Oral Rinses Market Size, Growth, Share & Trends Analysis

Oral Rinses Market by Product Type (Therapeutic, Cosmetic, Other Rinses), Indication (General Oral Health, Gingivitis & Periodontal Diseases), Distribution Channel (Consumer Stores, Retail Pharmacies, Dental Dispensaries), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The oral rinses market is projected to reach USD 5.89 billion in 2030, from USD 4.30 billion in 2025, with a CAGR of 6.5%. Oral rinse, or mouthwash, is a liquid solution intended for swishing or gargling in the oral cavity to reduce oral microbial load, freshen breath, and support overall oral hygiene. It may contain active ingredients such as antibacterial agents, fluoride compounds, astringents, essential oils, or herbal extracts, depending on the intended application, ranging from cosmetic freshening to therapeutic management of conditions such as gingivitis, halitosis, plaque, and dry mouth. Oral rinses are commonly used as adjuncts to brushing and flossing, and are available both over the counter and in prescription formulations.

KEY TAKEAWAYS

-

BY PRODUCTThe oral rinses market includes therapeutic rinses, cosmetic rinses, and other types, with therapeutic rinses seeing substantial adoption because of their effectiveness in treating conditions like gingivitis, plaque, and sensitivity. Cosmetic rinses continue to grow in popularity for freshening breath and providing aesthetic benefits, while other specialized formulations address specific oral health issues such as dry mouth or enamel protection.

-

BY INDICATIONGeneral oral health products make up the largest part of the oral rinses market, as mouthwashes are widely used for daily hygiene and preventive care. Their frequent and long-term use for cavity prevention, plaque control, and overall oral cleanliness sustains demand.

-

BY DISTRIBUTION CHANNELDriven by their widespread availability, affordability, and convenience, consumer stores continue to be the most popular distribution channel, making them the leading contributor to the oral rinses market.

-

BY REGIONAsia Pacific is expected to record the fastest growth, with a CAGR of 7.9%, driven by the rising prevalence of dental caries and other oral diseases in large countries like China and India, which increases the demand for oral rinses and other preventive oral care products.

-

COMPETITIVE LANDSCAPEThe major market players have implemented both organic and inorganic strategies, such as partnerships and collaborations. For instance, Kenvue announced a strategic scientific collaboration with the Indian Dental Association (IDA) in India to promote scientific research on the use of mouthwashes in oral care.

The oral rinses market is experiencing steady growth, mainly driven by increased awareness of oral hygiene, the prevalence of dental caries and periodontal diseases, and consumer preference for preventive dental care. The use of therapeutic and cosmetic rinses, including fluoride, antimicrobial, and herbal formulations, is rapidly expanding, helping consumers maintain oral health, reduce plaque and gingivitis, and freshen their breath. Meanwhile, dental care providers and retailers are focusing on product innovation, flavor variety, and convenient packaging to improve user compliance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oral rinses market is undergoing a significant transformation, influenced by emerging trends and disruptions that are altering revenue sources and impacting consumer behavior. There is a noticeable shift away from traditional formulations, such as alcohol-based, fluoride, and antiseptic mouthwashes, toward innovative and rapidly growing product categories. This change reflects evolving consumer preferences, driven by greater awareness of oral microbiome health and an elevated demand for personalized and convenient oral care options.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High incidence of dental caries and other oral diseases

-

Increasing income levels

Level

-

High cost of oral rinses

-

Side effects from prolonged use

Level

-

Trend of online purchasing and e-commerce

Level

-

Product recalls

-

Limited penetration in rural areas

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High incidence of dental caries and other oral diseases

The persistent high rate of oral diseases is a key driver for the growth of the oral rinses market. According to the WHO Global Oral Health Status Report (2022), about 3.5 billion people are affected by oral health problems, with a disproportionate 75% living in middle-income countries, highlighting a major public health issue. In the US, data from the American Association of Oral and Maxillofacial Surgeons (AAOMS) shows that nearly 69% of adults aged 35 to 44 lose one or more permanent teeth each year due to reasons such as dental caries, periodontal disease, or trauma. This concerning trend underscores the need for increased focus on preventive oral care options, including therapeutic mouthwashes that efficiently control bacterial levels, lower inflammation, and improve overall oral hygiene.

Restraint: Side effects from prolonged use

Prolonged use of oral rinses raises significant concerns about adverse effects, which limit their market presence. Long-term or excessive use of certain formulations, especially those with chlorhexidine, essential oils, or strong antiseptics, can cause negative outcomes like extrinsic tooth staining, dysgeusia, xerostomia, and mucosal irritation. These side effects are more common in individuals who use these products over an extended period, which can reduce the overall user experience and lead to lower compliance with daily oral hygiene routines. As a result, many consumers hesitate to use these products beyond short-term treatment, affecting repeat purchases and hindering market growth. In response, there is a noticeable shift toward safer, gentler, and more natural options that reduce adverse effects.

Opportunity: Trend of online purchasing and e-commerce

The rapid growth of e-commerce platforms offers a major opportunity for the oral rinses market. Consumers are increasingly choosing online shopping because of the convenience of home delivery, access to a wider range of products, and the ease of comparing reviews and prices. This trend has been further sped up by changes in consumer behavior after COVID-19, making digital shopping a key part of the oral care buying process. Additionally, strategic partnerships between oral care brands and large online marketplaces, along with targeted digital marketing efforts and subscription models, are boosting product visibility and building customer loyalty.

Challenge: Limited penetration in rural areas

The oral rinses market remains notably underserved in rural areas, mainly because of low awareness about oral health, price sensitivities, and poor distribution networks. Consumers in these regions often lack access to preventive dental care, leading to inconsistent availability of mouthwash products. Moreover, major brands tend to focus their marketing efforts on urban centers, which reduces brand visibility in non-metro markets. This underrepresentation limits sales growth and highlights the urgent need for targeted rural outreach, the creation of affordable SKUs, and partnerships between public and private sectors to improve access and education. Without strategic investments in last-mile distribution and culturally relevant marketing, brands risk overlooking a large, untapped market segment.

Oral Rinses Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Therapeutic and cosmetic oral rinses for daily oral hygiene | Widely trusted brand, cavity prevention, fresh breath, accessible pricing |

|

Antiseptic and fluoride-based rinses | Strong plaque control, cavity prevention, supports long-term oral health |

|

Mouthwashes for daily oral hygiene and freshness | Affordable oral care, cavity protection, fresh breath, strong presence in emerging markets |

|

Therapeutic and antiseptic rinses for gum health, enamel strength, and fresh breath | Supports gum health, strengthens enamel, freshens breath, and prevents cavities |

|

Therapeutic and specialized oral rinses for gingivitis, sensitivity, enamel repair, and dry mouth | Effective plaque and gingivitis control, relief for sensitivity and dry mouth, enamel protection, alcohol-free options |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oral rinses market operates within a broad ecosystem involving stakeholders across product development, manufacturing, marketing, regulation, distribution, and clinical endorsement. Manufacturers play a vital role by creating innovative mouthwashes for cosmetic and therapeutic purposes, using active ingredients like chlorhexidine, fluoride, and essential oils to target oral hygiene, plaque control, and gum health. Distributors, such as pharmacy chains, retail supermarkets, and e-commerce platforms, ensure wide product availability and easy access for consumers through established supply networks. Regulatory agencies like the US FDA and the EMA oversee product classification, labeling, and safety compliance, especially for prescription or therapeutic formulations. While reimbursement remains limited, some products like Chlorhexidine Gluconate Mouthwash are included in institutional formularies such as the US Department of Veterans Affairs, reflecting selective coverage based on clinical usefulness. Dental professionals, including general dentists and hygienists, serve as primary influencers by recommending or prescribing specific oral rinses suited to patient needs. Additionally, professional organizations, academic institutions, and public health groups contribute by issuing guidelines on safe and effective mouthwash usage, supporting patient education, and promoting best practices in oral hygiene.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oral Rinses Market, By Product

Therapeutic rinses remain the largest segment of the market because they are used to treat and prevent oral health issues, backed by clinical research and professional advice. These products are usually made with strong active ingredients like chlorhexidine or cetylpyridinium chloride, providing more than surface benefits; they help fight gingivitis, periodontitis, and cavities. Unlike cosmetic mouthwashes, which mainly target bad breath, therapeutic rinses are frequently used in professional dental care. This health advantage, along with improved awareness of detailed oral hygiene, helps keep their leading market position.

Oral Rinses Market, By Indication

General oral health dominates the oral rinses market. This is driven by the segment's appeal to a wide consumer base and compatibility with daily routines. The availability of these products through traditional retail channels and online platforms, without prescription restrictions, enhances their convenience. Additionally, leading manufacturers have invested heavily in awareness campaigns, positioning general oral health rinses as vital for preventive dental care. The widespread use of these products has also resulted in their inclusion in multi-brand promotional sets, further increasing their visibility.

Oral Rinses Market, By Distribution channel

The leading role of consumer stores in this market is because of their high visibility, established shopping habits, and trust in physical retail. These stores, especially supermarkets and convenience stores, provide a wide selection of oral hygiene products in conveniently located areas. The ability to physically inspect products, take advantage of price deals, and make immediate purchases helps keep their market leadership. Consumer stores remain the main source for health and hygiene products in many developing regions, further strengthening their top market position.

REGION

Asia Pacific to be fastest-growing region in oral rinses market during forecast period

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by several factors. The rising incidence of dental caries and other oral diseases is a primary growth catalyst, supported by increased awareness of oral health and preventive care. Growing middle-class incomes and changing lifestyles, which lead to greater oral health concerns, are further increasing demand. Additionally, strong participation from local and global companies introducing herbal and region-specific products, along with the rapid expansion of e-commerce and government initiatives, is making oral rinses more accessible and boosting adoption throughout the region.

Oral Rinses Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the oral rinses market, Colgate-Palmolive Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Church & Dwight Co., Inc. (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Colgate-Palmolive dominates through reach, Church & Dwight’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.09 BN |

| Revenue Forecast in 2030 (Value) | USD 5.88 BN |

| Growth Rate (2025–2030) | 6.5% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD MN/BN), Volume (Tons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Oral Rinses Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- April 2025 : Kenvue announced a strategic scientific collaboration with the Indian Dental Association (IDA) in India to advance scientific research on the use of mouthwashes in oral care.

- April 2024 : Church & Dwight Co., Inc.’s TheraBreath brand announced the launch of TheraBreath Deep Clean Oral Rinse in the US.

- February 2024 : Colgate-Palmolive announced a strategic partnership with IMPAct4Nutrition, a platform supported by UNICEF India, to raise awareness about oral health and nutrition among children.

- June 2023 : Procter & Gamble launched its new concentrated mouthwash called Crest Scope Squeez Mouthwash. This is P&G’s first concentrated mouthwash product. The innovative packaging of Crest Scope Squeez offers major benefits such as less packaging waste and customizable product strength, making it a convenient choice for consumers.

Table of Contents

Methodology

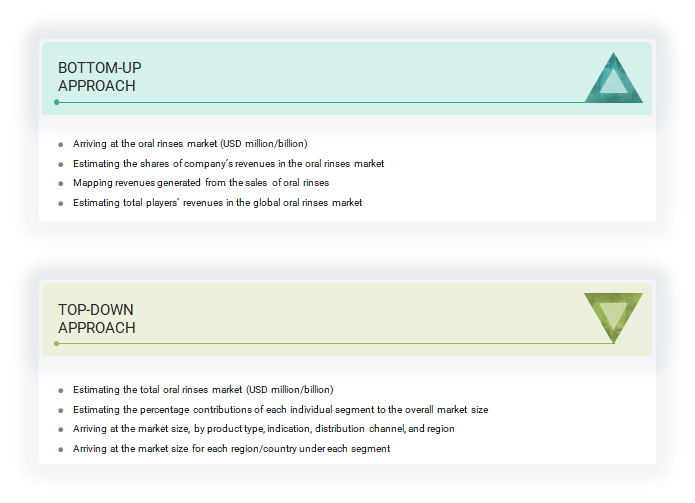

The study involved four main activities to estimate the current size of the oral rinses market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step validated these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. Both top-down and bottom-up approaches were used to arrive at a comprehensive estimate of the overall market size. Finally, market breakdown and data triangulation techniques were employed to determine the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensive use of various secondary sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the oral rinses market. It also helped obtain critical insights about key players in the industry, market classification, and segmentation based on current industry trends, down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, interviews with various sources were conducted from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, industry experts were interviewed, including CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations involved in the oral rinses market. For the demand side, industry experts, purchase and sales managers, doctors, and personnel from research organizations were engaged with. This primary research was essential to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

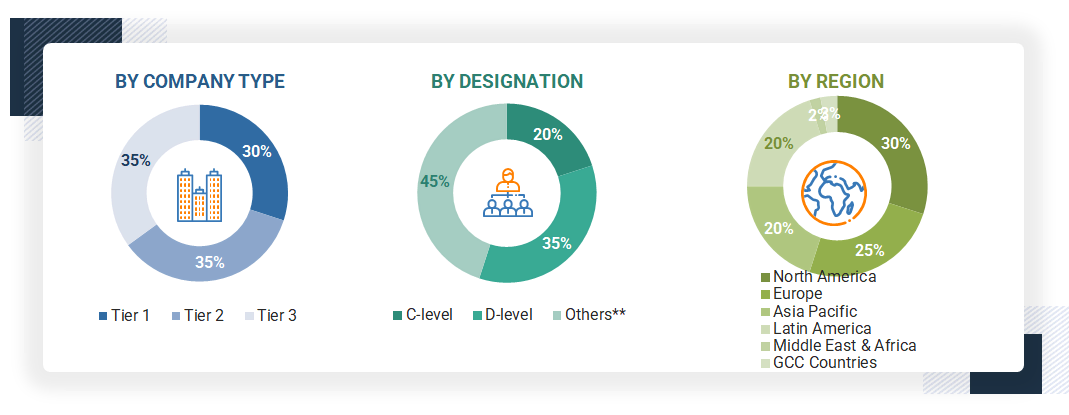

A breakdown of the primary respondents for the oral rinses market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the oral rinses market includes the following details.

The market sizing was undertaken from a global perspective.

Country-level Analysis: The size of the oral rinses market was determined from annual presentations by leading players and secondary data accessible in the public domain. The share of products and services within the overall oral rinses market was derived from secondary data and confirmed by primary participants to estimate the total market. These primary participants further validated the figures.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall oral rinses market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Oral Rinses Market Size: Bottom-up and Top-down Approach

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were applied, where relevant, to complete the overall market analysis and obtain precise statistics for various segments and subsegments. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Oral rinse, also called mouthwash, is a liquid solution used for swishing or gargling in the mouth to reduce bacteria, freshen breath, and promote overall oral health. It may contain active ingredients such as antibacterial agents, fluoride, astringents, essential oils, or herbal extracts, depending on its purpose, ranging from cosmetic freshness to treating conditions like gingivitis, bad breath, plaque, and dry mouth. Oral rinses are often used alongside brushing and flossing and come in both over-the-counter and prescription forms.

Stakeholders

- Oral Rinses Manufacturing Companies

- Contract Manufacturers

- Distributors, Suppliers, and Channel Partners of Oral Rinses

- Senior Management

- Finance Department

- Procurement Department

- Hospitals & Clinics

- E-commerce and Digital Platforms

- Retail Pharmacies and Supermarkets

- Academic & Research Institutes

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research and Consulting Service Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global oral rinses market by product type, indication, distribution channel, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the oral rinses market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To profile the key players in the oral rinses market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, partnerships, expansions, acquisitions, and product launches & approvals in the oral rinses market

Key Questions Addressed by the Report

What is the expected addressable market value of the oral rinses market over 5 years?

The oral rinses market is projected to reach USD 5.89 billion by 2030, at a CAGR of 6.5% during the forecast period.

What strategies are top market players adopting to penetrate emerging regions?

The major players in the market use partnerships, expansions, distribution agreements, product launches, and product approvals as important growth tactics.

Which segments have been included in this report?

This report includes segments by product type, indication, distribution channel, and region.

Which region has the highest CAGR in the oral rinses market during the forecast period?

The Asia Pacific region is expected to have the highest CAGR due to increasing oral health awareness, a growing middle-class population, better access to modern retail and e-commerce channels, rising urbanization, and government-led dental health initiatives.

Who are the top industry players in the global oral rinses market?

The top players are Colgate-Palmolive Company (US), Kenvue (US), Procter & Gamble (US), Haleon Group of Companies (UK), Unilever (UK), Church & Dwight Co., Inc. (US), and Lion Corporation (Japan).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oral Rinses Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oral Rinses Market