Postbiotics Market

Postbiotics Market by Source (Bacteria, Yeast), Application (Functional Food & Beverages, Dietary Supplements, Animal Feed, Cosmetics & Personal Care, and Pharmaceuticals), Form, Function, Manufacturing Technology, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The postbiotics market is projected to reach USD 224.5 million by 2030 from USD 146.7 million in 2025, at a CAGR of 8.9% from 2025 to 2030. The global demand for postbiotics is increasing significantly due to the growing awareness among customers due to their direct relation to digestive health, gut health, and immune health benefits, the rise in the demand for nutritious food, and the increase in the demand for quality animal products.

KEY TAKEAWAYS

- North America is expected to account for a 37.1% share of the postbiotics market in 2025.

- By source, the yeast segment is expected to register the highest CAGR of 9.2%.

- By application, the dietary supplements segment is projected to grow at the fastest rate from 2025 to 2030.

- By form, the dry segment is expected to dominate the market.

- ADM, Cargill, Incorporated, and Kerry Group PLC were identified as star players in the postbiotics market, given their strong market share and extensive product footprint.

- SILAB, Bioprox Healthcare, and Nutrignomix Sdn. Bhd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Postbiotics are used in various functional food & beverage applications and dietary supplements. Their integration in good-for-health products, such as functional snacks, yogurts, and cultured dairy drinks, has contributed significantly to the growth of the market. Manufacturers are coming up with various innovations in postbiotic products, thus providing a wide variety of choices for consumers. Furthermore, technological advancements in the field of postbiotics have enabled their inclusion in supplements and other non-food applications, such as cosmetics & personal care products.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of postbiotic suppliers, which, in turn, impacts the revenues of postbiotics manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising consumer awareness of gut health and overall wellness

-

Increasing incidence of digestive disorders and chronic health issues

Level

-

Competition from established alternatives like probiotics and prebiotics

-

Unclear clinical recommendations and prescription practices

Level

-

Technological and economic advantages over probiotics

-

Increasing R&D activities for postbiotics

Level

-

Yield optimization, storage, and stability

-

Regulatory uncertainty and lack of standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing incidence of digestive disorders and chronic health issues

Postbiotics provide a safe and effective alternative to live probiotics for individuals with weakened gut barriers or compromised immunity, where live microbes may pose a risk. Clinical studies have shown that heat-killed strains such as Lactobacillus acidophilus and L. paracasei retain immunomodulatory and anti-inflammatory effects, making them ideal for managing symptoms like bloating, loose stools, and gut dysbiosis. As healthcare systems increasingly shift toward preventive care and gut-focused interventions, postbiotics are well-positioned to serve as a stable, scalable solution for digestive and metabolic health challenges.

Restraint: Competition from established alternatives like probiotics and prebiotics

Despite the emerging benefits of postbiotics, they face stiff competition from well-established biotic categories, namely probiotics and prebiotics. These alternatives have been on the market longer, are widely recognized by consumers, and have strong backing in both scientific literature and marketing narratives. Probiotics, in particular, have become synonymous with gut health, appearing in everything from yogurts to dietary supplements. Many consumers continue to believe that live bacteria are essential for gut balance, often overlooking the advantages of inactivated microbial products like postbiotics.

Opportunity: Technological and economic advantages over probiotics

Postbiotics offer significant technological and economic advantages over probiotics, making them highly attractive for food, pharmaceutical, and nutraceutical manufacturers. Unlike probiotics, which rely on the viability of live microorganisms, postbiotics are composed of non-viable microbial cells, cell components, and metabolites produced during fermentation. This makes them inherently more stable and resistant to environmental stressors such as heat, oxygen, acidity, and pressure. As a result, postbiotics do not require cold chain storage or refrigeration, reducing logistical complexities and cost burdens associated with transport and shelf-life management. This thermal and processing stability allows postbiotics to be easily incorporated into a wider range of consumer products—including baked goods, ready-to-drink beverages, powdered supplements, and even cosmetics—without losing their functional benefits.

Challenge: Regulatory uncertainty and lack of standardization

One of the most pressing challenges hampering the growth of the postbiotics market is the ambiguity of a globally standardized regulatory framework. Unlike probiotics and prebiotics, postbiotics are still not clearly defined or regulated by major food and health safety authorities. Currently, no regulatory body—including the US FDA, EFSA in Europe, or Codex Alimentarius—has developed a dedicated framework for postbiotics in the context of food or dietary supplements (Thorakkattu et al., 2022). This regulatory vacuum creates ambiguity for manufacturers regarding acceptable ingredient classifications, permissible claims, and safety thresholds.

Postbiotics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In mid-2023, DSM-Firmenich acquired Adare Biome for approximately Euro 275 million (~USD 300 million). This acquisition granted DSM-Firmenich immediate access to proven postbiotic science, established manufacturing infrastructure, and a global distribution-ready portfolio. | Post-acquisition, DSM-Firmenich significantly bolstered its position in the microbiome wellness space. |

|

In early 2023, ADM invested over USD?30 million to open a pioneering production facility in Valencia, Spain—the first in the world to manufacture probiotics and postbiotics on the same site. | ADM could support the demand across Europe, Asia Pacific, and North America. It positioned ADM to scale health and wellness revenue from USD?500 million to a projected USD?2 billion within ten years, reinforcing ADM’s reputation as a leader in microbiome-enabled nutrition solutions. |

|

In 2018, Minneapolis-based Cargill acquired EpiCor, a supplier of postbiotic ingredients derived from Saccharomyces cerevisiae (baker’s yeast). EpiCor became part of Cargill Health Technologies, a business within Cargill focused on microbiome innovation. | EpiCor became one of the key postbiotic ingredients globally, featured in more products than any other postbiotic brand, establishing Cargill as a major stakeholder in the gut and immune health segments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map of the ecosystem is categorized into demand-side and supply-side companies. The postbiotics market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. ADM (US), Cargill, Incorporated (US), DSM-Firmenich (Netherlands), and Kerry Group plc (Ireland) spearhead product innovation and market penetration, while numerous smaller enterprises enhance the competitive landscape. The ecosystem includes ingredient suppliers, regulatory bodies & associations, small and medium-sized enterprises (SME), and demand-side companies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Postbiotics Market, By Source

Bacteria dominate the postbiotics market owing to their multiple health benefits, adaptability in formulations, and alignment with the current consumer trends, which is demand for digestive and overall wellbeing. Similar to inactivated preparations of therapeutic bacterial strains such as Lactobacillus, postbiotics provide excellent stability, safety, and ease of standardization, making them the perfect choice for product development in the fast-paced biotics arena. Since probiotics need live cells, bacterial postbiotics such as Humiome offered by DSM-Firmenich (Netherlands) use heat-stabilized microbial fractions and metabolites that provide stable, science-supported outcomes in various therapeutic areas ranging from gut health and immunity to metabolic health.

Postbiotics Market, By Application

The market for postbiotics in animal feed is highly affected by the reduced reliance on therapeutic antibiotics to retain antibiotic efficacy; the increased demand for quality animal products accompanies this. The selection of appropriate postbiotic strains and media for culturing plays a critical role in the development of probiotics for animal feed. Thus, the market for animal health and nutrition is expected to experience significant growth due to an increased focus on animal feed, with high opportunities in the dairy and meat industries.

Postbiotics Market, By Form

The dry form of postbiotic ingredients dominates the market owing to its better stability, easy handling, greater shelf life, and compatibility with a broad spectrum of product formulations. Dry postbiotics, in the form of powders or granules, are less susceptible to heat, moisture, and microbial degradation compared to liquid forms, thus perfect for applications in dietary supplements, functional foods, pet food, and animal feed products.

REGION

Asia Pacific projected to grow at a significant rate during the forecast period

Busy lifestyles, encouraging the consumption of convenience food products, and increasing spending on premium products have increased the demand for higher-priced fortified nutritional food & beverage products in the Asia Pacific. The application of postbiotics is estimated to grow faster in the region due to the demand from many consumers. Dietary supplements & functional food & beverage products are projected to form the fastest-growing application segment in this region. The region also presents immense opportunities for animal postbiotic products as governments are becoming increasingly concerned about the health and productivity of farm animals. Health deterioration in animals due to the use of Antibiotic Growth Promoters (AGPs) has also encouraged livestock owners to use probiotic and postbiotic-based feed. The application of postbiotics is expected to increase at a fast pace in Asia Pacific due to the rise in consumer demand.

Postbiotics Market: COMPANY EVALUATION MATRIX

In the postbiotics market matrix, Cargill, Incorporated (Star), a US company, leads the market through its high-quality postbiotic ingredients. EpiCor is a clinically validated postbiotic ingredient derived from Saccharomyces cerevisiae fermentation, designed to support immune and gut health. BASF (Germany) (Emerging Leader) is gaining traction with its product innovations in the postbiotics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 135.5 Million |

| Market Forecast in 2030 (value) | USD 224.5 Million |

| Growth Rate | CAGR of 8.9% during 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Tons) |

| Report Coverage | Revenue forecast, market share, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, and Rest of the World |

WHAT IS IN IT FOR YOU: Postbiotics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Postbiotics Manufacturers |

|

|

| Dietary Supplement Segment Assessment |

|

|

RECENT DEVELOPMENTS

- May 2025 : Lallemand Inc. (Canada) entered into a strategic global distribution agreement with Kirin Holdings to promote IMMUSE, one of the most clinically documented postbiotics on the market. This significantly bolstered Lallemand’s portfolio with a science-backed immune health postbiotic and to enhance the visibility and global market reach of IMMUSE, leveraging the complementary strengths of both companies to deliver advanced immune health solutions to consumers worldwide.

- May 2025 : ADM (US) heat-treated postbiotic, Bifidobacterium longum CECT 7347 (HT-ES1), won the Immune & Gut Health Ingredient category at the inaugural Vitafoods Europe Innovation Awards 2025. This recognition highlights ADM’s commitment to science-backed microbiome solutions, with clinical trials showing HT-ES1’s effectiveness in improving gut health and symptoms of IBS

- February 2025 : ADM (US) and Asahi Group Foods signed an exclusive distribution agreement for a proprietary postbiotic called Lactobacillus gasseri CP2305, developed by Asahi. This postbiotic is designed to support stress, mood, and sleep, and is backed by eight human clinical trials. ADM planned to begin distributing it globally starting in March 2025, targeting food manufacturers in North America, Europe, and Asia

- September 2024 : Biotenova Sdn. Bhd. (Malaysia) partnered with Universiti Putra Malaysia (UPM) to advance research on postbiotics, specifically Lassica K014, a patented ingredient derived from Lactobacillus plantarum. This aims to develop innovative treatments for inflammatory skin conditions like eczema and psoriasis. The research marks a breakthrough in microbiome-based therapy, offering stable, natural, and potentially safer alternatives to conventional skincare treatments.

- July 2024 : Cargill, Incorporated (US) signed an exclusive distribution agreement with Brenntag (Germany) Specialties Nutrition for its postbiotic ingredient EpiCor, made from fermented baker’s yeast (Saccharomyces cerevisiae). This deal covers a wide range of European regions including the UK, Ireland, France, Germany, Nordics, and Baltics. EpiCor is known for supporting immune and gut health, and aims to meet growing demand for functional health ingredients across Europe.

Table of Contents

Methodology

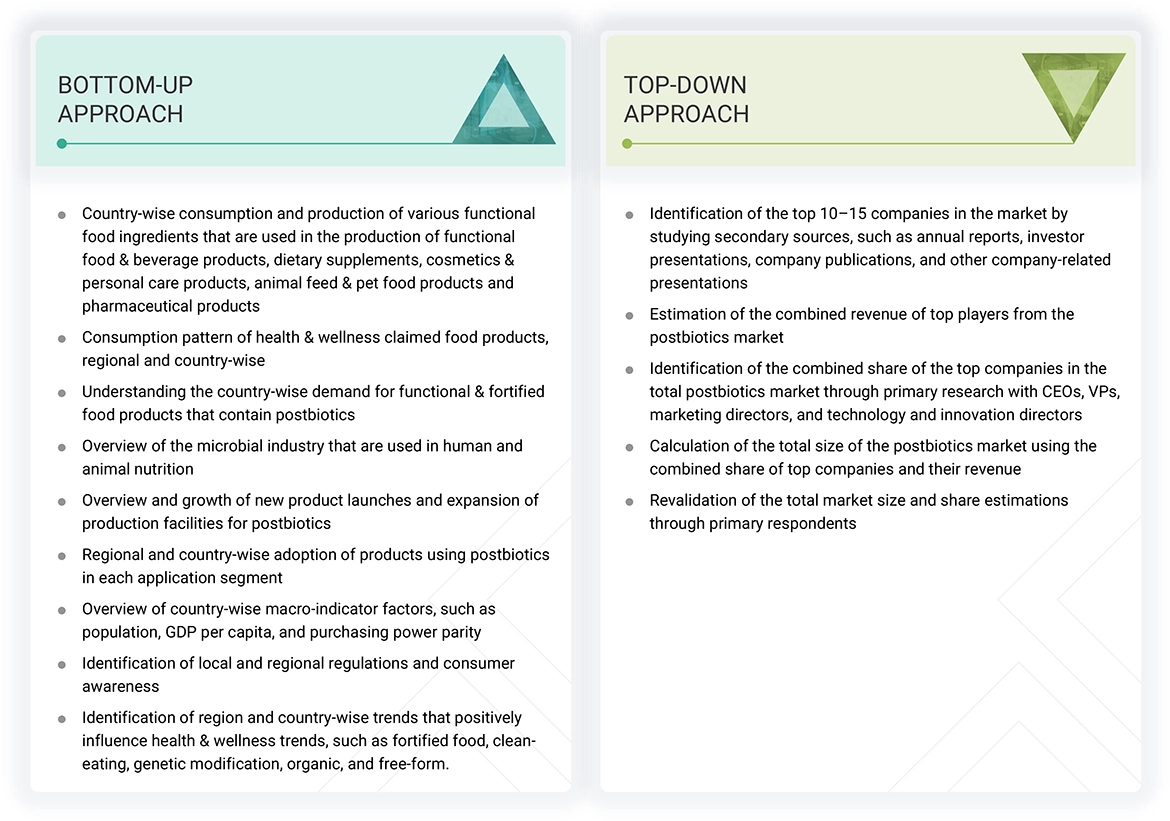

The study involved two major approaches in estimating the current size of the postbiotics market. Exhaustive secondary research was done to collect information on the market, source, application, form, function (qualitative), and manufacturing technology (qualitative) segments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

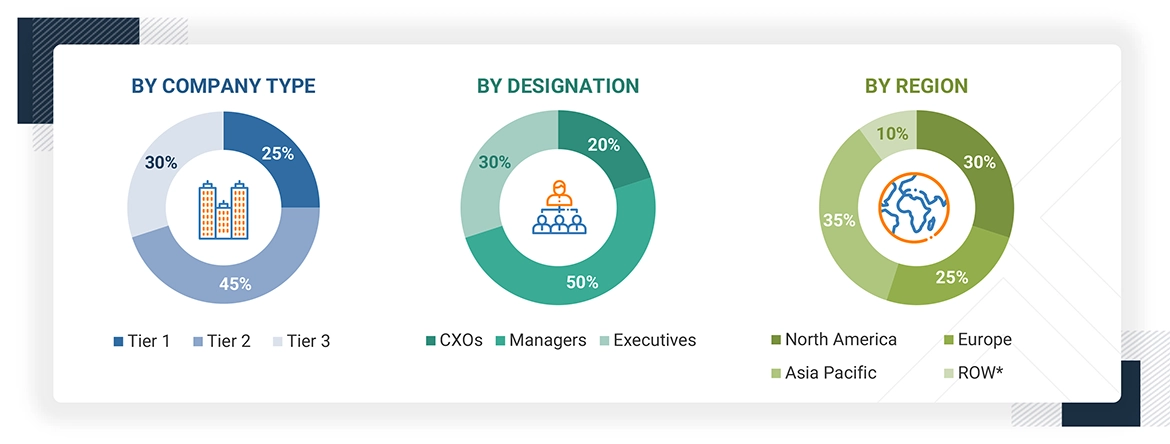

Primary Research

Extensive primary research was conducted after obtaining information regarding the postbiotics market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to source, application, form, and region. Stakeholders from the demand side, such as functional food & beverage manufacturers, dietary supplement manufacturers, cosmetics & personal care product manufacturers, feed & pet-food product manufacturers, and pharmaceutical product manufacturers, were interviewed to understand the buyers’ perspective on the suppliers, products, and the outlook of their business, which will affect the overall market.

Notes: RoW includes South America, Africa, and the Middle East

The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the availability of

financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = revenue = USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

ADM (US) |

Product Development Manager |

|

dsm-firmenich (Netherlands) |

Senior R&D Scientist |

|

Bioprox Healthcare (France) |

Marketing Director |

|

CJ CheilJedang Corp. (South Korea) |

Sales Head |

|

International Flavors & Fragrances Inc. (US) |

Senior Research Executive |

|

Probionic Corp (Korea) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the postbiotics market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Postbiotics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall postbiotics market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The International Scientific Association for Probiotics and Prebiotics (ISAPP) defines postbiotics as “a preparation of inanimate microorganisms and/or their components that confers a health benefit on the host.” These non-viable microorganisms are often more stable and convenient to include in almost any product.

Thus, postbiotic ingredients are a versatile functional ingredient for foods, health supplements, animal feed & pet food, cosmetic & personal care products, and pharmaceutical products. It is sourced from bacteria and yeast that are available in dry and liquid form. It is used for various functionalities such as digestive health, gut health, immune health, skin health, among others.

Stakeholders

- Raw material suppliers of postbiotics

- Postbiotics ingredient manufacturers & suppliers

- Intermediate stakeholders, including distributors, retailers, associations, regulatory bodies, and others

- Manufacturers and traders of food & beverage products and dietary supplements

- Manufacturers and traders of non-food applications, such as cosmetics & personal care products and feed & pet food

- Government organizations, institutes, and research organizations

-

Associations and industry bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- US Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- International Scientific Association for Probiotics and Prebiotics (ISAPP)

- Federation of European Microbiological Societies (FEMS)

- International Probiotics Association (IPA)

Report Objectives

- To determine and project the size of the postbiotics market based on source, application, form, function (qualitative), manufacturing technology (qualitative), and region, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the postbiotics market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe postbiotics market into key countries

- Further breakdown of the Rest of Asia Pacific postbiotics market into key countries

- Further breakdown of the South America postbiotics market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the projected size of the postbiotics market?

The postbiotics market was valued at USD 135.5 million in 2024 and is projected to reach USD 224.8 million by 2030, at a CAGR of 8.9% from 2025 to 2030.

Which are the key players in the postbiotics market, and how intense is the competition?

Key players include ADM (US), Cargill (US), dsm-firmenich (Netherlands), Kerry Group plc (Ireland), Associated British Foods plc (UK), BASF (Germany), Novozymes A/S (Denmark), IFF (US), MCLS Europe B.V. (Netherlands), Phileo by Lesaffre (France), Lallemand Inc. (Canada), Sami-Sabinsa Group (India), and CJ CheilJedang Corp. (South Korea). The market is highly competitive, driven by continuous R&D investments, product launches, deals, and innovations.

What are the growth prospects for the postbiotics market in the next five years?

The market is expected to experience robust growth due to a global shift toward healthier lifestyles and increasing demand for fortified functional food products.

What kind of information is provided in the company profiles section?

Company profiles provide a comprehensive business overview, including business segments, financial performance, geographical reach, revenue composition, and business revenue breakdown. They also offer insights into product offerings, key milestones, and expert analyst perspectives.

How is the Asia Pacific region contributing to market growth?

The Asia Pacific region is emerging as a key growth driver, supported by increasing health awareness, urbanization, and higher spending on premium products. Consumers in China, India, Japan, and Southeast Asia are adopting functional foods and health-benefit products, especially among younger urban populations. Additionally, government wellness initiatives, rising lifestyle-related health issues, and the expansion of e-commerce and mobile health platforms are boosting postbiotics adoption.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Postbiotics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Postbiotics Market