Power Electronics Software Market Size, Share and Trends, 2025 To 2030

Power Electronics Software Market by Design Software, Simulation Software, Analysis Software, Control Software, Rapid Control Prototyping, Embedded System Prototyping, Model-based Design, Automotive and Renewable Energy - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global power electronics software market is projected to grow from USD 3.33 billion in 2025 to USD 5.25 billion by 2030, at a CAGR of around 9.5% during the forecast period. Growth is driven by the increasing adoption of simulation and design software for optimizing semiconductor performance, thermal management, and circuit reliability in power electronic systems. Advancements in AI-based modeling, digital twin technologies, and system-level design tools are enhancing accuracy and reducing development cycles, enabling efficient deployment across automotive, renewable energy, consumer electronics, and industrial power applications.

KEY TAKEAWAYS

-

BY TYPEDesign software holds the largest market size in the power electronics software market as it is essential for modeling, simulating, and optimizing circuit designs before hardware implementation. Its ability to reduce development costs, enhance system efficiency, and accelerate product innovation drives widespread adoption across automotive, renewable energy, and industrial power applications.

-

BY TECHNOLOGYModel-based design holds the largest market size in the power electronics software market due to its ability to streamline the development process by enabling virtual prototyping, real-time simulation, and system-level testing. It reduces design errors, accelerates time-to-market, and supports complex system integration, especially in automotive, renewable energy, and industrial applications.

-

BY APPLICATIONThe industrial segment holds the largest market size in the power electronics software market due to widespread adoption of simulation and control tools for optimizing motor drives, power converters, and automation systems. Growing focus on energy efficiency, predictive maintenance, and digital twin integration across manufacturing and process industries further drives software adoption and market growth.

-

BY REGIONAsia Pacific holds the largest market size in the power electronics software market due to rapid industrialization, strong presence of semiconductor manufacturers, and increasing investments in electric vehicles and renewable energy projects. Countries like China, Japan, and South Korea are driving demand through advanced manufacturing, automation, and adoption of energy-efficient power management systems.

-

COMPETITIVE LANDSCAPEMajor players in the power electronics software market are pursuing both organic and inorganic growth strategies, including product innovation, software integration, and strategic collaborations to strengthen their global presence. The MathWorks, Inc., Synopsys, Inc., Cadence Design Systems, Inc., Keysight Technologies, and National Instruments Corp. are focusing on developing advanced simulation, modeling, and testing software for power electronic systems. These initiatives aim to enhance design accuracy, thermal and circuit performance, and system reliability, supporting the growing adoption of power electronics in electric vehicles, renewable energy systems, and industrial automation applications.

Power electronics software encompasses advanced design, simulation, and control tools that optimize the performance, efficiency, and reliability of power electronic systems. These solutions enable engineers to model, analyze, and test components such as converters, inverters, and semiconductor devices in virtual environments, reducing development time and costs. With growing demand for electric vehicles, renewable energy systems, and industrial automation, the power electronics software market is poised for strong growth, driven by advancements in digital twin technologies, AI-based modeling, and real-time simulation platforms that support scalable, energy-efficient, and intelligent power system design.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the power electronics software market is driven by the growing need for high-efficiency power systems and advancements in simulation and digital twin technologies. Over the next 4–5 years, companies’ revenue mix will shift from traditional circuit-level tools to integrated AI-driven design and predictive analysis platforms. Two key trends shaping this transition include the adoption of cloud-based simulation for real-time system validation and the integration of machine learning algorithms for optimizing thermal performance and reliability, enabling faster development cycles and smarter power conversion designs across automotive, renewable energy, and industrial applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of renewable energy sources

-

Growing shift towards electric vehicles

Level

-

High initial cost of power electronics software

-

Complexity and threat of data leakage

Level

-

Growth of industrial automation and robotics

-

Global expansion of smart homes and buildings

Level

-

Issues with integration and compatibility

-

Lack of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of renewable energy sources

The rising adoption of renewable energy sources is a major factor driving the growth of the power electronics software market. Renewable energy systems, such as solar panels, wind turbines, and energy storage solutions, depend on power electronics for efficient energy conversion, control, and grid integration. Power electronics software plays a crucial role by enabling accurate modeling, real-time simulation, and optimization of components like power converters, inverters, and controllers, ensuring maximum energy efficiency and system reliability.

Restraint: High initial cost of power electronics software

The high upfront cost of power electronics software presents a significant challenge in the market. These software solutions are critical for simulating, designing, and optimizing power electronics systems, and their adoption often requires substantial initial investment. This includes the purchase of specialized software licenses, and the high-performance hardware needed to handle complex simulations and calculations. Additionally, the software is frequently tailored for specific industries, such as renewable energy, electric vehicles, and industrial automation, which further increases its cost.

Opportunity: Growth of industrial automation and robotics

The increasing growth of industrial automation and robotics is driving significant opportunities in the power electronics software market. Power electronics software plays a critical role in designing, simulating, and optimizing the performance of electronic systems used in automated machinery and robotic applications. These systems require precise control of power conversion, motor drives, and energy efficiency, making advanced software tools essential for their development and operation.

Challenge: Issues with integration and compatibility

The power electronics software market faces a major challenge in integration and compatibility as businesses work to incorporate new software solutions into their existing systems. Many power electronics systems must connect with a range of legacy systems, hardware, and communication protocols, leading to complexities during implementation. Integrating new software with existing infrastructure, such as industrial control or renewable energy systems, often requires extensive customization and troubleshooting for smooth functionality.

Power Electronics Software Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides MATLAB and Simulink platforms for modeling, simulation, and control design of power converters, inverters, and electric drive systems. | Accelerates design validation and testing | Reduces development time | Enables seamless integration with hardware-in-the-loop (HIL) systems. |

|

Offers advanced semiconductor design and verification software for power electronics, focusing on circuit-level analysis and reliability optimization. | Improves power device performance | Enhances thermal and electrical accuracy | Supports faster time-to-market for high-efficiency designs. |

|

Develops simulation and PCB design software enabling system-level modeling and co-simulation for power management ICs and converters. | Enables precise design optimization | Enhances system integration | Reduces prototype iterations and overall design costs. |

|

Provides design and test tools for power electronics, including SPICE-based circuit simulators and real-time validation solutions. | Improves design reliability | Provides real-world performance insights | Ensures high accuracy in power loss and efficiency modeling. |

|

Specializes in automated testing and HIL simulation platforms for validating power electronic components and control algorithms. | Increases testing efficiency | Enables rapid prototyping | Enhances product reliability and safety through real-time performance monitoring. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The power electronics software ecosystem comprises a collaborative network of software providers, distributors, system integrators, and end users working together to enhance the performance and reliability of power electronic systems. Software providers such as The MathWorks, Keysight Technologies, and Cadence Design Systems focus on developing advanced modeling, simulation, and circuit analysis platforms that optimize converter, inverter, and semiconductor designs. System integrators like ABB, Siemens, and Altair play a crucial role in implementing these solutions into industrial automation, electric mobility, and renewable energy systems by integrating simulation software with real-time control and testing platforms. Distributors such as Avnet, Arrow Electronics, and TD Synnex ensure global supply and accessibility of design and testing software. End users, including Tesla, SunPower, and Samsung, leverage these tools to enhance product efficiency, reduce development costs, and accelerate innovation in electric vehicles, solar power systems, and consumer electronics applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Power Electronics Software Market, By Type

Design software holds the largest market size in the power electronics software market as it is essential for creating, modeling, and optimizing complex power circuits, converters, and semiconductor devices. Its wide adoption across automotive, renewable energy, and industrial sectors enables precise system design, improved efficiency, reduced prototyping time, and faster product development cycles.

Power Electronics Software Market, By Technology

Model-based design holds the largest market size in the power electronics software market as it enables engineers to simulate, analyze, and validate system behavior early in the design cycle. This approach reduces development time, improves accuracy, and supports seamless integration of hardware and software, driving its adoption in automotive, renewable energy, and industrial applications.

Power Electronics Software Market, By Application

The industrial segment holds the largest market size in the power electronics software market due to widespread adoption of automation, robotics, and energy-efficient motor control systems. Industries rely heavily on simulation and design software to optimize power conversion, improve equipment reliability, and reduce energy losses, driving strong demand for advanced software solutions.

REGION

Asia Pacific is expected to be fastest-growing segment in the power electronics software market during the forecast period

Asia Pacific is expected to witness the highest CAGR in the power electronics software market due to rapid growth in electric vehicle production, renewable energy deployment, and industrial automation. Strong government support for digital manufacturing, expanding semiconductor industries, and increasing adoption of advanced simulation tools in China, Japan, and South Korea drive market acceleration.

Power Electronics Software Market: COMPANY EVALUATION MATRIX

In the power electronics software market matrix, The MathWorks, Inc. (Star) leads with a strong market presence and a comprehensive suite of simulation and modeling tools, including MATLAB and Simulink, enabling precise design, control, and optimization of power converters, inverters, and electric drive systems across automotive, industrial, and renewable energy sectors. Infineon Technologies AG (Emerging Leader) is gaining momentum through its integration of software-driven design and digital twin technologies to enhance semiconductor performance and system-level efficiency, positioning itself as a key innovator in intelligent, simulation-enabled power electronics development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.08 Billion |

| Market Forecast in 2030 (Value) | USD 5.25 Billion |

| Growth Rate | CAGR of 9.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Power Electronics Software Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Software Provider / OEM |

|

|

| System Integrator / Design & Engineering Firm |

|

|

| Government / Energy Agency |

|

|

| Industrial / Automotive End User |

|

|

RECENT DEVELOPMENTS

- November 2024 : The MathWorks, Inc. in collaboration with NXP Semiconductors, announced the launch of Model-Based Design Toolbox (MBDT) for Battery Management Systems (BMS).

- January 2024 : Cadence Design Systems launched a new portfolio of applications for its Palladium Z2 Enterprise Emulation System, enhancing its capabilities for system-on-chip (SoC) verification. The new apps include the industry’s first 4-State Emulation for simulations requiring X-propagation, Real Number Modeling for mixed-signal design acceleration, and Dynamic Power Analysis offering up to 5X faster power analysis of complex SoCs.

- January 2023 : Keysight introduced a new feature for power electronics design, including a Switched-Mode Power Supply (SMPS) Performance Test Bench and Power Electronics Model Builder (PEMB).

- July 2023 : Synopsys, Inc. has expanded its capabilities for modeling and simulating power systems with renewable energy sources, including solar, wind, and battery storage.

Table of Contents

Methodology

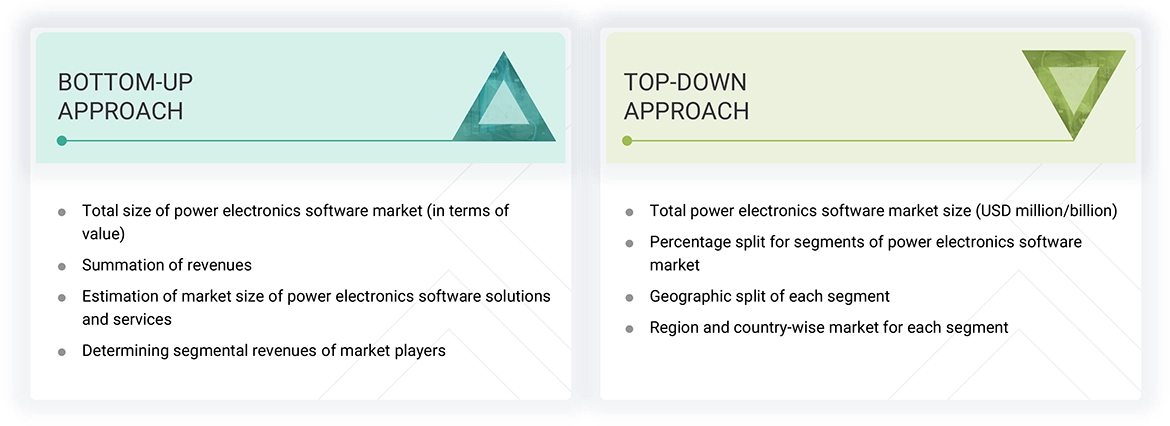

The research study involved 4 major activities in estimating the size of the power electronics software market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

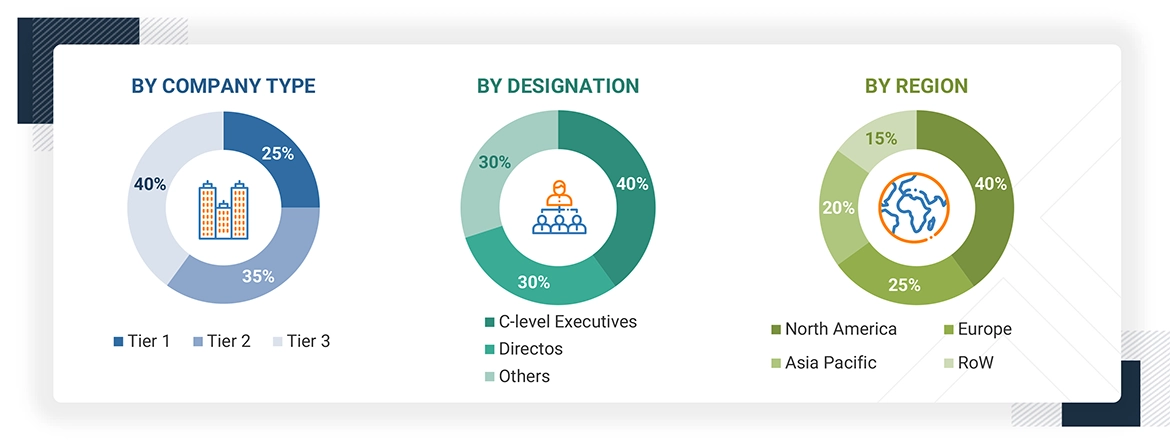

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the power electronics software market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the power electronics software market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the power electronics software market.

- Identifying various power electronics software solutions and services provided or expected to be offered by players in the value chain

- Tracking the major developers and providers of power electronics software and related services in different regions

- Estimating the market size for the power electronics software market in the respective countries of each region

- Tracking the ongoing and upcoming product launches and different inorganic strategies such as acquisitions, partnerships, and collaborations

- Forecasting the power electronics software market in each region based on trade data and GDP analysis

- Studying various paid and unpaid information sources such as annual reports, press releases, and white papers Conducting multiple discussions with key opinion leaders to understand the types of software and services deployed by power electronics software players and analyzing the break-up of the scope of work carried out by each major company

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CEOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the power electronics software market.

- Focusing, initially, on the top-line investments and spending in the ecosystems of various industries. Tracking further splits based on product launches, advancements in power electronics software technologies, power electronics software and solutions used for various industrial applications, and developments in the key market areas

- Representing and developing the information related to market revenue offered by key software, and service providers

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of software components and services pertaining to power electronics software

- Estimating the geographic split using secondary sources based on factors such as the number of players in a specific country and region, types of software, levels of services offered, and types of software implemented.

Power Electronics Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the power electronics software market.

Market Definition

Power electronics software is a combination of advanced tools and technologies designed to simulate, analyze, and optimize power electronic systems. These software solutions enhance the efficiency, reliability, and performance of power electronic devices and systems across various industries. Key functionalities of power electronics software include circuit simulation, thermal analysis, electromagnetic analysis, and control system design. Some prominent technologies and tools in this domain include SPICE-based simulation tools, finite element analysis (FEA) software, and model-based design platforms.

Power electronics software is primarily used in industries such as automotive, renewable energy, consumer electronics, industrial automation, aerospace, and telecommunications. Applications include designing and optimizing electric vehicle powertrains, managing energy conversion systems in renewable energy plants, improving power supplies in electronic devices, and ensuring efficient motor drives in industrial systems. These tools facilitate precise modeling and real-time performance analysis, enabling sustainable and energy-efficient operations.

Key Stakeholders

- Associations, organizations, forums, and alliances

- Software Developers

- Distributors and traders

- Suppliers

- Research organizations and consulting companies

- Semiconductor product designers and fabricators

- Software and service providers

- System integrators

- Technology investors

- Technology solution providers

Report Objectives

- To define, describe, segment, and forecast the power electronics software market size by type, technology, application, and region, in terms of value

- To describe and forecast the power electronics software market size in four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the power electronics software value chain and ecosystem, along with the average selling price by technology and region

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter's five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze the impact of AI/Gen AI on the power electronics software market

- To analyze the macroeconomic outlook for regions such as North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze strategies such as product launches, collaborations, acquisitions, and partnerships adopted by players in the power electronics software market

- To profile key power electronics software market players and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

The Impacts are as follows:

|

Optimization of Circuit Design and Simulation |

9 |

|

Predictive Maintenance and Fault Detection |

8 |

|

Energy Efficiency Optimization |

9 |

|

Automated Control and Real-time Decision Making |

8 |

|

AI-based Software Integration for Smart Grid Management |

7 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Power Electronics Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Power Electronics Software Market