Potassium Formate Market

Potassium Formate Market by Form (Liquid/Brine, Powder). Application (Deicing Agent, Drilling & Completion Fluids, Fertilizer Additives, Heat Transfer Fluids, Preservatives), End-Use Industry – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The potassium formate market is projected to reach USD 992.1 million by 2030 from USD 800.8 million in 2025, at a CAGR of 4.4% from 2025 to 2030. The increasing demand for potassium formate is primarily driven by its multifunctional performance, environmental compatibility, and safety advantages over conventional salts. In the oil and gas industry, it is increasingly favored as a high-density, biodegradable brine for drilling and completion fluids that improve wellbore stability while minimizing formation damage. Its role as an eco-friendly de-icing agent has also grown rapidly, especially in regions with strict environmental regulations seeking alternatives to chloride-based salts.

KEY TAKEAWAYS

-

BY FORMBy form include liquid/brine, powder form. The growth of potassium formate in the coming years is primarily driven by increasing adoption of its liquid/brine form, which offers superior solubility, ease of handling, and high-density performance in drilling, completion, de-icing, and heat transfer applications. Demand for this form is rising due to its environmental safety, low corrosion, and operational efficiency, especially in oil and gas and aviation sectors. Meanwhile, the powder form is experiencing steady but slower growth, supported by its advantages in storage stability, transport convenience, and cost-effectiveness for agriculture and chemical synthesis.

-

BY APPLICATIONThe potassium formate market spans key application areas including deicing agents, drilling & completion fluid, heat tranfer fluid, fertilizer additives, preservatives and other applications. As a de-icing agent, demand is surging, particularly at airports and municipalities, as it offers a less corrosive and eco-friendly alternative to chloride salts, preserving infrastructure and water quality. In heat transfer fluids, its low freezing point and non-toxic nature drive adoption in efficient HVAC and refrigeration systems. Also, in fertilizer additives and food processing (as a preservative/salt substitute), it continues to gain traction due to the push for high-potassium, sustainable agricultural practices and the growing preference for safe, non-toxic food-grade chemicals.

-

BY END-USE INDUSTRYThe potassium formate market serves diverse end-use industries including oil & gas, construction, agriculture, industrial,food & beverage and other end-use industries each contributing to its sustained expansion. In oil & gas, its primary market, demand is surging because potassium formate brine acts as a high-density, low-corrosive, and biodegradable drilling and completion fluid, crucial for stable and efficient operations in high-pressure, high-temperature (HPHT) and deepwater wells, replacing more toxic, conventional oil-based muds. In construction, it is increasingly adopted as a non-corrosive de-icing agent for roads and airport runways, preventing damage to concrete and infrastructure, as well as an anti-freezing additive for cold-weather concreting. All these industries are potentially growing which will help the market to grow in near future.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 4.8%, due to rapid industrialization, expanding chemical manufacturing capacity, and a strong agriculture base across countries like China, India, Japan, and South Korea. The region’s cost-effective raw materials, availability of skilled labor, and supportive government initiatives for domestic chemical and industrial R&D have encouraged large-scale adoption of potassium formate. Growing investment in agriculture, chemical, oil & gas industry, along with the rise of contract manufacturing organizations (CMOs) and academic research collaborations, further supports demand.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Perstorp Holding AB (Sweden), Clariant (Switzerland), Thermo Fisher Scientific Inc (US), Eastman Chemical Company (US), Tetra Technologies Inc (US). These companies are advancing potassium formate and broadening end-use adoption, reflecting the growing demand for potassium formate in various applications

The potassium formate market is projected to reach USD 992.1 million by 2030 from USD 800.8 million in 2025, at a CAGR of 4.4% from 2025 to 2030. Potassium formate is the potassium salt of formic acid, chemically represented as HCOOK. It is a white crystalline solid or colorless liquid (in solution form) that is highly soluble in water and known for its biodegradability, non-corrosive nature, and high density. The compound serves multiple industrial purposes—most notably as a key component in clear brine fluids for oil and gas drilling, a low-toxicity de-icing agent for runways and roads, and a heat transfer medium in cooling systems. Due to its excellent environmental profile and thermal stability, potassium formate is increasingly preferred over traditional chloride-based salts in applications where performance, safety, and sustainability are critical.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The potassium formate market is witnessing significant growth due to trends and disruptions that are reshaping customer businesses across various industries. In the oil and gas sector, there is a growing preference for potassium formate-based drilling and completion fluids due to their high density, thermal stability, and non-corrosive properties, making them ideal for high-pressure, high-temperature (HPHT) wells and offshore operations. This shift is further supported by stringent environmental regulations that favor biodegradable and non-toxic alternatives to traditional chloride-based fluids. In the de-icing industry, municipalities and airports are increasingly adopting potassium formate-based de-icers as a sustainable alternative to conventional salts. These products offer effective performance in low temperatures while minimizing infrastructure corrosion and environmental impact.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High demand for potassium formate in oil & gas end use industry.

-

Rising adoption in deicing application

Level

-

High production cost.

-

Volatile raw material prices

Level

-

Agricultural sector growth.

-

Technological advancements in the potassium formate market.

Level

-

Limited awareness in emerging economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High demand for potassium formate in oil & gas end use industry

The increasing application of potassium formate in the oil & gas sector is a major factor contributing to the increase in the overall potassium formate market. Potassium formate is valued in oil & gas production and end-use industry as a high-performance, high-density brine/liquid applied in workover, completion, and drilling fluids. The stability under high-pressure, high-temperature (HPHT) conditions, along with its low corrosiveness and biodegradability, makes it an ideal choice for operators aiming for efficiency while meeting stricter environmental regulations. Worldwide energy demand, particularly in unconventional reservoirs like shale and deepwater reservoirs, has driven the need for better drilling fluids that minimize formation damage and maximize well productivity—areas where potassium formate excels over traditional chloride-based alternatives. Increased demand not only boosts its use but also drives investment in production capacity and research to fulfill the specific needs of the oilfield services industry. As companies are under pressure to reduce their carbon footprint, the demand for sustainable chemicals like potassium formate boosts its market demand, generating a ripple effect that stabilizes supply chains, promotes aggressive pricing, and increases its use across regions of high oil & gas activity, such as North America and the Middle East

Restraint: High production cost

High production cost is a major hindrance to its market growth, primarily due to the cost of its production process. Potassium formate is usually manufactured by the reaction between potassium hydroxide or potassium carbonate and formic acid, whose processes are energy-intensive and raw materials are costly, especially when bought on an industrial scale. The necessity for having tight control of reaction conditions for the sake of product purity and consistency further pushes operating costs, as well as the demand for equipment suited to withstand the chemical’s nature. These high manufacturing costs are then passed on to the customer in the form of higher prices, which makes potassium formate a less competitive choice compared to lower-cost alternatives like calcium chloride or sodium formate for uses such as de-icing or drilling fluids, especially in cost-conscious markets or countries with lax environmental regulations. For some applications, like oil & gas, where potassium formate’s superior performance is essential, the cost aspect can continue to be an issue for mass adoption, especially among small operators or in tight-budget projects. Raw material price volatility, like formic acid, can fuel the cost pressures, limiting scalability, and market penetration. This financial cost impedes the ability of producers to lower prices or diversify into developing markets, ultimately restraining the potential for growth within the potassium formate market despite its technical and environmental advantages

Opportunity: Technological Advancement in Potassium Formate Market

Technological innovation has the potential to advance the market by improving production efficiency, expanding applications, and enhancing competitive advantage. Production process advances, for instance, in the form of more energy-efficient synthesis protocols or the use of high-performance catalysts on the reaction between formic acid and potassium compounds, can significantly reduce production costs, eliminating one of the principal bottlenecks in the market. For example, process automation, and reactor design technologies would decrease the cost of energy and enhance the yield, rendering potassium formate a more financially viable candidate for commercial production at an industrial scale. In addition to production, innovations in formulation and application such as the tailoring of potassium formate brines for the high-pressure, high-temperature conditions of ultra-deep oil & gas reservoirs or increasing its efficiency as a low-temperature heat transfer fluid—offer new opportunities for growth into the market. In addition, improvements in recycling or regenerating methods for potassium formate fluids applied in drilling or de-icing can enhance sustainability and economic benefit, attractive to green industries and regulators. Such advancements not only enhance its value proposition compared with conventional substitutes such as chlorides but also facilitate entry into new markets, including renewable energy systems or sophisticated agricultural applications. With the help of cutting-edge technology, producers can cope with increasing demand better, enter untapped markets, and promote potassium formate as a high-performance, green chemical, ensuring long-term development, and profitability within the market

Challenge: Limited awareness in emerging economies

Limited familiarity with emerging economies poses a significant threat to the growth of the market, limiting its adoption and scalability across areas with high industrial potential. In most developing economies in Asia Pacific, Middle East & Africa, and South America, sectors including oil & gas, agriculture, and construction maintenance tend to use traditional, inexpensive solutions such as sodium chloride or calcium chloride without knowledge of potassium formate’s superior performance and advantages of environmental sustainability. Such ignorance arises out of the dearth of marketing efforts, the dearth of the right kind of technical orientation, and the non-existence of local case studies highlighting its benefit such as ease of biodegradability, low corrosive nature, and suitability for utilization in high-density drilling mud or de-ice application. While potassium formate may not yet benefit from widespread campaigning or extensive professional training for industry experts, this presents a unique opportunity for decision-makers to explore an innovative and underutilized solution. Its perception as a premium or specialized product, combined with the current untapped potential in distribution channels and dealer networks, positions it as a promising option for those looking to pioneer new markets and establish a competitive edge. Furthermore, developing economies prefer cost savings in the short term to long-term sustainability, and it is difficult to justify the initial higher cost of potassium formate when its lifecycle benefits. This lack of awareness retards market penetration, limits demand growth, and prevents economies of scale that would otherwise reduce prices, thereby stunting the growth of the market in regions where industrial activity and environmental demand are increasing, hence becoming an ongoing impediment to realizing the full potential of potassium formate globally.

Potassium Formate Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces potassium formate brines for drilling, completion, and de-icing applications. | Offers high-density, low-corrosive, and biodegradable solutions ensuring operational efficiency and environmental compliance |

|

Develops potassium formate-based de-icing fluids and heat transfer media. | Provides excellent freezing point depression, corrosion protection, and sustainability for aviation and industrial systems. |

|

Supplies potassium formate clear brines and solids for well completion and workover operations. | Enables solids-free, high-density fluids that enhance wellbore stability and reduce formation damage in HPHT wells. |

|

Utilizes potassium formate in runway de-icers and secondary cooling fluids. | Delivers strong de-icing performance with minimal environmental impact and superior thermal efficiency. |

|

Manufactures potassium formate solutions for de-icing and oilfield service applications. | Provides eco-friendly, non-corrosive, and high-performance alternatives to conventional chloride-based salts. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The potassium formate ecosystem consists of a network of raw material suppliers, manufacturers, distributors, and end-use industries such as oil & gas, de-icing, agriculture, and chemical processing. Key players like Perstorp, Clariant, Tetra Technologies, Eastman, and Addcon dominate production, often integrating upstream formic acid sourcing to ensure consistent quality and supply. Distributors and specialty chemical suppliers facilitate global reach, while end-users drive demand through applications requiring high-density, biodegradable, and low-corrosion fluids. Regulatory bodies and environmental standards further shape the ecosystem, incentivizing the adoption of sustainable, non-halide solutions and influencing R&D, production, and supply chain strategies across the value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Potassium Formate Market, By Form

Liquid/brine form of potassium formate has the largest market share in terms of value and volume. Potassium formate liquid/brine is the market leader due to its superior solubility, simplicity of use, and improved performance in key industries such as oil & gas, deicing, and industrial cooling. Its extensive use as a drilling and completion fluid in oil & gas exploration, particularly in HPHT wells, is one of the primary reasons for its market leadership. In contrast with conventional brines, potassium formate minimizes wellbore instability, reduces formation damage, and increases lubrication, and it is, therefore, the first choice for offshore and Arctic drilling activities by operators such as Equinor and Gazprom Neft. The environmentally friendly and biodegradable properties of potassium formate have also spurred usage in deicing solutions, with key airports such as Zurich, Helsinki, and Copenhagen increasingly substituting chloride-based deicers with potassium formate brine as a way of adhering to stringent environmental policies. In industrial use, its non-corrosive nature and high thermal conductivity render it a good heat transfer fluid in refrigeration systems and data centers. Top producers of liquid potassium formate are TETRA Technologies Inc, Thermo Fisher Scientific Inc, ADDCON GmbH, Perstorp Holding AB, and Clariant, all of whom serve the increasing demand for environmentally friendly, high-performance brine solutions in various industries, globally.

Potassium Formate Market, By Application

The drilling & completion fluid application segment is expected to register the highest market share during the forecast period in the potassium formate market. Potassium formate is a preferred drilling and completion fluid due to its high density, low corrosiveness, and ecological compatibility, making it a popular choice in oil & gas as well as geothermal drilling. It is better in wellbore stability, lesser formation damage, and greater inhibition of shale when compared with conventional chloride brines, thus uniquely suited to HPHT wells. Its non-toxic and biodegradable chemical composition is in line with strict environmental laws, a reason top oil players such as Equinor, Shell, and BP have integrated potassium formate into their offshore and unconventional drilling operations, including utilizing deepwater wells in the North Sea and Arctic regions. Its fluid loss also makes it an excellent completion fluid for complex reservoirs and extended-reach drilling (ERD) operations. With growing oil & gas exploration activities, particularly in Norway, Russia, and North America, the high-performance drilling fluid market is continually on the rise. Some of the prominent producers and distributors of potassium formate for drilling are TETRA Technologies Inc., Perstorp Holding AB, ADDCON GmbH, and Hawkins, which are offering tailor-made brine solutions for fulfilling the industry’s changing technical and environmental demands.

Potassium Formate Market, By End-Use Industry

Based on end-use industry, the potassium formate market has been segmented into construction, oil & gas, industrial, food & beverage, agriculture, and others. Among these, the oil & gas end-use industry is expected to register the highest market share in the potassium formate market during the forecast period. The largest end use of potassium formate is oil & gas, stimulated by its centrality in high-pressure, high-temperature (HPHT) high-temperature wells drilling and completion fluids. Compared to conventional brines, potassium formate provides more effective wellbore stability, shale inhibition, and low formation damage, making it essential for offshore, deepwater, and unconventional operations drilling. As increased exploitation in extreme environments such as the North Sea, Arctic, and North American shale deposits continues to take place, potassium formate-based fluids find greater applications owing to their biodegradability and non-corrosive nature, in harmony with rigorous environmental regulations.

REGION

Asia Pacific to be fastest-growing region in global potassium formate market during forecast period

Asia Pacific is emerging as the fastest-growing market for potassium formate, driven by robust industrial expansion, increasing demand for eco-friendly solutions, and significant investments in infrastructure. Countries like China and India are leading the charge, with substantial growth in oil and gas exploration, construction, and agriculture sectors. The region's rapid urbanization and industrialization are fueling the need for high-performance materials like potassium formate in drilling fluids, de-icing agents, and heat transfer applications

Potassium Formate Market: COMPANY EVALUATION MATRIX

In the potassium formate market matrix, Perstorp Holding AB (Star), a Swedish company, leads the market through its manufacturing and distribution of potassium formate. The company's strategic investments, comprehensive product offerings, and commitment to sustainability. The company has significantly expanded its production capacities, including a notable investment in increasing potassium formate production in Europe, enhancing its ability to meet the growing global demand. Perstorp's potassium formate products are utilized across various applications, such as oil drilling and completion fluids, de-icing agents, and heat transfer fluids, owing to their high density, thermal stability, and environmental compatibility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 767.8 Million |

| Market Forecast in 2030 (value) | USD 992.1 Million |

| Growth Rate | CAGR of 4.4% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | • By Form: Liquid/Brine, Powder • By Application: Deicing Agents, Drilling & Completion Fluid, Heat Tranfer Fluid, Fertilizer Additives, Preservatives and other applications • By End-Use Industry: Oil & Gas, Construction, Agriculture, Industrial, Food & Beverage and Other End-Use Industries |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Potassium Formate Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Potassium Formate Manufacturers |

|

|

| Benchmarking of potassium formate forms (Liquid/Brine, Powder) | Comparative analysis of potassium formate providers, process efficiency, cost structure, and scalability | Supported clients in selecting the most cost-effective potassium formate |

| US Based potassium formate raw material supplier | US-based potassium formate suppliers which offer tailored brine concentrations, viscosity levels, and purity grades to meet specific drilling, de-icing, or heat transfer requirements.. | On-demand technical support, rapid supply chain solutions, and environmentally compliant formulations that enhance operational efficiency and reduce corrosion or environmental impact. |

| Application based potassium formate products | Application-based potassium formate products can be formulated for specific end-uses, such as high-density drilling fluids, low-freezing de-icers, or heat transfer solutions with tailored thermal properties. | Products offer enhanced performance, reduced environmental impact, and improved safety, ensuring operational efficiency and compliance with industry-specific regulations. |

RECENT DEVELOPMENTS

- November 2024 : Perstorp achieved International Sustainability and Carbon Certification (ISCC) PLUS as a trader with storage, allowing customers in the US to access mass-balanced renewable and recycled raw materials with verified sustainability benefits.

- July 2024 : Thermo Fisher Scientific had completed the acquisition of Olink, a leading provider of advanced proteomics solutions. This may also contribute to advancements in chemical formulations, such as improved production processes for specialty reagents like potassium formate.

- April 2024 : Clariant acquired Lucas Meyer Cosmetics, this acquisition strengthened Clariant’s Care Chemicals business, expanding its portfolio in personal care and skin health solutions. Potassium formate, known for its humectant and buffering properties, has been explored for use in high-performance skincare solutions

Table of Contents

Methodology

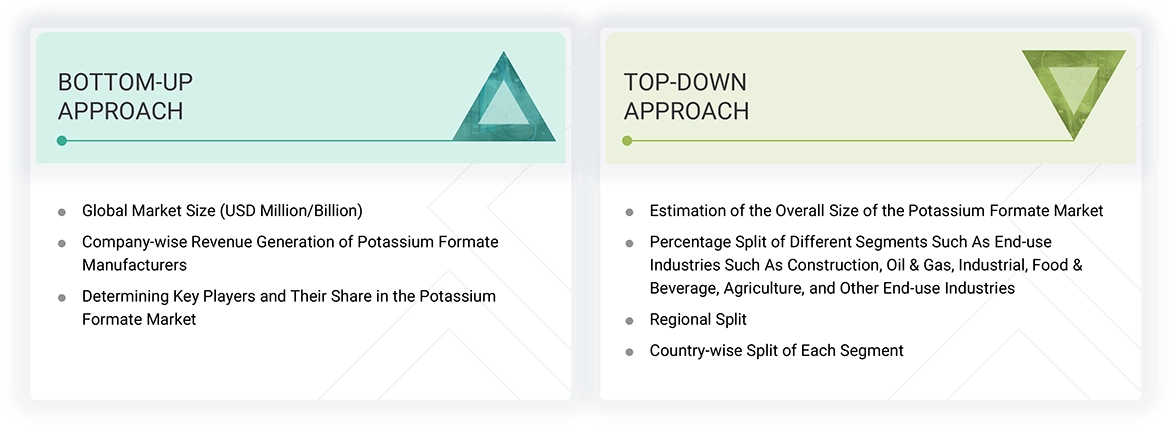

The study involves two major activities in estimating the current market size for the potassium formate market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering potassium formate and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the potassium formate market, which was validated by primary respondents.

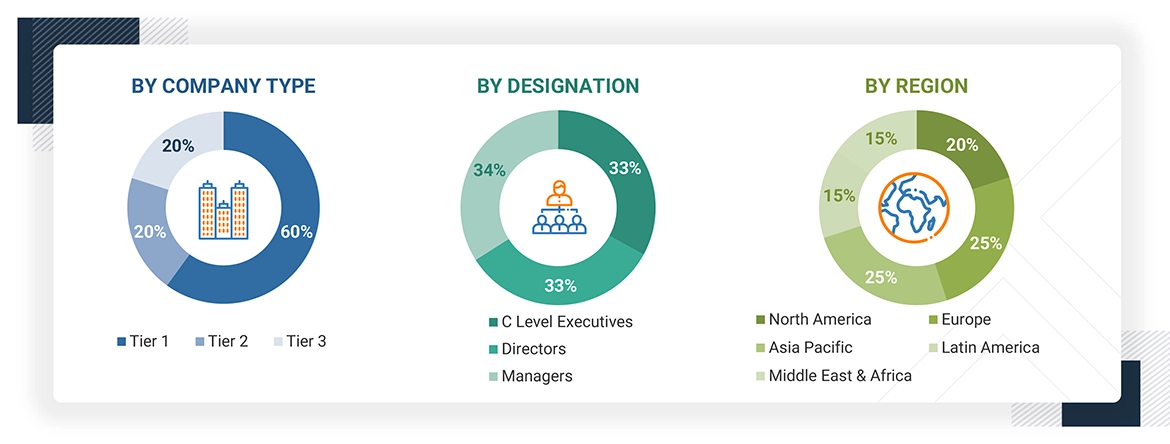

Primary Research

Extensive primary research was conducted after obtaining information regarding the potassium formate market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from potassium formate industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to form, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking potassium formate services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of potassium formate and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the potassium formate market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for potassium formate in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the potassium formate industry for each application. For each end-use, all possible segments of the potassium formate market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Potassium formate (HCOOK) is a potassium salt of formic acid, commonly used as a high-performance, eco-friendly chemical in various industrial applications. It is widely utilized as a drilling and completion fluid in the oil & gas industry, a biodegradable deicing agent for airports and highways, a low-chloride fertilizer additive in agriculture, and a heat transfer fluid in industrial refrigeration and data centers. Due to its non-corrosive, highly soluble, and environmentally safe properties, potassium formate is increasingly replacing traditional chloride-based chemicals, making it a preferred choice for sustainable and high-efficiency solutions across multiple sectors.

Stakeholders

- Potassium Formate Manufacturers

- Potassium Formate Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the potassium formate market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global potassium formate market, by form, by application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Potassium Formate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Potassium Formate Market