North America Cryogenic Equipment Market

North America Cryogenic Equipment Market by Equipment (Tanks, Valves, Vaporizers, Pumps), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-use Industry (Energy & Power, Chemical, Metallurgy, Transportation), System Type - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

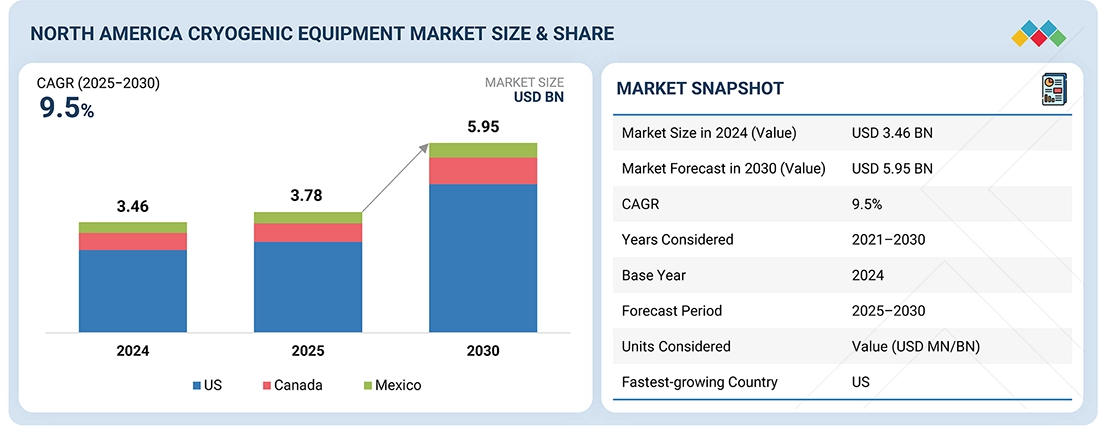

The North America cryogenic equipment market is projected to reach USD 5.95 billion by 2030 from an estimated USD 3.78 billion in 2025, growing at a CAGR of 9.5% during the forecast period. This is due to the expanding LNG export infrastructure, which is positioning the region as a global energy supplier. The industrial sectors demand for cryogens in metallurgy, transportation, electronics manufacturing etc. are rising within the region, driving its demand in the region.

KEY TAKEAWAYS

-

BY COUNTRYThe US is likely to capture a 75.3% share of the North America cryogenic equipment market in 2025.

-

BY EQUIPMENTBy equipment, the tanks segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY CRYOGENBy cryogen, the LNG segment is estimated to register a CAGR of 10.3% during the forecast period.

-

BY SYSTEM TYPEBy system type, the storage segment is expected to dominate the North America cryogenic equipment market.

-

BY END USERBy end user, the electronics segment is estimated to record a CAGR of 9.2% during the forecast period.

-

COMPETITIVE LANDSCAPELinde plc (Ireland), Chart Industries (US), Cryofab Inc. (US), Air Products and Chemicals, Inc. (US), and Taylor-Wharton (US) were identified as some of the star players in North America cryogenic equipment market.

The North America cryogenic equipment market is growing as a result of increased LNG production and export capacity, especially from US Gulf Coast facilities. Equipment investment is driven by industrial gas demand in the manufacturing, metallurgy, and electronics industries. Significant cryogenic infrastructure is needed for transportation and storage in the developing hydrogen economy. Demand is also increased by the expansion of the space industry, healthcare, and food preservation applications. Cleaner technologies that use cryogenic processes are also encouraged by stronger environmental restrictions, and continuous technological advancements improve system dependability and efficiency in all applications.

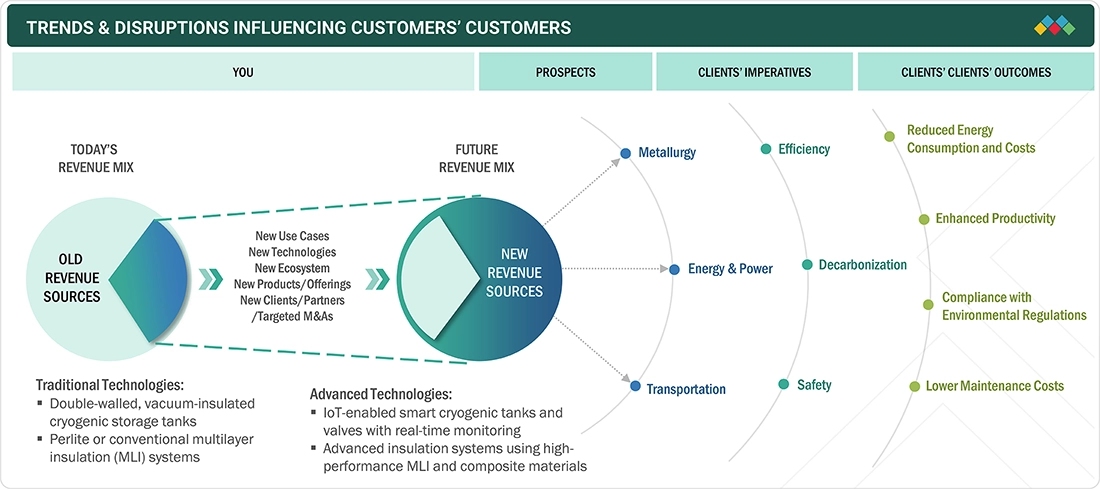

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As US maintains its position as the world's top exporter, the North America cryogenic equipment market is expected to rise significantly due to large expenditures in LNG infrastructure. Advanced cryogenic systems for chip fabrication are necessary for the semiconductor industry's regional expansion. Large-scale liquefaction and storage equipment is required for emerging hydrogen economy efforts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid transition toward clean energy

-

Increasing utilization of industrial gases in metallurgy, oil & gas, and energy power industries

Level

-

Volatile raw material and metal prices

Level

-

Launch of new space and satellite missions

-

Evolving applications of cryogenic electronics

Level

-

Hazardous and greenhouse emissions resulting from leakage of cryogenic fluids

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid transition toward clean energy

The North America cryogenic equipment market is drastically changing as a result of the rapid transition toward clean energy. Investment in LNG infrastructure as a transitional fuel has increased due to the commitment to lowering carbon emissions. The US is a major supplier of LNG worldwide. To enable fuel cell automobiles and industrial uses, the creation of a hydrogen economy presents a possibility that necessitates significant cryogenic liquefaction, storage, and transportation networks. Cryogenic energy storage systems are necessary for grid stabilization to integrate renewable energy. Cryogenic separation methods are also used in carbon capture and storage systems. Unprecedented capital investment in renewable energy infrastructure is driven by international climate agreements, business sustainability pledges, and government incentives.

Restraint: Volatile raw material and metal prices

Materials such as steel, aluminum, nickel alloys, and copper are crucial in making containers, heat exchangers, and piping systems that can handle cold temperatures. The cryogenic equipment manufacturing sector has to use these materials as they have to meet strict rules for withstanding cold temperatures. The materials they need are very specific. The cryogenic equipment manufacturing sector has to use them to make sure their equipment works properly. Price volatility complicates project budgeting, lowers equipment makers' profit margins, and might cause capital-intensive infrastructure projects to be delayed while operators wait for more favorable cost conditions. This uncertainty has an impact on both manufacturers' competitiveness and end users' willingness to make large-scale expenditures. This potentially delays market development despite solid underlying demand fundamentals across numerous industrial sectors.

Opportunity: Launch of new space and satellite missions

The North America cryogenic equipment market has outstanding growth prospects due to the expanding space sector. Through NASA's ambitious lunar and Mars exploration plans, the US leads the world in space activities. These programs require enormous amounts of liquid hydrogen and oxygen for propulsion systems. The frequency of launches for telecommunications, Earth observation, and space tourism applications is sharply rising due to commercial space endeavors, including SpaceX, Blue Origin, and many satellite operators. For the manufacture, storage, and fueling of propellants at growing spaceport facilities, each launch necessitates a sizable cryogenic infrastructure. Through quick turnaround times, the development of reusable rocket technology actually promotes the use of cryogenic equipment.

Challenge: Hazardous and greenhouse emissions resulting from leakage of cryogenic fluids

The transportation of cryogenic fluids has a significant amount of environmental and safety hazards that have to be sorted out by the industry to keep on growing. Increases in oxygen concentration or accumulating combustible gases can also lead to accidental releases of liquid gases that can cause severe cold burns, asphyxiation injuries in small areas, and explosives. The existence of large temperature variations that increase the potential of material embrittlement and thermal shock requires stringent safety measures and special training. Some activities that have cryogenic applications in the environmental perspective involve strong greenhouse gasses. As an example, leakages of methane alarm LNG plants as methane has greater global warming potential compared with carbon dioxide. Tighter emissions monitoring policies and potential schemes on carbon prices have an effect on operating economics, and regulatory oversight is increasing. Stagnation of production, fines on the part of the authorities, and even damage to one’s reputation may occur due to equipment malfunctions leading to major discharges.

NORTH AMERICA CRYOGENIC EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies custom vacuum-jacketed piping, transfer hoses, and dewars to upgrade cryogenic distribution in laboratories and small industrial plants in North America | Improved thermal efficiency with reduced heat leak and product loss | Higher reliability in liquid nitrogen transfer | Lower operating costs through decreased cryogen consumption | Increased safety due to robust, vacuum-insulated designs tailored to site constraints |

|

Provides cryogenic freezers, storage systems, and vapor shippers to modernize cold-chain management for biobanks, hospitals, and research labs across the US and Canada | Enabled secure long-term storage of biological samples at ultra-low temperatures | Improved sample integrity and regulatory compliance | Reduced risk of product spoilage during transport | Higher operational efficiency with purpose-built racks and inventory systems |

|

Delivers standard and custom liquid nitrogen dewars, small storage tanks, and transfer components for research institutions and niche industrial users requiring flexible cryogenic layouts | Achieved lower evaporation losses | More efficient handling of liquid gases | Reduced downtime through fit-for-purpose vessel sizing | Ability to integrate OEM or private-label solutions without major infrastructure changes, improving lifecycle economics of cryogen use |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Raw material suppliers, cryogenic equipment manufacturers, industrial gas manufacturers, and end users make up the ecosystem of the North America cryogenic equipment market. Aluminum, stainless steel, and specialty insulation supply component manufacturers that create valves, pumps, tanks, and control systems intended to function at very low temperatures.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Cryogenic Equipment Market, by Equipment

The segment includes tanks, valves, vaporizers, pumps, etc. (pipes, regulators, freezers, dewars, strainers, samplers, and heat exchangers). The group comprising the most significant percentage are the tanks as they are required in the bulk storage of the liquefied gases in the LNG facility, industrial gas facility and in the medical and food industries, which results in recurring requirements of stationary and transport tanks. It is predicted that pumps will have the highest growth since LNG bunkering, hydrogen refueling, and growing networks of industrial gas distribution platforms will need high-performance cryogenic transfer pumps with high reliability in loading, unloading, and circulation processes.

North America Cryogenic Equipment Market, by Cryogen

Cryogens include nitrogen, oxygen, argon, LNG, and hydrogen. The highest portion is attributed to nitrogen since it is widely used in food freezing, electronics production, metal processing, and healthcare where it has a strong network of industrial gas producers and distributors in North America. LNG will be the most rapidly expanding cryogen segment, as the area expands the liquefaction capacity, peak-shaving plants, small-scale LNG distribution and LNG-powered transport, which all necessitate specialized storage, transfer, and regasification equipment.

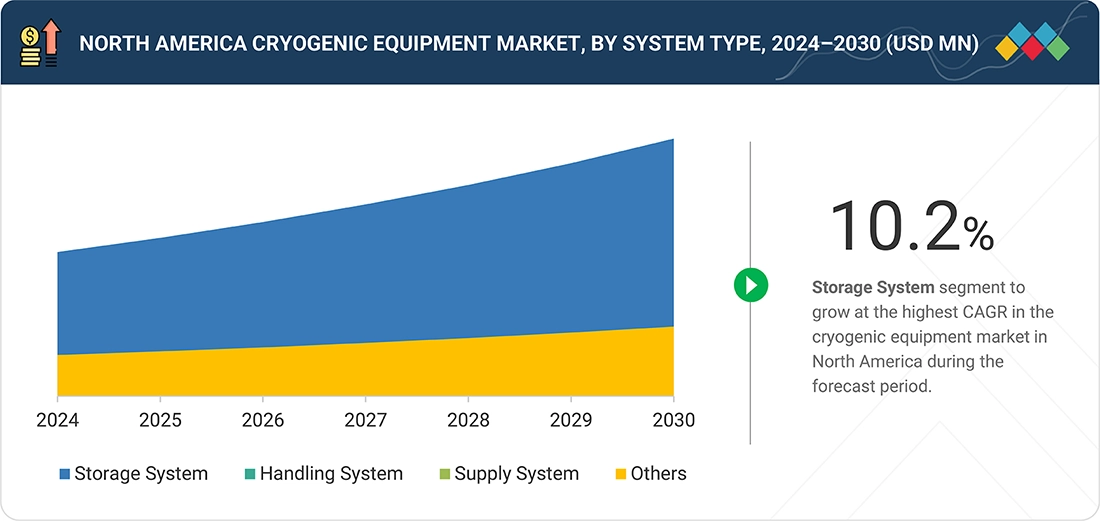

North America Cryogenic Equipment Market, by System Type

By system type, the market is segregated into storage systems, handling systems, supply systems, and other system configurations. Storage systems have the greatest share since nearly all the end users, including LNG terminals, hospitals, and food processors, require insulated vessels and tanks in which liquefied gases can be stored safely and over long periods. The simplest area to be involved in is the handling systems, comprising of transfer lines, hoses, valves, and manifolds that are involved in the movement and dispensing of cryogens, which are expected to be the most rapidly expanding as users increase point-of-use distribution, automation, and modules to enhance efficiency and safety at existing facilities.

North America Cryogenic Equipment Market, by End User

End-use industries are the metallurgy, energy & power, chemicals, electronics, transportation (shipping and rail and road transport), and other end-use industries. The biggest one is the energy & power segment, which is promoted by LNG import/export terminals, gas-generated power plants, and industrial gas usage in the refineries and petrochemical complexes that are dependent on cryogenic tanks, heat exchangers, and pumps. The most rapidly expanding end-user market is transportation, where shipping and road transport operators are switching to LNG and other cryogenic fuels as a means of cutting emissions, increasing the need to store the gas onboard, in fueling infrastructure, and in mobile cryogenic systems.

North America Cryogenic Equipment Market, by Application

The application segment includes CASU and non-CASU applications. CASU applications are driven by strong demand for high-purity oxygen, nitrogen, and argon across healthcare, chemicals, electronics, and metallurgy, where reliable large-scale gas separation at ultra-low temperatures is essential. Meanwhile, non-CASU applications support broader industrial and energy activities that do not require ultra-high purity gases. These include LNG transportation, bulk storage, liquefaction and regasification terminals, as well as rail and road transport systems. Growth in LNG infrastructure, industrial logistics, and energy security initiatives continues to support steady adoption across both application segments.

REGION

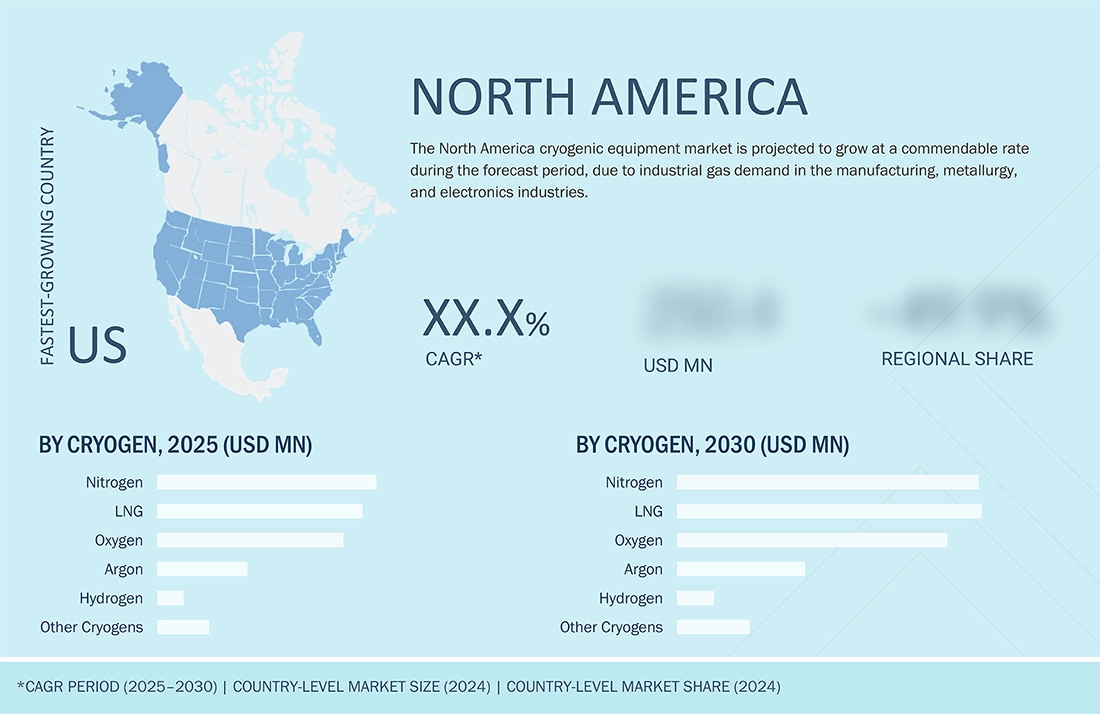

US to be fastest-growing country in North America cryogenic equipment market during forecast period

US is the largest country in the North America cryogenic equipment market due to a large and mature industrial base, a fast-growing LNG export capacity, and a high level of demand of the industrial gases. The largest portion of revenue in the region belongs to the US, estimates show that the country comprises over four-fifths of North America sales of cryogenic equipment with a heavy presence of storage tanks, pumps, valves, and heat exchangers at various LNG liquefaction and regasification facilities. The high levels of natural gas reserves and the fact that the country is the largest exporter of LNG have formed a basis of continuous investments in new export terminals, peak-shaving plants, and small-scale LNG infrastructure, all of which demand complex cryogenic systems. Simultaneously, refining, petrochemicals, healthcare, food processing, and aerospace continue to be quite active, which maintains high consumption of oxygen, nitrogen, and other industrial gases, leading to increased demand of cryogenic storage and distribution equipment in plants in the US.

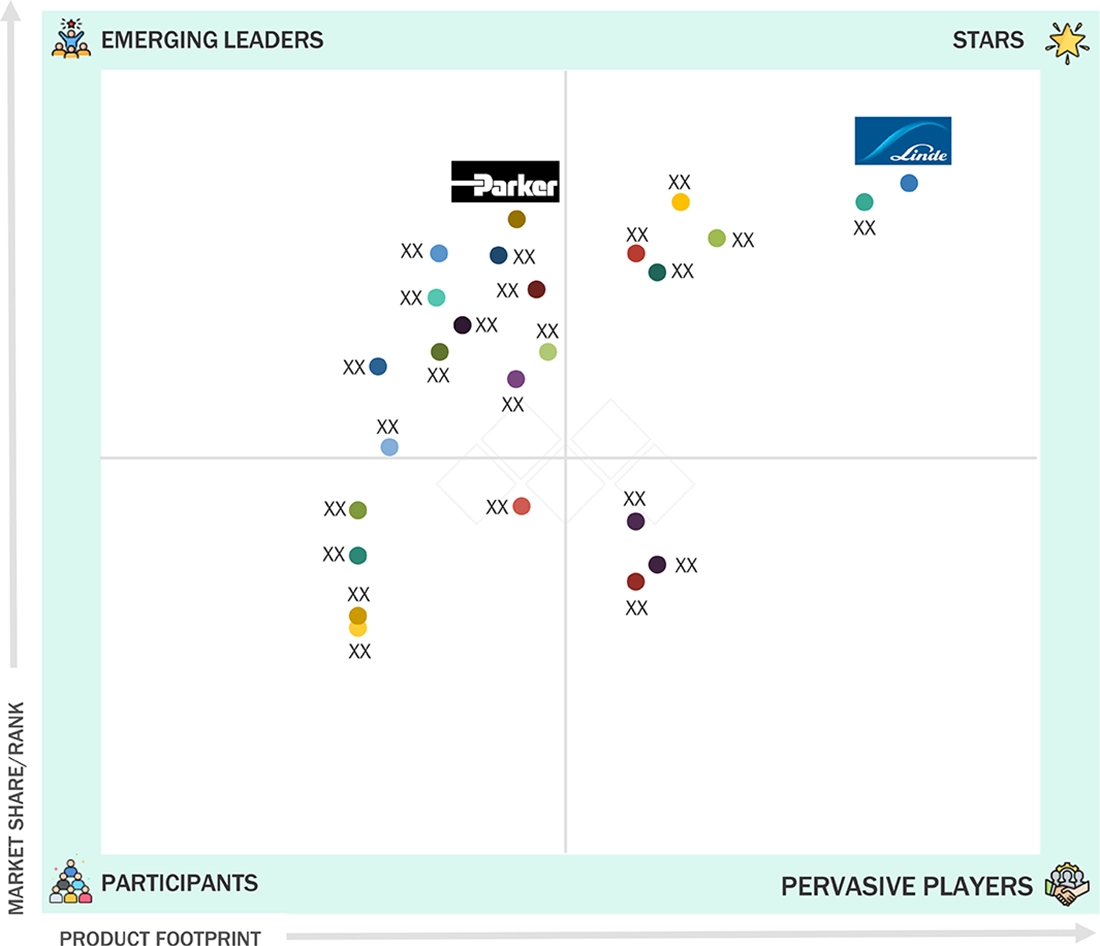

NORTH AMERICA CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

Linde plc and Chart Industries are positioned as star players in the North America cryogenic equipment market matrix, reflecting clear leadership in both market share and product breadth. The company differentiates itself through an extensive cryogenic equipments portfolio and strong reach across industries such as metallurgy, medical and electronics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Linde plc (Ireland)

- Chart Industries (US)

- Taylore-Wharton (US)

- Cryofab (US)

- Air Products and Chemicals, Inc (US)

- Air Liquide (France)

- Parker Hannifin Corp. (US)

- Flowserve Corporation (US)

- Emerson Electric Co. (US)

- PHPK Technologies (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.46 BN |

| Market Forecast in 2030 (Value) | USD 5.95 BN |

| Growth Rate | CAGR of 9.5% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered Covered | US, Canada, and Mexico |

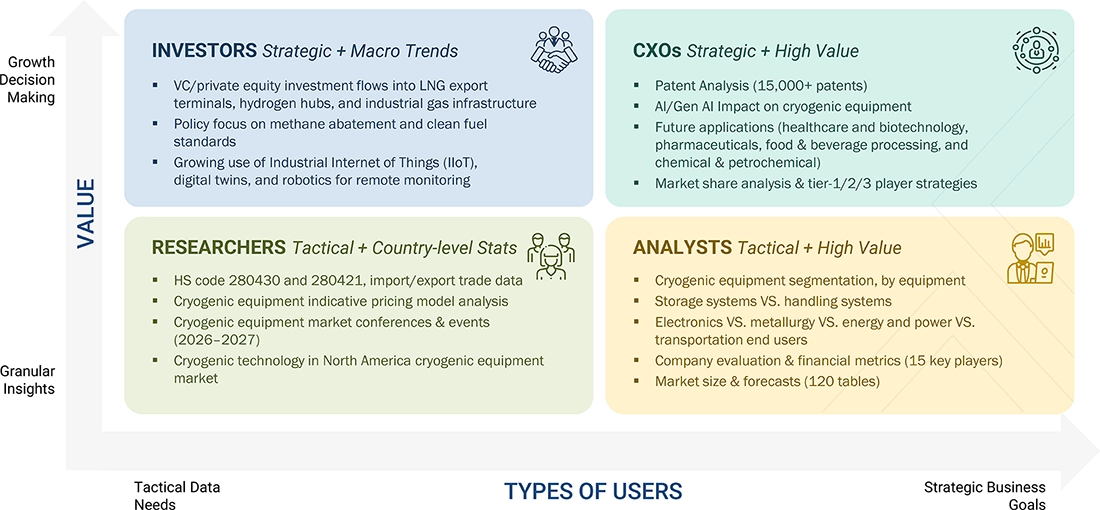

WHAT IS IN IT FOR YOU: NORTH AMERICA CRYOGENIC EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Energy & power utility / LNG operator | Maps of cryogenic tanks, pumps, vaporizers and transfer lines of LNG liquefaction, regasification and peak-shaving plants; benchmarking of storage and handling technologies; reliability and boil-off performance evaluation. | Maximize LNG storage and fuel-supply availability, minimize product wastage and energy usage, discover upgrade to higher efficient tanks and pumps and assist in planning new LNG-to-power or gas-fired plants using cryogenic. |

| Metallurgy / steel producer | Oxygen and other industrial gases cryogenic equipment screening; crystallization, heat-treatment installations screening cryogenic equipment screening; comparison of tank and piping alternatives to supply high-purity gases to furnaces and mills. | Enhance the quality and consistency of metals by use of stable low-temperature processing, increase productivity of furnaces and heat-treatment lines, minimize down-time associated with the disruption of gas supply, and decrease total gas and maintenance expenses. |

| Transportation / LNG fuel & logistics operator | Cryogenic network analysis of LNG bunkering, trucking, and rail requirements; sizing of mobile tanks, trailers, and fueling stations; benchmarking of hose and valve technologies of the fast and safe loading and offloading of LNG. | Make safe and efficient fueling with LNG, increase the range and use of LNG-powered ships, reduce the cost of fuel logistics, and aid in decarbonization goals by replacing traditional fuels with cryogenic LNG in marine and road transport. |

RECENT DEVELOPMENTS

- August 2023 : Chart Industries collaborated with 8 Rivers Capital, a North Carolina-based clean energy and climate technology company, to grab commercial opportunities for hydrogen technology and solutions. This collaboration includes developing equipment for 8 Rivers technologies backed up by Chart’s decades of experience in designing and manufacturing cryogenic, compression, and process technologies and helping 8 Rivers deliver reliable and cost-effective solutions to its customers.

- July 2023 : Air Products made significant investments to meet industry demand with increased winding capacity at its LNG equipment manufacturing facility in Port Manatee, Florida. Air Products expects that this increase in capacity, coupled with new proprietary innovations in fabrication methods, will enable Air Products to improve equipment delivery schedules.

- January 2023 : Chart Industries and Avina entered a partnership agreement. Avina supports the transition to green hydrogen in the transportation sector by providing infrastructure development and technological collaboration. According to the deal, Chart will supply its Howden compressors for Avina's state-of-the-art green hydrogen facility in Southern California (USA). The gaseous hydrogen will be compressed and used to decarbonize heavy-duty trucks, marking a significant milestone as the region's first green hydrogen plant. This partnership will help Chart Industries to use Avina’s US-based green hydrogen facility.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the North America Cryogenic Equipment Market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the North America Cryogenic Equipment Market involved the use of extensive secondary sources, directories, and databases, such as Hoover's, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the North America Cryogenic Equipment Market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The North America Cryogenic Equipment Market comprises several stakeholders, such as cryogenic equipment manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for types of cryogenic equipments such as rod lift systems, electric submersible pumps, progressive cavity pumps, and gas lift systems. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Cryogenic Equipment Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Cryogenic equipment comprises specialized machinery designed for use at extremely low temperatures, typically below -150 degrees Celsius. It enables the storage, transport, and handling of materials like gases and biological samples at these ultra-low temperatures. This technology finds application in various fields, from healthcare to aerospace, supporting scientific research and industrial processes.

The market for cryogenic equipment is the sum of revenues generated by global companies through the sales of cryogenic equipment.

Key Stakeholders

- Cryogenic equipment manufacturers and providers

- Industrial gas supplying companies

- Manufacturing industries

- R&D laboratories

- Consulting companies from energy & power sector

- Distributors of cryogenic equipment

- Government and research organizations

- State and national regulatory authorities

Objectives of the Study

- To define, describe, segment, and forecast the North America Cryogenic Equipment Market by equipment, cryogen, end-user industry, system type, application, and region, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to cryogenic equipment

- To analyze opportunities for stakeholders in the cryogenic equipment and draw a competitive landscape of the market

- To strategically analyze the ecosystem, tariffs and regulations, patents, and trading scenarios pertaining to cryogenic equipment

- To compare key market players based on product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures and collaborations, in the cryogenic equipment.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Cryogenic Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Cryogenic Equipment Market