Plywood Market

Plywood Market by Type (Softwood, Hardwood), Application (Construction, Industrial), Use Type (New Construction, Rehabilitation), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The plywood market is estimated to grow from USD 47.39 billion in 2024 to USD 60.31 billion by 2030, at a CAGR of 4.21% between 2025 to 2030. This growth is due to expanding construction and furniture industries, rising urbanization, and increasing demand for durable, cost-effective, and sustainable building materials. Plywood’s are thin layer or sheets of wood of uniform thickness, usually 5 mm or less in thickness, usually peeled or sliced. The veneer sheets are glued together with adhesives, in a way each layer is perpendicular to the one adjacent layer.

KEY TAKEAWAYS

-

BY TYPEHardwoo segment is projected to grow faster due to rising demand for high-quality, long-lasting, and visually appealing materials in furniture, cabinets, and interior design. This is primarily due to its strength, refined finish, and attractive patterns. As the global middle class expands, particularly in Asia Pacific, people are seeking premium, customized, and aesthetically pleasing furniture, which increases the need for hardwood. Sustainability is also a key factor. The growing awareness of eco-friendly construction materials and stricter regulations are driving both manufacturers and consumers toward this type of plywood, as it is often certified and proven to be more sustainable.

-

BY APPLICATIONThe industrial segment is projected to be the fastest-growing application in the global plywood market during the forecast period. The growth is largely driven by the increased use of material handling products, transport equipment, and structural uses like wall and roof bracings. However, construction continues to hold the largest share of the plywood market, primarily due to substantial demand for global building and infrastructure projects. Industrial usage is rapidly increasing as industries seek durable, cost-effective, and flexible materials to meet their specialized needs. This growth is bolstered by demand in logistics, manufacturing, and technology, positioning industrial applications as a dynamic and rapidly expanding segment within the global plywood market.

-

BY USE TYPEThe new construction segment dominates the plywood market, driven by robust urban infrastructure development, housing expansion, and commercial real estate growth across emerging economies. Rapid urbanization, rising disposable incomes, and government initiatives promoting affordable housing have significantly boosted demand for plywood in flooring, paneling, and furniture applications. Additionally, plywood’s versatility, cost efficiency, and eco-friendly alternatives to solid wood make it a preferred choice among architects and builders, reinforcing its leading position within the overall plywood market landscape.

-

BY REGIONEurope accounted for the third largest marke in the global plywood market is driven by its established production base, rigorous environmental and safety standards, and dominant presence of major end-use industries like furniture, packaging, and building & construction. The region’s regulatory authorities impose stringent standards on product durability and environmental sustainability, leading manufacturers to invest in plywood technologies to guarantee durability and sustainability. The growing emphasis of countries on innovation and R&D, as well as the presence of major global players, further supports the regions’ role in driving market trends and product performance.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Georgia-Pacific announced an investment of USD 14 million to modernize its Prosperity plywood mill, focusing on efficiency and equipment upgrades. This will increase output, improve durability, and strengthen plywood availability, supporting construction needs and contributing to a more stable market supply.

Plywood is widely used in furniture, packaging, agriculture, building and construction, interiors, roofing, and flooring. It serves a broad range of industries by providing structural support to both the interior and exterior of materials. By enhancing the weatherability and durability of plywood, manufacturers can maintain product quality, lower maintenance costs, and comply with stringent regulations and global standards. The type of plywood used, whether hardwood or softwood, entirely depends on the consumer’s intended use. Rapid urbanization worldwide is also driving the growing demand for plywood.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends like urbanization, sustainability, and digital innovation are reshaping revenue models in the plywood market. Emerging trends and technologies in the industry include AI-enabled defect detection systems, bio-based adhesives, and digitized inventory tracking. The plywood market is expected to grow steadily, driven by increasing demand from construction and industrial sectors, along with a global shift toward eco-friendly building materials and smart manufacturing practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Booming Furniture Industry

-

Rising demand for plywood in Asia Pacific due to growing building and construction industry

Level

-

Volatile raw materials prices

-

Environmental Concerns

Level

-

Technological advancements in manufacturing

-

Expanding residential and commercial construction

Level

-

Raw materials constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Booming Furniture Industry

The growth of the plywood market is primarily driven by the furniture industry, as plywood is widely used to create various types of furniture. With the construction of new residential and office spaces and a rising demand for modern decor, the use of plywood has increased significantly. Its lightweight, durability, and versatility make plywood the preferred choice for building a range of furniture items, including kitchen cabinets, wardrobes, freestanding tables, seating, and panels. Additionally, new markets have emerged because many Chinese consumers now own homes and are opting for ready-made furniture due to increasing disposable incomes and rapid economic growth in the region. As technology advances in the production of plywood, improvements in adhesives, moisture resistance, and termite protection have made it suitable for a wide variety of interior designs. The current trend favors furniture that is adjustable, space-saving, and eco-friendly. As a result, plywood is increasingly being used by designers and consumers in search of both attractive and sustainable furniture options. With the furniture and interior design markets continually expanding, particularly in emerging economies, the plywood market is likely to thrive and remain a vital material in homes and offices.

Restraint: Volatile raw materials prices

The rising prices of timber and lumber are hindering the growth of the plywood market for both producers and consumers. The price of wood, which constitutes the majority of plywood, can fluctuate significantly due to factors like shortages, increased shipping and energy costs, as well as trade policies and regulations. In 2021, lumber prices surged by over 57%, which had a significant impact on the plywood industry. This increase affected the costs of timber, adhesives, and resins and also raised transportation and labor expenses. As a result of these rapid changes, manufacturers are finding it challenging to plan investments, maintain stable sales prices, and secure contracts. Surges in input prices can erode profit margins and lead to higher prices for consumers. In addition, the increase in global trade conflicts and product tariffs has complicated supply chains and raised prices for raw materials. Regulations aimed at preventing deforestation and promoting sustainable forest management have also contributed to the higher costs and scarcity of certified wood. These challenges often compel manufacturers to absorb the extra expenses or pass them on to distributors and consumers, which can reduce competition in the market and hinder growth. As a result, the plywood market struggles to maintain stability and achieve growth due to the volatility of raw materials. Therefore, effective cost management and expansion are crucial for the plywood industry’s success.

Opportunity: Expanding residential and commercial construction

As more houses and businesses are constructed, the plywood market is presented with opportunities for growth and improvement. With an increasing number of people moving to cities and living in closer proximity, there is a greater demand for housing, offices, shops, and public utilities. Most of the demand for plywood comes from residential construction, although commercial construction is also growing rapidly as economies invest in development. In the construction industry, plywood is a popular choice for flooring, roofing, wall sheathing, concrete supports, and indoor finishes due to its strength, durability, and affordability. Government initiatives aimed at financing affordable housing and infrastructure development are generating increased demand, particularly in the Asia Pacific, Middle Eastern, and African regions, where large-scale projects are underway. Plywood is becoming more prominent in the construction industry, largely due to innovations that enhance its fire resistance and moisture protection. Consequently, builders and architects are increasingly opting for plywood because it is reliable, lightweight, and environmentally friendly, making it suitable for various applications in both residential and commercial projects. Given the steady growth in construction worldwide, the plywood industry is likely to experience a continuous stream of growth opportunities in the coming years.

Challenge: Raw materials constraints

The plywood market’s development is being significantly impacted by timber’s scarcity and unpredictable price fluctuations. Plywood manufacturers depend on quality timber; however, there is less availability due to deforestation, stricter environmental regulations, and logging practices that put additional pressure on forests. These issues increase production costs and the price of raw materials, making plywood less competitively priced compared to alternatives like MDF, plastics, or composites, especially when consumers are seeking the lowest prices. The situation in key production areas, such as Yamunanagar, is particularly critical, as the supply of poplar and eucalyptus is significantly lower than needed due to extensive production changes and shifts in wood sourcing. Higher costs for timber, adhesives, and electricity are impacting firms, leading to additional price increases for both manufacturers and their buyers. Consequently, manufacturers may either experience reduced profits due to higher costs or pass these increased expenses on to buyers, which could hinder market growth.

Plywood Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses plywood for manufacturing affordable, lightweight, and durable furniture, cabinets, and home décor products across global retail outlets. | Enables cost-effective mass production, supports sustainable sourcing, enhances product durability, reduces waste, and ensures design flexibility for modern, modular furniture. |

|

Utilizes plywood in automotive interiors, flooring panels, and transport crates for components. | Reduces vehicle weight, improves noise insulation, enhances strength, supports eco-friendly materials usage, and lowers logistics costs through reusable transport solutions. |

|

Uses plywood in construction, formwork, and interior infrastructure for residential and commercial projects. | Provides structural stability, reusability in formwork, smooth finishes, and cost efficiency, while reducing material waste in large-scale infrastructure projects. |

|

Employs plywood in manufacturing durable packaging and base panels for appliances. | Ensures safe appliance transport, enhances product protection, reduces packaging costs, and aligns with eco-friendly packaging practices. |

|

Uses plywood for interior furnishings, wall paneling, and modular furniture across hotels worldwide. | Offers premium aesthetics, longevity, acoustic comfort, and sustainability, while supporting consistent design standards across global hospitality properties. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of plywood. These companies have been in business for a while and have broad product portfolios, cutting-edge technologies, and wide international sales and marketing networks. The prominent companies in this market include Georgia-Pacific (US), Boise Cascade Company (US), Weyerhaeuser Company (US), UPM (Finland), SVEZA Group (Russia), Austral Plywoods (Australia), PotlatchDeltic Corporation (US), Greenply Industries Limited (India), Metsä Group (Finland), and CenturyPly (India).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plywood Market, By Type

Plywood is widely used in construction due to its cost-effectiveness and availability. Among the different types of plywood, softwood plywood holds the largest market share. This is primarily because softwood plywood, made from materials such as pine, fir, and spruce, is less expensive and easier to source. It is often the preferred choice for those undertaking large projects or seeking to save on costs. The construction industry, which accounts for the majority of plywood purchases worldwide, values softwood plywood for its lighter weight and the ease with which it can be shaped and installed. Softwood plywood is favored for its strength, stable dimensions, and excellent screw-holding ability. It is most commonly used for wall and roof sheathing, floors, subfloors, and concrete formwork. The easy bonding of softwood plywood leads to panels with consistent fiber alignment and fewer empty spaces, which enhances their durability and moisture resistance. Its versatility allows for a variety of applications, including residential and commercial construction, packaging, industrial panels, and fencing. Additionally, it requires only paint, stain, or treatment to finish.

Plywood Market, By Application

The construction application segment accounted for the largest share of the global plywood market. The segment is primarily driven by plywood's indispensable and high-volume usage in foundational structural elements. It serves extensively as sheathing for roofs and walls, provides stable subflooring for entire buildings, and is a critical material for concrete formwork, shaping everything from foundations to beams. These large-scale applications inherently consume vast quantities of material. plywood's cost-effectiveness compared to alternatives for such broad coverage, coupled with its ease of handling, cutting, and installation, makes it a practical choice for the fast-paced, budget-conscious construction industry

Plywood Market, By Use Type

Among the various applications of plywood, rehabilitation is experiencing the fastest growth due to economic, environmental, and demographic factors, surpassing new construction. As urban development limits land availability for new projects, renovating and restoring existing structures has become the preferred solution in many high-density areas. This trend raises concerns in Europe and North America, where a significant number of buildings are old and often require repairs, upgrades, or remodeling to meet modern standards and promote environmental sustainability. Rehabilitation plays a key role in achieving sustainability by keeping old structures in use, reducing demolition-related pollution, and conserving the energy that would be needed for new construction. There is a growing focus on preserving historical buildings, driven by increased social interest in architecture and a rising demand for cultural tourism. Additionally, as incomes rise and the trend of renovating or redecorating homes continues in countries like the US, Canada, and France, the demand for plywood has also increased.

REGION

Asia Pacific is expected to be the largest market for plywood during the forecast period

The plywood market is primarily dominated by the Asia Pacific region due to a combination of economic, demographic, and industrial factors. This region’s strength is largely driven by rapid urban growth and significant investments in infrastructure, particularly in countries like China, India, and various Southeast Asian nations. As GDP and population continue to rise quickly, there is an increased demand for new residential and commercial buildings. Plywood is favored in these sectors for its affordability, durability, and versatility, making it a popular choice for flooring, roofing layers, internal and external wall panels, and as formwork for concrete. The increase in income and diverse lifestyles in the Asia Pacific region has led to a significant rise in the production and design of furniture and interior spaces. Architects often choose plywood for modular furniture, cabinetry, and interior decoration due to its versatility and cost-effectiveness. Plywood is especially in demand in densely populated cities, where many people seek stylish and compact furniture options. Additionally, the availability of abundant resources, a low-cost workforce, and well-developed manufacturing facilities enables the Asia Pacific region to meet both local and international demands.

Plywood Market: COMPANY EVALUATION MATRIX

In the Pipe Insulation market matrix, Georgia-Pacific (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. Austral Plywoods (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While Georgia-Pacific dominates with scale, Austral Plywoods shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 47.39 BN |

| Revenue Forecast in 2030 | USD 60.31 BN |

| Growth Rate | CAGR of 4.21% from 2025-2030 |

| Actual data | 2020−2030 |

| Base year | 2024 |

| Forecast period | 2025−2030 |

| Units considered | Value (USD Billion) and Volume (Million Cubic Meters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Type (Hardwood, Softwood), Application (Construction, Industrial), Use Type (New Construction, Rehabilitation) and Region |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Plywood Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Plywood Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Plywood Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the applications | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- February 2025 : Georgia-Pacific announced an investment of USD 14 million to modernize its Prosperity plywood mill, focusing on efficiency and equipment upgrades. This will increase output, improve durability, and strengthen plywood availability, supporting construction needs and contributing to a more stable market supply.

- June 2023 : Georgia-Pacific invested USD 18 million in its Camden plywood plant to upgrade its equipment and improve its product portfolio’s efficiency.

- June 2022 : Boise Cascade Company acquired the production facilities of Coastal Plywood Company in Chapman, Alabama, and Havana.

- May 2022 : Weyerhaeuser Company purchased 80,800 acres of premium timberlands in North and South Carolina from a Campbell Global-managed fund. The company now has ownership or management of more than 900,000 acres of timberlands in the Carolinas.

Table of Contents

Methodology

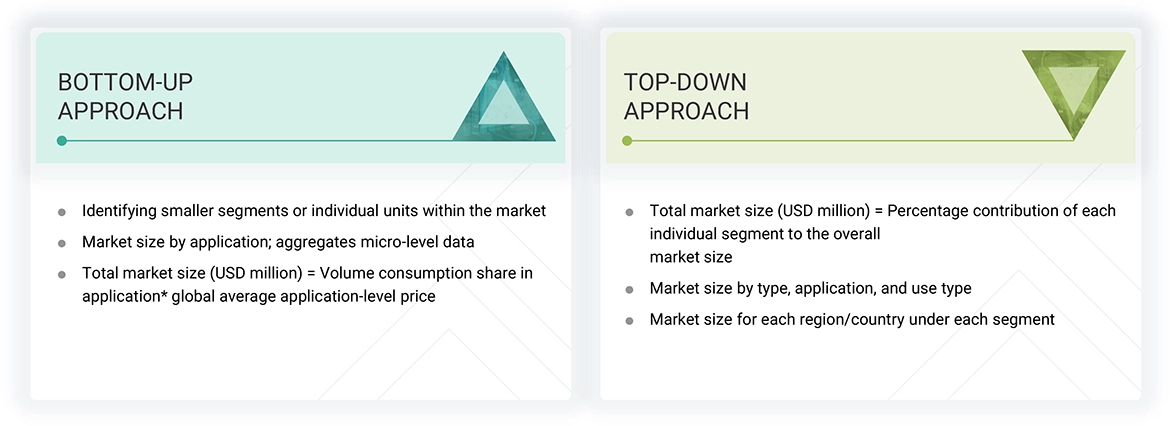

The study involved four major activities in estimating the market size of the plywood market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

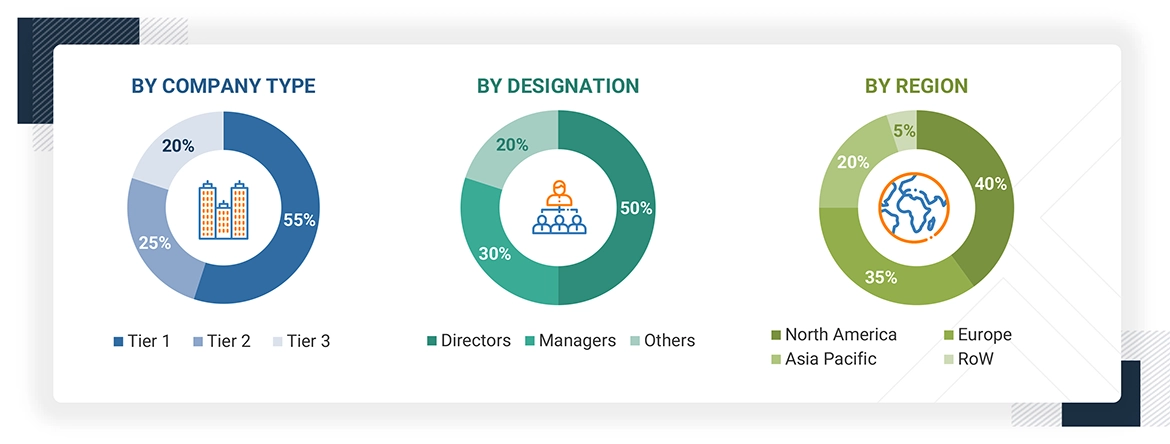

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of the profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The plywood market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the plywood market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, which is available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Georgia-Pacific | Senior Manager | |

| Boise Cascade | Innovation Manager | |

| Weyerhaeuser Company | Vice President | |

| UPM | Production Supervisor | |

| SVEZA Group | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the plywood market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the plywood industry.

Market Definition

According to the Food and Agriculture Organization (FAO), “Plywood is a thin layer or sheets of wood of uniform thickness, usually 5 mm or less in thickness, usually peeled or sliced. The veneer sheets are glued together with adhesives in a way that each layer is perpendicular to the adjacent layer.

Stakeholders

- Plywood Manufacturers, Dealers, and Suppliers

- Plywood Developers and Service Providers

- Veneer and Other Material Dealers

- Large Infrastructure/Architecture Companies

- Consulting Companies in the Timber, Hardwood, Architecture, and Furniture Industries

- Plywood Associations

- United Nations Economic Commission for Europe

- Environmental Protection Agency

Report Objectives

- To analyze and forecast the plywood market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global plywood market based on type, application, and use type

- To project the market size for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, with their key countries

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, and mergers & acquisitions in the plywood market

Key Questions Addressed by the Report

Who are the major players in the plywood market?

Georgia-Pacific (US), Boise Cascade Company (US), Weyerhaeuser Company (US), UPM (Finland), SVEZA Group (Russia), Austral Plywoods (Australia), PotlatchDeltic Corporation (US), Greenply Industries Limited (India), Metsä Group (Finland), and CenturyPly (India).

What are the drivers and opportunities for the plywood market?

Rising demand due to the building & construction industry, urbanization, infrastructure development, and the booming furniture industry are key drivers. Technological advancements in manufacturing are expected to create new opportunities.

Which strategies are the key players focusing on in the plywood market?

Product launches, partnerships, mergers & acquisitions, agreements, and expansions are the key strategies adopted by major players to expand their global presence.

What is the expected growth rate of the plywood market between 2025 and 2030?

The plywood market is projected to grow at a CAGR of 4.21% during the forecast period from 2025 to 2030.

Which major factors are expected to restrain the growth of the plywood market during the forecast period?

Volatile raw material prices and environmental concerns are expected to restrain market growth during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plywood Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plywood Market