Pharmaceutical Quality Management Software Market Size, Growth, Share & Trends Analysis

Pharmaceutical Quality Management Software (QMS) Market by Process (Clinical Trial, Regulatory, Manufacturing, Commercialization), Application (eSOP, CAPA, Compliance), Size (Large, Small), End User (pharma, biotech, CRO), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global pharmaceutical quality management software market is projected to reach USD 2.98 billion by 2030 from USD 1.59 billion in 2025, at a high CAGR of 13.3% during the forecast period. The pharmaceutical quality management software market is gaining significant traction, driven by the industry’s increasing focus on product safety, regulatory compliance, and operational efficiency.

KEY TAKEAWAYS

-

BY PROCESSThe Pharmaceutical Quality Management Software market, by process, spans Clinical Trials, Regulatory Compliance, Manufacturing/Production, Quality Assurance/Quality Control, Distribution & Supply Chain, Commercialization, Marketing & Sales, Post-Market Surveillance, and Others. Growth in this segment is driven by the need to standardize and automate quality workflows across clinical, manufacturing, and post-market operations, ensuring end-to-end compliance and audit readiness.

-

BY APPLICATIONBy application, the market is segmented into Document Control & eSOP, CAPA (Corrective & Preventive Action) Management, Audit & Inspection Management, Training Management, Regulatory & Compliance Management, Supplier Quality Management, Risk Management, Change Control Management, and Others (Equipment Management, Non-Conformance Handling, etc.). Adoption is propelled by the increasing requirement for integrated platforms that manage CAPA, document control, and regulatory activities through a unified digital framework.

-

BY ENTERPRISE SIZEBy enterprise size, the market is divided into Large Enterprises and Small & Medium Enterprises (SMEs). Demand across enterprise sizes is supported by the shift toward cloud-based, scalable QMS solutions that reduce validation complexity and enable remote compliance management.

-

BY END USERBy end user, the market is categorized into Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and Others. Expansion among end users is driven by the growing focus on regulatory transparency and quality consistency across pharma, biotech, CRO, and CDMO collaborations.

-

BY REGIONThe Pharmaceutical Quality Management Software market covers Europe, North America, Asia Pacific, Latin America, Middle East & Africa. Asia Pacific is emerging as the fastest-growing region, supported by rapid pharmaceutical manufacturing expansion, evolving regulatory frameworks, and accelerated digitalization of quality systems.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Veeva Systems Inc. (US), MasterControl Solutions, Inc. (US), Honeywell International Inc. (US), IQVIA (US), Qualio, Inc. (US), and Hexagon AB (Sweden) entered into several agreements and partnerships to cater to the growing demand for pharmaceutical quality management infrastructure.

The Pharmaceutical Quality Management Software market is driven by rising regulatory compliance pressures, digital transformation of manufacturing, increasing focus on risk and quality management, cloud-based deployment adoption, and growing demand for data-driven, automated systems ensuring traceability, audit readiness, and operational efficiency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the Pharmaceutical Quality Management Software market arises from evolving customer trends and operational disruptions. End users such as pharma, biotech, CROs, and CDMOs are key clients of the pharmaceutical quality management technology providers. Shifts toward digitalization, AI-driven risk management, and regulatory tightening are reshaping quality processes across the pharma value chain. These disruptions influence the revenue performance of pharma manufacturers and service partners, which in turn directly affects the demand, innovation pace, and revenue streams of pharmaceutical quality management technology vendors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent regulatory compliance pressures are pushing pharma companies to adopt QMS solutions

-

Globalization of pharmaceutical operations is driving the need for digitalization and automation of QMS systems

Level

-

Strict data protection laws (GDPR, HIPAA) raise cybersecurity costs and slow software adoption

-

Reluctance to adapt to new software solutions

Level

-

Increasing demand for specialized cloud-based software solutions in pharma manufacturing

-

Expansion across emerging regions, fuelled by rising pharmaceutical manufacturing activities and evolving regulatory frameworks

Level

-

Variability in regulatory standards across regions

-

High initial costs of pharma QMS solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent regulatory compliance pressures are pushing pharma companies to adopt QMS solutions

Pharmaceutical manufacturers face escalating scrutiny from regulatory bodies like the FDA, EMA, and WHO, particularly following high-profile drug recalls and contamination incidents. The FDA's modernized quality metrics program and the EU's Annex 1 revisions mandate comprehensive electronic batch record systems, real-time deviation tracking, and audit trail capabilities that paper-based systems cannot deliver. The quality management software automates 21 CFR Part 11 compliance, streamlines CAPA management, and maintains perpetual GMP readiness. With regulatory inspections now demanding data integrity evidence within hours rather than days, companies face potential market withdrawals and revenue losses exceeding millions per incident, making QMS adoption a financial imperative rather than an optional investment.

Restraint: Strict data protection laws (GDPR, HIPAA) raise cybersecurity costs and slow software adoption

GDPR's penalties and HIPAA's criminal liability provisions force pharma quality management software vendors to implement military-grade encryption, multi-factor authentication, and continuous penetration testing infrastructure. Patient data tokenization, anonymization engines, and geographic data residency requirements necessitate duplicate server architectures across jurisdictions, inflating operational costs by 40-60%. Small and mid-sized pharmaceutical companies, particularly in emerging markets, struggle with the high annual cybersecurity budget required for compliant cloud QMS platforms. Additionally, mandatory breach notification protocols and cyber insurance premiums create ongoing financial burdens, while lengthy security audits, often 6-9 months, delay deployment timelines and reduce ROI appeal.

Opportunity: Increasing demand for specialized cloud-based software solutions in pharma manufacturing

The shift toward biologics, cell therapies, and personalized medicines requires QMS platforms with advanced capabilities: cold chain monitoring for temperature-sensitive products, genealogy tracking for patient-specific treatments, and real-time batch release protocols. Contract Development and Manufacturing Organizations (CDMOs) managing 50+ client specifications simultaneously need multi-tenant cloud architectures with client-specific validation protocols. AI-powered predictive quality analytics can reduce out-of-specification events by 35%, while IoT integration with manufacturing equipment enables automated process deviation alerts. The CDMO market growth and outsourcing trends create demand for scalable, validation-ready SaaS QMS solutions offering pay-per-batch pricing models tailored to flexible manufacturing environments.

Challenge: Variability in regulatory standards across regions

Pharmaceutical Quality management software must simultaneously satisfy FDA's risk-based approach, EMA's centralized authorization procedures, China's NMPA evolving standards, and India's Schedule M requirements, each with conflicting documentation formats and validation expectations. A CAPA workflow approved for US operations may violate EU's GMP Annex 11 electronic signature requirements, forcing expensive custom development. Japanese PMDA's preference for Japanese-language interfaces and Brazil's ANVISA requiring local server hosting creates fragmentation that prevents economies of scale. Multinational manufacturers spend million annually maintaining parallel QMS configurations, delaying market entry and reducing competitive agility in fast-moving markets.

pharmaceutical quality management software market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-based QMS unifying quality, CAPA, and supplier oversight across global pharma operations. | Faster audit readiness, enterprise-wide visibility, and stronger regulatory confidence. |

|

Integrated QMS and batch record automation replacing paper-heavy QA workflows. | Shortens release cycles, reduces manual errors, and ensures end-to-end compliance. |

|

Enterprise QMS connecting audits, complaints, and supplier quality across multi-site networks. | Standardizes global quality operations and accelerates product approvals. |

|

Provides an integrated digital QMS through the BIOVIA platform for managing compliance, CAPA, and laboratory quality processes in pharma manufacturing. | Enhances regulatory compliance, data integrity, and product quality through unified digital workflows. |

|

Delivers cloud-based QMS and manufacturing execution solutions enabling pharma companies | Improves process efficiency, real-time visibility, and reduces deviation and batch-release cycle times |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pharmaceutical quality management software (QMS) ecosystem consists of key players (Honeywell, MasterControl, Veeva, Dassault Systèmes) providing integrated cloud-based QMS platforms; other players (SimplerQMS, KIVO, Qualityze) offering specialized niche solutions; cloud service providers (AWS, Microsoft Azure, IBM Cloud) delivering secure, GxP-validated infrastructure; and end users (Sanofi, Pfizer, Lilly, Novo Nordisk) implementing solutions for regulatory compliance and operational efficiency

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharmaceutical Quality Management Software Market, By Process

In 2024, the Manufacturing/ production segment held the largest share of the pharmaceutical quality management software market, as companies prioritized digitalizing GMP compliance, batch release, and deviation management. This phase handles the highest regulatory risk and operational complexity, driving investment in integrated QMS–MES–LIMS platforms. Vendors gain strong traction by enabling real-time quality control, automated CAPA, and electronic batch records, delivering measurable ROI through reduced downtime, faster product release, and improved audit readiness across global manufacturing operations.

Pharmaceutical Quality Management Software Market, By Application

In 2024, CAPA management held the largest share of the pharmaceutical quality management software market by application, as it serves as the backbone of regulatory compliance and continuous improvement. Pharmaceutical manufacturers prioritize CAPA solutions to systematically investigate deviations, implement corrective measures, and prevent recurrence, which is key for FDA and EMA audit readiness. Advanced CAPA modules integrate with document control, risk management, and change management systems, enabling end-to-end traceability, faster closure rates, and data-driven decision-making that directly impacts product quality and regulatory outcomes.

Pharmaceutical Quality Management Software Market, By Enterprise Size

In 2024, large enterprises held the largest share of the pharmaceutical quality management software market by enterprise size due to their extensive manufacturing networks, complex quality processes, and stringent global compliance requirements. These organizations invest heavily in enterprise-grade QMS platforms that integrate with ERP, MES, and LIMS systems to standardize quality operations across multiple sites. Their focus on audit readiness, data integrity, and digital transformation drives higher software adoption, customization, and long-term vendor partnerships compared to mid-sized or small pharmaceutical companies.

Pharmaceutical Quality Management Software Market, By End user

In 2024, Pharmaceutical companies dominated the end-user segment of the pharmaceutical quality management software market as they rely on advanced QMS platforms to manage quality across high-volume, multi-site manufacturing and contract ecosystems. Rising regulatory enforcement around data integrity, digital batch release, and serialization compliance has accelerated QMS deployment across formulation, biologics, and sterile manufacturing lines. Firms are integrating QMS with MES and LIMS to enable closed-loop deviation-to-CAPA control, electronic validation, and predictive quality analytics directly linking quality outcomes to supply continuity and release velocity.

REGION

Asia Pacific to be fastest-growing region in global Pharmaceutical Quality Management Software market during forecast period

Asia-Pacific emerges as the fastest-growing pharmaceutical quality management software market, driven by China and India's expanding generic manufacturing sectors, increasing regulatory convergence with ICH guidelines, and government mandates for digital quality compliance. Rapid CDMO growth in Singapore, South Korea, and Malaysia attracts multinational partnerships requiring validated QMS infrastructure. Rising biologics production, particularly biosimilars, necessitates sophisticated electronic batch records and traceability systems. Cost-effective cloud adoption, supportive digital health policies, and growing pharmaceutical exports to regulated markets accelerate regional QMS investment, with compound annual growth rates exceeding global averages.

pharmaceutical quality management software market: COMPANY EVALUATION MATRIX

In the pharmaceutical quality management software market matrix, Veeva Systems (Star) leads with a dominant market position and a robust cloud-based quality portfolio, driven by its Veeva Vault QMS platform and deep integration across regulatory, clinical, and manufacturing workflows. The company’s strong foothold among global pharmaceutical and biotech firms is reinforced by its GxP-compliant architecture, seamless data connectivity, and proven scalability across enterprise deployments. ComplianceQuest (Emerging Leader) is rapidly gaining traction through its Salesforce-native QMS platform, offering agile, modular solutions for mid- to large-scale pharma clients focused on digital transformation, real-time compliance monitoring, and AI-enabled deviation and CAPA management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.41 BN |

| Market Forecast in 2030 (value) | USD 2.98 BN |

| Growth Rate | CAGR of 13.31% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: pharmaceutical quality management software market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key QMS vendors (e.g., MasterControl, Veeva, Honeywell, Dassault Systèmes) covering segmental presence, pharma client base, pricing tiers, regulatory focus, and cloud/AI integration roadmap. | Enables competitive benchmarking, identifies functional and compliance gaps, and supports vendor selection, partnership evaluation, and market positioning strategies. |

| Regional Market Entry Strategy | In-depth assessment of regional compliance mandates (FDA, EMA, CDSCO, PMDA), digital readiness, pharma manufacturing clusters, and localization needs for validation, hosting, and audit support. | Reduces entry barriers for QMS providers, accelerates go-to-market strategy, and strengthens regulatory alignment and localization for regional deployment. |

| Local Risk & Opportunity Assessment | Identification of evolving GxP and data integrity regulations, cybersecurity requirements, validation burdens, and growth opportunities in cloud, AI/ML, and integrated eQMS for pharma and biotech. | Supports proactive risk mitigation, regulatory compliance planning, and investment prioritization for next-generation, inspection-ready QMS solutions. |

| Technology Adoption by Region | Mapping of QMS adoption maturity across North America, Europe, and Asia Pacific; analysis of cloud transition trends, integration with MES/LIMS/ERP, and drivers like digital quality initiatives and regulatory harmonization. | Guides regional product strategy, R&D focus, and investment in scalable, interoperable QMS solutions aligned with pharma digital transformation and compliance evolution. |

RECENT DEVELOPMENTS

- August 2025 : Veeva Systems and IQVIA partnered to deliver integrated clinical and commercial solutions, including quality management, enabling life sciences customers to leverage combined capabilities.

- March 2025 : MasterControl Solutions, Inc. acquired Qualer to integrate asset tracking, calibration, and maintenance functionalities into its existing quality and manufacturing software platform.

- October 2024 : Honeywell expanded its partnership with Salesforce to integrate TrackWise Quality and Life Sciences Cloud, offering unified digital solutions that streamline pharma and medtech quality, compliance, and collaboration.

Table of Contents

Methodology

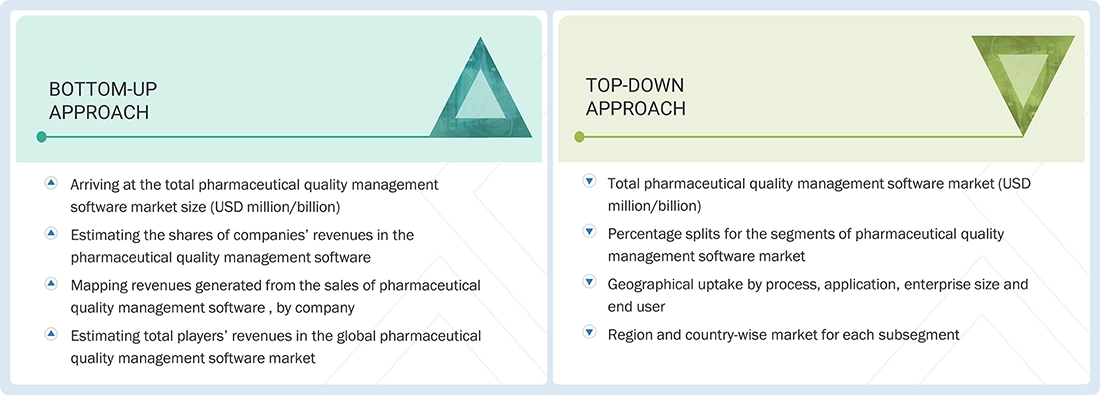

The study involved several key activities to estimate the current size of the pharmaceutical quality management software (QMS) market. Extensive secondary research was conducted to gather information on this market. The next step was to validate the findings, assumptions, and size estimates by consulting industry experts throughout the value chain through primary research. We employed various methods, including top-down and bottom-up approaches, to estimate the overall market size. Following this, we utilized market segmentation and data triangulation techniques to determine the size of specific segments and subsegments within the pharmaceutical quality management softwarecare market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing pharmaceutical quality management software care solutions is assessed using secondary data from both paid and free sources. This involves analysing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the pharmaceutical quality management software market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

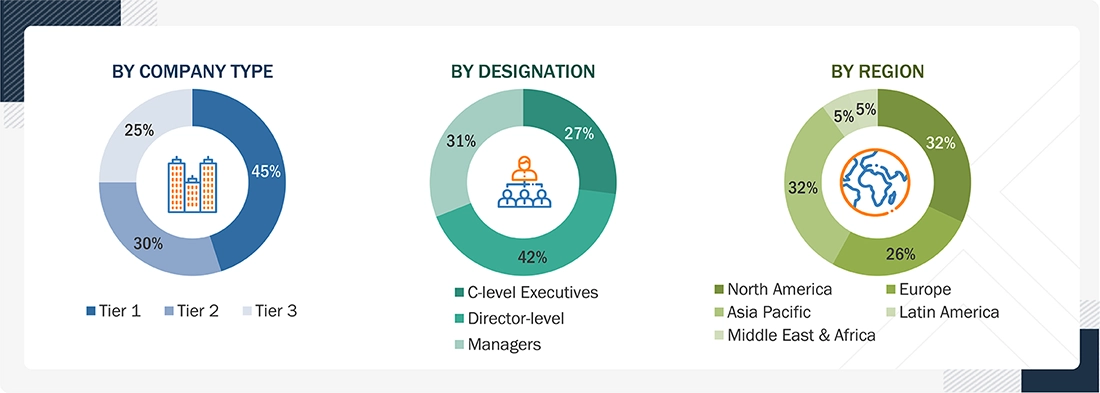

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyse industry trends, evaluate the competitive landscape of pharmaceutical quality management software care offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by process, application, enterprise size, end users, and region).

Pharmaceutical Quality Management Software Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the pharmaceutical quality management software market.

Market Definition

Pharmaceutical quality management software is a formalized, electronic system designed to document, automate, and manage all processes, procedures, and responsibilities associated with ensuring the quality and regulatory compliance of pharmaceutical products throughout their lifecycle. It serves as a centralized platform for managing critical quality activities including document control, SOPs, CAPA, audits, training, risk management, and supplier quality to ensure product safety, efficacy, and regulatory compliance..

Key Stakeholders

- Pharmaceutical companies

- Pharmaceutical quality management software Providers

- Biotechnology firms

- Academic Research Institutes

- Contract Manufacturing Organizations

- Contract Research Organizations

- Market Research and Consulting Firms

- Regulatory Authorities / Agencies

- Quality Assurance & Quality Control Departments

- Research & Development (R&D) Teams

- Third-party Auditors / Inspections Bodies

- Suppliers / Raw Material Vendors

Report Objectives

- To define, describe, and forecast the global pharmaceutical quality management software market based on process, application, enterprise size, end users, and region.

- To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall pharmaceutical quality management software market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the pharmaceutical quality management software market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

- To track and analyze competitive developments such as product & service launches; expansions; partnerships, agreements, and collaborations; and acquisitions in the pharmaceutical quality management software market

- To benchmark players within the pharmaceutical quality management software market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Pharmaceutical quality management software Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Pharmaceutical quality management software Market into Vietnam, Pakistan, New Zealand, and others

- Further breakdown of the Rest of Latin America Pharmaceutical quality management software Market into Argentina, Chile, Colombia, and others

- Further breakdown of the Rest of Middle East & Africa Pharmaceutical quality management software Market into Egypt, Nigeria, Israel, and others

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmaceutical Quality Management Software (QMS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmaceutical Quality Management Software (QMS) Market