North America Smart Irrigation Market

North America Smart Irrigation Market by System Type (Weather-based, Sensor-based), Controller, Sensor (Soil Moisture Sensor, Temperature Sensor, Rain/Freeze Sensor, Fertigation Sensor), Water Flow Meter, Greenhouse, and Open Field - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America smart irrigation market is projected to reach USD 1.11 billion by 2030 from USD 0.66 billion in 2025, at a CAGR of around 10.9% from 2025 to 2030. Strong emphasis on water conservation, widespread adoption of precision agriculture, rapid digitalization of farming operations, and expanding commercial landscaping demands drive market. Supportive federal and state programs promoting efficient water use, rising integration of IoT-enabled controllers and soil-moisture sensors, and increasing awareness among growers about yield optimization boost the adoption across agriculture, golf courses, public parks, and residential applications. The shift toward automated, data-driven irrigation systems is further reinforced by sustainability mandates, drought-resilience initiatives, and growing investments in climate-smart technologies across the region.

KEY TAKEAWAYS

-

BY COUNTRYBy country, Canada is expected to dominate the market, growing at a CAGR of 14.5% during the forecast period.

-

BY COMPONENTBy component, the sensor segment is expected to reach USD 660.4 million in 2025.

-

BY SYSTEM TYPEBy system type, the weather-based segment is expected to dominate the market in terms of market size.

-

BY APPLICATIONBy application, the agricultural segment is expected to register a CAGR of 11.5% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThe Toro Company (US), Rain Bird Corporation (US), HUNTER INDUSTRIES INC. (US), and HydroPoint (US) were identified as some star players in the North America smart irrigation market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESCropX Inc. (US), among others, is among SMEs that secures strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Countries such as US, Canada, Mexico are major contributors to the North America smart irrigation market growth. The high adoption of advanced agricultural technologies, strong presence of precision farming ecosystems, and rising awareness about efficient water management practices drive regional demand. Increasing emphasis on sustainability, widespread use of IoT-enabled irrigation controllers, and ongoing investments in climate-resilient agricultural infrastructure further support market expansion across large farm operations, commercial landscapes, and residential applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer trends and technological disruptions are reshaping irrigation practices across North America. IoT has become a core enabler of smart irrigation, driving the shift toward data-driven water management. IoT is the future of irrigation, enabling seamless cloud connectivity, automated scheduling, and remote monitoring of field conditions. Growers, landscapers, and facility managers can make more precise irrigation decisions by collecting, analyzing, and responding to real-time soil, weather, and crop data. This reduces water consumption, improves crop health, and minimizes manual intervention. With enhanced visibility into irrigation system performance, maintenance time is reduced, and real-time operational control is achieved.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of IoT-enabled irrigation controllers and sensor-based monitoring systems

-

Strong government and state-level initiatives promoting water conservation and sustainable landscaping

Level

-

Limited digital literacy and slow technology adoption among small- and medium-sized farmers

-

Compatibility and interoperability issues between legacy irrigation equipment and modern smart systems

Level

-

Rapid advancements in wireless soil-moisture sensors, weather-based controllers, and analytics platforms

-

Growing emphasis on drought-resilient irrigation supported by federal and state conservation programs

Level

-

Connectivity gaps in rural and remote agricultural areas

-

Data privacy and cybersecurity concerns with cloud-connected irrigation systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of IoT-enabled irrigation controllers and sensor-based monitoring systems

The North America smart irrigation market is driven by the rising adoption of IoT-enabled irrigation controllers, advanced soil-moisture sensors, and real-time monitoring systems that enhance water efficiency and crop health. Strong government and state-led initiatives promoting water conservation accelerate the shift from traditional practices to automated irrigation. Increasing pressure to optimize water usage in agriculture, landscaping, and commercial spaces is encouraging rapid deployment of connected irrigation technologies, while growing sustainability mandates further strengthen demand across farms, residential landscapes, and public infrastructure.

Restraint: Limited digital literacy and slow technology adoption among small- and medium-sized farmers

Key restraints limiting market growth include limited digital literacy and slow technology adoption among small- and medium-sized farmers, who often face challenges integrating advanced systems into existing operations. Compatibility and interoperability issues between legacy irrigation equipment and modern platforms create additional barriers. The lack of standardized communication protocols leads to operational inefficiencies and inhibits seamless system integration. High initial investment costs and resistance to adopting unfamiliar technology further restrict widespread adoption of smart irrigation solutions, especially in smaller or resource-constrained agricultural communities.

Opportunity: Rapid advancements in wireless soil-moisture sensors, weather-based controllers, and analytics platforms

Significant opportunities emerge from rapid advancements in wireless soil-moisture sensors, weather-based controllers, and AI-driven analytics platforms that enable highly accurate, automated irrigation. Growing emphasis on drought resilience and water-use optimization, supported by federal and state conservation programs, is expanding demand across agriculture, municipalities, and commercial landscaping. The rollout of 5G and LPWAN networks enhances remote monitoring capabilities, enabling scalable deployment across large fields. Increasing interest in sustainable practices and climate-smart agriculture further creates strong growth prospects for innovative smart irrigation solutions.

Challenge: Connectivity gaps in rural and remote agricultural areas

Major challenges include persistent connectivity gaps in rural and remote agricultural regions, which limit the functionality of cloud-connected irrigation systems. Inconsistent access to high-speed networks slows adoption of real-time monitoring and automated control tools. Data privacy and cybersecurity concerns pose additional risks, as smart irrigation relies on cloud platforms and IoT devices that require secure data transmission. The fragmented vendor ecosystem, combined with integration difficulties across hardware and software solutions, further complicates large-scale deployment for growers and landscape managers.

NORTH AMERICA SMART IRRIGATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Toro’s smart irrigation controllers and precision drip irrigation systems were deployed across a multi-acre commercial landscaping project in Arizona to manage watering schedules based on real-time evapotranspiration and soil-moisture conditions. | Significant water savings | Reduced landscape maintenance costs | Improved plant health through data-driven irrigation scheduling | Compliance with state water-efficiency regulations |

|

Rain Bird central control systems and IQ4 cloud-based irrigation solutions were implemented in a large municipal park network in California to remotely manage irrigation zones and adjust watering in response to microclimate variations. | Improved operational efficiency | Enhanced irrigation precision | Reduced water consumption across public green spaces | Minimized manual intervention | Reduced operating costs | Allowed rapid response to weather changes |

|

Hunter’s Hydrawise smart controllers and flow-sensing systems were integrated into a residential community irrigation upgrade program in Texas to enable automated adjustments and leak detection. | Substantial water savings | Early identification of irrigation system failures | Improved transparency for homeowners via mobile app alerts | Increased irrigation efficiency lowered utility bills and aligned the community with regional drought-resilience targets |

|

HydroPoint’s WeatherTRAK smart irrigation platform was deployed at corporate campuses across Washington and Oregon to optimize irrigation using hyper-local weather data and AI-driven water budgeting. | Major reductions in water usage | Improved compliance with state-level sustainability policies | Enhanced landscape quality | Reduced labor costs | Minimized water-related damage | Provide measurable environmental savings for corporate ESG reporting |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America smart irrigation ecosystem comprises system/component manufacturers, system integrators, and distributors. Smart irrigation end users include residential, commercial, agricultural, and municipal segments. Across the commercial segment, smart irrigation systems are deployed in corporate campuses, golf courses, hotels and resorts, sports turf facilities, retail complexes, and public parks. In agriculture, these systems support large farms, orchards, vineyards, and greenhouse operations through automated, data-driven water management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Smart Irrigation Market, By Country

Canada is projected to dominate the North America smart irrigation market due to strong government support for water conservation, high adoption of advanced agricultural technologies, and increasing smart farming investments. Its progressive sustainability policies and rapid deployment of connected irrigation systems enable the country to achieve the fastest growth during the forecast period.

North America Smart Irrigation Market, By Component

The sensor segment is expected to record the highest CAGR as soil-moisture, weather, and flow sensors are essential for accurate, automated irrigation decisions. Growing demand for real-time monitoring, improved water efficiency, and enhanced crop performance drives widespread adoption of sensor technologies, making them a critical component in smart irrigation systems.

North America Smart Irrigation Market, By System Type

Weather-based smart irrigation systems are projected to dominate market size as they adjust watering schedules based on real-time weather data, evapotranspiration rates, and climate patterns. Their ability to significantly reduce water waste, improve landscape health, and meet regulatory conservation requirements makes them preferable across residential, commercial, and agricultural applications.

North America Smart Irrigation Market, By Application

The agricultural segment is expected to register the highest CAGR due to increasing adoption of precision farming, rising water scarcity concerns, and strong need for automated irrigation. Farmers are adopting smart systems to optimize crop yields, reduce water usage, and enhance operational efficiency, making agriculture the fastest-growing application area.

REGION

Canada is expected to be fastest-growing country across North America Smart Irrigation market during forecast period

The smart irrigation market in Canada is witnessing strong growth driven by the increasing focus on water conservation, sustainability, and climate-resilient agriculture. Federal and state initiatives promoting efficient water use, along with rising adoption of IoT-enabled controllers and sensor-based systems, are accelerating market expansion. Demand is growing across agriculture, commercial landscapes, golf courses, and municipal parks, especially in drought-prone regions facing water scarcity challenges.

NORTH AMERICA SMART IRRIGATION MARKET: COMPANY EVALUATION MATRIX

In the North America Smart Irrigation market matrix, The Toro Company and Rain Bird Corporation (Star) lead with a strong market presence and extensive product portfolios, enabling wide adoption across residential, commercial, municipal, and agricultural applications. Their advanced smart controllers, sensor-based systems, and cloud-enabled platforms drive large-scale implementation and reinforce their leadership position across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- The Toro Company (US)

- Rain Bird Corporation (US)

- Hunter Industries Inc. (US)

- HydroPoint (US)

- Stevens Water Monitoring Systems Inc. (US)

- Weathermatic (US)

- HORTAU (Canada)

- CALSENSE (US)

- IrriGreen (US)

- Banyan Water Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.64 Billion |

| Market Forecast in 2030 (Value) | USD 1.11 Billion |

| Growth Rate | CAGR of 10.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America |

WHAT IS IN IT FOR YOU: NORTH AMERICA SMART IRRIGATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Smart Irrigation Equipment Manufacturer |

|

|

| Canadian AgTech Irrigation Startup |

|

|

| US-based WaterTech IoT Platform Provider |

|

|

| Smart Irrigation Components Supplier (Valves, Flow Meters) |

|

|

| Commercial Landscaping Customer (Multi-property Operator) |

|

|

RECENT DEVELOPMENTS

- October 2024 : At EIMA 2024, NETAFIM, a global leader in precision agriculture and part of Orbia, introduced two innovative products: GrowSphere and Orion PC. GrowSphere is an advanced digital irrigation and fertigation operating system that integrates IoT, cloud computing, and data analytics to automate irrigation based on real-time data and agronomic intelligence.

- August 2023 : The Rain Bird 11000 Series Rotor is a high-efficiency irrigation sprinkler head designed for large turf areas like sports fields, stadiums, and commercial landscapes. It delivers a 105-foot (32-meter) throw radius, allowing it to cover wider areas with fewer sprinkler heads compared to traditional systems.

- February 2022 : The Toro Company launched the Tempus Automation System for agricultural irrigation, a smart, user-friendly, and highly connected solution to automate and remotely manage irrigation systems. This system stands out for its advanced communication technology and ease of installation and maintenance.

Table of Contents

Methodology

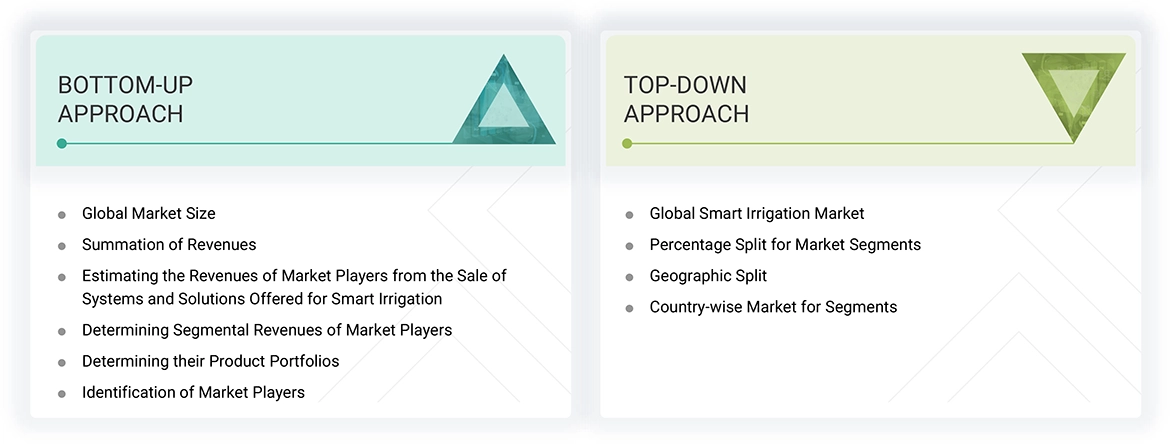

The research study involved four major activities in estimating the size of the North America smart irrigation market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the North America smart irrigation market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the North America smart irrigation market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the North America smart irrigation market.

- Major companies that provide north america smart irrigation systems were identified. This included analyzing company portfolios, product offerings, and presence across various regions.

- The segment-specific revenues of the companies, particularly those related to north america smart irrigation, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- Using this consolidated data, the global market size for north america smart irrigation was obtained.

The top-down approach has been used to estimate and validate the total size of the North America smart irrigation market.

- Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

- Estimated the overall North America smart irrigation market size, then segmented the global market by allocating shares based on the segments considered

- Distributed the segment-level markets into regions and countries by aligning regional north america smart irrigation activity with economic indicators, north america smart irrigation manufacturing presence, and national development initiatives

North America Smart Irrigation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the North Americasmart irrigation market

Market Definition

The smart irrigation sector involves the development, integration, and implementation of advanced irrigation technologies designed to optimize water usage in agricultural, commercial, and residential applications. This market focuses on improving irrigation efficiency, conserving water resources, and enhancing crop yields by automating and precisely controlling irrigation processes. North america north america smart irrigation systems utilize a network of technologies, including soil moisture sensors, weather-based controllers, flow meters, and automated valves, supported by IoT platforms, cloud computing, and data analytics, to deliver targeted water applications based on real-time environmental data. The north america smart irrigation industry provides a comprehensive range of solutions and services, such as sensor-based irrigation systems to monitor soil moisture and crop needs, climate-based irrigation controllers that adjust watering schedules based on weather data, and advanced control systems that enable remote management and automation of irrigation operations. These systems are capable of detecting leaks, measuring water flow, and preventing overwatering or underwatering, ultimately ensuring water efficiency and crop health.

Key Stakeholders

- Agricultural equipment component suppliers

- Original equipment manufacturers (OEMs)

- Irrigation system component and device suppliers and distributors

- Software, service, and technology providers

- Standardization and testing firms

- Government bodies such as regulatory authorities and policymakers

- Research institutes and organizations

- Farmer organizations

Report Objectives

- To define, describe, segment, and forecast the North America smart irrigation market by system type, component, and application in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the North America smart irrigation market

- To offer a detailed overview of the North America smart irrigation market’s value chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis

- To analyze industry trends, patents and innovations, and trade data (export and import data) related to north america smart irrigation

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To identify the key players and comprehensively analyze their market share and core competencies

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To investigate competitive developments, such as product launches/developments, collaborations, agreements, partnerships, acquisitions, and research & development (R&D), carried out by players in the North America smart irrigation market

- To profile key players in the North America smart irrigation market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Smart Irrigation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Smart Irrigation Market