North American Building Automation System Market

North American Building Automation System Market by Facility Management Systems, Security & Access Control, Wired Technologies, Fire Protection Systems, Building Energy Management Software, Residential, Industrial, Commercial - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

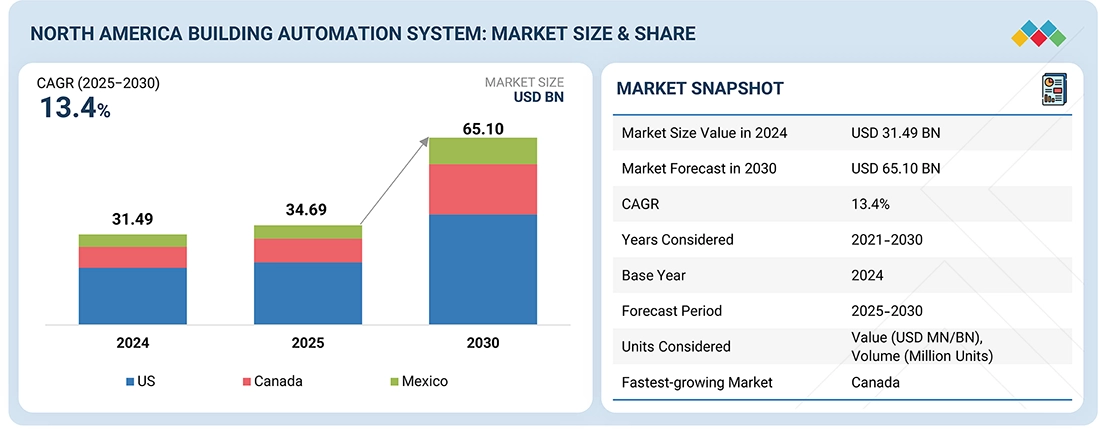

The North American building automation system market is projected to reach USD 65.10 billion by 2030 from USD 34.69 billion in 2025, at a CAGR of 13.4% from 2025 to 2030. Growth is driven by the increasing adoption of smart building technologies, tightening energy efficiency regulations, and the rising need for automated control of HVAC, lighting, security, and ventilation systems. Investments in IoT-enabled sensors, cloud-based management platforms, and AI-driven analytics, along with the push for digitalization across commercial and institutional buildings, are accelerating BAS deployment. Additionally, the growing emphasis on sustainability, carbon reduction, and real-time building performance optimization is enhancing operational efficiency, reducing energy costs, and supporting continued expansion of the North American building automation system market.

KEY TAKEAWAYS

-

BY COUNTRYCanada is projected to register the fastest growth of CAGR of 16.3%

-

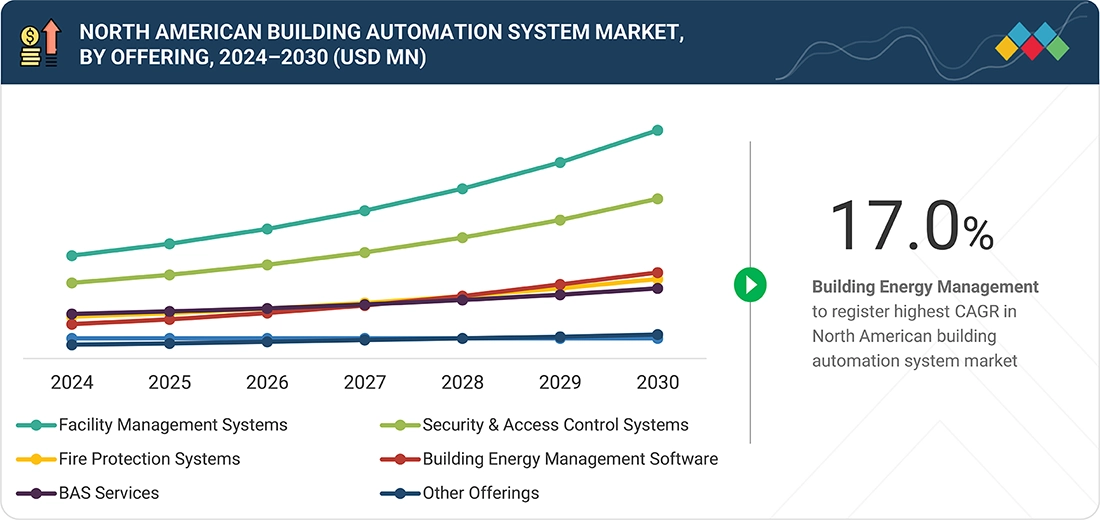

BY OFFERINGBy offering, the facility management systems dominates the market with share of ~33% in 2024.

-

BY APPLICATIONBy application, the market for industrial segment is projected to grow at a highest CAGR.

-

BY CONNECTIVITYBy connectivity, the market for wireless technologies segment is projected to grow at a higher CAGR.

-

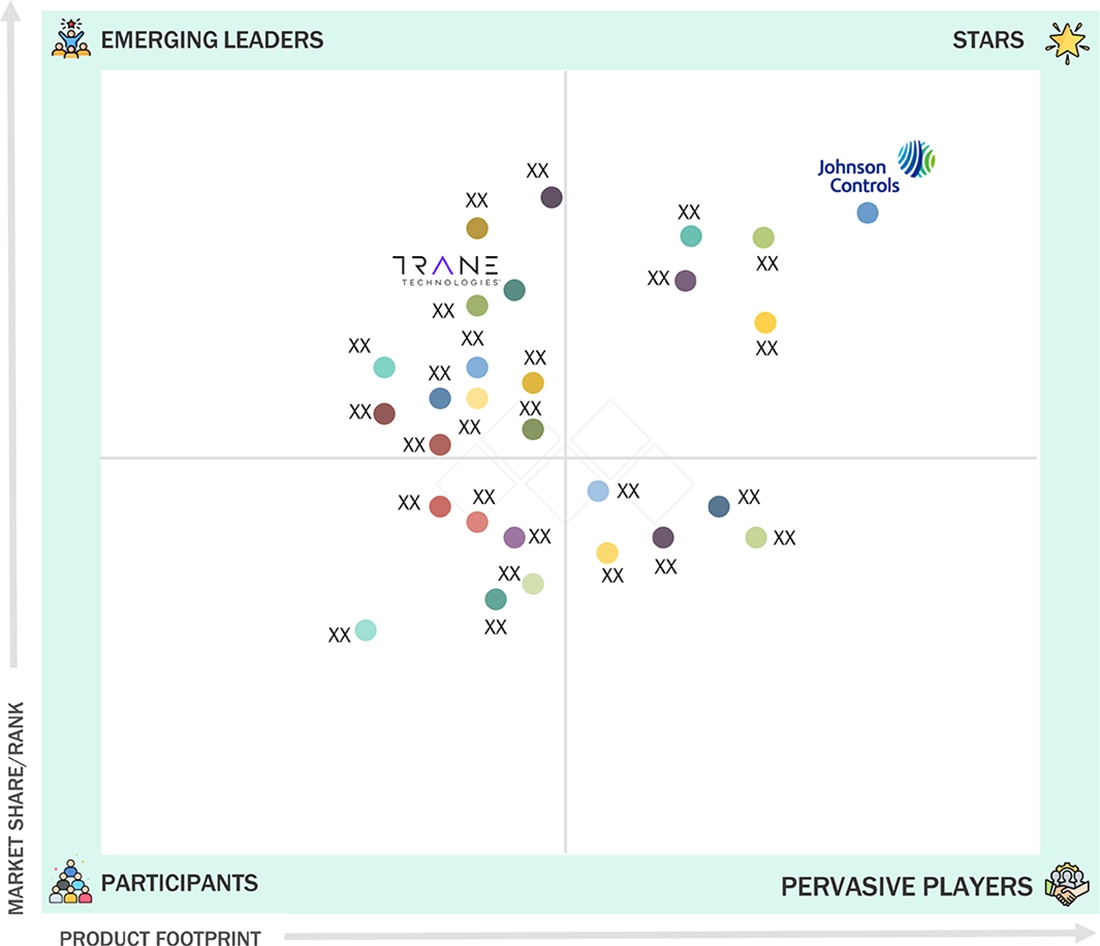

COMPETITIVE LANDSCAPECarrier (US), Siemens (Germany). and Honeywell International Inc. (US) were identified as some of the star players in the North American building automation system market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEDelta Intelligent Building Technologies (Canada) Inc. (Canada), Spaceti (UK), and 75F (US) among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The North American building automation system market is projected to grow rapidly over the next decade, driven by the rising need for energy-efficient, connected, and sustainable buildings. Commercial, residential, and industrial facilities are increasingly adopting automated HVAC, lighting, and environmental control systems to improve comfort, enhance indoor air quality, and reduce energy consumption. Climate-related temperature extremes are further increasing the demand for intelligent heating and cooling management, accelerating the adoption of advanced building automation solutions across the region.

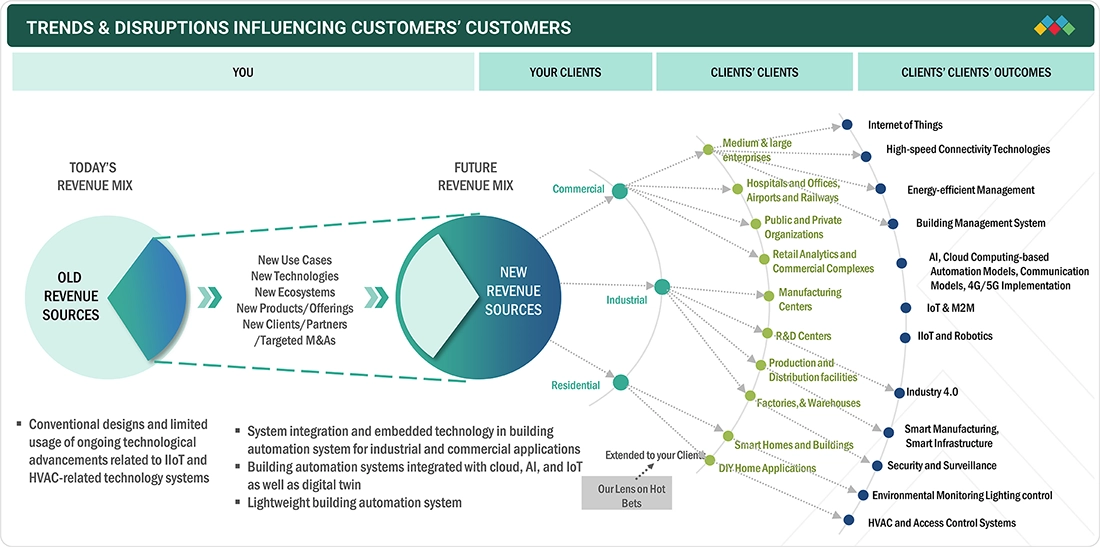

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer trends and disruptions are reshaping how buildings operate and how end users manage their facilities. The rise of IoT has significantly accelerated the evolution of building automation systems by enabling real-time connectivity, seamless integration, and intelligent decision-making. IoT-enabled BAS platforms support remote monitoring, predictive maintenance, and automated control across HVAC, lighting, security, and energy systems. Building operators can detect issues earlier, optimize equipment performance, and reduce downtime through continuous data-driven insights. With faster commissioning, enhanced connectivity, and centralized management, modern BAS delivers greater operational efficiency and improved occupant comfort across commercial, industrial, and residential environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High emphasis on constructing energy-efficient buildings

-

Incorporation of advanced surveillance and biometric technologies into building automation systems

Level

-

Technical complexities associated with installation and maintenance and shortage of skilled professionals

-

Difficulties in customizing building automation systems

Level

-

Increasing investments by governments and various stakeholders in establishment of smart cities

-

Government-led initiatives to enhance energy efficiency and comply with green building standards

Level

-

Lack of standardized communication protocols

-

Need to keep systems up-to-date with rapid technological advancements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High emphasis on constructing energy-efficient buildings

The North American building automation system market is expanding as demand rises for energy-efficient, sustainable, and smart buildings. Commercial, residential, and industrial facilities increasingly rely on BAS to manage HVAC, lighting, ventilation, and indoor air quality with greater precision. Climate-related temperature variations have heightened the need for intelligent control systems that can optimize heating and cooling loads. These shifts are driving higher adoption of BAS to reduce energy use, enhance comfort, and support long-term sustainability goals.

Restraint: Technical complexities associated with installation and maintenance and shortage of skilled professionals

Modern BAS deployments often require the advanced integration of sensors, communication networks, and software platforms, which creates complexity during installation and maintenance. Implementing systems such as IoT-enabled controls, automated HVAC management, and smart lighting requires skilled technicians familiar with networking, cybersecurity, and system programming. The shortage of trained BAS professionals across North America increases installation time, elevates costs, and slows adoption, particularly in small and mid-sized buildings.

Opportunity: Increasing investments by governments and various stakeholders in establishment of smart cities

Growing investment in smart city initiatives across North America is creating major opportunities for building automation systems. Governments and private stakeholders are promoting infrastructure that uses IoT-enabled controls, real-time monitoring, and integrated management platforms. BAS plays a central role by delivering data-driven optimization of energy, indoor environment, and building operations. As cities adopt connected lighting, smart grids, and intelligent buildings, demand for BAS solutions is expected to accelerate significantly.

Challenge: Lack of standardized communication protocols

A key challenge for the North American BAS market is the lack of uniform communication standards across devices and platforms. Many buildings operate with fragmented systems that use different protocols, making integration difficult and limiting interoperability. This creates compatibility issues between new BAS technologies and legacy equipment, increasing installation complexity and cost. The absence of standardization also slows digital transformation and discourages widespread adoption, especially in older buildings.

NORTH AMERICAN BUILDING AUTOMATION SYSTEM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of IoT-enabled smart home and building systems across student dormitories and classrooms, automating lighting, HVAC, and appliance control through smart devices. | 15–20% reduction in overall utility costs, improved occupant safety, and enhanced environmental comfort supporting digital campus sustainability goals. |

|

Deployment of automated HVAC, natural ventilation control, and sensor-driven building optimization at HouseZero, enabling real-time adjustments for ultra-low-energy performance. | 15–20% reduction in overall energy use, improved indoor comfort, and support for Harvard’s long-term sustainability goals. |

|

Implementation of Honeywell building automation system integrating HVAC equipment, chillers, boilers, VFD pumps, and room-level comfort controls across the Times Square property. | Achieved faster-than-expected ROI, significant energy savings, enhanced guest comfort, and improved maintenance efficiency through remote monitoring. |

|

Integration of an open-protocol BAS unifying HVAC, ventilation, lighting, and metering across multiple terminals to streamline operations and improve system coordination. | Over 25% reduction in construction costs, over 50% savings in maintenance, and improved operational efficiency supported by precise energy metering. |

|

Integration of AI-driven smart home devices across residential and hospitality facilities for automated lighting, climate, and security control through mobile and voice-enabled interfaces. | 18% improvement in energy efficiency, lower maintenance costs, and elevated guest experience through intelligent and customizable automation features. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North American building automation system ecosystem comprises hardware and software providers, control solution vendors, system integrators, and distributors. BAS end users include residential, commercial, and industrial facilities. Across the commercial segment, BAS solutions are widely deployed in offices, government buildings, airports, healthcare facilities, educational institutions, data centers, and retail environments to improve energy efficiency, comfort, and operational performance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Building Automation System Market, By Offering

The facility management systems segment accounted for a significant market share in 2024, supported by rising demand for centralized building monitoring, automated control of HVAC and lighting, and improved energy management capabilities. Growing adoption of IoT-enabled sensors, cloud-based platforms, and AI-driven analytics is enhancing system interoperability and enabling proactive maintenance. These advancements are helping residential, commercial, and institutional buildings reduce energy consumption, improve operational efficiency, and achieve long-term sustainability goals.

REGION

Canada is expected to be the fastest-growing country across North American building automation system market during the forecast period

Canada is projected to experience the fastest growth, driven by the expansion of smart infrastructure development and the modernization of aging buildings. Increasing adoption of intelligent BAS platforms, rising regulatory pressure for energy-efficient and low-carbon building standards, and growing demand from sectors such as data centers, healthcare, and commercial real estate are accelerating market expansion. Additionally, government incentives promoting energy management upgrades, advanced HVAC automation, and indoor air quality improvements are expected to further support BAS deployments nationwide throughout the forecast period.

NORTH AMERICAN BUILDING AUTOMATION SYSTEM MARKET: COMPANY EVALUATION MATRIX

In the North American building automation system market matrix, Johnson Controls (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across various industries, including commercial and industrial.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Johnson Controls (Ireland)

- Schneider Electric (France)

- Carrier (US)

- Siemens (Germany)

- Honeywell International Inc. (US)

- Robert Bosch GmbH (Germany)

- Legrand (France)

- Hubbell (US)

- ABB (Switzerland)

- Trane Technologies plc (Ireland)

- Lutron (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 31.49 Billion |

| Market Forecast in 2030 (Value) | USD 65.10 Billion |

| Growth Rate | CAGR of 13.4% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America: US, Canada, Mexico |

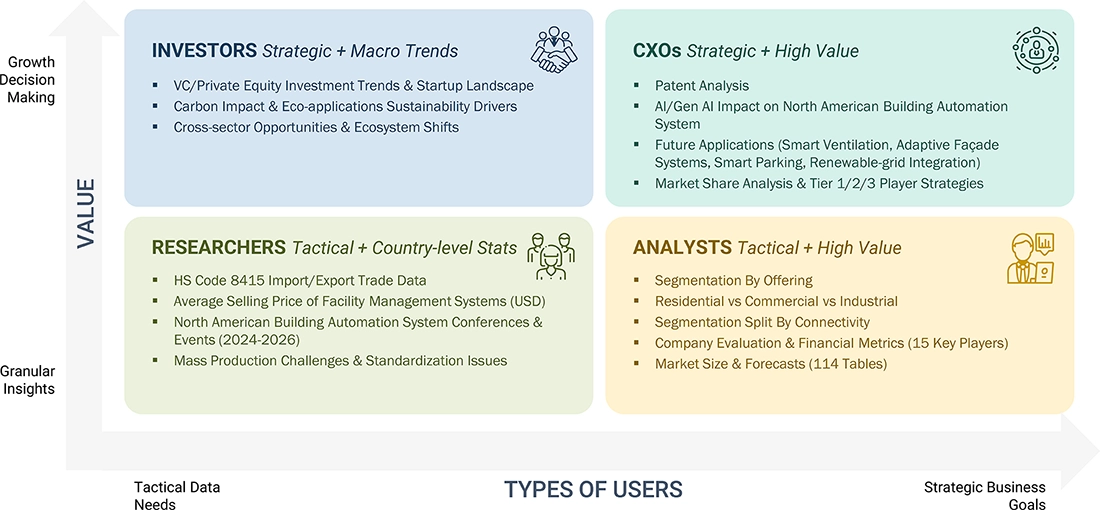

WHAT IS IN IT FOR YOU: NORTH AMERICAN BUILDING AUTOMATION SYSTEM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Building automation system manufacturer | Comprehensive competitive profiling of leading BAS vendors across HVAC controls, lighting automation, access management, and energy management platforms. Delivered strategic roadmap for next generation BAS integrating IoT, AI analytics, and cloud based building management systems. Included partnership and system integrator mapping for North America. | Identified emerging BAS innovation clusters and technology differentiation trends in North America. |

| Property developer / facility operator | Detailed benchmarking of BAS deployments across commercial, multi-residential, and institutional facilities, covering automation depth, interoperability, and energy performance outcomes. | Conducted cost benefit evaluation of BAS enabled HVAC, lighting, security, and energy optimization solutions. |

| Government agency / smart city authority | Conducted policy, regulatory, and infrastructure readiness assessment for large scale BAS adoption, covering building codes, cybersecurity standards, and municipal smart building frameworks. | Evaluated interoperability requirements, data governance frameworks, and compliance alignment with North American standards. |

| Technology provider / IoT platform integrator | Performed mapping of BAS platforms integrating AI-powered controls, IoT sensors, digital twins, and cloud-based analytics with open protocol interoperability. | Conducted cybersecurity framework assessment and validated BAS IoT data compliance mechanisms for North American markets. |

RECENT DEVELOPMENTS

- May 2025 : Automated Logic (US), a section of Carrier and known for its building automation and control systems, acquired Logical Building Automation. The acquisition aims to expand Automated Logic’s international presence and enhance its market influence in the building automation and controls sector.

- May 2025 : Legrand partnered with KODE Labs, a leader in smart building software, to bring out the Wattstopper 13 platform, the latest in smart lighting and building technology.

- March 2025 : Honeywell (US) introduced the Honeywell Home X25 smart thermostat at CES 2025. An easy-to-install thermostat features buttons on its user interface, whereas the Google Nest Learning Thermostat relies on touchscreens.

- January 2025 : Johnson Controls (Ireland) acquired Webeasy (Netherlands), a provider of building automation and control systems, to strengthen its position in the European building automation ecosystem. This strategic move is designed to enhance Johnson Controls' capabilities in delivering innovative, energy-efficient, and sustainable building solutions, particularly for small to medium-sized commercial buildings such as offices, schools, hotels, and sports facilities.

Table of Contents

Methodology

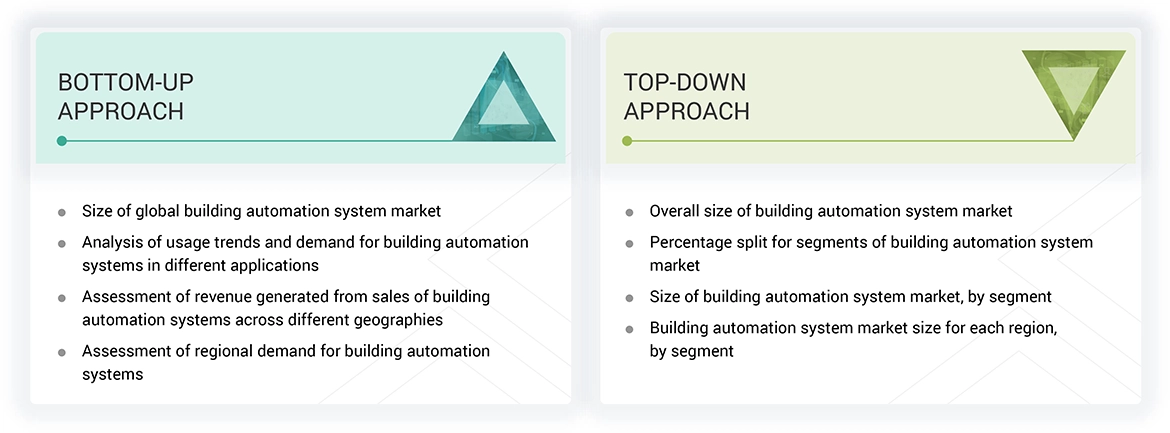

The research study involved four major steps in estimating the size of the north american building automation system market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry's supply chain, the market's value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding the north american building automation system market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across major regions— North America, Europe, Asia Pacific, and RoW. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been:

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the north american building automation system and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying major companies that provide north american building automation solutions and products

- Identifying major segments of north american building automation system products and solutions across various regions

- Identifying the market share estimates for deployments in different applications by understanding the demand for north american building automation system products and solutions

- Tracking the ongoing and upcoming developments of north american building automation system products

- Tracking the ongoing and upcoming offerings of north american building automation systems and forecasting the market size based on demand, investments, needs, and changes in demand

- Estimating the market size in various regions by analyzing the adoption of north american building automation system solutions in different applications

- Combining the regional market size for each segment to arrive at regional market estimates

- Interviewing multiple key leaders to understand the scope of the north american building automation system market, the demand for the product, and the market's future growth.

- Arriving at market estimates by identifying companies that provide north american building automation system products in different geographic regions and then combining this information to arrive at the market estimates for each region

- Verifying and validating estimates at every level by cross-checking them with the primaries, discussions with leaders, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases

North American Building Automation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at each market segment's and subsegment's exact statistics. The data has been triangulated by studying various factors and trends from the demand and supply sides in the north american building automation system market.

Market Definition

A north american building automation system (BAS) is a centralized control system that manages and monitors a building's mechanical and electrical equipment, such as HVAC, lighting, security, and fire systems. It integrates various subsystems to optimize energy efficiency, reduce operational costs, and enhance occupant comfort. BAS uses sensors, controllers, and software to automate tasks like adjusting temperature, controlling lighting based on occupancy, or managing ventilation. It is commonly used in commercial buildings, hospitals, and schools to streamline operations and support sustainability goals. Advanced BAS incorporates IoT and smart technologies for remote monitoring and data-driven decision-making.

Key Stakeholders

- Original device manufacturers (ODMs)

- Building automation service providers

- Networking technology vendors

- Real estate developers

- Building automation software and solution providers

- Building automation service providers

- Component suppliers

- Research organizations and consulting companies

- Sub-component manufacturers

- Technology providers

- Building automation system-related associations, organizations, forums, and alliances.

Report Objectives

- To describe and forecast the north american building automation system market based on communication technology, offering, application, and region in terms of value

- To describe and forecast the market, in terms of value, for various segments in four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To forecast the size of the north american building automation system market for facility management systems, by type, in terms of volume

- To strategically analyze the 2025 US Tariff pertaining to the market under study

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To provide a detailed overview of the north american building automation system supply chain and its industry trends

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the north american building automation system market

- To profile the key players and comprehensively analyze their market position in terms of the market share and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze competitive developments such as partnerships, collaborations, acquisitions, and product launches in the north american building automation system market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North American Building Automation System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North American Building Automation System Market