Pet Dietary Supplements Market Trends, Growth, and Forecast [Latest]

Pet Supplements Market by Type (Dogs, Cats, and Other Pet Type), Supplement From (Tablets & Capsules, Powders, Soft Chews, and Other Supplement Forms), Supplement Type, Function, Distribution Channel, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pet supplements market is projected to reach USD 4.11 billion by 2030 from USD 2.71 billion in 2025, at a CAGR of 8.7%. The growth is primarily driven by increased awareness among pet owners regarding preventive healthcare and wellness, which aligns closely with human health trends.

KEY TAKEAWAYS

- The North American pet supplements market accounted for a 36.4% revenue share in 2025.

- By pet type, the cat segment is expected to register the highest CAGR of 9.1%.

- By supplement form, the soft chews segment is projected to grow at the fastest rate from 2025 to 2030.

- By supplement type, the vitamins & multivitamins segment is expected to dominate the market.

- By distribution channel, the e-commerce segment is expected to dominate the market, growing at a higher CAGR of 9.2%

- Nestlé (Nestlé Purina Petcare Company), Elanco, and H&H Group were identified as star players in the pet supplements market, given their strong market share and extensive product footprint.

- VAFO Group, Nutramax Laboratories, and Aniamor, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The pet supplements market is undergoing a transformative phase, marked by a steady rise in demand and innovation. As the bond between humans and their pets deepens, pets are increasingly regarded as part of the family, and this emotional connection directly influences spending patterns. Consumers are now more willing to invest in premium, science-backed products that enhance the quality of life for their furry companions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Pet supplement manufacturers, suppliers, and specialty stores play a key role in the disruptive trends of this market. While coat and skin health have been a focus, immunity, digestive health, and heart health have been gaining more traction. Stress and anxiety support has also gained importance among pet parents. Shifts, which are changing trends or disruptions, will impact the revenues of end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in pet ownership and humanization

-

Increased awareness of pet health

Level

-

High cost of premium products

-

Lack of veterinarian endorsement

Level

-

Expansion of e-commerce platforms

-

Expansion of pet supplements use through strategic consumer education

Level

-

Regulatory and labeling complexities

-

Intense competition and brand proliferation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in pet ownership and humanization

The rising global trend of pet humanization is a cultural shift where pets are no longer seen as just animals but as integral family members. This phenomenon influences every aspect of pet care, from food to fashion, particularly health and wellness. As more households across developed and emerging economies embrace pet ownership, this emotional connection transforms consumer expectations and purchasing behavior.

Restraint: High cost of premium products

The rising cost of premium supplements for pets is becoming a significant barrier for many pet owners, especially in an economic climate shaped by inflation, supply chain disruptions, and potential tariffs. While these products often promise higher quality, better nutritional value, and targeted health benefits, their steep prices make them inaccessible to a significant portion of the market.

Opportunity: Expansion of e-commerce platforms

The explosive growth of e-commerce platforms has revolutionized how pet owners discover, evaluate, and purchase supplements for their animals. With the shift in consumer behavior toward online shopping, pet supplement brands have capitalized on digital retail channels to increase reach and visibility. Platforms such as Amazon, Chewy, Petco, and even niche DTC (Direct-to-Consumer) brands such as Zesty Paws and PetHonesty have made it easier than ever for pet parents to access a vast array of supplement products tailored to specific breeds, life stages, and health conditions.

Challenge: Regulatory and labeling complexities

Each country and, in some cases, individual regions within countries have their own rules, documentation standards, product approval processes, and labeling requirements for animal health products. These discrepancies can lead to delays, added costs, and even barriers to entry for businesses attempting to scale globally.

Pet Dietary Supplements Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

K9Vitality, a new entrant in the Indian pet supplement market, aimed to establish itself as a premium D2C brand offering nature-first, holistic health products for pets. | The partnership led to a successful brand launch, with K9Vitality gaining strong traction in a short period. |

|

NaturVet partnered with Magnetic Creative, a branding and marketing agency, to execute a full-scale rebranding initiative. | The new brand identity received a positive reception at the Global Pet Expo 2025, helping to reinforce NaturVet’s role as a trusted, innovative player in the pet wellness industry. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pet supplements market is supported by a dynamic and evolving ecosystem that spans from raw material sourcing to the end consumer. At the upstream level, the ecosystem begins with ingredient suppliers who provide essential components such as probiotics, vitamins, omega fatty acids, and botanical extracts. These suppliers are followed by formulators and contract manufacturers, who develop finished products in various delivery forms like soft chews, powders, and capsules. Veterinary professionals and animal nutritionists play a crucial advisory role during product development, ensuring that formulations are backed by clinical evidence and tailored to pet-specific health needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pet Supplements Market, by Pet Type

During the forecast period, dogs are expected to dominate the pet type segment in the pet supplements market. This trend is primarily driven by the increasing humanization of pets, where pet owners are more inclined to treat their dogs as family members and invest in their overall health and wellness. Dogs often suffer from common health issues such as joint pain, digestive problems, and skin allergies, which can be managed through targeted nutritional supplements.

Pet Supplements Market, by Supplement Type

The vitamins & multivitamins segment is estimated to account for a dominant share of the pet supplements market during the forecast period. This growth is largely attributed to the rising awareness among pet owners regarding the importance of balanced nutrition and preventive healthcare for pets. Vitamins and multivitamins are commonly used to support overall pet wellness, enhance immune function, improve skin and coat conditions, and address nutritional deficiencies that may arise due to aging or illness.

Pet Supplements Market, by Supplement Form

The soft chews segment is poised to dominate the pet supplements market during the forecast period. This surge is primarily driven by pet owners' increasing preference for supplement forms that are both palatable and easy to administer. Soft chews, resembling treats, are particularly appealing to pets, making the supplementation process more straightforward for owners. Their chewable nature enhances palatability and facilitates better digestion and nutrient absorption, which is especially beneficial for senior pets or those with dental issues.

REGION

North America is estimated to dominate the global pet supplements market in 2025

North America is estimated to dominate the pet supplements market in 2025. The strong market presence in the pet health industry can be attributed to several key factors. One significant aspect is the high rates of pet ownership, which continue to rise. Additionally, there is an increased awareness among pet owners about the importance of pet health. Many are showing a growing willingness to invest in premium health products for their pets. The region benefits from advanced veterinary infrastructure and a wide availability of pet supplements, further strengthening this trend.

Pet Dietary Supplements Market: COMPANY EVALUATION MATRIX

In the pet supplements market matrix, Nestlé (Nestlé Purina Petcare Company) (Star) leads with a strong market share and extensive portfolio in pet supplements, reflecting decades of research, clinical studies, and nutritional expertise, positioning it as a leader in both therapeutic and preventative health solutions for pets. Virbac (Emerging Leader) is gaining visibility with its specialization in pet supplements, strengthening its position through innovation and niche product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.50 Billion |

| Market Forecast in 2030 (value) | USD 4.11 Billion |

| Growth Rate | CAGR of 8.7% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, RoW (Middle East & Africa) |

WHAT IS IN IT FOR YOU: Pet Dietary Supplements Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Pet Supplement Manufacturers |

|

|

| Supplement Form Segment Assessment |

|

|

RECENT DEVELOPMENTS

- February 2025 : Elanco launched Pet Protect, a new line marking Elanco’s official entry into the pet supplements category, leveraging its strong veterinary heritage and the trusted Advantage brand, which has been a staple in pet health for over 25 years.

- January 2025 : Pooch & Mutt, one of the UK’s fastest-growing pet food brands, made a significant move in the pet wellness space by acquiring BIOME9, a pioneering company known for its science-backed, personalized gut health testing and supplement plans for dogs.

- May 2024 : Nestlé’s Purina Pro Plan Veterinary Diets announced the launch of its full range of therapeutic diets on Amazon, greatly expanding access to its science-backed pet nutrition.

- November 2023 : General Mills acquired Fera Pets, Inc., a vet-founded pet supplement company, and officially welcomed it into the company’s portfolio.

Table of Contents

Methodology

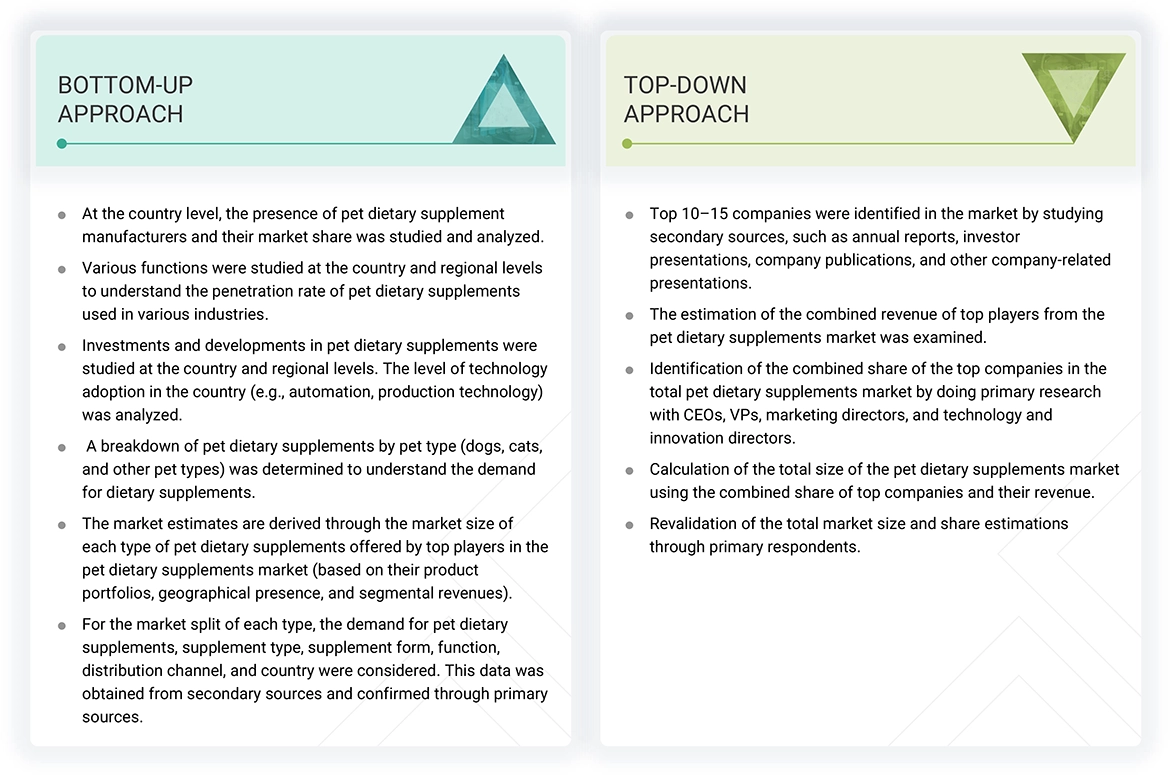

The study involved two major approaches in estimating the current size of the pet dietary supplements market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial market study.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

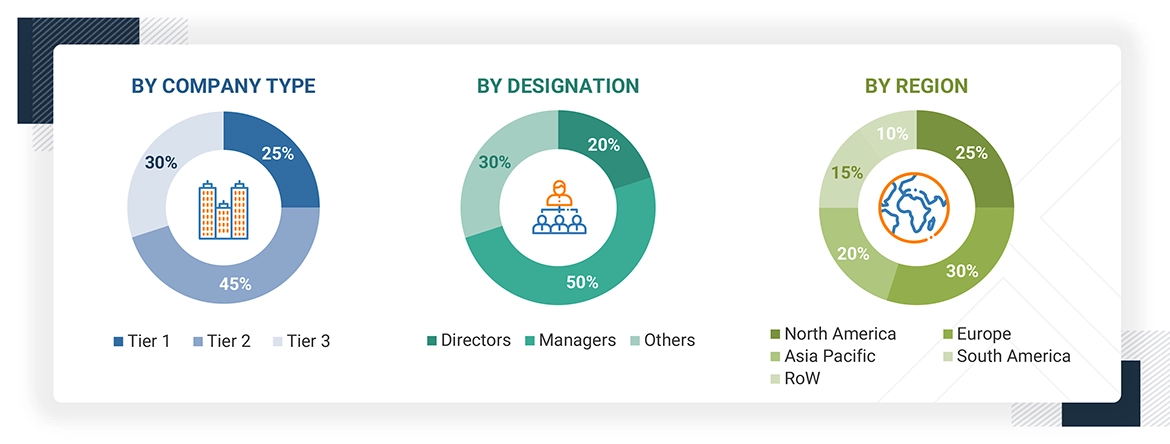

Primary Research

Extensive primary research was conducted after obtaining information regarding the pet dietary supplements market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to core material, core material form, shell material type, technology, end-user industry, functionality, and region. Stakeholders from the demand side, such as pet dietary supplement manufacturers, were interviewed to understand the buyers’ perspective on the suppliers, products, and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = revenue = USD

1 billion; Tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Nestlé (Nestlé Purina Petcare Company) (Switzerland) |

Product Development Manager |

|

Elanco (US) |

Senior R&D Scientist |

|

H&H Group (Hong Kong) |

Global Marketing Director |

|

SwedenCare AB (Sweden) |

Sales Head |

|

Mars, Incorporated (US) |

Senior Research Scientist |

|

Nutramax Laboratories (US) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the pet dietary supplements market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Pet Dietary Supplements Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall pet dietary supplements market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Pet supplements include a range of prescribed and non-prescription, dosage-based dietary supplements such as vitamins, multivitamins, probiotics & prebiotics, protein & peptides, among others, targeting various health issues in pets, such as bone and joint pain, digestive health, skin and coat health, immune system support, heart health, and stress & anxiety relief, among others. These supplements are available in diverse forms, including soft chews, tablets & capsules, powders, and others.

According to the National Animal Supplement Council (NASC), Pet supplements are products that contain ingredients such as vitamins, minerals, and herbs, with targeted health benefits that can help pets maintain the healthy function of their bodies. They can come in many forms, such as tablets, capsules, powders, pastes, liquids, and soft chews.

Stakeholders

- Pet dietary supplements manufacturers

- Contract manufacturers/OEMs

- Ingredients (raw material) suppliers [vitamins & minerals, probiotics/prebiotics, omega fatty acids (e.g., fish oil)]

- Packaging suppliers

- Pet dietary supplement importers and exporters

- Raw material suppliers

- Pet dietary supplements processors

- Regulatory bodies and associations

- Organizations such as the US Food and Drug Administration (FDA)

- US Department of Agriculture (USDA)

- American Pet Products Association

- Global Alliance of Pet Food Associations

- The European Pet Organization

- European Food Safety Agency (EFSA)

- EUROPA

- Association of American Feed Control Officials (AAFCO)

- Codex Alimentarius

- Food Safety Australia and New Zealand (FSANZ)

- American Veterinary Medical Association (AVMA)

- National Animal Supplement Council (NASC)

- Government agencies

- Intermediary suppliers, such as traders, distributors, suppliers, and E-commerce platforms of Pet dietary supplements

Report Objectives

- To determine and project the size of the pet dietary supplements market with respect to the pet type, supplement type, supplement form, function, distribution channel, and regions in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the pet dietary supplements market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe pet dietary supplements market into key countries

- Further breakdown of the Rest of Asia Pacific pet dietary supplements market into key countries

- Further breakdown of the Rest of South America pet dietary supplements market into key countries

- Further breakdown of the RoW pet dietary supplements market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the pet dietary supplements market?

The pet dietary supplements market is valued at USD 2.50 billion in 2024 and is projected to reach USD 4.11 billion by 2030, at a CAGR of 8.7% from 2025 to 2030.

Which are the key players in the pet dietary supplements market, and how intense is the competition?

Key players include Nestlé (Nestlé Purina Petcare Company) (Switzerland), Elanco (US), H&H Group (Hong Kong), SwedenCare (Sweden), and Mars, Incorporated (US). The market shows intense competition, driven by R&D investments, mergers, acquisitions, and innovations in encapsulation technologies.

What are the growth prospects for the pet dietary supplements market in the next five years?

The market is expected to experience significant growth, supported by rising pet ownership, increased awareness of pet health, and a growing focus on preventive healthcare. Demand for vitamins, joint health supplements, and digestive aids is projected to rise. Growth will also be fueled by natural/organic innovations, expansion of e-commerce, and greater investment aimed at improving pets' quality of life.

What kind of information is provided in the company profiles section?

Company profiles include a comprehensive business overview, covering business segments, financial performance, geographical reach, revenue composition, and business revenue breakdown. They also provide insights into product offerings, milestones, and analyst perspectives to highlight each company’s potential.

How is the Asia Pacific region contributing to market growth?

The Asia Pacific region is experiencing strong growth due to urbanization, rising disposable incomes, and increased pet ownership, especially among millennials and Gen Z. Growing awareness of pet health, preference for preventive care, and the expansion of e-commerce platforms are driving demand for pet dietary supplements. Countries such as India and Thailand are showing notable growth in premium pet care product adoption.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pet Supplements Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pet Supplements Market