Phosphorous Trichloride Market

Phosphorous Trichloride Market by Application (Plastic Additives, Agrochemicals and Pharmaceuticals, Surfactants, Flame Retardants, Oil & Gas, EV Battery Chemicals, and Water Treatment), Grade (Industrial and Pharmaceutical), Sales Channel (Direct Sales (B2B Contracts) and Distributors & Traders), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The phosphorus trichloride market is projected to grow from USD 2.43 billion in 2025 to USD 3.60 billion by 2030, registering a CAGR of 8.2% during the forecast period. The market is witnessing strong growth driven by rising demand from the pharmaceutical, agrochemical, water treatment, and chemical processing industries. Phosphorus trichloride serves as a crucial intermediate in the production of organophosphorus compounds, surfactants, plasticizers, and flame retardants. Its wide use as a reagent and chlorinating agent enhances process efficiency and product quality across various industrial applications.

KEY TAKEAWAYS

-

BY GRADEThe phosphorus trichloride market is segmented into Industrial, Pharmaceutical, Pure, Analytical, and Other grades. Pure grade PCl3 is widely used in high-precision chemical syntheses and industrial applications requiring minimal impurities. Analytical grade is employed in laboratory research, quality control, and specialized chemical reactions, while other grades cater to less stringent industrial processes, offering cost-effective solutions for bulk chemical production.

-

BY SALES CHANNELPhosphorus trichloride is distributed through Direct Sales and Distributors & Traders. Distributors and traders serve smaller manufacturers and regional markets, providing flexibility and localized support. Direct sales through B2B contracts are preferred by large-scale industrial consumers, ensuring consistent supply, long-term agreements, and technical support for large-volume applications.

-

BY PRODUCTION METHODThe production of phosphorus trichloride primarily involves Direct Chlorination and Substitution Reactions methods. Direct chlorination of white phosphorus is the most common industrial process, offering high yield and scalability. Substitution reactions are employed for producing specific phosphorus derivatives and specialized applications, providing versatility in downstream chemical manufacturing.

-

BY APPLICATIONPhosphorus trichloride finds application across multiple industries, including Agrochemicals & Pharmaceuticals, Surfactants, Flame Retardants, Oil & Gas, EV Battery Chemicals, Water Treatment, Plastic Additives, and Other Applications. Its use as a key intermediate enables the synthesis of organophosphorus compounds, additives, and specialty chemicals that are essential for manufacturing, agriculture, energy, and advanced material sectors.

-

BY REGIONAsia Pacific is expected to be the fastest-growing region in the phosphorus trichloride market, driven by rapid industrialization, expanding agrochemical and pharmaceutical production, and increasing adoption of advanced chemical intermediates. Rising investments in chemical manufacturing infrastructure, growing demand for water treatment chemicals, plasticizers, and flame retardants, and supportive regulatory frameworks for sustainable chemical production are accelerating market growth in the region.

-

COMPETITIVE LANDSCAPEKey players in the phosphorus trichloride market are pursuing both organic and inorganic growth strategies, including mergers and acquisitions, strategic partnerships, and expansion of production capacities. Companies such as Zhejiang Xin’an Chemical Group Co., Ltd. (China), ICL (Israel), Henan Qingshuiwuan Technology Co., Ltd. (China), LANXESS (Germany), and Solvay (Belgium) are enhancing their product portfolios to cater to downstream applications in plastics, agrochemicals, pharmaceuticals, surfactants, and water treatment, while also targeting regional expansions to meet the rising global demand for phosphorus trichloride.

Phosphorus trichloride plays a critical role as a key intermediate and chlorinating agent in the synthesis of various chemical compounds, including pharmaceutical ingredients, pesticides, surfactants, and flame retardants.Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are enforcing stringent environmental and safety standards, encouraging manufacturers to adopt safer production technologies, enhanced containment systems, and sustainable process designs. Additionally, the growing emphasis on water quality management and industrial efficiency is driving the use of phosphorus trichloride in advanced water and wastewater treatment applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effects on consumer businesses in the phosphorus trichloride market are influenced by shifts in customer trends and industry disruptions. Hotbets include agrochemical manufacturers, pharmaceutical companies, and specialty chemical producers, while target sectors cover plasticizers, flame retardants, surfactants, EV battery chemicals, and water treatment applications. Changes such as stricter environmental regulations, increasing demand for green and sustainable chemical intermediates, and the push for high-purity, low-waste production processes directly affect the revenues of these end users. These shifts in end-user demand, in turn, influence the revenues of hotbets, such as major phosphorus trichloride consumers in downstream chemical industries. Consequently, the performance and growth of phosphorus trichloride manufacturers are affected, as they must adapt production processes, supply chains, and product offerings to meet evolving regulatory standards, sustainability goals, and industry-specific requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Global Emphasis on Wastewater Treatment and Chemical Dosing

-

Increasing global Demand from Lithium-Ion Battery Production

Level

-

Stringent Environmental and Safety Regulations Hindering Market Flexibility

-

Hazardous Nature and Complex Handling Requirements Pose Operational Challenges

Level

-

Localization of Production to Reduce Dependency on Imports and Build Resilient Supply Chains

-

Strategic Collaborations and Vertical Integration by Agrochemical and Specialty Chemical Players

Level

-

Intensifying Price Pressure from Low-Cost Chinese Producers

-

Vulnerability Due to Raw Material Dependency on Elemental Phosphorus

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Global Emphasis on Wastewater Treatment and Chemical Dosing

According to the United Nations (UN), 2.2 billion people still lack access to safe drinking water, while global water use continues to rise by approximately 1% each year. Alarmingly, over 80% of wastewater generated globally is released into the environment untreated. The UN World Water Development Report also indicates that industrial freshwater usage, currently at 19%, is projected to reach 24% by 2050, adding pressure to improve wastewater treatment infrastructure and chemical management in industrial operations. In response, Target 6.3 of the Sustainable Development Goals aims to significantly reduce pollution and increase safe reuse of water by 2030. It emphasizes cutting down hazardous chemical discharges and halving the proportion of untreated wastewater. Progress toward this goal is tracked through SDG Indicator 6.3.1, which measures the percentage of wastewater safely treated by domestic and industrial sources according to national standards. This growing global effort to reduce pollution and ensure safe water management is accelerating demand for advanced water treatment chemicals. Phosphorus trichloride (PCl3), a key intermediate in the production of phosphonates and other phosphorus-based water treatment agents, is playing an increasingly vital role in this transformation. These derivatives are used extensively for scale inhibition, corrosion control, and chemical dosing in both municipal and industrial water treatment systems. As countries ramp up investments in water reuse and regulatory enforcement, the demand for PCl3-based chemicals is expected to grow significantly, particularly in emerging economies focused on decentralized and sustainable water treatment solutions.

Restraint: Stringent Environmental and Safety Regulations Hindering Market Flexibility

One of the most critical restraints affecting the phosphorus trichloride (PCl3) market is the tightening of environmental and safety regulations across major production and consumption regions. As a highly reactive and toxic chemical, PCl3 poses significant risks to human health and the environment if not handled, stored, or transported with the utmost care. This has led to the imposition of rigorous regulatory frameworks that govern nearly every stage of the product’s lifecycle from manufacturing and logistics to usage and disposal. Developing nations, especially those in Asia Pacific, are also stepping up enforcement of environmental laws to curb industrial pollution. India’s Central Pollution Control Board (CPCB), for example, has mandated zero-liquid discharge norms and real-time effluent monitoring systems for chemical manufacturing units, increasing operational complexity and compliance costs for PCl3 producers. These regulatory pressures translate into multiple operational and financial challenges. Companies are required to invest heavily in advanced safety equipment, emission control systems, wastewater treatment units, and worker training programs. Failure to comply can result in severe penalties, plant shutdowns, or revocation of licenses, thereby increasing operational risk. Furthermore, the transportation of PCl3 is a major logistical concern due to its corrosive nature and violent reaction with water, releasing toxic hydrogen chloride gas.

Opportunity: Localization of Production to Reduce Dependency on Imports and Build Resilient Supply Chains

Amid growing geopolitical uncertainties and supply chain vulnerabilities, a key opportunity emerging in the phosphorus trichloride (PCl3) market is the localization of production. Several nations, particularly in Asia, the Middle East, and South America, are shifting focus toward domestic manufacturing of critical chemicals, including phosphorus derivatives, to reduce reliance on imports and safeguard industrial resilience. The global trade disruptions and regional conflicts have exposed the risks of over-dependence on a limited number of PCl3-exporting countries, particularly China, which dominates global elemental phosphorus (P4) and PCl3 production. Governments and industries are now investing in local chemical value chains to mitigate import dependency and ensure a stable, secure supply of intermediates like PCl3. For instance, Saudi Arabia’s Vision 2030 strategy includes the development of specialty chemicals and intermediates, such as PCl3, through partnerships with global firms. Similarly, India has classified several chemicals, including phosphorus derivatives, under its Production Linked Incentive (PLI) scheme to bolster domestic output and reduce dependence on China. By developing localized PCl3 manufacturing capacities, countries can not only achieve strategic self-sufficiency but also support their domestic agrochemical, pharmaceutical, and flame-retardant sectors more effectively. Local production reduces transportation and storage risks, especially critical for hazardous chemicals like PCl3, and improves responsiveness to domestic demand fluctuations. Furthermore, this approach aligns with broader sustainability goals, as it can lower the carbon footprint associated with long-distance shipping of toxic chemicals and encourage region-specific waste and emissions management practices.

Challenge: Intensifying Price Pressure from Low-Cost Chinese Producers

The global phosphorus trichloride (PCl3) market is the intensifying price pressure from low-cost Chinese manufacturers, which is impacting the profitability and market share of international producers. China is by far the largest producer and exporter of elemental phosphorus (P4), the critical raw material used in PCl3 production. As a result, many domestic Chinese chemical firms benefit from easier access to raw materials, economies of scale, and lower production costs due to government-supported infrastructure and cheaper labor and energy. These advantages enable Chinese companies to offer PCl3 at significantly lower prices in the global market, putting considerable pressure on non-Chinese producers, especially those in North America, Europe, and parts of Asia. Companies operating in regions with stricter environmental standards, higher energy costs, and more expensive logistics are struggling to match Chinese price points without compromising margins. The situation is particularly acute in the merchant PCl3 market, where buyers are highly cost-sensitive. In such an environment, Western producers are often forced to focus on niche applications or specialty derivatives of PCl3 to maintain competitiveness. Even then, Chinese firms are rapidly moving up the value chain by expanding their technological capabilities and product portfolios, including high-purity grades and derivatives suited for pharmaceutical and electronic applications. Trade imbalances, dumping allegations, and the lack of harmonized global environmental enforcement further exacerbate the challenge. In some cases, international producers have advocated for anti-dumping duties or trade barriers to protect domestic production from undercutting by imports. However, such measures can only offer temporary relief and often lead to retaliatory trade actions.

Phosphorous Trichloride Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Employs phosphorus trichloride in the manufacture of flame retardants such as Fyrol TPP (triphenyl phosphate) and Fyrolflex RDP for plastics and electronics applications. | Provides enhanced flame resistance, ensures regulatory compliance in electrical & building materials, and supports sustainable material innovation. |

|

Uses phosphorus trichloride to synthesize aminotris (methylenephosphonic acid) (ATMP) and hydroxyethylidene diphosphonic acid (HEDP), key water treatment chemicals for scale and corrosion control. | Delivers high-performance inhibitors, extends industrial equipment lifespan, and reduces corrosion and scaling in power and chemical plants. |

|

Integrates phosphorus trichloride in producing Disflamoll and Levagard series of organophosphorus flame retardants and plasticizers used in polyurethane foams, PVC, and engineering plastics. | Improves thermal stability and fire retardancy of polymers, ensuring durability, regulatory compliance, and safety in automotive and construction sectors. |

|

Applies phosphorus trichloride in the manufacture of phosphorus-based intermediates like phosphorus oxychloride (POCl3) and triphenyl phosphite, used in battery electrolytes, polymer additives, and chemical catalysts. | Enables high-purity phosphorus chemistry, supports EV battery material innovation, and improves energy efficiency in advanced material synthesis. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The phosphorus trichloride ecosystem includes raw material suppliers (Yunnan Phosphorus Chemicals Group Co., Ltd), manufacturers (Zhejiang Xin'an Chemical Group Co., Ltd. , ICL , LANXESS,Solvay ), distributors (Univar Solutions LLC., ICC Chemical Corporation), and end users (Cipla). Key inputs like yellow phosphorus and chlorine are supplied by specialized manufacturers. Phosphorus trichloride manufacturers convert these materials under strict safety and environmental regulations due to its high reactivity. Distributors handle storage, transport, and delivery in compliance with hazardous materials rules. End users span agrochemicals, pharmaceuticals, flame retardants, and plastic additives, where PCl3 serves as a crucial intermediate for producing organophosphorus and specialty chemicals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Phosphorus Trichloride Market, By Application

Due to the global push for electric mobility and energy storage, EV battery chemicals are likely to be the fastest growing application segment for phosphorous trichloride. Phosphorous trichloride is essential to create specialty phosphorus compounds, which are used in electrolyte additives and flame retardants in lithium-ion batteries. Additives not only help to improve efficiency, but also stability and safety - very important performance metrics in the rapidly leading EV business phase. As battery technologies call for ever higher energy densities and long cycle lives, complying with higher specifications and consistency of input specifications (purity) such as phosphorous trichloride become increasingly necessary.

Phosphorus Trichloride Market, By Grade

With its expanding use in large-scale chemical synthesis and intermediate production, the industrial grade phosphorus trichloride segment is projected to be the fastest-growing in the phosphorous trichloride market during the forecast period. Industrial grade PCl3 is vital for manufacturing agrochemicals, flame retardants, and plasticizers, where high-volume, cost-effective processing is essential. Its solid demand is also bolstered by the growth of the water treatment, specialty chemicals, and other industrial markets that also require scalable, reliable chemical inputs. This segment has momentum due to the growing industrialization of emerging economies and demand for bulk chemicals that could have a more efficient supply chain. As technology and logistics continue to improve and provide better quality, availability, and competitiveness for industrial grade PCl3, industries will emphasize operational efficiency, regulatory compliance, and security and/or redundancy of supply. The demand for industrial grade phosphorous trichloride will therefore be the fastest-growing segment of the market.

REGION

Asia Pacific to be the fastest-growing region in the global phosphorus trichloride market during the forecast period

The Asia Pacific region is expected to be the fastest-growing segment in the phosphorous trichloride market supported by strong growth in agrochemicals, pharmaceuticals, and flame retardants. Countries such as China and India are undergoing rapid agricultural modernization, which is increasing the need for phosphorus-based pesticides and intermediates for which phosphorous trichloride is essential. Self-sufficiency in important chemical value chains is supported by regional governments, either for value-adding beyond tier one agriculture and manufacturing, or to clearly gain tradeable commodities such as phosphorous. For example, China's "Made in China 2025" strategy and India's Production Linked Incentive (PLI) scheme for the chemicals sector aim to develop domestic capabilities in the production of specialty and intermediate chemicals, including phosphorous trichloride derivatives.

Phosphorous Trichloride Market: COMPANY EVALUATION MATRIX

In the landscape of the phosphorus trichloride market, Zhejiang Xin’an Chemical Group Co., Ltd. (Star) holds a significant market share, offering a broad portfolio of phosphorus trichloride products and derivatives for applications in agrochemicals, pharmaceuticals, flame retardants, and plastic additives, primarily through direct sales to industrial consumers. Yangmei Chemical Industry Co., Ltd. (Emerging Leader) is gaining recognition with its focus on specialty phosphorus intermediates and innovative production processes, launching niche products and expanding its application base. While Zhejiang Xin’an Chemical leads through scale and a diversified product offering, Yangmei Chemical shows strong potential to move toward the leaders’ quadrant as demand for high-purity and sustainable phosphorus trichloride derivatives continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. Zhejiang Xin'an Chemical Group Co., Ltd. (China),

- 2. ICL (Israel)

- 3. Henan Qingshuiwuan Technology Co., Ltd. (China)

- 4. LANXESS (Germany),

- 5. Solvay (Belgium),

- 6. Yangmei Chemical Industry Co., Ltd (China),

- 7. Shandong Hanfeng (China),

- 8. Xuzhou Jianping (China),

- 9. Jiangsu Jacques Technology Co., Ltd (China),

- 10. Italmatch Chemicals S.p.A (Italy),

- 11. Jiangsu Tianyuan Chemical Co., Ltd (China),

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.21 Billion |

| Market Forecast in 2030 (value) | USD 3.60 Billion |

| Growth Rate | CAGR of 8.2 % from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Phosphorous Trichloride Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Phosphorus Trichloride Manufacturer |

|

|

| Agrochemical Intermediates Manufacturer |

|

|

| Flame Retardant & Plastic Additives Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2024 : ICL’s Industrial Products division signed an MOU with Orbia Fluor & Energy Materials (OF\&EM) to supply phosphorus trichloride (PCl3) for the production of lithium hexafluorophosphate (LiPF6), a key electrolyte in lithium-ion batteries.

Table of Contents

Methodology

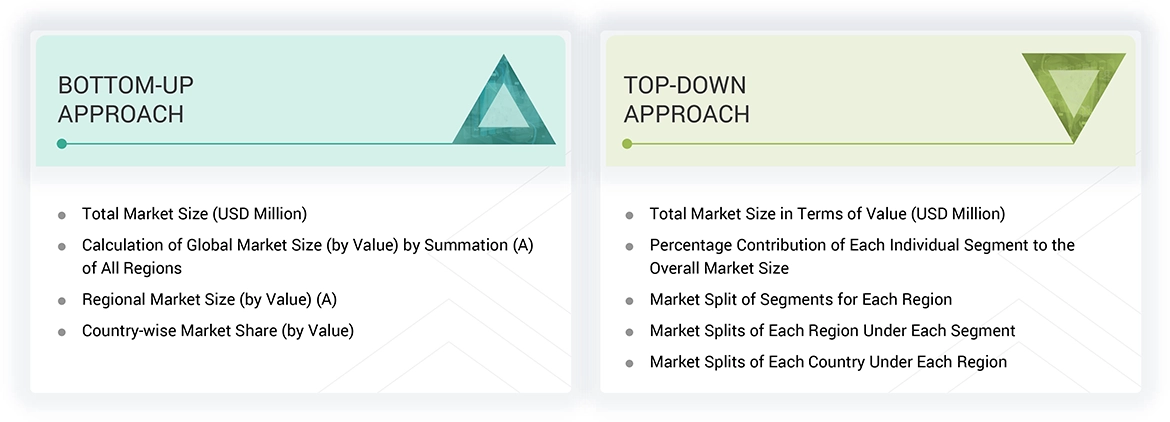

The study involved four major activities to estimate the current size of the global phosphorous trichloride market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of phosphorous trichloride through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the phosphorous trichloride market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

The market for the companies offering phosphorous trichloride is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the phosphorous trichloride market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of phosphorous trichloride vendors, forums, certified publications, and whitepapers. Secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the phosphorous trichloride market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of phosphorous trichloride offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

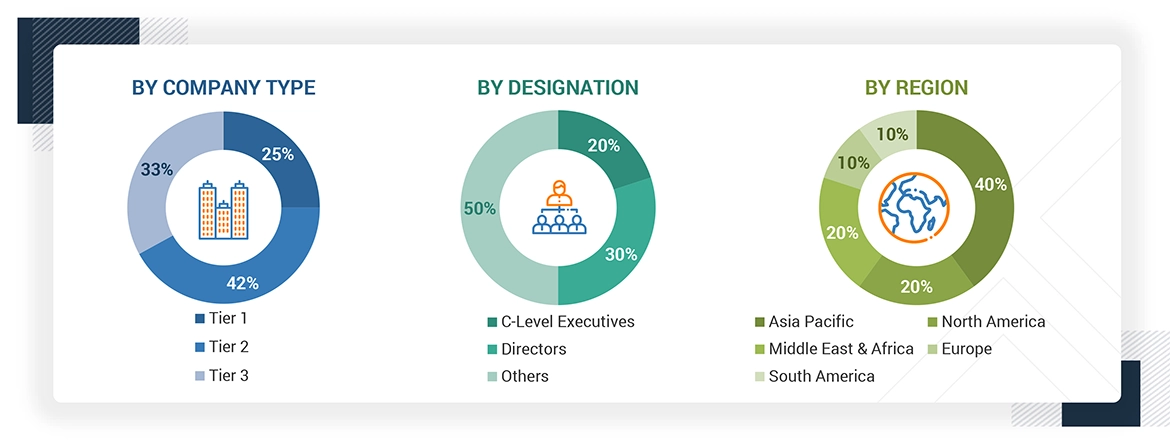

Following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global phosphorous trichloride market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Phosphorous trichloride is a colorless to yellow/orange fuming liquid and is characterized as a highly useful and highly reactive inorganic chemical compound primarily employed as an intermediate in the production of a wide variety of phosphorus-containing chemicals. Phosphorous trichloride is generated through the controlled reaction of yellow phosphorus (P4) with dry chlorine gas. Phosphorous trichloride is an important intermediate in the production of pesticides and herbicides (such as glyphosate), plasticizers, flame retardants, surfactants, and pharmaceutical intermediates. Phosphorous trichloride is a toxic compound that is highly corrosive and moisture-sensitive; elementally, and must be handled, stored, and transported correctly due to its reaction with water generating hydrogen chloride and phosphorous acid.

Stakeholders

- Phosphorous Trichloride Manufacturers

- Raw Material Suppliers

- Downstream Converters and Processors

- Distributors and Traders

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To define, describe, and forecast the size of the global phosphorous trichloride market based on application, grade, sales channel, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the phosphorous trichloride market

- To provide the impact of AI/Gen AI on the market.

Key Questions Addressed by the Report

Which factors are propelling the growth of the phosphorous trichloride market?

Growth is driven by rising demand for phosphorus-based agrochemicals and chemical intermediates, expansion of the pharmaceutical and life sciences industry, increasing use in flame retardants and plastic additives, and industrial growth in emerging economies.

What are the major challenges to the growth of the phosphorous trichloride market?

Challenges include uncertain supply of key feedstocks like yellow phosphorus and chlorine, high handling risks due to toxicity and corrosiveness, and inadequate infrastructure for storage and transport of hazardous chemicals.

What are the major opportunities in the phosphorous trichloride market?

Opportunities lie in the adoption of cleaner and safer production technologies, rising investments in specialty chemical production, growing demand in electronics and plastics, and manufacturing shifts to Asia Pacific and the Middle East.

What are the major factors restraining the growth of the phosphorous trichloride market?

Restrictive factors include strict environmental and safety regulations, high energy-related production costs, and the availability of alternative chemical substitutes in some applications.

Who are the major players in the phosphorous trichloride market?

Key players include Zhejiang Xin'an Chemical Group Co., Ltd. (China), ICL (Israel), Henan Qingshuiwuan Technology Co., Ltd. (China), LANXESS (Germany), and Solvay (Belgium).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Phosphorous Trichloride Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Phosphorous Trichloride Market