Railway Testing Market

Railway Testing Market by End Use, Superstructure Testing Equipment, Electrification Testing Equipment, Use case, Application, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The railway testing market is projected to grow from USD 3.91 billion in 2025 to USD 5.34 billion by 2032 at a CAGR of 4.6%. The shift of rail operators toward data-guided maintenance programs is boosting the requirement for precise and high-frequency inspection of track geometry, overhead systems, signaling assets, and rolling stock, thereby driving the growth of the market. Additionally, improved rail safety and reliability standards are strengthening the need for advanced testing platforms that support continuous monitoring. Moreover, the growing demand from heavy haul and freight corridor development is creating higher stress on network assets, which is pushing operators to adopt equipment that can detect faults earlier and reduce service disruptions.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to be the fastest-growing region during the forecast period. It is projected to grow from USD 1,041.2 million to USD 1,481.5 million, registering a CAGR of 5.2%.

-

By End UseBy end use, the rolling stock test equipment segment is expected to lead the railway testing market during the forecast period. It is projected to grow from USD 2,046.8 million in 2025 to USD 2,788.0 million by 2032.

-

By Use CaseBy use case, the train control segment is expected to lead the railway testing market during the forecast period. This segment is projected to grow from USD 283.6 million 2025 to USD 375.9 million by 2032, at a CAGR of 4.1% from 2025 to 2032.

-

By Electrification Testing EquipmentBy electrification testing equipment, the railway power supply testing equipment is expected to be the fastest-growing segment during the forecast period. The segment is projected to grow from USD 133.7 million in 2025 to USD 211.6 million in 2032, registering at a CAGR of 6.8%

-

By ApplicationBy application, the post-delivery & upkeep inspection segment is expected to lead the railway testing market during the forecast period. This segment is projected to grow from USD 791.4 million in 2025 to USD 1,136.9 in 2032, at a CAGR of 5.3%.

-

Competitive LandscapeThe railway testing market is dominated by key global players, such as Knorr-Bremse AG (Germany), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), HORIBA Group (Japan), and RENK Group AG (Germany). These players have attained a strong position due to their product footprint.

-

Competitive LandscapeMTS Systems Corporation (US), Hexagon AB (Sweden), Trimble Inc. (US) and Intertek Group plc (UK) are progressive companies due to their strong foothold and niche offerings in railway testing market.

The railways testing market is projected to grow at a significant rate during the forecast period as operators upgrade networks and increase inspection frequency to maintain safe and efficient operations. Rising traffic, ageing infrastructure, and stricter safety and reliability standards are strengthening demand for high precision testing tools. Heavy haul and freight corridor expansion is creating higher asset stress, which is driving adoption of advanced measurement systems. The shift toward data guided maintenance and the use of digital technologies for faster diagnostics is further supporting steady market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Railways are moving toward high capacity, high speed, and strict compliance, which are shifting the demand from basic inspection tools to systems that can secure network uptime and operational certainty. Operators are prioritizing early fault detection, automated verification, and real-time condition visibility to manage aging assets and expanding corridors without increasing downtime. Electrification upgrades and signaling modernization are also raising the requirement for precise validation of power, communication, and safety-critical systems. Spending is concentrating on equipment that supports predictive maintenance, continuous monitoring, and faster certification cycles, making advanced measurement platforms central to long term performance and regulatory alignment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Improved rail safety and reliability standards

-

Growing demand from heavy-haul and freight corridor development

Level

-

Fragmented rail infrastructure and lack of standardization

-

High cost of testing equipment

Level

-

Rail infrastructure expansion in emerging markets

-

Integration of digital technologies to increase demand for testing equipment

Level

-

Complex stakeholder ecosystem shifting requirements for testing equipment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Improved rail safety and reliability standards

The push toward high safety and reliability benchmarks has become a global priority and a fundamental growth driver for testing and measurement equipment across the railway industry. Regulators and operators are enforcing tighter compliance norms that demand consistent monitoring, quantifiable inspection data, and digital traceability. Standards such as EN 13848 for track geometry, EN 50126 for system reliability, and ISO 3095 for acoustic performance are now embedded in national operating guidelines, shaping procurement specifications worldwide.

Restraint: Fragmented rail infrastructure and lack of standardization

The global rail sector remains structurally fragmented, with infrastructure standards, design parameters, and testing methodologies varying widely across regions. Track gauge, signaling systems, electrification voltage, and safety certification processes differ from country to country, often even within the same region. According to the International Union of Railways (UIC), there are more than 20 active track gauge standards globally, ranging from 1,000 mm narrow gauge in Africa and Southeast Asia to 1,676 mm broad gauge in India and 1,520 mm Russian gauge across CIS nations.

Opportunity: Integration of digital technologies to increase demand for testing equipment

Digitalization is redefining the scope, efficiency, and value proposition of railway test and measurement systems worldwide. The adoption of advanced technologies, such as IoT-based sensors, AI-driven analytics, machine vision, LiDAR imaging, and digital twin modeling is transforming traditional testing processes into predictive and automated maintenance ecosystems. Rail operators are increasingly relying on continuous condition monitoring rather than periodic manual inspection to ensure asset reliability and minimize downtime.

Challenge: Complex stakeholder ecosystem shifting requirements for testing equipment

The railway industry operates within a multi-layered stakeholder ecosystem where responsibilities for infrastructure, rolling stock, operations, and maintenance are distributed across public authorities, private operators, regulatory agencies, and contractors. This diversity of ownership and governance models results in constantly evolving technical requirements for testing and measurement equipment.

Railway Testing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides brake testing systems that allow operators to certify braking performance as networks run tighter headways and higher frequency services | Strengthens operational reliability by reducing brake related service disruptions |

|

Supplies drivetrain and axle testing platforms that help depots validate traction components as fleets transition to higher power density propulsion systems | Improves drivetrain readiness for upgraded service patterns |

|

Deploys digital and wayside condition monitoring tools that support real time inspection as corridors shift toward data driven maintenance | Enables earlier fault detection and higher asset availability |

|

Offers electrical test benches that validate inverter and converter performance as operators integrate newer electric and hybrid traction technologies | Supports safe and efficient commissioning of modern propulsion systems |

|

Provides torsional testing systems that help assess drivetrain stability under rising load variability across mixed traffic corridors | Enhances propulsion system reliability during intensive daily operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the railway testing market. It covers raw material and component suppliers, equipment manufacturers, track measurement equipment providers, infrastructure providers, maintenance and service providers, regulatory bodies, railway operators, and testing service providers. Each category plays a distinct and critical role in supporting the development, deployment, and operation of advanced track measurement solutions within the rail industry's broader ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Railway Testing Market, By End Use

The rolling stock test equipment is projected to lead the market during the forecast period, as operators are maintaining higher reliability standards as train fleets are expanding and usage intensity is rising. Rolling stock test equipment is receiving preference since any failure in traction, braking, or onboard control systems is directly affecting service continuity and safety requirements.

Railway Testing Market, By Superstructure Testing Equipment

The rail mechanical testing equipment segment is projected to lead the market during the forecast period. Rail operators need to verify rail strength, fatigue life, and wear behavior as networks handle higher speeds and heavier axle loads, which increases the requirement for tensile, bending, and full scale fatigue testing. These factors are driving segment's growth.

Railway Testing Market, By Electrification Testing Equipment

The railway power supply testing equipment segment is projected to be the fastest-growing segment during the forecast period. Rail operators are upgrading traction substations and overhead electrification systems to handle higher power demand from modern trains, and these upgrades require tighter verification of power quality, load behavior, and protection system responses. These factors are driving segment's growth.

Railway Testing Market, By Use case

The train control segment is projected to be the fastest-growing segment during the forecast period. Rail operators are prioritizing safety compliance, digital signaling upgrades, and capacity improvement, supported by strong regulatory pressure and the shift toward automation. Additionally, investments in systems like CBTC, ETCS, and national ATP programs are increasing because they reduce collisions, optimize train headways, and support real time monitoring. These factors are driving segment's growth.

Railway Testing Market, By Application

The post-delivery & upkeep inspection segment is projected to be the fastest-growing segment as rail operators are tightening their performance assurance processes as networks expand, train frequencies increase, and system upgrades become more complex.

REGION

Asia Pacific to be fastest-growing region in global railway testing market during forecast period

Asia Pacific is projected to be the fastest-growing region in the railway testing market during the forecast period, as national rail programs in the region are expanding their capital expenditure on new corridors, suburban upgrades, and modern rolling stock, which is increasing the requirement for advanced measurement technologies that can manage high volumes of construction and maintenance activity. Additionally, governments in the region are accelerating timelines for high speed and freight projects, and operators are introducing tighter reliability targets, which is pushing the shift toward automated track geometry systems, overhead line inspection platforms, and onboard diagnostic solutions.

Railway Testing Market: COMPANY EVALUATION MATRIX

Knorr-Bremse is positioned as a Star in the railway testing market on account of its advanced, regulation-compliant solutions and strong global leadership, supported by constant innovation, digital automation, and a comprehensive product portfolio that addresses both safety and operational reliability. Spectris, meanwhile, is recognized as an Emerging Leader due to its strategic investments in accredited labs, advanced technologies, and market expansion, enhancing its capabilities for growth and positioning it for greater relevance across new applications and global railway measurement demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Knorr-Bremse AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Wabtec Corporation (US)

- HORIBA Group (Japan)

- RENK Group AG (Germany)

- WAGO (Germany)

- Spectris (UK)

- ADOR Tech (Canada)

- AMETEK Inc. (US)

- Keysight Technologies (US)

- National Instruments Corp. (US)

- Akebono Brake Industry Co., Ltd. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.71 Billion |

| Market Forecast in 2032 (Value) | USD 5.34 Billion |

| Growth Rate | CAGR of 4.6% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Company Share, Growth Factors and Trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, North America, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: Railway Testing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Railway test equipment manufacturers | Detailed benchmarking of leading and emerging suppliers, with actionable SWOT and microquadrant analysis | Equips client to identify best-fit partners and anticipate competitor moves for better positioning |

| Railway testing service providers | Granular breakdown by equipment type, geography, and application, tailored to client’s focus areas | Enables precise targeting of growth opportunities and resource prioritization |

| Railway test equipment manufacturers | Up-to-date mapping of innovation timelines, digital upgrades, and regulatory drivers | Helps future-proof investment, avoid obsolescence, and align roadmaps with industry evolution |

| Railway operators | Current and upcoming compliance summaries for core markets, linked to client’s operating geographies | Mitigates risk, speeds go-to-market, and supports sustained compliance in priority geographies |

RECENT DEVELOPMENTS

- October 2025 : Knorr-Bremse launched The LEADER Flow driver assistance system supports train drivers in daily operation with intelligent driving recommendations.

- October 2025 : ZF launched a new single-stage spur gear drive tailored for Indian railways, the gearbox features a specially developed sphero cast housing that is compact, lightweight at around 315 kg, and suitable for high-speed applications including trains like the Vande Bharat Express.

- June 2025 : ZF launched a new modular suspension damper program for retrofitting passenger rail vehicles, enabling operators to replace original dampers from other suppliers with standardized ZF components to reduce lifecycle costs and improve supply chain resilience.

- April 2025 : RENK Gears Private Ltd. (India) and Quantum Systems GmbH concluded a strategic partnership in India for R&D, software development, and production.

- March 2025 : Wabtec Corporation announced a USD 960 million cash acquisition of Sweden-based Dellner Couplers, a global leader in train connection systems for passenger rail. The deal expanded Wabtec's Transit portfolio and is expected to accelerate growth, innovation, and expand its offering in the resilient passenger rail market.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the railway testing market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included railway services and equipment for testing, test equipment and track measurment industry organizations [American Railway Association (ARA), Brazilian Association of the Railroad Suppliers (ABIFER), China Railway Society (CRS), China Academy of Railway Sciences (CARS), Gulf Cooperation Council (GCC), Indian Railway Conference Association (IRCA), Indian Railway Institute of Electrical Engineering (IRIEEN), International Union of Railways (UIC), Japan Association of Rolling Stock Industries (JARI), Mexican Association of Railway], corporate filings (such as annual reports, investor presentations, and financial statements), and company websites, whitepapers, and databases, and articles from recognized associations and government publishing sources. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

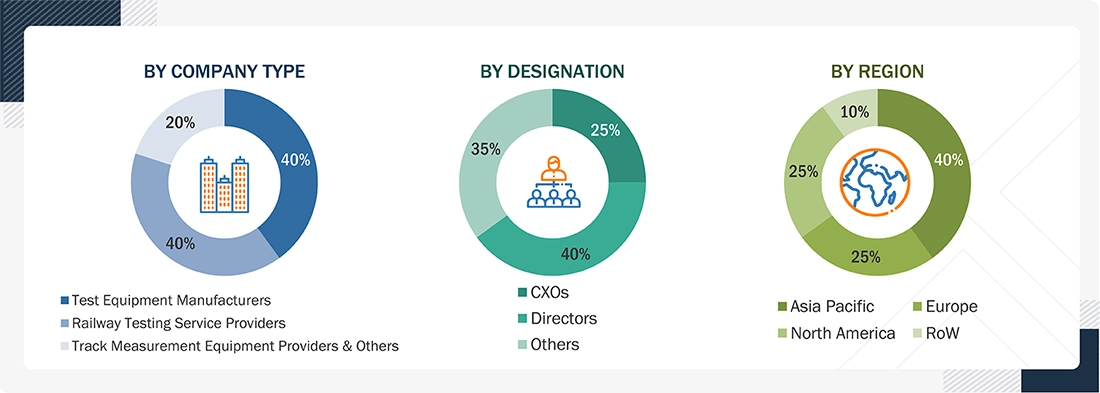

Primary Research

Extensive primary research was conducted after acquiring an understanding of the railway testing market through secondary research. Several primary interviews were conducted with market experts from the demand side (railway operators, system integrators, country-level government associations, and trade associations) and supply side (OEMs and component manufacturers) across major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 40% and 60% of primary interviews were conducted from the demand and supply sides, respectively. The primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were considered to provide a holistic viewpoint in this report.

Brief sessions with highly experienced independent consultants were conducted to reinforce findings from primaries after interacting with industry experts. This, along with the in-house subject matter experts’ opinions, led to the findings, as described in the remainder of this report.

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

Breakdown of Primaries

Note: Others include Sales Managers and Product Managers.

To know about the assumptions considered for the study, download the pdf brochure

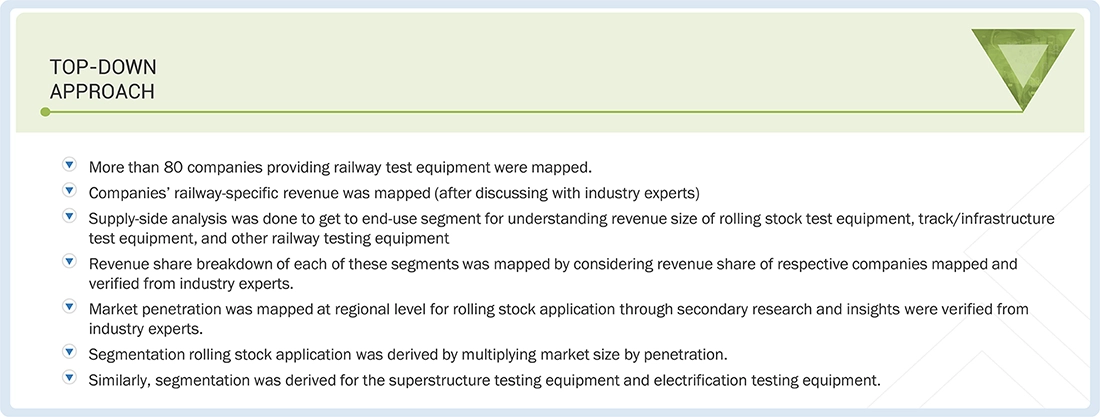

Market Size Estimation

Top-Down Approach:

The top-down methodology was followed to estimate the size of the railway testing market by application. More than 80 companies were covered, and their railway-specific revenue was mapped after discussing with industry experts. Supply side analysis was done, by end use, for understanding the revenue size of railway rolling stock test equipment, track/infrastructure testing equipment, and other test equipment. Revenue share breakdown for each of these segments was mapped by considering the revenue share of respective companies, mapped & verified by industry experts. Market penetration was mapped at the regional level for rolling stock applications through secondary research, and insights were verified from industry experts. Segmentation for rolling stock applications was derived by multiplying the market size by the penetration. Similarly, segmentation was derived for the super-structured testing equipment (Rail mechanical testing equipment, electronics and DAQ testing equipment, switches/turnouts testing equipment, sleepers/crossties, fastenings testing equipment, track measurement equipment, other superstructure testing equipment) and electrification testing equipment (On-board electronics test equipment, contact lines test equipment, traction power supply & substation testing equipment, railway power supply testing equipment).

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The railway testing market refers to the industry that produces and supplies specialized tools, systems, and devices for testing and monitoring railway infrastructure, such as tracks, rolling stock, and overhead lines, to ensure safety, quality, and efficiency. This market includes a wide range of products, from handheld tools to sophisticated, automated systems for on-track and in-lab measurements. The market’s growth is driven by factors like the need for enhanced safety, the increasing complexity of rail operations, and advancements in digital and sensor technologies.

Report Objectives

- To segment and forecast the railway testing market in terms of value (USD Million)

- To define, describe, and forecast the market based on end use, superstructure test equipment, electrification test equipment, application, use case, and region

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To define, describe, and forecast the size of the railway testing market with respect to growth trends and prospects, and determine the contribution of the segments to the total market

- To segment the market and forecast its size, by value, based on region (Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To segment and forecast the market size, by value, based on end use (Rolling stock test equipment, track/infrastructure test equipment, other test equipment)

- To segment and forecast the market size, by value, based on superstructure testing equipment (Rail mechanical testing equipment, electronics and DAQ testing equipment, switches/turnouts testing equipment, sleepers/crossties, fastenings testing equipment, track measurement equipment, other superstructure testing equipment)

- To segment and forecast the market size, by value, based on application (Design & development, manufacturing & fabrication, pre-delivery testing, post-delivery & upkeep inspection)

- To provide detailed information regarding the major factors (drivers, challenges, restraints, and opportunities) influencing the market growth

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To study the following with respect to the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders & Buying Criteria

- Funding, by Application

- Key Conferences & Events

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the market

- To track and analyze competitive developments, such as deals (mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Railway Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Railway Testing Market