Push-Pull Control Cables Market

Push-Pull Control Cables Market by Product type (Throttle, Gear Shift, Clutch, Parking Brake, Others), Industry (Automotive, Construction, Agriculture, Railway, Marine, Others), Cable Type, Application, Propulsion, and Region - Global forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The push-pull control cables market is projected to reach USD 9.24 billion by 2032, growing from USD 8.32 billion in 2032, at a CAGR of 1.5% from 2025 to 2032. Growth in the push-pull control cables market is driven by sustained demand for reliable mechanical actuation in automotive and off-highway systems, where precise and fail-safe force transmission is required. Additionally, increasing vehicle production, particularly in commercial vehicles, construction equipment, and agricultural machinery, continues to support the usage of control cables for throttle, clutch, braking, and transmission functions.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific push-pull control cables market is estimated to account for a share of 33.6% in 2025.

-

By ProductBy product, the spare wheel carrier cable segment is projected to register the highest CAGR by value during the forecast period.

-

By IndustryBy industry, the railways segment is projected to grow at the highest CAGR of 4.7% by value from 2025 to 2032.

-

By Vehicle TypeBy vehicle type, the passenger car segment is estimated to dominate the push-pull control cables market in 2025.

-

By ApplicationBy application, the auxiliary cable segment is projected to grow at the highest CAGR of 2.1% by value during the forecast period.

-

Competitive LandscapeHI-LEX Corporation (Japan), Suprajit (India), Orscheln Products (US), Kongsberg Automotive (Norway), and Carl Stahl Technocables GmbH (Germany) were identified as star players in the push-pull control cables market, given their strong market share and product footprint.

-

Competitive LandscapeCalifornia Push-Pull, Inc. (US) and THAI STEEL CABLE PUBLIC COMPANY LIMITED (Thailand) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The push-pull control cables market is growing steadily due to the continued need for deterministic, mechanically actuated force transmission in safety- and function-critical vehicle and equipment systems. OEMs in the automotive, marine, and industrial sectors rely on mechanical cables for throttle, clutch, braking, transmission, and latch actuation where reliability and predictable response are required. Additionally, the increasing production of commercial vehicles, off-highway equipment, and industrial machinery is sustaining the demand for push-pull control cables. Moreover, technological advancements in materials, low-friction liners, and compact routing are improving the durability and operational performance of these cables under severe conditions, which is also driving their demand across sectors.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Present revenue in the push-pull control cables market is generated from conventional push-pull cables and Bowden (pull-only) cables with steel inner cores, standard polymer liners, and mechanical end fittings used for manual force transmission. On the other hand, future revenue streams are expected to be driven by lightweight aluminum or composite-core push-pull cables, sensor-integrated push-pull cables enabling position or load feedback, and high-flex push-pull cables with PTFE or PEEK liners for low friction, reduced hysteresis, and extended cycle life.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in construction and agriculture equipment with heavy-duty control cables

-

Push toward compact packaging across marine, automotive, and industrial OEMs

Level

-

Increasing autonomy across industries driving e-actuation systems

Level

-

Expansion in EV auxiliary functions

-

Growth in marine craft manufacturing

Level

-

Durability and performance stability under severe conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in construction and agriculture equipment with heavy-duty control cables

The increasing demand for construction and agricultural machinery is driving the need for high-tensile, low-friction push-pull and pull-only cables for heavy-duty load cycles. These cables control throttle, clutch, and brake systems in loaders, excavators, tractors, and harvesters. Their key technical specifications include tensile strength of 1,000–1,500?N, abrasion resistance over 200,000 cycles, friction below 0.08, and temperature tolerance from -40°C to 120°C. push-pull control cables for off-highway and construction equipment feature PTFE-lined cores and reinforced housings, enabling precise, fail-safe actuation for transmission, throttle, braking, and safety systems with cycle life exceeding 500,000 operations. They maintain reliable performance under vibration up to 5?g, shock loads up to 50?g, thermal ranges from -40?°C to 125?°C, and high dust/abrasive exposure, ensuring deterministic control in heavy-duty conditions.

Restraint: Increasing autonomy across industries driving e-actuation systems

Increasing autonomy across the automotive, industrial, construction, agricultural, and marine sectors is constraining the demand for push-pull control cables in advanced equipment platforms. In on-highway vehicles, electronic throttle control and shift-by-wire architectures are standard in premium passenger vehicles and electric models. They eliminate throttle and shift selector cables from the system design. In construction equipment, autonomous forklifts deployed in warehouses and ports use electric steering, braking, and traction actuators, replacing multiple push-pull and brake cables. In agriculture, semi-autonomous tractors and equipment integrate electronic drive, braking, and steering systems to support precision guidance and remote operation, reducing reliance on mechanical linkages. Likewise, in marine applications, autonomous and remotely operated vessels adopt electronic actuation for propulsion and steering to enable centralized and redundant control systems.

Opportunity: Expansion in EV auxiliary functions

In EVs, hood, charge-port, parking release, HVAC airflow, and seat mechanisms require mechanical backup to meet redundancy and emergency access norms. As the production of EVs rises, the demand for mechanical cables is shifting from powertrain to body and interior systems. In marine electrification, mechanical cables remain mandatory for steering override, hatch access, battery isolation, and safety dampers due to power-loss and corrosion risks. Electric construction equipment continues to rely on mechanical cables for parking brakes, emergency stops, HVAC flaps, and manual overrides in harsh jobsite conditions. Thus, electrification of vehicles is sustaining the growth of the push-pull control cables market through added auxiliary and safety-critical functions across automotive, marine, and construction platforms.

Challenge: Durability and performance stability under severe operating conditions

Maintaining durability and performance stability in severe operating conditions remains a key challenge, as push-pull control cables must sustain low friction and high transmission efficiency across long routing paths. Multiple bends while limiting backlash, hysteresis, and compression losses continue to deliver consistent force transfer under extreme and repetitive load cycles typical of HCVs, mining equipment, and agricultural machinery. Additionally, vehicles operating in environments exposed to dust, moisture, and chemical contaminants demand robust sealing systems and high-wear-resistance liner materials to prevent premature degradation and functional variability.

PUSH-PULL CONTROL CABLES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Designs and supplies complete mechanical actuation solutions for throttle, clutch, and braking systems | Ensures smooth and reliable control in passenger and commercial vehicles under varying load and environmental conditions | Ensures high reliability, precision actuation, reduced maintenance, and ability to meet stringent global OEM standards |

|

Provides integrated cable systems for door operation, window regulators, and seat adjustments | Enables consistent mechanical actuation and ergonomic functionality across mass-production vehicle platforms | Ensures smooth operation, long service life, and compliance with quality standards critical for OEM production lines |

|

Delivers robust mechanical control solutions for throttle, brake, gear shift, pull-release, and remote valve systems in on-highway trucks and off-highway industrial/agricultural machinery, capable of operating in harsh conditions | Offers reliable actuation under vibration, dust, and thermal stress | Enhances operational safety and system longevity |

|

Supplies heavy-duty key interlock and parking-brake cable assemblies for commercial trucks and off-road vehicles | Engineered to withstand high stress, extended duty cycles, and adverse environmental conditions | Offers high durability, operational safety, and optimized for demanding commercial and utility fleet applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The push-pull control cables market ecosystem covers raw material suppliers, tier-1 system suppliers, mechanical control cable manufacturers, and automotive and off-highway OEMs. Leading raw material suppliers include ArcelorMittal, POSCO, 3M, and Solvay, supplying steel, polymer liners, and coatings essential for cable performance. Key tier-1 system suppliers and control cable manufacturers include HI-LEX, Suprajit, Kongsberg Automotive, and Orscheln Products. These participants design, assemble, and deliver precision push-pull control cables to OEMs. Major automotive and off-highway OEMs, including Toyota, Volkswagen, GM, Ford, Hyundai, Caterpillar, CNH Industrial, John Deere, Volvo CE, and Komatsu, integrate these cables into vehicles and machinery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Push-Pull Control Cables Market, By Product

By product, the parking brake cable segment is estimated to dominate the mechanical control cable market in 2025, supported by the mandatory use of these cables across passenger cars, light commercial vehicles, and heavy commercial vehicles. Parking brake cables provide a direct mechanical cable between the actuator and brake system, ensuring reliable holding performance in ICE, hybrid, and few EV platforms where electronic parking brakes are not adopted due to cost or architecture constraints. Many OEMs deploy mechanical parking brake cables for their fail-safe functionality, load retention capability, and regulatory acceptance, particularly in cost-sensitive and utility-focused vehicle segments. In industrial applications such as automotive, off-highway, and railway, the Polytetrafluoroethylene-Lined (PTFE-Lined) push-pull or pull-only designed cables are fitted to enable smooth actuation, resistance to contamination, and stable performance under vibration, thermal cycling, and corrosion exposure.

Push-Pull Control Cables Market, By Application

By application, the brake cable dominate the market in the push-pull control cables market due to mandatory fitment across all vehicle classes. The high cable count per vehicle, continued dependency on mechanical parking brakes in LCVs, HCVs, and off-highway equipment have increasing volumes of production of push-pull control cables used in brake applications. Even with EPB adoption, cable-based architectures still remain in use driving the demand for these cables.

Push-Pull Control Cables Market, By Industry

The automotive segment is projected to be the largest market during the forecast period. In the automotive sector, mechanical cables are used in passenger cars, light commercial vehicles, and heavy commercial vehicles. Growth in the segment is further driven by the high production of mechanical cables, need for frequent replacements, and their rising adoption in emerging markets. push-pull control cables are widely used for reliable and cost-effective actuation in ICE and hybrid vehicles, providing OEMs with lower warranty risks, easier maintenance, and better service. Their core technical advantages include low-friction liners that reduce operational resistance by up to 30%, corrosion-resistant inner wires that extend service life by 25–40%, and high durability supporting over 100,000 actuation cycles. Aftermarket replacements generate consistent recurring revenue, while growth is moderated by the increasing adoption of electronic actuation in premium vehicle segments.

Push-Pull Control Cables Market, By Cable Type

The push-pull cable market is projected to be a significant market during the forecast period driven. The growth of the market is attributed to their ability to provide precise bi-directional mechanical actuation across automotive, railway, and marine applications. In automotive, these cables control throttle, transmission, and parking brakes reliably. In railways, they operate traction, braking, and metro/high-speed train doors. In marine, they manage engine throttle, gear, and steering systems with smooth, fail-safe operation. Designed for both tensile and compressive loads, with PTFE-lined inner wires and compact housings, push-pull cables support tight packaging and long lifecycles exceeding 100,000 operational cycles. Their robustness and low maintenance make them ideal where electronic alternatives are costly or require mechanical redundancy. Rising auxiliary systems in vehicles, retrofitting of older fleets, and adoption in EV and hybrid platforms are further fueling demand in this market segment.

REGION

Asia Pacific to be fastest-growing region in global push-pull control cables market during forecast period

Asia Pacific is projected to lead the global push-pull control cables market during the forecast period, driven by increased vehicle production and strong regional supply chains across China, India, Japan, South Korea, and Thailand. The region's marine and railway sectors are expanding due to investments in ports, inland waterways, metro systems, and freight corridors, with mechanical cables specified for critical actuation and durability in challenging environments. Leading regional manufacturers and suppliers of push-pull control cables include HI-LEX Corporation (Japan), Suprajit (India), Ningbo Auto Cable Controls (China), Thai Steel Cable (Thailand), and Kongsberg Automotive (Norway). These companies lead the automotive, industrial, and transportation segments with high-cycle, low-friction, corrosion-resistant control cable systems. Marine fleets continue to rely on mechanical cables for throttle, gear, and steering control, while railways use them for braking, door actuation, and auxiliary systems across high-utilization and retrofit fleets. As OEMs and operators scale deployments in 2025, the demand for mechanical cables is increasingly focused on advanced mechanical cable solutions that optimize service life, operational safety, and lifecycle cost efficiency.

PUSH-PULL CONTROL CABLES MARKET: COMPANY EVALUATION MATRIX

In the push-pull control cables market matrix, HI-LEX Corporation (Star) leads with a strong global market share and a diversified portfolio spanning shift selector cables, throttle cables, clutch cables, and parking brake systems. Its position is reinforced by long-standing OEM relationships, high-volume vehicle platforms, and consistent performance across passenger vehicles, two-wheelers, and commercial vehicles during 2024–2025. SILA Group (Emerging Leader) is strengthening its position through expanding manufacturing capacity and a growing portfolio of push–pull and pull–pull push-pull control cables. The company is increasing penetration across automotive, agricultural machinery, and construction equipment segments, supported by competitive pricing, localized production, and rising adoption among cost-focused OEM programs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Suprajit (India)

- HI-LEX CORPORATION (Japan)

- Orscheln Products (US)

- Kongsberg Automotive (Norway)

- Carl Stahl Technocables GmbH (Germany)

- Sila Group (Italy)

- Diploma PLC (UK)

- Cablecraft (US)

- THAI STEEL CABLE PUBLIC COMPANY LIMITED (Thailand)

- Ficosa International SA (Spain)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.27 Billion |

| Market Forecast in 2032 (Value) | USD 9.24 Billion |

| Growth Rate | CAGR of 1.5% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: PUSH-PULL CONTROL CABLES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Automotive OEM |

|

|

RECENT DEVELOPMENTS

- April 2025 : Ficosa International SA announced a strategic partnership with Balkrishna Industries to co-develop next-generation mechanical control cable solutions specifically tuned for electric vehicle platforms. This effort blended Ficosa’s automotive systems experience with Balkrishna’s composites and material engineering strengths, and was aimed at rugged, cost-efficient cable actuation components.

- January 2025 : Aptiv formed a technical partnership with DURA Automotive Systems, targeting lightweight, high-performance control cable assemblies that integrate with modern vehicle body-architecture requirements.

- November 2024 : Suprajit entered a 50:50 technical joint venture with Japan’s Chuo Spring Company Ltd., focusing on designing, manufacturing, and supplying advanced transmission cables for automotive applications in India. The JV leveraged Chuo Spring's specialized Japanese technology and targeted leading Japanese OEM platforms.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

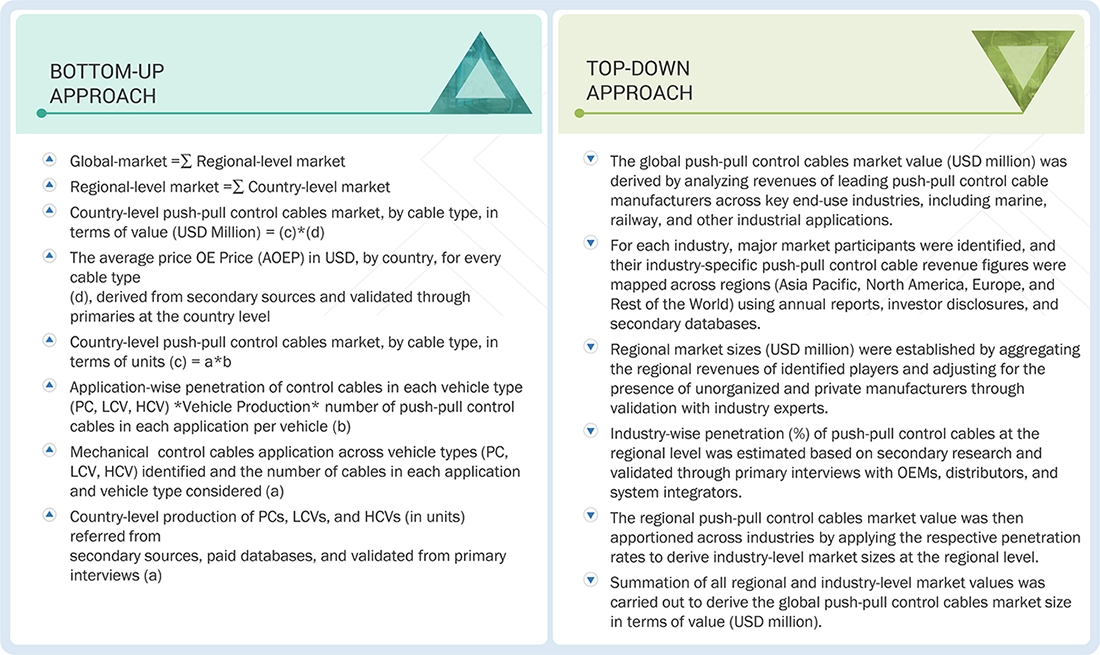

The study involves the use of four main activities to estimate the current size of the push-pull control cables market. Exhaustive secondary research was conducted to gather information on the market based on product, application, cable type, vehicle type, industry, and region. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for estimating the push-pull control cables market included automotive industry organizations, such as Organisation Internationale des Constructeurs d’Automobiles (OICA) and publications from government sources [country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (such as annual reports, investor presentations, and financial statements); and trade repository. Additionally, historical production data was collected and analyzed, and this data was further validated by primary research.

Primary Research

During the primary research process, various primary sources from the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, as well as key opinion leaders, were also interviewed.

Primary interviews were conducted to gather insights, including vehicle production forecasts, push-pull control cables market forecasts, future technology trends, and upcoming technologies in the push-pull control cables market. Data triangulation was conducted across all these points, utilizing information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides were interviewed to understand their views on the aforementioned points.

Primary interviews were also conducted with market experts from the demand (OEMs) and supply-side (Mechanical control cable manufacturers) players across four major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 46% and 54% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from our primaries. This, along with the opinions of our in-house subject matter experts, led us to the conclusions described in the remainder of this report.

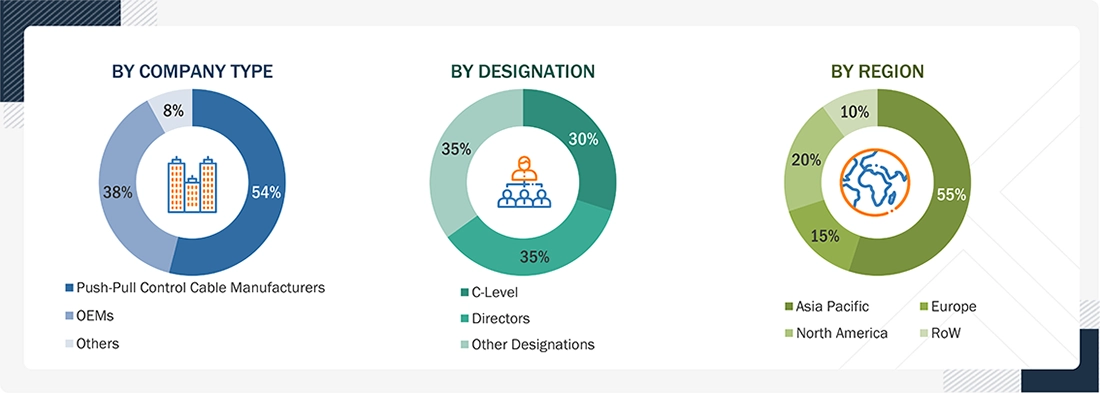

BREAKDOWN OF PRIMARY INTERVIEWS

Notes:

- Others included Sales, Marketing, and Product Managers.

- Other Designations included Infotainment Component and Technology Providers.

- Company tiers are based on the value chain, and not the revenue figures of companies listed.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was employed to estimate and validate the value of the push-pull control cables market, as well as its dependent submarkets.

Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The push-pull control cables market covers control cables, which are flexible mechanical assemblies used to transmit motion and force from a control input to a remote mechanism through an inner moving core guided by an outer conduit. They enable accurate mechanical actuation where rigid linkages are unsuitable due to routing, space, or movement constraints. Push-pull control cables are a category of push-pull control cables. They are designed to transmit force in compression and tension, allowing bidirectional movement and position control. Their inner core is constructed to resist buckling under compressive loads while maintaining smooth linear motion. Pull-only control cables are designed to transmit force only in tension and cannot carry compressive loads. Return motion in pull-only systems is achieved using external springs, gravity, or counteracting mechanisms.

Key Stakeholders

- Automotive OEMs

- Conduit, Liner, and Polymer Sheath Suppliers

- End Fitting, Terminal, and Linkage Hardware Manufacturers

- Fleet Operators and Industrial Equipment Owners

- Mechanical Control Cable Manufacturers

- Off-Highway, Agricultural, and Construction Equipment OEMs

- Rail, Marine, and Aerospace Equipment Manufacturers

- Steel Wire, Stranded Cable, and Rod Suppliers

- Testing, Certification, and Standards Organizations

- Tier-1 Mechanical System and Actuation Module Suppliers

- Tooling, Automation, and Cable Assembly Equipment Providers

Report Objectives

-

To define, describe, and forecast the size of the push-pull control cables market in terms of value (USD million) based on

- Industry (Automotive, Marine, Construction, Agriculture, Railway, Others)

- Application (Engine Cable, Transmission Cable, Brake Cable, Auxiliary Cable)

- Product (Throttle Cable, Gear Shift Cable, Clutch Cable, Parking Brake Cable, Hood Release Cable, Fuel Door Release Cable, Trunk Release Cable, Door Latch Cable, Spare Wheel Carrier Cable, Seat Recline Release Cable)

- Cable Type (Push-Pull Cable, Pull-Only Cable)

- Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle)

- Region (Asia Pacific, Europe, North America, Rest of the World)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To study the following concerning the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Impact of AI/Gen AI

- Trend and Disruption Impact

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- To understand competition in the push-pull control cables market and position players as stars, emerging leaders, pervasive players, and participants based on their product portfolios and business strategies

- To strategically analyze key player strategies/right to win, as well as evaluate the competitive leadership mapping

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, such as joint ventures, mergers & acquisitions, product launches/developments, and other activities carried out by key market players

Customizations Options:

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs. The following customizations are available:

- Push-pull control cables Market, By Industry, at Country Level (For Countries Covered In Report)

- Company Information, Profiling of Additional Market Players (Up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Push-Pull Control Cables Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Push-Pull Control Cables Market