Radiology AI Market Size, Growth, Share & Trends Analysis

Radiology AI Market by Offering (On-Device, SaaS), Function (Triage, Workflow, CDSS, Acquisition, Processing, Reporting), Modality (CT, MRI, X-ray), Indication (Onco, Cardio, Neuro), End User (Hospital, Imaging Center), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global radiology AI market is projected to reach USD 2.27 billion by 2030, up from USD 0.76 billion in 2025, growing at a CAGR of 24.5% during the forecast period. This growth is primarily driven by the global shortage of trained radiologists and high patient volumes, which create a demand for AI solutions that can triage cases, automate routine tasks, and enhance diagnostic efficiency.

KEY TAKEAWAYS

-

BY OFFERINGOn-device software is projected to grow at a CAGR of 24.7% during the forecast period.

-

BY FUNCTIONThe diagnostic imaging & interpretation segment is estimated to account for the largest share of the radiology AI market.

-

BY MODALITYComputed tomography (CT) segment is estimated to account for the largest share in radiology AI market.

-

BY INDICATIONThe oncology segment is projected to be the largest segment during the forecast period.

-

BY END USERBy end user, hospitals are estimated to account for the largest share in the radiology AI market.

-

BY REGIONNorth America dominate the radiology AI market with a share of 39.5% in 2024.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSGE Healthcare, Koninklijke Philips N.V., and Siemens Healthineer AG were identified as Star players focused on radiology AI.

-

COMPETITIVE LANDSCAPE - STARTUPSAidoc, HeartFlow Inc., and Viz.ai, Inc. have distinguished themselves among SMEs and startups due to their strong product portfolio and sound business strategy.

The growth of the radiology AI market is fueled by the increasing use of imaging in preventive and precision medicine, driving the need for faster and more accurate interpretation. The emergence of multimodal imaging data and AI-based quantitative analytics is enabling deeper diagnostic insights and personalized care. Strategic collaborations among AI startups, healthcare providers, and imaging equipment manufacturers are accelerating innovation and deployment. Additionally, the growing focus on operational efficiency, early disease detection, and cost optimization across healthcare systems is propelling widespread adoption of AI in radiology.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Radiology AI market is undergoing a major transformation driven by the convergence of digitalisation, automation, and precision healthcare demands. As radiology departments move toward data-driven and outcome-based diagnostics, AI solutions are increasingly being integrated into imaging workflows to enhance detection accuracy, accelerate reporting, and optimise operational efficiency. Cloud-based and hybrid AI deployments, along with federated learning, enabling institutions to leverage vast imaging datasets while maintaining data privacy compliance. Disruptive innovations such as explainable AI (XAI), multimodal image analytics, and generative AI are further redefining how radiologists interpret and contextualise imaging data, extending AI’s role from image analysis to predictive diagnostics and personalised treatment planning. Regulatory developments, including the US FDA’s evolving framework for adaptive AI/ML devices and the EU AI Act, are shaping product validation timelines and commercialisation strategies. Collectively, these technological and regulatory shifts are compelling healthcare providers, imaging centres, and AI vendors to rethink their infrastructure, compliance models, and investment priorities to remain competitive in an increasingly intelligent and value-focused radiology ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing medical imaging volumes

-

Rising demand for AI solutions to alleviate radiologist workload

Level

-

High implementation costs and ROI uncertainty

-

Regulatory fragmentation across regions

Level

-

Growing demand for Platform, multi-modal data, and OEM integration (PACS/EHR/marketplaces)

-

Untapped Growth Potential in Emerging Healthcare Markets

Level

-

Integration challenges with legacy radiology systems

-

Limited clinician trust and explainability demands

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing medical imaging volumes

The rapid increase in medical imaging volumes worldwide is a key driver accelerating the adoption of AI in radiology. With the growing prevalence of chronic diseases, aging populations, and expanding access to advanced imaging modalities such as CT, MRI, and PET, healthcare systems are generating an unprecedented volume of diagnostic images. This surge has intensified the workload on radiologists, leading to rising turnaround times and potential diagnostic delays. AI-powered radiology solutions are increasingly being deployed to automate image analysis, prioritize critical cases, and enhance workflow efficiency. By enabling faster, more accurate interpretations and improving clinical decision-making, AI technologies are helping healthcare providers manage the growing imaging burden while maintaining quality of care. In August?2024, NHS data show that of 723,243 CT scans performed, only 59,300 (8%) took place in community diagnostic centres, and of 398,199 MRI exams, just 53,572 (13.5%) were conducted outside hospitals. Although community centres’ share of overall diagnostic activity has doubled from 6% in August?2023 to 10% this year, hospitals still manage over 90?% of CT and MRI workloads, underscoring the urgent need for AI in radiology solutions to optimize imaging workflows, reduce reporting backlogs, and support radiologists in managing the growing diagnostic demand across healthcare settings.

Restraint: High implementation costs and ROI uncertainty

Hospitals and imaging networks face a sizeable, multi-component upfront bill to move from proofs-of-concept to routine, enterprise deployment. Direct line items include software licensing (per-study or per-site), on-premise servers or cloud capacity for model inference and image storage, PACS/EMR integration work, cybersecurity controls, and procurement of validated data pipelines for continuous performance monitoring, each of which is frequently priced and contracted separately. Vendor material from large imaging vendors highlights that AI must be tightly embedded into radiology workflows to deliver value, which in turn requires systems engineering and integration effort beyond the price of a single algorithm. Regulatory and validation costs compound the problem. Recent FDA guidance requires lifecycle planning, performance monitoring and change-control for AI-enabled devices, which increases the developer’s and the buyer’s obligations for post-market surveillance, re-validation after updates, and documentation, all recurring cost drivers that make capital budgeting and TCO modelling harder to predict. Public health bodies and professional colleges also flag that hospitals must often reallocate scarce operational budgets (rather than capital budgets) to pay for AI software, further weakening the investment case when paybacks are uncertain. These compliance and funding constraints make it hard to build a convincing business case for scale-up.

Opportunity: Growing demand for Platform, multi-modal data, and OEM integration (PACS/EHR/marketplaces)

The integration of AI with multi-modal data including medical imaging, electronic health records (EHR), genomics, laboratory results, and wearable device data represents a transformative opportunity in the radiology market. By combining diverse data sources, AI algorithms can generate more comprehensive insights, enabling precise diagnosis, personalized treatment planning, and predictive analytics. This convergence allows radiologists and clinicians to move beyond isolated image interpretation toward a holistic view of patient health, improving clinical decision-making and enhancing outcomes across complex disease pathways. Furthermore, multi-modal AI integration supports research and development in precision medicine by facilitating large-scale data analysis, identifying novel biomarkers, and accelerating clinical trial design. It also enables healthcare providers to implement proactive population health management strategies, detect early disease patterns, and optimize resource allocation. As healthcare systems increasingly adopt interoperable platforms, AI solutions capable of synthesizing multi-modal data will play a crucial role in driving innovation, improving diagnostic accuracy, and expanding the commercial potential of AI in radiology. Several high-impact examples illustrate the breadth of multi modality innovations: 1) Hyperfine’s Swoop Portable MR Imaging System (V2) delivers a full body MR capability at the point of care, enhancing access in satellite clinics or emergency departments and drastically reducing patient transport logistics. 2) GE’s Voluson Performance 16/18 ultrasound platforms, now cleared with embedded AI reconstruction and adaptive beamforming, accelerate 3D and 4D obstetric and cardiac studies, boosting throughput by up to 30?percent in high-volume women’s health centers. 3) Fujifilm’s Synapse?3D Base Tools and Canon’s UltraExtend?NX permit automated fusion of CT, MR and PET data into synchronized 3D renderings, enabling volumetric tumor tracking and dual energy analysis in a single viewer. 4) Canon’s UltraExtend NX complements ultrasound platforms by enabling offline review, advanced analysis, and integration with clinical workflows, illustrating how modality-specific workstations can plug into a broader multimodal ecosystem. Integrating AI across multi-modal data streams is a credible, high-impact growth vector for AI in radiology, one that shifts solutions from single-image automation toward outcome-driven, end-to-end clinical value. Vendors that focus on robust data interoperability, validated multi-modal models, and tightly governed clinical deployments will capture outsized market share as health systems move from pilots to production.

Challenge: Integration challenges with legacy radiology systems

Integration with existing radiology systems is a major commercialization barrier for AI solutions because most hospital imaging environments are built around legacy, vendor-specific PACS/RIS and EHR platforms that lack standardized, production-grade APIs. Differences in DICOM implementations, inconsistent HL7/FHIR support, and proprietary reporting workflows mean AI tools often require custom connectors or disruptive changes to clinician interfaces, adding engineering complexity, elongating deployment timelines, and increasing vendor dependence. The result is frequent workflow friction for radiologists (extra steps, context switching) and a higher risk that even clinically effective algorithms will fail to achieve routine use. Compounding the technical friction are data and governance challenges that directly affect model performance and regulatory readiness. Imaging datasets are highly heterogeneous (scanner models, acquisition protocols, annotation conventions), leading to unpredictable performance when models are moved from pilot sites to broader production. That variability, combined with fragmented patient-identifiers, limited labelled data, and inadequate monitoring for model drift, raises validation, liability, and compliance costs, forcing health systems to invest in extensive site-level testing, quality-assurance pipelines, and ongoing post-market surveillance before scaling. From a business perspective, these integration hurdles translate into higher implementation costs, slower ROI, and increased procurement risk, creating reluctance among CIOs and purchasing committees to greenlight wide deployments. Overcoming the challenge requires not only technical middleware and stronger interoperability standards but also cross-functional investment in IT resources, governance processes, and change management; without that commitment, AI vendors and health systems will struggle to move beyond pilots to sustainable, enterprise-scale adoption.

Radiology AI Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

GE Healthcare Edison Platform, Critical Care Suite, LOGIQ E10, Imaging Insights, AI Orchestrator, and TrueFidelity CT deliver AI-powered imaging, workflow optimization, and clinical decision support. | Enhances diagnostic precision, accelerates image reconstruction, improves workflow efficiency, enables real-time analysis, integrates multi-source data, and supports scalable, patient-centric radiology solutions |

|

Fujifilm’s REiLI platform uses advanced deep learning algorithms for organ segmentation, lesion detection, and quantitative feature extraction across CT, MRI, and X-ray imaging modalities. | Enhances diagnostic accuracy, supports early disease identification, minimizes manual interpretation time, and helps radiologists focus on complex or critical cases. |

|

AI-Rad Companion and myExam Companion provide AI-powered, cloud-based workflows and guided diagnostics to enhance radiology imaging and reproducibility. | Reduces repetitive task burden, improves diagnostic precision, ensures consistent imaging results, accelerates reporting, and optimizes workflow efficiency across radiology departments |

|

Philips AI Manager, CT Precise Image/Position, EPIQ CVx, IntelliSpace, SmartExam, SkyFlow Plus, SmartSpeed, and VitalEye optimize AI-powered imaging and workflow. | Improves diagnostic accuracy, reduces scan time, enhances reproducibility, automates planning, lowers radiation dose, streamlines workflow, and supports multi-modality radiology efficiency |

|

Canon AiCE, AI-assisted Ultrasound, and Automation Platform deliver deep-learning image reconstruction, automated measurements, and AI-driven workflow optimization across CT, MRI, and ultrasound. | Enhances diagnostic clarity, reduces radiation dose, improves anatomical visualization, accelerates exams, automates prioritization, and streamlines radiology workflow efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The radiology AI ecosystem connects healthcare providers, AI vendors, imaging equipment manufacturers, regulators, and patients to enable intelligent image-based diagnostics. Hospitals, imaging centers, and outpatient facilities deploy AI across CT, MRI, X-ray, ultrasound, and mammography for screening, diagnostic interpretation, image enhancement, workflow optimization, and clinical decision support. Technology players deliver software-based AI solutions and AI-embedded devices integrated with PACS, RIS, EHRs, tele-radiology systems, and cloud platforms. Regulatory bodies ensure safety, validate performance, and ensure compliance with data privacy regulations. Pharma, biotech, and MedTech stakeholders utilize AI-derived imaging insights in clinical development and precision care. Patients benefit from faster and more accurate diagnoses, as well as improved outcomes, which reinforces the adoption of radiology AI across regions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Radiology AI Market, By Offering

In 2024, the software/SaaS segment held the highest share in the radiology AI market. This dominance stems from the fact that software-based tools can be deployed across different imaging modalities and facilities, scale more easily than hardware, and integrate with existing PACS/RIS/EHR infrastructures. In particular, vendors are able to update algorithms, roll-out across sites, and support cloud-native deployments without requiring large capital equipment upgrades. The relatively lower barrier to entry and shorter time to value for software solutions has driven adoption by hospitals and imaging centers seeking ROI and workflow enhancement rather than device replacement. Furthermore, software enables support for multiple functions such as screening, triage, interpretation, post-processing which increases its addressable market compared to AI-embedded devices.

Radiology AI Market, By Function

In 2024, the diagnostic imaging & interpretation segment accounted for the largest share of the radiology AI market. This dominance is driven by its ability to directly enhance diagnostic accuracy and accelerate interpretation across high-volume imaging workflows. These AI solutions extract actionable insights from medical images by automating the detection of anomalies, quantification of disease markers, and reduction of interpretation errors, addressing radiologist burnout and backlog challenges. As this functionality delivers measurable clinical and operational improvements across screening, triage, diagnosis, monitoring, and reporting, healthcare providers prioritize these tools over other AI functions. As a result, vendors continue to channel R&D investments into advanced detection and analysis algorithms, reinforcing this segment’s leading position in the market.

Radiology AI Market, By Modality

CT-based AI solutions held the largest share of the radiology AI market in 2024, supported by the high global utilization of CT imaging in critical and time-sensitive care settings such as oncology, neurology, trauma, and cardiovascular diseases. CT scans generate rich, high-resolution volumetric data enabling AI to deliver tangible improvements in lesion detection, image reconstruction, segmentation, and radiation dose optimization. Healthcare providers value CT-AI tools for their ability to reduce false negatives, accelerate emergency workflows, and improve patient outcomes. As CT systems are widely deployed across hospitals and imaging centers, adoption barriers are lower, allowing AI integration to scale rapidly. These advantages collectively reinforce CT as the leading modality segment within radiology AI.

Radiology AI Market, By Indication

Neurology accounted for a significant share of the radiology AI market in 2024. This leadership is attributed to the high global burden of neurological disorders such as stroke, brain tumors, Alzheimer’s disease, and multiple sclerosis, where rapid and accurate imaging interpretation is critical. AI tools significantly improve the detection of subtle neural abnormalities, reduce diagnostic delays, and enhance clinical decision-making in acute and chronic neuro-care pathways. Additionally, neuroimaging AI solutions have achieved earlier regulatory clearances and stronger product maturity compared to many other therapeutic areas, encouraging broader deployment across emergency and specialized care settings. As health systems increasingly prioritize clinical outcomes in time-sensitive neurological conditions, adoption of AI in neuro-diagnostics continues to accelerate, firmly positioning this segment at the forefront of indication-based market growth.

Radiology AI Market, By End User

In 2024, the hospital segment held the largest market share in the Radiology AI market, driven by consistently high imaging volumes, well-established PACS/RIS/EHR infrastructure, and a strong institutional focus on reducing diagnostic turnaround times and enhancing clinical accuracy. Hospitals are under pressure to manage growing case loads, address radiologist shortages, and improve patient outcomes, making them the primary adopters of AI-enabled image analysis, workflow automation, and decision-support tools. Their scale and integration capabilities also enable better ROI realization from AI deployments, further reinforcing their market leadership.

REGION

Asia Pacific to be fastest-growing region in global radiology AI market during the forecast period

The Asia Pacific is expected to be the fastest-growing region in the Radiology AI market, driven by a combination of structural demand drivers and rapid digital health modernization. The region has one of the world’s highest imaging volumes, fueled by a large and aging population, a rising chronic disease burden, and the accelerated expansion of diagnostic infrastructure in emerging economies such as China and India. Governments across the Asia Pacific region are prioritizing AI adoption through national roadmaps, reimbursement reforms, and investments in smart hospitals, thereby improving readiness for advanced imaging technologies. In addition, the region faces an acute shortage of trained radiologists, which creates a strong commercial need for AI-enabled workflow automation and clinical decision support. Partnerships between hospitals, radiology groups, and global AI vendors, coupled with the emergence of competitive local innovators, are further accelerating deployment. The combination of unmet clinical needs, supportive regulatory evolution, and scalable cost advantages positions Asia Pacific as the highest-growth market in radiology AI.

Radiology AI Market: COMPANY EVALUATION MATRIX

In the radiology AI market matrix, GE Healthcare (Star) leads with a broad and clinically validated portfolio covering CT, MRI, X-ray, and ultrasound imaging. Its strength lies in deep integration with imaging hardware, strong regulatory approvals, and enterprise-scale deployment capabilities across hospitals worldwide. Enlitic, Inc. (Emerging Leader) is gaining momentum with innovative, multi-specialty AI solutions focused on acute care, real-time triage, and cross-workflow orchestration. While GE HealthCare maintains leadership through scale, product maturity, and end-to-end workflow integration, Enlitic, Inc. shows strong potential to advance toward the Leaders’ Quadrant amid rising demand for rapid diagnosis, ED efficiency, and vendor-neutral AI orchestration across imaging networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens Healthineers AG (Germany)

- Microsoft (US)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (US)

- Fujifilm Holdings Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

- Merative (US)

- DeepHealth (RadNet, Inc.) (US)

- Shanghai United Imaging Healthcare Co., LTD (China)

- Hologic, Inc. (US)

- Enlitic, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.61 Billion |

| Market Forecast in 2030 (value) | USD 2.27 Billion |

| Growth Rate | CAGR of 24.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Radiology AI Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape and Solution Benchmarking | Comparative profiling of top Radiology AI players covering revenue share, key applications (stroke, PE, oncology, trauma, chest, cardiac), FDA/CE approvals, integration capabilities (PACS/EHR), and AI workflow automation maturity. Inclusion of a product positioning matrix based on model precision, deployment flexibility, and clinical validation strength. | Enables benchmarking of competitive positioning, identifies performance and integration gaps, and supports strategic alliances or product differentiation strategies. |

| Regional Market Entry and Regulatory Mapping | Detailed mapping of regulatory frameworks (FDA, CE, SFDA, MDR) and AI/ML software approval pathways. Assessment of reimbursement codes, tele-radiology licensing, and localization needs for data residency and clinical validation. | Reduces regulatory risk, supports faster time-to-market, and ensures compliance alignment across North America, the EU, GCC, and Asia Pacific regions. |

| Technology Adoption and Readiness by Hospital Tier | Assessment of AI adoption maturity across hospital tiers (academic, tertiary, secondary) and specialties. Mapping of key drivers, including digital infrastructure readiness, data governance, and clinician training levels. | Guides go-to-market strategy, aligns deployment models (cloud/on-premise), and identifies early adopters for pilot deployments. |

| Partnership and Ecosystem Mapping | Identification of ecosystem partners—PACS/RIS vendors, imaging OEMs, cloud providers, and hospital networks—for co-development and bundled solution opportunities. | Accelerates ecosystem expansion, enhances interoperability, and strengthens value-chain partnerships to scale AI deployment. |

| Market Forecasting and Demand Modeling | Bottom-up estimation of AI deployment volumes across radiology departments, segmented by modality (CT, MRI, X-ray), hospital size, and region. Scenario modeling for adoption under different reimbursement and regulatory conditions. | Provides actionable market sizing insights, investment prioritization, and scenario-based planning for commercial expansion. |

RECENT DEVELOPMENTS

- July 2025 : GE HealthCare has received FDA 510(k) clearance for the Revolution Vibe CT system, targeting the rapidly growing cardiac CT (CCTA) imaging market. This system incorporates AI-based features to improve image quality and reduce scan times.

- July 2025 : Siemens Healthineers AG partnered with Apollo Hospitals (India) to develop AI-driven imaging solutions for liver disease, with a focus on Metabolically Dysregulated-Associated Steatotic Liver Disease (MASLD). The collaboration will leverage AI and quantitative ultrasound tools for early detection, risk stratification, and monitoring, addressing a significant public health challenge in India and supporting precision population health strategies.

- May 2025 : Philips announced a collaboration with NVIDIA to develop a large foundation model specifically for MRI. The model is designed to build upon NVIDIA’s VISTA-3D and MAISI work, aiming to enable faster scans, higher image quality (including denoising and super-resolution), zero-click scan planning, and automated image-finding/interpretation features that can be embedded into MR workflows.

- November 2023 : Nuance (a Microsoft company) announced PowerScribe Smart Impression / Advanced Auto Impression — generative AI features that draft radiology impressions and accelerate reporting (deployed at early-adopting health systems). The capability automates parts of the radiology impression, aiming to reduce reporting time and clinician burnout while preserving radiologist oversight. This is a practical, production-grade use of generative AI in radiology workflows.

Table of Contents

Methodology

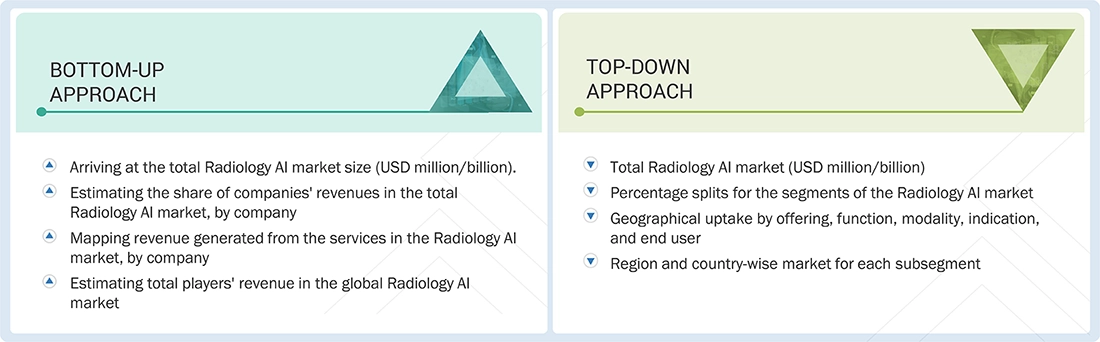

The study involved major activities to estimate the current size of the radiology AI market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the radiology AI market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing Radiology AI solutions is assessed using secondary data from both paid and free sources. This involves analyzing the product portfolios of major industry players and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases. The secondary research process involved consulting various secondary sources to identify and collect information relevant to the study. These sources included annual reports, press releases, investor presentations from radiology AI vendors, forums, certified publications, and white papers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of radiology AI solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively employed to perform market estimation and forecasting for the overall market segments and subsegments outlined in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends, by offering, function, modality, indication, end user, and region).

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the radiology AI market.

Market Definition

Radiology AI solutions are specifically designed to support, enhance, and automate radiology practices. These AI-driven solutions utilize advanced algorithms, including machine learning, deep learning, and computer vision, to support medical imaging acquisition, enhancement, analysis, interpretation, and reporting across various modalities, such as X-ray, CT, MRI, ultrasound, and mammography. They support image segmentation and quantification, lesion detection, diagnostic support, workflow optimization, predictive analytics, and clinical decision support. They integrate with existing PACS and RIS platforms to improve diagnostic accuracy, efficiency, and standardization. In addition to supporting clinical decision-making, Radiology AI solutions enable triage, quality assurance, and predictive analytics by identifying subtle imaging patterns that indicate disease risk, progression, or response to therapy, enhancing overall imaging workflow performance.

Stakeholders

- Radiology AI Providers

- OEM Vendors

- Cloud Providers

- Radiologists & Imaging Specialists

- Hospitals

- Diagnostic & Imaging Centers

- Clinics & Outpatient Settings

- Specialty Centers

- Hardware Providers

- Startups & Innovators

- Academic and Research Institutions

- Patients & Patient Advocacy Groups

Report Objectives

- To define, describe, and forecast the global radiology AI market, by offering, function, modality, indication, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall radiology AI market

- To assess the radiology AI market with regard to Porter’s Five Forces, regulatory landscape, value chain, ecosystem map, patent protection, and key stakeholders’ buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the radiology AI market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the radiology AI market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as collaborations, agreements, partnerships, acquisitions, expansions, product launches and enhancements, and R&D activities in the radiology AI market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Radiology AI Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Radiology AI Market