Plastic-coated Wire Ropes Market

Plastic-coated Wire Ropes Market by Coating Type (PVC, PE, PP, Others), Material Type (Galvanized Steel Wire Rope, Stainless Steel Wire Rope), Diameter, End-use Industry (Construction, Mining, Marine), and Region - Global Forecast to 2030

Updated on : November 27, 2025

PLASTIC-COATED WIRE ROPES MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The plastic-coated wire ropes market is projected to reach USD 1.78 billion by 2030 from USD 1.32 billion in 2025, at a CAGR of 6.2% from 2025 to 2030. The growth of the plastic-coated wire ropes market is driven by the rising growing opportunities in industries such as construction, marine, automotive, mining, and infrastructure.

KEY TAKEAWAYS

-

BY MATERIAL TYPEThe plastic-coated wire ropes market comprises galvanized steel wire ropes and stainless steel wire ropes based on material type.

-

BY COATING TYPEKey coating types include PVC, PE, PP and Others (nylon, PU, TPE).

-

BY DIAMETERThe plastic-coated wire ropes market comprises ≤1/4 Inch and >1/4 Inch diameter steel wire ropes based on diameters.

-

BY APPLICATIONKey applications of plastic-coated wire ropes span the construction, mining, marine and others (industrial, aerospace & defense, consumer goods, transportation, and oil & gas) segments.

-

BY REGIONThe plastic-coated wire ropes market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific is the largest market for plastic-coated wire ropes and is home to several prominent rope companies. It is also witnessing huge number of residential and commercial construction projects that are contributing to the increasing adoption plastic-coated wire rope products.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Axcel Johnson International (Sweden), WireCo (US), Stratasys (US), Teufelberger (Austria)and Bekaert (Belgium) have entered into a number of agreements and partnerships to cater to the growing demand for plastic-coated wire ropes across innovative applications.

The global market for plastic-coated wire ropes is experiencing a steady and robust expansion due to solid demand for durable, corrosion-resistant wire ropes. Growing opportunities in industries such as construction, marine, automotive, mining, and infrastructure primarily propel the growth of this market; plastic-coated wire ropes provide higher protection against abrasion, weathering, and chemicals than uncoated wires. The ongoing development and improvement in coating materials such as PE and PVC have increased flexibility, strength, and sustainability, and hence, the coating of wire ropes is keeping pace with changing safety and environmental regulations all across the world.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of plastic-coated wire ropes manufacturers, and target applications are clients of plastic-coated wire ropes manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of plastic-coated wire ropes manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PLASTIC-COATED WIRE ROPES MARKET DYNAMICS

Level

-

Rising demand from construction and infrastructure development

-

Superior corrosion resistance and durability compared to uncoated wire ropes

Level

-

High cost and limited temperature resistance

-

Environmental concerns over plastic usage

Level

-

Rising demand in the automotive and aviation maintenance sector

-

Growing industrialization and urbanization in Asia Pacific region

Level

-

Regulatory pressure about the use of plastic

-

Competition from synthetic ropes in certain applications

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand from construction and infrastructure development

The growing demand from construction and infrastructure sectors is one of the significant factors propelling the growth of the global plastic-coated wire ropes market. Urbanization worldwide is developing rapidly around good infrastructure—especially with emerging economies such as India, China, Indonesia, and Brazil—as more large-scale infrastructure projects, including tunnels, bridges, airports, ports, rail systems, and skyscrapers are getting adopted. In addition, with advanced architecture being very complex and demanding high strength and durability for safety, best materials are getting preferred over traditional materials.

Restraint: High cost and limited temperature resistance

The high cost and performance restrictions of plastic-coated wire ropes in extreme temperature conditions are contributing factors that hinder the global acceptance of plastic-coated wire ropes. In comparison to typical plain uncoated steel wire ropes, plastic-coated wire ropes are relatively more expensive due to the additional layer of polymer typically made of PVC, PE, or nylon, and the manufacturing processes. This price difference is of greater concern in more price-sensitive markets and in markets and industries that have very limited procurement budgets, such as low capital construction, small-scale mining, or some agriculture industries, which still prefer uncoated or plain wire ropes because they are more affordable and easier to procure.

Opportunity: Rising demand in the automotive and aviation maintenance sector

The expansion of the automotive and aviation industries, particularly in developing markets, provides a considerable opportunity for plastic-covered wire ropes. Wire ropes are prominent in vehicle hoisting systems, tow cables, aircraft hangar operations, engine support systems, and cargo restraint applications - all of which require smooth operation, abraded resistance, and durability. The use of plastic, typically PVC, PE, or nylon, limits corrosion and mechanical wear and damage associated with repeated handling and frequent exposure to oils or fuel residues while also subjected to a humid environment or extreme temperatures.

Challenge: Regulatory pressure about the use of plastic

One of the major threats for the global plastic-coated wire ropes market is large barrier to the global plastic-coated wire rope market is the expanding government regulation and environmental implications surrounding plastic materials. As global populations strive to be more environmentally friendly, governments and organizations have been increasing their regulations and controls against the use of plastic materials, especially in industrial and non-consumer spaces. Plastic materials (PVC and polyethylene) have a petrochemical origin and have environmental implications if disposed of or recycled improperly.

Plastic-coated Wire Ropes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High usage in lifts and secures scaffolding, tower cranes, and safety nets on large sites | Increased safety, corrosion resistance, and reduced maintenance cost. |

|

High adoption in haft hoisting and dragline operations in deep mines. | Abrasion resistance, higher safety margins, and longer lifespan in harsh mining. |

|

Plastic-coated ropes in mooring, anchoring, and winching of commercial vessels global. | Withstands saltwater, UV rays, and is flexible for extended marine reliability. |

|

Plastic-coated wire ropes to secures turbine towers and platforms during installation. | Flexibility and protection from weather-related wear during offshore installs. |

|

Plastic-coated wire ropes under lift systems for ore and materials in underground copper mines. | Extended operating intervals, reduces breakage risk, optimized for heavy loads. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PLASTIC-COATED WIRE ROPES MARKET ECOSYSTEM

The plastic-coated wire ropes market ecosystem consists of raw material suppliers (LG Chem, Dow, BASF), plastic-coated wire ropes manufacturers (Bekaert, WireCo, Teufelberger, KisWire), and end users (Caterpillar, Hyundai Heavy Industries, Boskalis, Liebherr). Ecosystem analysis highlights how collaboration, innovation, and strategic partnerships within this ecosystem drive advancements in plastic-coated wire ropes production, while integrating efficiency and sustainability. Understanding the dynamics of this ecosystem is essential for identifying growth opportunities and addressing challenges in the evolving plastic-coated wire ropes industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PLASTIC-COATED WIRE ROPES MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plastic-coated Wire Ropes Market, By Coating Type

As of 2024, PVC coating held the largest share of the plastic-coated wire ropes market and will continue leading the market. This is driven mainly by the great performance/cost/versatile nature of PVC. PVC-coated wire rope can demonstrate excellent resistance to corrosion, moisture, UV exposure and abrasion, providing a secure fit for a wide range of market applications including construction, marine, industrial rigging, fencing, lifting and security. The coating provides a protective cover over its steel core and the intended use for a seasoned product can greatly reduce its overall useful life cycle, even in harsh or adverse environmental and mechanical conditions.

Plastic-coated Wire Ropes Market, By Material Type

In 2024, galvanized material type dominated the plastic-coated wire ropes market. The underlying reason for this is galvanized wire ropes are cost effective, have good mechanical strength, and are widely available; they are the most commonly used wire rope for very many industrial and commercial applications. In the galvanization process, steel wire is coated with a layer of zinc", and this process provides corrosion resistance and extends the life of the wire rope, especially when used in semi-corrosive or outdoor environment. Once this galvanized wire rope is additionally encased with plastic (typically PVC, PE or nylon) this offers a further layer of protection via plastic coating, and together with the zinc layer of the wire rope offers sacrificial corrosion resistance and the plastic coating and layer provides another layer of protection against abrasion, moisture, UV rays and even chemical degradation.

Plastic-coated Wire Ropes Market, By Application

With construction application being the dominant end-user segment in the global plastic-coated wire ropes market (particularly galvanized wire ropes), it is safe to state that the typical construction project refers to galvanized steel rope versus stainless steel rope. This dominance stems from the more significant demand that construction projects require, but also its cost-sensitive nature in which contractors must maintain margin while also having to meet the performance specifications of the projects. These projects often require rope that exhibits durability in demanding environments (outdoors), resistance to corrosion, and high-tensile capabilities.

REGION

North America to be fastest-growing region in global plastic-coated wire ropes market during forecast period

The Asia Pacific plastic-coated wire ropes market is expected to register the highest CAGR during the forecast period. Fast industrialization and huge construction, mining, marine, and infrastructure expenditures in countries such as China, India, Japan, and among Southeast Asian regions have thus paralleled growth in infrastructure investment, urbanization, and industrial activity. In China (GB/T) and India (IS), the domestic standards bodies accept galvanized-and-coated ropes for almost all heavy-duty applications and specify stainless steel only for niche or particular applications, high salinity, or merely aesthetic projects—which again reinforces regional preferences for galvanized products.

Plastic-coated Wire Ropes Market: COMPANY EVALUATION MATRIX

In the plastic-coated wire ropes market matrix, Bekaert (Star) leads with a strong market share and extensive product footprint, catering to wide range of applications and end-use industries. Hamburger Drahtseilerei A. Steppuhn GmbH (Emerging Leader) is gaining visibility with its premium steel wire ropes, including plastic-coated variants for demanding industrial applications., strengthening its position through innovation and niche product offerings. While Bekaert dominates through scale and a diverse portfolio, Hamburger Drahtseilerei A. Steppuhn GmbH shows significant potential to move toward the leaders’ quadrant as demand for for plastic-coated wire ropes continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PLASTIC-COATED WIRE ROPES MARKET PLAYERS

PLASTIC-COATED WIRE ROPES MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.23 Billion |

| Market Forecast in 2030 (value) | USD 1.78 Billion |

| Growth Rate | CAGR of 6.2% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Plastic-coated Wire Ropes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Construction Firm |

|

|

| Mining Operator |

|

|

| Marine & Shipping Company |

|

|

| Wire Rope Distributor |

|

|

| Industrial OEM |

|

|

RECENT DEVELOPMENTS

- July 2025 : Axcel Johnson International expanded its global presence by acquiring Canada based Lam-é St-Pierre Group. This acquisition is made by the lifting solutions business group which is engaged in offering rigging and lifting products and services. This strategic acquisition has created opportunities for a new geographic market for the company.

- May 2025 : WireCO launched Boomfit, a plastic-coated steel wire rope. A key highlight of Boomfit is its proven plastic-coated steel core, utilizing CASAR’s renowned Plast rope technology. This enhances durability along with long-lasting performance of the rope.

- February 2025 : Bekaert announced that it has reached an agreement on the sale of its Steel Wire Solutions businesses in Costa Rica, Ecuador, and Venezuela to Grupo AG. This transaction values the underlying entities at a consolidated enterprise value of approximately USD 73 million and is expected to result in net proceeds for Bekaert of approximately USD 37 million.

Table of Contents

Methodology

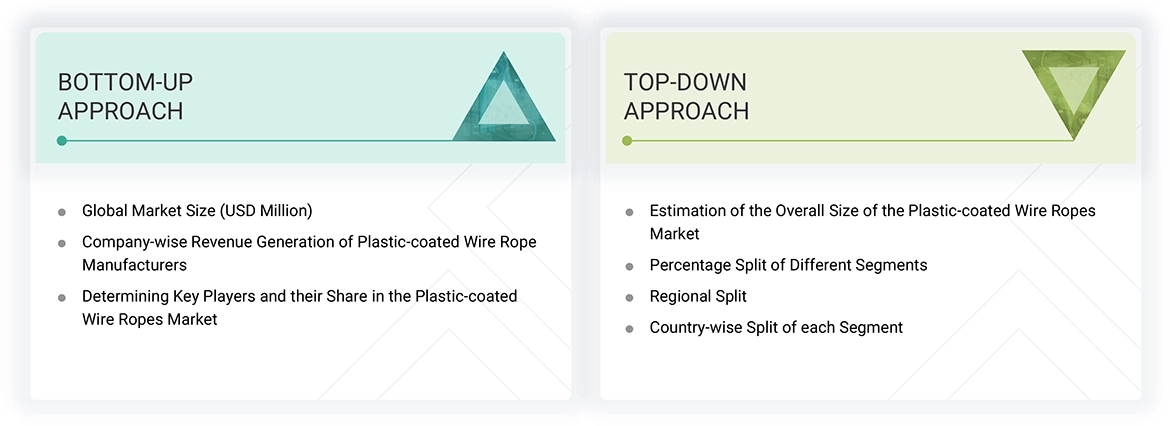

The study involves two main activities in estimating the current market size for the plastic-coated wire ropes market. Extensive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the entire market size. Subsequently, market segmentation and data triangulation were employed to determine the sizes of segments and subsegments.

Secondary Research

Secondary sources used for this research include financial statements of companies offering plastic-coated wire ropes and information from various trade, business, and professional associations. Secondary research was employed to gather key insights about the industry’s value chain, the main players, market classification, and segmentation down to the regional levels based on industry trends. The secondary data was collected and analyzed to determine the overall size of the plastic-coated wire ropes market, which was confirmed by primary respondents.

Primary Research

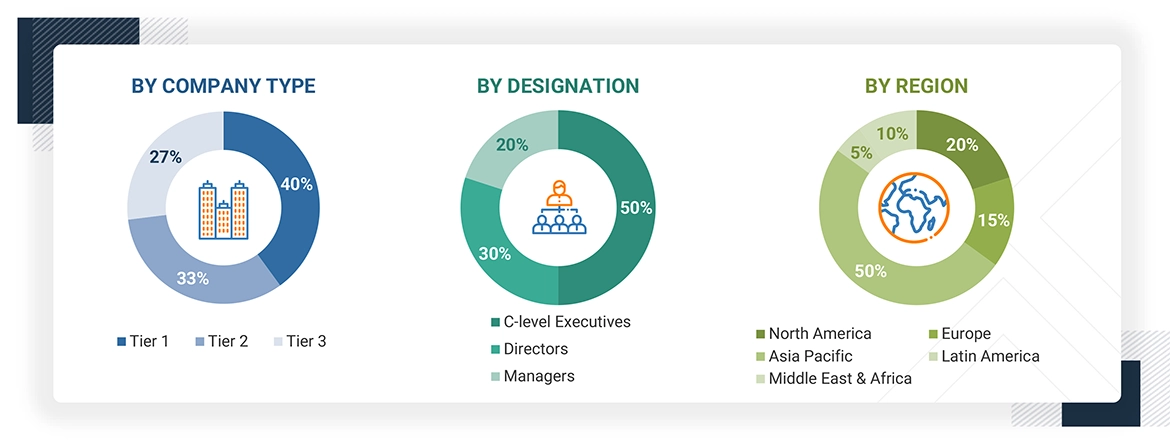

Extensive primary research was carried out after gathering information on the plastic-coated wire ropes market through secondary research. Multiple interviews were conducted with market experts from both demand and supply sides across key regions including Asia Pacific, Europe, North America, the Middle East & Africa, and Latin America. Data was collected via questionnaires, emails, and phone calls. Supply-side sources included industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, and product development/innovation teams, along with key executives from vendors, system integrators, component suppliers, distributors, and key opinion leaders in the plastic-coated wire ropes sector. These interviews provided insights on market statistics, revenue data, market segmentation, market size estimates, forecasts, and data triangulation. They also helped identify trends related to coating types, material types, diameter ranges, end-use applications, and regions. Stakeholders on the demand side, such as CIOs, CTOs, CSOs, and installation teams of end users utilizing plastic-coated wire ropes, were also interviewed to understand their perspectives on suppliers, products, component providers, current usage, and overall market outlook.

Breakup of Primary Research

Point1

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the plastic-coated wire ropes market includes the following details. The market sizing was conducted from the demand side. The market was expanded based on procurements and upgrades in plastic-coated wire rope products across different end-use industries at a regional level. These procurements provide information on the demand aspects of the plastic-coated wire ropes industry for each end-use application. For each end-use application, all potential segments of the plastic-coated wire ropes market were combined and mapped.

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into various segments and subsegments. The data triangulation and market breakdown methods explained below were used, where applicable, to finalize the overall market analysis and obtain accurate statistics for different market segments and subsegments. The data was triangulated by examining factors and trends from both demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The plastic-coated wire ropes market includes steel wire ropes coated with materials like PVC, nylon, polyethylene (PE), polypropylene (PP), polyurethane (PU), or PTFE. These coatings boost the ropes’ performance by improving corrosion resistance, abrasion resistance, UV protection, and reducing maintenance needs. They are suitable for demanding applications in industries such as construction, mining, marine, oil & gas, material handling, and cranes. Plastic-coated wire ropes are favored for their combination of a strong metal core with the flexibility, lightweight properties, and protective qualities of modern polymers, often resulting in longer service life and less maintenance in tough conditions. The market grows as products address the need for durable, efficient solutions made from modern materials in industrial settings. It continues to evolve alongside advancements in coating technologies and increasing emphasis on safety, sustainability, and customization worldwide.

Stakeholders

- Plastic-coated wire rope manufacturers

- Plastic-coated wire rope suppliers

- Raw material suppliers

- End-use applications

- Government bodies

- Universities, governments, and research organizations

- Research and consulting firms

- R&D institutions

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the plastic-coated wire ropes market size in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global plastic-coated wire ropes market by coating type, material type, by diameter, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely Asia Pacific, Europe, North America, the Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as acquisitions, agreements, contracts, and product developments/launches, to draw the competitive landscape

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which are the major companies in the plastic-coated wire ropes market?

Major players include Axel Johnson International (Sweden), WireCo (US), Stratasys (US), Asahi Ropes (India), Bekaert (Belgium), Teufelberger (Austria), Loos & Co. Inc. (US), Chongqing Titan Suhe Co., Ltd. (China), Hamburger Drahtseilerei A. Steppuhn GmbH (Germany), Jiangyin Jinliyuan Steel Wire Rope Co., Ltd. (China), SWR Ltd. (UK), and Lexco Cable (US), among others.

What are the drivers and opportunities for the plastic-coated wire ropes market?

The rising demand in global construction and infrastructure projects is a major driver. Additionally, opportunities arise from the growing need for superior corrosion resistance and durable material options offered by plastic-coated wire ropes.

Which region is expected to hold the largest market share?

Asia Pacific holds the largest market share, driven by significant industry demand in the region.

What is the total CAGR expected to be recorded for the plastic-coated wire ropes market during 2025–2030?

The market is expected to grow at a CAGR of 6.2% from 2025 to 2030 in terms of value.

How is the plastic-coated wire ropes market aligned?

The market remains stable and shows strong potential due to high demand from end-use industries such as construction, mining, marine, and others. It is supported by well-established companies like Bekaert, WireCo, Teufelberger, etc.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plastic-coated Wire Ropes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plastic-coated Wire Ropes Market