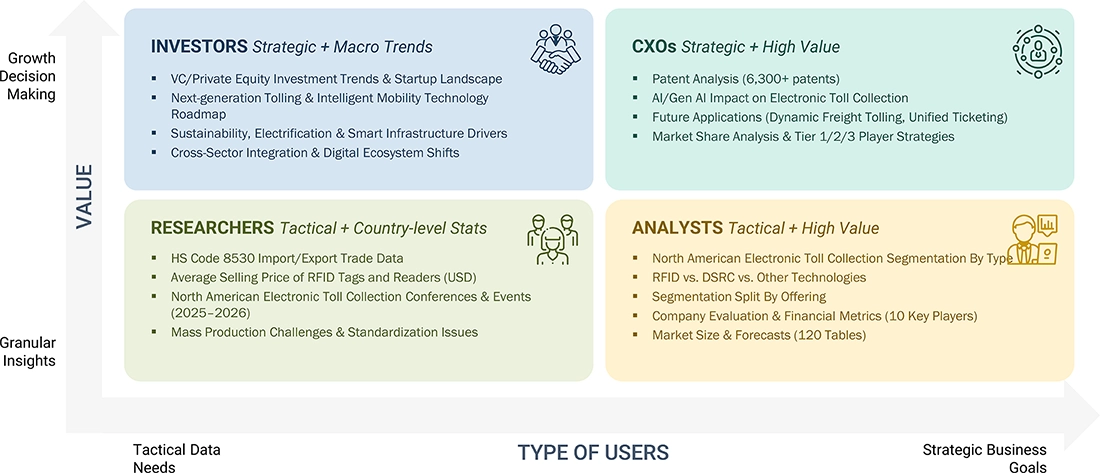

North America Electronic Toll Collection Market

North America Electronic Toll Collection Market by Radio-Frequency Identification, Dedicated Short-Range Communications, Back Office & Other Services, Highways, Urban Areas, Transponders/Tag-based Tolling Systems - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

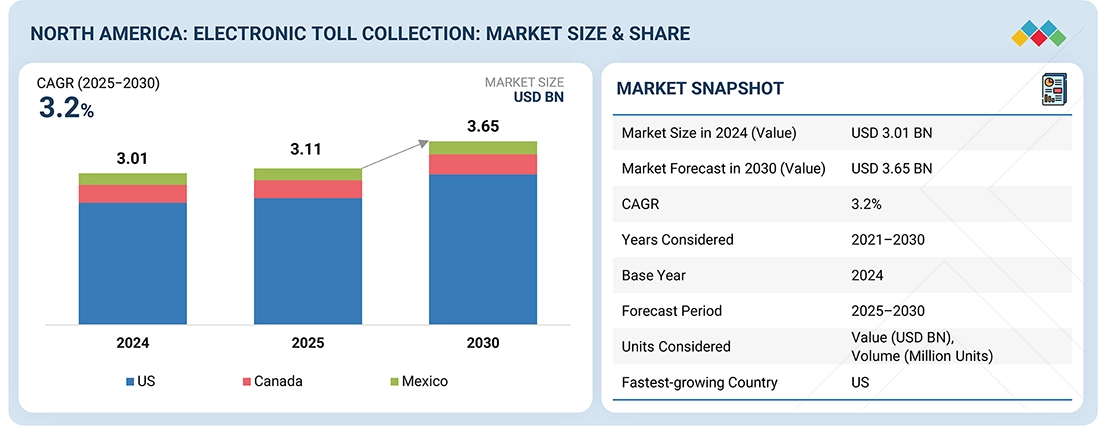

The North America electronic toll collection market is expected to grow from USD 3.11 billion in 2025 to USD 3.65 billion by 2030 at a CAGR of 3.2% during the forecast period. The region is experiencing rapid upgrades from manual and hybrid tolling systems to fully electronic and cashless setups, supported by significant federal and state funding for highway expansion and congestion-reduction projects. Increasing deployment of ANPR, RFID, and GNSS-based tolling solutions, along with AI-enabled violation detection and automated billing, is enhancing operational efficiency and reducing revenue leakage. Furthermore, the growing adoption of connected and electric vehicles, improved interoperability among toll agencies, and ongoing public–private partnerships for roadway modernization are boosting system reliability and driving consistent growth in the ETC market across North America.

KEY TAKEAWAYS

-

BY REGIONThe US is projected to register the highest CAGR of 3.5% during the forecast period.

-

BY TYPEBy type, the transponders/tag-based tolling systems segment dominated the market, with ~92% in 2024.

-

BY TECHNOLOGYBy technology, the RFID segment dominated the market with ~94% in 2024.

-

BY OFFERINGBy offering, the back office & other services segment is projected to grow at the fastest rate of 3.6% from 2025 to 2030.

-

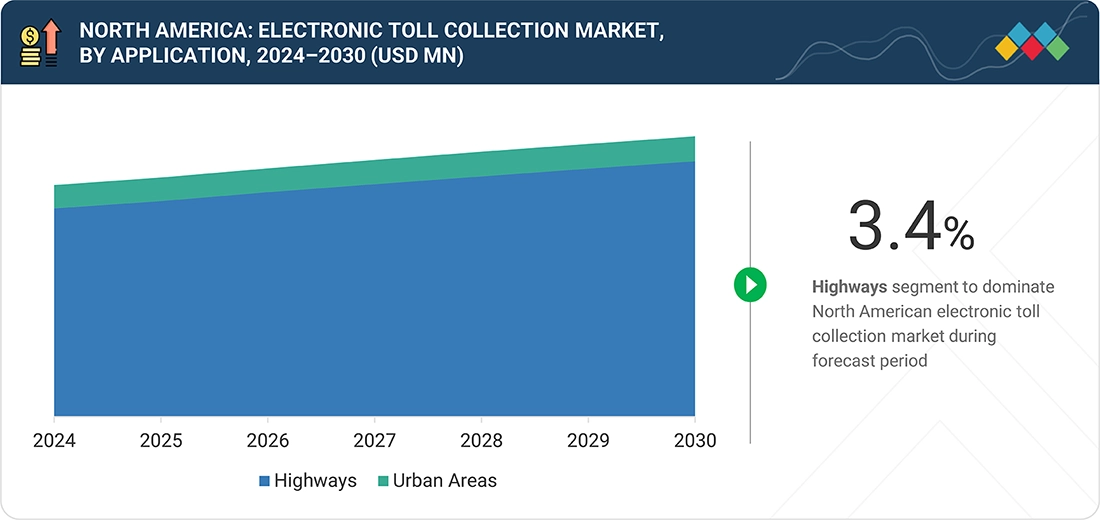

BY APPLICATIONBy application, the highways are expected to dominate the market with ~90% share in 2024.

-

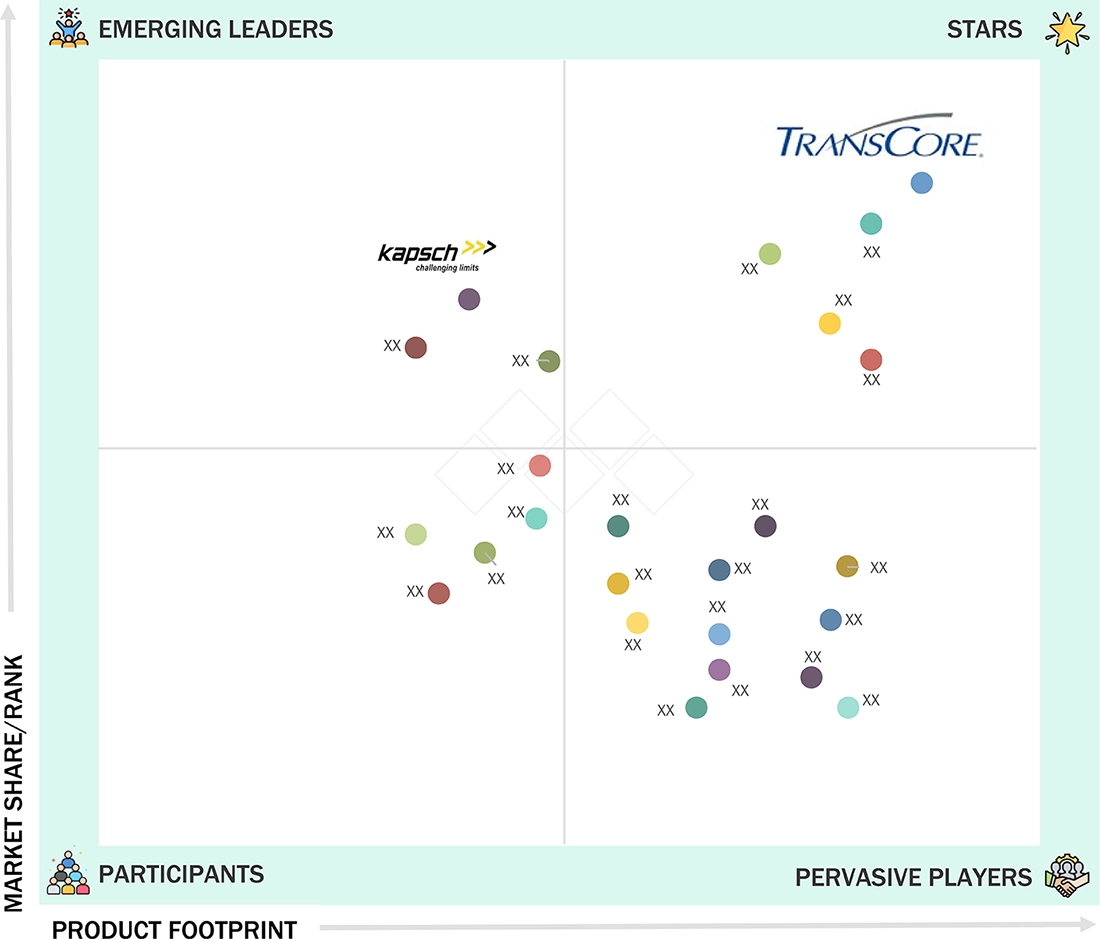

COMPETITIVE LANDSCAPE - KEY PLAYERSKapsch TrafficCom AG, Conduent Incorporated, and ST Engineering (TransCore) are recognized as star players in the electronic toll collection market due to their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESBestPass Inc., ClearRoad, Inc., and Blissway Inc. have stood out among startups and SMEs by establishing solid footholds in specialized niche areas, highlighting their potential as emerging market leaders.

The North America electronic toll collection (ETC) market is expected to grow substantially over the next decade, driven by rapid digital transformation in transportation infrastructure, increasing demand for contactless payment systems, and expanding government efforts toward intelligent and sustainable mobility networks.

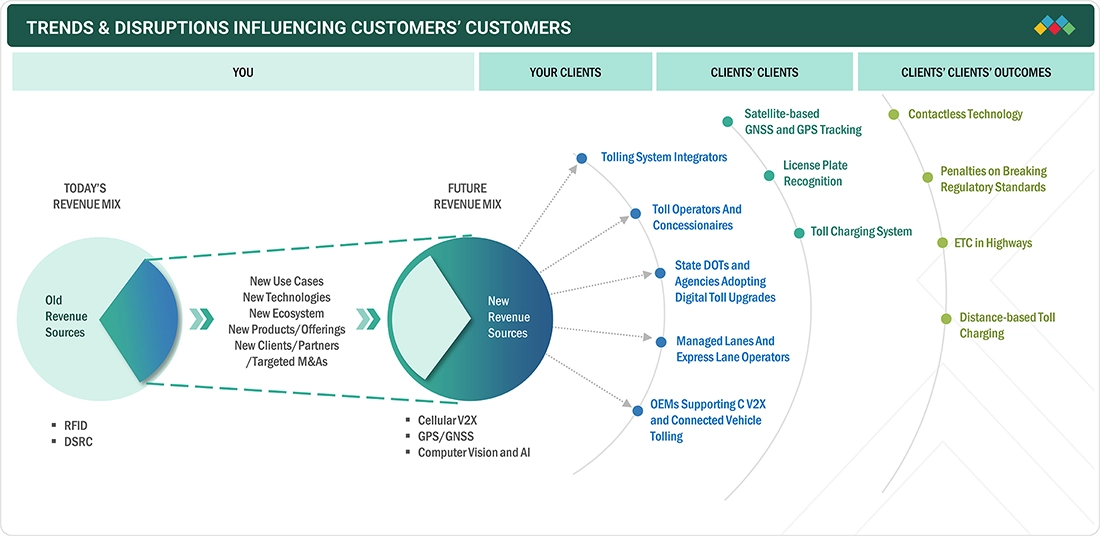

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The mobility and transportation sector mainly includes highway authorities, urban transit agencies, logistics providers, and infrastructure developers. Electronic toll collection systems have been widely implemented across these areas to enable smooth vehicle identification, cashless payments, and congestion management. Additionally, new opportunities are emerging through the integration of AI-powered license plate recognition (ANPR/ALPR), satellite-based GNSS tolling, and connected vehicle data analytics for real-time traffic management. These innovations are expected to drive the future of smart mobility ecosystems, enhancing efficiency, sustainability, and revenue growth for toll operators and governments alike.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of cashless and open-road tolling (ORT) across the US and Canada

-

Strong government focus on congestion pricing, road modernization, and highway digitalization

Level

-

High capital and maintenance costs of upgrading legacy toll plazas to fully automated ORT systems

-

Resistance from certain states and public groups towards congestion pricing programs

Level

-

Increasing adoption of multilane free-flow (MLFF) systems across US toll roads

-

Expansion of interoperability agreements across states

Level

-

Data privacy concerns related to license plate recognition, user tracking, and transaction history

-

Interoperability gaps between different state-operated toll networks despite ongoing integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid expansion of cashless and open-road tolling (ORT) across the US and Canada

Electronic toll collection systems in North America are experiencing rapid expansion, supported by comprehensive modernization initiatives of highways and the ongoing transition to fully electronic tolling throughout the United States and Canada. Federal and state transportation authorities are emphasizing congestion mitigation, revenue security, and enhanced traffic management through digital tolling improvements. Widespread adoption of Automatic Number Plate Recognition (ANPR), Radio Frequency Identification (RFID), and Global Navigation Satellite System (GNSS)-enabled tolling, complemented by substantial investments in artificial intelligence (AI)-powered analytics, vehicle classification, and violation detection technologies, is propelling the growth of electronic toll collection (ETC). Furthermore, increasing interoperability amongst toll agencies and multi-state toll networks is significantly improving user convenience and facilitating seamless mobility across different regions.

Restraint: High capital and maintenance costs of upgrading legacy toll plazas to fully automated ORT systems

Despite strong momentum, high upfront investment costs still limit agencies from moving from traditional or mixed tolling systems to fully automated ETC platforms. North America toll operators face considerable expenses for gantry installation, high-precision sensors, back-office integration, and long-term upkeep of AI-enabled and cloud-based tolling systems. Retrofitting existing roadways, upgrading communication layers, and ensuring cybersecurity compliance further increase operational costs. Smaller toll agencies and local authorities, in particular, encounter budget constraints that slow the shift to fully electronic tolling.

Opportunity: Increasing adoption of multilane free-flow (MLFF) systems across US toll roads

North America shows strong growth opportunities driven by the rising adoption of multi-lane free-flow tolling, which removes booth-based delays and improves traffic flow on busy US and Canadian expressways. The expansion of connected vehicle ecosystems, digital mobility-as-a-service platforms, and AI-powered traffic analysis is supporting more efficient toll collection and revenue management. Public–private partnerships for roadway upgrades and the inclusion of EV-specific tolling incentives also promote market growth. Ongoing shift toward interoperable, account-based tolling systems across major toll authorities further boosts long-term scalability.

Challenge: Data privacy concerns related to license plate recognition, user tracking, and transaction history

As ETC systems evolve toward cloud-based architectures, real-time analytics, and vehicle-to-infrastructure communication, North America faces increased concerns about data security and privacy. Unauthorized access, system breaches, violations of privacy regulations, and transaction errors pose operational risks. Agencies must comply with strict data protection laws, including federal requirements and state-specific privacy regulations like the California Consumer Privacy Act (CCPA). Ensuring accurate vehicle recognition, reducing false positives in ANPR systems, and keeping audit-ready transaction records are vital challenges for toll operators aiming to protect user trust and system integrity.

NORTH AMERICA ELECTRONIC TOLL COLLECTION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Migration from manual toll plazas to statewide open-road tolling supported by cloud-based back-office systems and automated violation management | Up to 40% improvement in operational efficiency, lower staffing and plaza maintenance costs, smoother traffic flow, and minimized crash points near former toll booths. |

|

Implementation of open-road tolling (ORT) and express lanes on Bay Area bridges and highways using RFID + ALPR hybrid tolling infrastructure | 40% reduction in delay at peak hours, improved lane throughput, reduced emissions, enhanced revenue collection, and consistent travel-time reliability. |

|

Integration of E-ZPass electronic toll payment and account management system for streamlined customer service | Shorter wait times, easier account handling, reduced payment discrepancies, and higher customer satisfaction. |

|

Migration to cloud-based toll management platform with AI-enabled OCR and real-time analytics to improve operational efficiency | 40% reduction in operational costs, increased billing accuracy, 100% system uptime, and better data visibility for operators. |

|

Deployment of fully electronic tolling system on 183A, 290 Toll, and Mopac Express using RFID tags (TxTag), license plate tolling, and real-time traffic analytics to support commuters in fast-growing Austin metro areas | Reduced peak-hour travel times by up to 60%, improved commuting reliability for daily users, faster emergency vehicle response due to decongested corridors, and higher toll accuracy with minimized billing disputes for end-users. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

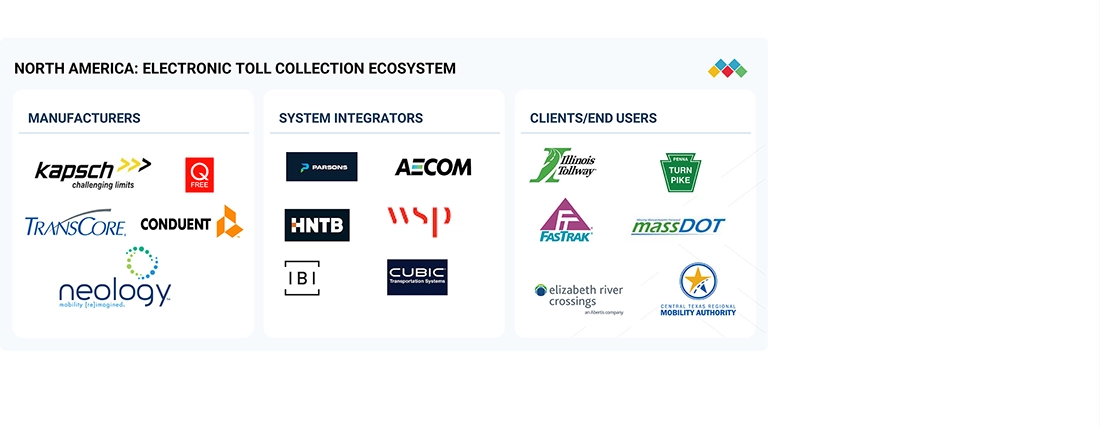

MARKET ECOSYSTEM

The North America electronic toll collection ecosystem is supported by a robust network of established solution providers, system integrators, and public tolling authorities. Prominent ETC system manufacturers such as Kapsch TrafficCom, TransCore, Q-Free, and various regional technology suppliers play a pivotal role in delivering ANPR, RFID, GNSS, and back-office tolling platforms. These solutions are integrated and implemented by leading North America infrastructure and engineering firms, including Parsons, AECOM, HNTB, and WSP, facilitating large-scale upgrades from legacy tolling systems to multi-lane free-flow and fully electronic systems. On the demand front, prominent tolling agencies and state authorities such as Illinois Tollway, Pennsylvania Turnpike, MassDOT, FasTrak, and other regional operators are expediting the adoption of digital and interoperable tolling frameworks. Collaboration among manufacturers, integrators, and end-user agencies is propelling advancements in AI-driven tolling, congestion pricing, smart mobility integration, and revenue maximization within the North America ETC market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Electronic Toll Collection Market, By Type

The transponder/tag-based tolling systems segment held the largest market share in North America in 2024, driven by the long-standing use of RFID transponders across US and Canadian highways. Major toll networks such as E-ZPass, FasTrak, TxTag, SunPass, and others rely heavily on tag-based systems because of their proven reliability, low latency, and strong interoperability across multiple-state tolling corridors. The ongoing modernization of express lanes, expansion of managed lanes, and shift toward all-electronic and open-road tolling are maintaining the dominance of transponder-based solutions in the North America market.

North America Electronic Toll Collection Market, By Technology

The RFID technology segment held a large share of the North America market in 2024, driven by widespread use of E-ZPass-compatible tags and agency-specific RFID systems across state and regional toll networks. ANPR (Automatic Number Plate Recognition) continues to grow in popularity as states expand video tolling and license plate-based billing for violators and non-tag users, while GNSS-based tolling remains in early stages of adoption for distance-based charging pilots. The combination of RFID tags with high-accuracy ANPR systems is becoming the preferred hybrid setup for North America ITS-aligned toll operations.

North America Electronic Toll Collection Market, By Offering

The back office and services segment captured the largest market share in North America in 2024, driven by the increasing demand for cloud-based billing engines, account and violation management systems, and multi-agency interoperability platforms. Tolling authorities across the region are investing in real-time data analytics, automated reconciliation, customer service automation, and predictive maintenance for lane equipment. Service providers are increasingly supporting large-scale ETC programs, helping agencies optimize revenue, streamline operations, and meet evolving data governance and cybersecurity standards.

North America Electronic Toll Collection Market, By Application

The highways segment held the largest market share in North America in 2024, supported by widespread ETC deployment across interstate highways, express toll lanes, managed lanes, and major cross-border routes. States are quickly upgrading to multi-lane free-flow systems to reduce congestion, increase throughput, and enable dynamic pricing models. North America cities are also testing congestion pricing, parking automation, and distance-based charging, which further drives ETC adoption as part of broader smart mobility and roadway modernization efforts.

REGION

US expected to register highest CAGR in North America electronic toll collection market during forecast period

The US will experience the fastest growth rate from 2025 to 2030, driven by the swift transition toward fully electronic and multi-lane free-flow tolling systems across federal, state, and regional highway networks. State transportation agencies are prioritizing ETC to eliminate manual tolling processes, improve congestion management, and enhance revenue transparency, especially as declining fuel tax revenues accelerate the shift toward usage-based road charging. This growth is further supported by continuous upgrades to managed lanes, expansion of tolled expressways, and increased adoption of RFID and Automatic Number Plate Recognition (ANPR)-based video tolling systems. Additionally, the reduction in hardware costs, robust policy support for digital mobility infrastructure, and initiatives aimed at achieving interoperability across large toll networks, such as E-ZPass, reinforce the nation's momentum toward the comprehensive adoption of fully electronic tolling.

NORTH AMERICA ELECTRONIC TOLL COLLECTION MARKET: COMPANY EVALUATION MATRIX

In the North America electronic toll collection market, TransCore and Kapsch TrafficCom AG (Stars) hold dominant positions, driven by their extensive product footprints, strong market share, and long-standing leadership in multi-lane free-flow systems, RFID-based tolling, ANPR video tolling, and advanced back-office solutions. Their ability to deliver large-scale, interoperable, and highly reliable tolling platforms has positioned them at the forefront of the region’s ETC landscape. Several technology vendors identified as Emerging Leaders are gaining traction through focused innovation in cloud-based back-office platforms, AI-enabled vehicle recognition, and data-centric tolling solutions, broadening their relevance in regional deployments. Meanwhile, a broad set of Participants and Pervasive Players contribute to the ecosystem by offering modular, cost-effective, and specialized components that support local operational needs and niche tolling applications. Collectively, these companies are boosting competitiveness across the North America ETC market by advancing tolling automation, interoperability, and digital mobility capabilities, in line with the region’s shift toward fully electronic and open-road tolling.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Kapsch TrafficCom AG (Austria)

- Conduent, Inc. (US)

- ST Engineering (TransCore) (Singapore)

- Cubic Corporation (US)

- Neology, Inc. (US)

- Siemens (Germany)

- Indra (US)

- Q-Free (Norway)

- EFKON GmbH (Austria)

- FEIG ELECTRONIC (Germany)

- Thales (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.11 Billion |

| Market Forecast in 2030 (Value) | USD 3.65 Billion |

| Growth Rate | CAGR of 3.2% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America (US, Canada, Mexico) |

WHAT IS IN IT FOR YOU: NORTH AMERICA ELECTRONIC TOLL COLLECTION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| ETC System Manufacturer | In-depth competitor profiling of North America ETC vendors across RFID, 6C, ANPR, and MLFF technologies | Strategic roadmap development for US and Canada tolling modernization programs |

| Highway Authority / Toll Operator | Detailed benchmarking of ETC deployment models across MLFF, ANPR video tolling, HOT/express lanes, and managed lanes | Evaluation of revenue assurance KPIs, violation processing efficiency, and lane availability metrics |

| Transportation Ministry / Smart City Agency | Policy and infrastructure readiness mapping for nationwide digital tolling expansion | Assessment of interoperability with digital payment ecosystems (credit card tolling, mobile wallet integration) |

| Technology Provider / Payment Integrator | Market mapping of ETC payment technologies including account-based systems, Pay-by-Plate, contactless cards, and fleet payment integrations | Evaluation of cybersecurity standards, PCI compliance, and AI-driven fraud detection |

RECENT DEVELOPMENTS

- January 2024 : Neology entered into a contract with the Humber Bridge Board (HBB) (UK), which is responsible for managing and maintaining the Humber Bridge. According to the contract, Neolgy is expected to provide end-to-end tolling capability, roadside systems, back-office solutions, a website, and mobile app solutions to HBB.

- September 2024 : Neology acquired P Square Solutions, a tolling services and technology firm. This acquisition creates a new business division called Neology PSquare, significantly improving Neology’s ability to provide complete tolling solutions worldwide.

- April 2023 : Conduent Incorporated introduced innovative digital payment solutions for the transportation sector, mainly for tolling, using real-time payments over the RTP network. These solutions allow toll road users to pay bills and top up accounts instantly and securely. Tolling agencies can send invoices and receive payments within minutes.

Table of Contents

Methodology

The research study involved four major steps in estimating the size of the North America Electronic Toll Collection Market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding the North America Electronic Toll Collection Market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across North America. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the North America Electronic Toll Collection Market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying applications wherein electronic toll collection systems are deployed or are expected to be used

- Analyzing major providers of electronic toll collections and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing the average selling price of electronic toll collection systems powered by different technologies

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming developments in the market that include investments, research and development activities, product launches, contracts, collaborations, and partnerships undertaken, and forecasting the market size based on these developments

- Carrying out multiple discussions with the key opinion leaders to understand the installation of electronic toll collection systems and the sales of related raw materials and products to analyze the break-up of the scope of work carried out by the key companies manufacturing panels

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the North America Electronic Toll Collection Market.

Market Definition

The electronic toll collection system automates the process of collecting tolls on roads, bridges, tunnels, etc. The system eliminates the need for drivers to stop and pay tolls manually by using cash or tokens, thereby reducing traffic congestion and improving the efficiency of toll collection. In an ETC system, vehicles equipped with electronic transponders or tags can pass through toll booths or designated lanes without stopping. These transponders communicate with overhead gantries or roadside equipment, allowing tolls to be automatically deducted from a prepaid account linked to the transponder. Alternatively, some ETC systems utilize license plate recognition technology to identify vehicles and calculate the toll amount accordingly.

The benefits of an ETC system include reduced travel times, increased convenience for drivers, improved traffic flow, and lower operational costs for toll authorities. Additionally, ETC systems can support dynamic toll pricing strategies, where toll rates vary based on factors such as time of day, level of congestion, or vehicle type, helping to manage traffic demand more effectively. The ETC system is crucial in modern transportation infrastructure as it streamlines toll collection processes and enhances the overall driving experience.

Key Stakeholders

- Original device manufacturers (ODMs)

- System integrators

- Software providers

- Raw material and manufacturing equipment suppliers

- Electronic toll collection system manufacturers

- Government departments, such as municipal corporations, transport agencies, highway authorities, and road construction corporations

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- End users

- Technical universities

- Government/private research institutes

- Market research and consulting firms

Report Objectives

- To describe and forecast the size of the North America Electronic Toll Collection Market, by type, technology, offering, application, and region, in terms of value

- To forecast the size of the North America Electronic Toll Collection Market for RFID tags, by region, in terms of volume

- To describe the payment methods through which the toll can be paid electronically

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the North America Electronic Toll Collection Market

- To analyze the electronic toll collection value chain and ecosystem, along with the average selling price of electronic toll collection systems

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, AI/Gen AI impact, trade values, the 2025 US Tariff, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To provide details of the macroeconomic outlook for regions

- To analyze strategies such as product launches, contracts, collaborations, acquisitions, and expansions adopted by players in the North America Electronic Toll Collection Market

- To profile key players in the North America Electronic Toll Collection Market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Electronic Toll Collection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Electronic Toll Collection Market