North America Edge AI Hardware Market

North America Edge AI Hardware Market by Device (Wearables, Robots, Edge Servers), Processor (CPU, GPU, and ASIC), Function (Training, Inference), Power Consumption (Less than 1 W, 1–3 W, >3–5 W, >5–10 W, and More than 10 W) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America edge AI hardware market is projected to reach 716.7 million units by 2030 from 349.8 million units in 2025, at a CAGR of 15.4% during the forecast period. A key market driver is the growing deployment of IoT devices across various industries, including smart homes, industrial automation, healthcare, and transportation. Many of these applications require real-time data processing, allowing decision-making to occur locally rather than in the cloud.

KEY TAKEAWAYS

-

BY COUNTRYThe US is expected to dominate the North America edge AI hardware market in terms of volume with a share of 89% in 2025.

-

BY DEVICEBy device type, the smart mirror segment is expected to register the highest CAGR of 39.4% during the forecast period.

-

BY FUNCTIONBy function, the training segment is expected to register the highest CAGR during the forecast period.

-

BY POWER CONSUMPTIONBy power consumption, the 1–3 W segment is expected to dominate the North America edge AI hardware market in terms of volume in 2025.

-

BY PROCESSORBy processor, the GPU segment is expected to witness significant growth during the forecast period.

-

BY VERTICALBy vertical, the automotive & transportation segment will grow at the fastest rate during the forecast period.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)Qualcomm Technologies, Inc., Intel Corporation, and NVIDIA Corporation were identified as star players in the North America edge AI hardware market, given their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Imagination Technologies, Cambricon, Horizon Robotics, and CEVA Inc. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The North America edge AI hardware market is driven by several factors, including the growing demand for IoT-based edge computing solutions, the rising adoption of 5G networks that integrate IT and telecom, and the increasing need for dedicated AI processors for on-device image analytics. However, market growth is significantly hindered by limited on-device training capabilities and a notable shortage of skilled AI professionals.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The diagram illustrates the evolving role of edge AI hardware, transitioning from consumer-focused applications in 2024—such as electronics, hospitality, and retail—to more industrial and enterprise-driven applications by 2030, including healthcare, automation, chatbots, and agriculture. This shift reflects the growing demand for edge AI in high-value use cases, including image detection, fraud detection, data analytics, and automated translation. Industries like automotive, healthcare, and manufacturing are integrating edge AI to enable advanced functionalities, ranging from advanced driver assistance systems (ADAS) and autonomous vehicles to robotics and industrial automation. A notable example is Tesla, which utilizes edge-based deep learning for real-time object detection. Overall, the market is shifting toward mission-critical, low-latency applications, positioning edge AI as a crucial enabler of next-generation industry solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Need for real-time data processing and reduced cloud dependency

-

Development of dedicated AI processing units for edge device applications

Level

-

Complexities associated with network implementation

Level

-

Advancements in edge AI hardware through generative AI workload optimization

-

Development of on-device visual processors for next-generation mobile AI applications

Level

-

Balancing performance and power consumption in edge AI systems

-

Developing cohesive edge AI standards across diverse industry requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Development of dedicated AI processing units for edge device applications

In North America, the demand for dedicated AI processors is accelerating as enterprises, hyperscalers, and device manufacturers increasingly shift toward on-device inference. Companies such as Intel, AMD, Qualcomm, and Apple are advancing edge-optimized SoCs with integrated NPUs to support real-time AI tasks. The rapid expansion of connected devices across consumer electronics, industrial automation, and smart infrastructure is reinforcing the need for localized processing to reduce cloud latency and enhance responsiveness.

Restraint: Complexities associated with network implementation

North America continues to face challenges related to the high cost of modernizing edge infrastructure, including densifying networks, expanding fiber backhaul, and integrating edge nodes. While the region is technologically mature, enterprises continue to struggle with legacy systems, fragmented connectivity in rural areas, and the operational burden of scaling edge deployments. These factors make large-scale implementation resource-intensive and can limit performance when real-time data access or local storage optimization is required.

Opportunity: Opportunities in ultra-low latency AI applications with 5G-powered edge infrastructure

With North America leading global 5G commercial deployments, the region is well-positioned to capitalize on ultra-low-latency AI applications. Telecom operators such as Verizon, AT&T, and T-Mobile are actively integrating mobile edge computing (MEC) capabilities, enabling advanced use cases in autonomous vehicles, smart manufacturing, robotics, and immersive experiences. This ecosystem creates significant growth potential for vendors offering AI accelerators, MEC hardware, and integrated 5G–edge AI solutions.

Challenge: Balancing performance and power consumption in edge AI systems

Developers in North America face growing pressure to deliver high-performance edge AI solutions within strict thermal and power budgets, especially in battery-operated devices, EV platforms, and industrial systems. As AI workloads become more complex—including generative AI and advanced perception systems—manufacturers must optimize models, fine-tune hardware architectures, and implement efficient power management. The challenge is intensified by rising expectations for sustainability and regulatory scrutiny around energy efficiency.

North America Edge AI Hardware Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Jetson AGX Orin deployed in robotics and edge AI systems for real-time perception and automation. | High-accuracy inference, improved operational efficiency, reduced latency, and enhanced autonomous navigation |

|

Ambarella CVflow AI SoCs powering 5 nm security camera platforms for smart video analytics | Enhanced image quality, efficient edge-based video inference, low latency, and improved surveillance processing |

|

Jetson Orin Nano used across industrial automation, smart surveillance, retail vision analytics, and healthcare edge-AI systems | Lower latency, reduced cloud costs, better real-time decisions, and power-efficient on-device inference |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America edge AI hardware ecosystem comprises original equipment manufacturers, hardware providers, edge AI software platform providers, distributors, and standard bodies. These players are supported by a growing base of edge AI software platforms and solution vendors that enable model optimization, device orchestration, and edge-to-cloud integration across key European industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Edge AI Hardware Market, by Device

In North America, smartphones continue to represent the largest share of edge AI hardware adoption, driven by high device penetration, rapid upgrade cycles, and strong demand for AI-driven features such as advanced imaging, personal AI assistants, and on-device generative AI. The region’s emphasis on privacy and low-latency processing is accelerating the shift toward on-device AI computation. Wearables are gaining momentum as US consumers adopt more health, fitness, and biometric monitoring devices powered by low-power NPUs. This category is expected to post one of the fastest growth rates as brands integrate richer AI capabilities and expand into healthcare, enterprise productivity, and sports analytics.

North America Edge AI Hardware, by Function

Inference is projected to dominate the North America edge AI hardware landscape, supported by strong demand for real-time analytics across consumer electronics, automotive systems, industrial automation, and smart surveillance. Most AI workloads in the region prioritize fast on-device inference to reduce cloud dependence, enhance data privacy, and meet stringent latency requirements. With the rise of autonomous vehicles, advanced robotics, and AI-enabled IoT deployments, inference-optimized processors and accelerators are becoming a core investment area. Training at the edge remains niche but is gradually emerging in applications such as adaptive robotics, personalized AI services, and federated learning initiatives led by major US tech companies.

North America Edge AI Hardware, by Power Consumption

In North America, edge AI devices operating in the 1–3 W power range are expected to dominate the market due to strong adoption across smartphones, wearables, smart cameras, and IoT endpoints. These devices rely on low-power NPUs and AI accelerators to deliver real-time inference without excessive energy consumption—an increasingly important requirement in U.S. consumer electronics and industrial IoT deployments. As demand rises for AI-enabled mobile devices, smart homes, and low-power industrial sensors, the 1–3 W segment will continue capturing the largest share of edge AI hardware consumption in the region.

North America Edge AI Hardware, by Processor

CPUs will continue holding a substantial share of the North America market, given their widespread use in smartphones, tablets, smart speakers, and edge gateways that perform AI-supported tasks. While NPUs and GPUs are gaining momentum for advanced edge inference, CPUs remain integral in hybrid AI workloads and general-purpose edge computing. U.S. device manufacturers and cloud-edge players increasingly integrate AI-optimized CPUs from Apple, Qualcomm, AMD, and Intel, supporting both lightweight inference and efficient multitasking across consumer and enterprise devices.

North America Edge AI Hardware, by Vertical

The Automotive & Transportation sector is projected to record the highest growth in North America, driven by rapid advancements in autonomous driving, ADAS systems, connected vehicle platforms, and intelligent transportation infrastructure. U.S. automakers and mobility technology firms are investing heavily in edge AI processors to support real-time perception, sensor fusion, and decision-making within vehicles. Additionally, logistics companies and fleet operators are adopting AI-enabled cameras, telematics units, and predictive maintenance systems to enhance safety and operational efficiency. As regulatory momentum grows for vehicle safety automation and smart mobility initiatives, the Automotive & Transportation vertical will experience the fastest expansion in edge AI hardware demand across the region.

REGION

Mexico is expected to be the fastest-growing country in the North America edge AI hardware market during the forecast period

Mexico is expected to witness the highest growth rate in the North America edge AI hardware market, driven by strong momentum in nearshoring-led manufacturing expansion, the rapid adoption of industrial automation and robotics, and increasing investments in 5G networks, smart-city initiatives, and AI-driven public safety solutions. The country’s growing automotive and electronics production ecosystem further accelerates demand for advanced edge AI devices.

North America Edge AI Hardware Market: COMPANY EVALUATION MATRIX

In the North America edge AI hardware market matrix, NVIDIA and Qualcomm (Star) lead with strong technological leadership and broad AI accelerator portfolios, driving the large-scale deployment of edge intelligence across key sectors, including automotive, industrial automation, smart devices, and connected infrastructure.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Qualcomm Technologies, Inc. (US)

- Huawei Technologies Co., Ltd. (China)

- SAMSUNG (South Korea)

- Apple Inc. (US)

- MediaTek Inc. (Taiwan)

- Intel Corporation (US)

- NVIDIA Corporation (US)

- IBM (US)

- Micron Technology, Inc. (US)

- Advanced Micro Devices, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Volume) | USD 292.7 Million Units |

| Market Forecast in 2030 (Volume) | USD 716.7 Million Units |

| Growth Rate | CAGR of 15.4% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America (US, Canada, and Mexico) |

WHAT IS IN IT FOR YOU: North America Edge AI Hardware Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market Mapping of Edge AI Devices |

|

|

| Benchmarking of Edge AI Chip Providers |

|

|

| Industrial & Automotive Edge AI Opportunity Assessment |

|

|

| Inference vs. Training Workload Analysis |

|

|

| 5G & Edge Infrastructure Impact Study |

|

|

RECENT DEVELOPMENTS

- January 2025 : Qualcomm unveiled new edge-AI innovations at CES 2025, strengthening on-device AI capabilities across mobile, IoT, and embedded systems.

- April 2025 : Qualcomm’s Snapdragon 8 Elite Platform received the 2025 Edge AI and Vision Product of the Year award, recognizing its leadership in edge-AI processing for consumer and IoT devices.

- October 2025 : NVIDIA and Qualcomm were highlighted as driving North America’s edge-AI ecosystem by enabling edge-first computing across PCs, automotive platforms, and industrial systems.

- October 2025 : Qualcomm introduced the AI200 and AI250 processors designed for high-performance AI workloads spanning edge devices and data-center environments.

Table of Contents

Methodology

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the North America edge AI hardware market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and OneSource) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the North America edge AI hardware market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the North America edge AI hardware market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the North America edge AI hardware industry, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the North America edge AI hardware market. After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the obtained critical numbers. Primary research has been conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

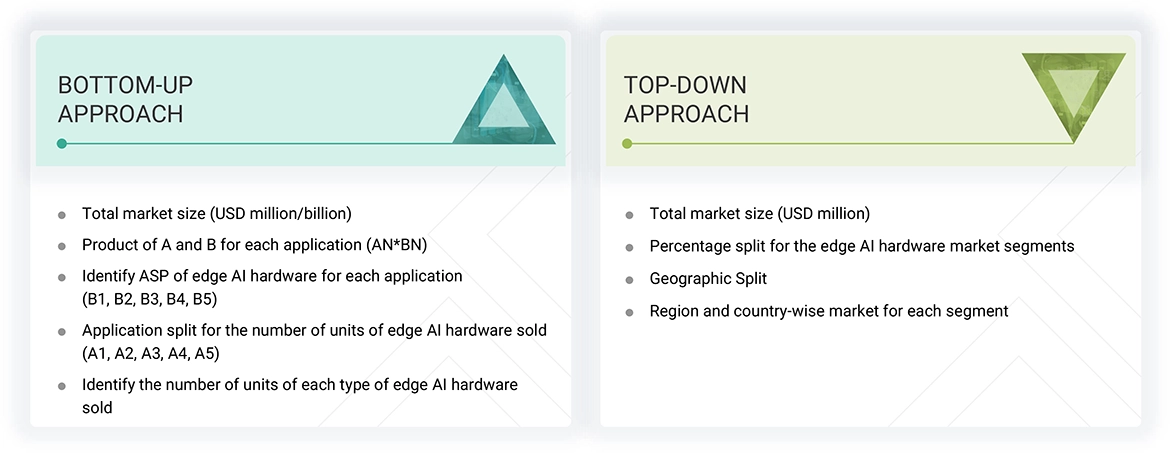

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights about the North America edge AI hardware market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

North America Edge AI Hardware Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Artificial intelligence (AI) technology is now implemented in smartphones, automobiles, drones, and robots. Edge AI is the combination of edge computing and artificial intelligence. Edge AI is the implementation of AI applications in devices throughout the physical world. In this technique, the computation of AI is done near the user at the edge of the network, close to where the data is located, rather than centrally in a cloud computing facility or private data centers. Edge AI offers a way to process data faster than cloud processing. The release of low-power and high-computing processors has led to integrating AI algorithms into devices. Developing dedicated AI processors for edge devices has resulted in AI inference performed on devices rather than the cloud platform.

Key Stakeholders

- Semiconductor companies

- Technology providers

- Universities and research organizations

- System integrators

- AI solution providers

- AI platform providers

- AI system providers

- Investors and venture capitalists

- Manufacturers and people implementing AI technology

- Government agencies

- IoT providers

- Consulting firms

Report Objectives

- To define, describe, and forecast the North America edge AI hardware market, in terms of volume, by processor, power consumption, device, function, vertical, and region

- To define, describe, and forecast the North America edge AI hardware market, in terms of value

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the North America edge AI hardware market

- To analyze supply chain, market/ecosystem map, trend/disruptions impacting customer business, technology analysis, Porter's five force analysis, trade analysis, case study analysis, patent analysis, key conferences & events, and regulations related to the North America edge AI hardware market

- To analyze opportunities for stakeholders in the North America edge AI hardware market by identifying the high-growth segments

- To strategically analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, and partnerships of leading players

- Analyzing opportunities in the market for stakeholders and providing a competitive landscape for the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Edge AI Hardware Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Edge AI Hardware Market