Precision Cleaning Solutions Market

Precision Cleaning Solutions Market by Type (Aqueous Cleaning, Solvent-Based Cleaning, Vapor Degreasing, Ultrasonic Cleaning), Component (Metals, Plastics, Ceramics, Glass), End-use Industry (Electronics & Semiconductors, Healthcare, Aerospace & Defense, Automotive, Optics & Photonics, Industrial), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The precision cleaning solutions market is projected to reach USD 9,853.3 million by 2030 from USD 7,665.2 million in 2025, at a CAGR of 5.2% from 2025 to 2030. Globally, the demand for precision cleaning solutions is rising due to the rapid growth of semiconductor, aerospace, automotive, and medical device industries, which require contamination-free components for high performance and reliability. The increasing miniaturization of electronic parts and stricter cleanliness and environmental standards are driving adoption of advanced cleaning technologies.

KEY TAKEAWAYS

-

BY TYPEBy type includes aqueous cleaning, solvent based cleaning, vapor degreasing, ultrasonic cleaning and other types. Aqueous systems are gaining traction for their eco-friendly and cost-effective nature as industries move away from hazardous solvents. Solvent-based cleaning remains vital for tough contaminants but is shifting toward low-VOC, non-flammable formulations. Ultrasonic cleaning is expanding in semiconductor and medical manufacturing for its superior precision, while vapor degreasing using advanced HFE solvents is being re-adopted for its efficiency. Overall, the market is moving toward sustainable, automated, and high-efficiency cleaning technologies driven by regulation, miniaturization, and the need for contamination-free production.

-

BY COMPONENTSThe precision cleaning solutions market spans key components areas including metal, plastics, ceramics, glass and other components. Plastics require mild cleaning agents to avoid surface damage and will see rising use in medical and electronic assemblies, boosting demand for aqueous and solvent-free methods. Ceramics in aerospace and semiconductors need high-intensity ultrasonic or vapor-phase cleaning for fine particulate removal. Metals remain key in automotive and aerospace sectors, focusing on corrosion prevention with eco-friendly solvents. Glass, essential in optics and displays, demands residue-free cleaning for clarity. Going forward, precision cleaning will emphasize customized, automated, and sustainable systems aligned with miniaturization and stricter quality standards.

-

BY END-USE INDUSTRYThe precision cleaning solutions market serves diverse end-use industries including electronics & semiconductors, healthcare, aerospace & defense, automotive, optics & photonics, industrial and other end-use industries, each contributing to its sustained expansion. Over the next decade, these industries are projected to grow steadily, propelled by R&D investments, demand for sustainable chemistry, and the shift toward high-value specialty applications.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 7.4%, due to the rapid expansion of electronics, semiconductor, automotive, and medical device manufacturing in countries like China, Japan, South Korea, and India. The region’s strong industrial base, coupled with increasing investments in high-tech production and cleanroom facilities, is driving the adoption of advanced cleaning technologies.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Emerson Electric Co. (US), Dow (US), Crest Ultrasonics Corp. (US), 3M (US), Techspray (Georgia). These companies are advancing precision cleaning solutions and broadening end-use adoption, reflecting the growing demand for precision cleanings solutions in various end-use industries.

The precision cleaning solutions market is projected to reach USD 9,853.3 million by 2030 from USD 7,665.2 million in 2025, at a CAGR of 5.2% from 2025 to 2030. Precision cleaning solutions are advanced cleaning systems and chemistries designed to remove microscopic contaminants such as oils, particulates, residues, and films from critical components and surfaces. They are used in industries like electronics, aerospace, medical devices, and semiconductors where even trace impurities can affect performance or safety. These solutions combine mechanical, chemical, and ultrasonic methods to achieve ultra-clean, residue-free surfaces that meet stringent quality and regulatory standards.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The precision cleaning solutions market is witnessing significant trends and disruptions reshaping customer businesses across various industries. New formulations and innovative manufacturing techniques drive the development of products with improved efficiency. The increasing focus on sustainability and environmental regulations is prompting companies to adopt eco-friendly solutions, enhancing their operational efficiency and reducing their carbon footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Stringent industry regulations

-

•Rising adoption in automotive industry

Level

-

•High capital investment

-

•Rigorous cleaning validation requirements in critical industries

Level

-

•Emergence of hybrid systems combining aqueous & solvent cleaning

-

•Rising demand from Asia Pacific region

Level

-

•Meeting diverse and evolving cleanliness standards across industries and regions

-

•Navigating trade-off between cleaning efficiency and environmental sustainability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent industrial regulations to drive demand for precision cleaning solutions

Stringent regulatory requirements in industries are the major force behind the precision cleaning solutions market in that they set very high standards of cleanliness and environmental practices that force companies to develop superior cleaning technologies and chemistry to meet the demands. Aerospace & defence, healthcare, electronics & semiconductors, automotive, optics & photonics, industrial, and other end-use industries take assurance that components are up to strict safety, performance, and environmental standards and precision cleaning must be utilized to extract contaminants without damage to the components. For instance, the U.S. Environmental Protection Agency's (EPA) Significant New Alternatives Policy (SNAP) bans toxic solvents like trichloroethylene (TCE) and n-propyl bromide (nPB), pushing companies towards low-toxicity, non-ozone-depleting alternatives like 3M Novec or Techspray PWR-4. Similarly, the European Union's REACH regulation restricts harmful substances, pushing purchasing preferences towards aqueous and PFAS-free cleaning systems. The FDA's Current Good Manufacturing Practices (cGMP) for medical devices mandate residue-free cleaning to secure patient safety, further driving ultrasonic and solvent-based solutions. Regulations drive higher R&D spend on sustainable, high-performance cleaning systems, enhancing market growth. By mandating compliance, regulations not only advance cleanliness standards but also drive innovation, making precision cleaning a vital enabler of regulatory compliance and operational excellence

Restraint: High capital investment required for precision cleaning solutions

Heavy capital investment is one of the significant restraints in the precision cleaning solutions industry, particularly for small and medium-sized enterprises (SMEs). New cleaning systems for example, ultrasonic, vapor degreasing, hybrid, or automated multi-stage systems—require heavy initial investment in equipment acquisition, installation, and integration into existing manufacturing lines. There are also recurring operating costs, such as specialized cleaning solutions, maintenance, training, and regulatory compliance. These expenses can be especially burdensome in price-conscious sectors or economies with limited availability of funding. While large manufacturers in aerospace, medical, and semiconductor industries will likely bear these costs because of rigorous cleanliness standards, SMEs use manual or semi-automated processes that sacrifice consistency and repeatability. Besides, the lack of visibility of short-term ROI discourages investment, especially when the benefits—such as defect reduction, product durability, and compliance with regulations—are not quantifiable. This financial barrier not only discourages technology uptake but also limits market penetration in emerging economies. Therefore, high capital intensity discourages broader adoption, especially by cost-conscious industries and small-scale manufacturers, thus limiting the growth prospects of the global precision cleaning solutions market.

Opportunity: Emergence of hybrid system combining aqueous and solvent cleaning

The development of hybrid systems that combine aqueous and solvent cleaning in precision cleaning solutions presents a significant opportunity for the precision cleaning solutions market through flexible, high-performance cleaning, appropriate for diverse industry requirements while meeting stringent environmental and regulatory demands. These green hybrid solutions, which bring the environmentally safe, biodegradable benefits of aqueous cleaning and the aggressive solvency of solvent-based methods together, facilitate efficient removal of intricate contaminants like oils, fluxes, and particulates from intricate components in aerospace & defense, healthcare, electronics & semiconductors, industrial, optics & photonics and automotive industries. For example, products such as Crest Ultrasonics' or UCM AG's UCMCombiLine employ ultrasonic aqueous cleaning followed by solvent rinsing to provide residue-free outputs on metals, plastics, and ceramics, improving efficiency and regulatory acceptability such as the U.S. EPA's Significant New Alternatives Policy (SNAP), which limits toxic solvents, and the EU's REACH, encouraging safer chemistries. Such flexibility attracts producers seeking flexible solutions for various applications, driving market expansion. By reducing reliance on stand-alone solutions and enabling adaptation, hybrid systems encourage innovation, expand market opportunities, and enable companies to capitalize on rising demand for sustainable, high-purity cleaning in hi-tech industries.

Challenge: Meeting diverse & evolving cleanliness standards across industries and geographies

Achieving diverse and evolving levels of cleanliness across geographies and industries is a central challenge to the precision cleaning solutions business. Different industries—such as aerospace (e.g., AMS 2700), medical devices (e.g., ISO 19227, ISO 13485), and semiconductors (e.g., ISO 14644, IEST standards)—have very precise and stringent levels of contamination, which vary not only by use but also by geography. As global supply chains grow, manufacturers must contend with a multifaceted world of regulatory compliance and industry certifications to fulfill customer demands and regulatory needs. This complexity further loads the burden on equipment manufacturers and chemical formulators to create flexible, multi-compliant systems and chemistries. Moreover, the constant upgrading of specifications owing to technological developments and stringent environmental regulations (e.g., REACH, RoHS, and GHS) requires continuous product innovation and validation. From solution providers' perspective, this means longer development times, more R&D cost, and the need for sophisticated application engineering. From end-users' perspective, it brings about risk and uncertainty of operation, particularly in export businesses. The failure to standardize on a global level also inhibits scalability as well as lags new cleaning technology adoption. Altogether, this regulatory fragmentation adds complexity, cost, and risk—greatly inhibiting growth and operational efficiency in the precision cleaning solutions industry.

Precision Cleaning Solutions Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers precision cleaning automation systems integrated with ultrasonic and vapor degreasing technologies, enabling consistent contaminant removal and improved operational efficiency in electronics and medical manufacturing. | Enhances process reliability, reduces cleaning time, and minimizes solvent waste through intelligent process control. |

|

Provides advanced cleaning chemistries, including solvent blends and surfactants, tailored for high-precision electronics and aerospace components. | Ensures residue-free cleaning while meeting stringent environmental and safety regulations, improving product longevity and performance. |

|

Specializes in ultrasonic cleaning equipment designed for precision applications such as optics, semiconductors, and aerospace components. | Offers deep, uniform cleaning of complex geometries and micro-contaminants, improving part quality and reducing rework. |

|

Supplies precision cleaning fluids and engineered materials that replace traditional solvents like HFCs or HCFCs in high-tech manufacturing. | Delivers high cleaning efficiency with low toxicity and global warming potential, supporting sustainable and regulatory-compliant operations. |

|

Manufactures precision cleaners and degreasers formulated for electronics, avionics, and medical device maintenance. | Provides fast-drying, non-corrosive cleaning that prevents component damage, extending equipment lifespan and reliability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of precision cleaning solutions encompasses a diverse network of chemical suppliers, equipment manufacturers, distributors, end-users, and regulatory bodies, all interlinked to ensure efficient, high-quality cleaning processes. Chemical suppliers provide specialized cleaning agents, including aqueous, solvent-based, and environmentally friendly formulations, while equipment manufacturers design ultrasonic, vapor degreasing, spray, and automated cleaning systems tailored to industry-specific requirements. Distributors and service providers facilitate supply chain management, maintenance, and technical support, ensuring consistent performance and uptime for end-users in electronics, aerospace, medical devices, and automotive sectors. Regulatory bodies such as the EPA, FDA, and RoHS influence formulation standards, environmental compliance, and safety protocols, driving innovation toward low-VOC, non-flammable, and biodegradable solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Precision Cleaning Solutions Market, By Type

Precision cleaning solutions market by type will be led by ultrasonic cleaning due to its special ability to offer very effective, non-destructive, and reproducible cleaning performance for a wide range of industrial processes. The technology employs high-frequency ultrasonic sound waves to produce microscopic cavitation bubbles in an aqueous or solvent-based cleaner fluid that penetrate small geometries, blind holes, and sensitive crevices inaccessible to conventional mechanical or spray-based processes. With industries like healthcare, aerospace & defense, electronics & semiconductors, optics & photonics, automotive, industrial and others requiring progressively higher cleanliness, ultrasonic cleaning is the precision, repeatability, and safety required to maintain international standards. The market is also trending towards water-based, eco-friendly chemistries, and ultrasonic systems are also extremely compatible with such solutions, thus increasing their attractiveness in the face of tightening regulations.

Precision Cleaning Solutions Market, By Components

Metal components will dominate precision cleaning products market by segment due to its widespread application in high-precision industries such as aerospace & defense, automotive, healthcare, electronics & semiconductors, and heavy machinery. These applications rely on metal components—such as stainless-steel medical devices, titanium aerospace components, and aluminum enclosure of electronic devices—where super-clean surfaces are required to operate properly, withstand long lifetimes, and comply with stringent industry standards such as AMS 2700 and ISO 19227. Metal parts typically have complex geometries and close tolerances, which require the use of sophisticated cleaning technologies such as ultrasonics, vapor degreasing, and aqueous systems to remove contaminants such as oils, oxides, particulate, and residues completely.

Precision Cleaning Solutions Market, By End-Use Industries

The electronics & semiconductors industry is expected to dominate the precision cleaning solutions market by end use due to its complete reliance on ultra-clean components and environments. As devices are miniaturizing further and integrated circuits are becoming denser and more complex, even micro-contaminants such as ionic residues, sub-micron particles, or organic films can adversely affect functionality, reduce yield, or trigger long-term reliability failures. Precision cleaning is also needed at other points in semiconductor production—from wafer production and photolithography to packaging and end assembly—where surfaces need to be free from contaminants to affect conductivity or adhesion.

REGION

Asia Pacific to be fastest-growing region in global grignard reagents market during forecast period

The precision cleaning solutions in Asia Pacific is expected to register the highest CAGR during the forecast period, due to the rapid growth of electronics, semiconductor, automotive, and medical device manufacturing, which require ultra-clean, contamination-free components. The region’s strong industrial base, increasing investments in high-tech production, and rising adoption of automated and eco-friendly cleaning systems drive market expansion. Coupled with stringent quality standards, regulatory compliance, and cost-effective manufacturing advantages, these factors contribute to Asia Pacific exhibiting the highest CAGR in the global precision cleaning solutions market.

Precision Cleaning Solutions Market: COMPANY EVALUATION MATRIX

In the precision cleaning solutions market matrix, Emerson Electric Co. (Star), a American company, leads the market through its manufacturing and distribution of precision cleaning solutions. The company's strong expertise in automation, process control, and integrated cleaning systems. The company offers advanced ultrasonic, spray, and vapor degreasing solutions that ensure consistent, high-quality cleaning for critical industries such as electronics, aerospace, and medical devices. Emerson’s focus on innovative, automated, and environmentally compliant technologies allows manufacturers to improve efficiency, reduce solvent use, and maintain strict contamination standards.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7,315.0 Million |

| Market Forecast in 2030 (value) | USD 9,853.3 Million |

| Growth Rate | CAGR of 5.2% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | • By Type: Aqueous Cleaning, Solvent Based Cleaning, Vapor Degreasing, Ultrasonic Cleaning and Other Types • By Components: Metal, Plastics, Ceramics, Glass and Other Components • By End-Use Industry: Electronics & Semiconductors, Healthcare, Aerospace & Defense, Automotive, Optics & Photonics, Industrial and Other End-Use Industries |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Precision Cleaning Solutions Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Precision Cleaning Solution Manufacturers | • Detailed company profiles of precision cleaning solutions competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Assessment of collection, and government policy ecosystem related to precision cleaning solutions | • Identified & profiled 20+ precision cleaning solutions companies • Track adoption trends in high-growth APAC industries • Highlight new customer clusters driven by sustainability mandates |

| Benchmarking of precision cleaning solutions Types (aqueous, solvent-based chemicals, ultrasonic cleaning, vapor degreasing) | • Comparative analysis of precision cleaning solutions providers, process efficiency, cost structure, and scalability | • Supported clients in selecting the most cost-effective precision cleaning solutions |

| US Based precision cleaning solutions raw material supplier | Tailored cleaning chemistries and formulations for specific industries, materials, and contaminant types, along with adaptable delivery formats and concentrations. | Technical support, on-site testing, regulatory compliance guidance, and eco-friendly, low-VOC solutions that enhance performance, reduce waste, and ensure customer satisfaction. |

| Application based precision cleaning solution products | Application-specific cleaning solutions designed for electronics, medical devices, aerospace, or automotive components, optimized for material compatibility and contaminant removal. | Enhanced process efficiency, residue-free cleaning, integration with automated systems, and compliance with industry standards, improving product reliability and reducing operational costs. |

RECENT DEVELOPMENTS

- January 2024 : Emerson Electric Co. introduced the Branson Series GMX-Micro ultrasonic metal welders, a series of high-precision machines designed to address the changing needs of electric vehicle (EV) batteries, conductors, and electronics applications.

- August 2023 : Emerson Electric Co. acquired FLEXIM GmbH, a Berlin-based global leader in clamp-on ultrasonic flow measurement technology for liquids, gases, and steam.

- September 2023 : Dow had launched DOWSIL CC-8000, a biodegradable cleaning solution designed to remove uncured silicone residues from manufacturing equipment and surfaces in industries such as automotive, aerospace, and electronics.

Table of Contents

Methodology

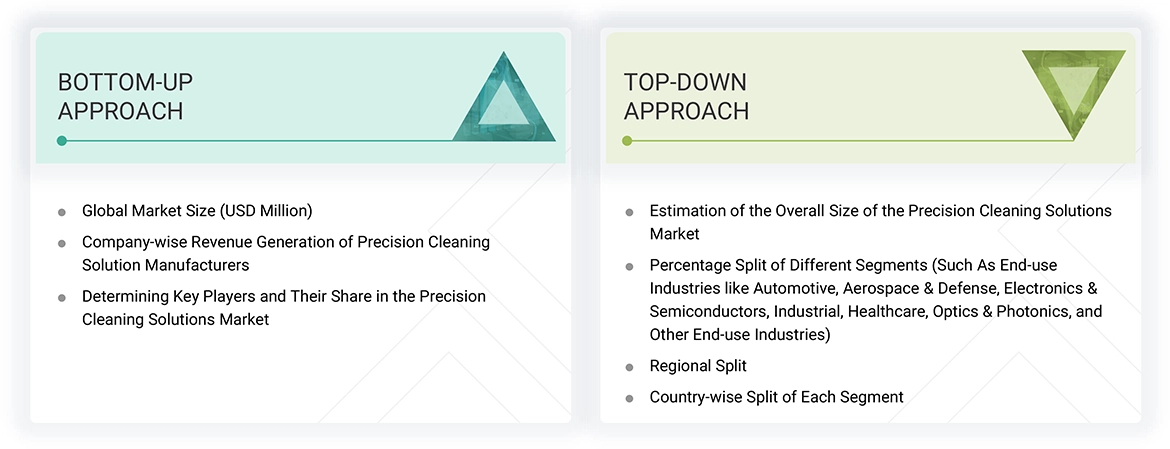

The study involves two major activities in estimating the current market size for the precision cleaning solutions market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering precision cleaning solutions and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the precision cleaning solutions market, which was validated by primary respondents.

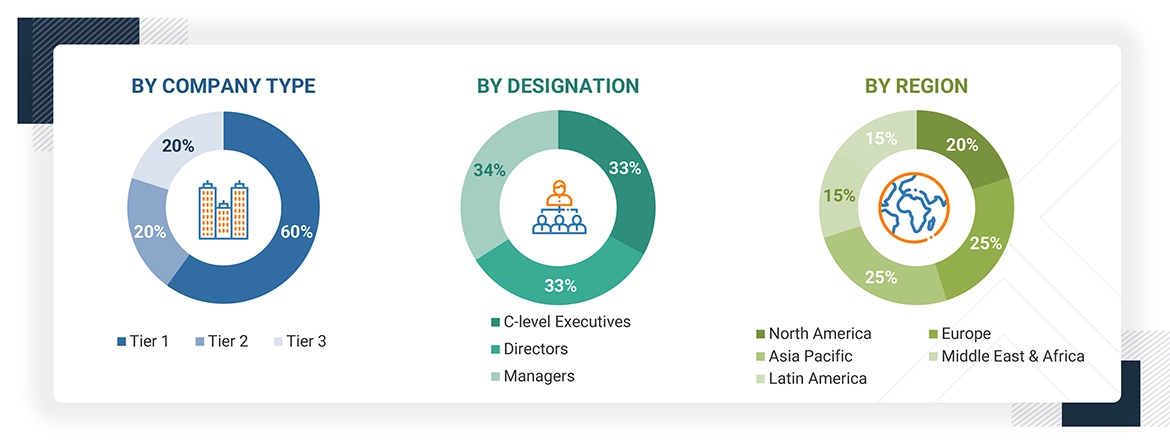

Primary Research

Extensive primary research was conducted after obtaining information regarding the precision cleaning solutions market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from the precision cleaning solutions industry, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, component, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking precision cleaning solutions, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of precision cleaning solutions and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the precision cleaning solutions market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for precision cleaning solutions in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the precision cleaning solutions industry for each application. For each end-use, all possible segments of the precision cleaning solutions market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Precision cleaning solutions refer to specialized cleaning processes, equipment, and chemistries designed to remove microscopic contaminants such as particles, oils, residues, and films from critical components with extremely high levels of cleanliness and accuracy. These solutions are essential in industries where even trace amounts of contamination can compromise product performance, safety, or regulatory compliance, such as electronics & semiconductors, healthcare, aerospace & defense, optics & photonics, and automotive. Precision cleaning encompasses a variety of technologies, including aqueous cleaning, solvent-based cleaning, ultrasonic cleaning, vapor degreasing, and hybrid systems, often integrated with multi-stage rinsing and drying systems for complete decontamination. The objective is to achieve consistent, residue-free surfaces while preserving the integrity of delicate or complex components.

Stakeholders

- Precision Cleaning Solution Manufacturers

- Precision Cleaning Solution Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the precision cleaning solutions market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global precision cleaning solutions market by type, component, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Cleaning Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precision Cleaning Solutions Market