North America Industrial Metrology Market

North America Industrial Metrology Market by Equipment (CMMs, ODS, X-ray & CT Systems, AOI Systems, Form Measurement Machines), Software, Services, Application, End-use Industry (Automotive, Semiconductor, Aerospace & Defense) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America industrial metrology market is expected to grow to USD 6.1 billion by 2030 from USD 4.7 billion in 2025, at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2030. The growth is fueled by increasing adoption of high-precision manufacturing, robust digital transformation efforts, and rising demand for automated quality inspection in automotive, aerospace, electronics, and heavy engineering industries. US manufacturing is rapidly modernizing, with smart factories, digital twins, and inline/real-time metrology integration becoming crucial for productivity and compliance. Growing investments in electric vehicle (EV) production, semiconductor expansion, and defense manufacturing are further driving demand for advanced 3D measurement, CT inspection, and optical metrology systems.

KEY TAKEAWAYS

-

BY COUNTRYBy country, the US is expected to dominate the market, and progress at a CAGR of 5.9% during the forecast period.

-

BY OFFERINGBy offering, the services segment is expected to grow at the highest CAGR.

-

BY EQUIPMENTBy equipment, the CMMs are expected to dominate in terms of market share.

-

BY APPLICATIONBy application, the quality control & inspection segment is expected to register the highest CAGR.

-

BY End-USE INDUSTRYBy end-use industry, the new medical segment is expected to grow at the highest CAGR of ~9.0-10.0% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSFARO, KLA Corporation (US), and Applied Materials (US) were identified as key players in the North America industrial metrology market, given their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESGelSight, Machine Metrics, Nordson Corporation, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Countries such as the US, Canada, and Mexico are key players in the North America industrial metrology market. The presence of advanced manufacturing hubs, increasing adoption of automation, and a rapid move toward precision-focused production processes are fueling market growth in the region. The US, in particular, leads the way due to its extensive automotive, aerospace, semiconductor, and medical device manufacturing sectors, which rely increasingly on high-accuracy measurement, 3D inspection, and quality assurance technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Digitalization has revolutionized metrology workflows, with Industry 4.0, IoT-enabled systems, and connected measurement platforms redefining how companies oversee quality and production. IoT-driven metrology is becoming the foundation of modern manufacturing—allowing smooth data transfer between measurement devices, production lines, and cloud-based analytics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Demand for High-Precision Manufacturing Across Automotive, Aerospace, and Electronics

-

Rapid Shift Toward Automation and Inline/Real-Time Inspection

Level

-

Shortage of Skilled Metrology and Quality Professionals

-

High Initial Investment and Integration Complexity

Level

-

Growing Adoption of Metrology in EV, Battery, and Semiconductor Ecosystems

-

Expansion of Smart Factories and Digital Twins in Manufacturing

Level

-

Increasing Competition from Low-Cost Asian Suppliers

-

Economic Uncertainty and Slowdown in Capital-Intensive Industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for high-precision manufacturing across automotive, aerospace, and electronics

North America’s robust base of advanced manufacturing—especially in automotive, aerospace, and precision engineering—continues to drive demand for industrial metrology solutions. Growing use of tighter tolerances, lightweight parts, EV production, and autonomous vehicle systems has made 3D measurement, CMMs, optical metrology, and CT inspection essential for maintaining quality and minimizing rework. As OEMs adopt automation and digital twins, metrology systems with higher accuracy, repeatability, and integration with smart factories are becoming increasingly vital throughout the production process.

Restraint: Shortage of skilled metrology and quality professionals

Despite high demand for precise measurement, the region continues to face a persistent shortage of trained metrologists, quality engineers, and technicians. Operating advanced systems, analyzing measurement data, and applying advanced quality control processes require specialized skills. This talent shortage hampers the adoption of sophisticated systems and slows down the expansion of AI-enabled or fully automated metrology technologies in factories.

Opportunity: Growing adoption of metrology in EV, battery, and semiconductor ecosystems

The rapid expansion of EV manufacturing, battery gigafactories, and advanced semiconductor packaging in North America is creating new metrology needs. Battery cells, fuel systems, power electronics, and semiconductor modules require ultra-high precision inspection to guarantee safety, thermal performance, and structural integrity. Emerging technologies like hybrid bonding and advanced substrate manufacturing further increase the demand for nanoscale and high-resolution measurement systems, leading to strong long-term growth opportunities.

Challenge: Increasing competition from low-cost Asian suppliers

North America manufacturers are facing increasing competition from cost-effective metrology providers in China, Taiwan, and other parts of Asia. These companies are quickly enhancing the capabilities of optical scanners, machine vision systems, and portable measurement devices at much lower prices. This pricing pressure can reduce margins for established North America and European measurement technology vendors and slow down replacement cycles for budget-conscious manufacturers.

NORTH AMERICA INDUSTRIAL METROLOGY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lockheed Martin integrated Zeiss optical 3D scanning and CT inspection for turbine components, composite structures, and fuselage assemblies | Used extensively in F-35 and missile program manufacturing | Improved dimensional accuracy, reduced certification cycle time, enhanced traceability, and lowered scrap for aerospace-grade assemblies |

|

GM adopted automated 3D measurement cells using Hexagon CMMs and scanners for inline BIW inspection across EV production lines. The system validates weld accuracy, panel gaps, and chassis geometry in real time. | Increased inspection throughput, reduced rework, enabled faster EV model launches, and improved BIW consistency across plants |

|

Uses automated 3D inspection systems on EV battery packs and vehicle body panels | Enhanced production quality, reduced assembly errors, and better component fitment |

|

Employs laser trackers and structured light scanning to verify aerospace structures and assemblies | Ensured assembly accuracy, reduced errors, and improved overall production efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players in the North America industrial metrology market with a significant global presence include Hexagon AB (Sweden), FARO (US), KLA Corporation (US), and CREAFORM (Canada). The industrial metrology ecosystem involves R&D, hardware & software providers, end-users, and service providers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

North America Industrial Metrology Market, By Offering

The hardware segment dominates the North America Industrial Metrology Market, driven by widespread adoption of high-precision coordinate-measuring machines (CMMs), optical and laser scanners, in-line inspection systems, and displacement sensors across US and Canadian manufacturing facilities. Demand grows due to the region’s focus on achieving tighter tolerances, increasing productivity, and meeting strict quality standards in automotive, aerospace, medical device, and semiconductor manufacturing.

North America Industrial Metrology Market, By Equipment

CMMs lead the North America industrial metrology market for equipment, driven by their essential role in precision machining, high-volume automotive manufacturing, aerospace part validation, and tooling inspection. Bridge and gantry CMMs remain common in large-scale production, while portable and articulated arm CMMs are experiencing strong demand for flexible, on-site measurement applications.

North America Industrial Metrology Market, By Application

Quality control and inspection account for the largest share of the market, reflecting the region’s emphasis on process optimization, defect elimination, and compliance with strict regulatory and industry-specific quality standards. Automotive OEMs and Tier-1 suppliers rely heavily on CMMs, digital scanning, and automated inspection for dimensional validation, assembly verification, and part conformity.

North America Industrial Metrology Market, By End-Use Industry

The automotive industry holds the largest share of the North America Industrial Metrology Market, driven by the region’s emphasis on precision engineering, strict compliance standards, and the broad adoption of automation in vehicle and component manufacturing. US and Canadian automotive OEMs and Tier-1 suppliers are heavily investing in CMMs, 3D scanners, inline inspection systems, and digital quality platforms to ensure dimensional accuracy, minimize defects, and speed up production cycles for both ICE and electric vehicle programs.

REGION

US is expected to be the fastest-growing country across the North America Industrial Metrology market during the forecast period

The industrial metrology market in North America is growing strongly due to the US manufacturing sector’s focus on digital transformation, quality assurance, and process automation. The country’s effort to boost domestic manufacturing—supported by policies like the CHIPS and Science Act, reshoring efforts, and increased investment in smart factories—is pushing the adoption of high-precision measurement technologies. There is a rising demand for CMMs, 3D optical scanners, in-line inspection systems, and automated metrology solutions, especially in the automotive, aerospace, and semiconductor industries, where tighter tolerances and higher throughput are essential.

NORTH AMERICA INDUSTRIAL METROLOGY MARKET: COMPANY EVALUATION MATRIX

In the North America industrial metrology market landscape, Faro and KLA Corporation dominate with a strong market presence and a wide product range, promoting widespread adoption across various industries, including aerospace & defense, automotive, architecture & construction, medical, electronics, energy & power, heavy machinery, and mining.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- FARO (US)

- KLA Corporation (US)

- Creaform (Canada)

- Automated Precision Inc. (US)

- Applied Materials (US)

- ATT Metrology Solutions. (US)

- Bruker (US)

- Nordson Corporation (US)

- InnovMetric Software Inc. (Canada)

- TriMet (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.5 Billion |

| Market Forecast in 2030 (Value) | USD 6.1 Billion |

| Growth Rate | CAGR of 5.6% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America (US, Canada, Mexico) |

WHAT IS IN IT FOR YOU: NORTH AMERICA INDUSTRIAL METROLOGY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Industrial Metrology Solution Providers |

|

|

| Manufacturing Solution Providers |

|

|

| Component Suppliers |

|

|

| Metrology Software Developers |

|

|

| Investors & Venture Capital Firms |

|

|

RECENT DEVELOPMENTS

- September 2025 : FARO Technologies launched its next-generation Quantum Max ScanArm across North America, offering faster scanning speed, better volumetric accuracy, and more software automation for automotive assembly, aerospace inspection, and precision machining. The product launch highlighted FARO’s dedication to supporting digital manufacturing workflows and enabling quicker inspection cycles.

- October 2024 : Creaform released updated HandySCAN 3D | MAX Series devices that provide better accuracy and faster scanning for large and complex parts. The new series offers 30% more precision for 5-meter parts with its improved measurement range, which spans from 0.075 mm to 0.010 mm/m. The updated system now delivers improved measurement results along with new scanning tools and more powerful computer software.

- June 2024 : Hexagon Manufacturing Intelligence acquired a US-based robotics automation company specializing in automated inspection cells for EV and aerospace manufacturing. The acquisition included advanced robotic-guided metrology platforms used for high-throughput dimensional inspection and in-line quality control. This strategic move greatly strengthened Hexagon’s position in automated metrology and expanded its solutions portfolio for high-growth sectors such as electric vehicles and semiconductor manufacturing.

Table of Contents

Methodology

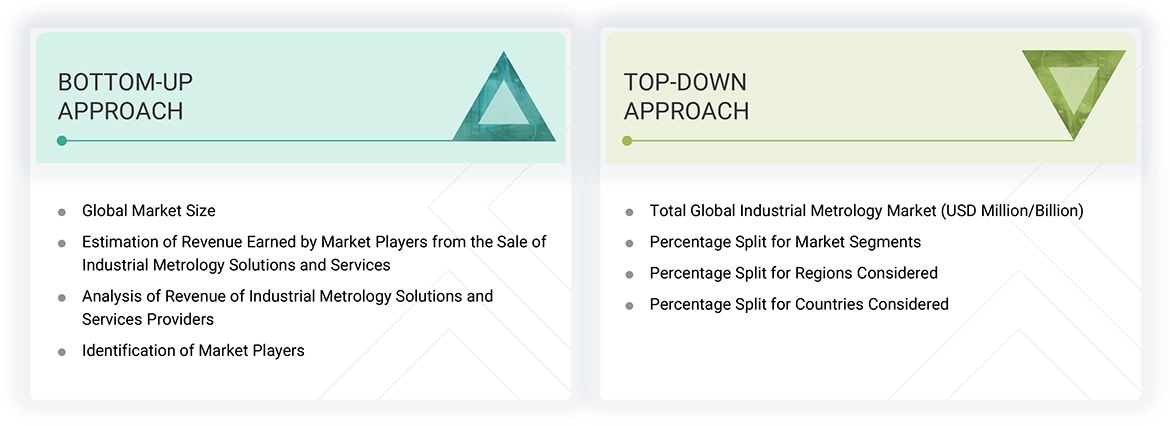

The research study involved 4 major activities in estimating the size of the North America industrial metrology market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the North America industrial metrology market report, the market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the North America industrial metrology market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across North America. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the North America industrial metrology market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the North America industrial metrology market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the North America industrial metrology market and studying their solutions

- Analyzing trends related to the adoption of north america industrial metrology solutions and services

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of north america industrial metrology solutions and services

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

North America Industrial Metrology Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall North America industrial metrology market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Industrial Metrology provides accuracy and precision in production and quality inspection. It includes measurement and inspection processes, calibration routines, measurement system control, and managing the instruments of measurement in manufacturing industries. By harmonizing measurement with industry needs, north america industrial metrology increases product quality, promotes technological innovation, and fuels a competitive manufacturing environment. North america industrial metrology also contributes to scientific and industrial progress by facilitating innovation and efficiency. The North America industrial metrology market has been segmented based on offering, equipment, application, end-use industry, and geography. Based on offering, the market is segmented into hardware, software, and services. Equipment comprise CMMs (Coordinate-measuring machines), ODS (Optical scanners and digitizers), measuring instruments, X-ray & CT systems, AOI (Automated optical inspection) Systems, form measurement machines, and 2D equipment. These technologies find widespread usage in multiple end-use industries such as aerospace & defense, automotive, architecture & construction, medical, electronics, energy & power, heavy machinery, mining, and others. Some of the notable applications of north america industrial metrology are quality control & inspection, reverse engineering, and mapping & modeling in these industries.

An SSE solution requires four fundamental security capabilities: zero trust access network (ZTNA), cloud access security broker (CASB), secure web gateway (SWG), and firewall-as-a-service (FWaaS).

Key Stakeholders

- Raw material suppliers

- North america industrial metrology product manufacturers

- Original equipment manufacturers (OEMs)

- OEM technology providers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

- Metrology-related associations, organizations, forums, and alliances

- Government bodies such as regulatory authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To define, describe, and forecast the North America industrial metrology market, by offering, application, end-use industry, and region, in terms of value

- To forecast the North America industrial metrology market, by equipment, in terms of value and volume

- To estimate the historical and forecast market sizes, by equipment, for ODS and CMMs, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the north america industrial metrology supply chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To provide information pertaining to key technology trends and patent analysis related to the North America industrial metrology market

- To provide information regarding trade data related to the North America industrial metrology market

- To strategically profile key players in the North America industrial metrology market and comprehensively analyze their market shares and core competencies

- To benchmark the market players using the company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market rankings/shares and product portfolios

- To analyze competitive developments, such as agreements, expansions, acquisitions, product launches, collaborations, partnerships, and research & development (R&D), in the North America industrial metrology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Industrial Metrology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Industrial Metrology Market