PTFE Tapes and Films Market

PTFE Tapes and Films Market by Technology (Skived, Cast, Extruded, Expanded PTFE Films & Tapes), Application (Medical & Pharmaceuticals, Chemical Processing, Automotive, Aviation & Aerospace, Electrical & Electronics, Building & Construction, Others), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The PTFE tapes and films market is predicted to reach USD 1.21 billion by 2030 from USD 0.93 billion in 2025, registering a CAGR of 5.5% during the forecast period. The growth of the PTFE tapes and films market is driven by the continuous demand for materials with outstanding thermal resistance, chemical inertness, and low friction in several industries. Renewable energy, electric vehicles, and new energy sources have heightened demand in a range of sectors, including aerospace, automotive, chemicals, construction, and electrical and electronics.

KEY TAKEAWAYS

-

BY TECHNOLOGYBy technology, the PTFE tapes and films market is segmented into skived PTFE films & tapes (non-adhesive, adhesive-backed), cast PTFE films & tapes (non-adhesive, adhesive-backed), extruded PTFE films & tapes (non-adhesive, adhesive-backed), expanded PTFE films & tapes (non-adhesive, adhesive-backed), and other technologies. Skived (adhesive-backed) PTFE tapes and films lead the market due to their versatility, ease of use, and excellent thermal and chemical resistance. They form strong bonds with various surfaces without extra adhesives, making them ideal for industrial, electrical, and aerospace applications.

-

BY APPLICATIONBy application, the market is divided into medical & pharmaceuticals, chemical processing, automotive, aviation & aerospace, electrical & electronics, building & construction, and other applications. The electrical and electronics industry holds the largest market share due to PTFE tapes and films’ excellent dielectric properties, outstanding thermal stability, and strong resistance to chemicals and moisture. They are widely used for insulation, cable wrapping, and coil winding in high-performance electrical systems.

-

BY REGIONThe PTFE tapes and films market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is the fastest-growing region in the PTFE tapes and films market due to expansion of the industrial base, infrastructure development, and demand from end-use sectors such as electronics, automotive, and chemical processing.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Taconic, Chukoh Chemical Industries, Ltd., and AGC Inc., have entered into a number of agreements and partnerships to cater to the growing demand for PTFE tapes and films across various applications.

The PTFE tapes and films market is driven by the increased usage of high-performing materials with excellent thermal resilience, chemical inertness, low friction properties, and dielectric properties. The following reasons are driving this increase: rapid industrial growth in Asia Pacific, led by investment in the electronics, automotive, aerospace, and construction industries; growing applications in healthcare and pharmaceuticals for biocompatible seals; and growing restrictions on food processing and chemicals that require non-toxic and FDA-compliant solutions. Finally, innovations in expanded PTFE for the fuel cell and semiconductor industries drive an expansion of the PTFE tape and film product line, augmented by urbanization and a shift to sustainable technology.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. In the PTFE tapes an films market, clients like Boeing, Siemens, and General Electric emphasize high material performance, durability, and efficiency. Their key imperatives include thermal stability, electrical insulation, chemical resistance, and lightweight design. These align with their clients’ needs for reliable, energy-efficient, and long-lasting solutions, underscoring the role of PTFE tapes and films in driving innovation, operational reliability, and sustainability across aerospace, energy, and industrial sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand from high-growth end-use sectors

-

Requirement for high-performance materials in extreme operating environment

Level

-

High production and raw material costs

-

Environmental and health concerns related to PFAS and PTFE manufacturing

Level

-

Development of sustainable and eco-friendly PTFE alternatives and development processes

-

Integration of advanced materials and nanotechnologies for enhanced properties

Level

-

Complex manufacturing and application processes

-

Balancing innovation with cost-effectiveness

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand from high-growth end-use sectors

The increasing demand from high-growth end-use segments, including electronics, automotive, aerospace, chemical processing, and health care, remains a large driver behind overall market growth for PTFE tapes and films. The high-growth end-use segments are not only occurring in conjunction with recent material innovations, but also along a demographic that is looking for performance-based materials that can withstand extreme temperatures, typically have excellent chemical resistance, and can structurally withstand an incredibly complex set of environmental requirements. PTFE is one such unique material. For instance, in the electronics end-use segment, rapid miniaturization and advancements in high frequency devices, have resulted in significant increases in demand for PTFE films for insulation, cable wrapping, and dielectric applications.

Restraint: High production and raw material costs

The high cost of manufacturing, along with the high cost of the raw materials, constrains growth potential in the PTFE tapes and films market. In order to manufacture PTFE, three starting raw materials are brought together under controlled conditions, fluorspar, hydrofluoric acid, and chloroform. The process of polymerization is complex, has much additional energy requirement, as well as controlled environmental conditions, contributing to a high cost of manufacture. The worldwide price fluctuations and limited availability of the starting raw material fluorspar, both of which are primary contributors to the high cost of PTFE tapes and films, adds to the overall high cost of manufacturing PTFE tapes and films. This can be more complicated in parts of the world with limited local sources of fluorspar.

Opportunity: Development of sustainable and eco-friendly PTFE alternatives and development processes

The introduction of sustainable, eco-friendly PTFE alternative and processing methods opens up a design space for the PTFE tapes and films market. As environmental regulatory and industry activities expand, manufacturers will continue to invest in safer technologies to produce cleaner, recyclable, or low-emissions PTFE alternatives. New developments in technologies for fluoropolymer recycling, sources of bio-based feedstock, and energy-efficient manufacturing methods can reduce the carbon footprint associated with more traditional processing of PTFE. This transition can satisfy companies’ goals around sustainability and can open new market segments, especially with environmentally conscious consumers and industries, like medical, electronics, and automotive, that want materials exhibiting both performance and sustainability.

Challenge: Complex manufacturing and application processes

The PTFE tapes and films market faces a significant challenge of balancing the ever-increasing environmental and safety regulations with affordability. Regulatory bodies have begun to increase the level of controls on fluoropolymer manufacturing in their jurisdictions in response to global concerns over emissions, as well as potential health concerns regarding certain processing chemicals (for example, PFOA). Responding to these regulations will require manufacturers to invest in new manufacturing technologies and emission control systems, as well as identify safer alternatives for any materials associated with their processes. Research and Development (R&D) budgets will need to be used in ways that increase compliance with regulations, but which come at a higher cost to the manufacturer., a challenge as many end-use industries are price-sensitive and use competitively priced materials. It is exceedingly difficult for manufacturers to comply with regulations and still provide affordable products.

PTFE Tapes and Films Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops PTFE films and tapes used in electrical insulation, wire and cable wrapping, and industrial sealing applications, ensuring consistent performance under extreme conditions. | High dielectric strength, chemical inertness, temperature resistance |

|

Produces PTFE adhesive tapes and films for aerospace, electronics, and photovoltaic industries, providing smooth release surfaces and protection against wear and friction. | Low friction, non-stick properties, weather resistance |

|

Manufactures PTFE films and tapes for semiconductor, automotive, and chemical processing sectors, supporting critical insulation and sliding applications. | Heat resistance, cleanroom compatibility, dimensional stability |

|

Offers high-performance PTFE-based laminate films and tapes used in RF/microwave circuits and flexible electronics, enhancing signal reliability and thermal management. | Excellent dielectric properties, thermal conductivity, stability in high-frequency applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The PTFE tapes and films market ecosystem consists of raw material suppliers (Chemours Company, Honeywell, Solvay), manufacturers (3M, Nitto Denko Corporation, Saint-Gobain), distributors (Budnik Converting, Bron Tapes, Plustar) and end users (The Boeing Company, General Electric, Siemens). Raw material suppliers provide high-purity PTFE resins and additives ensuring chemical resistance and dielectric strength. Manufacturers process these into specialized tapes and films using extrusion, calendaring, and skiving for electrical, aerospace, and industrial uses. Distributors enable global supply with custom slitting and lamination. End users apply them for insulation, low friction, and heat resistance. Regulatory bodies like ASTM and ISO ensure quality and reliability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PTFE Tapes and Films Market, By Technology

Skived (adhesive-backed) PTFE tapes and films lead the market due to their versatility, easy application, and outstanding thermal and chemical resistance. They form strong bonds with diverse surfaces without extra adhesives, making them ideal for industrial, electrical, and aerospace uses. Their superior insulation, anti-friction, and sealing capabilities enhance their adoption, while rising demand for high-temperature, non-stick materials in manufacturing and electronics further strengthens their dominance.

PTFE Tapes and Films Market, By Application

The electrical and electronics industry represents the largest market segment for PTFE as a function of its exceptional dielectric strength, thermal stability and chemical and moisture resistance. High-performance electrical systems utilize PTFE fabrics and films for insulation, cable wrapping, and coil wrapping. Their reliability under extreme conditions is indispensable when it comes to electronics manufacturing, while the increasing demand for compact, high-efficiency devices drives their further usage in the electrical and electronics industry.

REGION

Asia Pacific to be fastest-growing region in global PTFE tapes and films market during forecast period

Asia Pacific is the fastest-growing region in the PTFE tapes and films market due to rapid industrialization, expanding electronics manufacturing, and strong aerospace and automotive production bases in countries like China, Japan, South Korea, and India. Rising investments in high-performance materials, growing demand for energy-efficient and miniaturized electronic components, and increasing infrastructure development drive consumption. Additionally, the presence of key PTFE producers and cost-effective manufacturing capabilities further accelerate market growth across the region.

PTFE Tapes and Films Market: COMPANY EVALUATION MATRIX

3M is a star player in the PTFE tapes and films market due to its extensive product portfolio, strong R&D capabilities, and global presence, enabling it to deliver high-performance solutions for electrical, aerospace, and industrial applications. The company’s focus on innovation and advanced adhesive technologies enhances product reliability and versatility. In contrast, Chukoh Chemical Industries, Ltd. is an emerging leader, leveraging its specialized expertise in fluoropolymer processing and expanding product offerings to meet rising regional demand for high-quality PTFE materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.88 Billion |

| Market Forecast in 2030 (Value) | USD 1.21 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: PTFE Tapes and Films Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electronics Manufacturer | Supplier benchmarking and capability assessment for PTFE tape/film for insulation, cable wrapping, and electronics assembly | Identifying best-fit suppliers based on performance, compliance, and pricing for cost optimization |

| Material Manufacturer | Performance analysis and technical comparisons of PTFE tapes/films for lamination and die-cutting applications | Highlighting value-added differentiation and supporting specification for diverse end-use sectors |

| Automotive Manufacturer | Evaluation of PTFE film tape properties for thermal, abrasion, and chemical resistance in automotive harness and sealing | Enabling qualification for safety-critical uses and mapping advanced grades for targeted adoption |

RECENT DEVELOPMENTS

- April 2025 : Taconic introduced 6525-08 RD, a next-generation plasma spray masking tape that sets the industry standard for thermal spray applications today. It is engineered for extreme heat resistance (up to 329°C/625°F); it sticks lightly on the metal surface while resisting airborne contaminants and abrasion, leaving no adhesive residues, even under the harshest working conditions. This tape offers sharp, clean-lined masking, bridges less coating, and is colored red for visibility.

- February 2025 : Chukoh Chemical Industries, Ltd. introduced the ASF-110, ASF-121T, and AGF-400/500 series with separators, adding to its range of adhesive tapes. The AGF-400/500 series tapes have fluororesin-impregnated glass cloth for additional strength, making them perfect for applications in electronics, manufacturing, and packaging. The ASF series tapes use PTFE film with silicone or acrylic adhesive

- October 2024 : AGC Inc. launched the AGC Chemicals Technical Center in Hsinchu Taiwan with a focus on improving chemical support for the semiconductor and electronics sectors. This center has been key in optimizing the development and use of PTFE tapes and films. It has streamlined product evaluation and testing processes, allowing local manufacturers to receive customized products more efficiently. Moreover, it has been helpful to AGC in understanding regional market trends which helps in strategically aligning PTFE solutions with customers’ technology roadmaps and speeding up the development of advanced materials designed for semiconductor manufacturing processes.

Table of Contents

Methodology

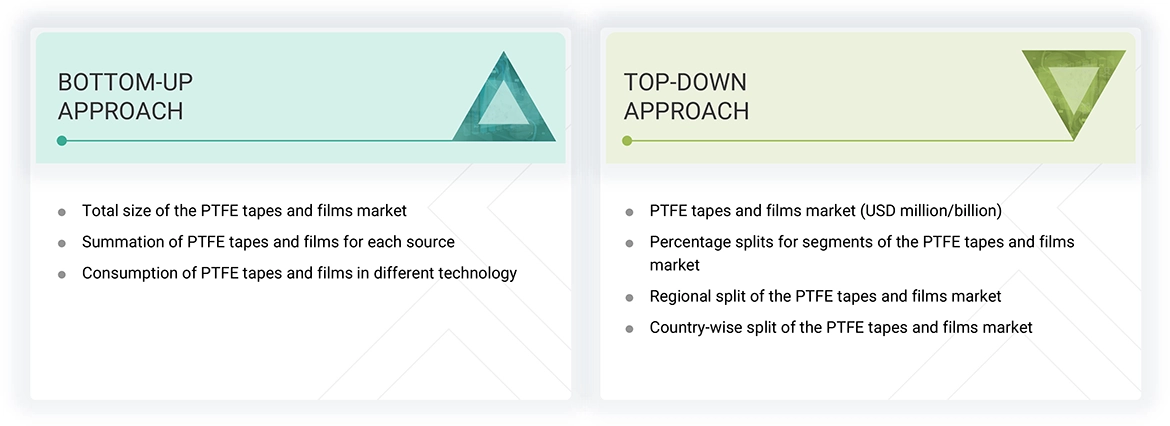

The study involved four major activities to estimate the current size of the global PTFE tapes and film market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of PTFE tapes and films through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the PTFE tapes and films market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the PTFE tapes and films market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

The PTFE tapes and films market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the PTFE tapes and films market. Primary sources from the supply side include associations and institutions involved in the PTFE tapes and films market, key opinion leaders, and processing players.

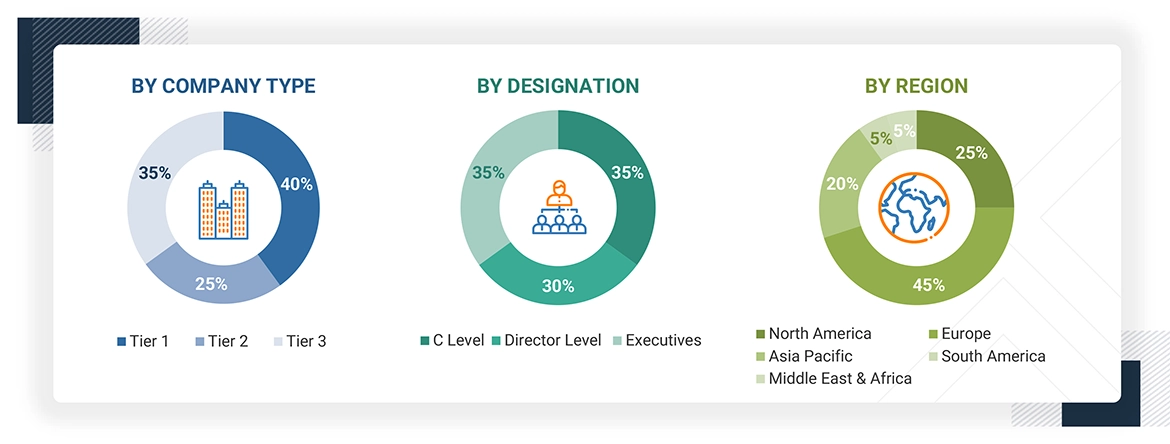

The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the PTFE tapes and films market by technology, application, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the PTFE tapes and films market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

PTFE (polytetrafluoroethylene) tapes and films are high-performance materials made from polytetrafluoroethylene, which is a synthetic fluoropolymer with exceptional chemical resistance, thermal stability, and low friction. They are available as adhesive and non-adhesive tape and film products and find utility in a wide variety of industrial applications, such as sealing, insulation, lubrication, and surface protection. Tapes and films also have excellent dielectric properties, making them useful for electrical and electronics sectors, such as wire insulation and shielding. In addition to their chemical performance, PTFE tapes and films are useful in extreme temperatures and corrosive environments, which is why they are common in aerospace, chemical processing, automotive, and other industries. Their non-stick surface, flexibility, and durability improve wear reduction, minimize contamination, and add to efficiency and component lifespan for equipment and other components.

Stakeholders

- PTFE Tape and Film Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the PTFE tapes and films market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on technology, application, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA)—along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile the leading players and comprehensively analyze their key developments, such as new product launches, expansions, and deals, in the PTFE tapes and films market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Frequently Asked Questions (FAQ)

Which factors are propelling the growth of the PTFE tapes and films market?

Increasing demand from high-growth end-use sectors, the need for high-performance materials in extreme environments, rapid industrialization and infrastructure development in developing economies, and stringent regulatory demand for reliable and safe sealing solutions are driving market growth.

What are the major challenges to the growth of the PTFE tapes and films market?

Balancing regulatory requirements with cost-effectiveness is the primary challenge impacting market growth.

What are the major opportunities in the PTFE tapes and films market?

Opportunities include the development of sustainable and eco-friendly PTFE alternatives and processes, along with the integration of advanced materials and nanotechnologies to enhance performance.

What are the major factors restraining the growth of the PTFE tapes and films market?

High production and raw material costs, environmental and health concerns related to PFAS and PTFE manufacturing, competition from alternative high-performance materials, and raw material price volatility are key restraining factors.

Who are the major players in the PTFE tapes and films market?

Major players include 3M (US), Saint-Gobain (France), Nitto Denko Corporation (Japan), Rogers Corporation (US), and Guarniflon S.p.A. (Italy).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the PTFE Tapes and Films Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in PTFE Tapes and Films Market