North America PEEK Market

North America PEEK Market by Reinforcement Type (Glass-Filled, Carbon-Filled, Unfilled), Processing Method (Extrusion, Injection Molding), End User (Electrical & Electronics, Aerospace, Automotive, Oil & Gas, Medical), and Country – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America PEEK market is projected to grow from USD 0.40 billion in 2025 to USD 0.58 billion by 2030, at a CAGR of 7.9% during the forecast period. As manufacturing hubs in the US, Canada, and Mexico push toward high reliability, miniaturization, lightweighting, and heat-resistant components, PEEK has become a preferred material due to its exceptional thermal stability, mechanical strength, chemical resistance, and durability. The region is also witnessing growing localization of PEEK compounding and component production, which makes the material more accessible for diverse applications. With strong technological upgrades, expanding electric vehicle and semiconductor industries, and a shift toward premium engineering plastics, Asia Pacific is emerging as the most dynamic and strategically important market for PEEK globally.

KEY TAKEAWAYS

-

By CountryThe US is projected to grow at the highest rate (8.5%), in terms of value, in the North America PEEK market during the forecast period.

-

By Reinforcement TypeBy reinforcement type, the glass-filled segment accounted for a 36.3% share, in terms of value, in 2024.

-

By Processing MethodBy processing method, the extrusion segment is expected to dominate the North America PEEK market during the forecast period.

-

By End UserBy end user, the electrical & electronics segment accounted for the largest share (30.4%), in terms of value, of the North America PEEK market in 2024.

-

Competitive Landscape - Key PlayersAvient Corporation, RTP Company, and Westlake Plastics were identified as some of the star players in the North America PEEK market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsPolymer Industries and Trident Plastics, Inc., among others, have distinguished themselves as startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

North America is emerging as the most dynamic and strategically important market for PEEK globally. The region is witnessing growing localization of PEEK compounding and component production, which makes the material more accessible for diverse applications. With strong technological upgrades, expanding electric vehicle and semiconductor industries, and a shift toward premium engineering plastics, the market is poised for growth in the coming years.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The North America PEEK market is rapidly evolving as industries move beyond traditional oil & gas and electrical & electronics applications toward advanced, high-value sectors such as aerospace, medical, automotive, and next-generation electronics. Demand is driven by the region’s strong emphasis on lightweighting, high durability, thermal stability, and chemical resistance qualities that position PEEK as a superior alternative to metals and standard polymers. Reinforced grades like glass-filled and carbon-filled PEEK are gaining prominence, while extrusion and injection molding remain core processing methods supporting precision manufacturing. With rising adoption in aerospace components, medical implants and devices, and heat-resistant electronic parts, the market is being reshaped by innovation and the growing need for high-performance materials across mission-critical applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for high-performance materials across industries

-

Lightweighting initiatives in aerospace and automotive

Level

-

Slow adoption in cost-sensitive industries

-

Complex processing requirements

Level

-

Rising investments in aerospace and defense

-

Increasing miniaturization in electronics

Level

-

Intense competition from alternative high-performance materials

-

Need for continuous R&D investment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for high-performance materials across industries

The North America PEEK market is growing massively due to the fact that the whole region is leaning more and more towards the use of high-performance materials that can satisfy very strict mechanical, thermal, and chemical standards in the advanced industries. One of those materials is PEEK, which is still the strongest and most prominent of all due to its excellent strength-to-weight ratio, high temperature resistance, and so forth. It is strong enough to take the place of the conventional materials used for making components in delicate parts, such as engine blocks and turbine blades. PEEK's exceptional tribological performance is one of its important properties the automotive industry values. The medical industry's quest for the properties of PEEK is mainly driven by its tremendous biocompatibility and resistance to sterilization, which have allowed it to be employed in implants and surgical instruments. The demand for PEEK still increases as the manufacturers hunt for the materials that will not only offer longer component life, lower maintenance costs, but also advancements in miniaturized next-generation designs. Ultimately, the North American region is positioned as a performance-driven engineering area mainly because of PEEK being a key enablement factor.

Restraint: Slow adoption in cost-sensitive industries

North America PEEK market is restricted significantly with the slow albeit gradual acceptance of the material in price-sensitive industries that still choose a cheaper engineering plastics or metals for their products. The high cost of PEEK production mainly due to its complicated polymerization process, energy-consuming manufacturing, and specialized processing requirements makes it much costlier compared to polymers like PPS, PEI, PA, or POM. Therefore, consumer goods, general industrial equipment, and low-grade automotive components often avoid PEEK unless necessary. These industries are focused on initial material costs rather than long-term performance benefits, which is one of the reasons for the limited penetration of PEEK. Moreover, small and medium-sized manufacturers often do not possess high-temperature molding machines, which results in further delay of adoption. This cost barrier to access keeps the material locked up in high-end, critical applications while it is slow in getting into the mainstream industrial areas.

Opportunity: Rising investments in aerospace and defense

The North America PEEK market is progressively supported by increasing investments in the aerospace and defense industry as the region keeps on modernizing its aircraft, boosting the production for new aircraft, and upgrading the defense equipment. In the US, aerospace companies and defense contractors are adopting the use of high-performance materials, including PEEK, to not only improve fuel economy, but also reduce the weight of the components and enhance their durability in extremely harsh operating environments. PEEK has several excellent properties, including compliance with flame-smoke-toxicity (FST), highest thermal stability, chemical resistance, and long fatigue life, which makes it suitable for critical applications like brackets, cable insulation, ducting, housings and high-stress structural parts. The transition of military platforms to lighter composite materials and the recovery of production in the commercial aircraft sector are the major causes of steadily increasing demand for PEEK components.

Challenge: Intense competition from alternative high-performance materials

The North America PEEK market faces a major challenge owing to the rising competition from other high-performance materials like PPS, PEI, PAI, PTFE, and advanced composites. Besides, these materials sometimes come with the same advantages, such as lasting thermal stability, chemical resistance, and mechanical strength at much lower prices or with more reliable supply chains. In some uses, high-performance thermosets and metal alloys are also in contention with PEEK, particularly when high rigidity or thermal resistance is called for. With industries having to weigh the cost against performance, the alternative polymers are regularly taking the lead which in turn is causing the delay in PEEK's adoption. This tough competition is compelling the manufacturers of PEEK to come up with new ideas, to lower their prices and to be able to show value that is so clear to the customers that it ensures the company's long-term growth in market share.

NORTH AMERICA PEEK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-precision connectors and insulating components in smartphones and semiconductor equipment | High dielectric strength for stable electrical performance | Dimensional stability during high-temperature soldering | Improved device miniaturization and heat resistance |

|

PEEK used in EV battery insulation, high-voltage connectors, and thermal management modules | High heat resistance improving safety in battery packs | Lightweight components supporting range improvement | Enhanced durability in high-frequency charging cycles |

|

PEEK components in aircraft interior systems, brackets, and cable insulation | Significant weight reduction compared to metal parts | Flame resistance and low smoke/toxic emissions | Improved fuel efficiency and easier manufacturability |

|

PEEK spinal cages and orthopedic implants | Biocompatibility and radiolucency (transparent in X-rays) | Bone-like modulus reducing stress shielding | High fatigue resistance for long-term implant stability |

|

PEEK used in high-wear seals, valve seats, and pump components | Excellent chemical resistance for harsh process environments | Long service intervals due to low wear | Stable mechanical properties under continuous heat exposure |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America PEEK market ecosystem is a tightly integrated chain that starts with specialized global suppliers of monomers and intermediates, feeding into a small group of regional and multinational resin manufacturers and compounders, such as Avient, RTP, Westlake Plastics, and others that tailor high-performance grades for demanding applications. These raw materials move through niche engineering-plastics distributors, including players like Conventus, which provide inventory, technical support, and access to smaller OEMs across aerospace, medical, automotive, electronics, and industrial sectors. End users, such as precision gear and power-transmission manufacturers (e.g., ATA Gears, Elecon) and medical and aerospace OEMs capture value from PEEK’s combination of high temperature resistance, chemical stability, strength-to-weight ratio, and biocompatibility, driving steady demand growth and reinforcing North America’s position as a key global hub for PEEK innovation and consumption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America PEEK Market, By Reinforcement Type

The glass-filled segment is projected to lead the North America PEEK market during the forecast period. This growth is driven by the use of glass-filled PEEK across the aerospace, automotive, medical, and electronics industries. Glass-filled PEEK provides a good balance of price and performance. It gives excellent mechanical strength, wear resistance, and high-temperature stability at a lower price than carbon-filled PEEK. The automotive, aerospace, medical, and industrial sectors are the main users of this material because of its capacity to support high-demand, cost-sensitive parts. The volume growth of glass-filled PEEK is primarily due to the regulatory pressures for lighter, higher-performing components and the material's adaptability to different processing methods. Due to the rising demand for light-weight and durable materials, the glass-filled segment is projected to lead the market during the forecast period.

North America PEEK Market, By End User

The electrical & electronics segment is projected to be the fastest-growing segment during the forecast period. PEEK's properties, such as excellent insulation, resistance to high temperature, and durability, make it suitable for use in various electronic components, such as connectors, housings, and power electronics. PEEK is the material of choice over traditional ones by manufacturers as electronic devices, semiconductors, and high-performance products are continuously being developed. Preferable material trends are also influenced besides the rising demand by major drivers like miniaturization, lightweight and dependable components, and the expansion of semiconductor and electronics manufacturing.

REGION

US is projected to account for the largest share of North America PEEK market during the forecast period

The US is projected to lead the North America PEEK market during the forecast period, thanks to strong growth of the aerospace, automotive, electrical & electronics, medical devices, and industrial sectors in the country, which is driving the use of PEEK due to its great strength, heat resistance, and longevity. Moreover, the rise in electric vehicles (EVs) and new technologies in semiconductor production are other factors driving the demand for PEEK in the US. The stringent regulatory framework for performance materials in major industries and the rising trend towards the use of light-weight and strong components are among the reasons for the expansion of the PEEK market in the US.

NORTH AMERICA PEEK MARKET: COMPANY EVALUATION MATRIX

In the North America PEEK market matrix, Avient Corporation (Star) leads with a strong market share and extensive product footprint, driven by its PEEK solutions which is adopted by various end users. Polymer Industries (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Avient Corporation dominates through scale and diversified portfolio, Polymer Industries’ PEEK shows significant potential to move toward the leaders’ quadrant as demand for PEEK continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Avient Corporation (US)

- RTP Company (US)

- Westlake Plastics (US)

- Drake Plastics (US)

- Americhem (US)

- Polymer Industries (US)

- Trident Plastics, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.37 BN |

| Forecast Size in 2030 (Value) | USD 0.58 BN |

| CAGR | 7.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada, Mexico |

WHAT IS IN IT FOR YOU: NORTH AMERICA PEEK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Manufacturer of Electronics and Semiconductors |

|

|

| Automotive & EV OEM/Tier 1 Supplier |

|

|

| Aerospace & Defense Company |

|

|

| Medical Device Manufacturer |

|

|

| Industrial Equipment & Machinery Manufacturer |

|

|

| 3D Printing/Additive Manufacturing Company |

|

|

RECENT DEVELOPMENTS

- November 2024 : Avient Corporation launched Colorant Chromatics Transcend Biocompatible PEEK Pre-Colored Compounds and Colorants at MEDICA 2024, a major medical technology trade fair. These innovative compounds are designed for the healthcare industry, offering materials that have been tested for ISO 10993 biocompatibility. This ensures they meet the highest standards for medical applications.

- March 2024 : Drake Plastics and DEMGY Group formed the Liberty Alliance, a partnership to expand high-performance polymer solutions. DEMGY became the preferred distributor in France for Drake's machinable semi-finished shapes, offering turnkey solutions. Its product portfolio includes extruded bars, sheets, seamless tubes, and near-net shapes from special formulations of PEEK and polyketone, as well as Torlon polyamide-imide and other high-performance polymers. The partnership strengthened companies' market reach in aerospace, mobility, and semiconductors, providing high-quality, cost-effective technical solutions globally.

Table of Contents

Methodology

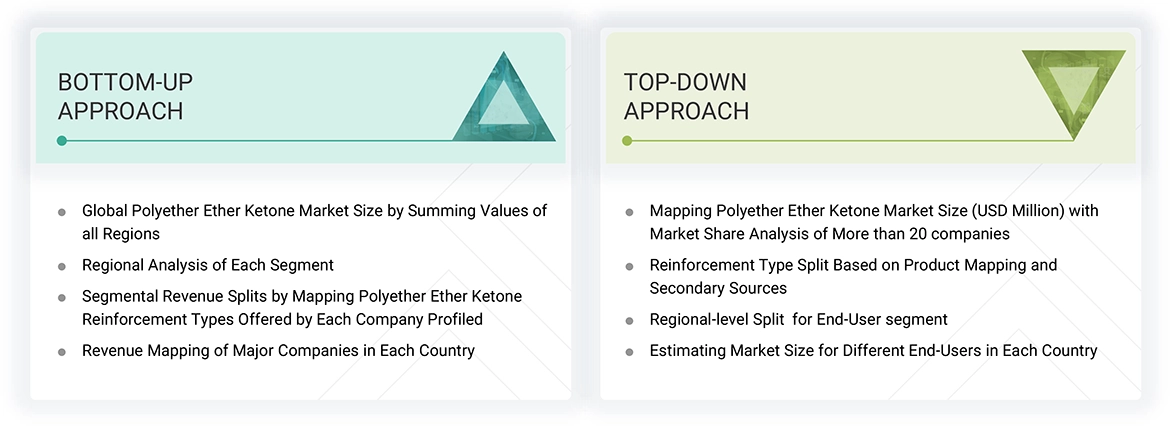

The research encompassed four primary actions in assessing the present market size of North America PEEK. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the North America PEEK value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to determine the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market is initiated by collecting revenue data from prominent suppliers using secondary research. During the secondary research, sources such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The North America PEEK market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of electrical & electronics, automotive, oil & gas, medical, aerospace, and other applications. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the North America PEEK market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the North America PEEK market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global North America PEEK Market Size: Bottom-Up and Top-Down Approaches

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyether ether ketone (North America PEEK) is a high-performance, semi-crystalline thermoplastic polymer known for its excellent mechanical strength, thermal stability, chemical resistance, and flame retardancy. It is widely utilized in demanding engineering applications due to its ability to maintain performance under extreme conditions. North America PEEK is available in several reinforcement types, including unfilled polyether ether ketone (pure North America PEEK), glass-filled polyether ether ketone for improved rigidity and dimensional stability, and carbon-filled polyether ether ketone for enhanced strength, stiffness, and thermal conductivity. The polymer is processed through advanced methods such as injection molding and extrusion, which allow for the production of complex components with high precision. Owing to its superior properties, North America PEEK finds extensive applications across various end-use industries, including electrical and electronics, aerospace, automotive, oil and gas, and medical. These industries leverage North America PEEK’s performance benefits for parts such as insulators, connectors, engine components, implants, and seals, making it a critical material in high-reliability environments.

Stakeholders

- Polyether ether ketone manufacturers

- Polyether ether ketone suppliers

- Polyether ether ketone traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global North America PEEK market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global North America PEEK market

- To analyze and forecast the size of various segments (end-use and type) of the North America PEEK market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America PEEK Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America PEEK Market