North America n-Butanol Market

North America n-Butanol Market by Grade (Industrial, Pharmaceutical), Application (Butyl Carboxylate, Direct Solvents), End-use Industry (Agriculture, Paints & Coatings), Feedstock (Conventional), Distribution Channel, Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America n-Butanol market is growing steadily, owing to the high demand from domestic chemical production industries. N-butanol has been largely used as a solvent and intermediate in the large-scale production of acrylates, solvents, plasticizers, and specialty chemicals. The rise in industrial manufacturing, infrastructure maintenance, and refurbishment activities contributes to the stable demand for n-Butanol-based chemical intermediates. The need to improve domestic supply chain encourages producers to mainly use locally produced chemical inputs, such as n-Butanol. Increased investments in the production of value-added chemicals also support the regional market growth. Furthermore, government regulations concerning product safety, emissions, and handling influence producers to use high-quality chemical intermediates, driving the market.

KEY TAKEAWAYS

-

By CountyIn North America, the US dominated with a share of 90.6% in 2024.

-

By ApplicationBy application, the butyl carboxylate segment dominated the market with a share of 61.1% in 2024.

-

By End-use IndustryBy end-use industry, the paints & coatings segment is expected to register a CAGR of 5.9% between 2025 and 2030.

-

By GradeBy grade, the industrial segment is projected to grow at the fastest rate during the forecast period.

-

By FeedstockBy feedstock, the conventional segment is projected to record the highest CAGR from 2025 to 2030.

-

Competitive Landscape- Key PlayersBASF and Dow were identified as Star players in the North America n-Butanol market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

-

Competitive Landscape- StartupsTexmark Chemicals, Inc. has distinguished themselves as progressive companies among startups and SMEs due to their strong product portfolio and business strategy.

The demand for n-Butanol in North America is rising due to its growing application as a major intermediate in large-scale chemical production. The increased production of resins, solvents, and performance chemicals also contributes to the rising demand for n-Butanol as a chemical intermediate. The infrastructure development spending on the renovation of industries further leads to the rising demand for chemicals dependent on n-Butanol. Manufacturers are also strengthening domestic supply chains, which increases reliance on locally produced chemical intermediates.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The North America n-Butanol market is influenced by strong sustainability trends and operational disruptions. One of the key trends is the increasing shift toward bio-based n-Butanol. This trend is being specified by corporate sustainability goals and increasingly strict environmental regulations. Producers have been investing in fermentation technologies and renewable feedstocks. At the same time, there is an increased demand from the coatings, adhesives, and specialty chemicals sectors. This demand helps maintain the stable usage of conventional n-Butanol. Key disruptors in the industry include volatility in energy pricing and fluctuations in the price of feedstocks from petrochemicals. Supply chain tightening and regulatory compliance costs also pressure margins.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for n-Butanol-based coatings, adhesives, and performance materials

-

Increased domestic chemical production and industrial activity

Level

-

Environmental compliance costs associated with emissions, storage, and solvent handling regulations

Level

-

Growing interest in lower-carbon or partially bio-based production routes

-

Potential for long-term supply partnerships with downstream manufacturers seeking stable, regionally sourced intermediates

Level

-

Competition from alternative solvents and emerging low-VOC formulations

-

Pressure on producers to maintain consistent quality while managing cost fluctuations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for n-Butanol-based coatings, adhesives, and performance materials

Increased domestic chemical production and industrial activity in North America are creating sustained rise in demand for n-Butanol. This is driven by expanding the scale and complexity of downstream manufacturing operations. Chemical producers are increasing output of intermediates and formulated products to support domestic industries rather than relying on imports. This shift raises the need for stable and readily available alcohols used in synthesis and formulation. n-Butanol is increasingly selected as it supports consistent reaction performance and process efficiency in large-volume operations. Higher utilization rates at existing plants and new investments in production facilities further increase consumption. These developments directly link rising domestic production activity to stronger and more resilient demand for n-Butanol in North America.

Restraint: Environmental compliance costs associated with emissions, storage, and solvent handling regulations

Environmental compliance costs related to emissions control, storage requirements, and solvent handling regulations are factors that limit the North America n-Butanol market. Chemical manufacturers using n-Butanol are investing in emission monitoring systems and vapor recovery units. This is done to meet air quality and safety standards. These requirements increase operational and capital expenditures. Stricter regulations on volatile organic compound emissions also require reformulation efforts and additional compliance testing. This, in turn, raise production timelines and costs. In some applications, end users may shift toward alternative solvents with lower regulatory burdens to reduce compliance expenses. The cost of training, documentation, and periodic regulatory audits further adds to financial pressure. These compliance-related costs reduce cost competitiveness and slow the expansion of n-Butanol consumption across North American industries.

Opportunity: Growing interest in lower-carbon or partially bio-based production routes

Growing interest in lower-carbon and partially bio-based production routes presents significant opportunity for the North America n-Butanol market. Chemical producers increasingly assess alternative feedstocks and cleaner methods of production as ways of reducing carbon intensity and meeting corporate sustainability targets. This opens up opportunities for the suppliers of n-butanol to develop a bio-based or hybrid production route. Demand is rising from coatings, adhesives, personal care, and specialty chemical manufacturers that prefer lower-emission inputs for formulations. Government incentives and funding programs also support investing in greener technologies. All these dynamics drive capacity upgrades, product diversification, and long-term growth of the regional market.

Challenge: Competition from alternative solvents and emerging low-VOC formulations

The North America n-Butanol market is primarily affected by the competition posed by alternative solvents and the emergence of low-VOC formulations. Many industries that are n-Butanol consumers are looking for solvent substitutes with the same performance characteristics. These alternate substances have low volatility, less odor, or better regulatory compliance characteristics. Moreover, the changes in the water-based systems, the high-solids coatings, and the novel solvent blends, are reducing reliance on traditional alcohol-based solvents in certain applications. Regulatory pressure to lower VOC emissions further accelerates this shift. As a result, some manufacturers may replace n-Butanol or reduce usage levels in formulations.

NORTH AMERICA N-BUTANOL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces n-Butanol at integrated facilities for coatings, butyl acrylates, butyl acetates, plasticizers, and industrial solvents | Stable product quality | Strong backward integration | Secure supply for coatings and chemical manufacturers |

|

Manufactures n-Butanol for use in coatings, adhesives, glycol ethers, and solvents across its performance chemicals network | Reliable supply chain | Optimized downstream integration | Strong technical support for industrial customers |

|

Supplies and utilizes n-Butanol for production of esters, specialty polymers, coatings intermediates, and solvents | Enhanced performance in downstream formulations | Broad product portfolio synergy | Consistent quality standards |

|

Produces n-Butanol for adhesives, coatings, esters, and specialty chemical intermediates | Large production capacity | Robust supply network | Integration with downstream chemical and polymer manufacturers |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North American n-Butanol market requires a well-integrated supply chain network involving raw material suppliers, producers, distribution/trading companies, and end-use sectors. Raw material suppliers offer critical feedstocks, such as petrochemical propylene and renewable biomass. Producers use these materials to produce n-Butanol either through traditional methods or emerging bio-based processes. Distributing companies act as an interface between producers and industrial sectors requiring n-Butanol as an input. End-use sectors include paints, pharmaceutical, adhesives, and specialty chemicals requiring n-Butanol as an additive or a raw material. The coordinated operation of all these sectors within a market helps in maintaining efficient product quality and distribution.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America n-Butanol Market, by Grade

Industrial grade n-Butanol accounts for the largest market share in North America. This is due to its suitability for large-scale chemical production. This grade offers the required purity for industrial applications. It is also cost-effective compared to higher-purity alternatives. Industries such as paints and coatings, adhesives, packaging, and specialty chemicals extensively use industrial grade n-Butanol in their production processes. Its steady availability from established facilities in the US and Canada ensures uninterrupted supply and operational efficiency. The technical versatility of the industrial grade allows its use across a number of manufacturing processes, providing flexibility to the producers. All these factors combined strengthen the dominant position of the industrial grade segment in the region.

North America n-Butanol Market, by Feedstock

Conventional feedstock captures for the largest share of the North American n-Butanol market. This is due to the reliance on established oxo-process technology, which converts petrochemical-derived propylene into n-Butanol. This route is widely available, cost-efficient. This is supported by advanced supply chain for feedstock procurement and large-volume distribution. Major US and Canadian producers operate long-standing conventional units that benefit from economies of scale and reliable integration with downstream chemical plants. Though the interest in bio-based alternatives continues to rise, its limited commercial capacity and higher production costs restrict widespread adoption. Conventional feedstock remains the dominant and commercially preferred route toward ensuring consistent supply and maintaining leadership in North America n-Butanol market.

North America n-Butanol Market, by Application

The butyl carboxylate application holds for the largest share of the North America n-Butanol market as it serves as the main intermediate for producing butyl acetate and acrylate. These compounds are widely used in manufacturing inks, coatings for industrial equipment, and specialty adhesives that require precise chemical properties. The US and Canada have well-established production facilities. This helps ensure high-volume processing and consistent product quality. Investment in process improvements, solvent recovery systems, and adherence to regional environmental regulations further strengthens its application. The strong infrastructure coupled with stable industrial demand and integration with downstream processes guarantees the continued dominance of butyl carboxylates in the region.

North America n-Butanol Market, by End-use Industry

Paints & coatings is the leading segment in the North America n-Butanol market, as the chemical is used extensively as a solvent, intermediate, and component in high-performance coatings. It ensures better pigment dispersion, regulates evaporation rates, and aids in film formation. All these factors are considered important in industrial, commercial, and protective coatings. The growth of infrastructure projects, industrial maintenance activities, and residential construction across the region propels sustained consumption. Additionally, there is a rising development of environment-friendly coatings by producers in the US and Canada, which use n-Butanol extensively to meet performance requirements. The established production capacity, supply chains, and developments in coatings technologies maintain n-Butanol's popularity, ensuring that paints & coatings remain the predominant segment.

REGION

Mexico to be fastest-growing region in North America n-Butanol market during forecast period

Mexico is expected to be the fastest-growing in the North America n-Butanol market during the forecast period due to its expanding manufacturing base. The country has strong growth in paints and coatings demand. This is driven by construction and infrastructure projects. Rapid urbanization is supporting residential and commercial building activity. The country also has a large and growing automotive sector. This increases the demand for coatings, adhesives, and plasticizers that use n-butanol. The chemical industry is expanding due to foreign direct investment. Many global chemical companies are setting up or expanding local production. The country offers lower production and labor costs compared with the US and Canada. This improves cost competitiveness. Trade agreements, such as USMCA, support cross-border chemical trade. This improves supply chain integration. Agriculture growth also supports solvent demand for agrochemical formulations. Rising personal care and pharmaceutical manufacturing adds further demand. Increasing focus on local chemical production reduces import dependence, accelerating n-Butanol consumption in the country.

NORTH AMERICA N-BUTANOL MARKET: COMPANY EVALUATION MATRIX

The North America n-Butanol market is characterized by a mix of emerging leaders, participants, pervasive players, and stars. The chart highlights Dow (Star) as a strong market leader in terms of both market share and product footprint. Sasol (Emerging Leaders) exhibits a broad product presence but a relatively moderate market share. Several smaller players cluster in the "Participants" and "Pervasive Players" zones, reflecting niche positioning or early-stage growth potential. Overall, market dynamics suggest strong competition, with global giants driving innovation while smaller companies strive for differentiation and market penetration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF (Germany)

- Dow (US)

- Eastman Chemical Company (US)

- OQ Chemicals (Germany)

- Mitsubishi Chemical Group Corporation (Japan)

- INEOS Group (UK)

- Sasol (South Africa)

- PETRONAS Chemicals Group Berhad (Malaysia)

- SABIC (Saudi Arabia)

- KH Neochem Co., Ltd. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.13 Billion |

| Market Forecast in 2030 (Value) | USD 1.48 Billion |

| Growth Rate | CAGR of 4.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | US, Canada, and Mexico |

WHAT IS IN IT FOR YOU: NORTH AMERICA N-BUTANOL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Breakdown | Instead of regional-level insights, the report provides country-specific data for major North American n-Butanol markets such as US, Canada, and Mexico. Includes national production capacities, feedstock sources, import/export volumes, distribution networks, key manufacturers, and government policies influencing chemical production, sustainability initiatives, and bio-based adoption. | Helps clients identify high-potential countries for n-Butanol sales, understand regulatory impacts on conventional and bio-based feedstock demand, evaluate investment needs for plant expansion or modernization, and design country-specific sourcing or partnership strategies. |

| Feedstock-specific Deep Dive | Detailed segmentation and analysis of n-Butanol feedstocks: conventional and bio-based. Includes production process mapping, input-output efficiency, cost comparisons, environmental compliance, and case studies of bio-based integration and energy-efficient conversion. | Enables stakeholders to target fast-growing feedstock segments, optimize sourcing strategies, and support R&D for sustainable production, and carbon footprint reduction |

| Grade Customization | Comparative assessment of industrial, pharmaceutical, and other grades of n-Butanol. Includes quality benchmarks, purity levels, suitability for different chemical processes, production costs, and regulatory compliance requirements. | Supports manufacturers, distributors, and end-users in selecting the optimal grade for specific formulations and applications, balancing cost, performance, and regulatory adherence across coatings, adhesives, pharmaceuticals, and specialty chemicals. |

RECENT DEVELOPMENTS

- July 2024 : Univar entered a distribution agreement with Eastman under which it serves as Eastman’s preferred distributor for plasticizers. This agreement has implications for the n-Butanol market. This is because n-Butanol is widely used as a solvent and intermediate in the production of plasticizers such as butyl acetate and butyl acrylate. Through this partnership, Univar supported the commercial distribution of Eastman’s plasticizer portfolio, including sustainable products such as Benzoflex 9-88 and Eastman 168 SG.

- September 2022 : The Dow Chemical Company and Johnson Matthey announced that Anqing Shuguang Petrochemical Oxo Co., Ltd. has licensed its LP Oxo Technology and is able to produce about 225,000 tons of oxo alcohol annually. This is the 23rd license for this technology in China and the second LP Oxo license for Anqing.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the North America n-Butanol Market . Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The North America n-Butanol Market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the North America n-Butanol Market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in chemical sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in n-butanol industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of n-butanol and outlook of their business, which will affect the overall market.

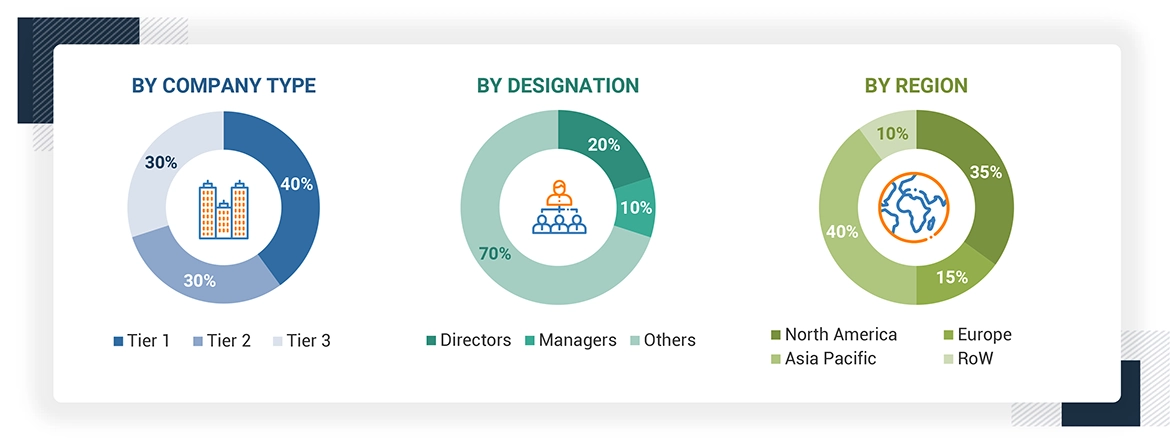

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the North America n-Butanol Market .

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The chemical formula for n-butanol, also known as normal butanol or n-butyl, is represented by C3H9OH. It is a transparent liquid with a strong, easily recognizable smell. From a chemical standpoint, n-butanol is distinguished by its boiling point of 117.7°C and freezing point of -89.0°C. The substance has a density of approximately 0.8109 g/cm3 at a temperature of 20 degrees Celsius. It has limited solubility in water, around 7.7% by weight at the same temperature, but can dissolve in various organic solvents like ethanol and ether. Because of its tendency to easily catch fire, n-butanol is commonly utilized. It is used in a variety of industries for its function as a solvent and as a chemical intermediary in the creation of other substances.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the North America n-Butanol Market , in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on grade, distribution channel, feedstock, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

The study involved four major activities in estimating the market size of the North America n-Butanol Market . Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The North America n-Butanol Market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the North America n-Butanol Market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in chemical sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in n-butanol industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of n-butanol and outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the North America n-Butanol Market .

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The chemical formula for n-butanol, also known as normal butanol or n-butyl, is represented by C3H9OH. It is a transparent liquid with a strong, easily recognizable smell. From a chemical standpoint, n-butanol is distinguished by its boiling point of 117.7°C and freezing point of -89.0°C. The substance has a density of approximately 0.8109 g/cm3 at a temperature of 20 degrees Celsius. It has limited solubility in water, around 7.7% by weight at the same temperature, but can dissolve in various organic solvents like ethanol and ether. Because of its tendency to easily catch fire, n-butanol is commonly utilized. It is used in a variety of industries for its function as a solvent and as a chemical intermediary in the creation of other substances.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the North America n-Butanol Market , in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on grade, distribution channel, feedstock, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America n-Butanol Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America n-Butanol Market