Probe Pin Market

Probe Pin Market by Pogo Type, Stamping Type, Spring Contact, Non-Spring Contact, Semiconductor Testing (Wafer-level Testing, and Package-level Testing), Frequency Range (<1 GHz, 1-10 GHz, 10-40 GHz, >40 GHz) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The probe pin market is projected to reach USD 1.08 billion by 2032, up from USD 0.68 billion in 2025, growing at a CAGR of 6.9% from 2025 to 2032. Market growth is driven by increasing semiconductor testing volumes, advanced node scaling, rising adoption of high-frequency and fine-pitch probes, and expanding OSAT and wafer-level testing capacity. Additional momentum comes from AI, HPC, 5G, and automotive electronics, which demand higher test coverage, improved signal integrity, and durable probe technologies across wafer, package, and PCB testing environments.

KEY TAKEAWAYS

- The Asia Pacific probe pin market dominated with a market share of 73.0% in 2024.

- By contact type, the spring contact segment is expected to dominate the probe pin market.

- By manufacturing method, the pogo-type segment is projected to register the highest growth during the forecast period.

- By application, the semiconductor testing segment is expected to register a CAGR of 6.5%.

- FEINMETALL, INGUN, and CCP Contact Probes Co., Ltd., among others, were identified as Star players in the probe pin market, as they have focused on continuous innovation, strong global distribution networks, and robust operational and financial performance.

- Da-Chung Contact Probes Enterprise Co., Ltd., Shenzhen Rongtenghui Technology Co., Ltd., and CFE Corporation Co., Ltd. have distinguished themselves among startups and SMEs due to their expanding product portfolios, cost-effective manufacturing capabilities, and increasing presence in high-growth applications.

The probe pin market is witnessing steady growth, driven by rising semiconductor testing demand, increasing IC complexity, and the expansion of wafer-level and high-density PCB testing. Growing adoption of fine-pitch, high-frequency, and high-current probe technologies is enhancing test accuracy, signal integrity, and production efficiency. Advancements in probe materials, micro-spring designs, and automation in ATE environments are further reshaping the market landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The probe pin market is undergoing a clear transformation, shifting from traditional revenue sources such as standard spring probes and legacy node test interfaces toward advanced, high-performance solutions. This shift is driven by the rapid adoption of fine-pitch technologies, high-current power device testing, and the growing need for RF and high-frequency probing. Emerging requirements in advanced packaging, including wafer-level chip-scale packaging (WLCSP), fan out, 2.5D, and 3D IC structures, are further accelerating demand for MEMS-based and hybrid probe designs. These hotspots reshape customer priorities, prompting clients to enhance probe durability, reduce contact resistance, and support faster and more accurate testing. Downstream customers, including foundries and OSATs, increasingly seek lower test costs, higher yield, and improved reliability across evolving semiconductor applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for advanced packaging and wafer-level chip-scale packaging

-

Rising SiC & GaN power semiconductor testing

Level

-

Ultra-fine pitch manufacturing limitations

-

High cost of advanced materials

Level

-

Rapid expansion of automotive electronics and electric vehicle power devices

-

Growth in mems, sensor & IoT testing

Level

-

Low-Cost competition from asian suppliers

-

High customization needs & lack of standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need for advanced packaging and wafer-level chip-scale packaging

The probe pin market is strongly driven by the rapid transition toward advanced semiconductor packaging, including 2.5D/3D stacking, fan-out wafer-level packaging, and chip-scale devices requiring extremely precise electrical testing. As device geometries shrink and I/O densities increase, manufacturers rely on high-performance probe pins to ensure reliable contact, low resistance, and accurate signal measurement. The accelerating adoption of AI, HPC, automotive, and 5G chips further amplifies demand for fine-pitch, high-frequency, and high-current testing capabilities.

Restraint: Ultra-fine pitch manufacturing limitations

Ultra-fine pitch manufacturing remains a major restraint, as producing probe pins capable of consistent performance below 20–30 µm pitch is technically challenging. Precision machining, material stability, spring force control, and plating uniformity become increasingly difficult at such miniature scales. These limitations can lead to reduced durability, higher contact resistance, and lower yield during high-volume testing. As semiconductor nodes continue shrinking, the gap between testing requirements and achievable probe pin robustness remains a key bottleneck.

Opportunity: Rapid expansion of automotive electronics and electric vehicle power devices

The expansion of automotive electronics and electric vehicle power devices presents a major opportunity for the probe pin industry. EVs require extensive testing for power management ICs, ADAS processors, SiC-based power modules, and safety-critical control units. High-current, high-temperature, and vibration-resistant probes are increasingly demanded by both semiconductor manufacturers and automotive OEMs. As EV adoption accelerates globally, the need for reliable, durable, and mission-critical test probes will continue rising, creating long-term recurring opportunities for manufacturers specializing in advanced test interfaces.

Challenge: Low-Cost competition from asian suppliers

A key challenge for established probe pin manufacturers is intensifying price competition from low-cost Asian suppliers. These companies benefit from lower manufacturing expenses, aggressive pricing strategies, and rapid scalability. While cost-effective products attract high-volume PCB and consumer electronics test users, they often pressure premium suppliers to reduce margins or justify higher pricing through superior performance. Maintaining differentiation through innovation, durability, fine-pitch capability, and reliability becomes increasingly important for global players competing against emerging lower-cost entrants.

probe-pin-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses high-performance spring probes and high-frequency test pins in wafer-level and package-level testing for advanced processors, AI accelerators, and high-speed I/O validation. | Ensures signal integrity, improves test accuracy at high speeds, and reduces retest rates for complex ICs. |

|

Deploys fine-pitch probe pins in wafer probing for 5 nm/3 nm nodes, enabling reliable contact on ultra-small pads during foundry production testing. | Enhances yield monitoring, minimizes probe mark damage, and supports stable high-volume semiconductor manufacturing. |

|

Utilizes micro-spring probes in memory (DRAM/NAND) and logic IC testing to handle high temperatures, high currents, and dense test patterns. | Improves throughput, boosts test stability, and optimizes performance validation for advanced memory devices. |

|

Applies RF-optimized and high-current probe pins for mobile SoC, 5G modem, and mmWave chipset testing across development and production stages. | Enables accurate RF measurements, speeds up test cycles, and supports rapid time-to-market for wireless chipsets. |

|

Integrates durable pogo pins and automotive-grade test probes in ATE systems for power management ICs, analog devices, and automotive semiconductors. | Enhances reliability under varying load conditions, reduces maintenance, and supports stringent automotive quality standards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The probe pin market ecosystem consists of raw material providers (Materion, Heraeus, JX Nippon Mining & Metals, Mitsubishi Materials, Umicore), probe pin manufacturers (FEINMETALL, INGUN, CCP Contact Probes, Seiken, LEENO, Smiths Interconnect), system integrators (Cohu, Advantest, Teradyne, FormFactor, Micronics Japan, JEM), and end users (TSMC, Intel, Samsung Electronics, Qualcomm, Texas Instruments, Micron). Raw material suppliers enable high-conductivity and durable pin construction, while manufacturers deliver fine-pitch and high-frequency probe technologies. Integrators embed these pins into advanced test interfaces, and end users drive demand through increasing wafer, package, and PCB testing volumes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Probe Pin Market, By Contact Type

As of 2024, spring contact pins held the largest share of the probe pin market and are expected to maintain their dominance through 2025. Their widespread use across semiconductor wafer probes, package-level testing, and PCB test fixtures is driven by their durability, stable contact performance, and ability to support high-cycle testing. Continued advancements in fine-pitch spring technologies and the growing testing needs of advanced IC packages reinforce the strong demand for spring contact probe pins.

Probe Pin Market, By Manufacturing Method

As of 2024, the pogo-type manufacturing method accounted for the largest share of the probe pin market and is projected to retain its lead through 2025. Pogo pins remain the preferred choice for high-reliability, repeatable electrical contact in semiconductor, electronics, and automotive device testing. Their versatility, long cycle life, and compatibility with automated test equipment (ATE) contribute to sustained adoption. The expansion of applications in high-frequency and high-current testing continues to strengthen the dominance of pogo-type connectors.

Probe Pin Market, By Application

As of 2024, semiconductor testing represented the largest application segment in the probe pin market and is expected to continue leading through 2025. The rising complexity of integrated circuits, growth of advanced packaging, and expansion of wafer-level testing directly increase demand for high-precision probe pins. The shift toward AI, HPC, automotive, and 5G chip testing further drives this segment, positioning semiconductor testing as the core application area for probe pins globally.

Probe Pin Market, By End User Industry

As of 2024, the consumer electronics industry held the largest share of the probe pin market and is anticipated to maintain its lead through 2025. The sector’s high production volumes, rapid product refresh cycles, and dependence on dense PCB architectures significantly increase testing requirements. Smartphones, wearables, IoT devices, and home electronics all require extensive PCB and component-level testing, driving strong consumption of probe pins in this industry. Continuous innovation in compact, high-performance devices reinforces this leadership.

REGION

Asia Pacific to be fastest-growing region in global probe pin market during forecast period

The Asia Pacific probe pin market is expected to register the highest growth during the forecast period, driven by the region’s strong semiconductor fabrication base, rapid expansion of electronics manufacturing, and increasing adoption of advanced testing technologies. Countries such as China, Taiwan, South Korea, Japan, and Singapore are major contributors, supported by investments in wafer-level testing, OSAT capacity expansion, and high-density PCB production. Rising demand for AI, 5G, automotive electronics, and consumer devices further accelerates the need for fine-pitch, high-frequency, and high-reliability probe pins across the region.

probe-pin-market: COMPANY EVALUATION MATRIX

In the probe pin market matrix, FEINMETALL (Star) leads with a strong market share and a comprehensive portfolio of spring-loaded probes, fine-pitch contact pins, and high-frequency testing solutions. Its strong global presence, precision engineering capabilities, and continuous advancements in micro-spring technology position it as a dominant force in semiconductor and electronics testing. Smiths Interconnect (Pervasive) is steadily expanding its influence with high-reliability probe technologies, robust material science expertise, and broad integration across semiconductor, aerospace, and defense applications. Its growing adoption in high-performance test environments signals strong potential to move toward the leaders quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- FEINMETALL (Germany)

- INGUN (Germany)

- CCP Contact Probes Co., Ltd. (Taiwan)

- Seiken Co., Ltd. (Japan)

- LEENO INDUSTRIAL INC. (South Korea)

- Incavo Otax Inc. (Japan)

- ISC Co., Ltd. (Japan)

- Smiths Interconnect (UK)

- Everette Charles Technologies – Cohu Subsidiary (US)

- PTR HARTMANN GmbH (Germany)

- KITA Manufacturing Co., Ltd. (Japan)

- Harwin (UK)

- QA Technologies Company (US)

- Shanghai Jianyang Electronics Technology Co., Ltd. (China)

- Suzhou Shengyifurui Electronic Technology Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.63 Billion |

| Market Forecast in 2032 (Value) | USD 1.08 Billion |

| Growth Rate | CAGR of 6.9% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: probe-pin-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor Manufacturer |

|

|

| OSAT (Outsourced Semiconductor Assembly & Test) |

|

|

| ATE & Test Interface Provider |

|

|

| Electronics & Consumer Device OEM |

|

|

| Automotive & EV Supplier |

|

|

RECENT DEVELOPMENTS

- Septmber 2023 : The company launched a new high-frequency pogo pin featuring a compressible shielding structure to reduce interference during mating, enabling improved signal integrity and enhanced performance for advanced high-frequency testing applications.

Table of Contents

Methodology

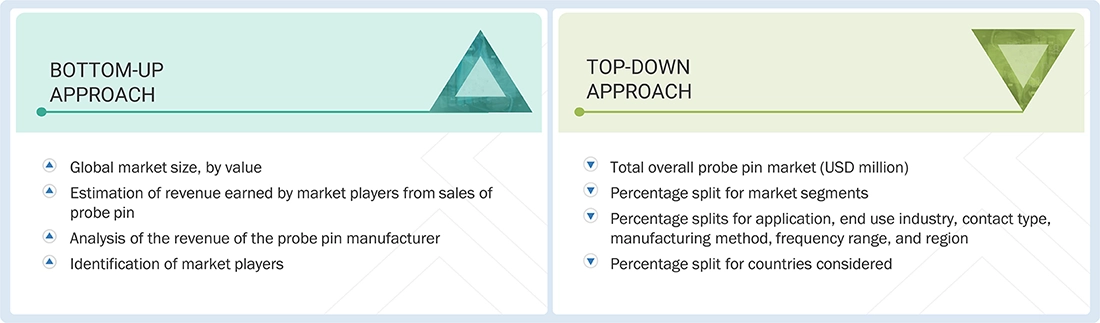

The study involved major activities in estimating the current market size for the probe pin market. Exhaustive secondary research was done to collect information on the probe pin industry. The next step was to validate these findings and assumptions through primary research with industry experts across the supply chain. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. Following this, the market breakup and data triangulation procedures were used to determine the market size of the segments and subsegments within the probe pin market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources, such as company reports, white papers, journals, and industry publications. This process helps understand the supply and value chains, identify key players, analyze market segmentation and regional trends, and track major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

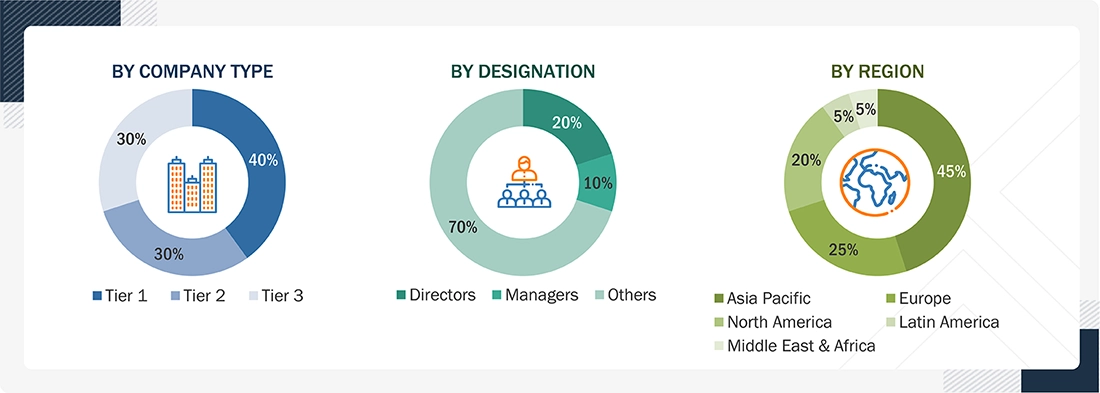

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the probe pin market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across five major regions: North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa. This primary data was collected through questionnaires, emails, and telephonic interviews.

Other designations include product managers, sales managers, and marketing managers.

Tier 1 companies include market players with revenues exceeding USD 500 million; Tier 2 companies earn revenues between USD 100 million and USD 500 million; and Tier 3 companies earn up to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A bottom-up procedure was employed to determine the overall size of the probe pin market.

- Identifying stakeholders in the probe pin market that influence the entire market, along with participants across the value chain

- Analyzing major manufacturers of probe pins as well as studying their product portfolios

- Analyzing trends related to the adoption of probe pin based on contact type

- Tracking the recent developments in the market that include investments, R&D activities, product launches, collaborations, acquisitions, expansions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of the probe pin market

- Segmenting the overall market into various other market sub-segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

The top-down approach was used to estimate and validate the total size of the probe pin market.

- Identifying top-line investments in the ecosystem, along with segment-level splits and significant developments

- Obtaining information related to the market revenue generated by the key players of the probe pin market

- Conducting multiple discussions with key opinion leaders from major companies that manufacture probe pins

- Estimating geographic splits using secondary sources based on the number of players in a specific region, the types of probe pins provided, and various supply chain participants related to the market

Probe Pin Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market has been segmented into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and determine the exact statistics for each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the probe pin market.

Market Definition

A probe pin is a precision-engineered conductive needle used within semiconductor test equipment to establish temporary electrical contact with a device under test (DUT) during wafer- or package-level testing. In professional terms, probe pins enable accurate signal transmission between the tester and the semiconductor device, allowing manufacturers to validate performance, detect defects, and ensure product reliability before downstream processing or shipment. They are typically designed for high durability, fine pitch compatibility, and stable electrical characteristics to support advanced nodes and increasingly complex IC architectures.

Key Stakeholders

- Raw material providers

- Probe pin manufacturers

- Probe card & test interface manufacturers

- Materials & alloy suppliers

- Semiconductor test equipment companies

- Foundries

- OSATs

- Distributors & supply chain intermediaries

- Research, standards & regulatory bodies

Report Objectives

- To define, describe, and forecast the size of the probe pin market, by application, end user industry, contact type, manufacturing method, frequency range, and region in terms of value

- To describe and forecast the size of the probe pin market, by contact type, in terms of volume

-

To forecast the market for various segments with respect to the main regions, namely,

Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa in terms of value - To provide global macroeconomic outlooks

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, value chain, unmet needs and white spaces, interconnected market and cross-sector opportunities, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders and buying criteria, case study analysis, trade analysis, patent analysis, Porter’s five forces, key conferences and events, AI impact, impact of 2025 US tariff, and regulations related to the probe pin market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation, and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive strategies, such as equipment launches, expansions, agreements, collaborations, and acquisitions, undertaken by market players

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Probe Pin Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Probe Pin Market