component, application, communication systems, end-user, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Natural Disaster Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Natural Disaster Management Market