This study undertook an extensive process to determine the current dimensions of the protective relay market, beginning with an in-depth secondary research phase focused on gathering data from the market, related markets, and the overall industry context. This initial data collection was followed by a thorough validation using primary research, which included discussions with industry experts across the value chain. Market size evaluations were then conducted for each country through a tailored analysis, leading to a detailed breakdown of the market. Data from these analyses were cross-checked to estimate the sizes of different segments and sub-segments. By integrating both secondary and primary research methods, the study ensures that the findings are both accurate and reliable.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, the Statista Industry Journal, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the protective relay market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the protective relay market.

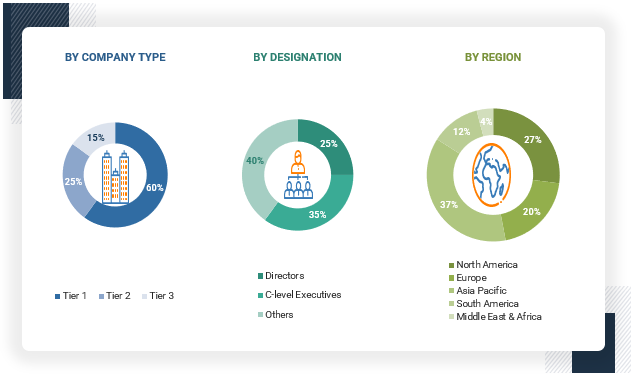

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents.

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the protective relay market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Protective Relay Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

A protective relay is a power system component that senses abnormalities or faults in the power system and initiates the control circuit operation. Major power system components such as transmission lines, feeders, busbars, transformers, motors, generators, and capacitor banks are capital-intensive assets that need to be protected in case of faults. Protective relays serve this purpose by continuously monitoring system health and by initiating switchgear operation to disconnect the faulty sections of the power network.

The market for protective relays is defined as the sum of revenues global companies generate from selling their protective relays. These devices are used by various end-users such as utilities, industries, railway & metro, and others. The regions considered for the protective relay market study include North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Stakeholders

-

Consulting companies in energy & power sector

-

State and national regulatory authorities

-

Organizations, forums, alliances, and associations

-

Investors/Shareholders

-

Manufacturers’ associations

-

Protective Relay raw material and component manufacturers

-

Protective Relay manufacturers, dealers, and suppliers

-

Electrical equipment manufacturers’ associations and groups

-

Power utilities and other end-user companies

-

Consulting companies in the energy and power domain

-

EV protective relay manufacturers

Report Objectives

-

To define, describe, and forecast the global protective relay market based on voltage, technology, end-user, application, and region

-

To provide detailed information regarding the major factors influencing the growth of the protective relay market (drivers, restraints, opportunities, and industry-specific challenges)

-

To strategically analyze the protective relay market concerning individual growth trends, future prospects, and contributions of each segment to the market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To benchmark players within the market using the proprietary Vendor DIVE framework, which analyzes the market players on various parameters within the broad categories of business and product strategies

-

To track and analyze competitive developments such as expansions, new product launches, partnerships & collaborations, and mergers & acquisitions in the protective relay market

-

To forecast the protective relay market, by region, in terms of volume.

-

To project the market sizes for each of the major regions—North America, Europe, Asia Pacific, Middle East & Africa, and South America,—at the individual national levels

-

To sketch a competitive environment for market participants and assess the potential for stakeholders in the protective relay business

-

To compare key market players for the market share, product specifications, and applications

-

To strategically profile key players and comprehensively analyze their market ranking and core competencies

-

To track and analyze competitive developments in the protective relay market, such as sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions

-

To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Protective Relay Market