Portable Ultrasound Market Size, Growth, Share & Trends Analysis

Portable Ultrasound Market by Product (Probes, System & Console, Software, Service), Platform (Trolley/Cart, Handheld, Laptop/Tablet), Application (Trauma, OB/GYN, Cardio, Vascular, Pediatric), End User (Hospital, Imaging Centers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The portable ultrasound market is expected to reach USD 3.83 billion by 2030, up from USD 2.49 billion in 2025, growing at a CAGR of 9.0% from 2025 to 2030. The global market is experiencing strong growth as healthcare systems worldwide increasingly move toward point-of-care and home-based diagnostics. Portable ultrasound devices, including compact, handheld, and wireless options, are becoming essential for improving access, lowering diagnostic turnaround times, and enabling quick clinical decisions in various care settings such as emergency rooms, ICUs, outpatient centers, and rural clinics. The market is growing rapidly, fueled by advances in miniaturization, battery life, image quality, and AI-assisted imaging. Additionally, post-pandemic healthcare models emphasizing decentralized and remote diagnostics have greatly accelerated the adoption of portable ultrasound systems across both developed and emerging economies.

KEY TAKEAWAYS

- The North America portable ultrasound accounted for a market share of 42.9% in 2024.

- By Product type, the transducers/probes segment if expected to register highest CAGR of 9.6%

- By application, the Obstetrics/Gynecological Applications is expected to dominate the market with market share of 20.4% in 2024.

- By end user, Imaging centers centers will grow the fastest during the forecast period with a CAGR of 9.6%.

- Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), are some of the star players of portable ultrasound market (global) given their strong market share and product footprint.

- Echonous (US), Edan Instruments (China), and Mobisante (US), among others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

Recent years have seen a transformation in the portable ultrasound landscape, with the increasing integration of AI-powered image analysis, cloud connectivity, and wireless data transfer capabilities. This enables clinicians to access real-time imaging and interpretation support even in resource-limited environments. The emergence of handheld ultrasound probes that can connect directly to smartphones or tablets has democratized imaging, allowing broader use among general practitioners and non-radiologist clinicians. Furthermore, there is growing utilization of ultrasound in primary care, sports medicine, and home health, supported by rising emphasis on early detection and preventive care. Vendors are also differentiating through subscription-based software models and tele-ultrasound platforms, allowing remote scanning assistance and virtual consultations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

From a customer perspective, the portable ultrasound market is experiencing disruptions caused by the merging of imaging hardware and digital health ecosystems. Hospitals, clinics, and imaging centers face pressure to speed up diagnostic processes while controlling costs and dealing with staff shortages. The rollout of AI-powered auto-measurement tools and cloud PACS integration enables quicker triage and reporting, transforming the operations of imaging departments. Additionally, OEMs and healthcare providers are exploring new business models, such as pay-per-scan or device leasing, to reduce the burden of high initial costs. These disruptions are also driven by regulatory changes—FDA’s focus on software as a medical device (SaMD) is altering approval timelines for AI-assisted ultrasound. For customers, moving from standalone devices to connected diagnostic platforms offers workflow benefits but also presents challenges in IT integration and cybersecurity.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements in portable ultrasound devices

-

Growing demand for point-of-care diagnostics

Level

-

Limited reimbursement coverage

-

High operating cost

Level

-

Integration of AI in portable ultrasound

-

High growth potential in emerging economies

Level

-

Limited battery life and connectivity issues

-

Shortage of skilled radiographers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological advancements in portable ultrasound devices

Key drivers for market growth include the rising prevalence of chronic and lifestyle diseases, such as cardiovascular disorders, liver disease, and obstetric complications, which necessitate rapid bedside diagnostic imaging. Additionally, the expansion of telemedicine and home healthcare services has propelled the need for portable, easy-to-use diagnostic devices. Governments and NGOs in developing regions are increasingly supporting the adoption of portable ultrasound in maternal and fetal health programs to bridge rural access gaps. Furthermore, technological innovations—including AI-assisted diagnostics, Doppler imaging in handheld formats, and advanced transducer materials—are enabling higher image quality and diagnostic accuracy comparable to traditional cart-based systems.

Restraint: Limited reimbursement coverage

Despite the promising outlook, the market faces restraints such as limited reimbursement coverage for point-of-care ultrasound procedures in several countries, which restricts broad-scale adoption. In addition, operator dependency and training requirements remain significant barriers, as consistent diagnostic accuracy relies heavily on clinician proficiency. Some hospitals are also hesitant to integrate portable ultrasound systems into established imaging workflows due to concerns around data integration, cybersecurity, and interoperability with existing EHR/PACS infrastructure. Moreover, price sensitivity in emerging markets and competition from refurbished systems continue to constrain profitability for premium device manufacturers.

Opportunity: Integration of AI in portable ultrasound

The next wave of opportunities lies in the integration of AI, machine learning, and cloud analytics to enable predictive diagnostics and automated reporting. The growing focus on value-based care and remote monitoring models will fuel demand for portable ultrasound devices in home-based chronic disease management, rural telemedicine hubs, and paramedic emergency response systems. Furthermore, collaborations between OEMs, digital health startups, and tele-radiology providers are opening new avenues for subscription-based ultrasound-as-a-service models. Expanding applications in musculoskeletal imaging, anesthesiology, and veterinary diagnostics further broaden the addressable market. Emerging economies in the Asia-Pacific and Latin America represent major growth hotspots, given their healthcare infrastructure modernization and government focus on accessible imaging.

Challenge: Limited battery life and connectivity issues

The industry continues to grapple with challenges related to regulatory harmonization, cybersecurity of connected devices, and standardization of AI algorithms across different imaging platforms. Variability in scan quality due to differences in probe handling, training levels, and device specifications remains a concern, particularly for handheld systems. Another critical challenge is integrating portable ultrasound into clinical workflows without disrupting existing imaging hierarchies or overburdening radiology departments. Manufacturers also face pricing pressure and supply chain volatility, particularly for semiconductor components and the battery lifecycle. Balancing affordability with innovation while maintaining clinical-grade accuracy will be crucial for sustaining long-term competitiveness in this fast-evolving market.

Portable Ultrasound Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Assessment of Volume Status in Nephrology Using Hand-Carried Ultrasound | Assist with determining intravascular volume |

|

Handheld ultrasound for early detection of left ventricular dysfunction or valvular abnormalities during routine outpatient visits | Provides immediate insights without referring patients to echocardiography labs, speeding up decision-making |

|

Pneumonia Diagnosis / Vaccine Effectiveness in Pediatric Public Health Settings | Portable ultrasound helps avoid ionizing radiation, reduce reliance on X-ray, and makes diagnostic tools usable in low-resource settings |

|

Portable ultrasound used in maternity wards and rural clinics to monitor fetal growth, amniotic fluid, and detect complications | Expands access to prenatal care in underserved regions, reducing maternal and neonatal complications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The portable ultrasound ecosystem comprises a tightly connected network of device manufacturers, software developers, digital health integrators, service providers, and end users. Leading OEMs such as GE HealthCare, Philips, Siemens Healthineers, Fujifilm Sonosite, Butterfly Network, and Clarius anchor the ecosystem through innovation in handheld and wireless ultrasound systems. Around them, AI and cloud software partners enable automated image analysis, real-time diagnostics, and remote data sharing to enhance clinical efficiency. Telehealth and EMR platform providers integrate portable ultrasound data into connected care workflows, supporting point-of-care and remote diagnostics. Distributors and service partners play a key role in market access, clinician training, and post-sales support, while flexible pay-per-use and subscription models are reshaping procurement dynamics. Regulatory bodies such as the FDA and EMA are adapting frameworks for AI-driven imaging, ensuring safety and interoperability. Hospitals, clinics, emergency departments, and home care providers form the primary demand base, adopting portable ultrasound for faster, bedside decision-making. Academic institutions and investors further accelerate the ecosystem by validating technologies and funding innovation. Collectively, this ecosystem is shifting from a hardware-centric model to an AI-enabled, data-driven diagnostic network that enhances accessibility, affordability, and clinical precision.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Portable Ultrasound Market, By Product Type

Recent trends indicate a strong push toward multi-frequency and multi-modality probes that reduce the need for multiple transducers while maintaining diagnostic precision. AI-enhanced probe technology is emerging as a key differentiator, offering automated anatomical recognition, auto-adjustment of gain and depth, and guided scanning assistance, which improves usability for non-radiologists. Manufacturers are also investing in solid-state and CMUT probe architectures to improve heat management and battery efficiency while reducing signal noise. Wireless transducers with integrated batteries and Bluetooth/Wi-Fi connectivity are increasingly favored in home care and field settings for their portability and infection control benefits.

Portable Ultrasound Market, By Platform

Compact cart-portable systems remain the largest revenue segment because they balance mobility with near-cart image quality, multi-probe support, and broader modality coverage (e.g., Doppler, cardiac presets) that hospitals and high-throughput urgent care settings require; handhelds are the fastest-growing on the back of falling ASPs, app-based workflows, and expanding non-radiology use, while laptop/ultraportables occupy a stable niche among anesthesia, MSK, and point-of-care users who need better ergonomics and battery life than a handheld but lower footprint than full cart

Portable Ultrasound Market, By Application

Point-of-care emergency and critical care is the largest application because rapid bedside assessments (FAST, lung, vascular access) directly impact outcomes and are now embedded in ED/ICU protocols; obstetrics & gynecology sustains high demand through routine prenatal screening in decentralized settings, while musculoskeletal and anesthesia/nerve block are expanding quickly as non-radiologist clinicians incorporate ultrasound to reduce complications and improve procedural accuracy.

Portable Ultrasound Market, By End User

Hospitals (tertiary and large secondary) account for the largest share driven by multiprocedure utilization, budget capacity, and stringent cybersecurity/IT needs favoring premium portable systems; ambulatory surgery centers, urgent care clinics, and physician offices are the fastest-growing end users, as they pivot to ultrasound for on-site triage, follow-ups, and procedural guidance, and home-health/community programs are emerging via pay-per-use models.

REGION

Asia-Pacific to be fastest-growing region in global Portable Ultrasound market during forecast period

APAC is the fastest-growing region due to simultaneous tailwinds: healthcare infrastructure expansion beyond metros, policy-led maternal/child health and emergency care programs, rapid growth of private ambulatory networks, stronger price elasticity for handhelds and laptop units, and local manufacturing/assembly initiatives that compress price points and lead times; additionally, clinician training programs and tele-ultrasound pilots in India, Southeast Asia, and China accelerate first-time adoption among non-radiology specialties.

Portable Ultrasound Market: COMPANY EVALUATION MATRIX

On “Clinical Performance & Breadth,” established OEMs (GE HealthCare, Philips, Siemens Healthineers, Fujifilm Sonosite) score highest, with superior probes, beamforming, Doppler quality, and validated presets across emergency, cardiac, OB/GYN, and MSK. On “Ease of Use & Workflow,” leaders pair intuitive UIs with one-touch protocols, robust battery life, and seamless PACS/EMR connectivity; here, Sonosite and GE often stand out in rugged point-of-care environments, while Philips and Siemens excel in enterprise interoperability. On “AI & Software Velocity,” digital-native players (Butterfly Network, Clarius) push rapid over-the-air feature releases, automated measurements, and attractive app UX, while tier-1 OEMs are quickly closing the gap with FDA-cleared AI toolkits and tighter cybersecurity. On “TCO & Commercial Flexibility,” handheld-first firms lead with lower ASPs, subscriptions, and pay-per-probe models; OEMs counter with enterprise bundles, service SLAs, and financing. Finally, on “Support, Training & Validation,” incumbent OEMs retain an edge via global service coverage, clinical education programs, and large installed bases that de-risk procurement for hospitals. Net-net: incumbents dominate high-acuity, enterprise deployments; challengers win greenfield, physician-office, and budget-sensitive use cases—making partnerships (AI apps, cloud) a key differentiator across both camps.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.32 billion |

| Market Forecast in 2030 (Value) | USD 3.83 billion |

| Growth Rate | 9.0% (2025-2030) |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025 |

| Units Considered | Value (USD Million/Billion),Volume (Units Sold) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Portable Ultrasound Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading OEM |

|

|

| Software provider |

|

|

RECENT DEVELOPMENTS

- September 2024 : GE HealthCare (US) launched the enhanced Venue ultrasound system, along with a new point-of-care ultrasound (POCUS) solution, Venue Sprint. Venue Sprint is a highly portable ultrasound device that integrates the advanced Venue software, AI-powered tools, superior image quality, and wireless probe functionality, compatible with the Vscan Air handheld system.

- July 2024 : GE HealthCare (US) acquired Intelligent Ultrasound Group Plc (UK). The company plans to integrate these solutions across its ultrasound portfolio, enhancing its capabilities with technology designed to improve workflows and streamline usability, ultimately benefiting both clinicians and patients.

- September 2023 : Hologic (US) entered into a definitive agreement to sell its SSI ultrasound imaging business to SSH Holdings Limited (UK) with a sales price of USD 1.9 million.

Table of Contents

Methodology

The research methodology utilized to examine the global portable ultrasound market is thoroughly detailed on the website. This section provides a clear understanding of the structure, processes, and practices employed for collecting and analyzing field data, ensuring its accuracy and reliability. This transparency allows various stakeholders to critically assess the credibility of the findings, conclusions, and recommendations presented in the report, enabling informed decision-making.

Secondary Research

We utilized a variety of sources for this secondary research, including D&B Hoovers, Bloomberg Businessweek, Factiva, white papers, annual reports, company filings, investor presentations, and SEC filings. This comprehensive approach allowed us to create an extensive database of key participants in the industry. The database contains the most relevant information about incumbent companies, multi-level market segmentation, industry trends within each segment, significant mergers and acquisitions, and the impact of groundbreaking technological developments in the portable ultrasound market.

Primary Research

The primary research involved both qualitative and quantitative techniques and was conducted in depth with participants from both the supply and demand sides through interviews.

On the supply side, interviews were held with high-level executives, including CEOs, vice presidents, marketing directors, sales directors, regional sales managers, and directors of technology and innovation, from leading companies and organizations that produce and deliver therapy products.

On the demand side, professionals interviewed included clinicians, procurement managers, purchasing managers, department heads, and subject-matter experts from hospitals, surgical centers, diagnostic centers, maternity centers, ambulatory centers, research institutions, and academia, as well as other end users.

Overall, this research provided valuable insights into market segmentation, key players, trends and dynamics, and growth drivers in the market.

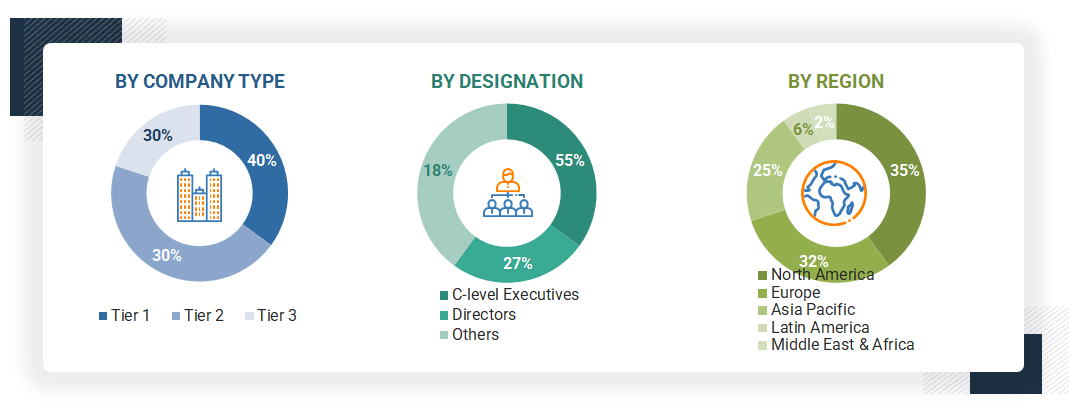

A breakdown of the primary respondents is provided below:

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

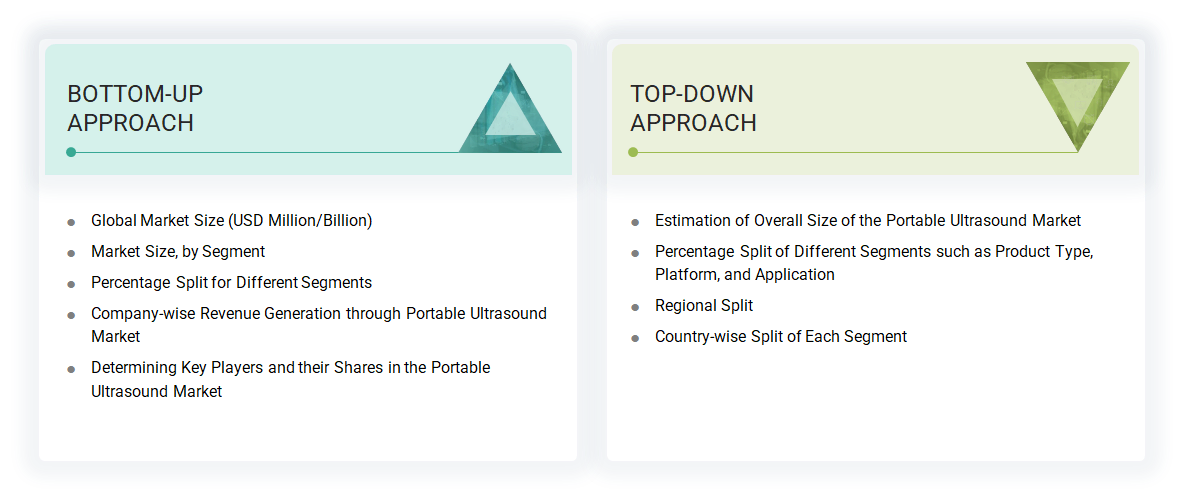

Market Size Estimation

The report provides a comprehensive analysis of the portable ultrasound market. Key players were identified through both primary and secondary data sources. The secondary analysis relied on annual and financial reports from major companies in the market, while the primary research involved in-depth interviews with key opinion leaders, including CEOs, directors, and senior marketing executives.

A segment-based approach was employed to determine the global market value, utilizing revenue data from leading solution and supplier providers. This process included the following steps:

- Identifying all key players in the global portable ultrasound market.

- Analyzing their reported annual revenues, whether specifically related to ultrasound or encompassing their overall business units or products.

The data was then projected to arrive at the overall value for the portable ultrasound market.

Data Triangulation

The research method employed involved segmenting the global portable ultrasound market into various participants and categories. Data triangulation and segmentation techniques ensured accurate information was available for all market segments. A series of analyses was conducted to examine both the demand and supply sides of the market. The combination of top-down and bottom-up approaches provided a comprehensive understanding of the portable ultrasound market.

Market Definition

The portable ultrasound market focuses on smaller, lighter ultrasound systems designed for easy maneuverability and accessibility in various healthcare settings. These portable ultrasound systems utilize sound waves generated by key transducer components to create real-time moving images of body structures, tissues, organs, and fluids based on echogenicity. The development and widespread use of portable ultrasounds have significantly increased their application in point-of-care diagnostics across fields such as emergency medicine, critical care, obstetrics, cardiology, and remote patient healthcare. Portable ultrasound systems are particularly useful when quick imaging is required, in non-traditional settings, or to enhance access to diagnostic imaging.

Stakeholders

- Healthcare institutions (hospitals and diagnostic centers)

- Research institutions

- Clinical research organizations

- Academic medical centers and universities

- Reference laboratories

- Accountable care organizations (ACOs)

- Research and consulting firms

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Group purchasing organizations (GPOs)

- Medical research laboratories

Report Objectives

- To define, describe, and forecast the global portable ultrasound market based on product, platform, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges), along with the current trends

- To strategically analyze micromarkets with respect to their individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments for five regions: North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments in the portable ultrasound market, such as acquisitions, product launches, expansions, agreements, joint ventures, alliances, and collaborations

Frequently Asked Questions (FAQ)

How do government policies and reimbursement schemes impact the portable ultrasound market?

They affect the availability, affordability, and, consequently, the adoption of portable ultrasound systems. For instance, favorable reimbursement policies improve the demand for portable ultrasound systems as healthcare providers are willing to invest in technologies covered by insurance programs.

What regulatory and government bodies are used to update portable ultrasound data?

The regulatory guidelines that can be used are the Health Insurance Portability and Accountability Act (HIPAA), the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the American Institute of Ultrasound in Medicine (AIUM), among others.

What significant strategies are leading players adopting to enter emerging regions?

Distribution agreements, partnerships, product launches, and product approvals are the major growth strategies adopted by major market players.

What factors influence the pricing of portable ultrasound systems, and how do they vary across different types and models?

The pricing of portable ultrasound systems varies based on technology, including trolley/cart-based, laptop-based, and tablet-based models, as well as image quality and AI integration. Higher-end systems tend to have lower prices because they are utilized for specialized applications.

How is AI integrated into portable ultrasound technology, and how does it impact diagnostic accuracy and workflow efficiency?

By enhancing the algorithm utilized by sonographers, AI can automatically interpret ultrasound images, identify anomalies, and improve image resolution. These advancements contribute to greater diagnostic accuracy and increased efficiency, resulting in faster diagnoses with reduced reliance on human input.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Portable Ultrasound Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Portable Ultrasound Market